NZDAUD trade ideas

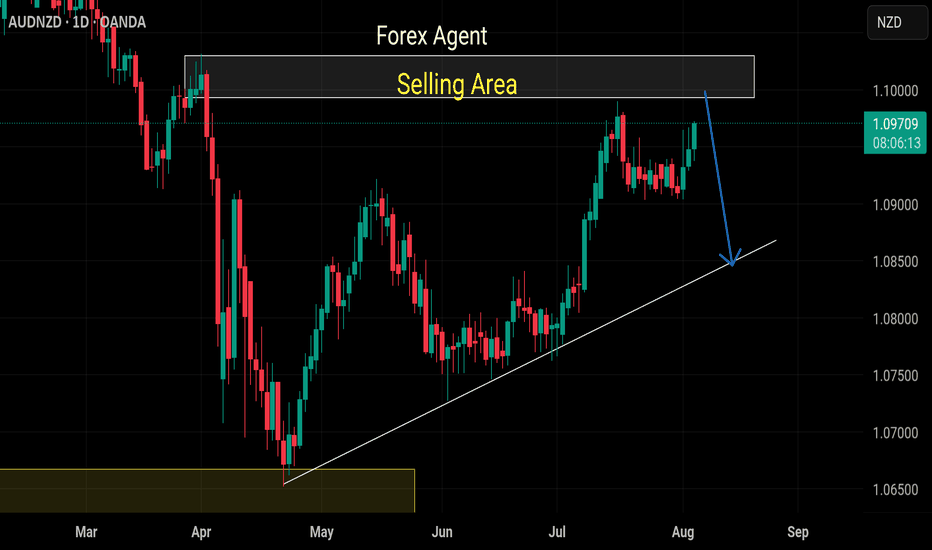

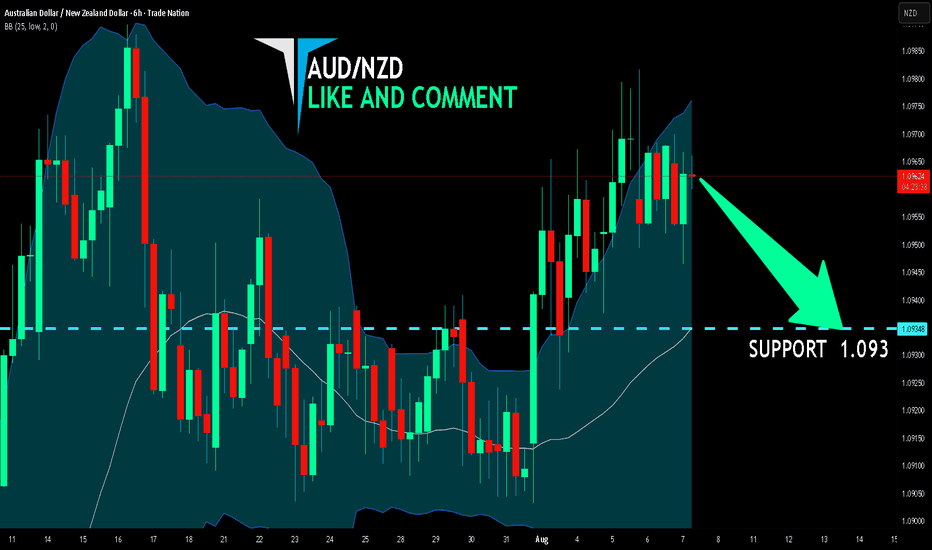

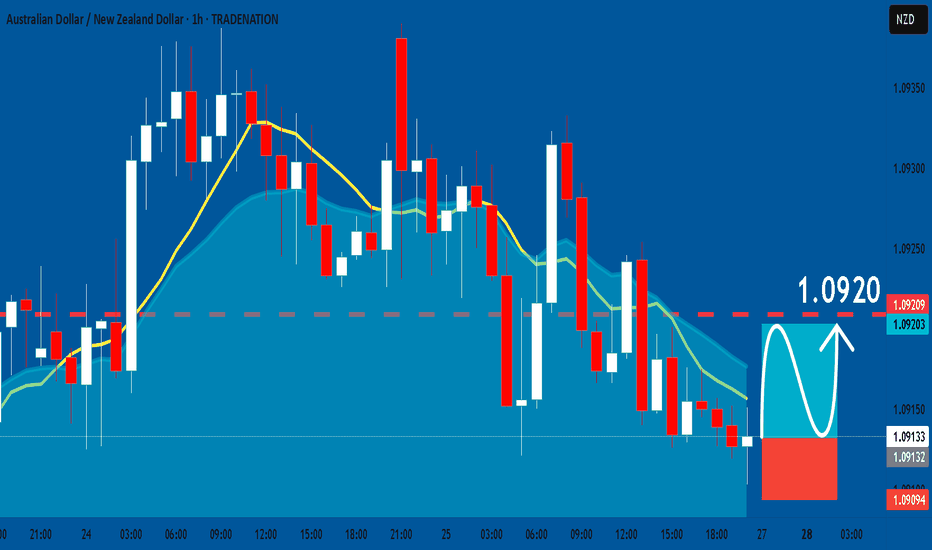

AUDNZD: Expecting Bearish Continuation! Here is Why:

Looking at the chart of AUDNZD right now we are seeing some interesting price action on the lower timeframes. Thus a local move down seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

