IBM trade ideas

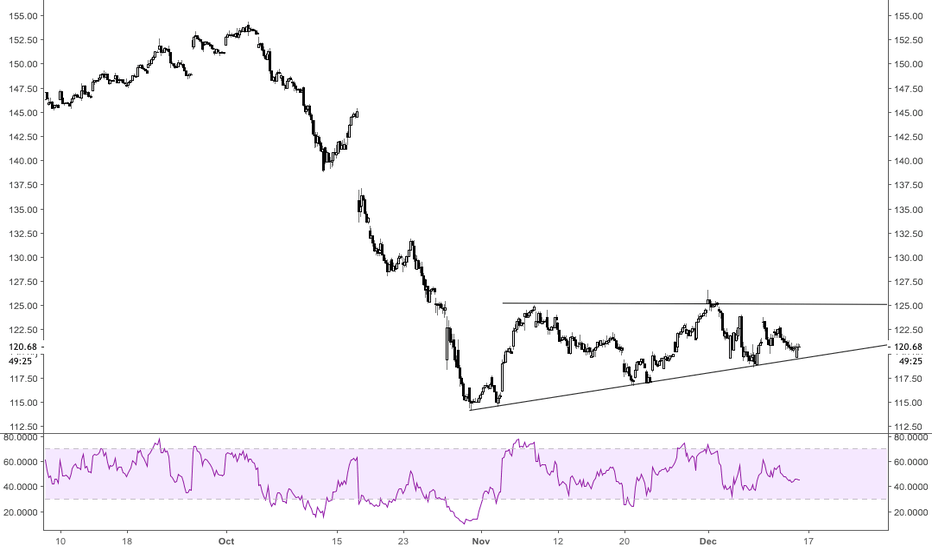

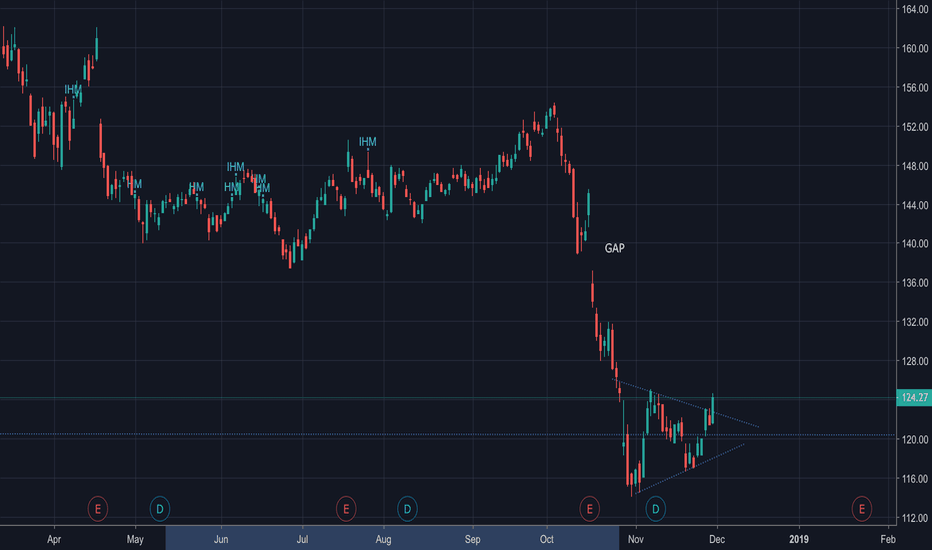

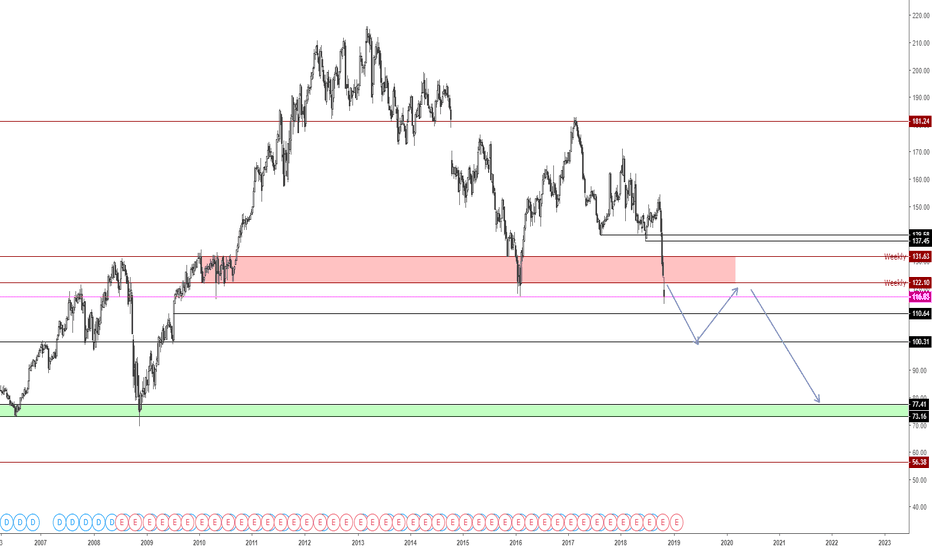

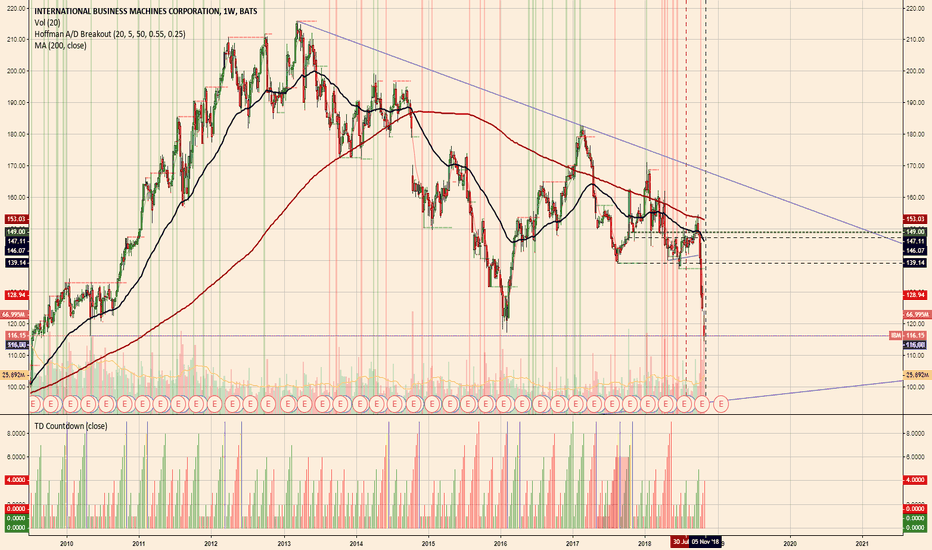

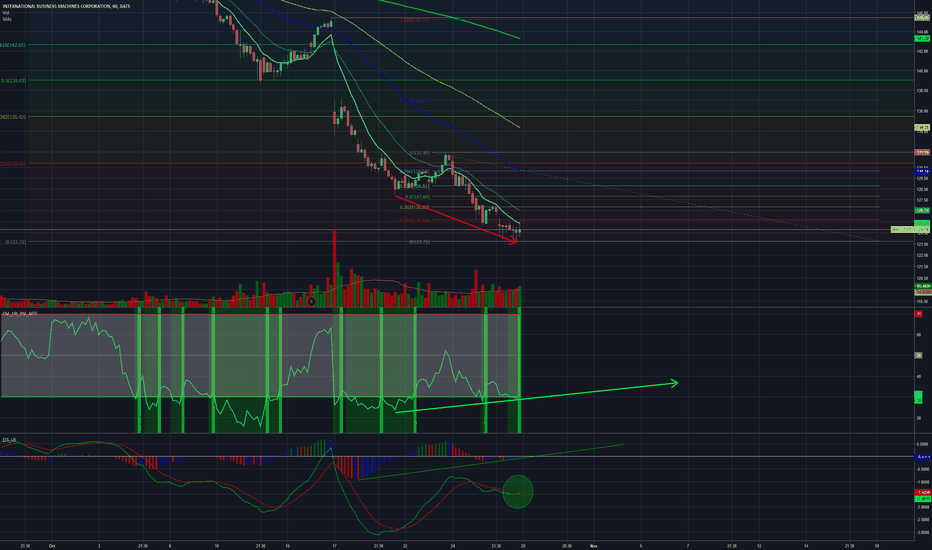

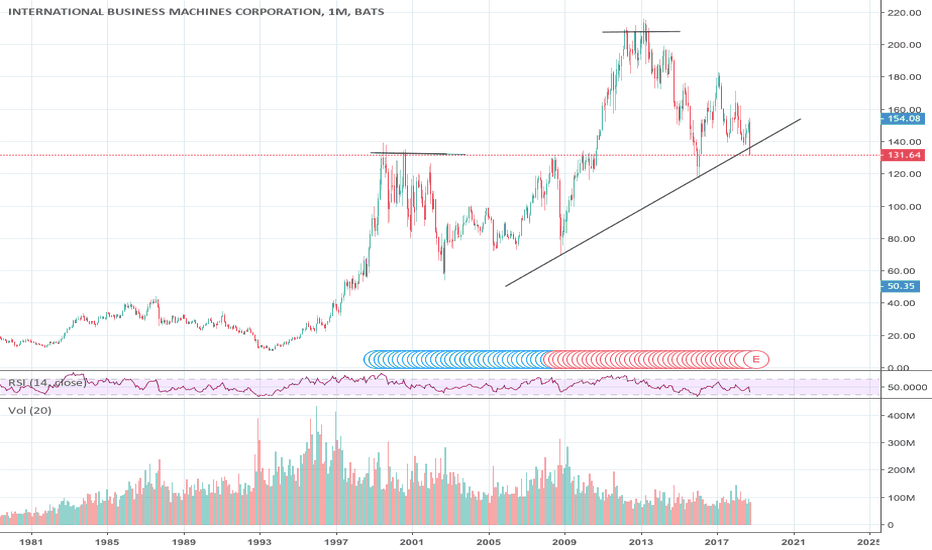

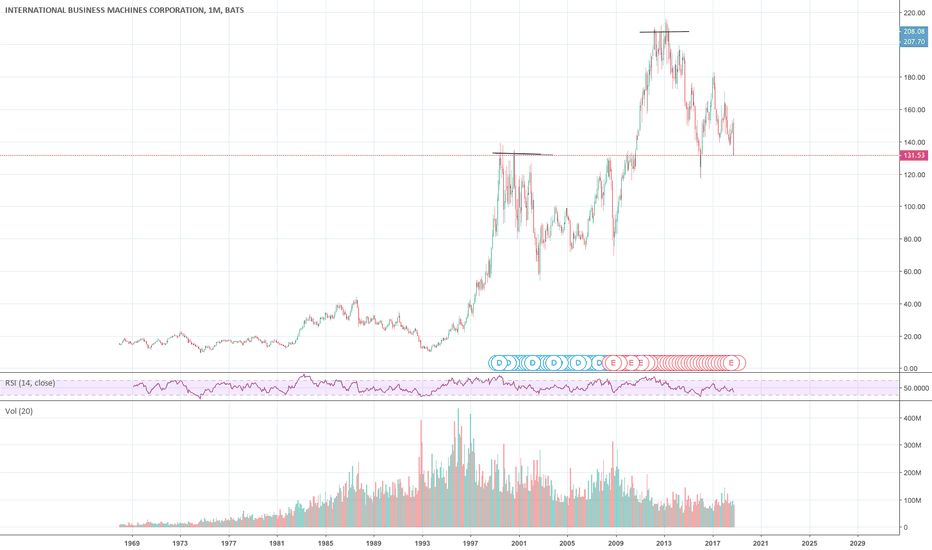

IBM Weekly analysisWith a typical sell on news on top on a market selloff IBM broke down the 122-131 OB that contains the biggest consolidation period in price

i've drawn the most probable scenario where price will assess the mentioned OB as resistance.

STRATEGIES RECCOMENDED

1. If price closes weekly above 123 it will create a SFP signaling LONG.

2. If you were SHORT you can move you SL to above 131 and keep an eye to the SFP

I am giving a neutral calification just because in case you want to play it at tomorrow open there is not trade with a decent RR.

