GS trade ideas

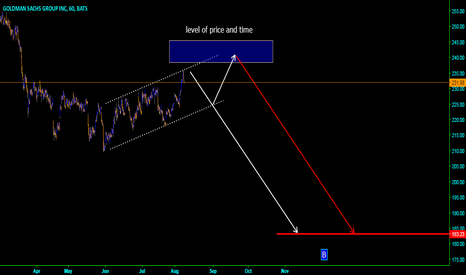

GS inside day after earningsGS has a inside day after earnings, and it's one of my favorite trade!

The stock futures had a little bit plunge this afternoon as the news about Spain, while in terms of inside day, we won't be afraid of news.

What we focus on more is the direction it breaks.

If it's able to break to the upside, it means it shows great relative strength and it's still a nice long; If it breaks to the downside, then it will pretty much be a short-term trade as I am not bearish with the stocks yet.

Also, there is a potential bat pattern entry

I drew this kind of pattern several times as it can give different strategy depending on different kinds of scenario, so I have a clear mindset to deal with the unpredictable market movement.

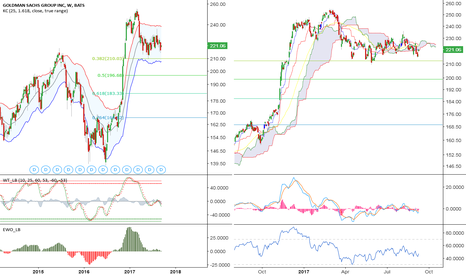

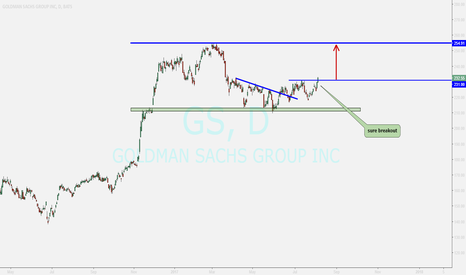

Goldman Sachs: QuestionableThe current consolidation occurs with in the primary uptrend. Normally we would be quite bullish on such a stock, but the current flat correction is taking too long for comfort. Earlier attempts to make a push higher have not succeeded and the lack of demand while the broader market is flirting with new highs does not match the trend phase.

With considerable scepticism and caution we look to the upside as long as 210 holds as critical support. Buying is only justifiable when the trigger at 230.90 is taken out. Target then comes in at 264.50 with 250 being intermediate resistance.