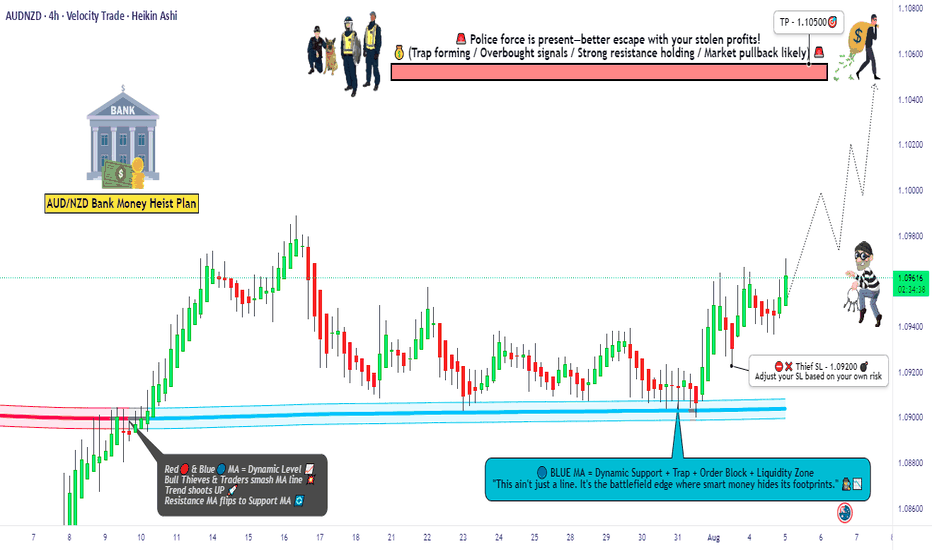

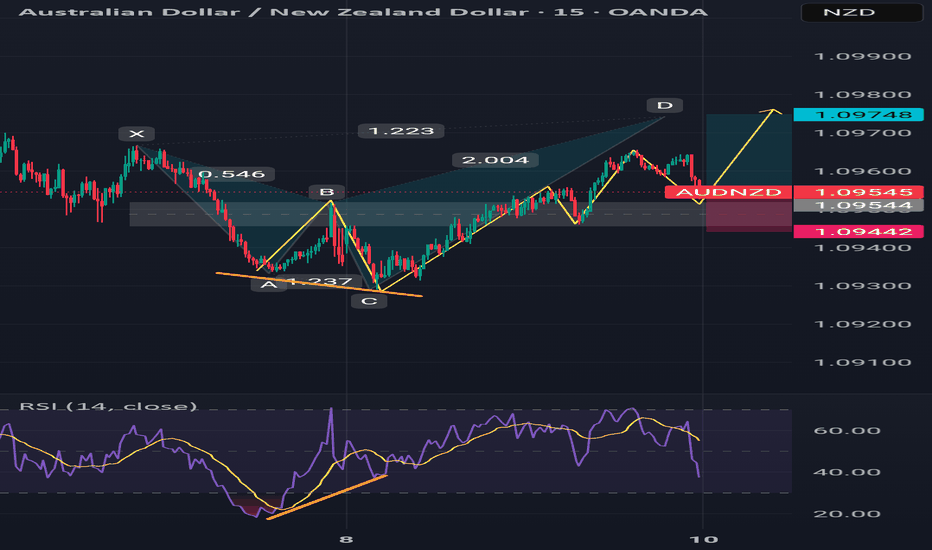

AUD/NZD Heist Loading... Will the Kiwi Surrender to the Aussie?🦘💵 AUD/NZD BULLISH LOOT RAID – THIEF TRADER ENTRY ACTIVE! 🔓🧠

🧭 Asset: AUD/NZD

📊 Plan: Bullish Heist in Progress

🎯 Entry: Thief dives in at any price – using layered limit orders to trap the perfect fill.

🛑 Stop Loss: 1.09200 – Emergency exit if alarms go off 🚨

💰 Target: 1.10500 – Vault full of pips awaiting collection! 💼💸

🕵️♂️ THIEF STRATEGY SNAPSHOT:

The Aussie is loading up the bags and the Kiwi’s guard is down 🐨🆚🥝.

This isn't just a trade—it’s a covert FX raid. Thief is stalking price silently, placing sneaky limit orders in layers—waiting for the market to slip up.

🚪 No fixed door in—every pullback is a crack in the vault.

⚔️ Patience is the blade—entries are stealthy, exits are explosive.

🧠 Using both market structure + sentiment, we sniff out the liquidity stash!

💡 TRADE TIPS FROM THE THIEF'S VAULT:

📉 Layer entries across minor dips (M15-H1 zones) – never chase.

🏃♂️ Price nearing reversal zones? Use tight stops and trail profits like a pro.

📰 Avoid entries during red news – get in before the crowd, not with them.

🧭 This pair respects structure. Don't fight momentum—ride it like a bandit horse.

🔔 THIEF CODE: “We don’t predict—we prepare.”

🎯 Lock in, layer deep, loot fast.

💬 Drop your setup thoughts below 💣

❤️ Like this? Smash that 👍 and join the thief crew!

📌 Save this plan & follow for more stealth market raids.

🕶️ Stay sharp. Stay hidden. Stay profitable.

💼 Next vault breach loading... 👇

📍#ThiefTrader #AUDNZD #LayeredLootPlan #ForexHeist #MarketRaiders

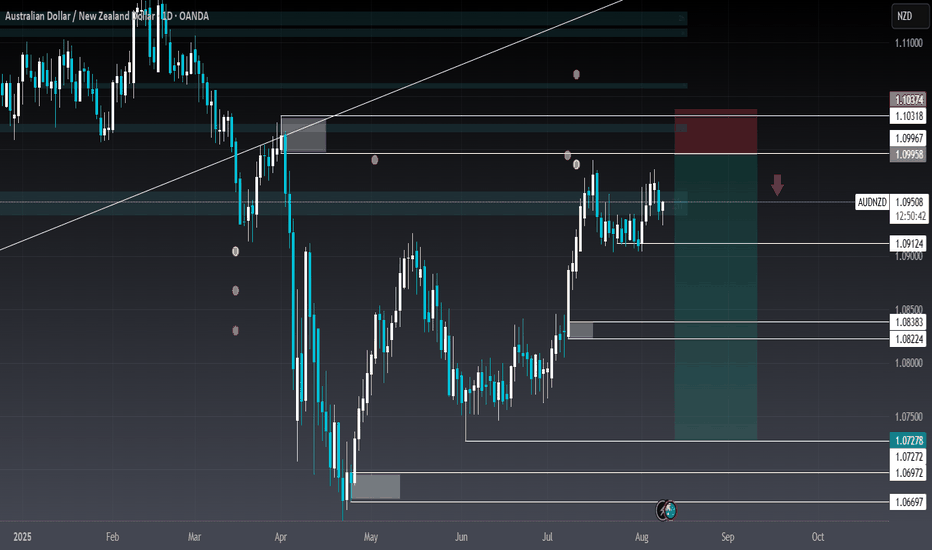

AUDNZD Technical + Fundamental Align for DownsideToday I want to analyze a short position on the AUDNZD ( OANDA:AUDNZD ) pair, first, let's look at it from a fundamental analysis perspective .