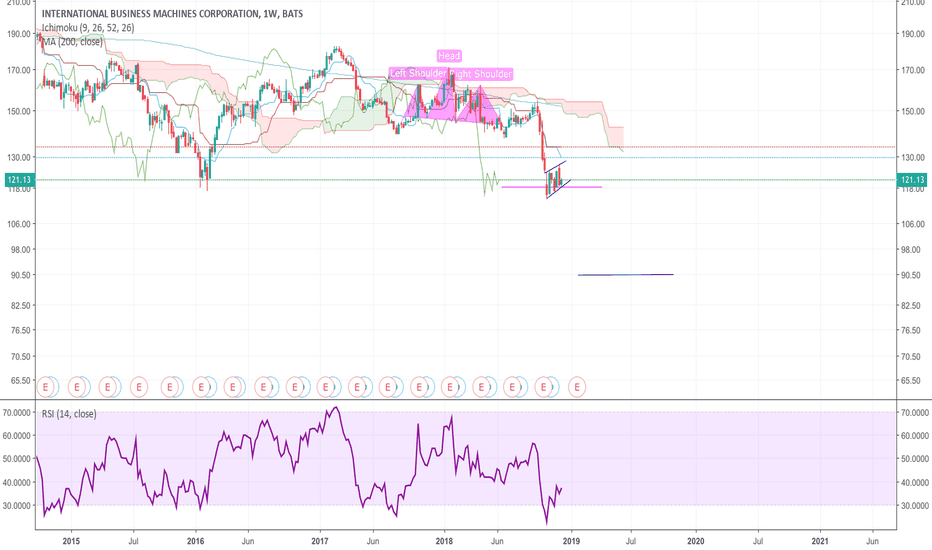

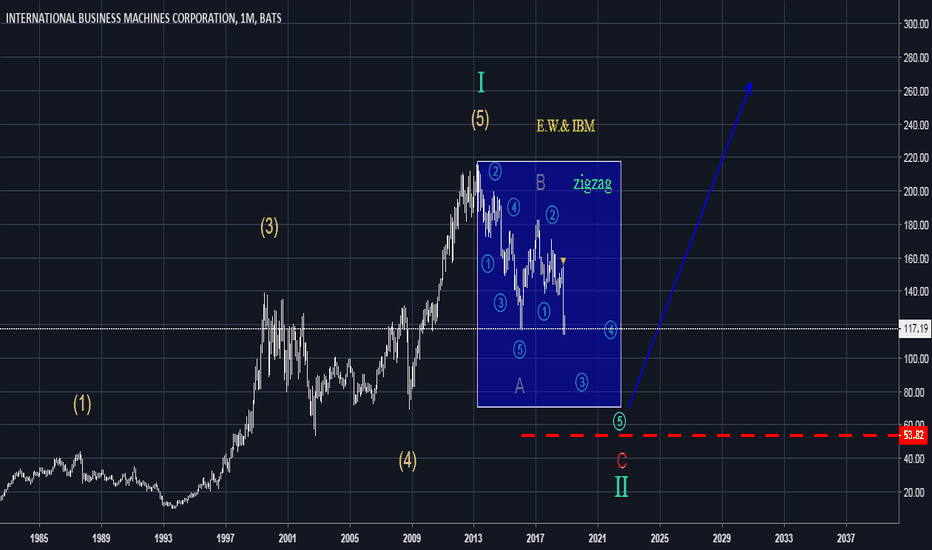

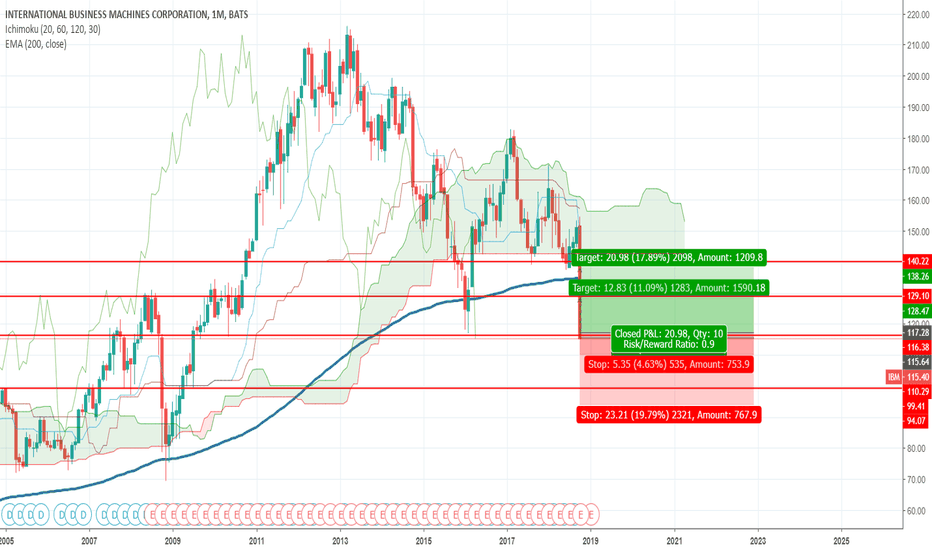

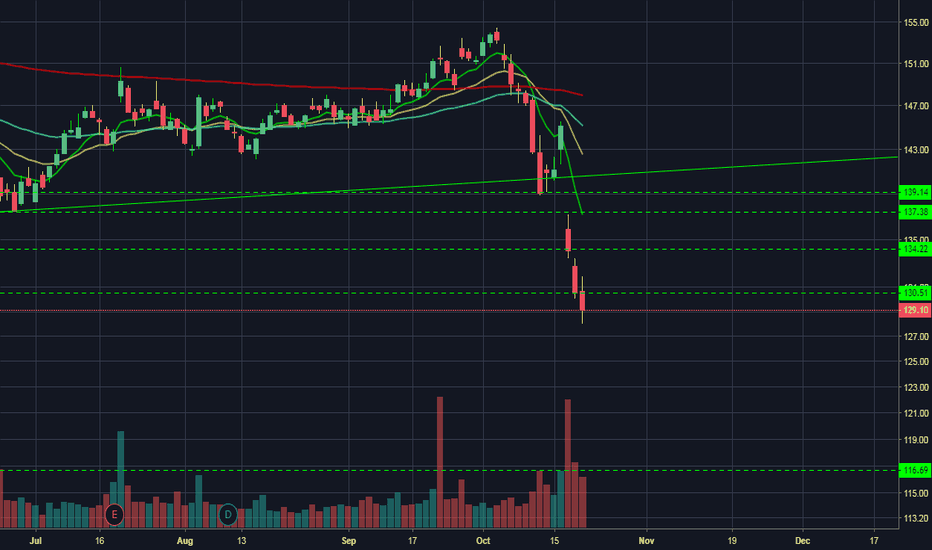

IBM oversold, potential rally comingEvery time the monthly RSI has dropped to todays levels over the last 16 years we have seen a rally. With a retrace of even the smallest run here (39.55%) we could expect a price target of 170. In consideration with the RHT acquisition this could be significantly higher. I don't usually chart off RSI alone so this is purely speculation. I'm not looking to trade options here but I'm buying the stock long.

