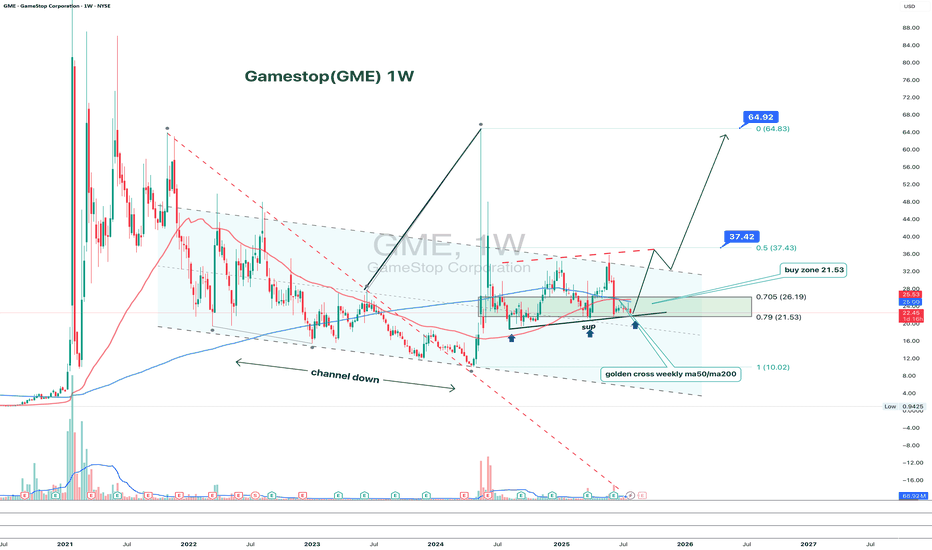

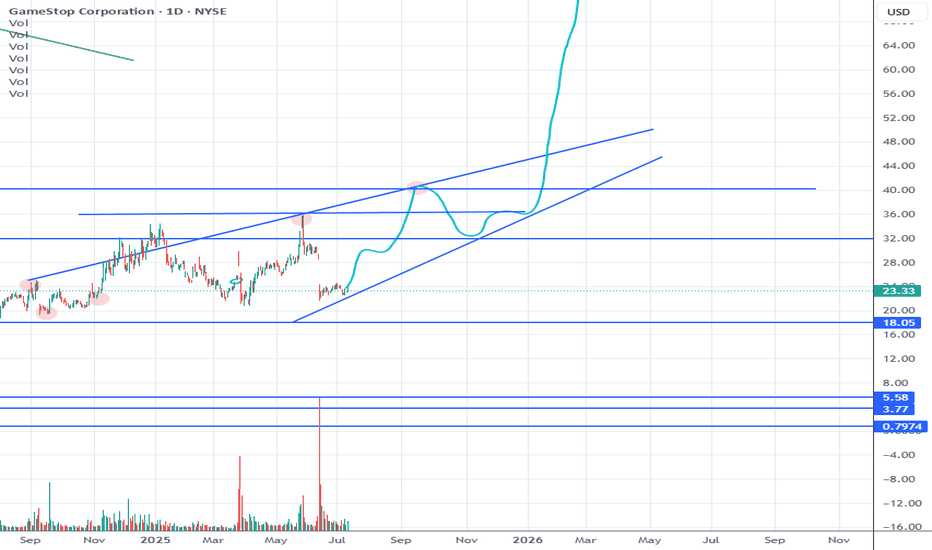

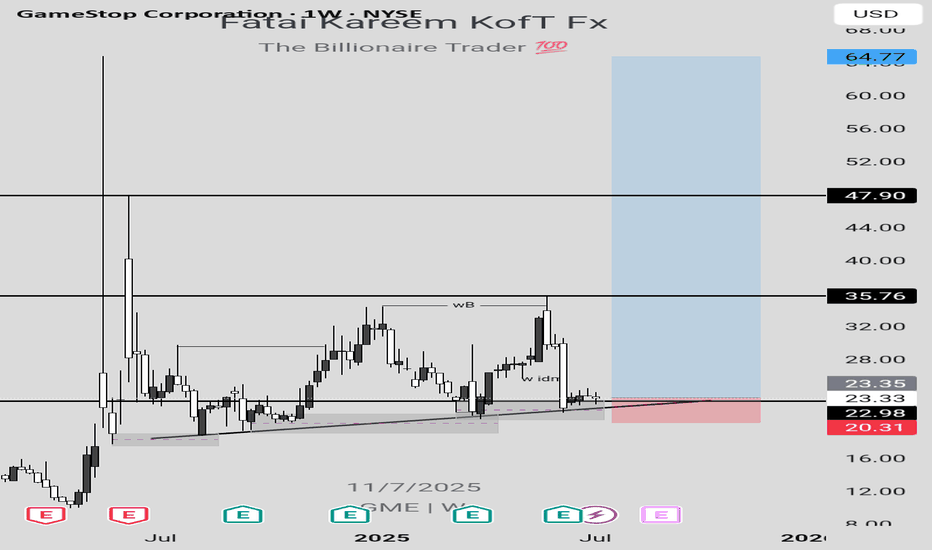

GME 1W: when the memes fade, the structure speaksGameStop is once again testing the lower boundary of its long-term consolidation, bouncing off the 21.53 zone - a level that aligns with the 0.79 Fib retracement and historical support. This zone also intersects with a key trendline on the weekly chart, and just recently, a golden cross (MA50 cross

Key facts today

GameStop Corp. (GME) has been identified as a major participant in the recent resurgence of meme stocks, alongside AMC Entertainment Holdings, with its stock price down 74% from its peak values.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.47 USD

131.30 M USD

3.82 B USD

408.70 M

About GameStop

Sector

Industry

CEO

Ryan Cohen

Website

Headquarters

Grapevine

Founded

1996

FIGI

BBG000BB5BF6

GameStop Corp. offers games and entertainment products through its ecommerce properties and stores. It operates through the following geographic segments: United States, Canada, Australia, and Europe. Each segment consists primarily of retail operations, including stores and ecommerce properties focused on games, entertainment products, and technology. GameStop offers new and pre-owned gaming platforms from the major console and PC manufacturers, sells new and pre-owned gaming software for current and certain prior generation consoles, and offers a variety of in-game digital currency, digital downloadable content, and full-game downloads. The firm’s stores and ecommerce sites operate primarily under the names GameStop, EB Games, and Micromania. Its pop culture themed stores also sell collectibles, apparel, gadgets, electronics, toys, and other retail products for technology enthusiasts and general consumers in international markets operating under the Zing Pop Culture brand. The company also publishes Game Informer, a print and digital gaming publication. GameStop was founded by Daniel A. DeMatteo in 1996 and is headquartered in Grapevine, TX.

Related stocks

Golden Cross on GME WeeklyGME Chart Breakdown, Déjà Vu or Destiny? Something big just lit up the weekly chart, the 50 MA has pierced through the 200 MA, forming that golden cross traders dream about. On the weekly timeframe. Not a drill.

Now, let’s rewind. The last time this pattern appeared? January 2021. The infamous squ

