SI trade ideas

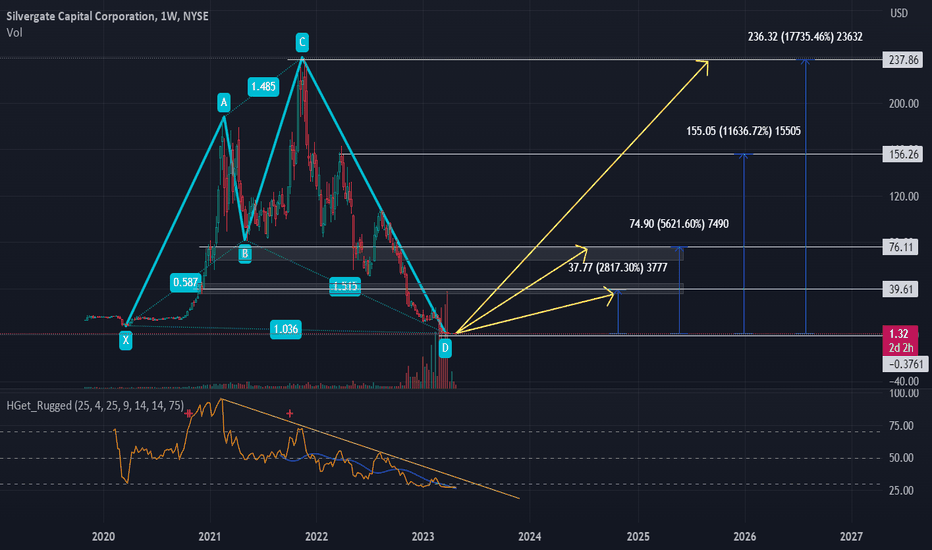

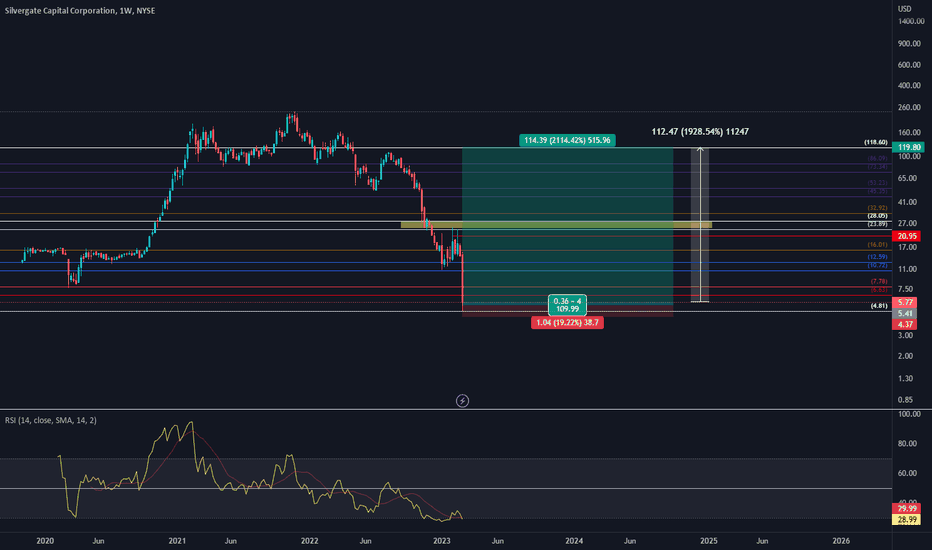

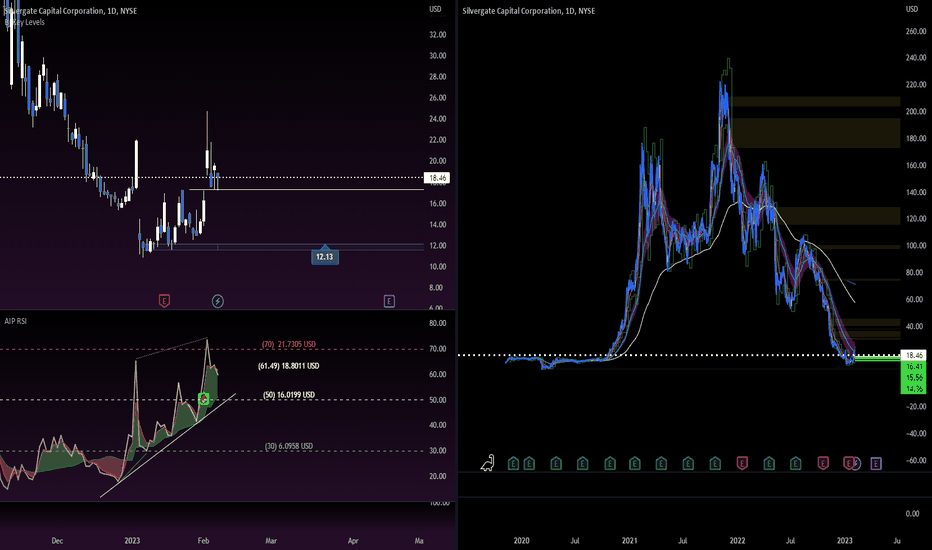

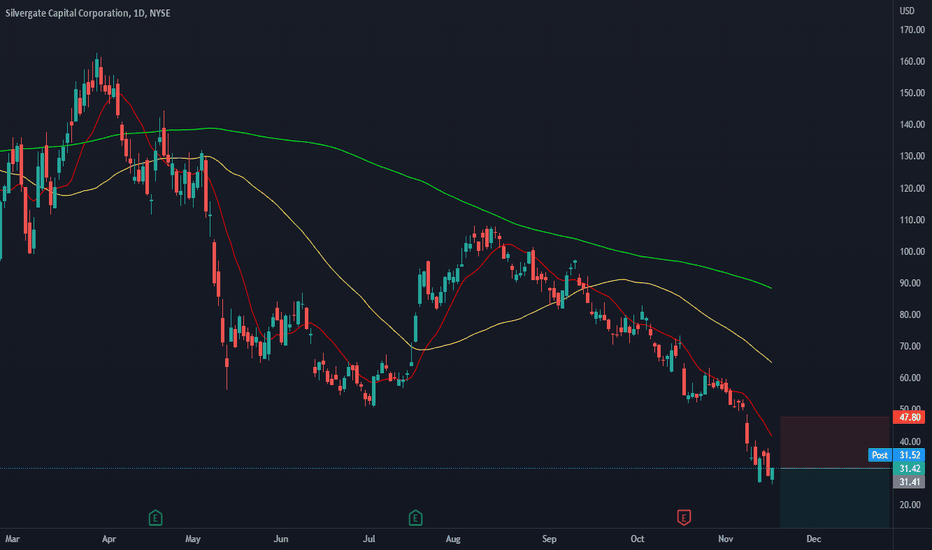

Silvergate BottomWe've seen massive capitulation and it has formed a harmonic shark pattern in the process.

It will likely go sideways from here initially but generally