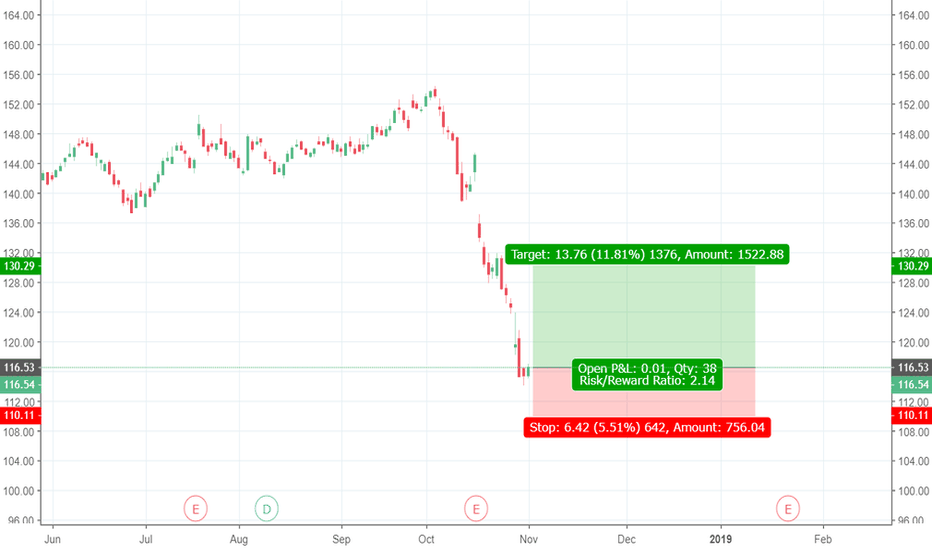

IBM - FREE MONEY!Dear Traders,

IBM has struck a deal to acquire cloud software company Red Hat for $34 billion.

IBM will pay $190 per share for the software company, which it described as the world’s leading provider of open source cloud software, a more than 60% premium to Red Hat’s closing stock price of $116.68 on Friday. Shares traded upwards of $175 in June, but disappointing earnings combined with a volatile market had seen the price drop sharply.

Here are the key points from the deal announcement:

IBM will acquire all of the issued and outstanding common shares of Red Hat for $190.00 per share in cash, representing a total enterprise value of approximately $34 billion.

JPMorgan advised IBM on the deal and provided most of the financing. Guggenheim Partners represented Red Hat on the deal.

IBM will remain committed to Red Hat’s open governance, open source contributions, participation in the open source community and development model, and fostering its widespread developer ecosystem.

IBM and Red Hat also will continue to build and enhance Red Hat partnerships, including those with major cloud providers, such as Amazon Web Services, Microsoft Azure, Google Cloud, Alibaba and more, in addition to the IBM Cloud.

Red Hat will join IBM’s Hybrid Cloud team as a distinct unit, preserving the independence and neutrality of Red Hat’s open source development heritage and commitment, current product portfolio and go-to-market strategy, and unique development culture.

Red Hat will continue to be led by Jim Whitehurst and Red Hat’s current management team. Jim Whitehurst also will join IBM’s senior management team and report to Ginni Rometty. IBM intends to maintain Red Hat’s headquarters, facilities, brands and practices.

“IBM will become the world’s #1 hybrid cloud provider, offering companies the only open cloud solution that will unlock the full value of the cloud for their businesses,” Ginni Rometty, IBM chairman and CEO, said.

“Joining forces with IBM will provide us with a greater level of scale, resources and capabilities to accelerate the impact of open source as the basis for digital transformation and bring Red Hat to an even wider audience – all while preserving our unique culture and unwavering commitment to open source innovation,” Jim Whitehurst, president and CEO of Red Hat, said.

