NZDAUD trade ideas

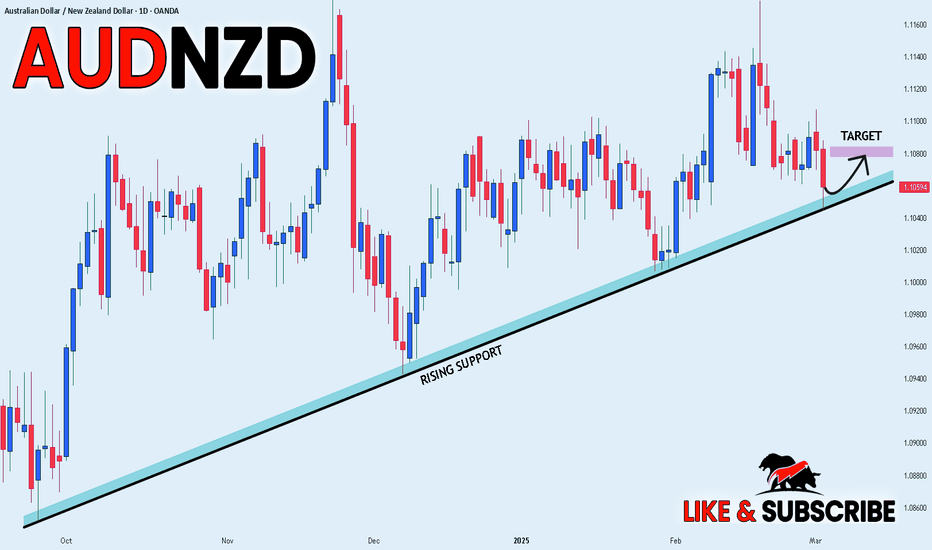

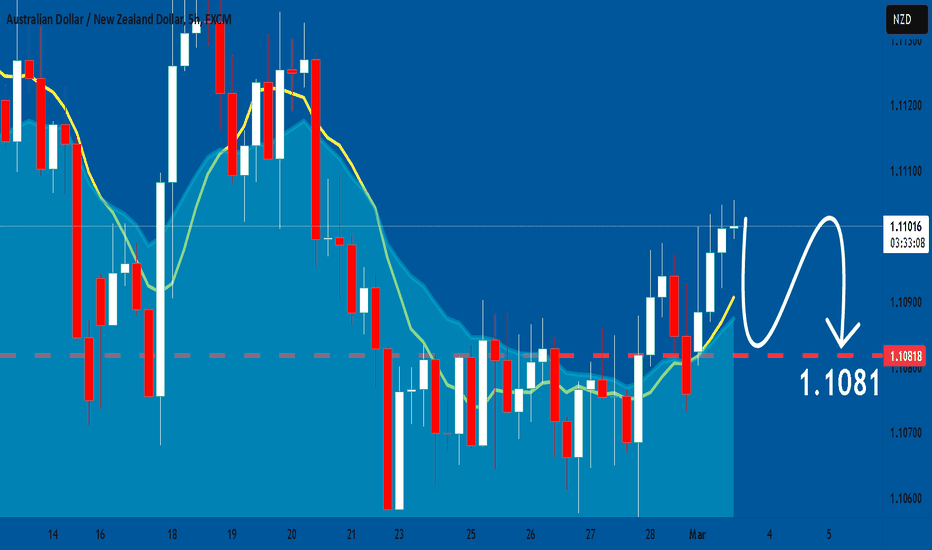

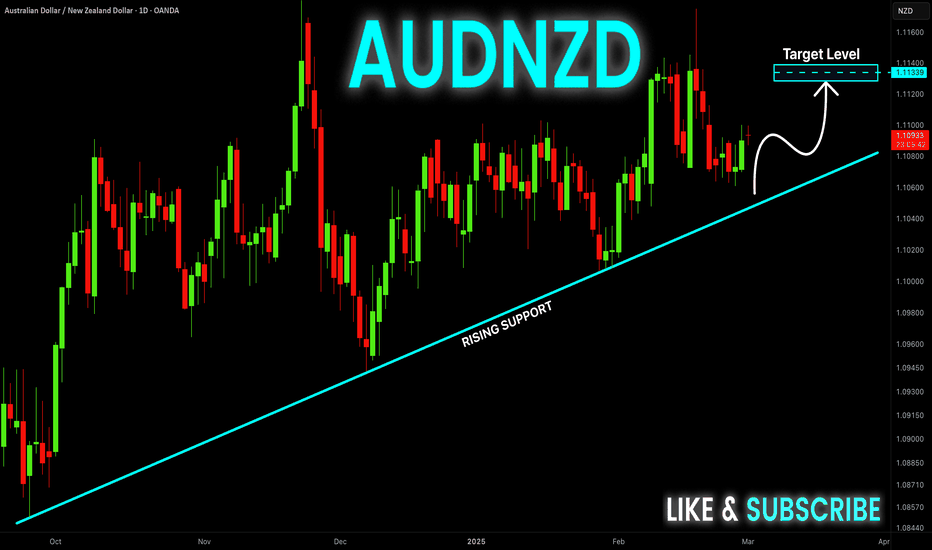

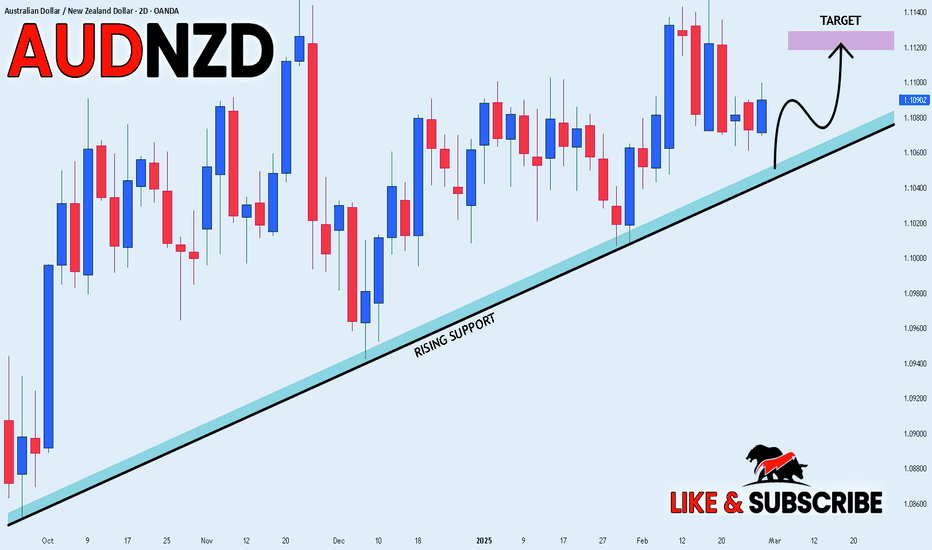

