Goldman Sachs | Detailed Fundamental Analysis Investment banking behemoth Goldman Sachs recently announced its intention to acquire GreenSky, a sales and "buy-now-pay-later" fintech company, in an all-stock deal worth about $2.2 billion. GreenSky is a major intermediary for home improvement loans and planned transactions, and allows customers to make purchases and repay them in multiple payments over some time.

GreenSky currently serves a $9 billion loan portfolio and has served about 4 million consumers with about $30 billion in loans since launch. Here are three reasons why Goldman is entering the "buy-now-pay-later" realm and acquiring GreenSky.

First, to help continue Marcus' growth.

Over the past several years, GS has been looking to grow its franchise in consumer lending to generate more stable revenues that can be volatile in investment banking. An important part of that strategy was the bank's launch of its digital bank, Marcus, which offers high-yield savings accounts, loans, and credit cards, and eventually plans to offer checking accounts as well.

GreenSky will help Marcus expand its offering of credit products, but apart from that, it will help the bank increase its overall user base. Marcus currently has about 8 million customers.

GreenSky provides a low-cost strategy for acquiring not only more customers who will take high-profit loans, but also customers who can be cross-sold other Marcus products - whether it's a savings or checking account or perhaps a mortgage.

In a presentation on the acquisition, Goldman said GreenSky represents an opportunity to capture the $430 billion home repair market, which provides 20% plus returns at scale.

GreenSky has also created a network of more than 10,000 salespeople with whom it works to transact and engage customers at the point of sale. This segment could also be valuable in the future. Goldman already offers many capital markets and investment banking products that it could sell to these customers.

And who knows, maybe at some point the bank will expand its consumer franchise into business banking. Of course, this is not projected or anticipated, but this segment could be a great starting point if Goldman ever decides to do so.

Second, it would help improve the bank's stability.

Most fintech companies tend to struggle to generate the profitability and returns that shareholders want because they are acting as a bank without being a licensed bank. Not being a bank has its advantages, most notably less regulatory oversight, which allows these fast-moving technology companies to be more nimble and acquire customers in a much more efficient way than a traditional bank.

But the disadvantage is that fintechs cannot collect cheap deposits to finance loans and therefore have to count on partner banks and warehouse space, which increases the cost of financing. GreenSky also relies on partner banks for its loans, which probably costs them as well.

With the backing of a major bank like Goldman, GreenSky won't have to worry as much about the financing aspect, especially if Marcus proves successful in collecting deposits. The bank will also probably be able -- if it wants to -- to put these high-interest loans on its balance sheet and collect regular monthly interest payments.

This is more profitable than selling loans for fees, on which GreenSky earns most of its income. Goldman will also be able to offer GreenSky more resources to improve its technology platform.

Well, third, it's a pretty good purchase price.

Goldman's $2.2 billion offer sent GreenSky's stock soaring more than 50 percent, but the purchase price is not such a crazy valuation for a somewhat promising fintech company operating on a "buy-now-pay-later" basis, a sector that is now attracting a lot of investor interest. On a prospective basis and after the Goldman announcement, GreenSky currently trades at 3.8 to sales, 20 to earnings, and 14.3 to earnings before interest, taxes, depreciation, and amortization (EBITDA).

As Marcus and the consumer banking franchise seem to be on the right track, this Goldman deal is to everyone's liking. It offers the consumer banking business a whole new customer base with a low acquisition rate to which it can hopefully cross-sell its other consumer banking products. In addition, the price Goldman is paying is reasonable, given how large the bank is and how the bank's stability should make GreenSky's operations more efficient and profitable.