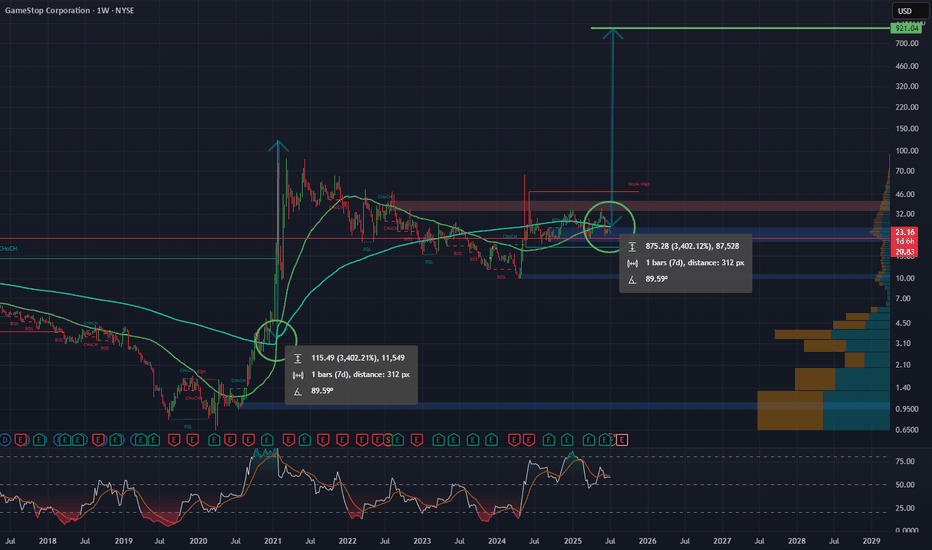

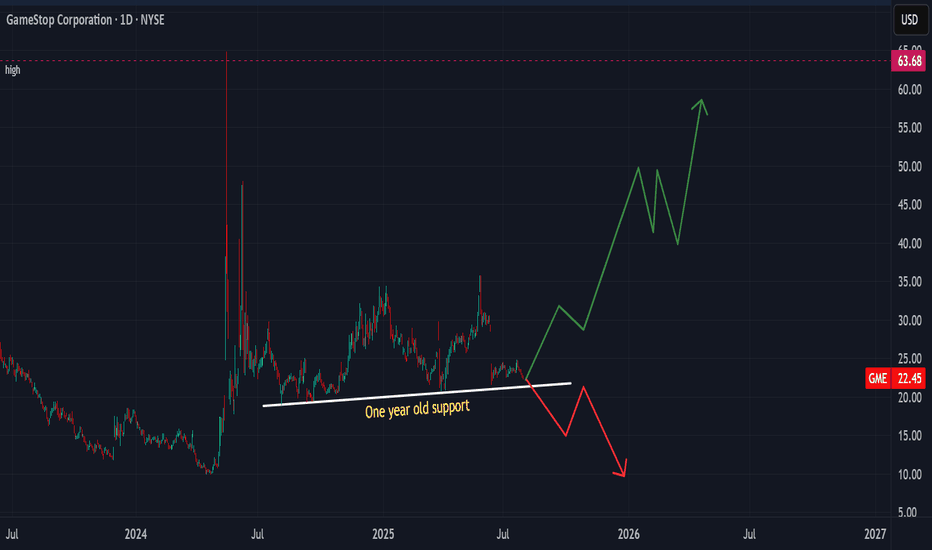

THIRD TIME IS A CHARM (SUPPORT BREAK OR FURTHER ADVANCE)Price action has been holding the one year support line from July 2024 until now. A break will see GameStop price declining further to the old support at 10.00 USD. However, price is favourably expected to rise further to test the 47.00 USD and an extension to the old high if this support holds.

