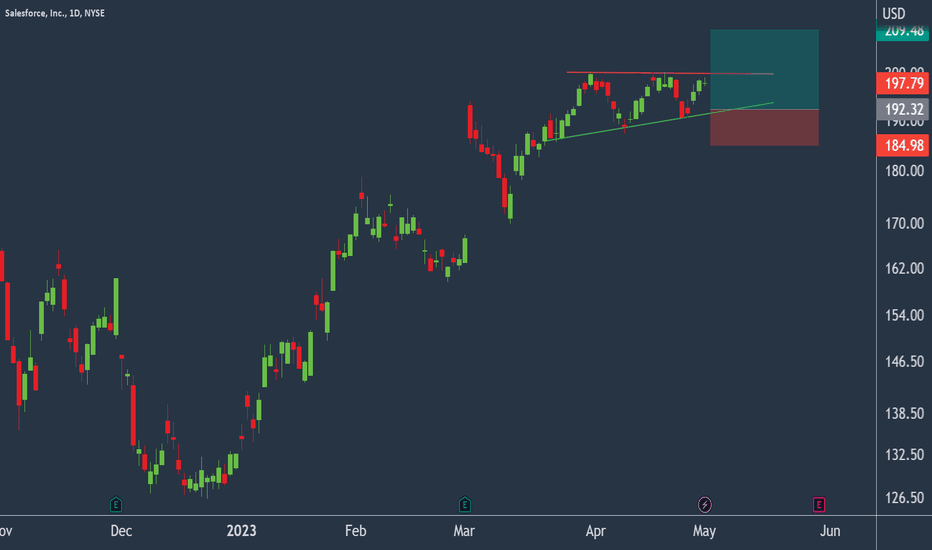

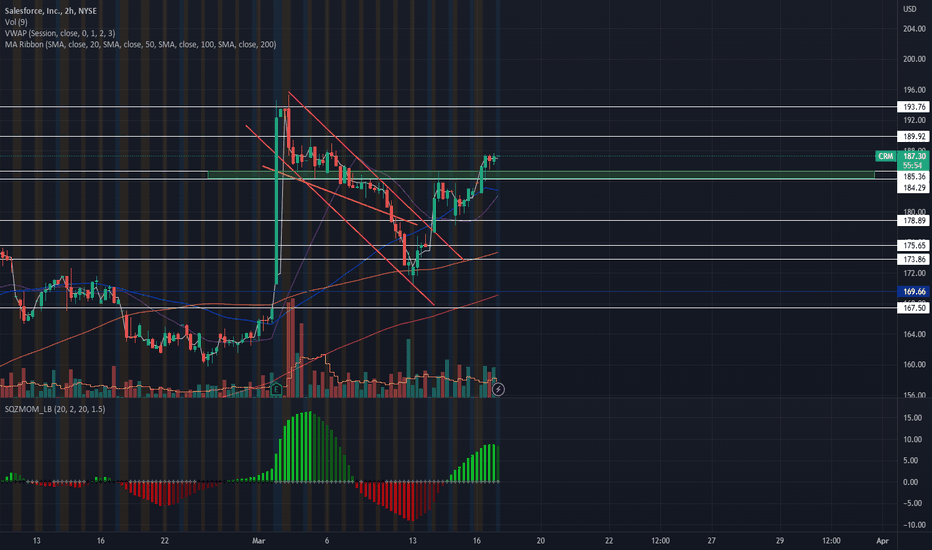

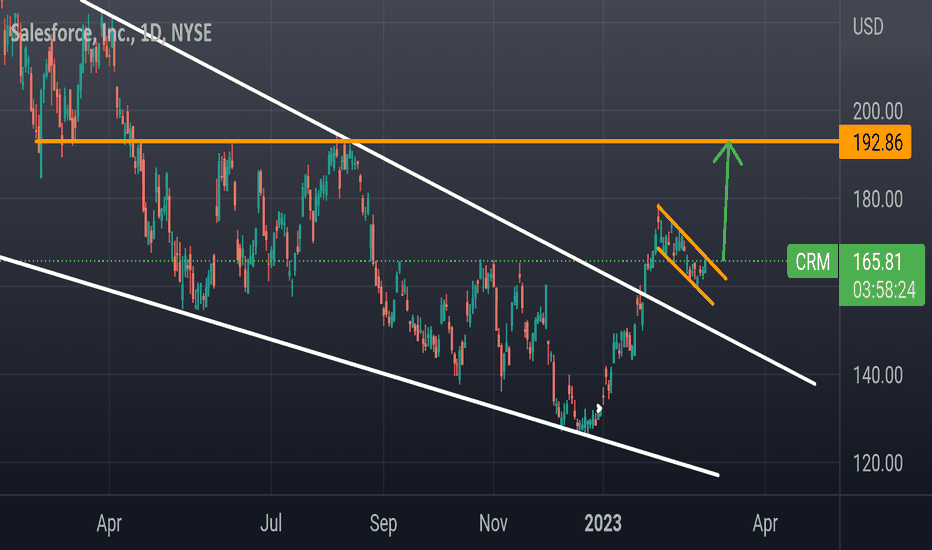

Salesforce in an ascending triangle.Salesforce - 30d expiry - We look to Buy at 192.32 (stop at 184.98)