Fundamental View on AUDNZD

Key reasons to short AUDNZD:

Australian weakness:

Recent data show weakening consumer sentiment and declining building approvals. The RBA seems hesitant to hike further, putting pressure on the Aussie.

New Zealand resilience:

The RBNZ maintains a relatively hawkish stance. Inflation is still a concern, and the central bank is committed to keeping rates high, supporting NZD strength.

Monetary policy divergence:

The divergence between RBA’s dovish stance and RBNZ’s hawkish approach supports further downside in AUDNZD.

----------------------

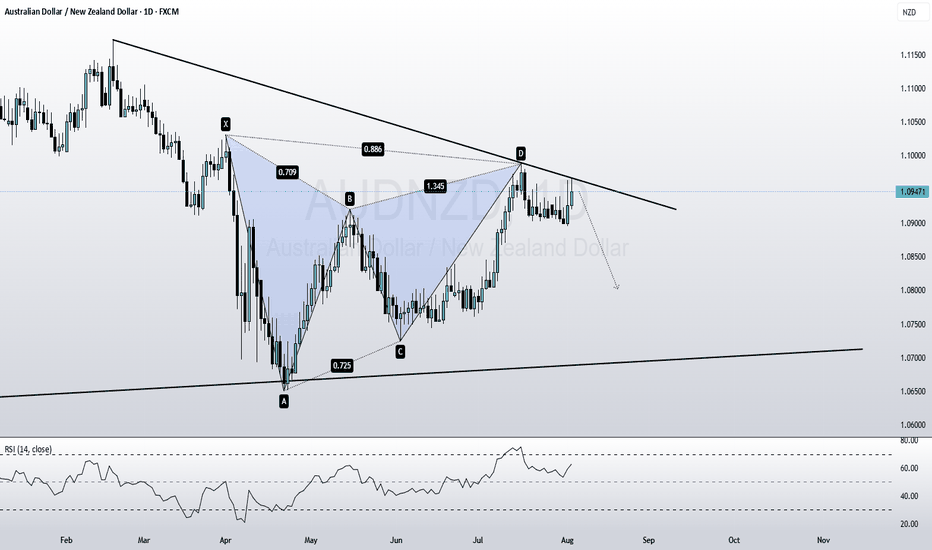

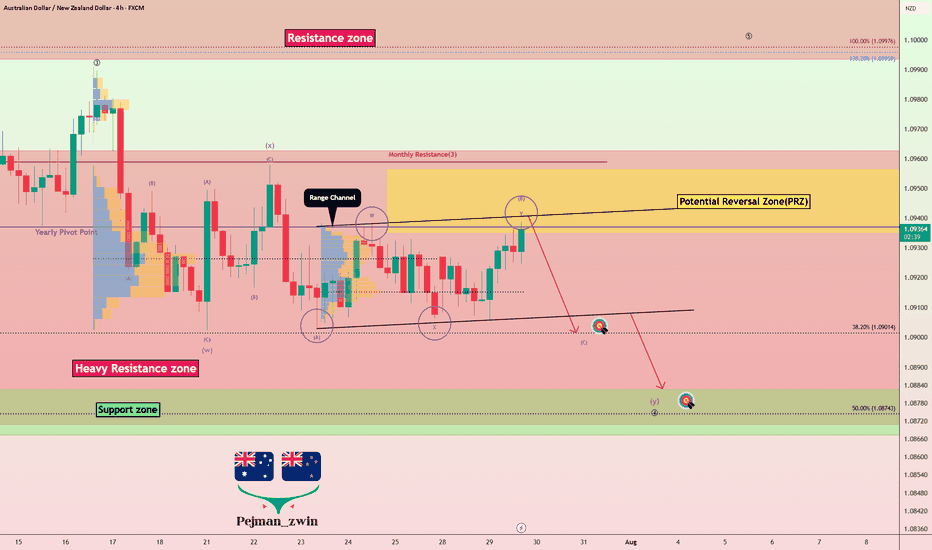

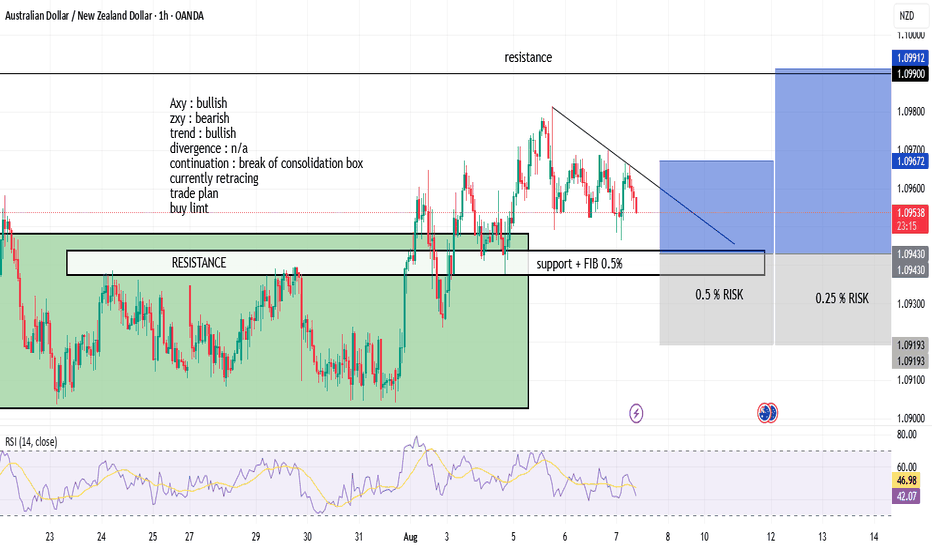

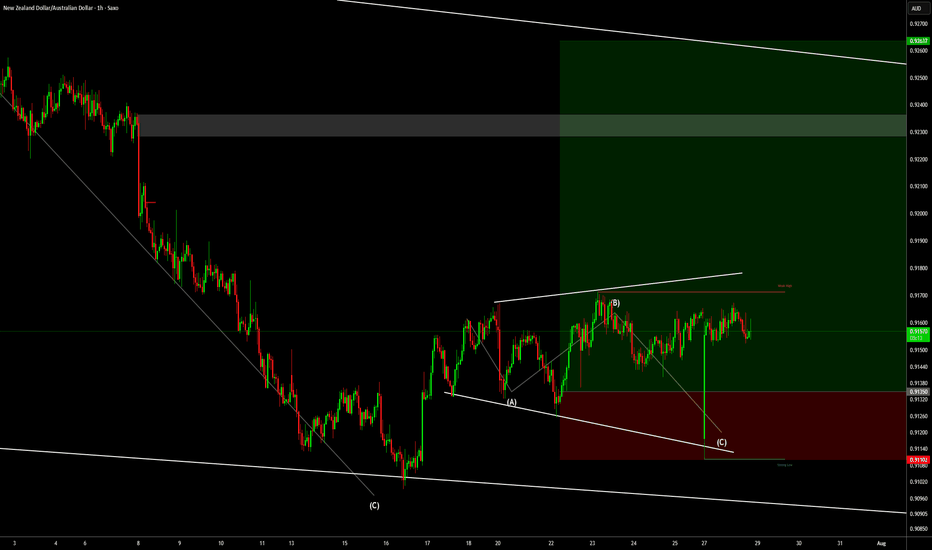

