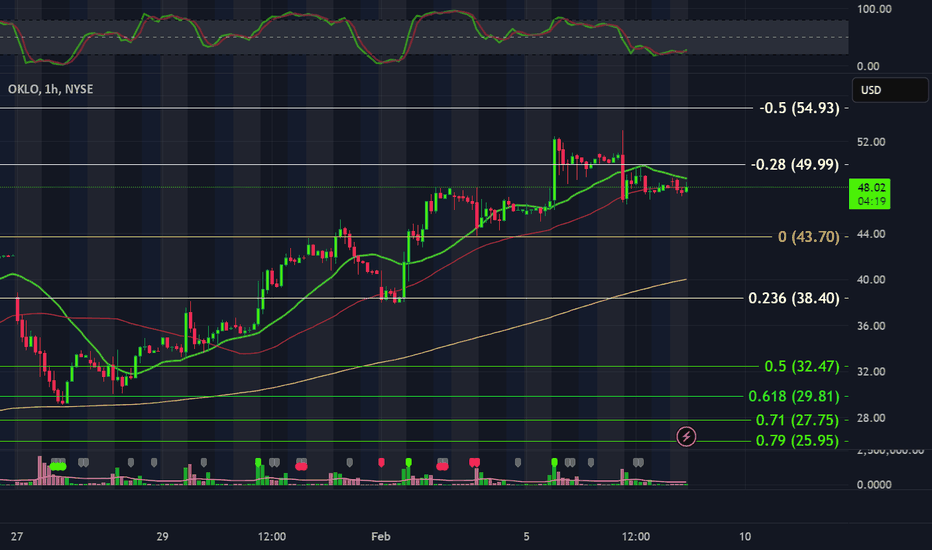

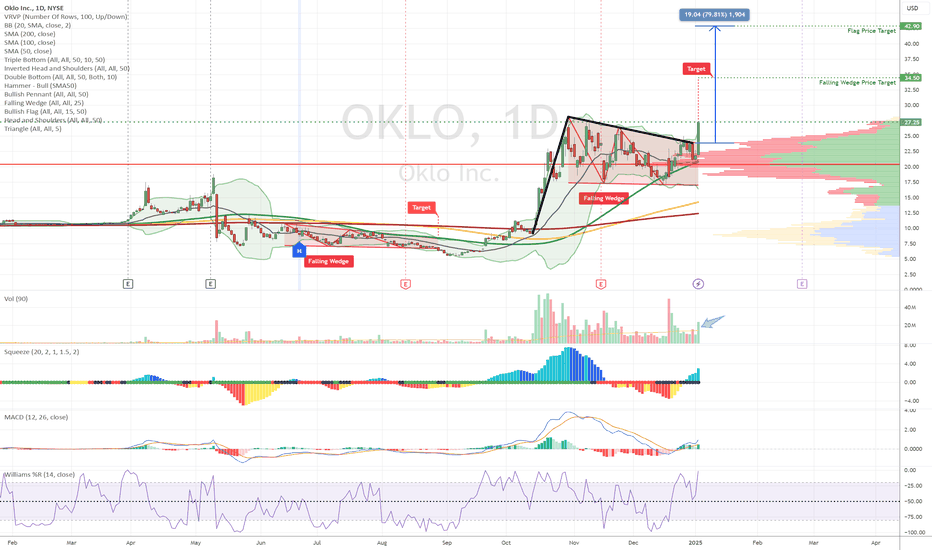

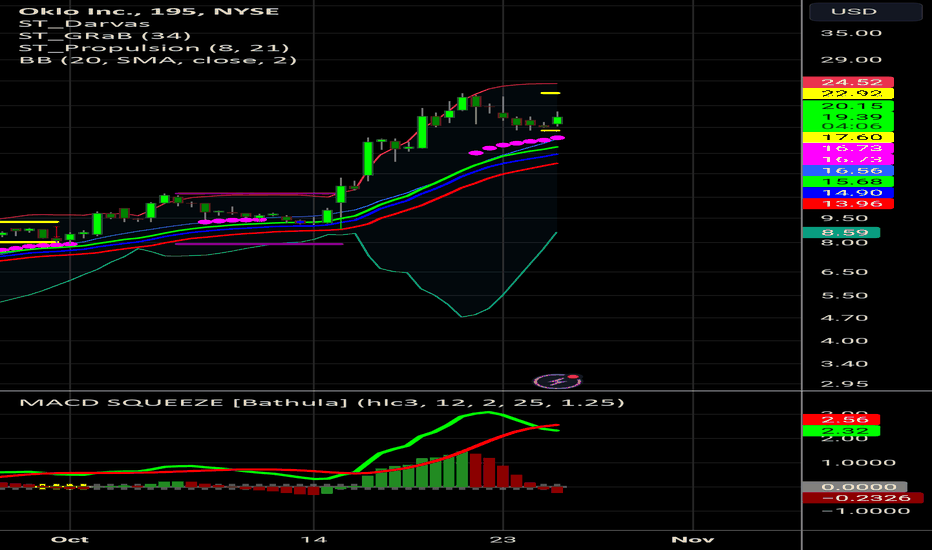

OKLO/USD – 30-Min Long Trade Setup!📌 🚀🔹 Asset: OKLO Inc. (OKLO)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Breakout Trade📌 Trade Plan (Long Position)