The primary trend remains bullish.

Price action has formed a bullish ascending triangle formation.

Trend line support is located at 192.

The bias is to break to the upside.

Trading close to the psychological 200 level.

A break of bespoke resistance at 200, and the move higher is already underway.

This stock has seen good sales growth.

Our profit targets will be 209.48 and 212.48

Resistance: 200 / 205 / 210

Support: 190.50 / 187.31 / 185

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

CRM trade ideas

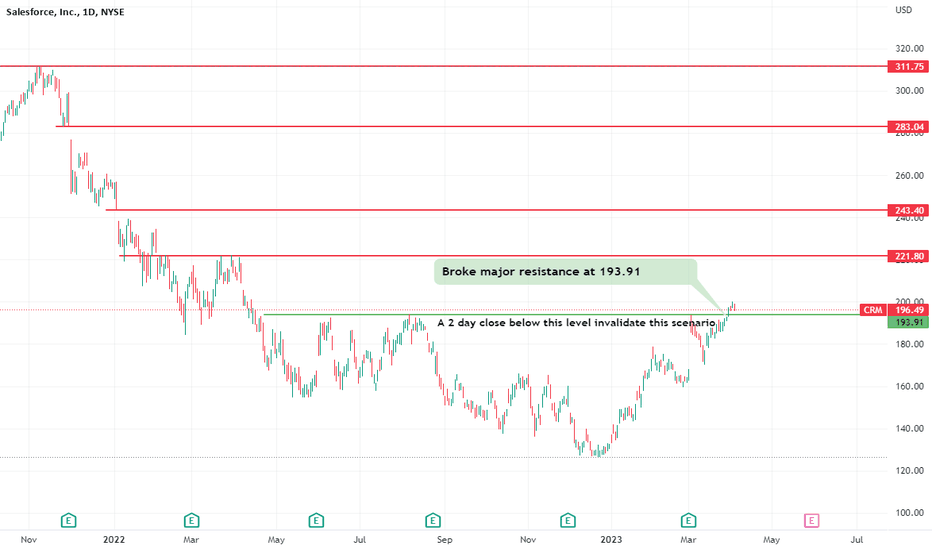

Bullish break?The stock has recently broken out of a consolidation zone and is poised to begin a fresh uptrend. The company stats are more on the growth side, with Bloomberg analysts predicting that EPS would increase by 36.4% in 2024. Fundamentally and technically, things are looking well; if the final aim of 311.75$ is met, a possible return of 58% might be accomplished. A two-day closing below 193.91 will render the scenario worthless.

