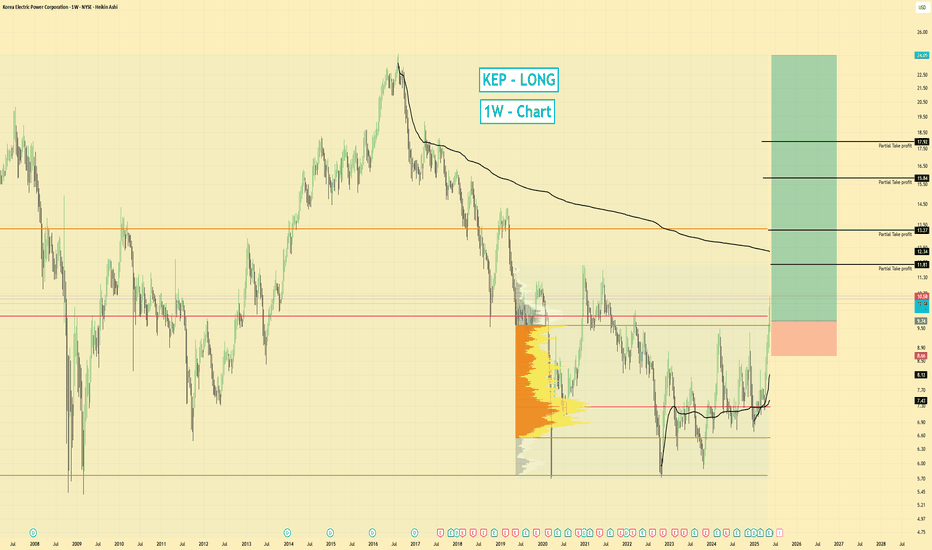

KEP | Long | Momentum Breakout from Volume Zone | (May 2025)KEP | Long | Momentum Breakout from Volume Zone | (May 2025)

1️⃣ Short Insight Summary:

