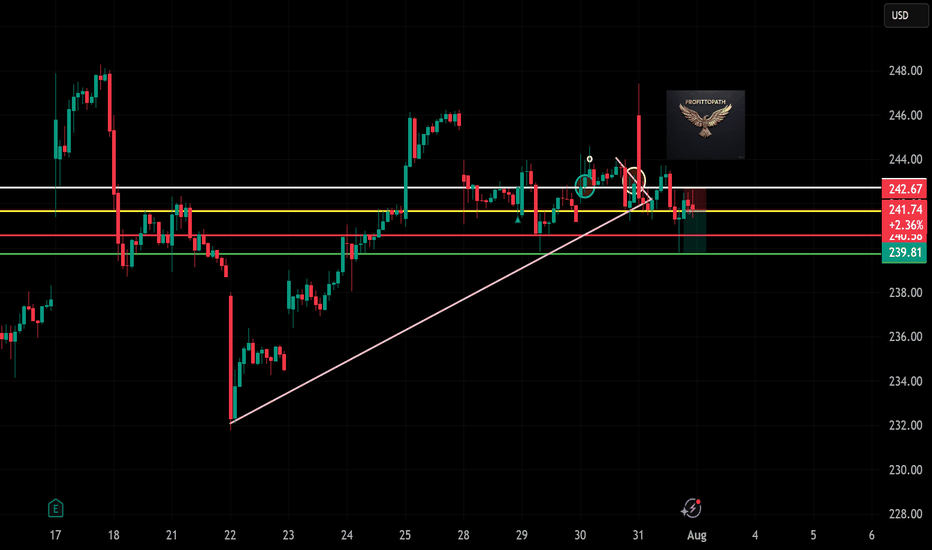

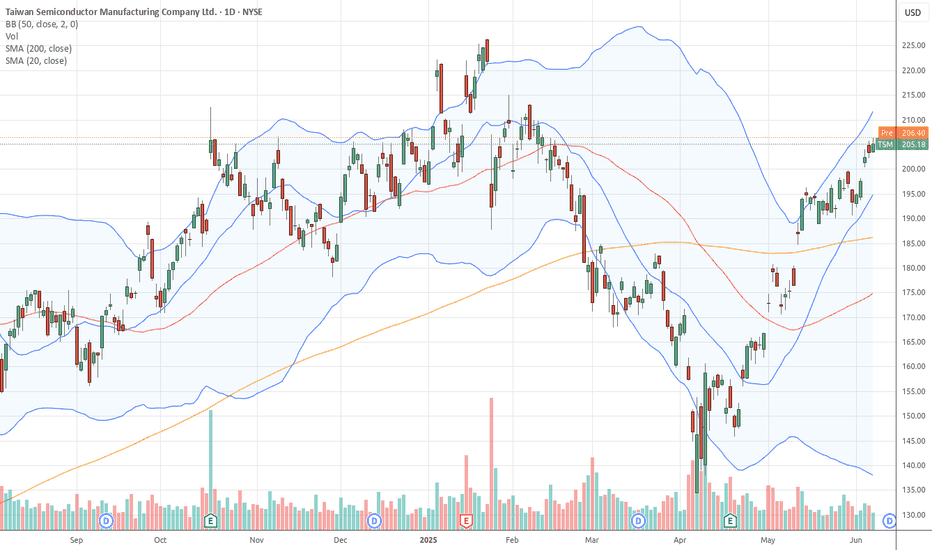

Trade Setup: LONG on TSM !📈 (Taiwan Semiconductor)

🕰️ Timeframe: 30-minute chart

🔍 Pattern: Ascending triangle breakout

📉 Previous Trend: Recovery after drop

🔁 Setup: Bullish continuation with breakout confirmation

🧩 Technical Breakdown:

Support Zone:

~$242.50 (yellow horizontal support)

Uptrend line holding as dynamic su

Key facts today

Taiwan Semiconductor Manufacturing Co. (2330) shares fell 1.7% following the U.S. announcement of a new 20% tariff on Taiwan, raising concerns about its role in the global chip supply chain.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