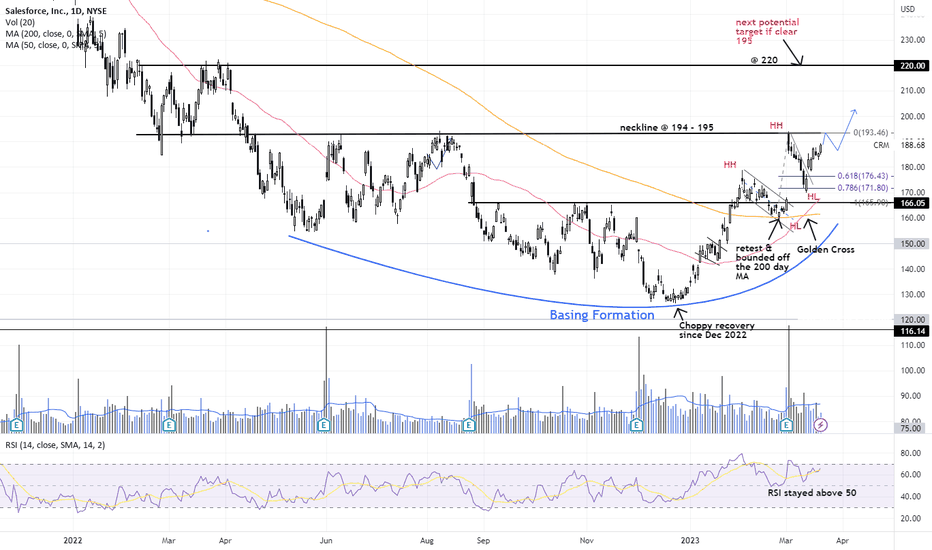

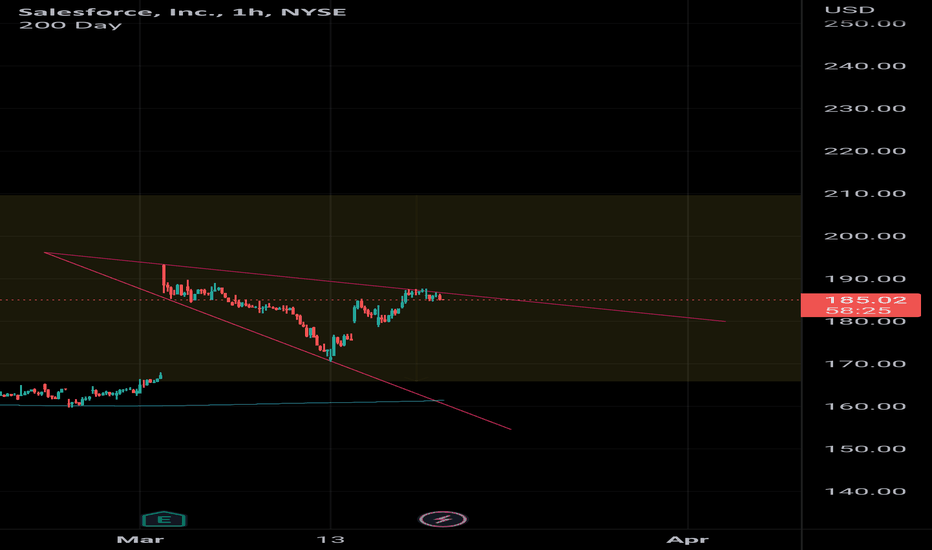

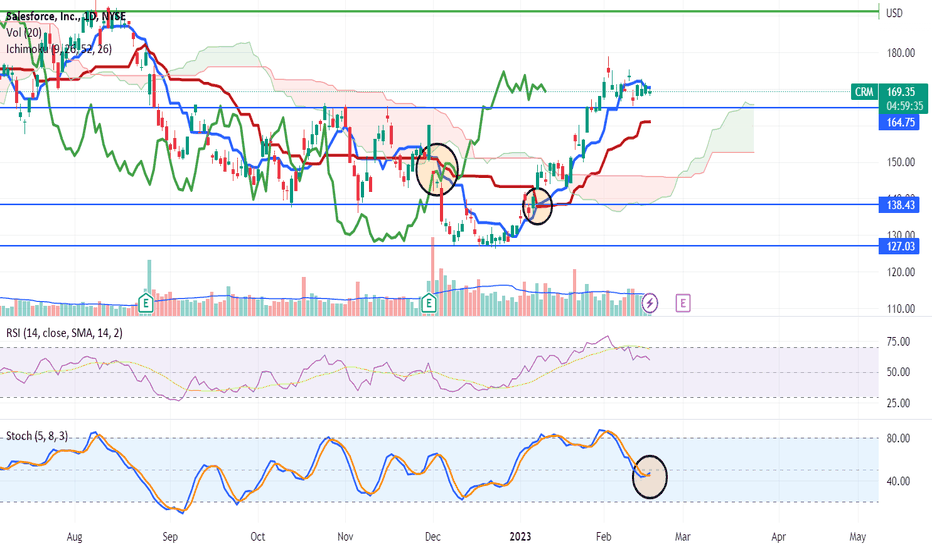

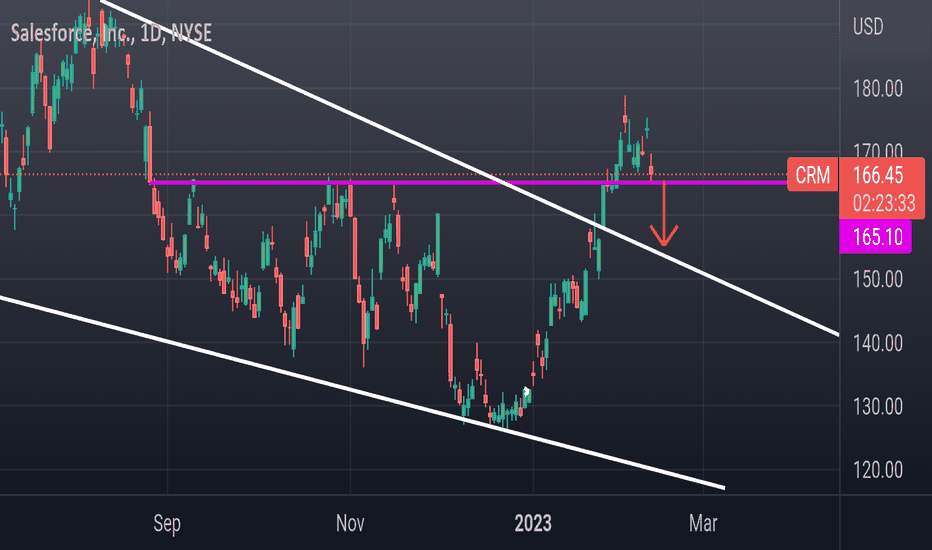

CRM - approaching neckline @ 195CRM had been basing for about 10 month now (since last May), the first sign that the worst could be over was when it broke above the 200 day movving average on 27 Jan, then a retest of this MA a month later on 27 Feb which validated the 200 day MA as the new "support".

Several days later on 2nd Mar, it gapped up strongly on earnings beat, stopping right at a significant neckline around 195. Then proceeded to pullback and almost closing the entire gap in the coming days. While the stock has been staging a recovery since hitting the low in Dec last year, it also experienced steep pullbacks on the way up. Buying the dips would certainly had been a better option in this chopping conditions.

Despite the volatility, what is clear however is that the stock is still on it's way to recovery, forming higher hi's (HH) and higher lo's (HL), with RSI staying at 50 or higher since early Jan, and a Golden Cross since 10 Mar.

It could attempt to break the neckline @ 195 again in the coming days and if and when it is finally able to break and stay above this level, then we could (hopefully) see more a more steady rise with pullbacks that are less steep (ie within 50% fib retracement of each mini up swing). And the next target could be around 220.

We can "predict" price targets but it is important to manage our risk with trailing stop losses and see what the market gives us.

Disclaimer: Just my 2 cents and not a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance and don't forget that money management is important! Take care and Good Luck!