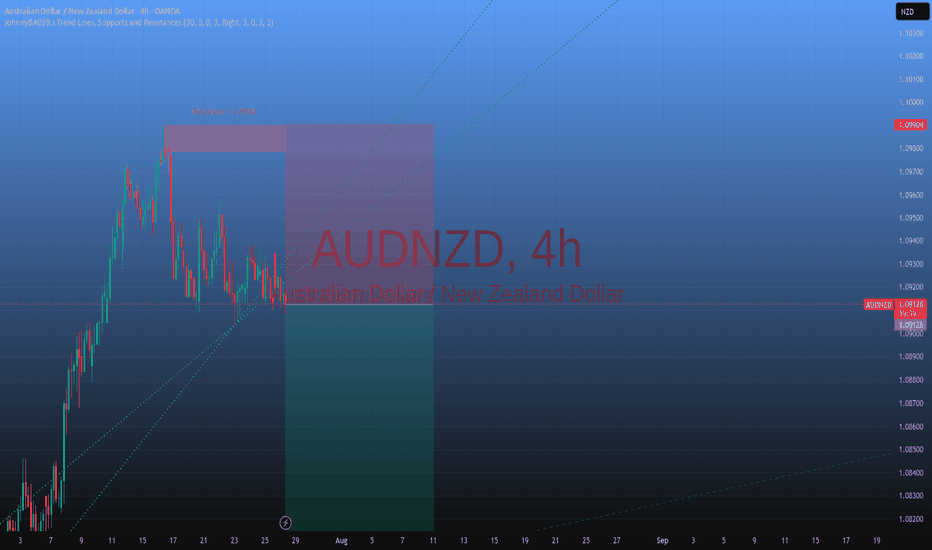

Now let's take a look at AUDNZD from a technical analysis perspective on the 4-hour timeframe .

AUDNZD is currently trading in a Heavy Resistance zone(1.0963 NZD-1.0870 NZD) near the upper line of the Range Channel , Potential Reversal Zone(PRZ) and Yearly Pivot Point .

In terms of Elliott Wave theory , AUDNZD appears to be completing microwave B of microwave Y of the main wave 4 .

I expect AUDNZD to drop to at least 1.0904 NZD(First Target) based on the above explanation .

Second Target: 1.0886 NZD

Note: Stop Loss(SL): 1.0963 NZD

Please respect each other's ideas and express them politely if you agree or disagree.

Australian Dollar/New Zealand Dollar Analyze (AUDNZD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