36.53 B USD

90.12 B USD

5.18 B

About TAIWAN SEMICONDUCTOR MANUFACTURING

Sector

Industry

CEO

Che Chia Wei

Website

Headquarters

Hsinchu

Founded

1987

FIGI

BBG000BD8ZK0

Taiwan Semiconductor Manufacturing Co., Ltd. engages in the manufacture and sale of integrated circuits and wafer semiconductor devices. Its chips are used in personal computers and peripheral products, information applications, wired and wireless communications systems products, and automotive and industrial equipment including consumer electronics such as digital video compact disc player, digital television, game consoles, and digital cameras. The company was founded by Chung Mou Chang on February 21, 1987 and is headquartered in Hsinchu, Taiwan.

Related stocks

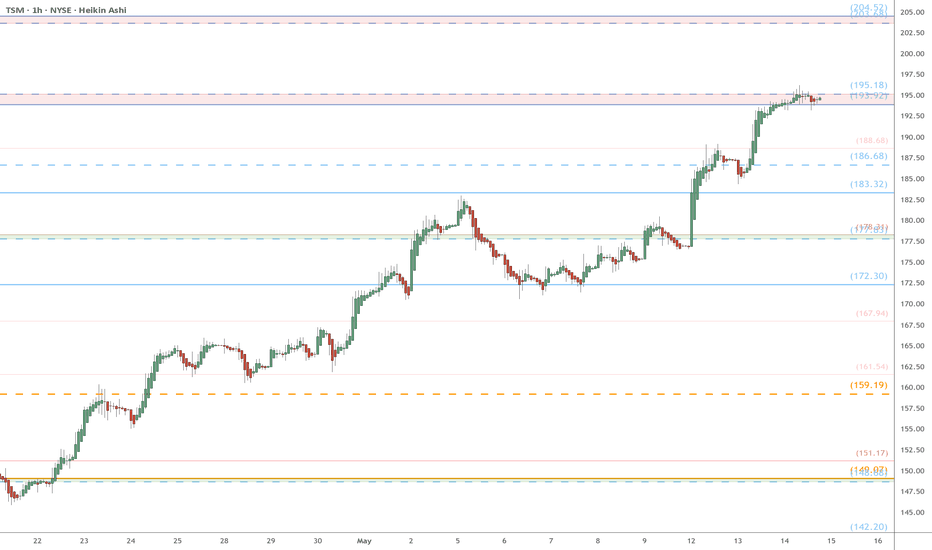

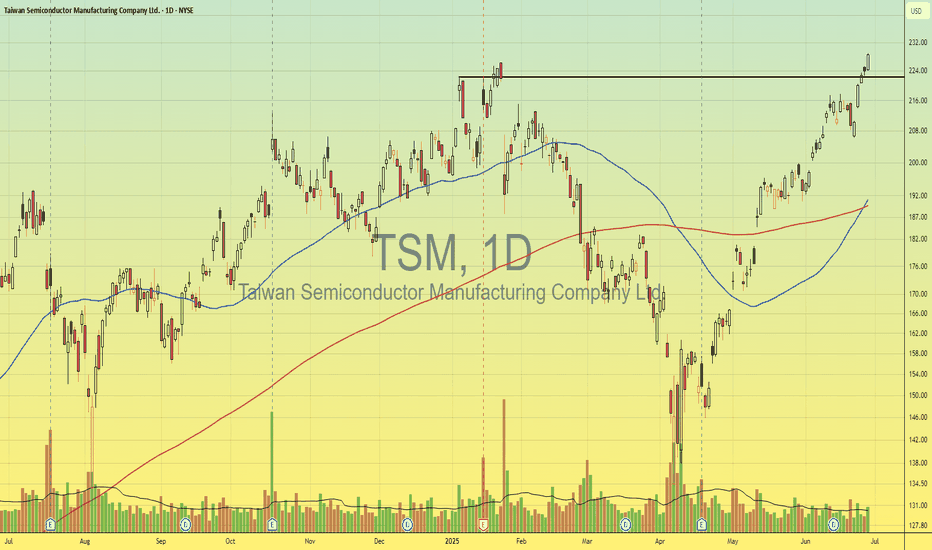

TSM eyes on $194: Major Resistance to Break-n-Run or Dip-to-Buy TSM has been recovering with the chip sector.