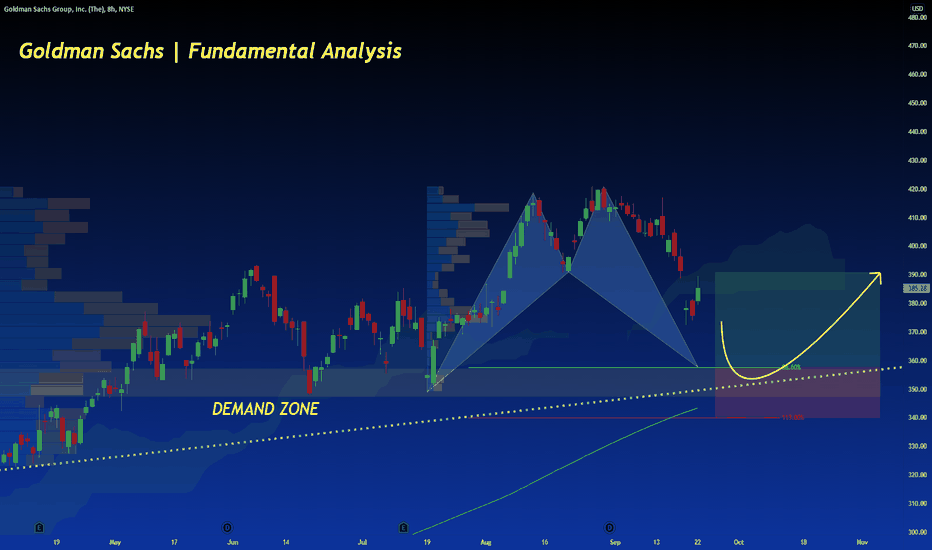

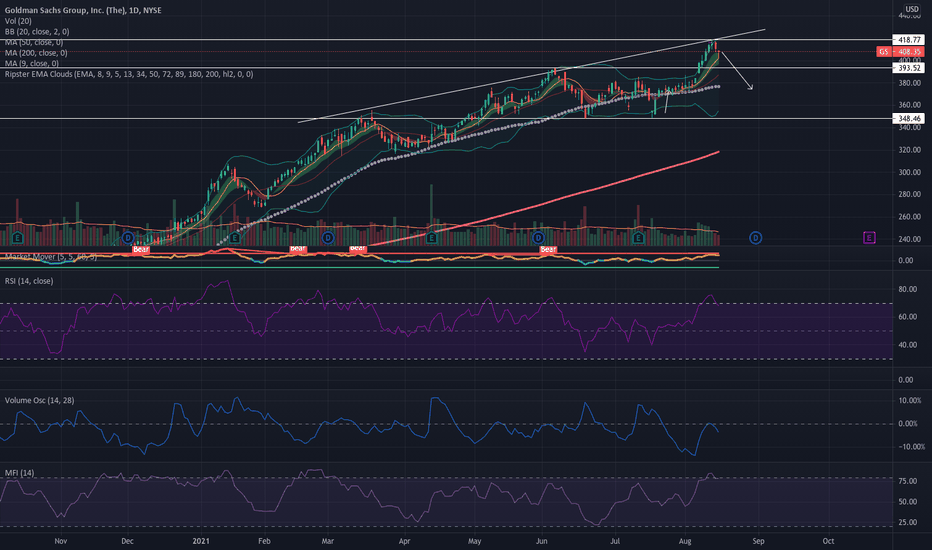

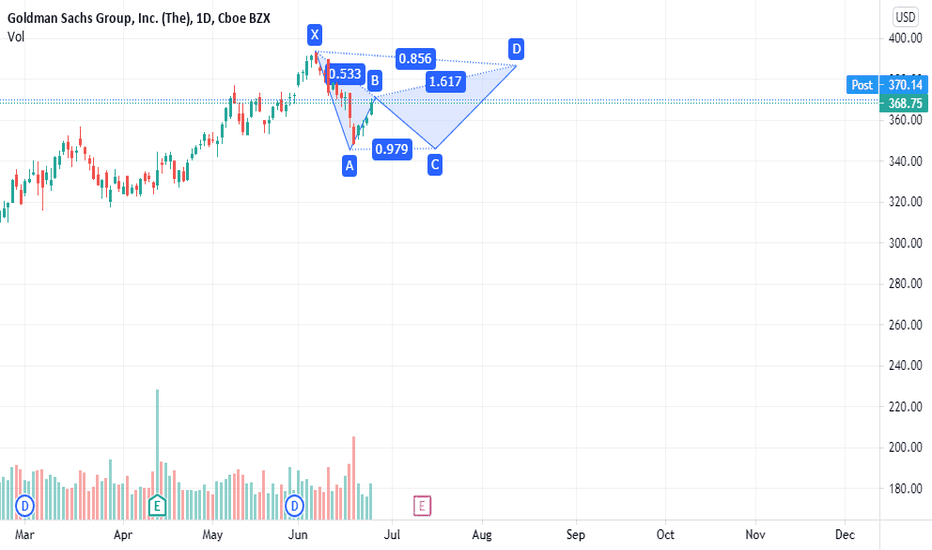

GS trade ideas

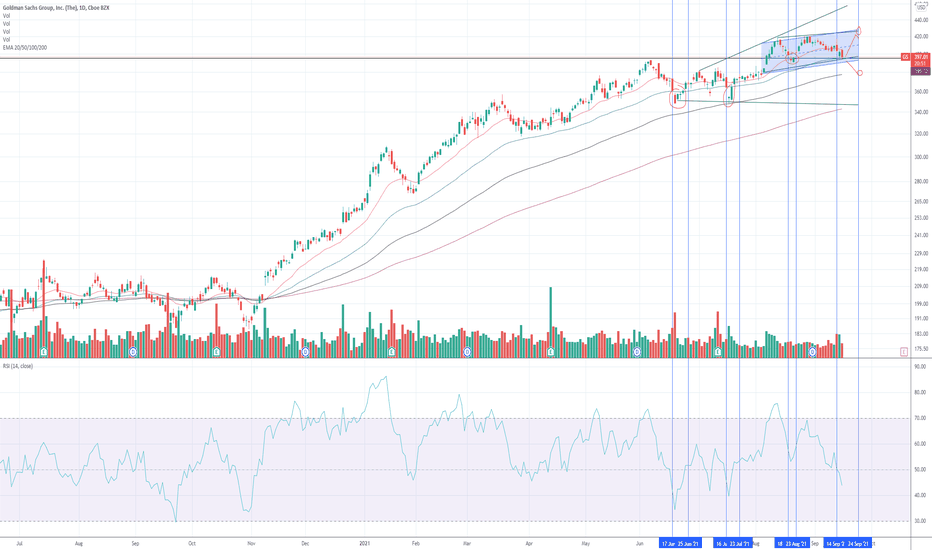