we already had our first change of structure under wyckoff accumulation.

Its just a matter of time before this fully reverses.

If you missed bitcoin a decade ago, this is your next bitcoin.

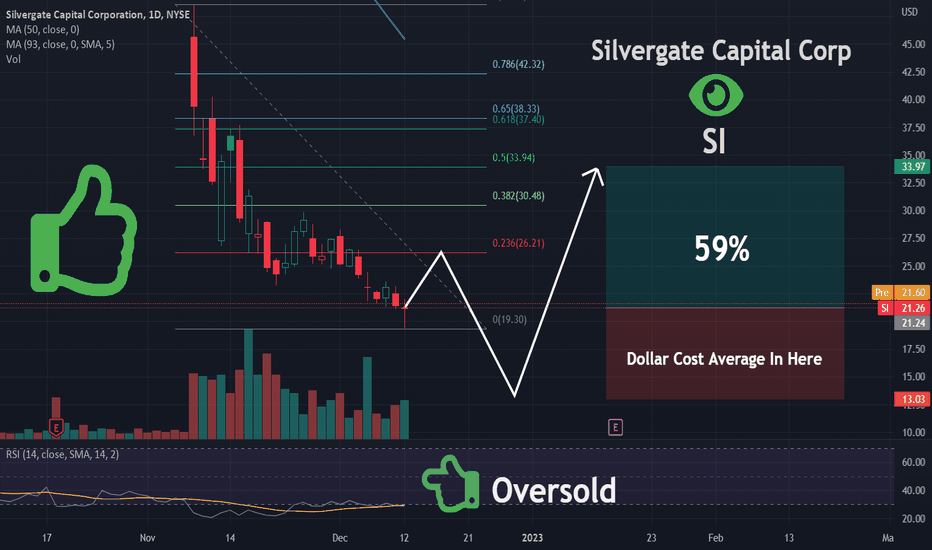

Our trigger is RSI trendline break or Wyckoff Accumulation breakout, which ever comes first.

Not a financial advise.