✅ Entry Zone: Above $30.29 (Breakout Confirmation)

✅ Stop-Loss (SL): Below $27.00 (Invalidation Level)🎯 Take Profit Targets:

📌 TP1: $34.99 (First Resistance Level)

📌 TP2: $41.08 (Extended Bullish Move)📊 Risk-Reward Ratio Calculation

📉 Risk (SL Distance): $30.29 - $27.00 = $3.29 risk per share

📈 Reward to TP1: $34.99 - $30.29 = $4.70 (1:1.4 R/R)

📈 Reward to TP2: $41.08 - $30.29 = $10.79 (1:3.3 R/R)🔍 Technical Analysis & Strategy

📌 Symmetrical Triangle Breakout: Price breaking above the resistance trendline, signaling bullish momentum.

📌 Support Rejection: Strong bounce from $27.00 support, indicating buying pressure.

📌 Volume Confirmation Needed: Ensure high buying volume when price holds above $30.29 to confirm bullish breakout.

📌 Momentum Shift Expected: If price sustains above $30.29, potential rally toward $34.99, then $41.08.📊 Key Support & Resistance Levels

🟢 $27.00 – Stop-Loss / Strong Support

🟡 $30.29 – Breakout Level / Long Entry

🔴 $34.99 – First Resistance / TP1

🔴 $41.08 – Final Target / TP2📉 Trade Execution & Risk Management

📊 Volume Confirmation: Ensure strong buying volume above $30.29 before entering.

📉 Trailing Stop Strategy: Move SL to entry ($30.29) after TP1 ($34.99) is hit.💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $34.99, let the rest run toward $41.08.

✔ Adjust Stop-Loss to Break-even ($30.29) after TP1 is reached.⚠️ Fake Breakout Risk

❌ If price fails to hold above $30.29 and drops back, exit early to avoid losses.

❌ Wait for a strong bullish candle close above $30.29 before entering aggressively.🚀 Final Thoughts

✔ Bullish Setup – Breakout from consolidation suggests a potential trend shift.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.4 to TP1, 1:3.3 to TP2.💡 Stick to the plan, manage risk, and trade smart! 🚀📈🔗 Hashtags for Reach & Engagement:

#StockMarket 📉 #OKLO 📊 #TradingNews 📰 #MarketUpdate 🔥 #Investing 💰 #Trading 📈 #Finance 💵 #ProfittoPath 🚀 #SwingTrading 🔄 #DayTrading ⚡ #StockTrader 💸 #TechnicalAnalysis 📉 #EconomicNews 🏛️ #FinancialFreedom 💡 #MarketTrends 📊 #StockAlerts 🔔 #TradeSmart 🤓 #Bullish 🐂 #RiskManagement ⚠️ #TradingCommunity 🤝

OKLO trade ideas

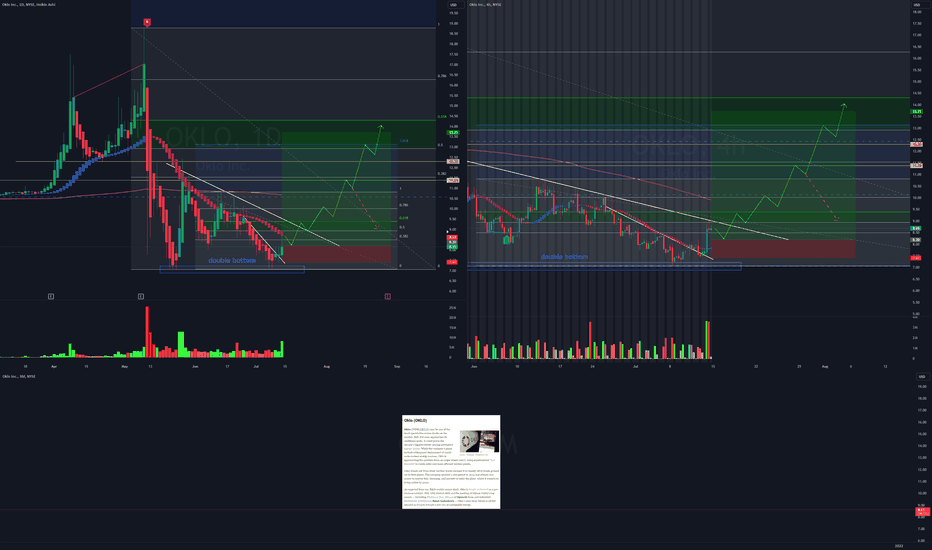

A Review of Multiple Charts Using TDA and Fibonacci, SMAs, StochEach morning, my partner and I go live for members of our mentorship and/or provide them with a pre-market analysis video to help them identify setups, entries and exits for stock options trading. This is simply a peek inside the content created for members.