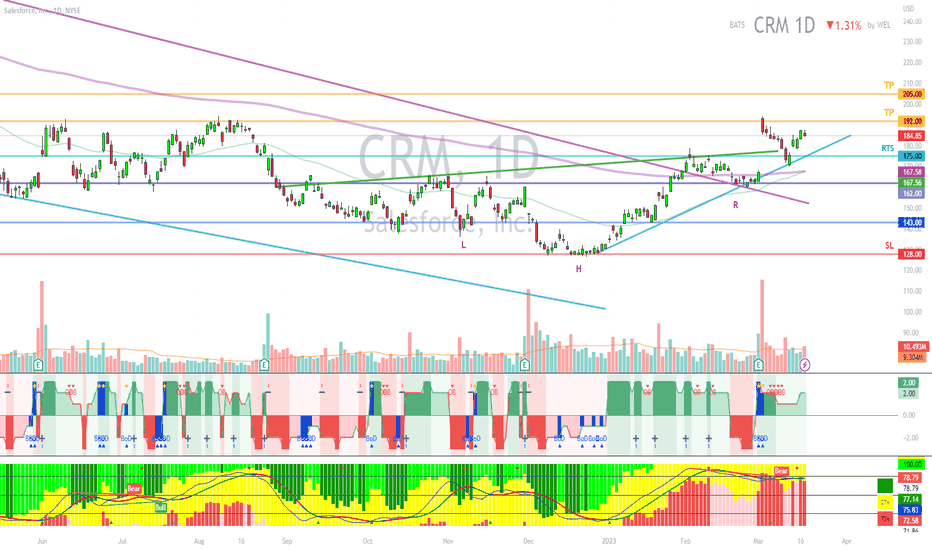

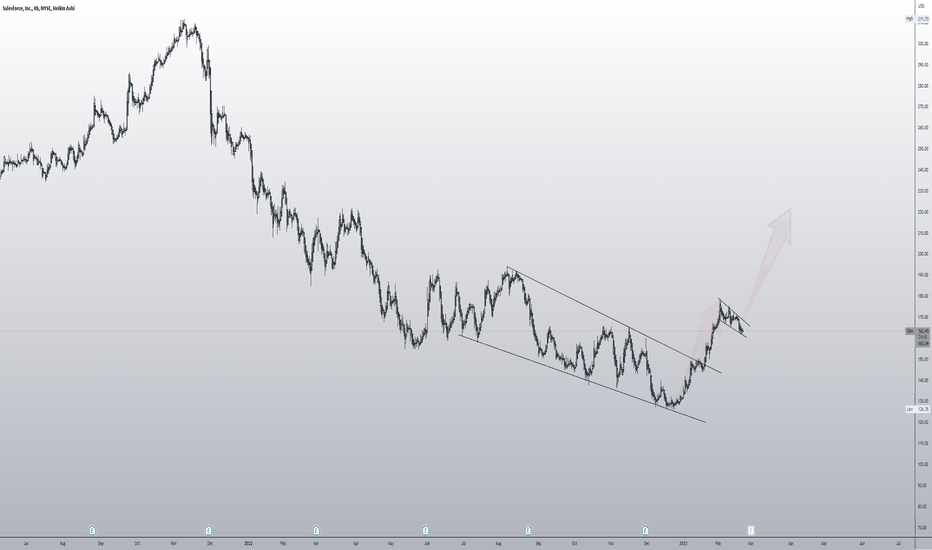

CRM - Breakout Falling Trend [MIDTERM]- CRM has broken the ceiling of the falling trend in the medium long term, which indicates a slower initial falling rate.

- CRM has given a positive signal from the inverse head and shoulders formation by a break up through the resistance at 177.

- Further rise to 233 or more is signaled.

- CRM is approaching's resistance at 192, which may give a negative reaction.

- However, a break upwards through 192 will be a positive signal.

- Positive volume balance, with high volume on days of rising prices and low volume on days of falling prices, strengthens the stock in the short term.

- Overall assessed as technically neutral for the medium long term.

*EP: Enter Price, SL: Support, TP: Take Profit, CL: Cut Loss, TF: Time Frame, RST: Resistance, RTS: Resistance to be Support LT TP: Long Term Target Price

Verify it first and believe later.

WavePoint ❤️

What now?$CRM had its great move up and seems to be slowing a bit.

A methodology for trading short term like I do, that I like, is cut the weeds and keep the flowers.

Or sell the losers, keep the winners. We also can't marry a stock, so it is up to the trader to determine when the asset turns into a weed.

Personally, for me if we break the supply zone I marked, I am out fully. Always take gains and try and practice that.

Trades are not investments, but try to trade something you wouldn't mind investing in! :)

CRM trying to move moreReally great set up.

If you were averaging into this one from for a bit, you're very happy right now. It looks like a calm target is $190.

Have to see how it interacts with the resistance it hit. If we can turn that into support that would be great.

This company could easily be in the $190-210 range in my opinion.

Need the rest of the market to play along and this can moon.

CPI was decent and SVB situation seems fine. Melt up mode on market can send this one.

need more$CRM is a name that had great earnings and is reverting back down to the pre-earnings level. This is interesting because as traders we know we want that gap filed but we don't know how long that may take

I put the flag up there but it's kinda dumb. what really happened was that break down of that line I colored gold.

Maybe we see the gap fill and then. $190-200?

I don't think that is a dumb thing to look for.

Gotta see how SIVB and CPI play out.