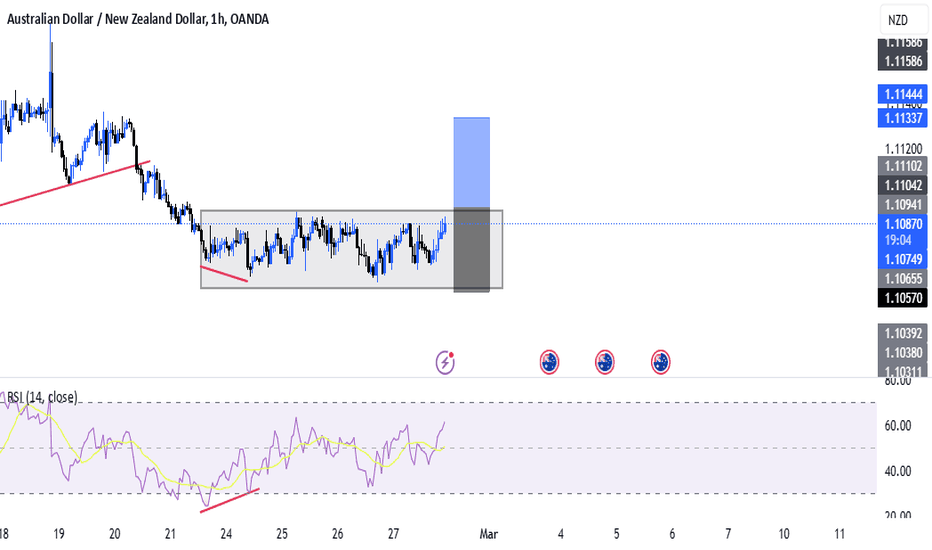

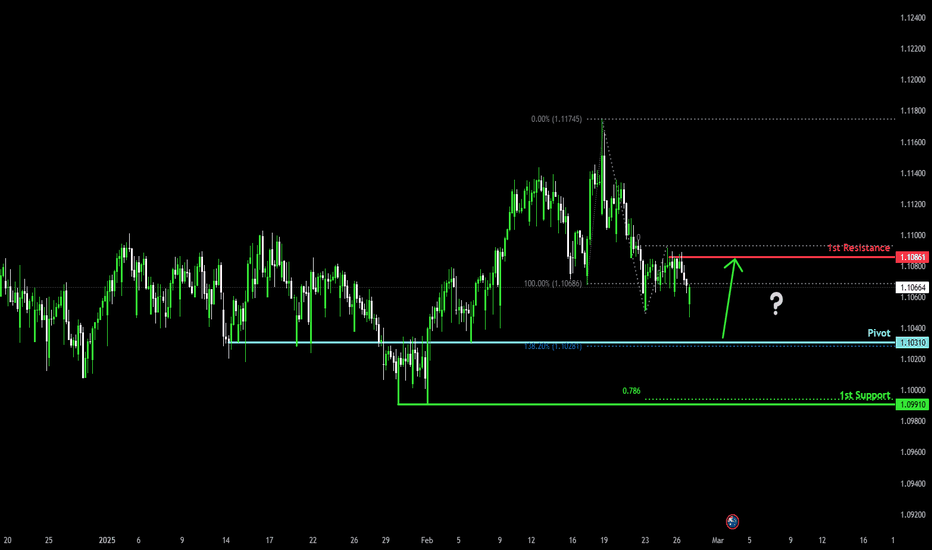

Bullish bounce?AUD/NZD is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 1.1031