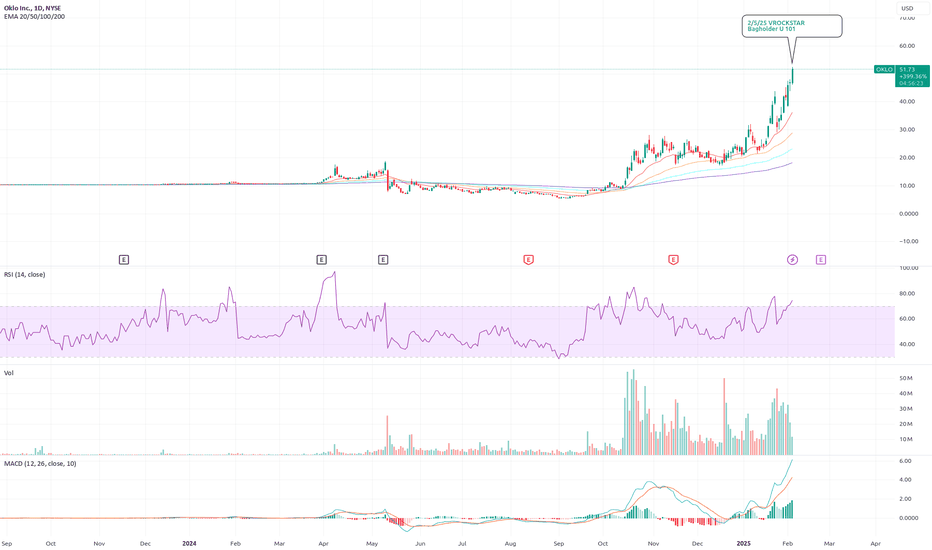

2/5/25 - $oklo - Bagholder U 1012/5/25 :: VROCKSTAR :: NYSE:OKLO

Bagholder U 101

- won't see revenue for 3 years

- but mom, valuation doesn't matter

- k

- added it today to the list of 10ish small shorts i have on to hedge this overbaked cake of a market

let's see, anything's possible in the casino

but if u don't have an exit plan, go take a look in the mirror to see who others are planning to dump to