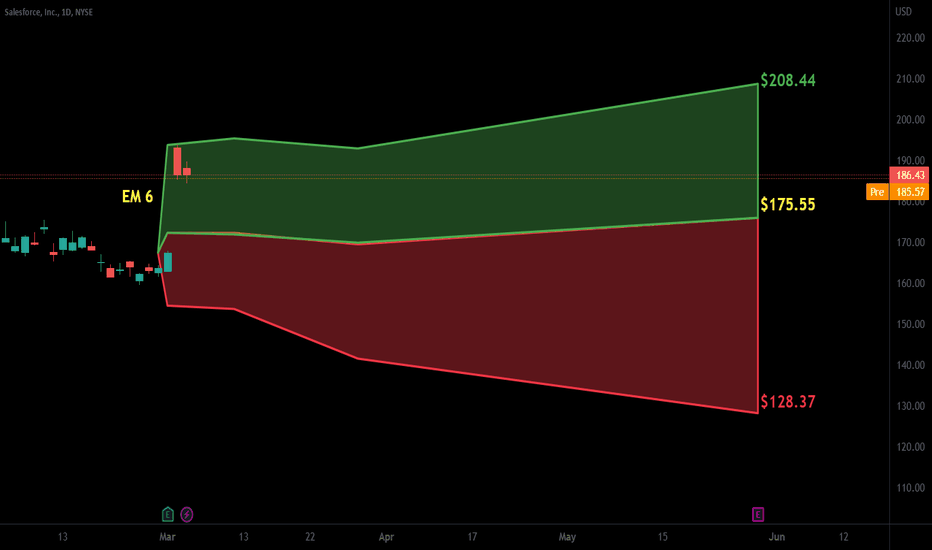

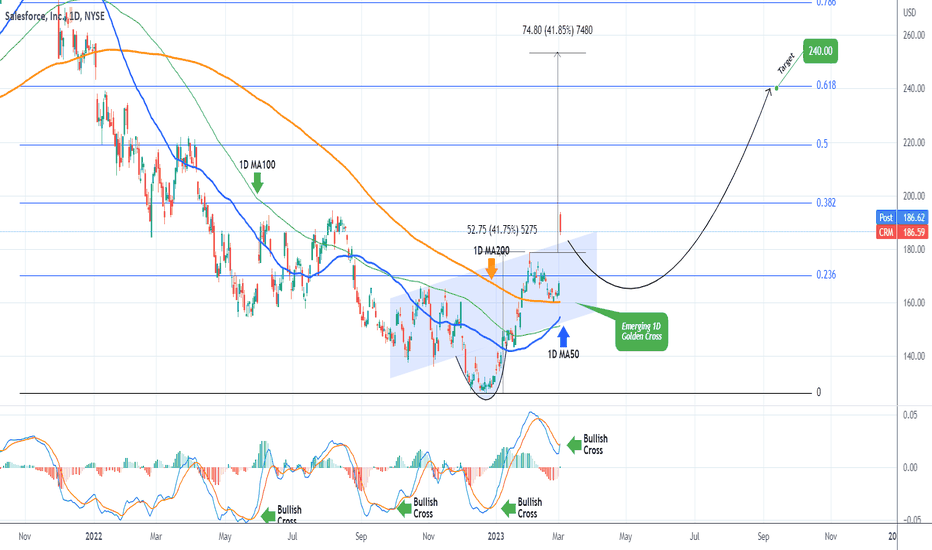

CRM's Inverse Head and Shoulders aiming at $240 by Q4Salesforce Inc (CRM) broke above its Inverse Head and Shoulders (IH&S) pattern and by early next week should form a Golden Cross on the 1D time-frame. With the MACD just forming a Bullish Cross, we have all the confirmation we need to go heavily bullish on CRM and with the Support of the 1D MA100 (green trend-line) on the long-term, target the 0.618 Fibonacci retracement level at $240 by Q4.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