1st Support: 1.0991

1st Resistance: 1.1086

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

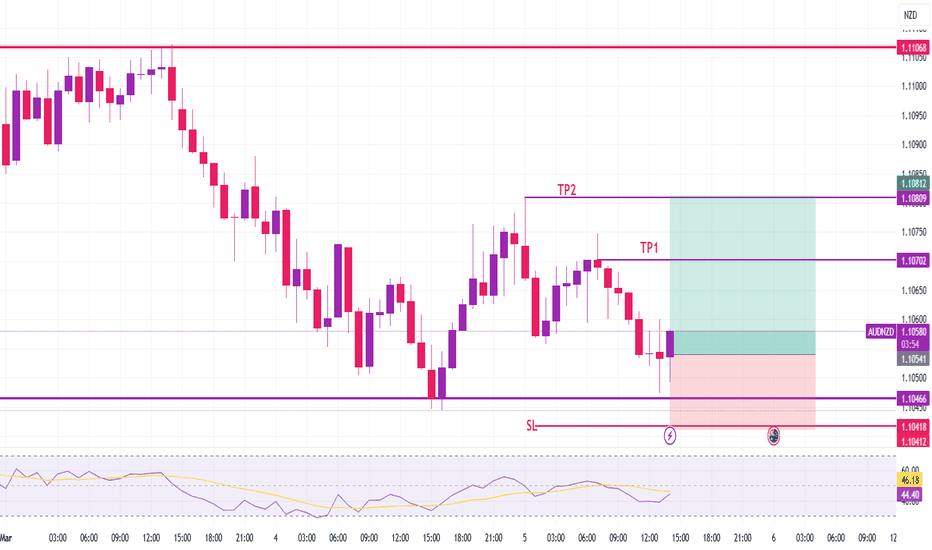

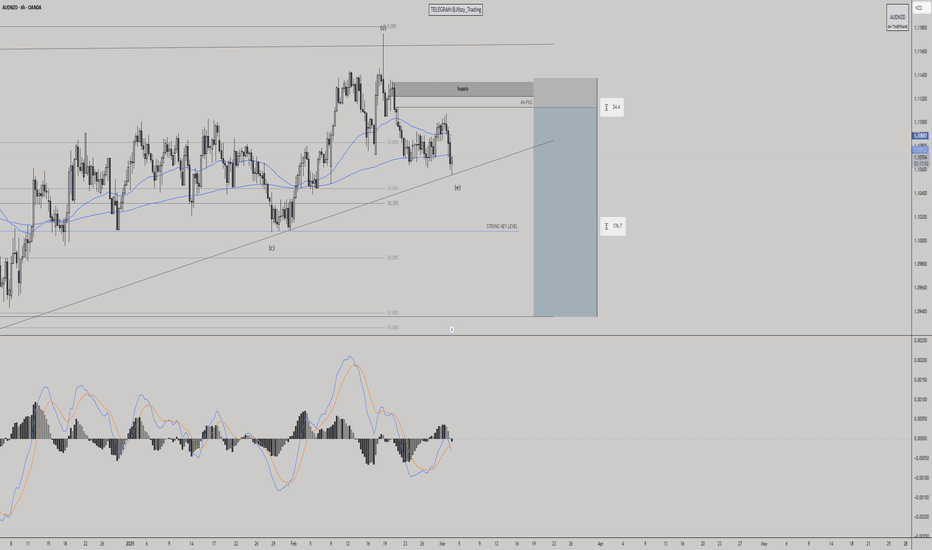

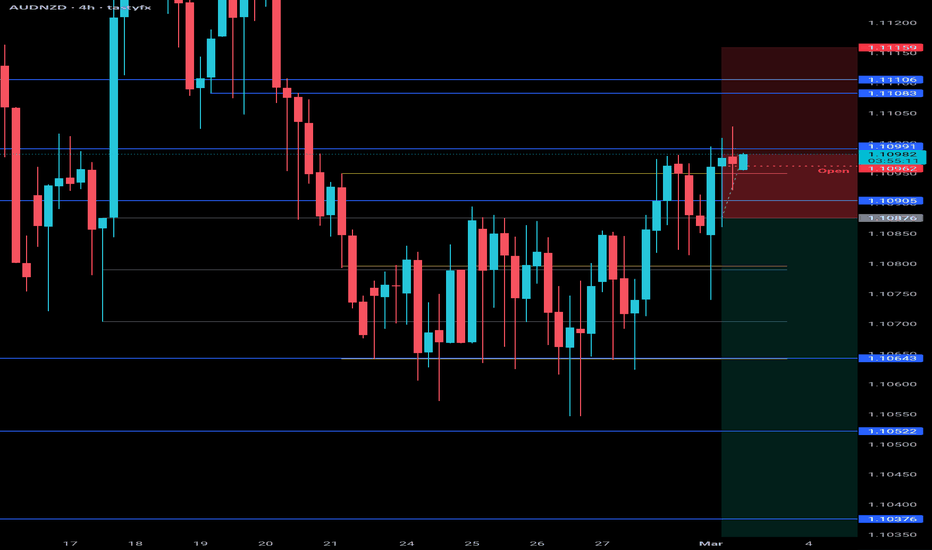

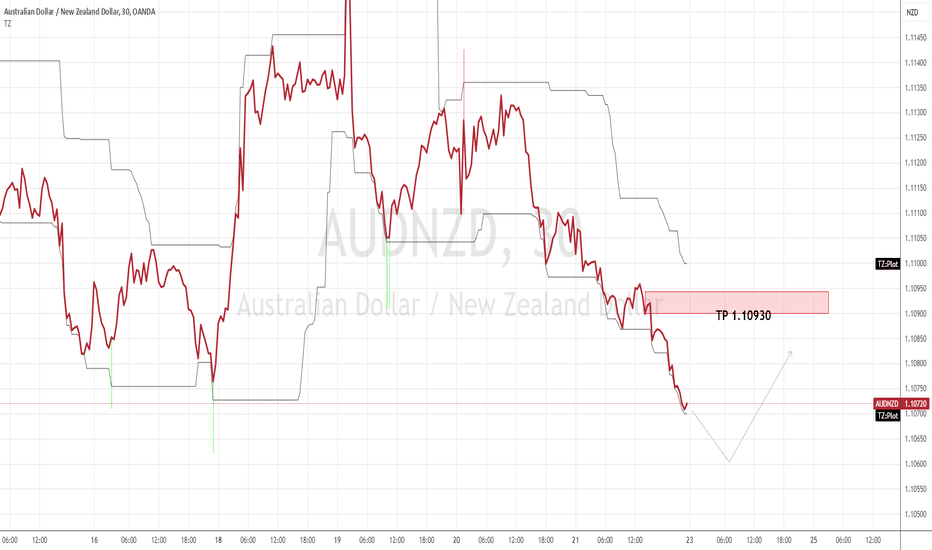

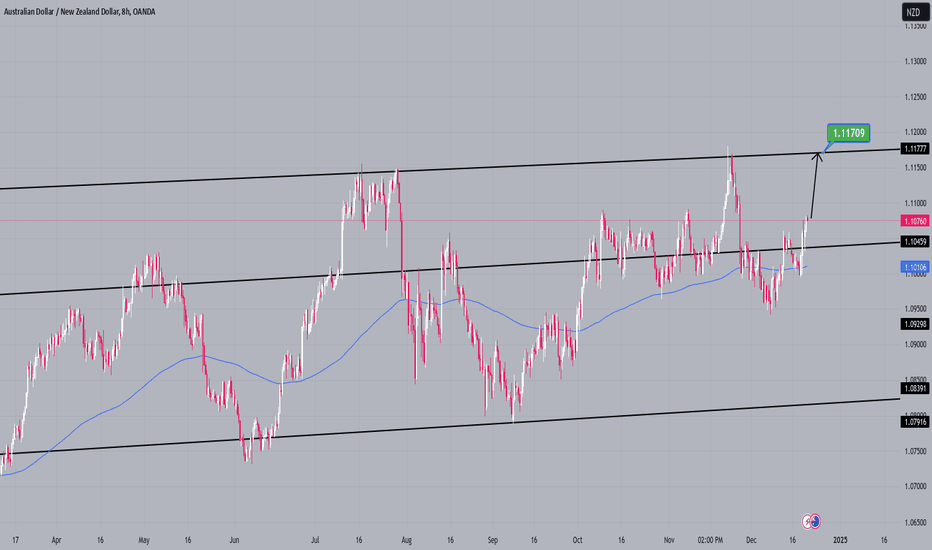

AUD/NZD - Strong sell IdeaThis chart has had some clean previous price action.

Long term we have been bullish and Im going for a counter Trend trade into a possible breakout

We have a strong sell indication with Bearish pressure failing to take out the previous high.

Id like for price to return slightly higher into our supply zone but I do believe that price will breakout before returning higher.

This will be posted in my $100-$1000 chat so many sure to message to be apart of that.