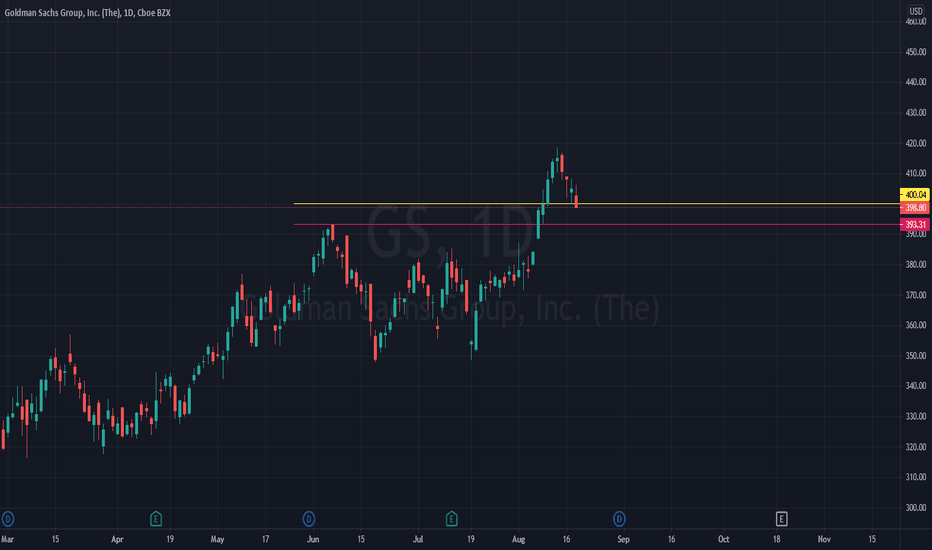

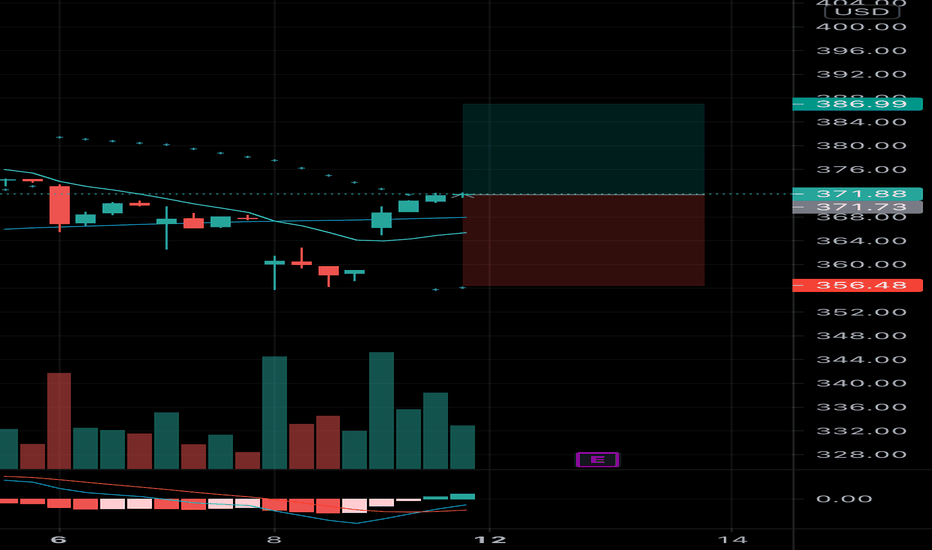

GS Daily TimeframeSNIPER STRATEGY (new version)

It works ALMOST ON ANY CHART.