V

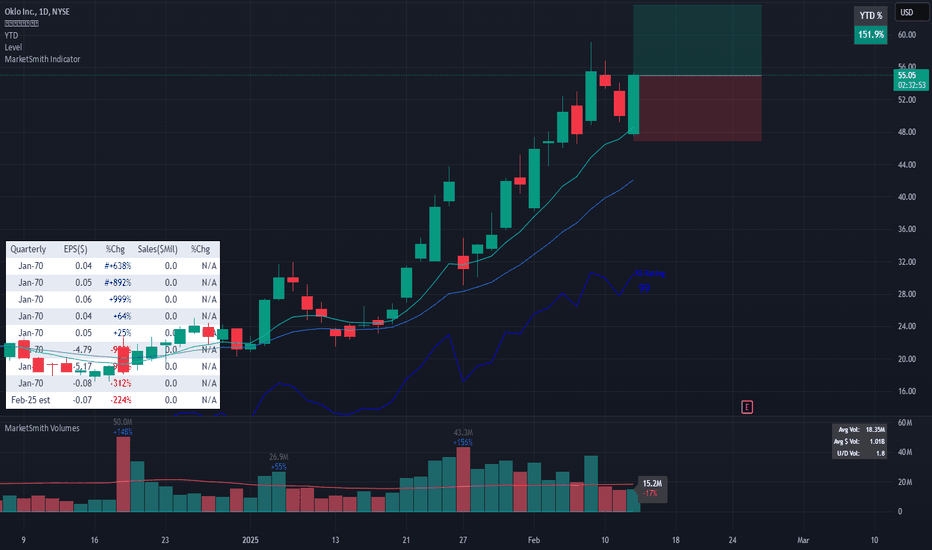

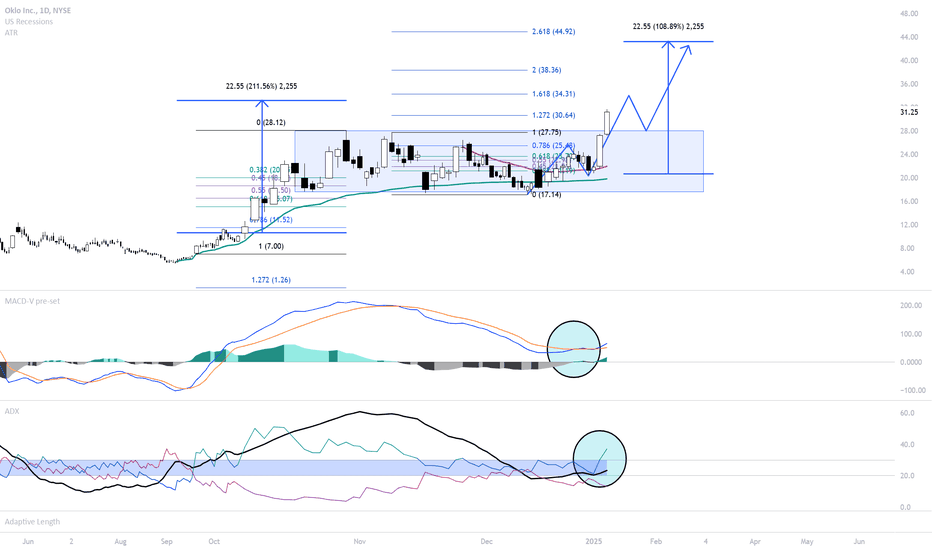

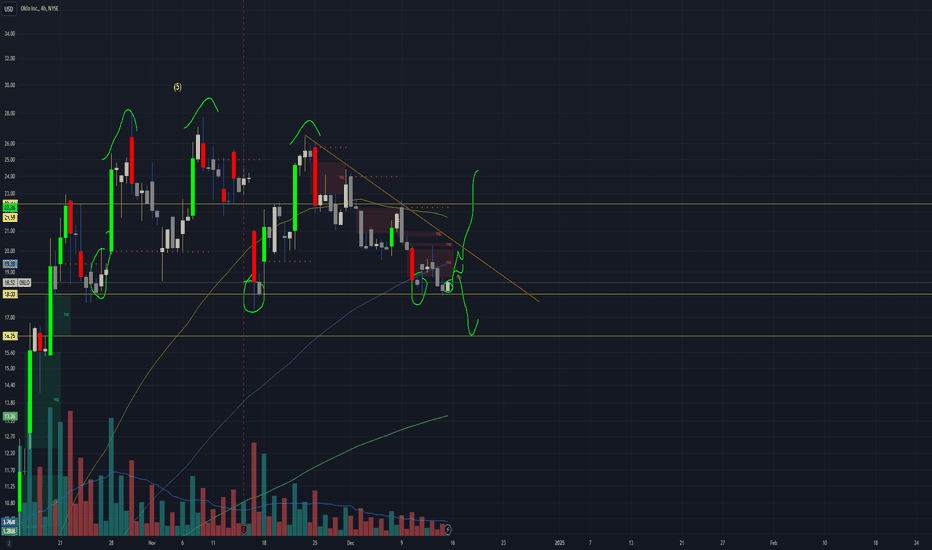

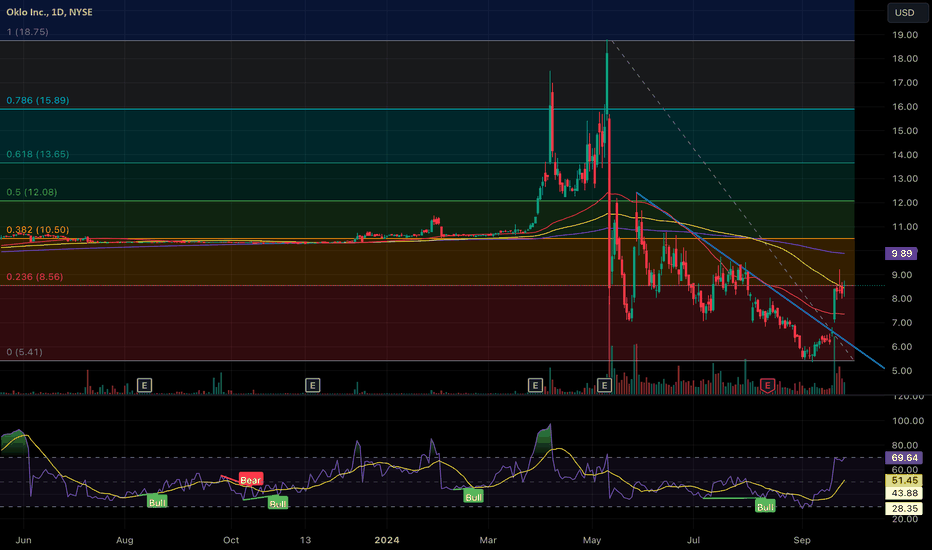

OKLO: mid-term topping potential in nuclear space The swing long set-up from Dec pullback is about to fully realize its potential

From my Dec chart archive:

pbs.twimg.com

And Jan update:

pbs.twimg.com

when I wrote: "It wouldn't not surprise me to see price pulling back bellow Oct's highs slightly and finding support on rising 8/21 emas before continuing its advance. Until price is above 21 ema, next important macro-resistance zone: 33-40"

As for now my operative scenario that price is preparing either to finish its upside momentum extending towards: 46-50 resistance zone or already have finished it and in the process of bouncing before a larger corrective way starts unfolding in the coming weeks.

If we have the mid-term top already in place, then 20-12 macro support zone might be a good place for the larger bottom to start forming before the new larger upside trend beginnes.

The same kind of pattern (bounce and new larger corrective way down) I expect to manifest itself in the coming weeks in other leading energy names (NNE, CLS, VST, GEV)

If price moves above the resistance zone mentioned, the proposed scenario needs to be re-assessed.

Thank you for your attention and wishing you the best trading and investing results in 2025!