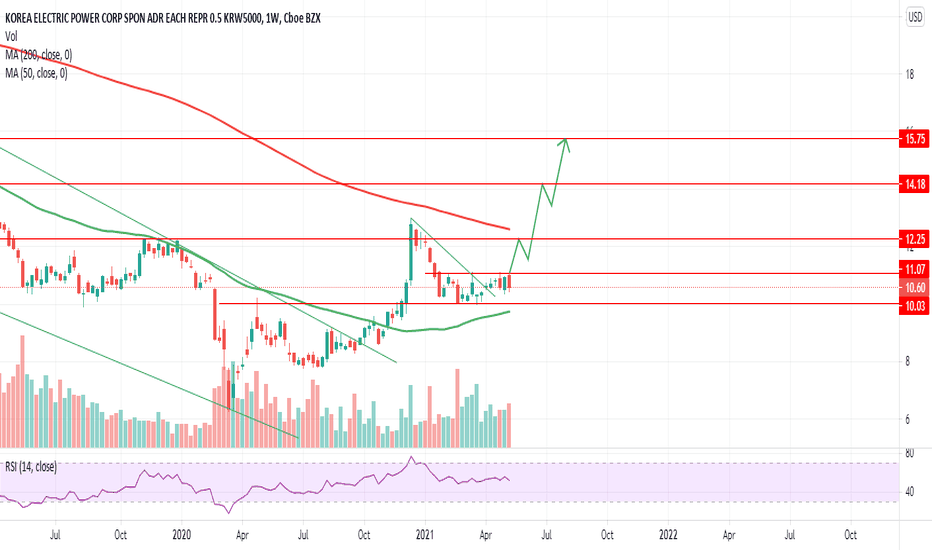

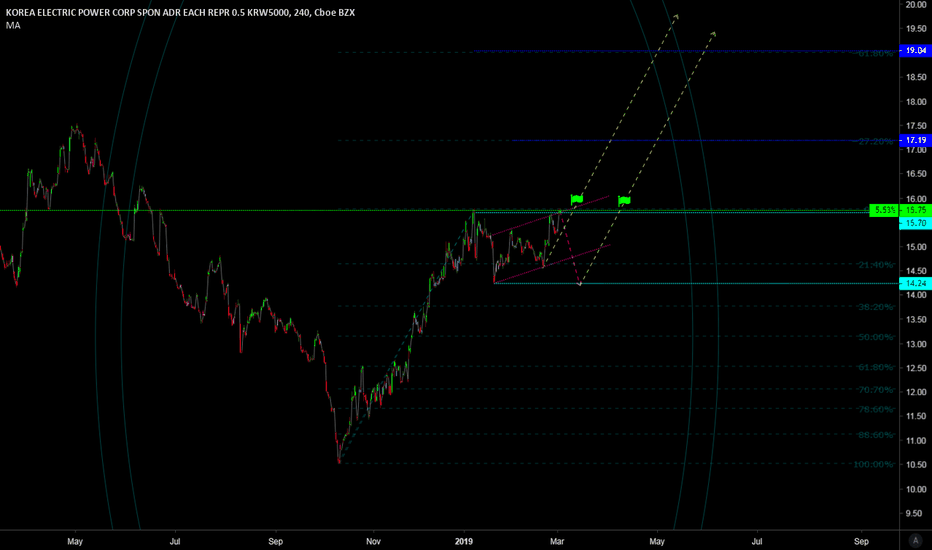

Korea Electric Power (KEP) is breaking out of a major volume area with strong momentum. After clearing a key point of control on the 3D chart, the stock looks like it's gearing up for much higher levels. Weekly

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.51 USD

2.56 B USD

68.49 B USD

1.28 B

About Korea Electric Power Corporation

Sector

Industry

CEO

Dong-Cheol Kim

Website

Headquarters

Naju-si

Founded

1961

ISIN

US5006311063

FIGI

BBG000BCWG90

Korea Electric Power Corp. engages in the development of electric power resources. It operates through the following business segments: Transmission and Distribution, Electric Power Generation (Nuclear), Electric Power Generation (Non-Nuclear), Plant Maintenance and Engineering Service, and Others. The Transmission and Distribution segment consists of operations related to the transmission, distribution and sale of electricity to end-users. The Others segment refers to the company's foreign operations. The company was founded on December 31, 1981 and is headquartered in Naju-si, South Korea.

Related stocks

RiskMastery's Breakout Stocks - KEP EditionWelcome to RiskMastery's Breakout Stocks - Stocks with breakout potential.

In this edition, we'll be looking at NYSE:KEP ...