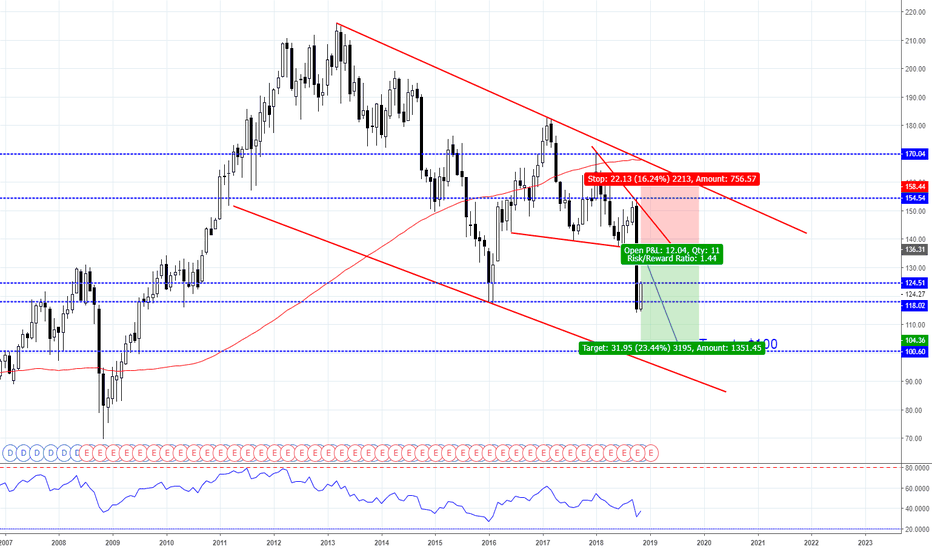

Let's talk about TA now:

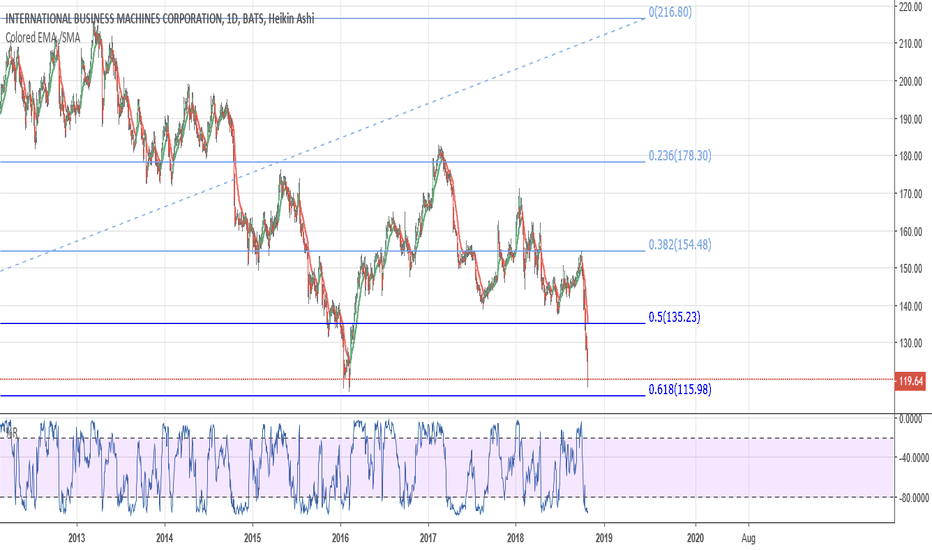

Weekly RSI is OVERSOLD !

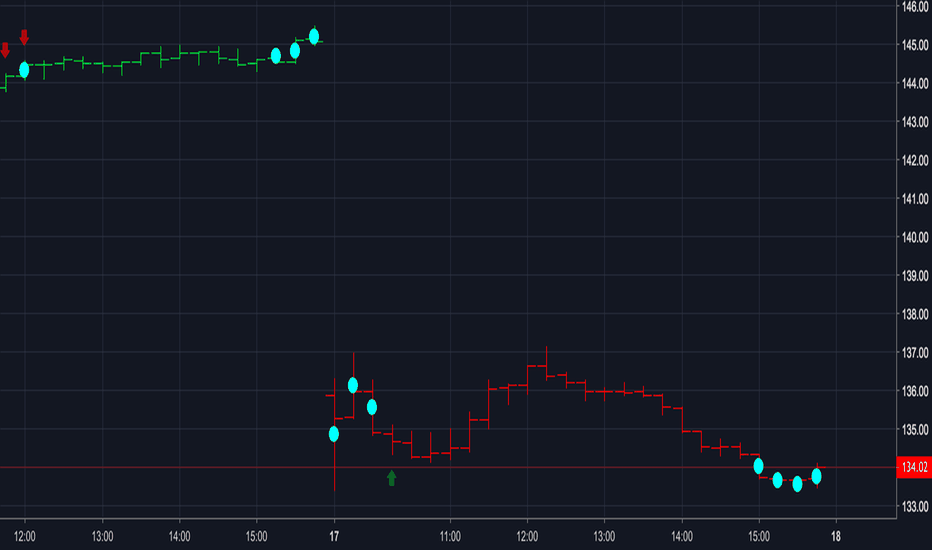

Daily looks superrr zweeeeet! I see a possible divergence!

