Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.35 USD

2.73 B USD

70.41 B USD

353.22 M

About Prudential Financial, Inc.

Sector

Industry

CEO

Andrew F. Sullivan

Website

Headquarters

Newark

Founded

1875

FIGI

BBG01944YDQ2

Prudential Financial, Inc. engages in the provision of insurance, investment management, and other financial products and services. It operates through the following segments: Prudential Investment Management, Inc. (PGIM), U.S. Businesses, International Businesses, and Corporate and Others. The PGIM segment is involved in the provision of investment management services and solutions related to public fixed income, public equity, real estate debt and equity, private credit and other alternatives, and multi-asset class strategies. The U.S. Businesses segment includes retirement strategies, group insurance, and individual life. The International Businesses segment focuses on investing in existing businesses and assessing acquisition opportunities. The Corporate and Other Operations segment relates to the corporate items and initiatives not allocated to business segments. The company was founded by John Fairfield Dryden in 1875 and is headquartered in Newark, NJ.

Related stocks

PRUDENTIAL PLCMonday, 14 November 2022

12:50 PM (WIB)

Prudential Plc is a holding company, which engages in the provision of insurance and financial services. It operates through the Asia and U.S. geographical segments. The Asia segment consists of health and protection, other life insurance, mutual funds, sel

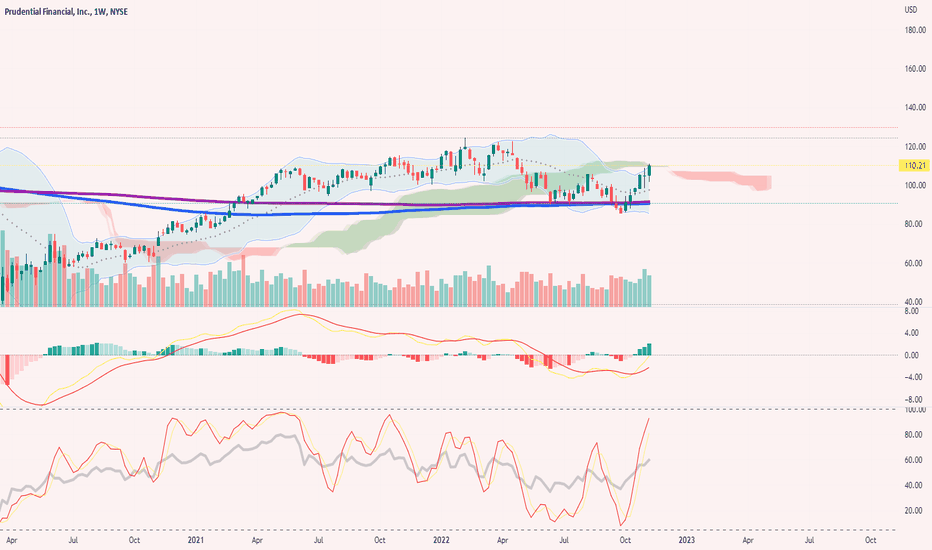

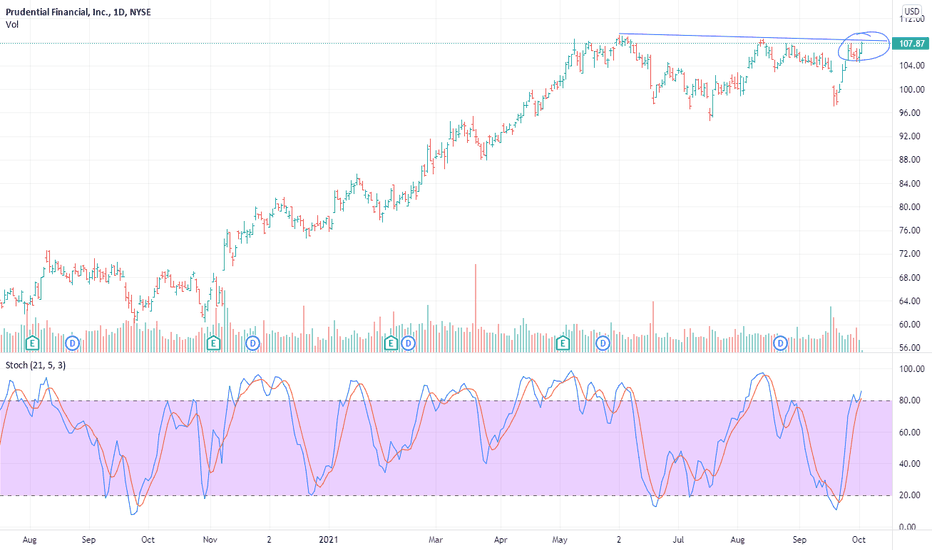

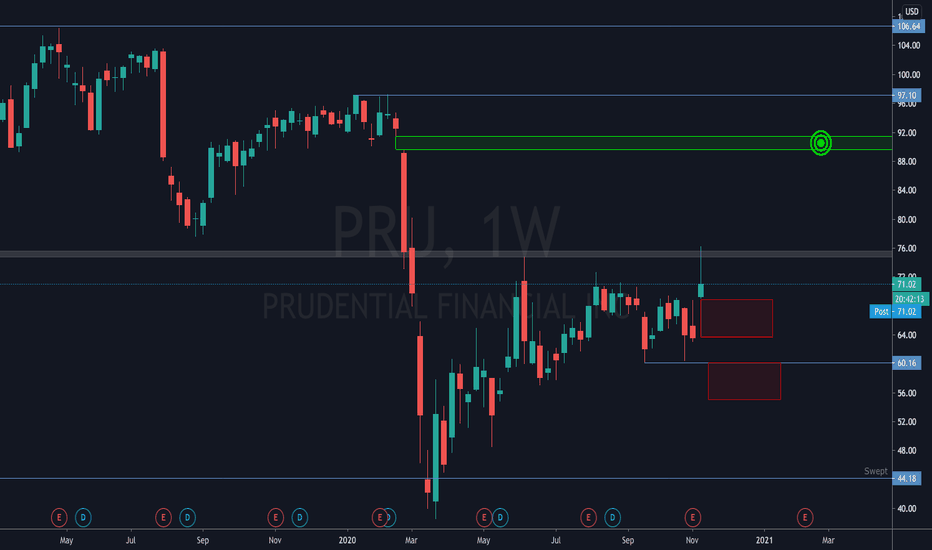

PRU 1W, Continuation To Gap-fill And Higher?Technical:

PRU has a lot of upside potential over the next few months with several clean areas of liquidity on the chart. The first target I'm looking for is the 91.00 area to fill that gap. If we get up there, we may see a pullback depending on whether price moves to that point in a thin way or a s

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

PRU4882937

Prudential Financial, Inc. 3.7% 13-MAR-2051Yield to maturity

6.51%

Maturity date

Mar 13, 2051

PRU4575771

Prudential Financial, Inc. 3.935% 07-DEC-2049Yield to maturity

6.43%

Maturity date

Dec 7, 2049

PRU4575768

Prudential Financial, Inc. 3.905% 07-DEC-2047Yield to maturity

6.34%

Maturity date

Dec 7, 2047

US744320BL5

PRUDENT.FINL 23/53 FLRYield to maturity

6.30%

Maturity date

Mar 1, 2053

PRU4962852

Prudential Financial, Inc. 3.0% 10-MAR-2040Yield to maturity

6.24%

Maturity date

Mar 10, 2040

US74432QCE3

PRUDENT.FINL 19/50 MTNYield to maturity

6.20%

Maturity date

Feb 25, 2050

PRU5768097

Prudential Financial, Inc. 6.5% 15-MAR-2054Yield to maturity

6.20%

Maturity date

Mar 15, 2054

PRU4613335

Prudential Financial, Inc. 4.418% 27-MAR-2048Yield to maturity

6.10%

Maturity date

Mar 27, 2048

PRU4125879

Prudential Financial, Inc. 4.6% 15-MAY-2044Yield to maturity

6.04%

Maturity date