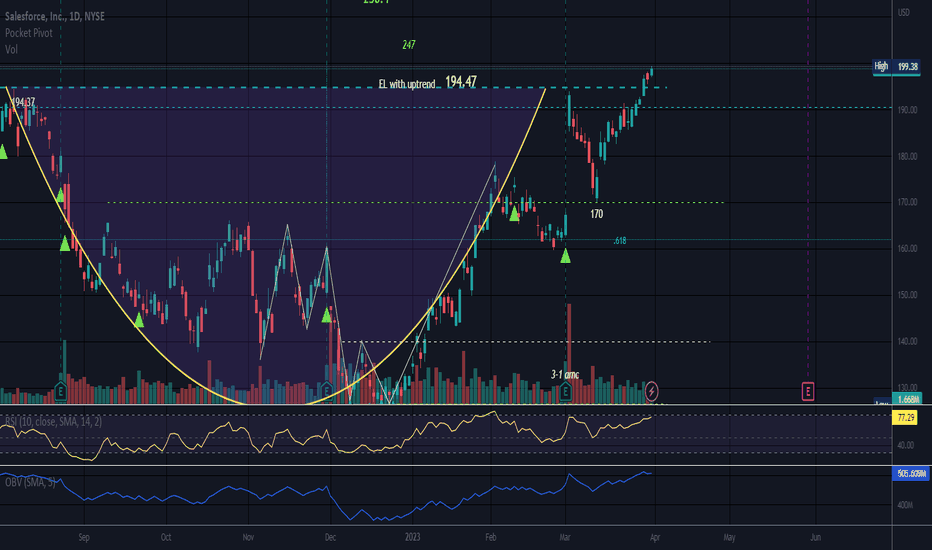

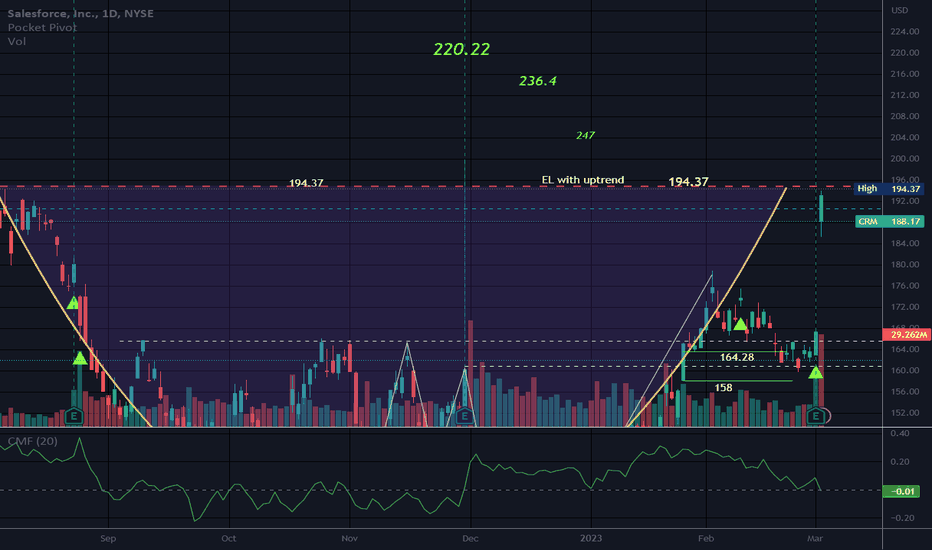

Cup and HandleEarnings were obviously well received.

Price has not reached long entry level (EL) but it is knocking on the door.

Price much surpass the left side, or the sell side of the cup.

I have noted as of late after a big price move in one day, it is best for me to sell and take the profit.

Nothing is ever predictable but until this reaches EL, this is a neutral pattern.

No recommendation/Price is just above the .618 of the trend up. Short is just over 1%.

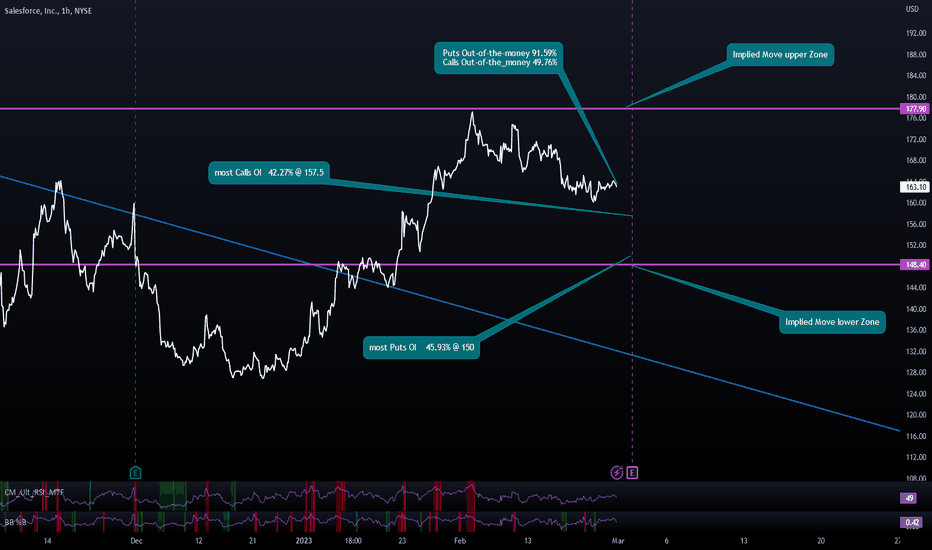

Where will CRM go today?As you might now, later that day CRM will publish their earnings. What is priced in in the options and what does that tell us?

IV, IM

- We have a very high Implied Volatility. The calculated Implied Move is 14.90 USD according to my data. Therefore the lower Zone is at ~148 and the upper zone is at ~178. This is a 9% move!

- Remember the Implied Volatility is equal to one standard deviation. Therefor the chance is 68% that the price stays within the zone from 148 - 178 after earnings.

PUTS

- The number of Put-Options out-of-the-money compared to the Put-Option in-the-money is 91.59%. Remember, when Put-Options will be in-the-money at expiration they are assigned. Hence Option Traders speculate on a change of price and not want to buy or sell the underlying, you can safely assume, that the vast majority (91%) of all Option Traders believe, that the price will not drop any further.

- The most traded Put Option price is at 150 USD. 46% of all traders believe, the price will not drop below 150 USD.

- If the price would drop below 150, many shares will be assigned and bought at that price. Therefor, 150 USD will act as natural resistance.

CALLS

- Calls out and in-the-money are very even. There is no signal to recognize.

- The most traded Call is at 157.50. Hence Calls become worthless when they are out-of-the-money at expiration, its safe to assume that 42% of all Option-Trader that buy Callls, believe the price will be above 157.50 USD.