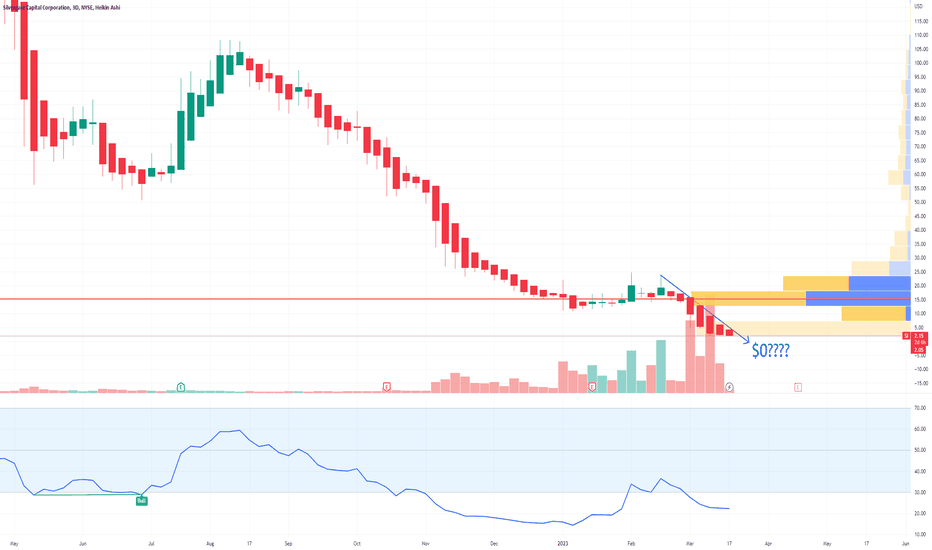

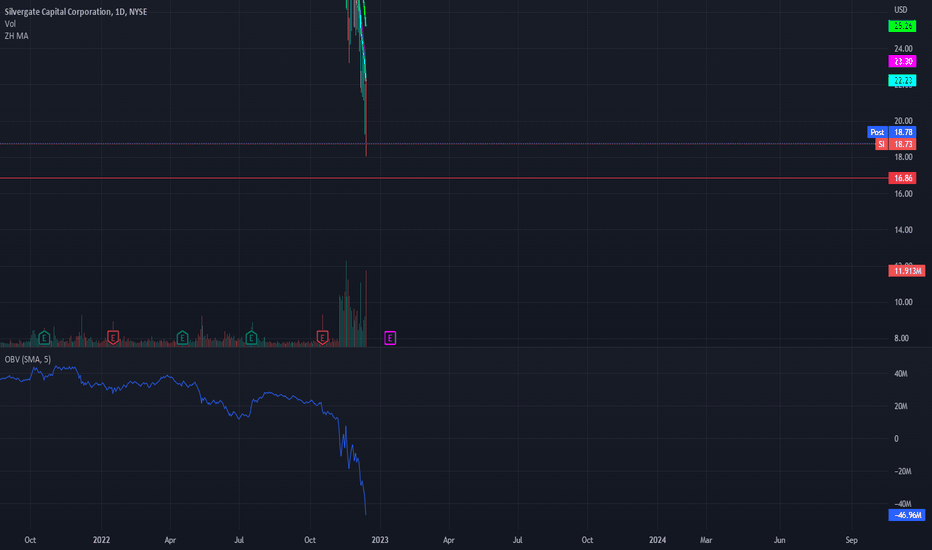

SI Silvergate Capital going to $0???If you haven`t sold crypto`s favorite bank, SI Silvergate, here:

Then you should know that Silvergate Capital Corp, the parent company of Silvergate Bank, announced its closure and liquidation of assets on Wednesday.

Shortly after, New York state banking regulators closed down Signature Bank to prevent the fallout from the failure of Silicon Valley Bank.

Lawyers representing plaintiffs in a class action lawsuit by FTX customers against 18 defendants, including Signature and Silvergate, claim that these events will severely limit the amount of money they can access if they can prove the banks are responsible.

Kerry Miller of Fishman Haygood, whose firm filed the lawsuit in Miami federal court, stated that FTX customers may have to rely on insurance policies covering the banks' top executives and board members since these events impose another hurdle.

Haven`t seen any bidders for it, or other banks supporting SI SIlvergate.

Most likely to file for bankruptcy and go to $0.

Looking forward to read your opinion about it.

Why SI Silvergate Capital Corporation Collapsed ? If you haven`t bought puts here:

Then you should know that last week, Silvergate's stock plunged by up to 45% following the company's announcement that it would delay filing its annual report due to ongoing investigations by various regulatory bodies, including the U.S. Department of Justice.

This led major players in the crypto industry, including Coinbase and Paxos, to sever ties with Silvergate.

The second largest bank serving digital assets companies, Silvergate, announced that it would wind down its operations on March 8.

Analysts attributed the decline to a loss of trust in the crypto industry following the FTX meltdown, as well as concerns raised by short sellers primarily on Twitter.

Silvergate primarily serviced cryptocurrency firms, including FTX, which ultimately failed.

I am still bearish on the outlook of this stock!

Looking forward to read your opinion about it!

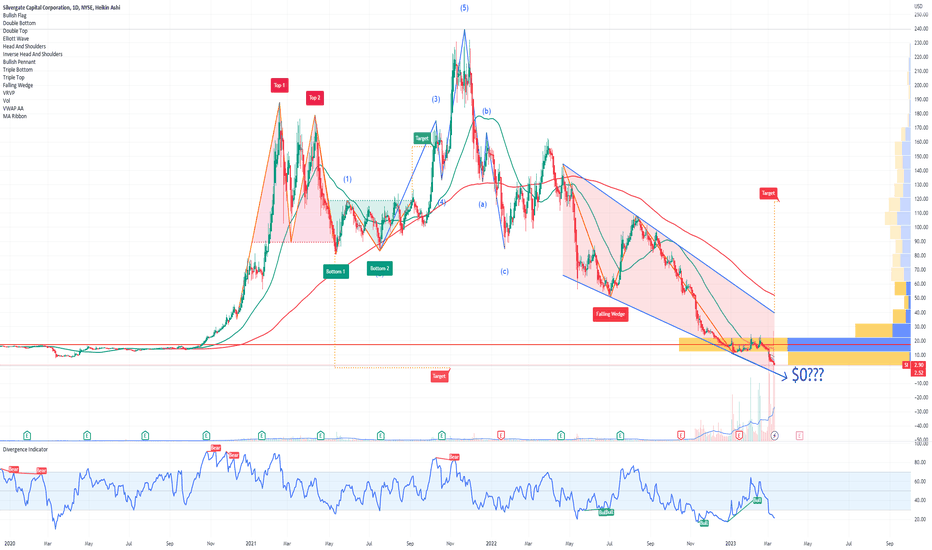

Silvergate Capital - Crypto's White Knights About to Eat a MOASSSo, Silvergate Capital is this bank that services the crypto market and is arguably a pretty shady company.

It's a shady company because crypto itself is extremely filthy, is a cult, and doing business with shady cult people who are printing money out of thin air on the Internet brings with itself certain problems that no bank who is legit is willing to muddy its hands with.

Crypto is this thing that was originally supposed to provide a check and balance against a national central banking system that was corrupted by the globalists. But, like everything else, crypto was co-opted and ruined by the exact same system it was designed to destabilize.

History has come to pass, and just like really dirty water, you can't make it clean ever again. You can only burn it and watch it vanish.

If you want to see where the real scam with crypto and its "stablecoins" like BUSD and Tether is, then you need to start looking at how Chinese Communist Party-related entities have pumped and dumped other cryptos, ultimately for conversion into BTC and ETH, which are offloaded on both foreign (South Korea) and US domestic exchanges in exchange for USD.

The ultimate purpose of which is for CCP princelings to enrich themselves, and for the regime to have an under-the-table blood transfusion route for USD, which it has needed to stay alive all these years. They need USD because you need USD to buy oil and commodities. It's just that simple. Don't believe it? Look at what happened with Sri Lanka last year when it ran out of USD reserves and couldn't buy oil. People burned the presidential palace to the ground, and their president had to run away in a helicopter.