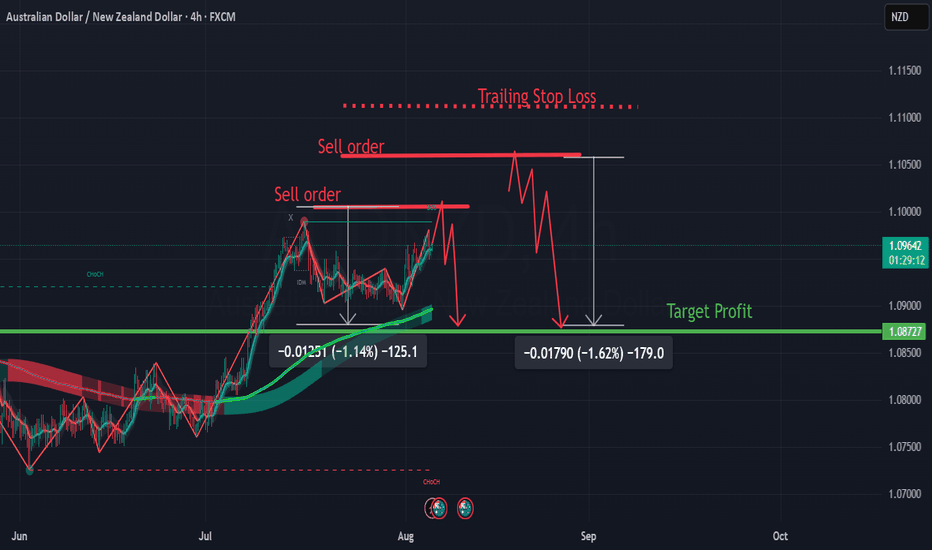

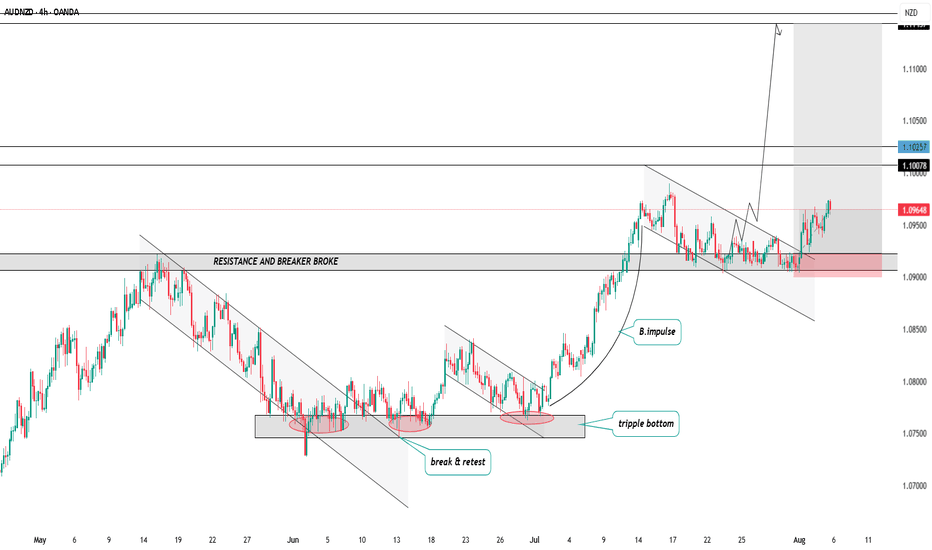

AUDNZD: Waiting for the Kangaroo to SlipThe trend is up — but I’m not buying the bounce. AUDNZD is pushing into resistance, and while the bulls still have short-term control, I’m watching closely for a sell signal. I want to short this pair — but not until the chart tells me the rally is running out of steam.

📉 Trade Bias: I’m looking to short AUDNZD at resistance — once price action confirms weakness.

Here’s why I’m eyeing this setup:

🇦🇺 AUD strength is driven by global optimism, not domestic momentum

🇳🇿 NZ business confidence is booming — 11-year high

🔄 Both central banks are cautious, but the RBA is closer to cutting

🔮 RBA’s next move (August 12) could trigger AUD downside

📊 COT data shows flat AUD bets and a tilt toward NZD shorts reversing

AUD’s recent rally has little to do with fundamentals. It’s been lifted by risk-on flows tied to global trade headlines — but under the hood, things don’t look so hot. Inflation is softening, and the RBA is likely to cut rates soon. Meanwhile, domestic spending and investment remain weak.

NZD isn’t flying, but it’s holding firm. Confidence is building slowly, and although more rate cuts may come later, the RBNZ is taking its time. Traders seem to be shifting away from NZD shorts, showing a slow turn in sentiment.

If AUDNZD stalls here, this could be a fading opportunity. But I won’t jump in without confirmation.

Patience first, then action. Are you watching this zone too — or still riding the bull? 👇