Risking 25Pips for a return of 175Pips

Good luck to any trades that might follow

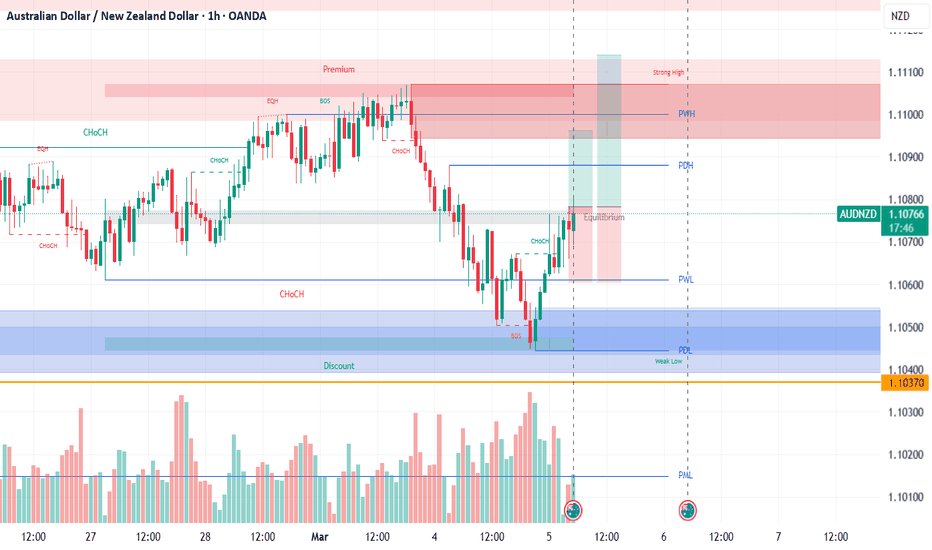

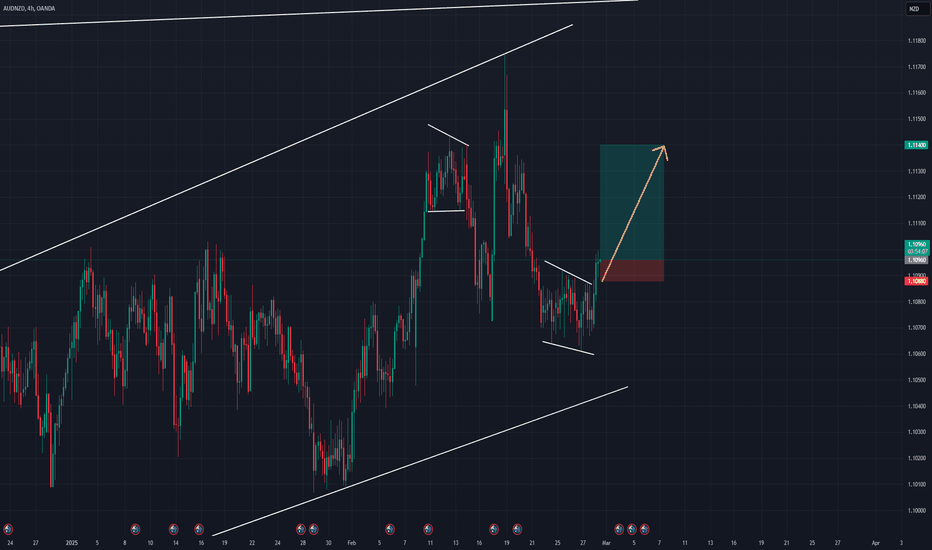

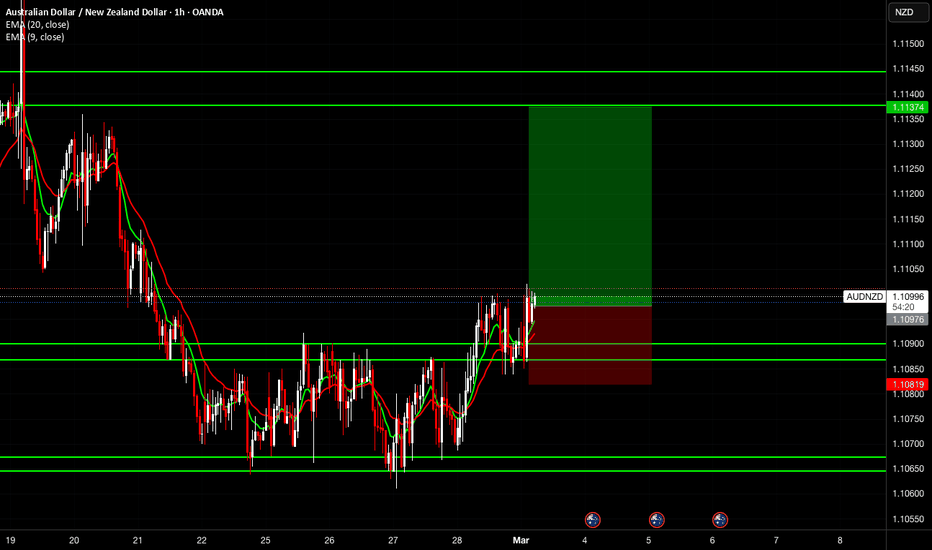

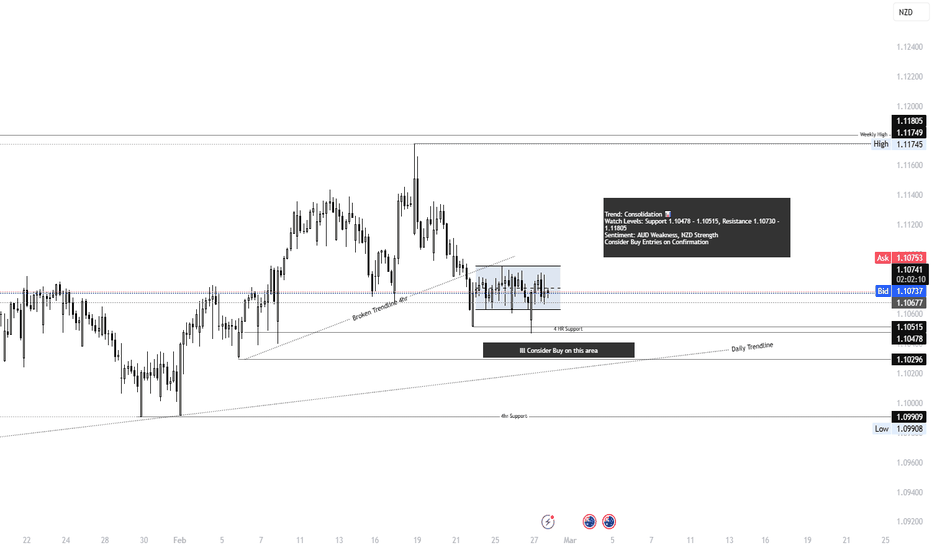

AUD/NZD - Technical Analysis & Market Sentiment📉 Bearish Bias

✅ Moving Averages (50MA & 200MA) - Price is below key MAs, signaling a downtrend. (+2)

✅ MACD - Histogram below the signal line, confirming bearish momentum. (+1)

✅ Parabolic SAR - Dots above price action, indicating a downtrend. (+1)

✅ Range Consolidation - Price stuck in a tight range, showing weak bullish momentum. (+1)

🔻 Total Bearish Score: 5

📰 Sources:

MACD & Parabolic SAR - IFC Markets

Price Action & Moving Averages - XTB

📈 Bullish Bias

✅ 1HR Support Holding - Buyers defending support level, preventing breakdown. (+1)

✅ Daily Trendline Support - Price bouncing off the long-term trendline. (+2)

✅ Stochastic Oscillator - Near oversold territory, potential reversal setup. (+1)

🔹 Total Bullish Score: 4

📰 Sources:

Trendline Support - XTB

Stochastic Oversold - RoboForex

📊 Sentiment & Market Factors

📉 RBA Dovish Tone (- Bearish) - Reserve Bank of Australia signaled potential rate cuts. Source📈 NZD Strengthening (+ Bullish) - Strong economic data supports NZD. Source

📉 Weak Commodity Prices (- Bearish) - Falling iron ore prices weigh on AUD. Source

📌 Final Bias: Slightly Bearish (Score: 5 vs 4)