The Communist Party has never been powerful. The Communist Party is dangerous, but it's not powerful. Nothing as riddled by corruption as it is counts as "powerful." It's just that all its members are bound by "mutually assured destruction."

Since none of the white knights are willing to touch the topic of the connection to history's most wicked and brutal regime and just want to sound off about Binance and Tether for likes on Twitter, this should already tell you a lot about the integrity of the people who claim to be fighting for justice.

But if there's one thing I despise the most, it's the soy leftists who feign to be white knight justice warriors who are opposed to the crypto ponzi and the money laundering scheme, because they just, like, really have morals, yeah?

But in reality they use the opportunity to bring in a glut of followers and readers who lost a lot of money in crypto and are resentful and disenfranchised to both grift from and spread socialist indoctrination to.

That group of scum happens to be a group boys and girls who has been, only because they were provided intelligence from someone who understands, holding puts on SI and SBNY for a very long period of time.

People who are following the instructions of others tend to fail at thinking for themselves, and they tend to get greedy and forget that they don't actually have any abilities.

If you don't believe it, just look at all the fools who called for $85 and $55 Tesla when it was already at $100 after falling for four or five straight months. Their bottom puts, and their puts all the way back up, all expired worthless as Tesla more than doubled in value and never even dipped again.

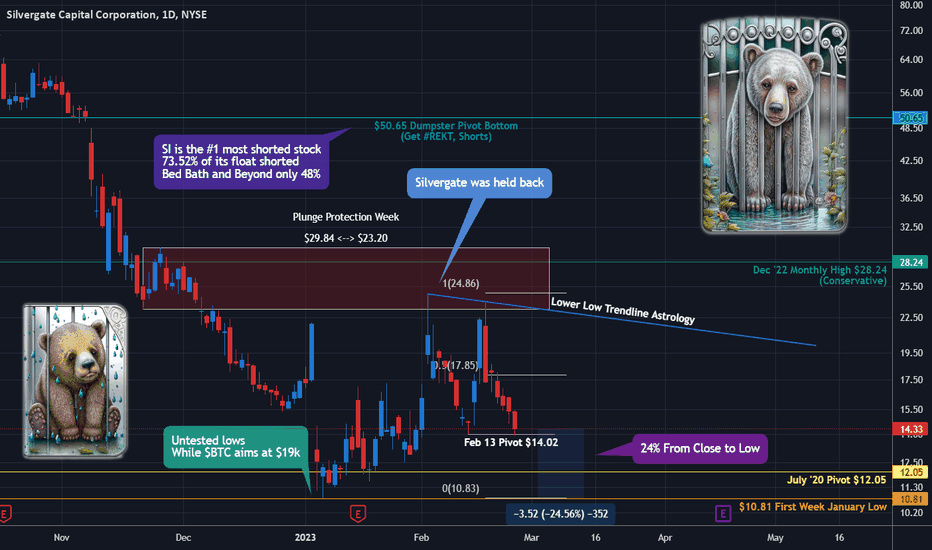

Further to my point, Silvergate is the #1 most shorted stock in the market , and by a huge margin. 73.5% of the float is shorted as of Jan. 31, the most recent reporting. Putting that into perspective, everyone's favourite memecoin to lose money on, Bed Bath and Beyond , only had 48% of its float shorted.

Now, it's a fallacy to think that because something is super shorted that you're going to get a "MOASS," and even stupider to think that retail can combine their bottle depot pocket change to take out Wall Street's positions.

That was never what happened with Wall Street Bets and Gamestop. What really happened is a narrative was spun on the Marxist Reddit PR train to bring in idiots to provide exit liquidity at the top, and only an idiot would believe the narrative that retail combined forces to injure the pearly gates of the world's financial heart.

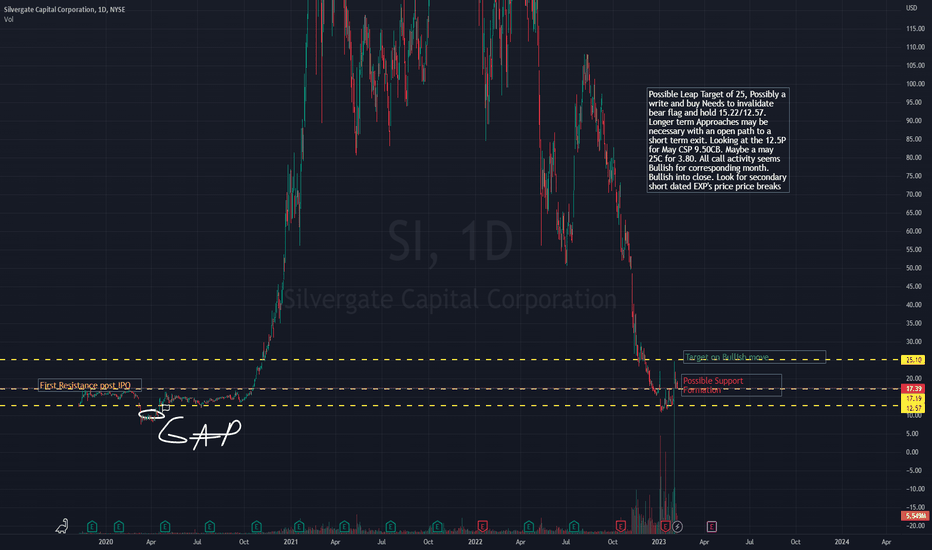

Moreover, despite SI being such a piece of crap and the crypto market being on the verge of being smashed by the Federal Reserve and the US Treasury as they take down stablecoins to install a Central Bank Digital Currency and their own version of the CCP's social credit system, one based on "saving the world from climate change," according to 12/31 SEC filings , the biggest holders of SI, fundamental names like Blackrock and Vanguard, State Street, Block.One, Morgan Stanley, etc, all increased their positions.

