GS trade ideas

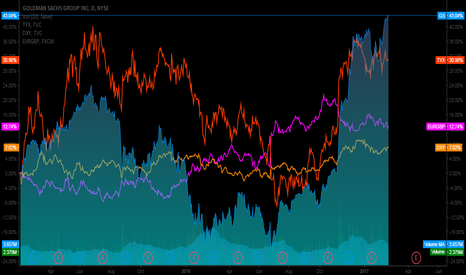

I MADE THIS TRADE EARLIER TODAY BUT DIDN'T HAVE TIME TO PUBLISH GOLDMAN RARELY TRADES BELOW THE LOWER BOLLINGER BAND, LET ALONE STAYS THERE FOR DAYS AT A TIME. THIS IS ONE OF THE FEW TIMES IT HAS AND IS DRAMATICALLY OVERSOLD AS WELL AS BEING THE CLASS OF THE GROUP. IT IS ALSO THE MOST HEAVILY WEIGHTED EQUITY IN THE DOW, RESPONSIBLE FOR $106 OF THE $307 PT DECLINE FROM THE TOP (THRU FRI). I BOUGHT THE GS 4/7/232.50 CALLS @ $1.51 (CLOSED $1.29)WHILE THE STOCK RALLIED 5 OFF THE LOW AND 1.50 FROM THE HIGH...A GREAT SETUP FOR TOMORROW...OZ

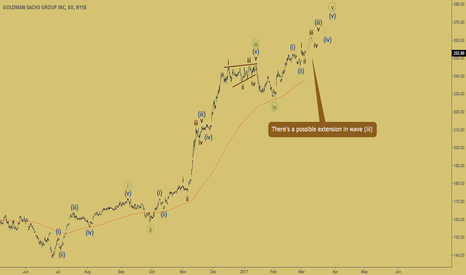

Long Goldman Sachs Group Inc.we ile a lot the set up for this stock. The 230 support looks like its working fine, we would be looking for long positions towards the 252-254 support. We are looking for a last bull rally in the markets before a massive sell off in the third and fourth quaters of this year

Goldman Sachs 'Agnostic' On Gold PricesGoldman Sachs analysts say they are “agnostic” toward gold, looking for the price a year out to be only slightly above current levels.

Gold has rallied a little more than $100 an ounce since the metal hit its December low, with Goldman saying the bounce has been in line with other market moves, such as long-dated U.S. real interest rates, and shifts in sentiment towards U.S. growth and wealth creation.

One more push before we hit a soft patchA while back I published a chart of the Dow Jones suggesting the market had more upside potential and now I am showing you a chart of Goldman Sachs that is telling us we should see one more push before the market retreats with an unknown intensity. On thing for sure the next push up would be a good time to take some money off the table. An ideal target would be 261 where we have equality between wave (i) and (v) but the minimum requirement is just to push above 247.

While it would be great if GS just spike up right now, keep in mind there's no way to tell if its wave (iv) is over or not. So just be patient if we keep moving sideways for a little while.