FIG IPO: Is it Worth the Hype?IPO Highlights

IPO pricing & volume

-Figma priced its IPO at $33 per share on July 30, 2025 (above its revised range of $30–32 and the initial $25–28 range—raising over $1.2 billion by selling approximately 36.94 million shares.

Valuation

-This pricing placed its valuation at around $19–19.5 billion fully diluted, close to the US $20 billion Adobe had once offered in a failed acquisition attempt.

Financial Profile & Business Strengths

Revenue and profitability

-Figma posted US $749 million in revenue for 2024 (up 48% YoY), and revenue in Q1 2025 grew by 46% to $228.2 million. It also delivered $44.9 million in net income during Q1 2025, signaling improved profitability after a net loss the prior year (inflated by a one‑time $1 billion breakup fee from Adobe).

Customer base & margins

-The company boasts 13 million monthly active users and covers 95% of Fortune 500 companies, with strong 91% gross margins and approximately 18% operating margins.

Cryptocurrency holdings

-Figma holds $69.5 million in a Bitcoin ETF and $30 million in USD Coin, planning to reinvest these into Bitcoin, a strategy similar to that of MicroStrategy.

Strategic & Market Implications

Signal for IPO revival

-Figma is the largest enterprise-software IPO since 2021 and is seen as a potential catalyst for a broader IPO rebound, potentially opening the floodgates for other companies such as Canva, Databricks, and more.

Market perception & analyst viewpoints

-Analysts, including Gil Luria at D.A. Davidson, view Figma as well-positioned in the AI/design space. Others caution that rising usage of generative AI could disrupt future margins, creating both potential and uncertainty.

Competitive landscape

-The IPO sets the stage for Figma to directly compete with Adobe. Despite Adobe’s recent stock decline, analysts expect both companies to potentially thrive given growing demand for creative tools.

-Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Stock prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not personally liable for your own losses, this is not financial advise.

FIG trade ideas

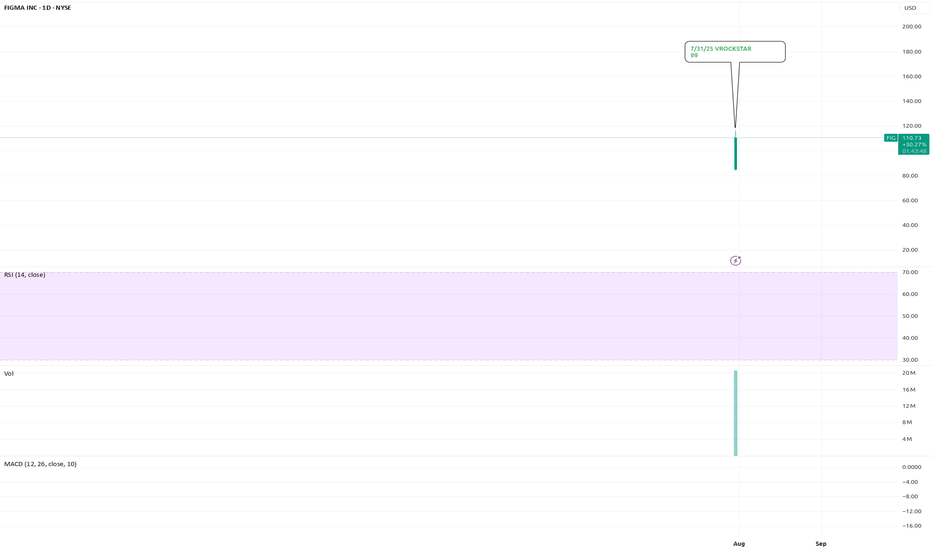

7/31/25 - $fig - gg7/31/25 :: VROCKSTAR :: NYSE:FIG

gg

- didn't even want this at $33 or wherever the money changers filled it

- saw that it opened at like... $90? tf

- now it's $100?

- i'm commenting here to share with you that we're at the point in the market where nothing makes sense if you zoom far enough in

- take a step back, there's a lot of value out there

- but paying 3x the IPO price for this?

- it's an interesting trade, but don't try to make it make sense because it won't and you'll cause some brain damage

- nobody ever went broke taking profits.

- gl to those who bought my bags at over $100. enjoy.