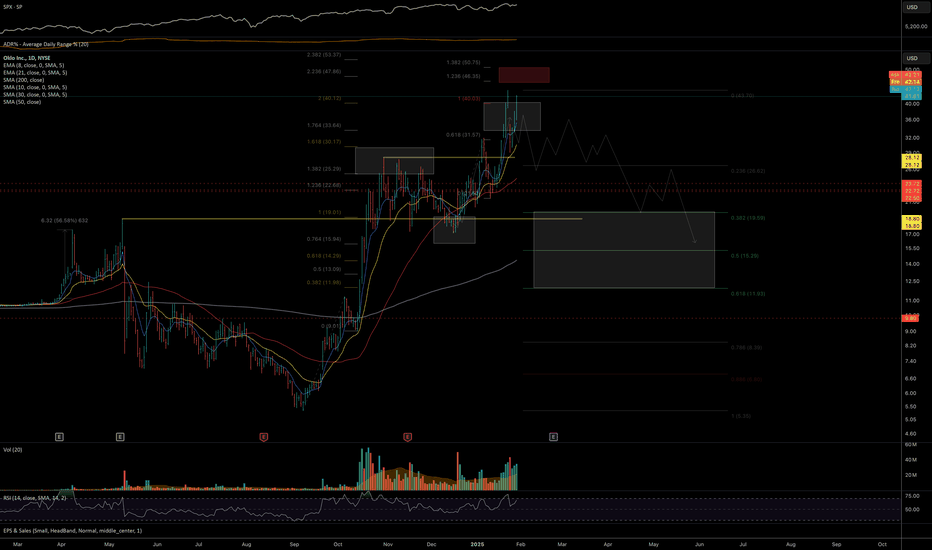

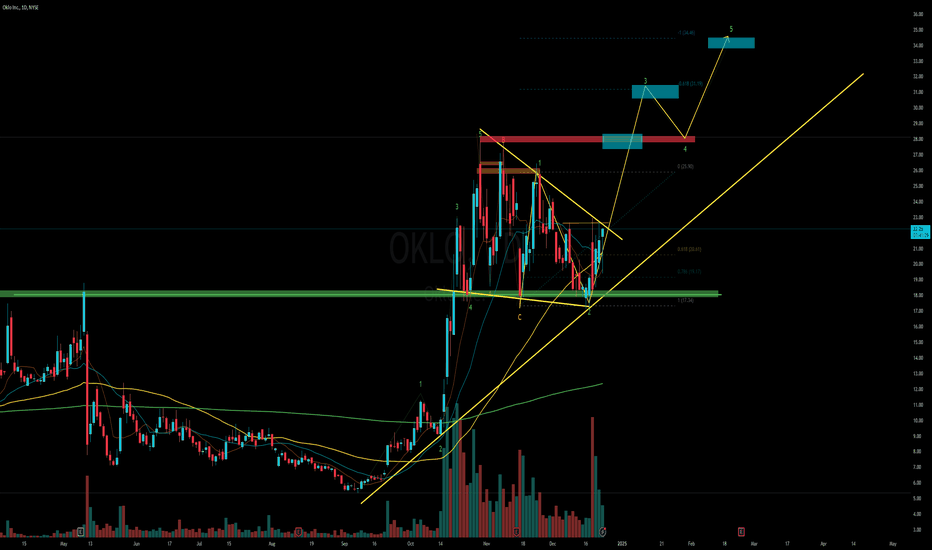

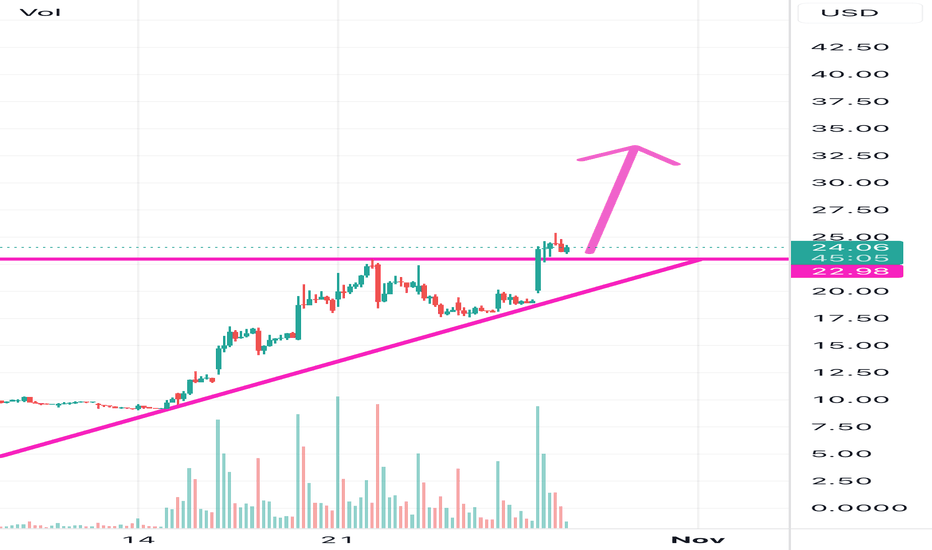

$NYSE:OKLO breaking a Wedge/Flag with short term 25%-60% upsideNYSE:OKLO is breaking out of a consolidation pattern (falling wedge) And what appears to be a flag pattern.

Confirmation is a 24% uptick in price along with strong volume.

Initial Price Target is ~$34.50 to complete the falling wedge pattern, which is a short term 25% upside.

Secondary Price Target is ~$42.90 to complete the flag pattern, which is a longer term 60% upside

Good Luck!

Oklo Inc. (OKLO) AnalysisCompany Overview:

Oklo Inc. NYSE:OKLO is at the forefront of the clean energy revolution, specializing in compact nuclear reactors designed for efficiency and scalability. Its innovative solutions position it as a transformative player in addressing the global demand for clean, reliable energy.

Key Catalysts:

Landmark Partnerships:

Switch Partnership: A deal to supply 12 gigawatts of nuclear power highlights Oklo’s leadership and demonstrates its capacity to scale operations, significantly boosting its revenue potential.