It produces Weak, Medium and Strong signals based on consisting elements.

NOT ALL TARGETS CAN BE ACHIEVED, let's make that clear.

TARGETS OR ENTRY PRICES ARE STRONG SUPPORT AND RESISTANCE LEVELS.

ENTRY PRICE BLACK COLOR

TARGETS GREEN COLOR

STOP LOSS RED COLOR

DO NOT USE THIS STROTEGY FOR LEVERAGED TRADING.

It will not give you the whole wave like any other strategy out there but it will give you a huge part of the wave.

The BEST TIMEFRAMES for this strategy are Daily, Weekly and Monthly however it can work on any timeframe.

Consider those points and you will have a huge advantage in the market.

There is a lot more about this strategy.

It can predict possible target and also give you almost exact buy or sell time on the spot.

I am developing it even more so stay tuned and start to follow me for more signals and forecasts.

START BELIEVING AND GOOD LUCK

HADIMOZAYAN

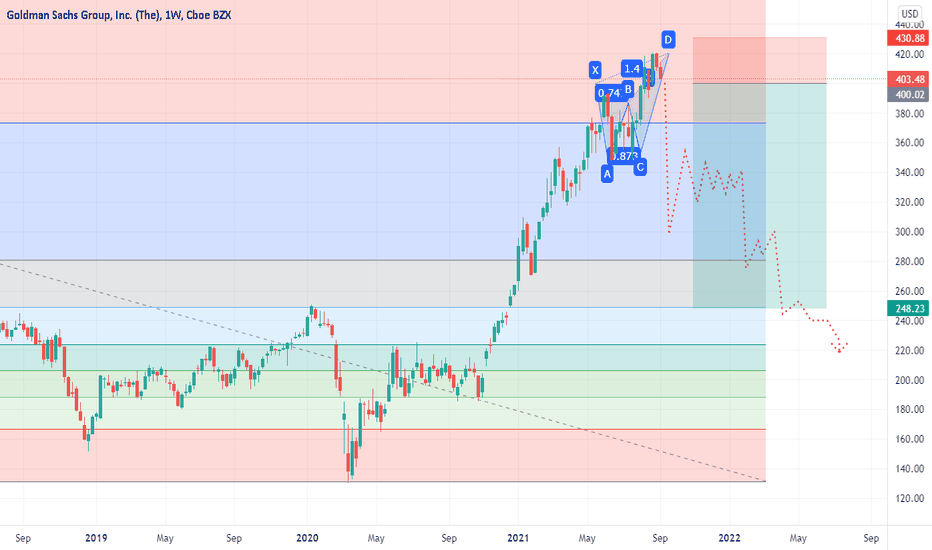

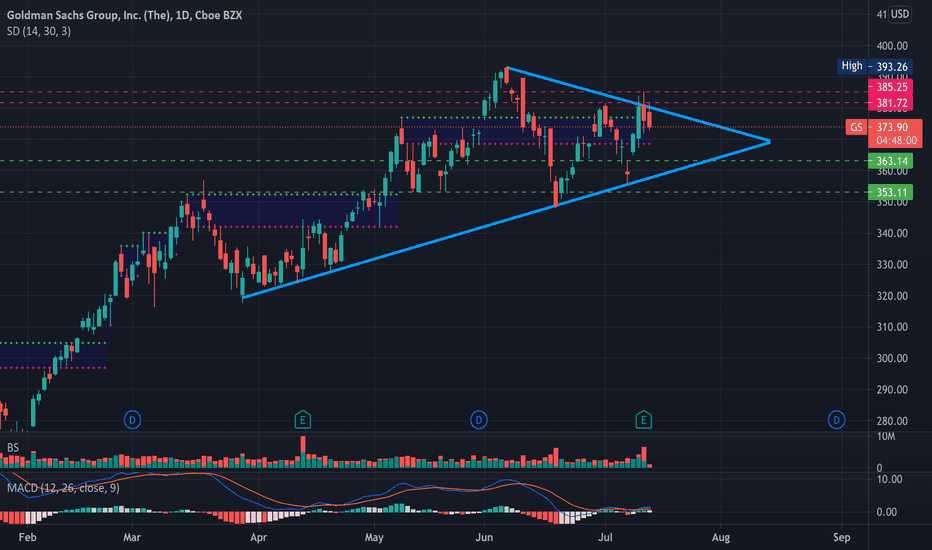

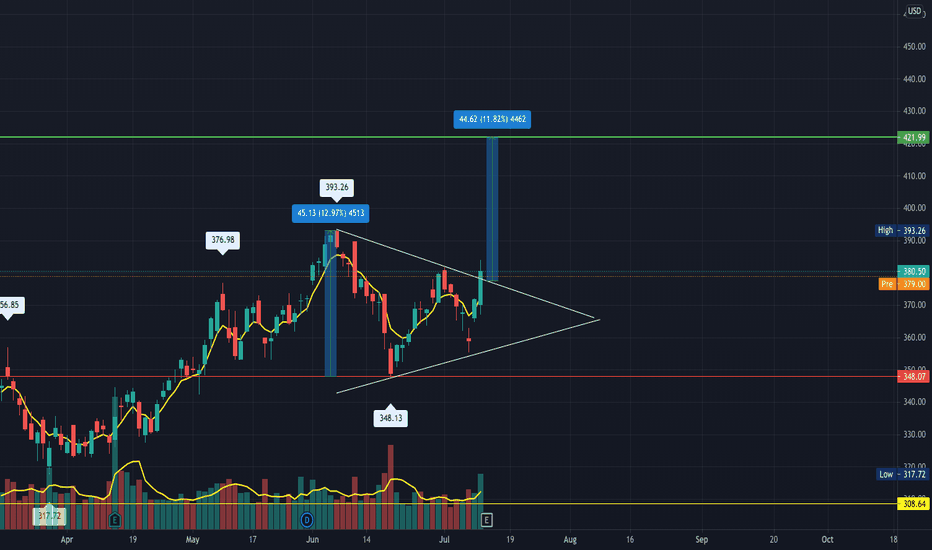

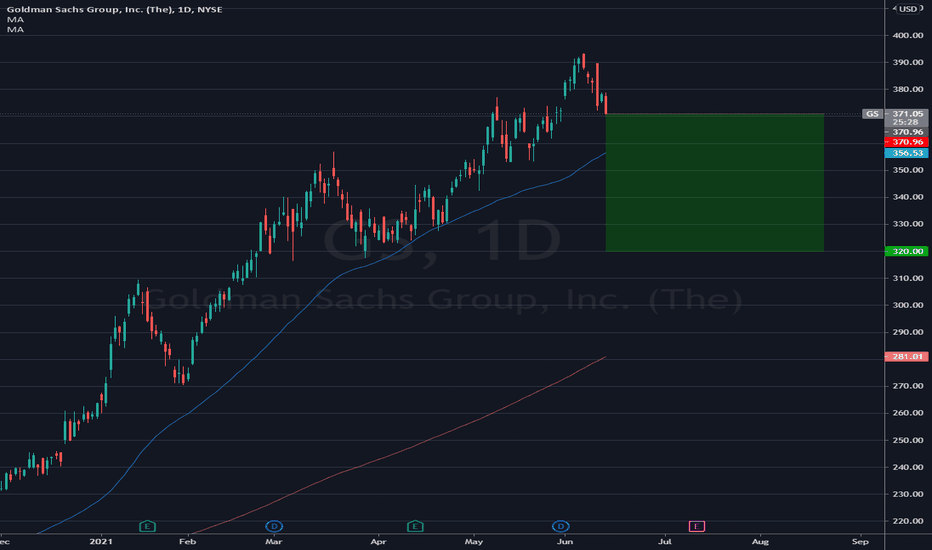

The case for the Goldman short.You can't short companies just because you think they are abhorrent (You just give your money to people you'd not like), but just for the record - I don't like GS. Been waiting a while for the shorting opportunity to set up in GS.

GS has been hy6per parabolic through the last swing. A common trait of a blown-off top. These moves often terminate in the 161 extension area of the previous fall. There can be some false breakouts but when the market gets back under the 161 the sellers come in hard and strong.

We have a bearish butterfly completing. The butterfly and the head and shoulders are two of the most common false breakout patterns I tend to see around large inflection points. When I see a butterfly here I am usually willing to speculate not only the butterfly will drop the market but also that the break it makes will develop into a second trade. The price action I am looking for here is there to be a hard sell-off. A breaking of the range and harmonic low. The market slowly ranging for a while (Probably at least a few days) and then a hard second break - which is where we'll be into the meat of the downtrend.

This is similar to a previous BTC forecast, which is linked for an example.