May 15, 2044

PRU4040145

Prudential Financial, Inc. 5.1% 15-AUG-2043Yield to maturity

5.98%

Maturity date

Aug 15, 2043

US744320BK7

PRUDENT.FINL 22/52 FLRYield to maturity

5.97%

Maturity date

Sep 1, 2052

See all PRH bonds

Curated watchlists where PRH is featured.

Frequently Asked Questions

The current price of PRH is 25.01 USD — it has decreased by −0.52% in the past 24 hours. Watch Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 stocks are traded under the ticker PRH.

PRH stock has fallen by −0.40% compared to the previous week, the month change is a 1.58% rise, over the last year Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 has showed a −4.47% decrease.

PRH stock is 0.88% volatile and has beta coefficient of 0.12. Track Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 stock price on the chart and check out the list of the most volatile stocks — is Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 there?

Today Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 has the market capitalization of 37.92 B, it has decreased by −0.58% over the last week.

Yes, you can track Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 financials in yearly and quarterly reports right on TradingView.

Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

PRH earnings for the last quarter are 3.29 USD per share, whereas the estimation was 3.18 USD resulting in a 3.54% surprise. The estimated earnings for the next quarter are 3.40 USD per share. See more details about Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 earnings.

Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 revenue for the last quarter amounts to 13.41 B USD, despite the estimated figure of 14.12 B USD. In the next quarter, revenue is expected to reach 13.72 B USD.

PRH net income for the last quarter is 707.00 M USD, while the quarter before that showed −57.00 M USD of net income which accounts for 1.34 K% change. Track more Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 financial stats to get the full picture.

Yes, PRH dividends are paid quarterly. The last dividend per share was 0.37 USD. As of today, Dividend Yield (TTM)% is 4.95%. Tracking Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 dividends might help you take more informed decisions.

Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 dividend yield was 4.39% in 2024, and payout ratio reached 69.33%. The year before the numbers were 4.82% and 74.14% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 28, 2025, the company has 38.2 K employees. See our rating of the largest employees — is Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 on this list?

Like other stocks, PRH shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 technincal analysis shows the neutral today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 stock shows the sell signal. See more of Prudential Financial, Inc. 5.950% Junior Subordinated Notes due 2062 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.