V

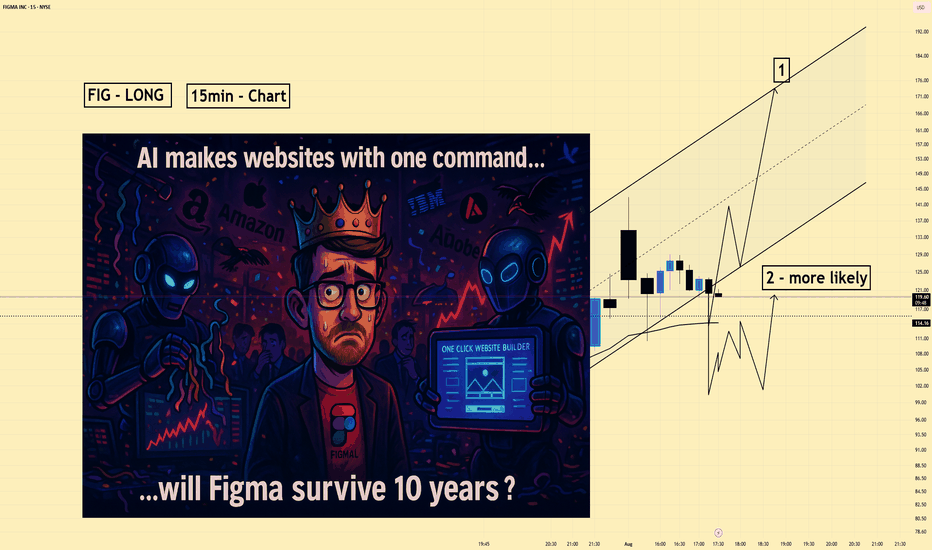

Figma (FIG) | Short Bias | AI Pressure on Design (Aug 2025)Figma (FIG) | Short Bias | AI Pressure on Design Platforms (Aug 2025)

1️⃣ Short Insight Summary:

Figma just went public with a huge IPO pop, but the company faces serious long-term questions. With AI rapidly changing design workflows and tech giants aggressively cutting costs through automation, the design-collaboration market could look very different in a few years.

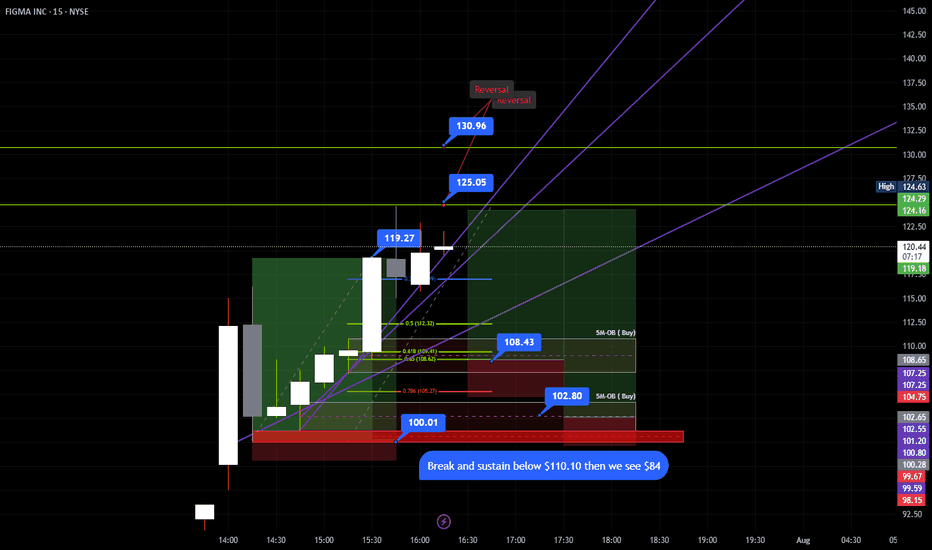

2️⃣ Trade Parameters:

Bias: Short

Entry: Watching for re-tests near $110–$115 (post-IPO highs)

Stop Loss: Above $120 to protect against strong breakout continuation

TP1: $95

TP2: $80

(These levels can adjust based on broader market reaction and SPX performance)

3️⃣ Key Notes:

Figma is an incredible platform, but it must keep up with AI-powered design tools that can build full websites and products in minutes. We’re already seeing major tech companies (IBM, Amazon, Apple) laying off staff because AI is streamlining operations. If Figma doesn’t stay ahead, its massive IPO valuation could be hard to justify.