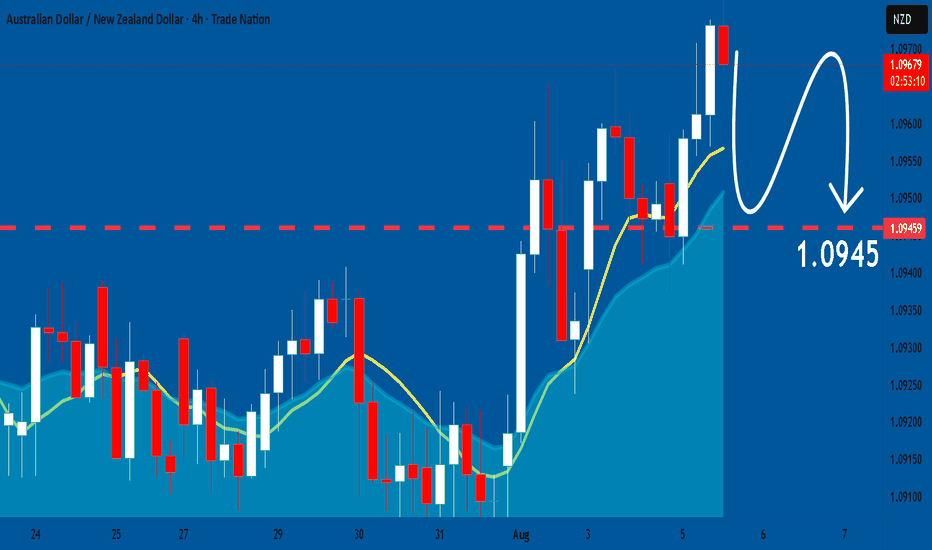

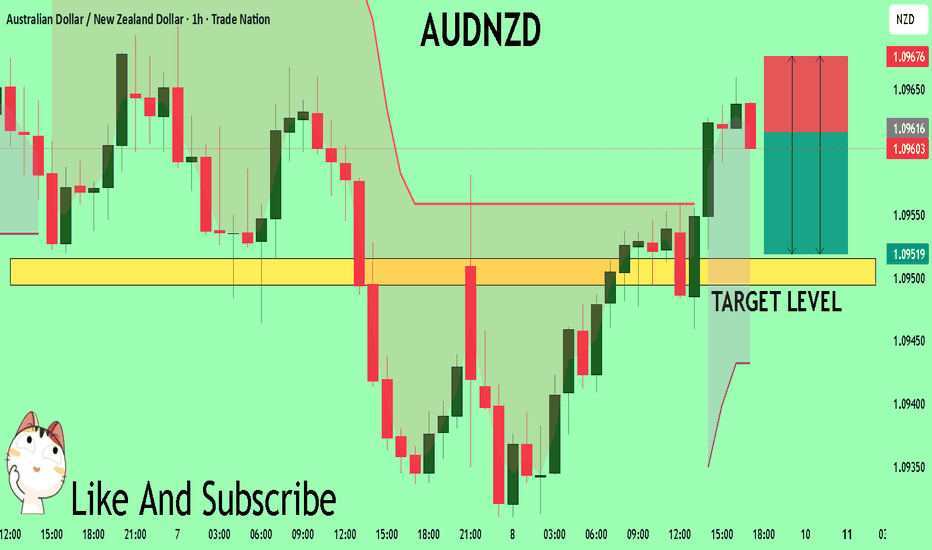

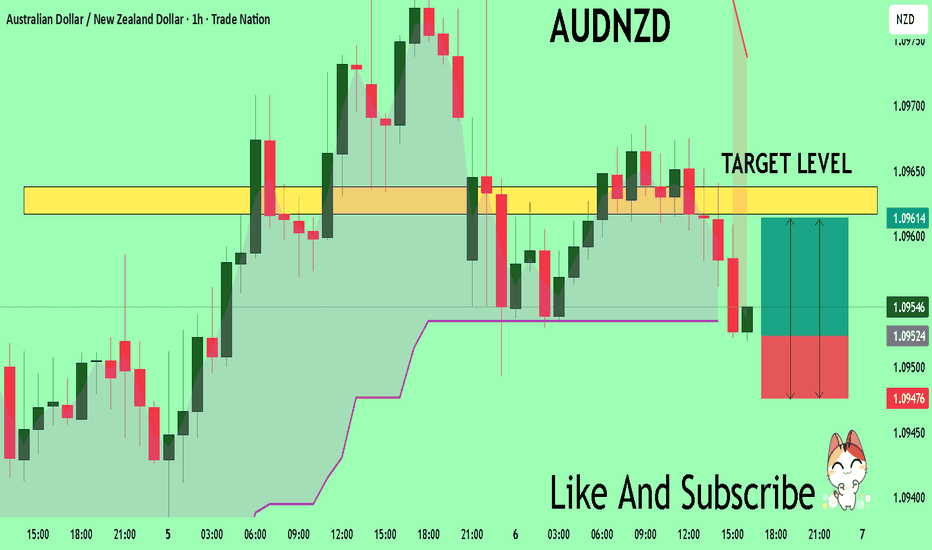

AUDNZD Trading Opportunity! SELL!

My dear friends,

Please, find my technical outlook for AUDNZD below:

The instrument tests an important psychological level 1.0961

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.0951

Recommended Stop Loss - 1.0967

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

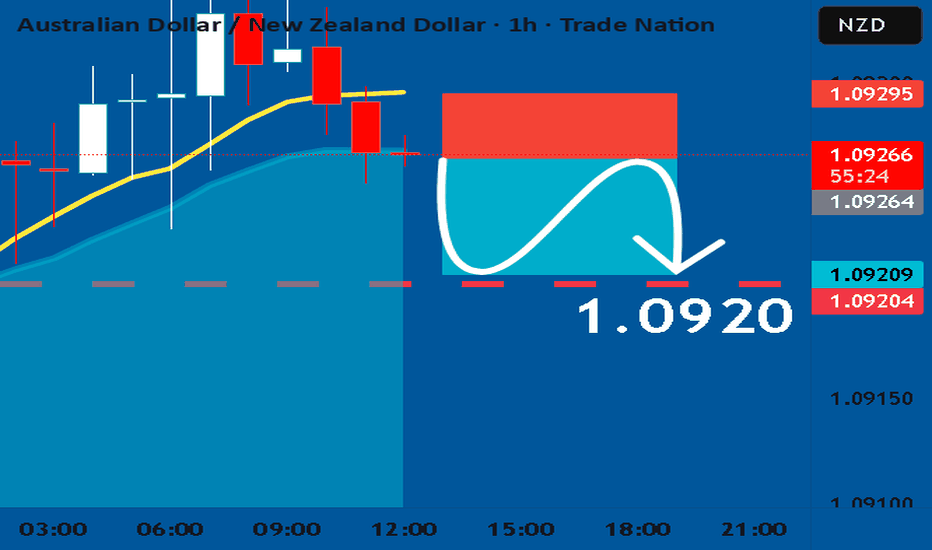

AUDNZD: Short Signal Explained

AUDNZD

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell AUDNZD

Entry Level - 1.0926

Sl - 1.0929

Tp - 1.0920

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

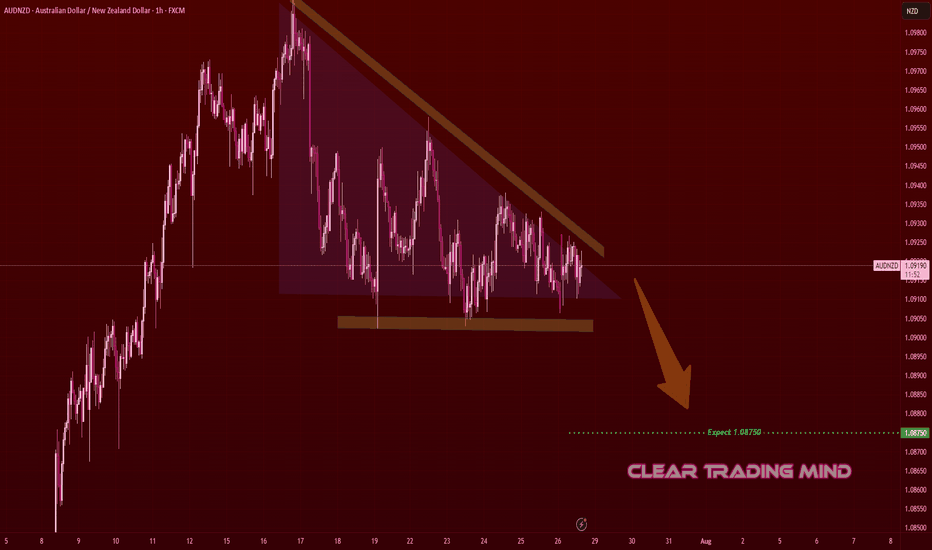

AUDNZD Descending Triangle – Bearish Breakout SetupOn the 1-hour chart, AUDNZD is forming a descending triangle 📐, a bearish continuation pattern.

