OSCR trade ideas

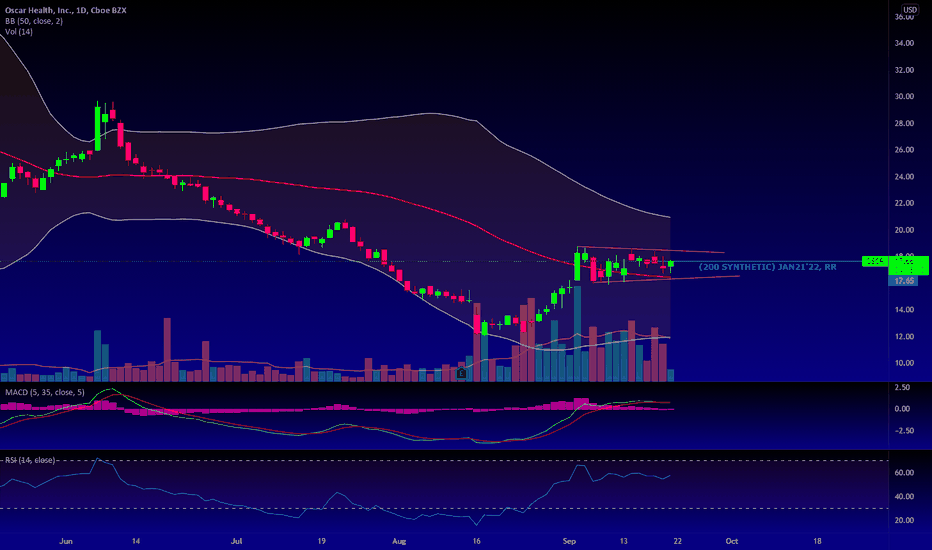

OSCR (Long) Awaiting B/OMultiple cluster buys from CEO and Directorship over the last couple of months - most recent 17SEPT. Purely technical play set up for breakout - synthetic long. PT is 21.70 which is a result of my own fundamentals and tech analysis. Primary motivation is the ongoing insider buying and tech set up of price action.

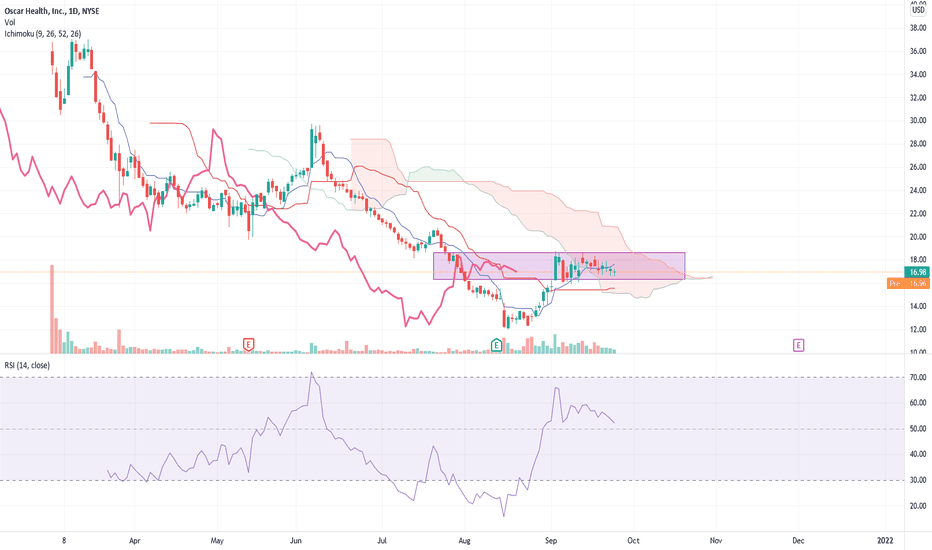

OSCR : incertitude phaseOSCR in Daily still bearish but we just begun an incertitude phase. It is preferable to wait before to identify the new direction.

Positifs signals we are waiting for:

• Break the range by superior limit

• Ichimoku composant cross the cloud (Price, chninkou and tenken

In the other hand we have Two supports to see : 16.42 and 15.40

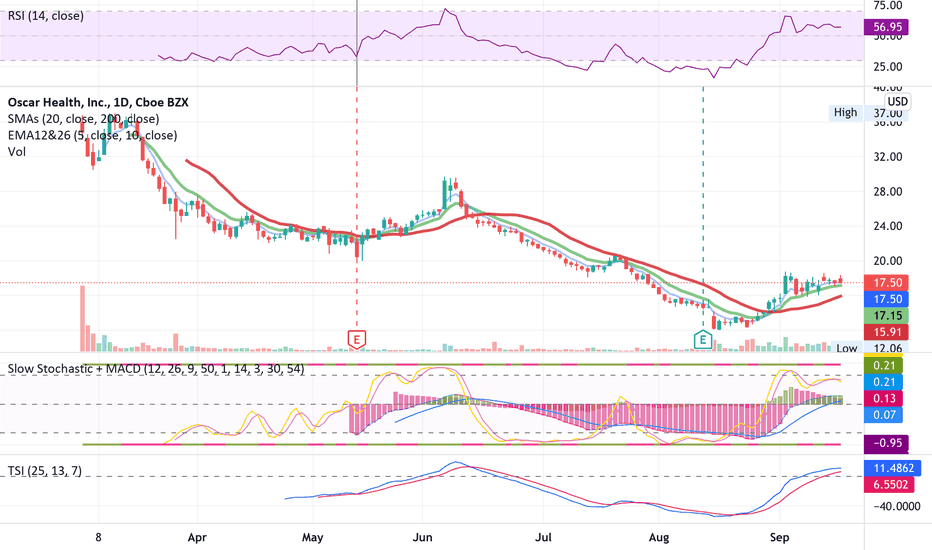

$OSCR is giving a GREAT IPO SHORT opportunity todayIPO intraday trading strategy idea

Oscar Health is tech-enabled medical insurance provider.

The share price is falling and gonna continue this trend today.

The demand for shares of the company still looks lower than the supply.

These and other conditions can cause a fall in the share price today.

So I opened a short position from $36;

stop-loss — $37,70

take-profit — $31,00/MOC price

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.