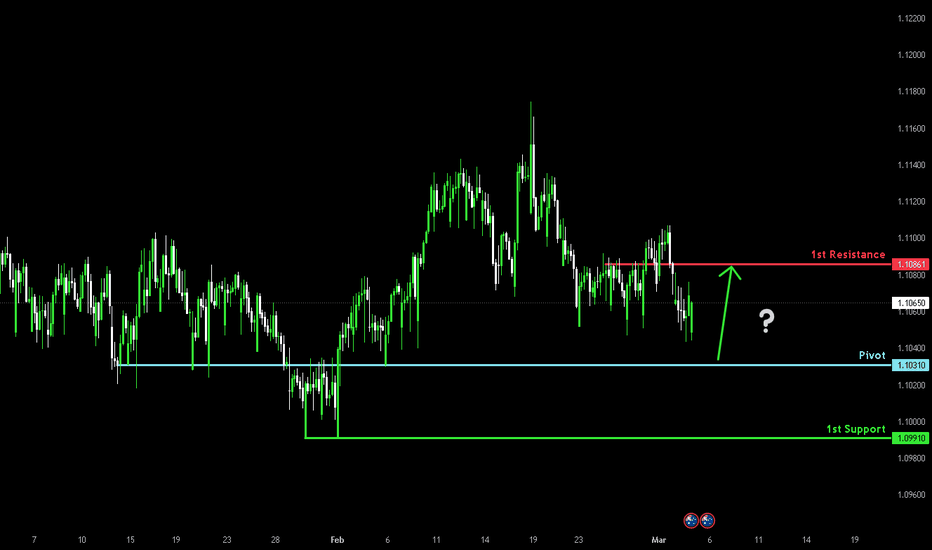

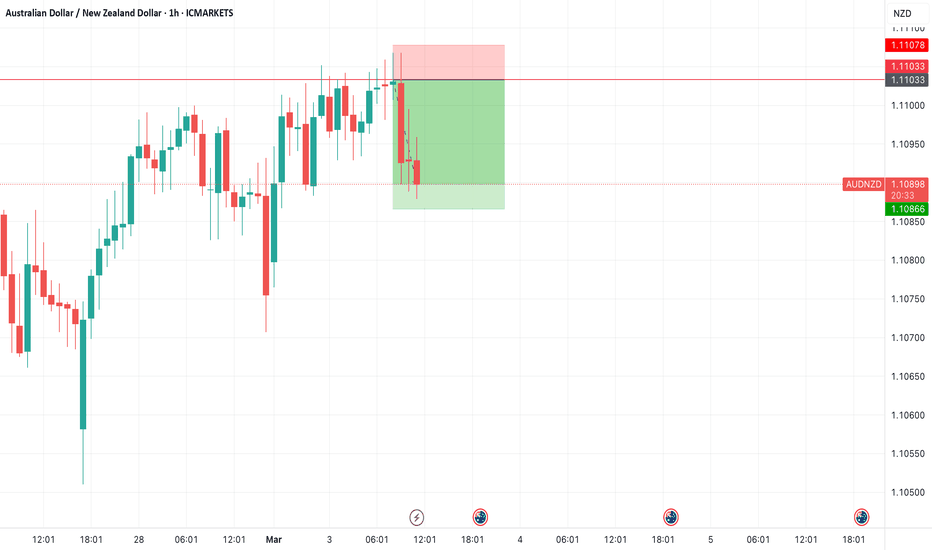

Bullish bounce?AUD/NZD is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 1.10310

1st Support: 1.09910

1st Resistance: 1.10861

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

The #1 Lesson From Professional Trading Let me tell you a story about how I got a professional cobbler to fix my back pack bag....

-

When I boarded a bus leaving town, the strap on my back pack cut...it was on the right side at the bottom end.

-

I felt sad.I noticed that the straps where starting to rip about 5 months ago.My elder brother asked to use my bag.

-

"Dont carry heavy things!"

I told him.

-

About a 4 weeks ago he asked for my bag again.

-

"Will you take it to the clobber?"

He suggested.

-

You see before today I took it to an amateur clobber about 4 years ago.