Hourly chart confirms my Bullish Divergence.

This is free money.

Key resistance points: 132$ - 145$

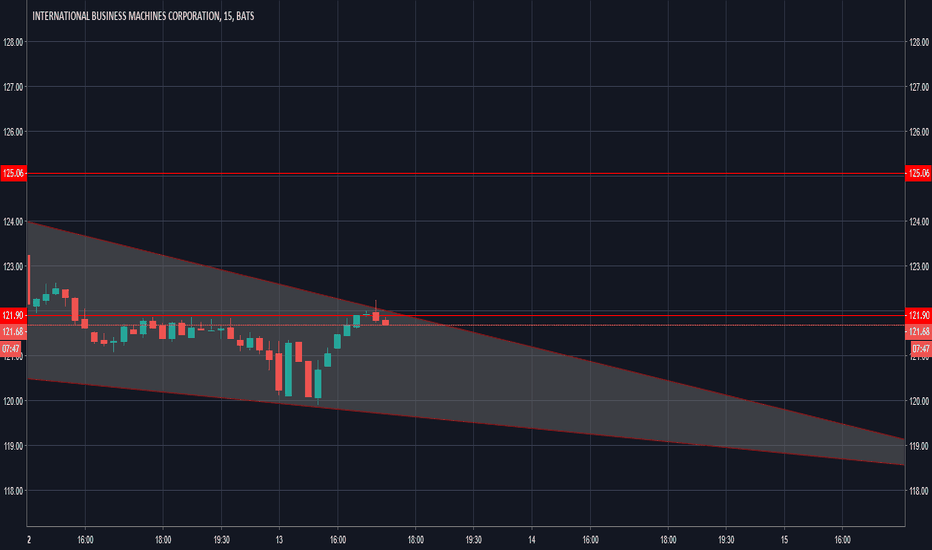

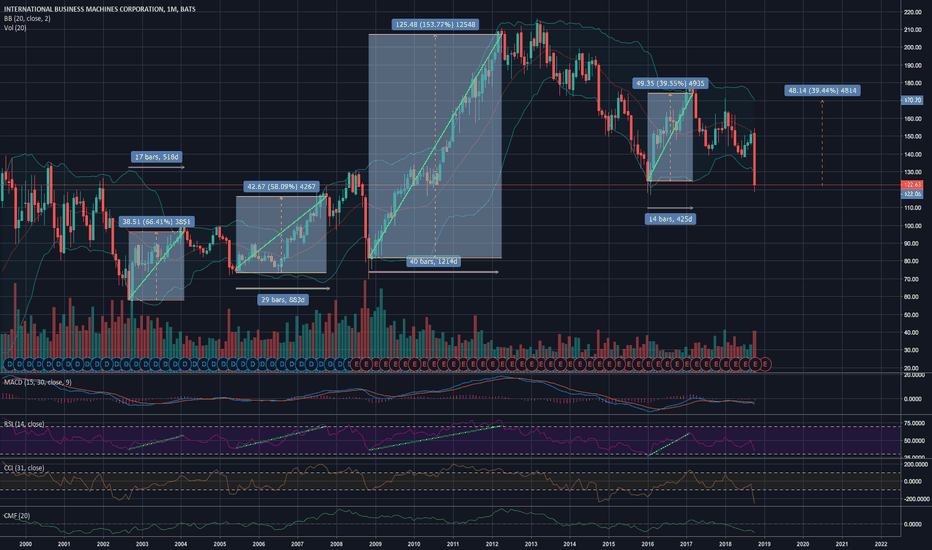

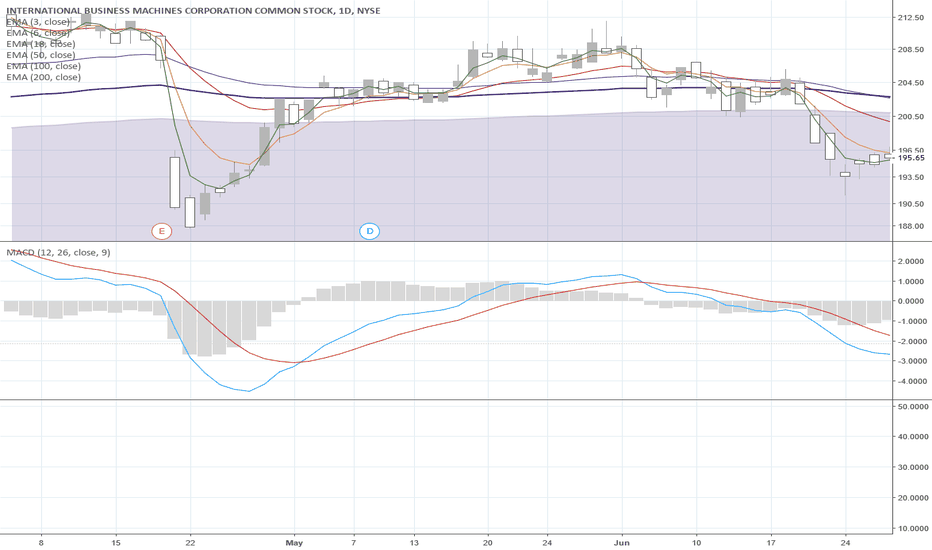

MACD IBM May-Jun 2013 In the candlestick chart at the top you'll see daily interval prices of IBM corporation with a layover of the 12 and 26 period exponential moving averages. In the lower portion of the chart you'll see the MACD indicator, the slower 'trigger line' or 9 period Simple moving average, and the zero line around which the first two oscillate.