Currently testing a Major Resistance zone.

Look for a Dip-to-Buy or Break-n-Retest entry.

$193.92-195.18 is the exact zone of concern.

$177.83-178.31 is the first major support.

$203.68-204.56 is the first resistance above.

============================

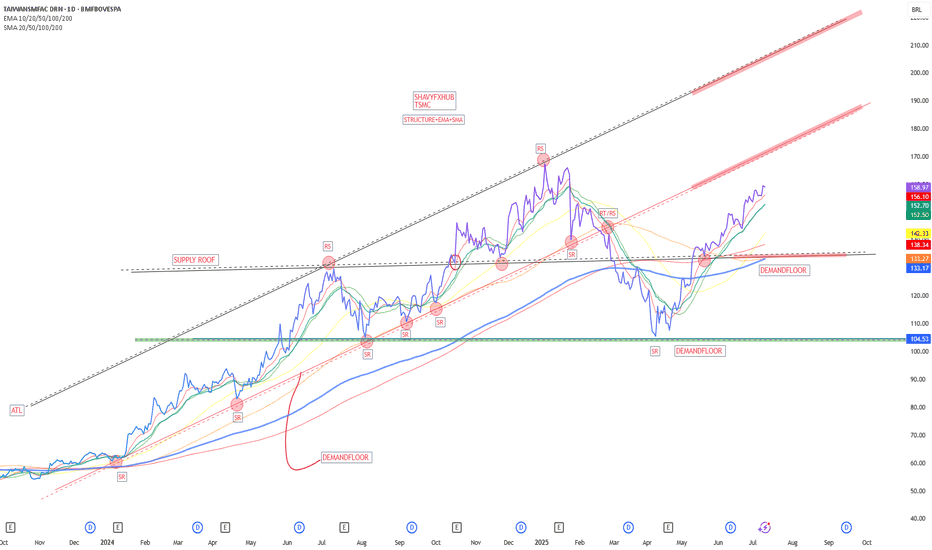

TSMCThe Taiwan Semiconductor Manufacturing Company Limited (TSMC) is the world’s largest and most advanced semiconductor foundry, headquartered in Hsinchu Science Park, Taiwan. Founded in 1987 by Morris Chang, TSMC pioneered the pure-play foundry model, focusing exclusively on manufacturing chips design