That should really ring some bells for you boys who are following the soy leftists on Twitter to ape on how crypto, SBNY, SI, Tether, and Binance are all going to $0, and going to $0 tomorrow.

You're a few months early. Guillotines fall from high up. Use your brain.

Moreover, you can divine some insight from the options chain . Open interest on puts with strikes at $10, $15, and $17.50 are in the high four and mid five digits expiring March 17, and in the low four digits expiring in April from $12.50.

But starting in May, open interest on calls with strikes from $15 to $50 are low to high four figures, while in May, there's 35,000 contracts of open puts from $10.

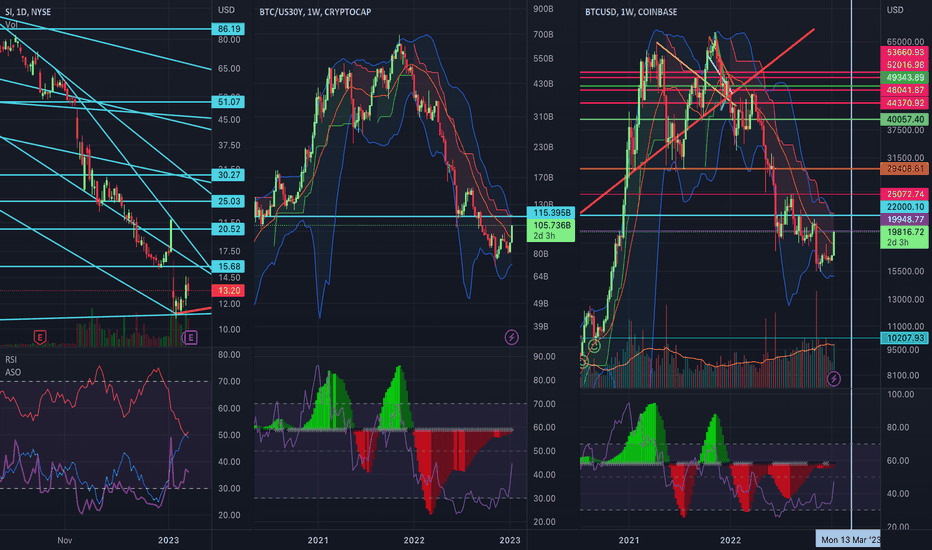

I'm of the opinion that Bitcoin is about to retrace significantly to take out early bulls and trap overzealous bears who don't understand market structure and can't think like the market maker.

Bitcoin - Can You Fade the Bear Trap for $34,000?

Since SI is a crypto bank it will be algorithmically moved in connection with the underlying asset. There is confluence in the price action on SI in that the lows have not been retested.

Yet, the dump on crypto is not going to be to set new lows. It's more likely to print new highs.

But what the monthly candles tell you is that an extremely critical pivot was already taken out in January:

And what weekly candles show you is that when price bounced back into the $20s, PA both printed lower highs and was held back by the mitigation candle left in November

Moreover, from the Friday close to the low is a 25% range. This % is a very significant amount from a PNL perspective.

Thus, I believe that what is coming is:

1. Too early to go long and PA doesn't support it.

2. Crypto is likely to correct before going up again, if it goes up again.

3. Bottoms are untested, and so a double bottom is possible, but a 78%+ retrace is slightly more likely.

4. Bears are looking for $0.00 because they're very smart, very rational, and are avatars of justice.

5. MMs are going to show them the meaning of "expired worthless" because they're the ones who sold them the puts, lol.

You have to understand that a call for a long trade is not an endorsement of a company, the stock market's health at large, or an underlying instrument.

It's simply that things don't go to the bottom in a straight line, and the more greedy people become, the more fearful you should be.

This is a Warren Buffet quote, and if you can keep a cool head you can take advantage of what's about to happen.

Not only can you take advantage of the long opportunity, but you can use the wisdom to find the best short for when these D-list banks really do go to $0.

SI Silvergate Capital Corporation Options Ahead of EarningsLooking at the SI Silvergate Capital Corporation options chain ahead of earnings , I would buy the $12 strike price Puts with