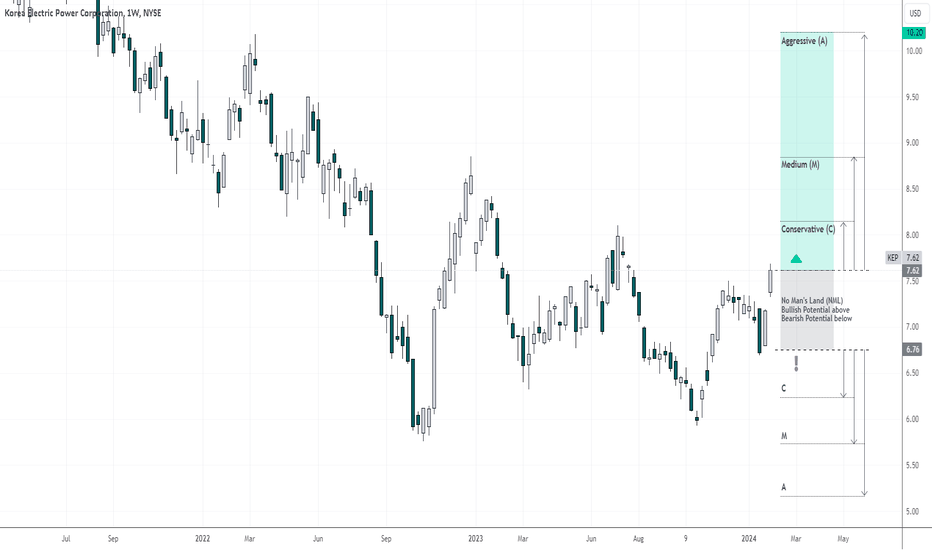

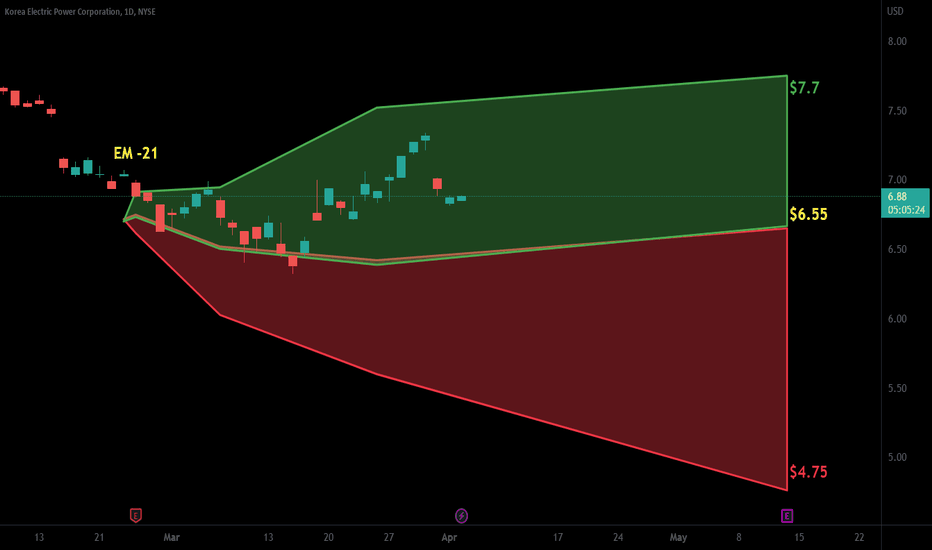

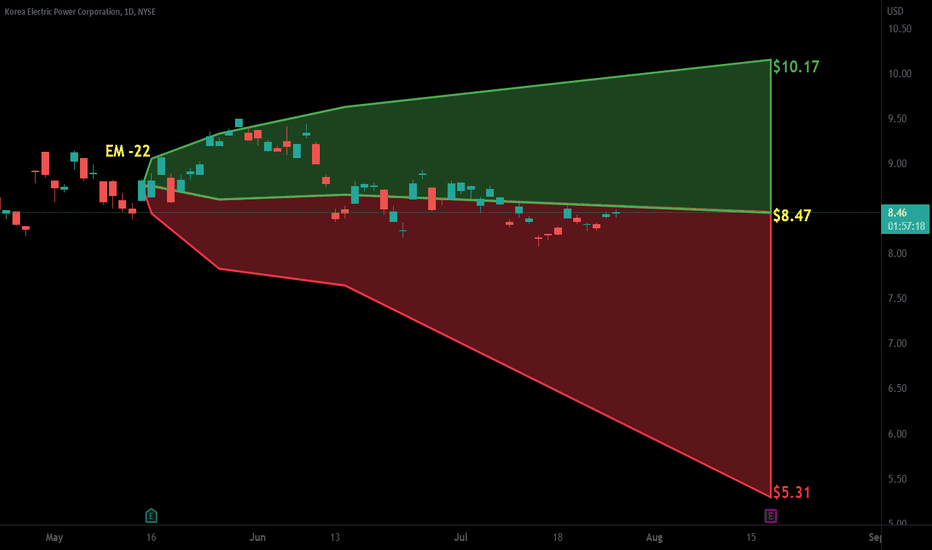

I believe this code is at a point of potential volatility.