RPower Memorandum: Supporting data centers, a rapidly growing market, Oklo expands into industries with high energy demands, further solidifying its presence in strategic high-growth markets.

Robust Order Book:

With 14 gigawatts of secured orders, Oklo demonstrates strong market demand and a clear path toward sustained growth and market leadership in advanced nuclear energy solutions.

Market Potential & Expansion:

Oklo’s compact nuclear technology offers cost-effective, carbon-free energy, positioning it to capitalize on global trends toward decarbonization, increased data center energy needs, and clean energy mandates.

Investment Outlook:

Bullish Case: We are bullish on OKLO above the $31.00-$32.00 range, driven by strong partnerships, robust order growth, and expanding applications for its technology.

Upside Potential: Our target for OKLO is $60.00-$61.00, supported by its innovative solutions, increasing market adoption, and entry into high-demand sectors like data centers.

🚀 OKLO—Powering a Clean Energy Future with Innovation and Scalability. #NuclearEnergy #CleanTech #Innovation

Trading JournalSpeculative play

Decided to play this one as there were other speculative play that were moving higher,

original stop of 8% loss ( didn't hold true, kept it for -12% loss) thinking it could potentially shakeout and move higher but there was no buying coming in.

Stupid play, stupid result

Oklo getting ready to moveOklo, Smr energy play, Trumps pick for DOE on the board. Imo, looks like a wycoff accumulation in a wave 2 structure, w a target of 1.618-2.618 fib extension. I am wrong, if this trades back below 17.20 area, should set up and play w 18.56 and move higher. Good rr right here.

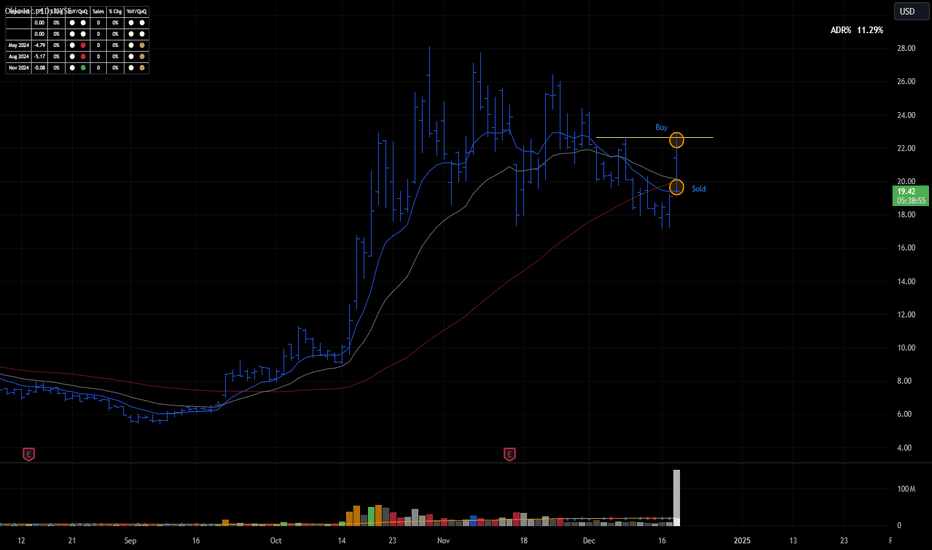

OKLO ANALYSIS - COULD BE A POTENTIAL SHORT 12/16/2024Level 18 has been tested three times, and all three times, there were significant buyers showing up around this level. This time, I haven't seen that yet. I will wait to see how it reacts to the 19 level in the next session. If the selling pressure remains heavy, we may see Oklo trading at the 16.50 level this week.

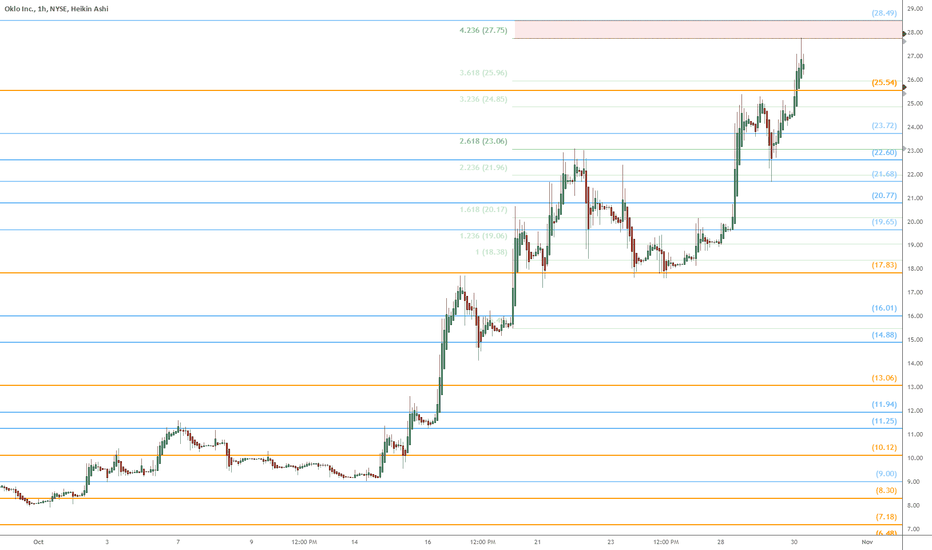

OKLO heads up going into $28: possible End-of-Wave dip incoming Nuclear stocks have been exploding (lol).