2023-1-20 expiration date for about

$1.05 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

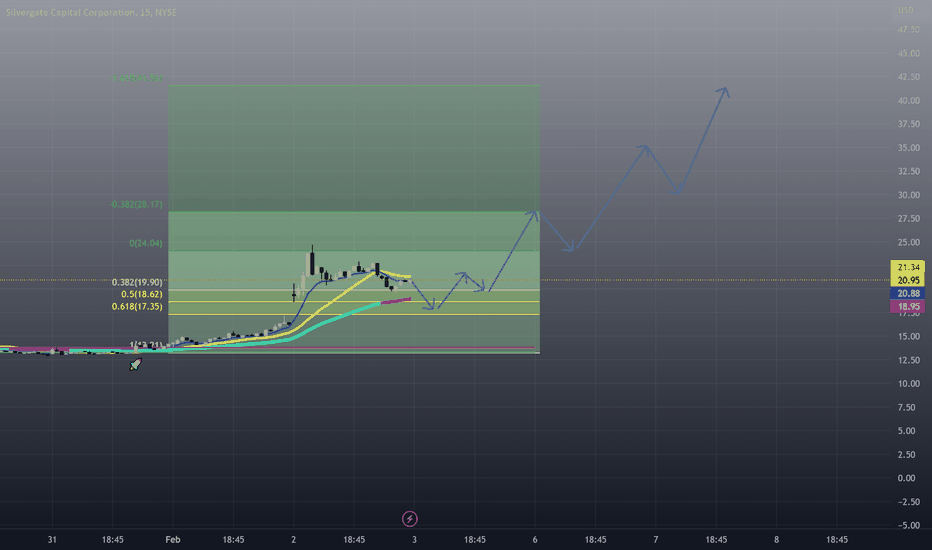

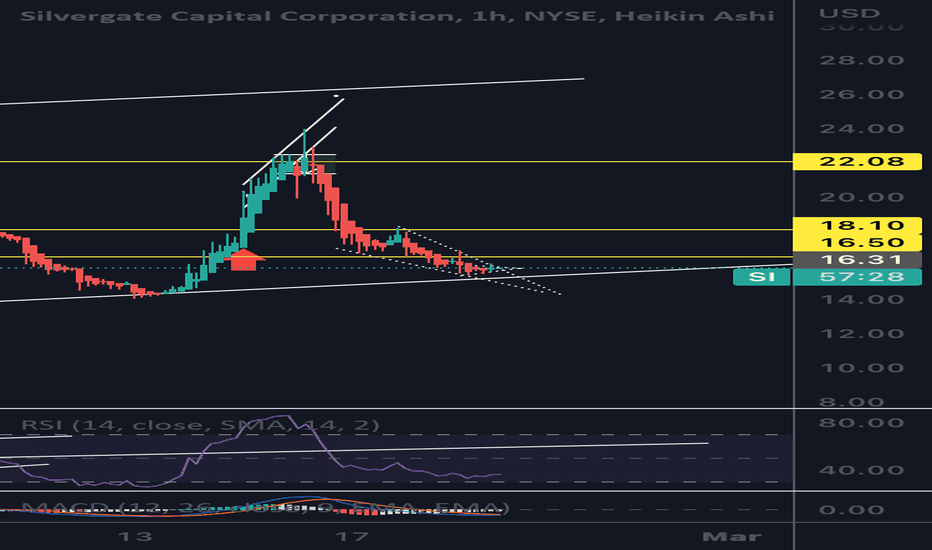

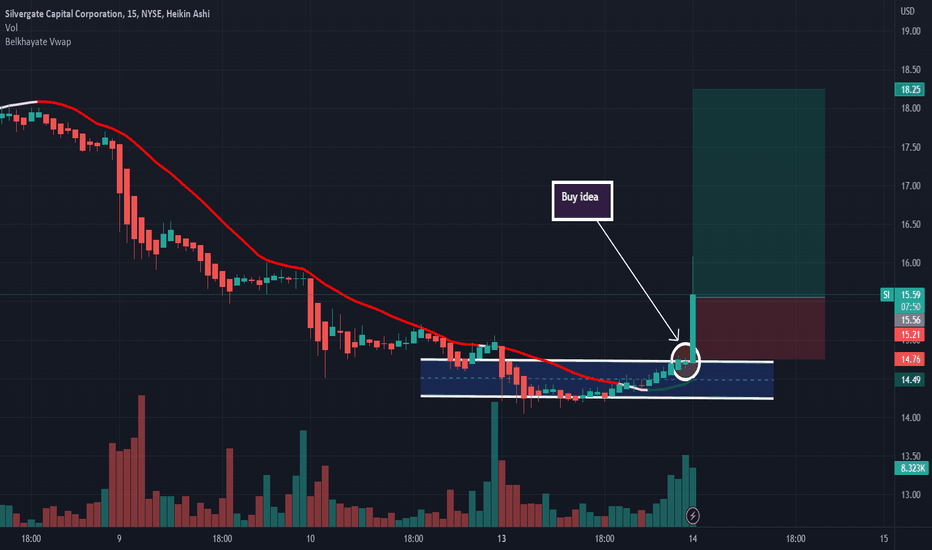

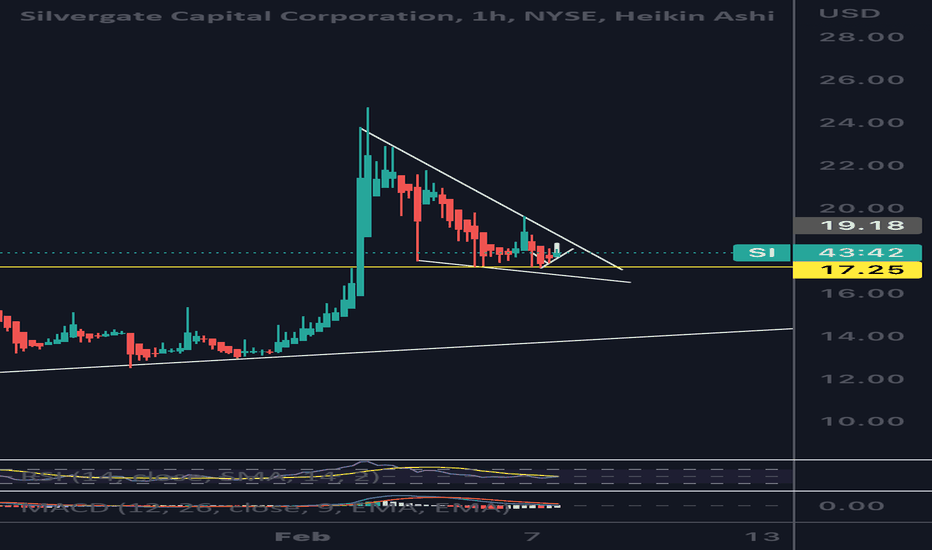

SiLVERGATE Had a falling wedge here. Monster reistance in 2 levels for me 16.50 and my favorite 17.25. Curently I’m scalping an entry at 15.63. I’m already entered. I’m watching a 15 min symtrical triangle forming within a fallingnwedge. If we can flip 16$ into support that should get us to retest 16.50. We need to reclaim 16.50 first and then we can retest 17.25. What we do there will decide if this will get more bullish or not. 1725 is the biggest level for me to reclaim or reject. The biggest long term support is 15.15. If we break lower that’s the buy zone for me I will add to my postion there

