GS trade ideas

Goldman Sachs Anti Set UPGS seems to be attracting demand recently. The trend down is losing momentum and it might just be the time to enter an anti set up here for a modest 1.5-2R target. Though sellers can enter this market any time, it seems more probable that bulls will take this higher to the Warning Line.

GS - HS& formation short from $236.83 to $19.13 GS seems forming a possible downward neckline H&S formation. Twiggs money flow deep in the negative side. Now if it can break its neckline around 236, it can decline down to 220 area.

* Trade Criteria *

Date First Found- April 26, 2018

Pattern/Why- H&S formation

Entry Criteria- $236.83

Exit Criteria- $219.13

Stop Loss Criteria- $246.77

Indicator Notes- Twiggs money flow deep in the negative.

Special Note- $225 July Puts which are currently reported to be $4.80

Please check back for Trade updates. (Note: Trade update is little delayed here.)

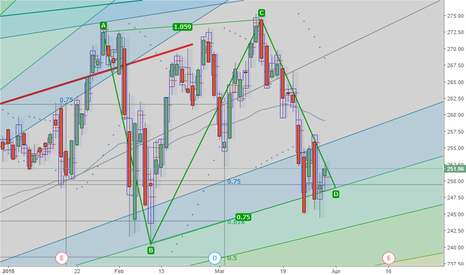

GoldmanSachs ready to shine..? This is one of my shorter time scale predictions heading into the earnings reports coming up.

With all the volatility we have managed to open a couple of more postions during the beginning of the week that are already in the green, these are set with a x1 leverage on our PI profile on eToro (Willscuba).

We currently have a reducing wedge but have seen some drawdowns recently to geo-politics. Making this a good time to increase our exposure by a small margin.

The earnings report is due April 17 before the bell.

The whisper on the street is $6.03 where as the consensus is $5.67.

If the numbers come through better than expected for JPMorgan due this friday before the bell then that should start the ball rolling for all the other financial sector stocks that we are currently holding as they usually trade in sympathy if the first few do well -unless there is a really big red herring that crops up-.

Even if the earnings disapoint we still have almost 20% free in the portfolio to capitalize on the dips that could occur just like we have with all the trade war news and potential rate hikes.

NYSE:GS

GS - Bullish Put Weekly Put Spread (OTM)Symbol: Goldman Sachs or GS

Current Price: $252.19

Short Put

SELL/WRITE

Option: 13th April $245.00 Put

Price per option: $1.09

Contracts: #5 x 100

Total cost: $109

Long Put

BUY

Option: 13th April $242.50 Put

Price per option: $0.77

Contracts: #5 x 100

Total cost: $385

Spread: Net debit/credit: $ 0.32 (net credit)

Entry cost: $160 (next credit/you get in account NOW)

Max. Risk: $1090

Max. Return: $160

Break evens at expiry: $244.70