OKLO just hit a possible Wave-Endpoint.

Looking for a dip to enter or add longs.

$ 27.75 - 28.49 is the key resistance here.

If dips, we will measure and project targets.

=======================================

.

NUCLEAR HYPE..!# George Soros' Guide to Trading Bubbles

George Soros is known for his ability to profit from market bubbles and crashes. Here are some key principles of his approach:

1. **Theory of Reflexivity**: Markets are inherently unstable due to feedback loops between prices and fundamentals. Rising prices can improve fundamentals, which then justifies even higher prices.

2. **Identify the Trend**: Look for sectors or assets experiencing rapid price appreciation and growing investor enthusiasm.

3. **Ride the Wave**: Once a bubble is identified, participate in the upward momentum rather than trying to short it prematurely.

4. **Watch for Warning Signs**: Monitor for signs of instability or changing sentiment. These could include:

- Extreme valuations

- Widespread public participation

- Increasing volatility

- Deteriorating fundamentals

5. **Prepare to Reverse**: Be ready to quickly change position from long to short when the bubble shows signs of bursting.

6. **Risk Management**: Use stop-losses and position sizing to protect against the unpredictable nature of bubbles.

7. **Patience and Timing**: Bubbles can last longer than expected. Don't try to precisely time the top or bottom.

8. **Understand Market Psychology**: Recognize the roles of greed, fear, and herd behavior in driving bubbles.

9. **Stay Flexible**: Be willing to admit when you're wrong and change your stance as new information emerges.

10. **Look for Knock-on Effects**: Consider how a bubble in one area might impact related sectors or assets.

Remember: Trading bubbles is extremely risky. This approach requires deep market knowledge, significant capital, and a high tolerance for risk.

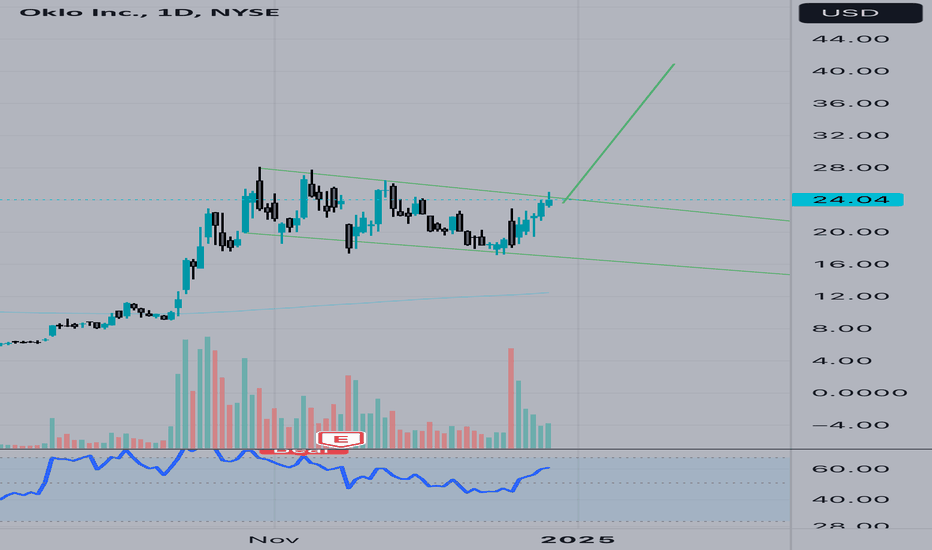

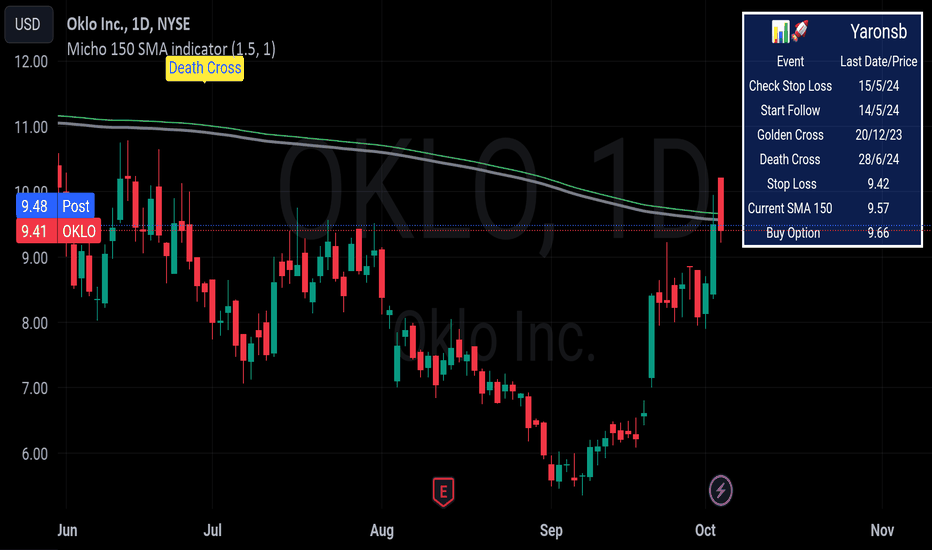

Strategic Monitoring of Oklo Inc - A Key Turning PointThe attached chart highlights Oklo Inc at a critical juncture, signaling a strong opportunity for future tracking. Recent developments in the stock suggest it's an interesting time to follow the potential trend. Oklo Inc, specializing in renewable energy, is at an exciting phase of growth and innovation, making it a promising candidate for long-term observation.