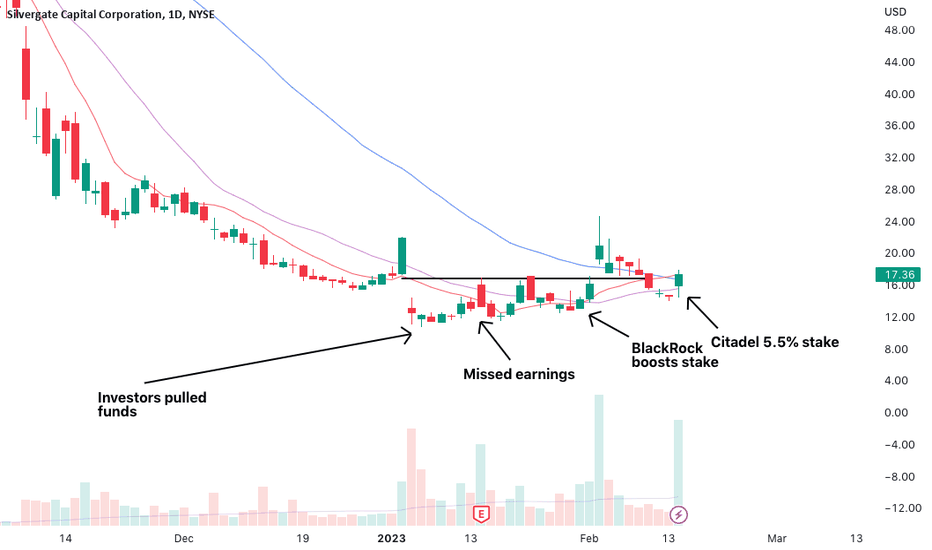

Stock Idea: $SI (15 Feb 2023)$SI

- Been sharing this for awhile. Something exciting developing in SI

- Stock unable to move lower on bad news

- High-volume rallies on good news. Recently, Citadel taking 5.5% stake in company

- 70% short interest as % of float

- Building a mini base after steep downtrend

SI Bag Holders sad, Me Happy SI looks like a train wreck that got hit by a pane crash. That said I like the juice in the options. I am buyer here with a neutral outlook until we can get some more price validation. It should be noted that big hands just entered this pie. But their pockets are beeper than mine so I will proceed with caution

Silver gate This thing could get going. We had a sick bounce off a previous double top of 17.25. I added 50 shares at this level. I’m looking for an uptrend to contiue. This level could be a good support buy but also 17.43 is a solid level. Personally I think this is a big falling wedge into support. Ready for blast off but just be catious of a break of 16.90. This could cancel the idea. I’m long so let’s see how this fed talk goes and looking for a breakout of 19.40s