S

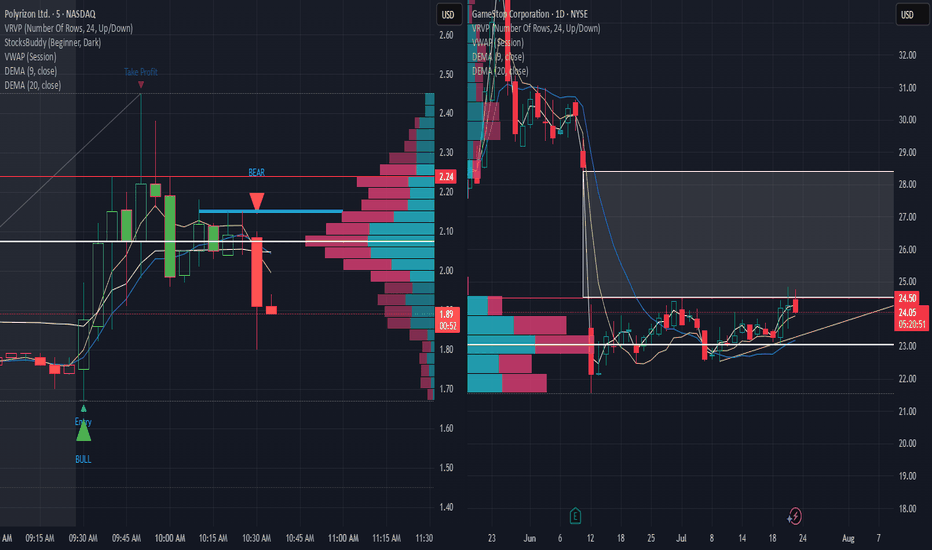

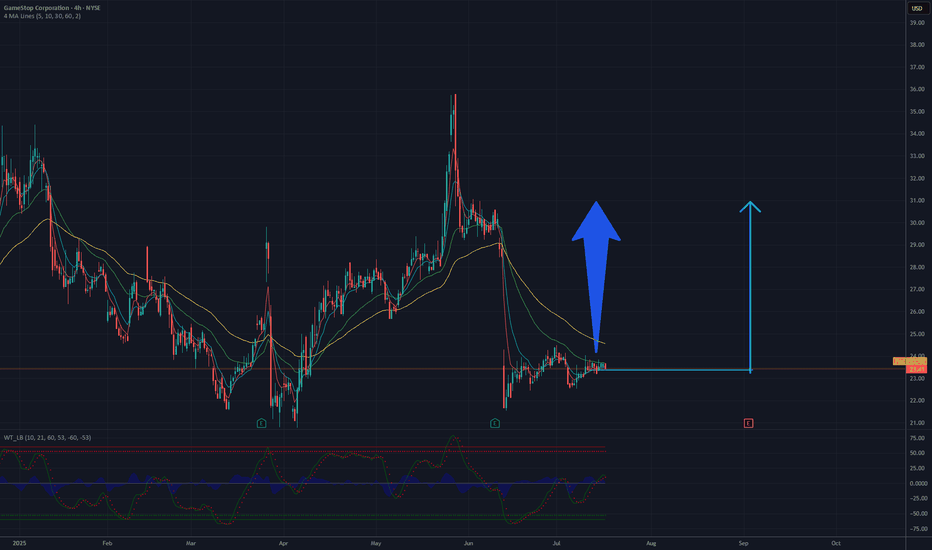

Is it a time for GAMESTOP? 30 $ in the sightAnalysis of the GameStop (GME) chart suggests a potential rise to 30 USD, based on current trends and technical levels. The 4-hour chart shows a recent decline following a sharp increase, with the price currently fluctuating around 23-24 USD. Key support is located at approximately 22 USD, which cou