NYSE:OKLO Oklo Inc is an innovative company in the clean energy sector, focusing on developing advanced, small-scale power plants that offer efficient and sustainable energy solutions.

Oklo…. $8.40…. Looks like a good speculative buyFloated at $10.00 back in July 2021, share price did nothing for almost 3years. This March it took off and hit $18.00 then tanked to $5.30.

The share price the took off again rising 27% last Friday after constellation Energy’s announcement that they were restarting 3 mile Island nuclear power plant and sell the energy to Microsoft.

Oklo has hit the first Fibonacci retracement level and consolidated.The company is planning to build small scale Nuclear fission plants to power server centres, early days and currently loss making but SAM Altman is the Chair of Oklo.

I’m looking at the next Fibonacci level as the next target.

OKLO - Nuclear Energy Company - Sympathy to NNEOklo Inc is developing advanced fission power plants to provide clean, reliable, and affordable energy at scale. It is pursuing two complementary tracks to address this demand: providing reliable, commercial-scale energy to customers; and selling used nuclear fuel recycling services to the U.S. market. The Company plans to commercialize its liquid metal fast reactor technology with the Aurora powerhouse product line. The first commercial Aurora powerhouse is designed to produce up to 15 megawatts of electricity (MWe) on both recycled nuclear fuel and fresh fuel.

This is a sympathy play to NNE, which had a significant run recently. The Nuclear Energy sector is poised for substantial growth in the next decade. It remains one of the most reliable and efficient energy sources available today.

Key Technical Levels:

We might see a small pullback to 8.00 zone -where would be a pefect entry.

Breakout Zone: $9.0

Action: If the stock breaks above this range with strong volume, it might signal a continuation of the upward trend.

Resistance Points:

$9.40

$10.00

$11.40

$13.00

Surpassing these levels could signal a positive trend. Consider taking profits at these stages to realize gains.

Trading Strategy:

Take Profit (TP): Target 10.00 or at 14.00to capitalize on the anticipated price gap closure.

Stop Loss (SL): Set at under $7.40 to mitigate potential losses.

Chart Analysis:

Please refer to the attached chart for detailed analysis of price trends and movements.

Trading Advisory:

Exercise caution and consider market conditions and your own risk tolerance when trading. It's advisable to conduct comprehensive research or consult with a financial advisor before engaging in trading activities.

Disclaimer: This content is for informational purposes only and should not be considered financial advice.

OKLO a pre revenue green energy startup LONGOKLA represents a high risk high reward play on green energy. It is a pre-revenue nuclear

power generation plant in Idaho destined to sell electricity to the grid as well as nearby

government customers including a miliary base. As such the risk is inherent but so is the

potential upside. This is a long trade buying at the bottom and looking for 50% upside or more.

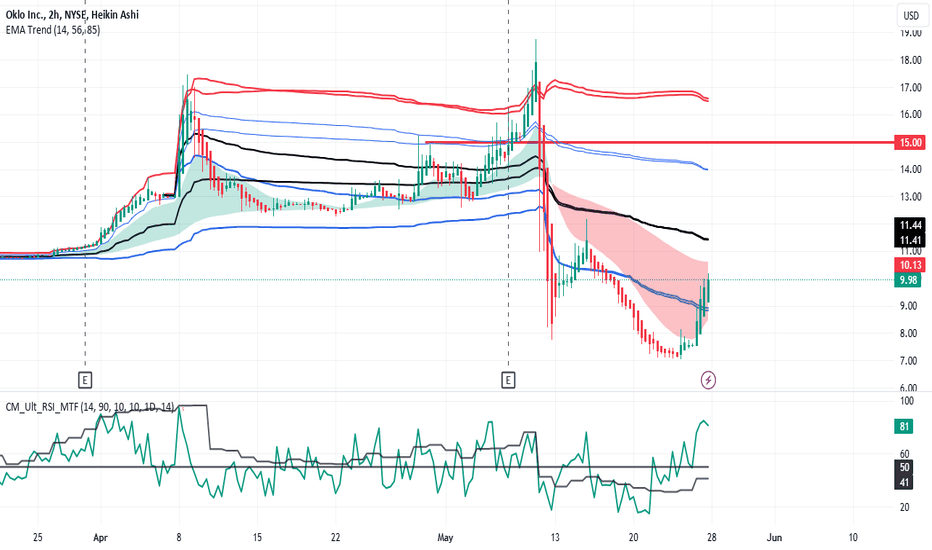

On the 120 minute chart price is ascending through EMA lines in the past couple of days.

Price is rising as compared with anchored VWAP lines and the RSI indicator confirms bullish

momentum. I will take a long trade here especially as making a trade supporting green energy

helps in a socially responsible way the energy trend in sustainability.