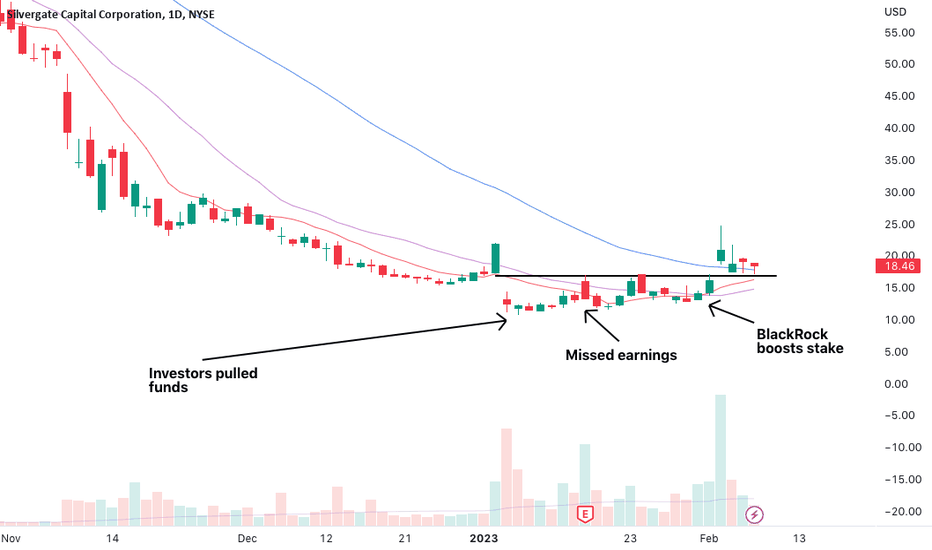

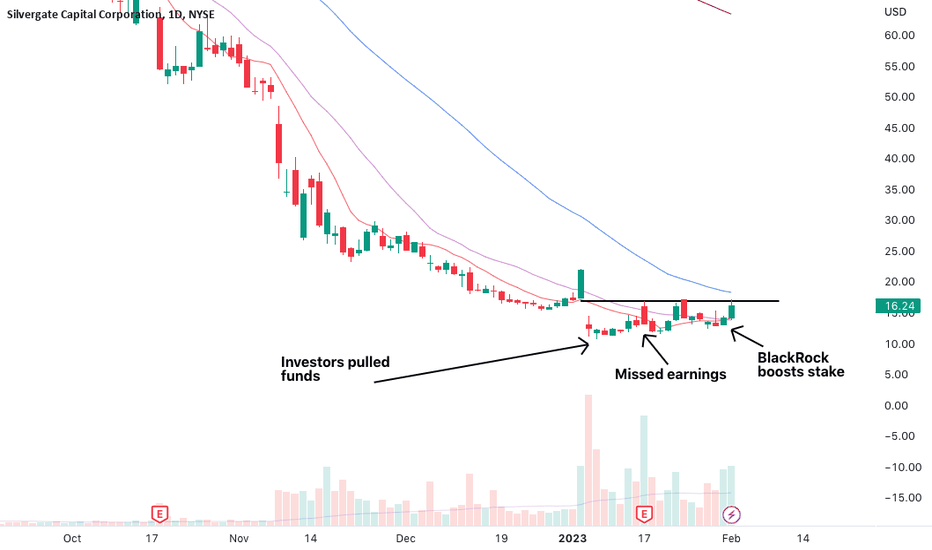

Stock Idea: $SI (2 Feb 2023)$SI

- Looks unable to go down further, despite investors pulling out funds and missing earnings

- BlackRock announced increase in stake in company on 31 Jan

- Building mini inverse H&S. Watching for potential breakout. Could be explosive given strength in cryptos #BTC #ETH

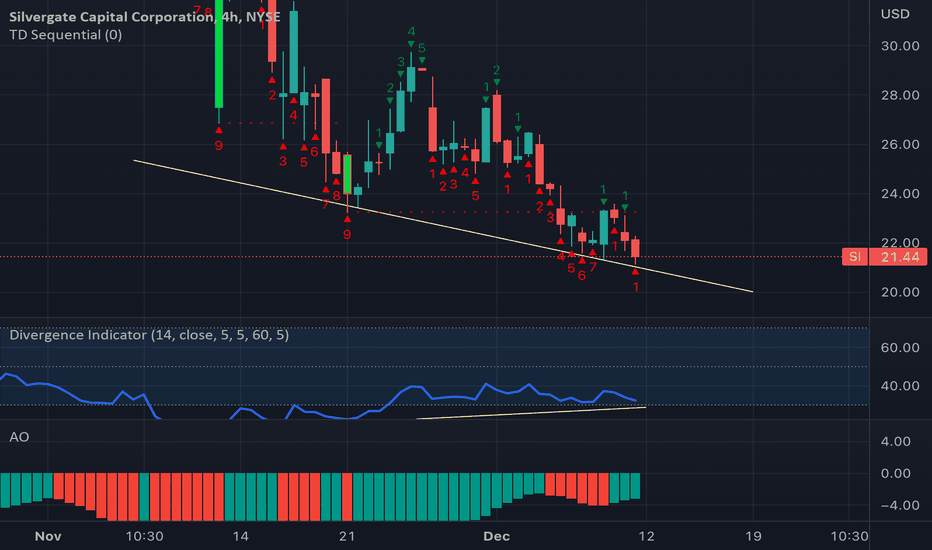

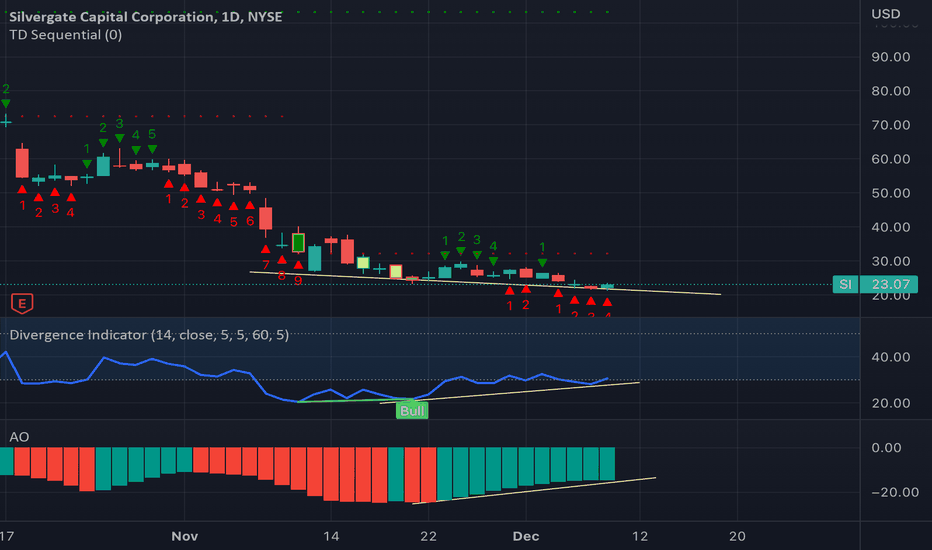

Short squeeze coming soon$SI looks primed for a short squeeze, 40% of the float is short interest , momentum is trending up on the AO, shorts need to cover soon or they are going to get blown up, $SI actually has a robust balance sheet and the claims from the shorts are baseless, Crypto isn't going anywhere, $si being the only crypto bank in the US they have the advantage

SI | Adding a Position Here | Oversold BounceSilvergate Capital Corporation operates as a bank holding company for Silvergate Bank that provides banking products and services to business and individual clients in the United States. The company accepts deposit products, including interest and noninterest bearing demand accounts, money market and savings accounts, and certificates of deposit accounts. Its loan products comprise one-to-four family real estate loans, multi-family real estate loans, commercial real estate loans, construction loans, commercial and industrial loans, mortgage warehouse loans, and reverse mortgage loans, as well as consumer loans and other loans secured by personal property. The company also provides cash management services for digital currency-related businesses. Silvergate Capital Corporation was founded in 1988 and is headquartered in La Jolla, California.