If price can hold above $7.62 ... Bullish potential may be unlocked.

My key upside targets include:

-

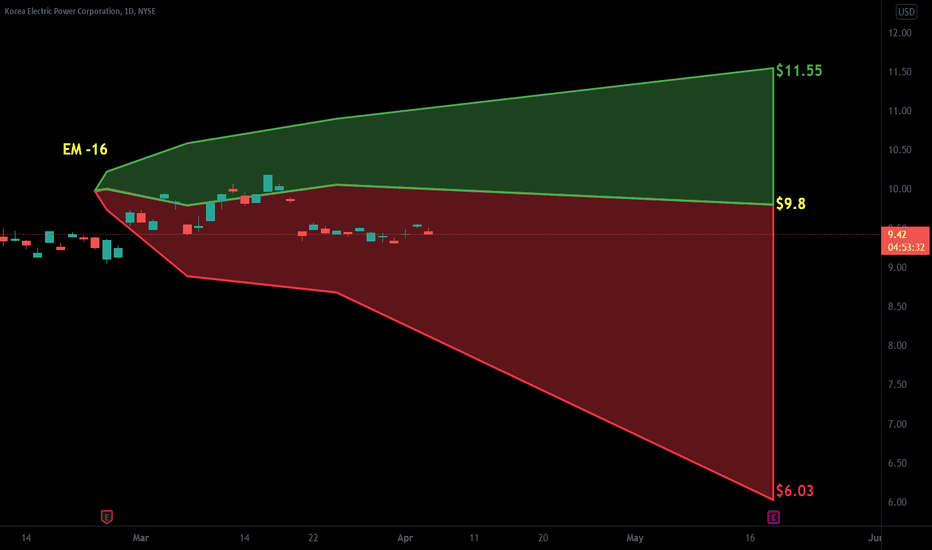

KEP recently changed trend and is ready for more gainsNYSE:KEP is moving side ways after changing trend, long the break out at 11.1$ with stop around 9.8$. Anticipated price action and targets are shown on the chart.

Hit the like button please if you find this useful :)

This is only my own view and not a financial advice, do your own analysis before b

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

KEP5740234

Korea Electric Power Corporation 5.375% 31-JUL-2026Yield to maturity

—

Maturity date

Jul 31, 2026

KEP5484218

Korea Electric Power Corporation 5.375% 06-APR-2026Yield to maturity

—

Maturity date

Apr 6, 2026

K

KEP4520175

Korea Hydro & Nuclear Power Co., Ltd. 3.125% 25-JUL-2027Yield to maturity

—

Maturity date

Jul 25, 2027

K

KEP5150113

Korea South-East Power Co., Ltd. 1.0% 03-FEB-2026Yield to maturity

—

Maturity date

Feb 3, 2026

K

KEP5170393

Korea Hydro & Nuclear Power Co., Ltd. 1.25% 27-APR-2026Yield to maturity

—

Maturity date

Apr 27, 2026

K

KEP5449413

Korea Hydro & Nuclear Power Co., Ltd. 4.25% 27-JUL-2027Yield to maturity

—

Maturity date

Jul 27, 2027

K

KEP5286906

Korea Midland Power co., Ltd. 1.25% 09-AUG-2026Yield to maturity

—

Maturity date

Aug 9, 2026

KEP5484220

Korea Electric Power Corporation 5.5% 06-APR-2028Yield to maturity

—

Maturity date

Apr 6, 2028

K

KEP5697077

Korea Hydro & Nuclear Power Co., Ltd. 5.0% 18-JUL-2028Yield to maturity

—

Maturity date

Jul 18, 2028

KEP6000332

Korea Electric Power Corporation 4.75% 13-FEB-2028Yield to maturity

—

Maturity date

Feb 13, 2028

See all KEP bonds