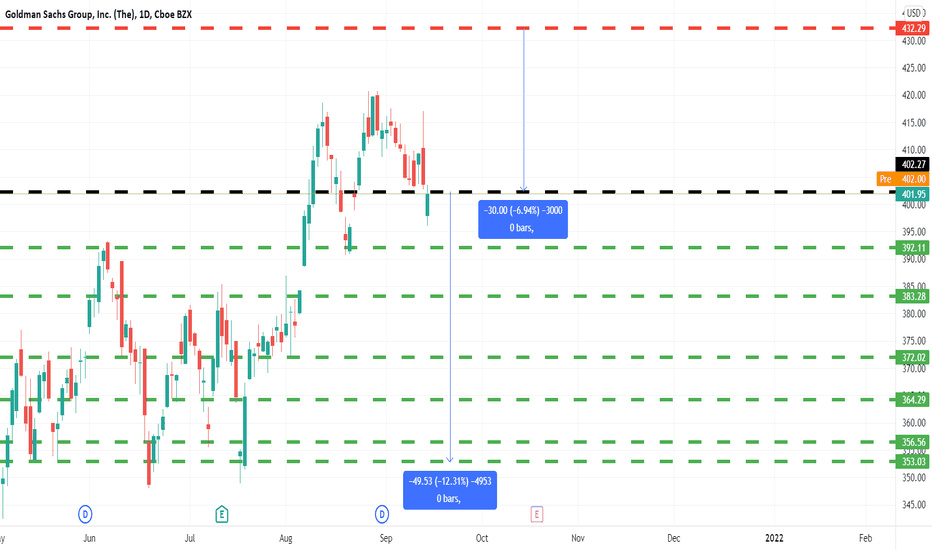

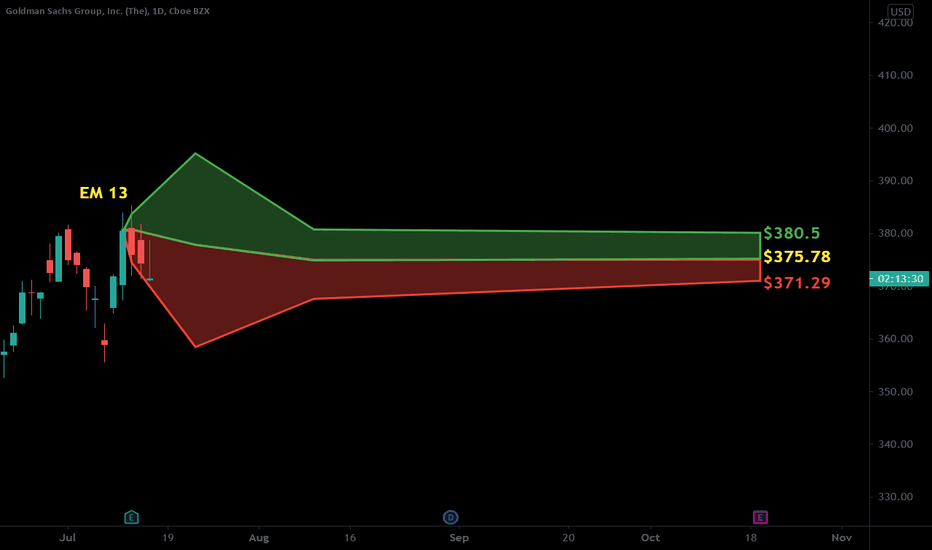

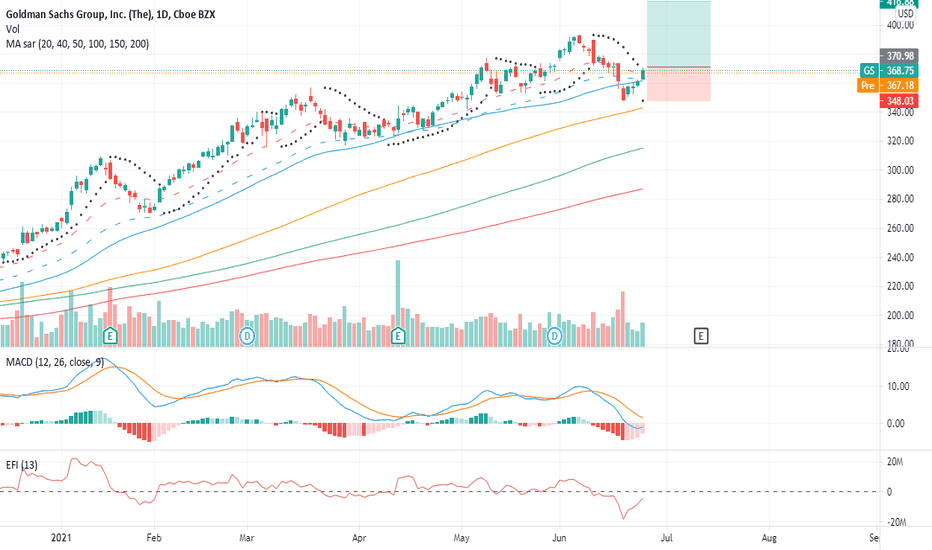

$GS with a Neutral outlook following its earnings #Stocks The PEAD projected a Neutral outlook for $GS after a Positive over reaction following its earnings release placing the stock in drift B