S&P 500 reaction is also key—if the index weakens, high-flying IPO names like Figma could see sharper corrections.

4️⃣ Follow-up:

I’ll revisit this trade idea after we see how price reacts around the $110–$115 zone and how broader market sentiment plays out.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

FIGMA INC. (FIG) – IPO Day Momentum + AI Design Wave📈 FIGMA INC. (FIG) – IPO Day Momentum + AI Design Wave

Figma just launched its IPO at $33/share, raising over $1.2B with intense demand (reportedly 40× oversubscribed). The stock opened explosively around $85 and surged past $115 within hours—marking one of the strongest SaaS IPOs in recent memory.

This debut is powered by:

The failed $20B Adobe acquisition (2023), which boosted Figma’s independence and cash position via a ~$1B break-up fee.

Accelerated AI integration: new tools like Figma Make, Draw, and Buzz debuted at Config 2025, reinforcing its leadership in collaborative design.

A rebound in tech valuations and strong market timing for IPOs, with Figma now positioned as a bellwether for high-growth SaaS.

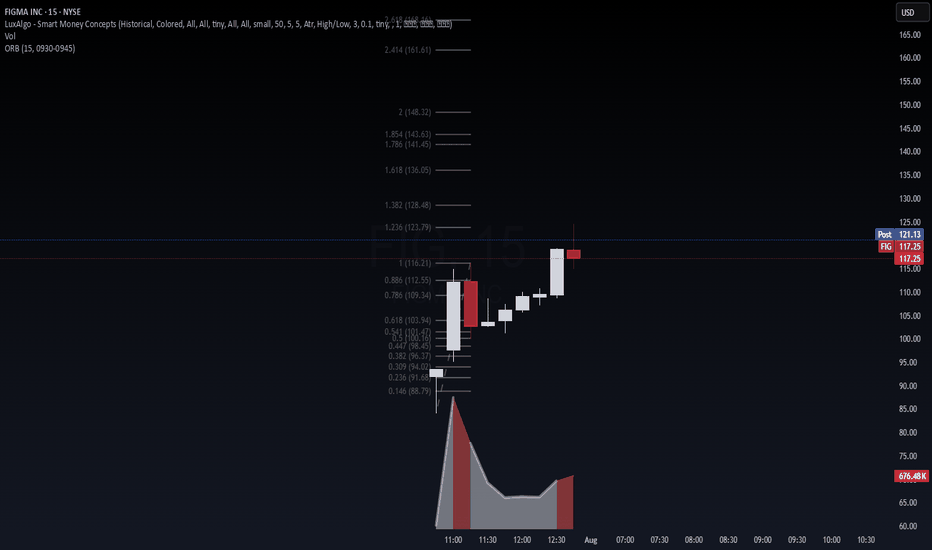

🔍 Technical View (15-min chart):

After the opening range breakout (0930–0945), price cleanly moved through the 0.618 and 1.00 Fibonacci levels. FIG is now hovering near 1.236 ($123.79) with next key extension at 1.382 ($128.48). Volume confirms sustained interest. A hold above $116 signals strength. Watch for:

Breakout continuation above $123.79 → $128.50

Retest of VWAP/Fib levels ($112–$109) for re-entry

Lock-up risk, but low near-term float = volatile upside

🎯 Thesis: This is institutional-grade price action backed by AI momentum, macro timing, and a clean technical base. Trade the trend, not the headline.

#FIG #IPO #AI #SaaS #Breakout #Fibonacci #VolanX #WaverVanir #TradingStrategy #MacroSignals

Waiting for Break at 5.25The company EPS is expected to grow from 0.07 this year to 0.87 next year. The Industry average price/earnings ratio is about 18x so I’m estimating the stock could grow back up to touch last year highs around $8 within the next months.

The price started and held and up-trending move at the end of June and found some resistance at 5.25. its now restarting the trend and I'm looking to get in once it breaks the previous resistance. I’m going to set my profit target at about $5.50.