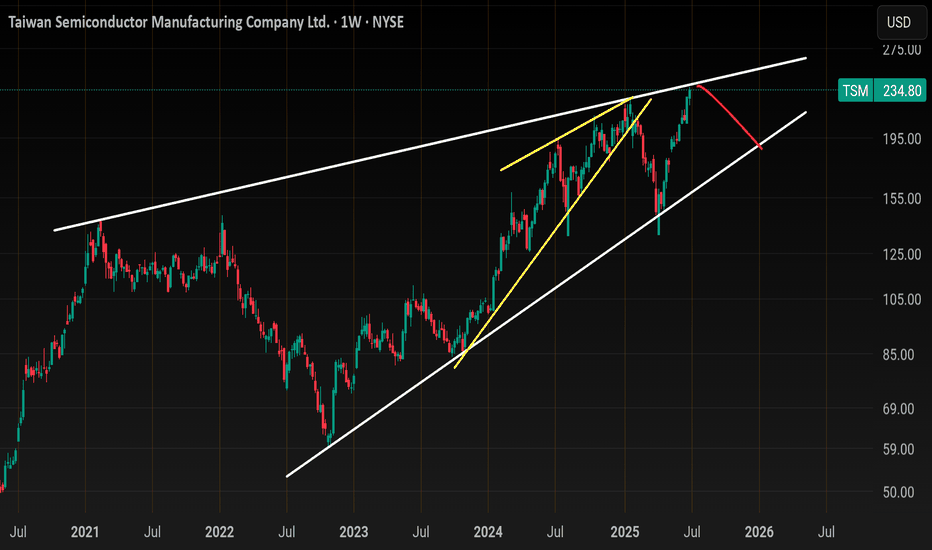

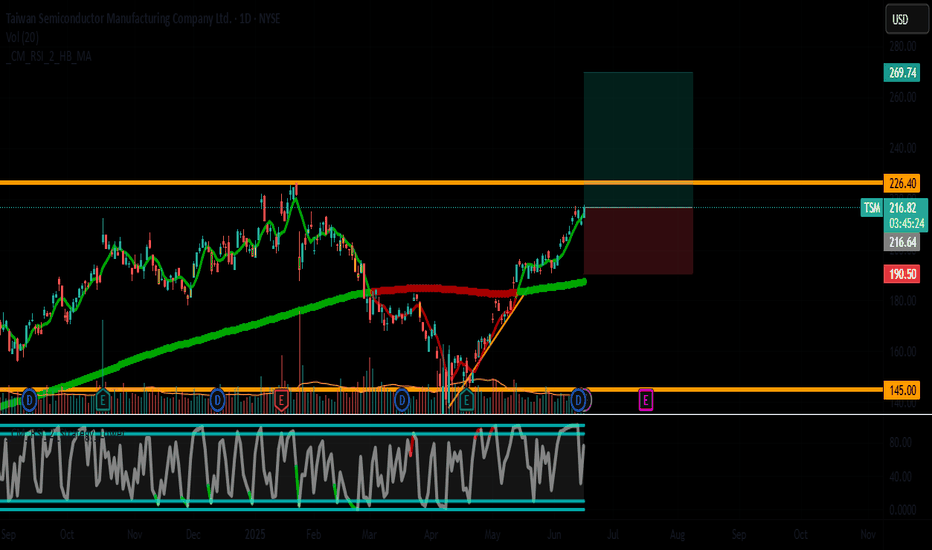

TSM (Taiwan Semiconductor)-Breakout Play with Strong FundamentaTicker: TSM (NYSE)

Recommendation: BUY

Current Price: $216.62

Entry Zone: $216 - $218 (Breakout confirmation)

Stop Loss: $190 (Key support level, -12.3% from entry)

Take Profit: $270.04 (+24.7% upside)

Risk/Reward Ratio: 1:2

📈 Technical Analysis

Trend: Strong bullish momentum across all timeframes

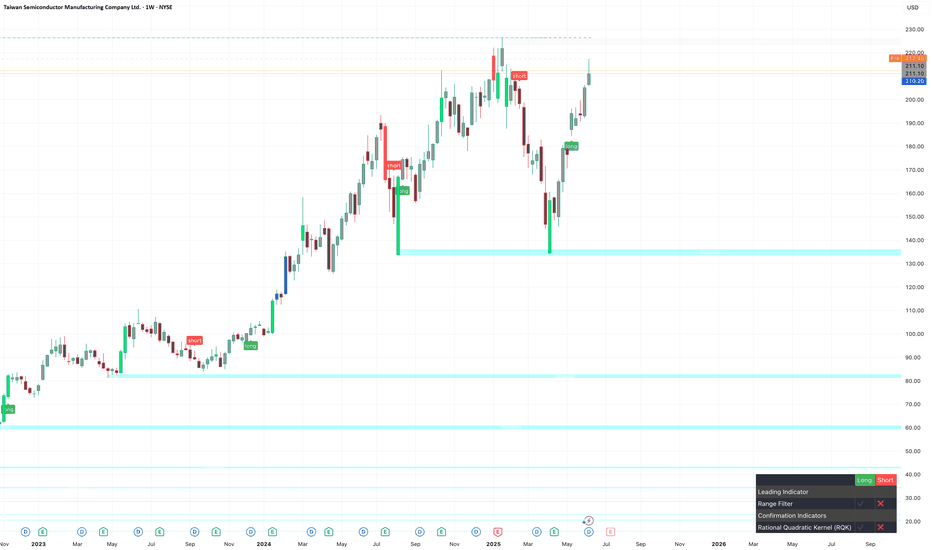

TSM - Bullish Trade IdeaENTRY ZONE & STRIKE ANALYSIS

Optimal Entry Range: $209.80–$210.60 (Pullback Zone into Arc FVG base)