- Horizontal support is holding but getting repeatedly tested

- Lower highs indicate selling pressure

Plan:

- Break and close below support may trigger a bearish continuation

- Target: 1.08750 🎯 (≈ 35 pips from current price)

- Invalidation if price breaks above descending trendline and holds

Reasoning:

- Descending triangle often leads to breakdowns when tested multiple times

- Lower highs show sellers gaining control

- Short bias remains as long as price respects the triangle resistance

(Personal chart study, not financial advice)

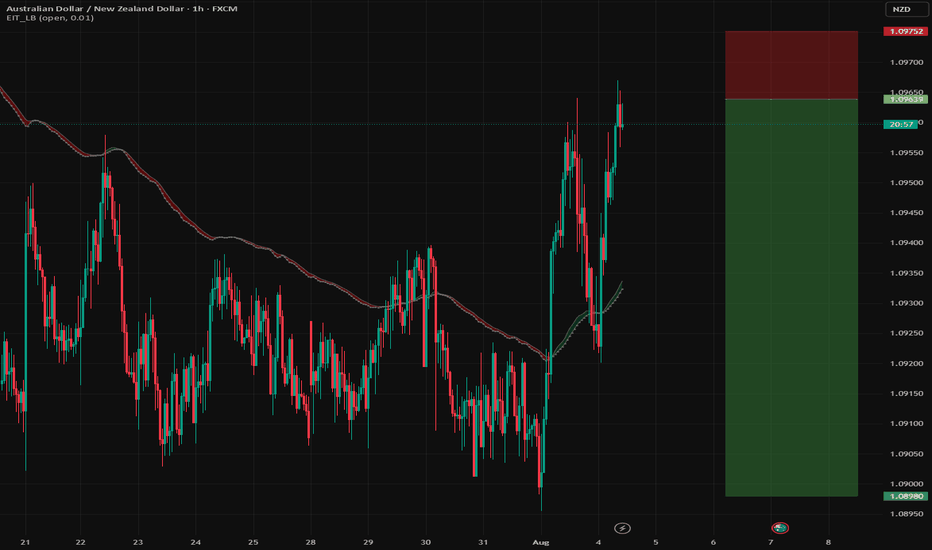

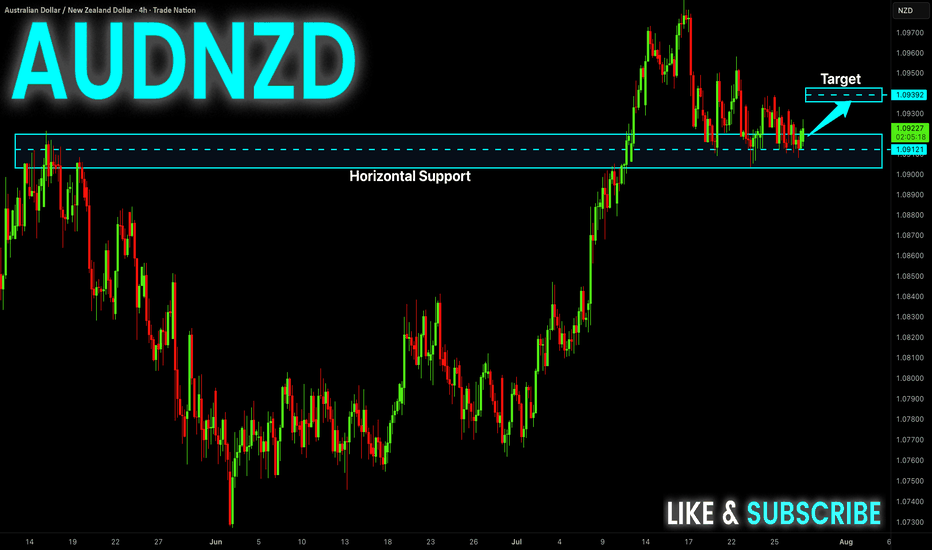

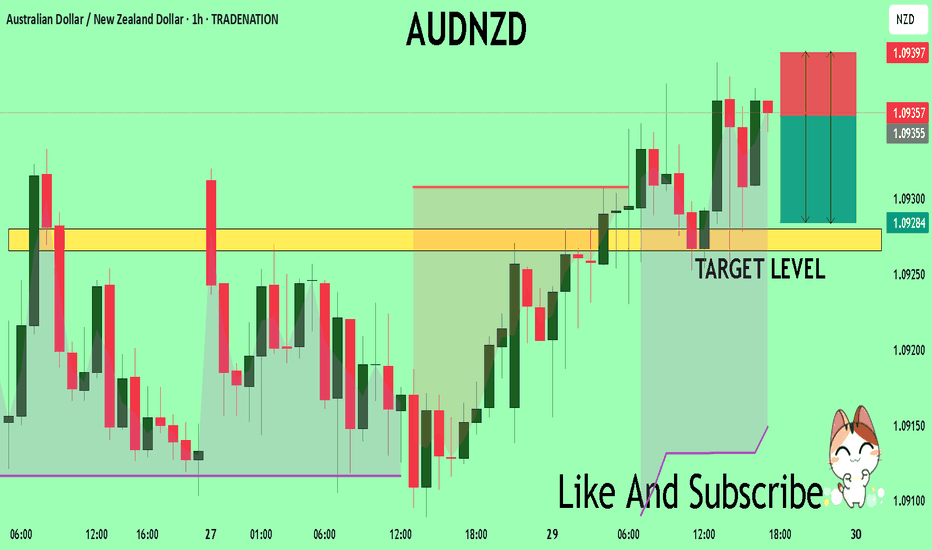

AUD-NZD Rebound Ahead! Buy!