The typical default parameters for the MACD are most commonly 12/26/9, meaning the MACD plots the difference between the 12 and 26 (12-26) Exponential moving averages. The 9 parameter represents the 9-period Simple moving average of the MACD calculation.

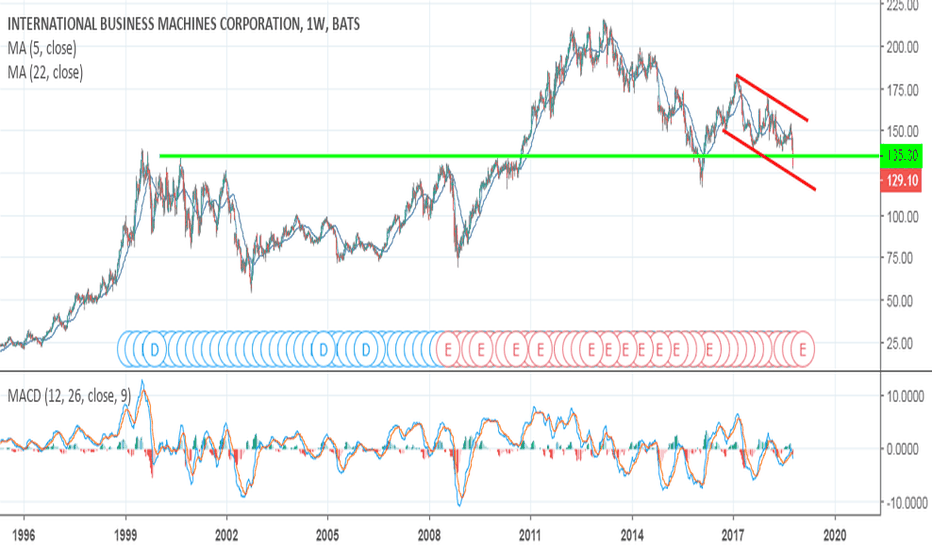

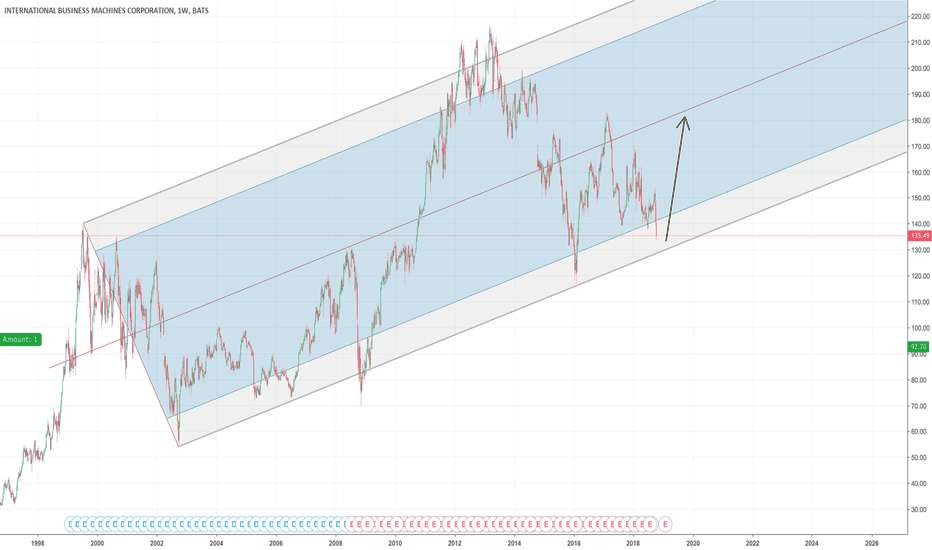

IBM is Testing Major Support Level of the 18 Year TrendPrice is heading to final support level of the bullish channel, which spans all the way back to the year 2000. Today price fell by as much as 5%, as IBM Q3 report shows slowdown in revenue growth. With dividend yield at 4.3% and PE below 12, IBM looks more and more attractive as a long term investment. Nevertheless, price could fall further to the final support level, potentially to 130.00.