Momentum Entry: Above $214.35 with 15m/30m breakout + bull volume

Strike Focus: TSM 215c / 220c

Expiration Range: June 28 → July 5 (prefer IV pop from short consolidation breakout)

🛡 SL/TP LADDER

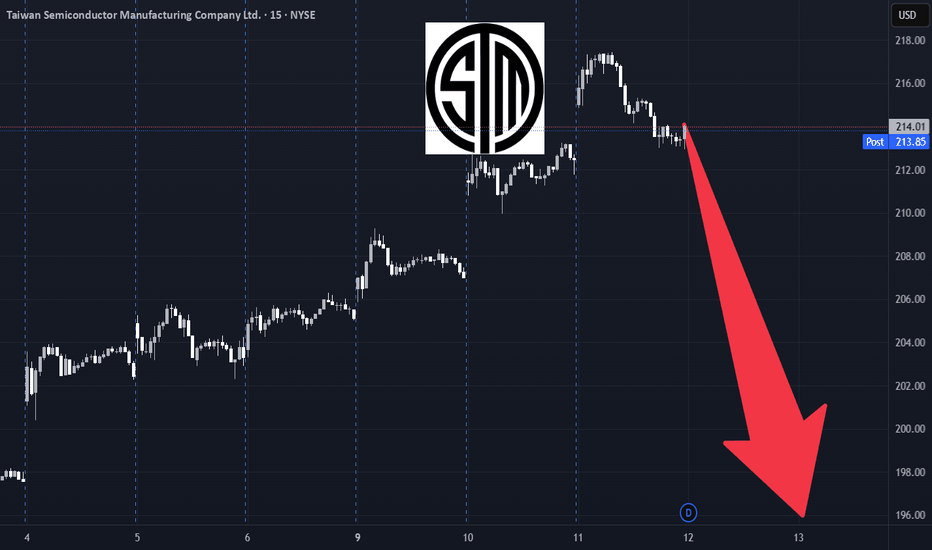

TSM Weekly Options Setup – Overbought with Max Pain Pressure (20📉 TSM Weekly Options Setup – Overbought with Max Pain Pressure (2025-06-11)

Ticker: NYSE:TSM (Taiwan Semiconductor)

Bias: 🔻 Moderately Bearish (Short-Term)

Setup Type: Max Pain Reversion Play | Confidence: 65%

Expiry: June 13, 2025 | Entry Timing: Market Open

🔍 Technical & Sentiment Snapshot

📍 Pr

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

TSM5285159

TSMC Arizona Corp. 3.25% 25-OCT-2051Yield to maturity

5.78%

Maturity date

Oct 25, 2051

TSM5285158

TSMC Arizona Corp. 3.125% 25-OCT-2041Yield to maturity

5.60%

Maturity date

Oct 25, 2041

TSM5399900

TSMC Arizona Corp. 4.5% 22-APR-2052Yield to maturity

5.27%

Maturity date

Apr 22, 2052

TSM5050794

TSMC Global Ltd. 1.375% 28-SEP-2030Yield to maturity

4.68%

Maturity date

Sep 28, 2030

TSM5170546

TSMC Global Ltd. 2.25% 23-APR-2031Yield to maturity

4.62%

Maturity date

Apr 23, 2031

TSM5170544

TSMC Global Ltd. 1.75% 23-APR-2028Yield to maturity

4.55%

Maturity date

Apr 23, 2028

TSM5285157

TSMC Arizona Corp. 2.5% 25-OCT-2031Yield to maturity

4.48%

Maturity date

Oct 25, 2031

TSM5399899

TSMC Arizona Corp. 4.25% 22-APR-2032Yield to maturity

4.47%

Maturity date

Apr 22, 2032

TSM5448853

TSMC Global Ltd. 4.625% 22-JUL-2032Yield to maturity

4.38%

Maturity date

Jul 22, 2032

TSM5399898

TSMC Arizona Corp. 4.125% 22-APR-2029Yield to maturity

4.34%

Maturity date

Apr 22, 2029

TSM5285156

TSMC Arizona Corp. 1.75% 25-OCT-2026Yield to maturity

4.34%

Maturity date

Oct 25, 2026

See all TSM bonds