Hello,Traders!

AUD-NZD made a retest

Of the wide horizontal support

Level again at 1.0909 and we

Are already seeing a bullish

Reaction so a local bullish

Rebound can be expected

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDNZD Trading Opportunity! BUY!

My dear subscribers,

This is my opinion on the AUDNZD next move:

The instrument tests an important psychological level 1.0952

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.0961

My Stop Loss - 1.0947

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUD/NZD BEARS ARE STRONG HERE|SHORT

Hello, Friends!

AUD-NZD uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 1.093 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the AUD/NZD pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

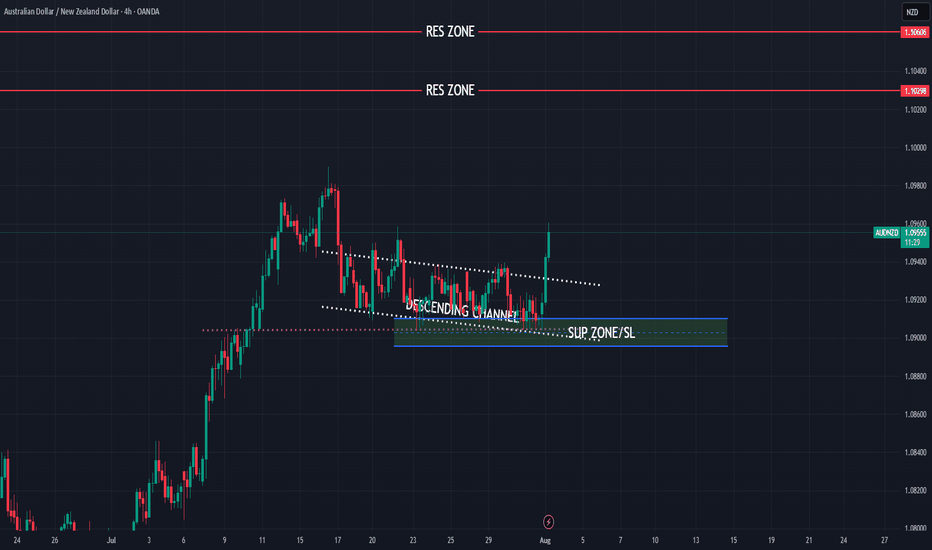

AUDNZD still bullish trend expecting

OANDA:AUDNZD last five analysis accurate (attached), here is new view on AUDNZD, still bullish expecting, price is not break strong zone, bouncing - pushing strongly from same, looks like DESCENDING CHANNEL is breaked.

Here still bullish expectations having.

SUP zone: 1.09100

RES zone: 1.10300, 1.10600

AUDNZD Technical Analysis! SELL!

My dear friends,

AUDNZD looks like it will make a good move, and here are the details:

The market is trading on 1.0935 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 1.0928

Recommended Stop Loss - 1.0939

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Trade management for NZD/AUDThe US-EU trade deal boosted USD demand and jolted FX markets at the open. This, coupled with low liquidity during the Monday Asian session caused a gap in this pair. Our short term trade was taken out at break even, while our medium term trade narrowly survived. This was a technical play in an odd pair, opportunistic while doing some charting :) I took profit at 1:1 and will wait to deploy capital elsewhere.

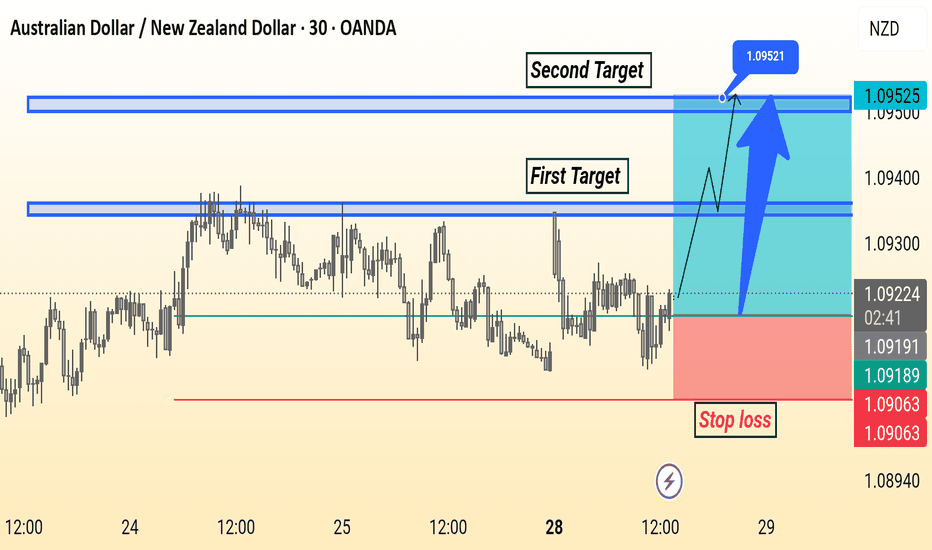

AUD/NZD Analysis is Ready Move Will Be Fly This AUD/NZD 30-minute chart shows a bullish setup with entry around 1.09216. The first target is near 1.09400 and the second target is at 1.09521. A stop loss is placed below support at 1.09063. The analysis suggests a potential upward move after a breakout.

AUDNZD: Bullish Continuation & Long Trade

AUDNZD

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy AUDNZD

Entry Level - 1.0913

Sl - 1.0909

Tp - 1.0920

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️