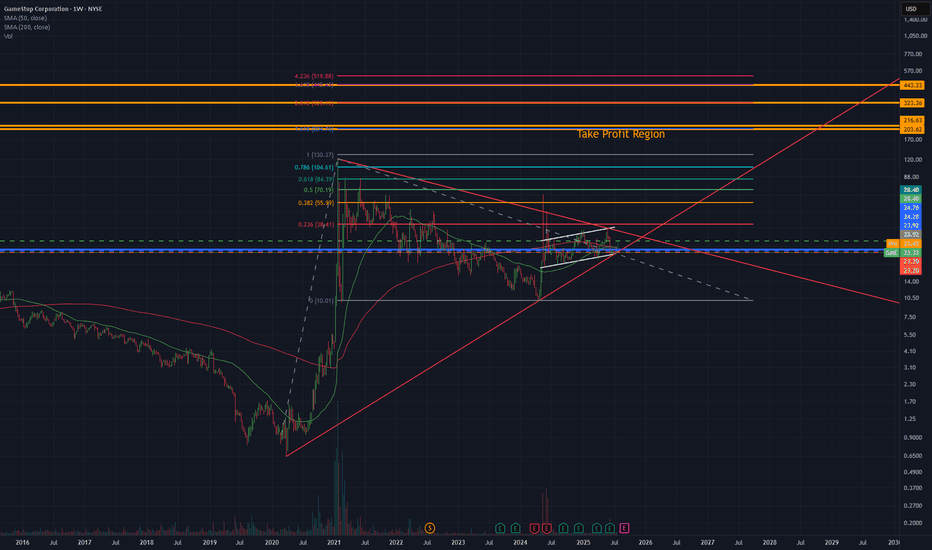

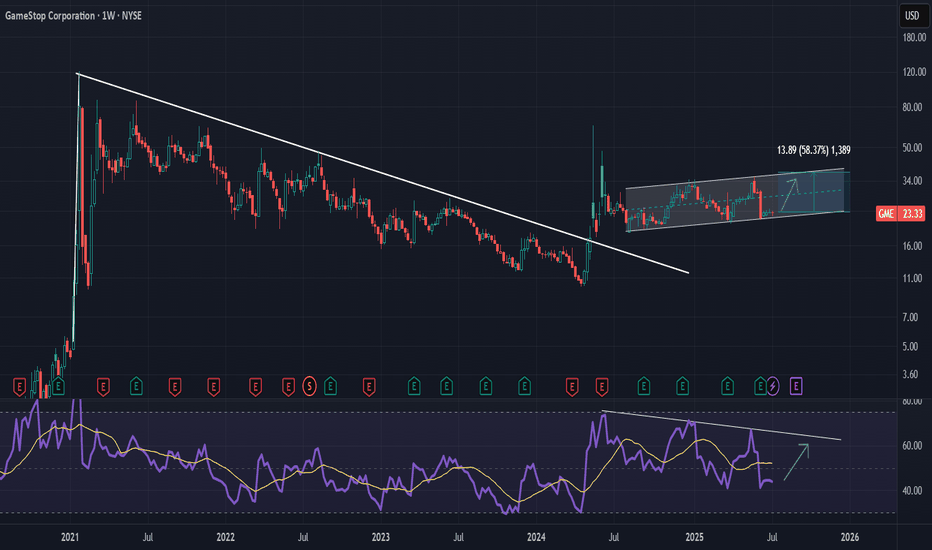

GME is ready to decide (weekly candles)I'm bullish because the market is bullish

Reasons for being Bullish

-above 200sma weekly and have held it as support

-200sma day crossed above 200sma weekly

-everyone knows about the stock, momentum could be something never seen before because of the notion of becoming rich in a day. Treating this

GME Potential UpsideGME looks attractive from a risk to reward perspective. I am not interested in the short squeeze speculation but the technicals and recent acquisition of BTC in their balance sheet has caught my attention as they have been sitting on capital for quite some time now.

Theres a clear gap around 28.50

GME LONG IDEA UPDATEDIn my previous post regarding the long opportunity on GME stock, I called a long signal after a break out of a downtrend line. However, price had dropped down to the demand zone, giving another long opportunity.

To take advantage of this long opportunity, you can buy at the current market price, w

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where GME is featured.

Frequently Asked Questions

The current price of GME is 22.10 USD — it hasn't changed in the past 24 hours. Watch GameStop stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange GameStop stocks are traded under the ticker GME.

GME stock has fallen by −6.03% compared to the previous week, the month change is a −7.04% fall, over the last year GameStop has showed a −3.58% decrease.

We've gathered analysts' opinions on GameStop future price: according to them, GME price has a max estimate of 13.50 USD and a min estimate of 13.50 USD. Watch GME chart and read a more detailed GameStop stock forecast: see what analysts think of GameStop and suggest that you do with its stocks.

GME stock is 3.13% volatile and has beta coefficient of 0.03. Track GameStop stock price on the chart and check out the list of the most volatile stocks — is GameStop there?

Today GameStop has the market capitalization of 10.04 B, it has increased by 2.51% over the last week.

Yes, you can track GameStop financials in yearly and quarterly reports right on TradingView.

GameStop is going to release the next earnings report on Sep 3, 2025. Keep track of upcoming events with our Earnings Calendar.

GME earnings for the last quarter are 0.17 USD per share, whereas the estimation was 0.08 USD resulting in a 112.50% surprise. The estimated earnings for the next quarter are 0.19 USD per share. See more details about GameStop earnings.

GameStop revenue for the last quarter amounts to 732.40 M USD, despite the estimated figure of 750.00 M USD. In the next quarter, revenue is expected to reach 900.00 M USD.

GME net income for the last quarter is 44.80 M USD, while the quarter before that showed 131.30 M USD of net income which accounts for −65.88% change. Track more GameStop financial stats to get the full picture.

GameStop dividend yield was 0.00% in 2024, and payout ratio reached 0.00%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 6 K employees. See our rating of the largest employees — is GameStop on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. GameStop EBITDA is 80.10 M USD, and current EBITDA margin is 0.56%. See more stats in GameStop financial statements.

Like other stocks, GME shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade GameStop stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So GameStop technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating GameStop stock shows the neutral signal. See more of GameStop technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.