Summarize:

- Resistance at 150 due to Put Options

- Strong bullish signal Put Options (91% overall, above price 163.61 USD)

- Bullish signal Call Options (42% believe above 157.50 USD)

(all data is analyzed with the expiration day 3.3.23)

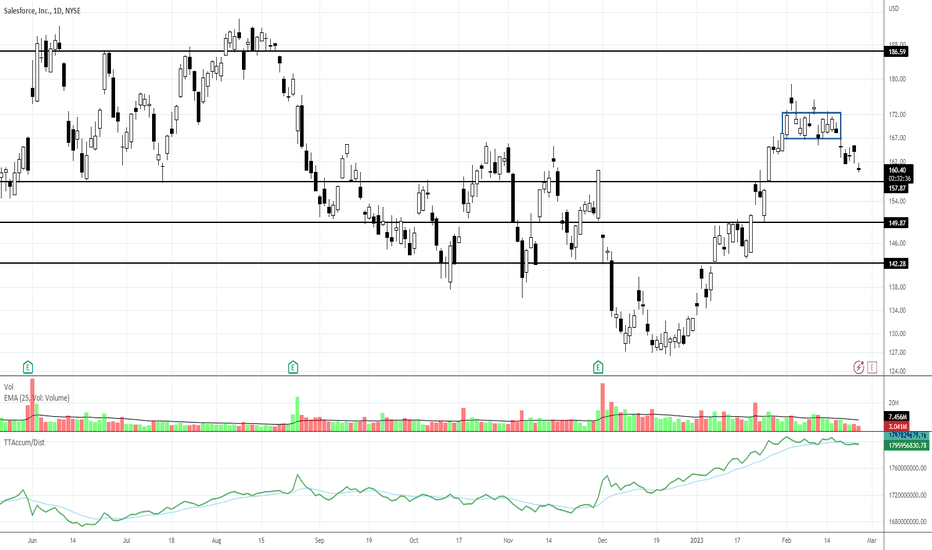

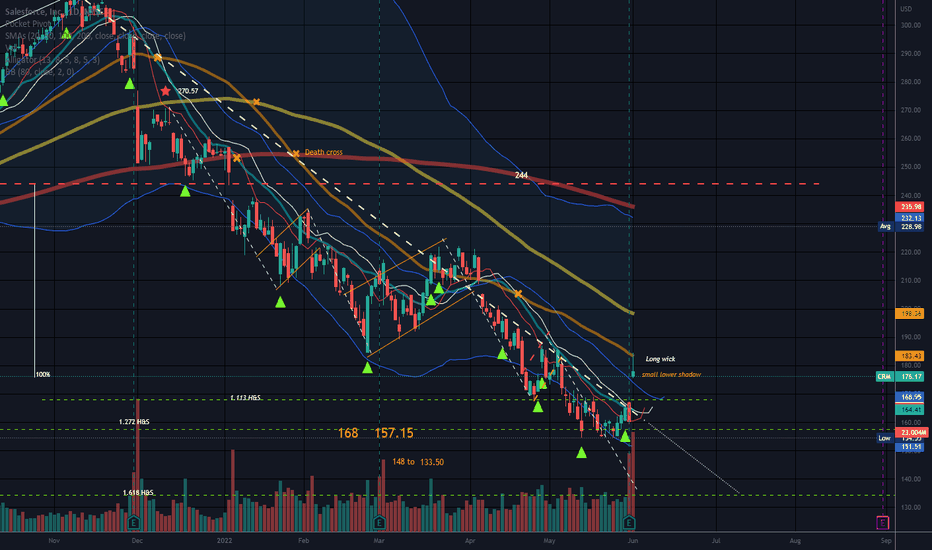

CRM Setting Up for Earnings Next WeekCRM reports earnings next week. This was a pre-earnings run that settled into an unstable sideways trend and then went down due to a lack of strong retail buying.

Volume is exceedingly low to the downside. This is not a sell short setup. Buy zone support is too close from the bottom formation.

NVDA had a similar pattern and gapped up on its earnings release news.

Candles/Good News CRM traded to 184.42 today after an Earnings Beat. At 176.33 as I write this.

Price broke through the resistance line of the channel down.

Daily chart.

Right this second there is a candle with a long top wick and no bottom shadow. This can change by market close.

Candles have a habit of forming a bottom shadow, be it today or tomorrow or next week. Bullish so far as it has not traded below the open which gapped price to the upside.

Almost half of securities with good earnings or good news peak in 2 weeks or less in a bull market. I do not think we are in a bull market anymore but a great move for CRM.

Be safe//Laura