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

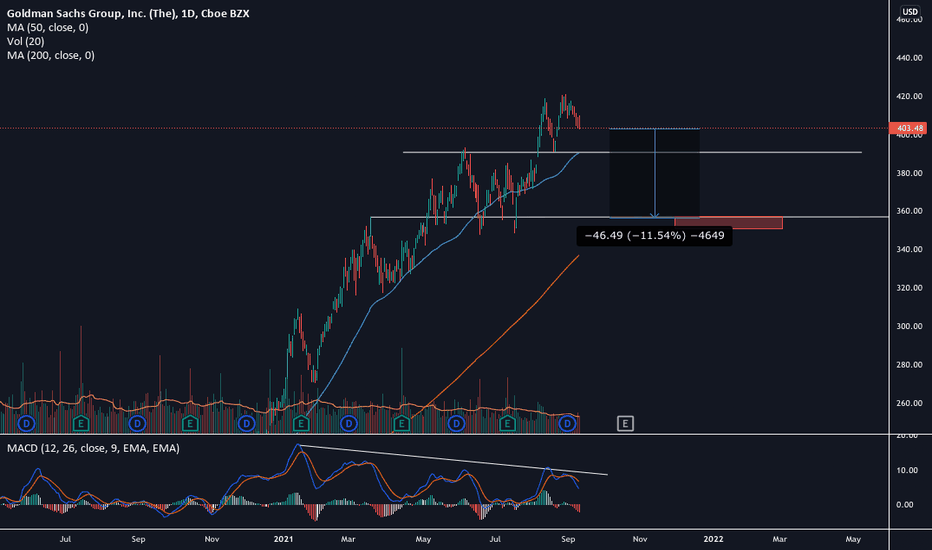

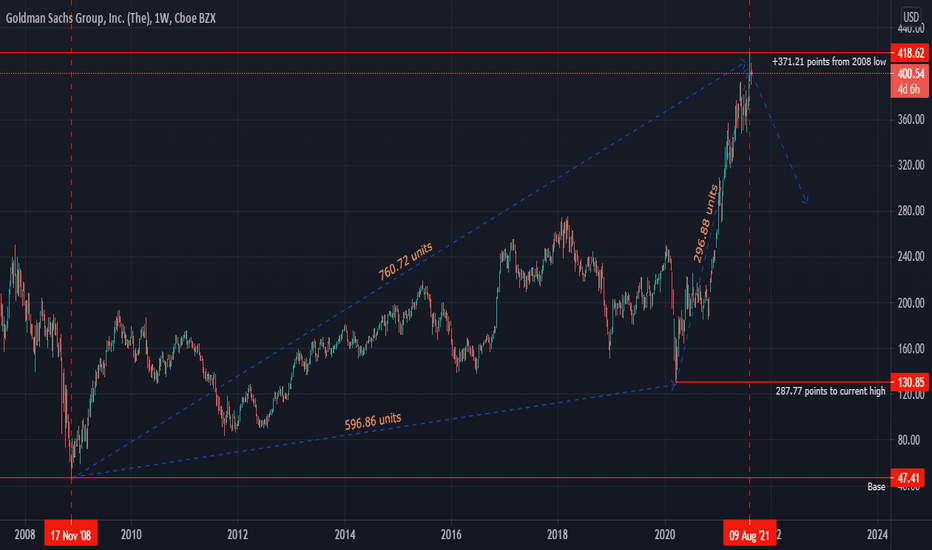

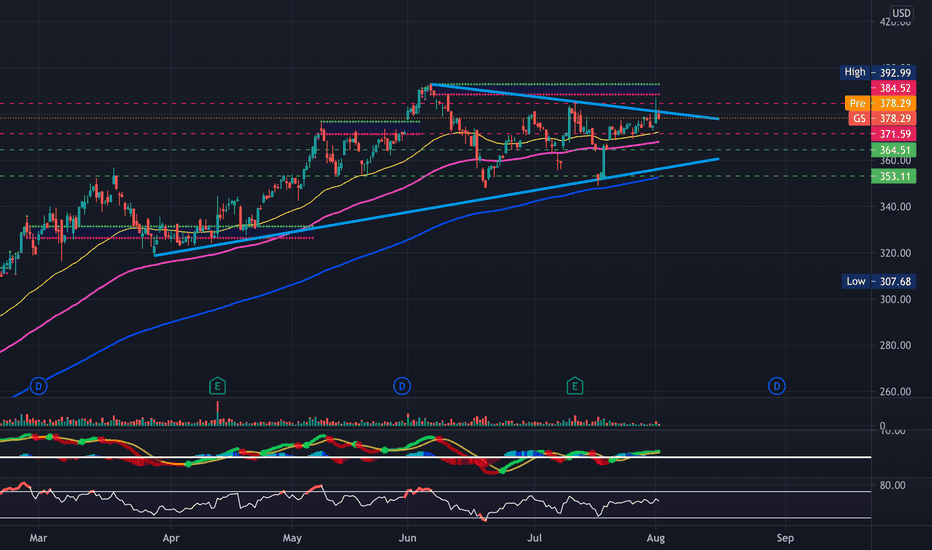

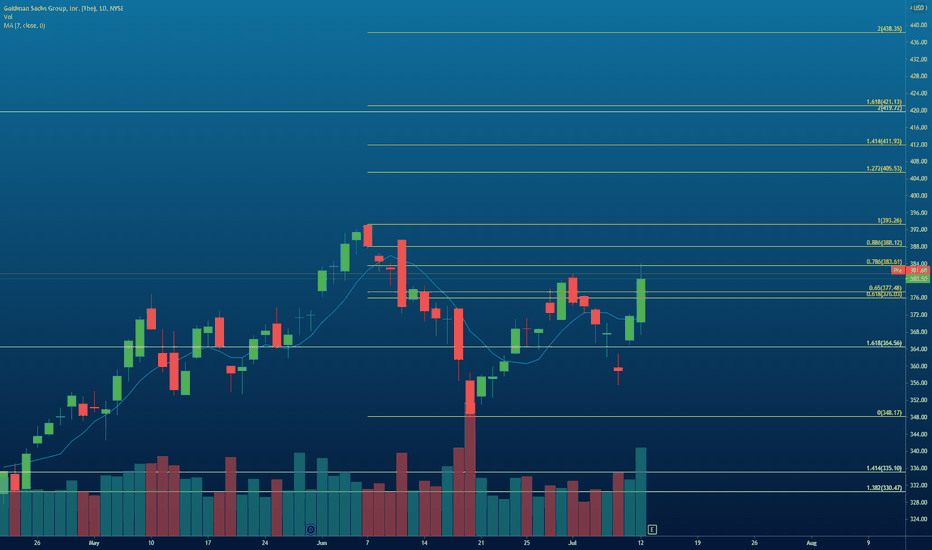

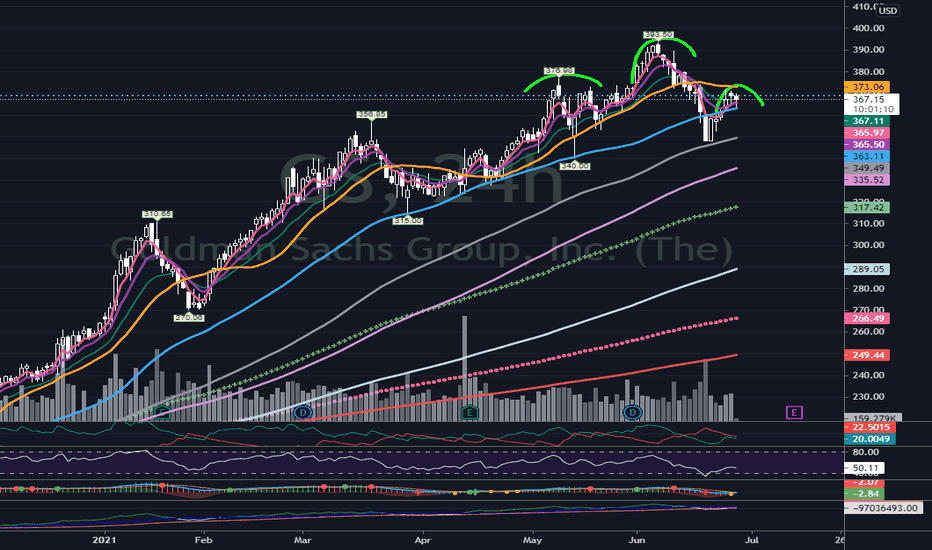

$GS Goldman Sachs Fibonacci Levels

Hopefully you find the chart helpful in terms of Supports & Resistance etc.

we refrain from adding commentary on the chart as that is reserved for our members and we are very conscious of not giving financial or trading advice.

Thank you for taking time to consult our chart and we would really appreciate a like, follow or comment.