It was a "shoddy" job.

He fixed it in a nick of time .

I hated the way it was fixed the straps where put on in a "cock-eye" way

One strap was shorter while,the other side longer.

"As long as I can carry stuff"

I frustratly thought to myself.

Well today, I took it to a professional and he took about 40 minutes to fix it.

Why?

Because he had to undo the bad job that the amateur cobbler did 4 years ago,and then rework the straps to their normal lengths.

On both the right side and left side.

Am happy with the new fix.The back pack bag straps are at normal lengths now.

Listen the lesson is this.

👉 Professional Trading Takes Time To Learn- Just like it took time for a professional cobbler to fix my bag.

It won't be easy in the beginning but if you keep practicing one day you will be a professional trader.

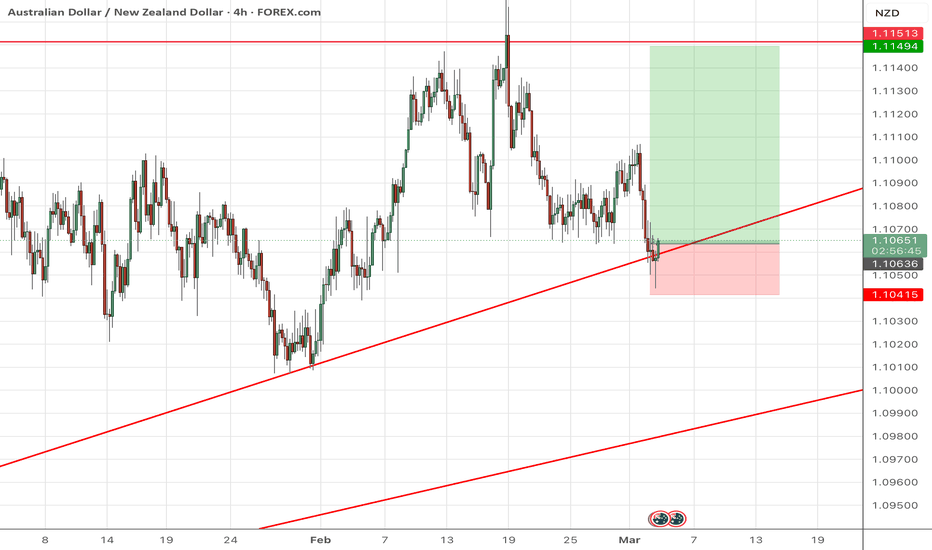

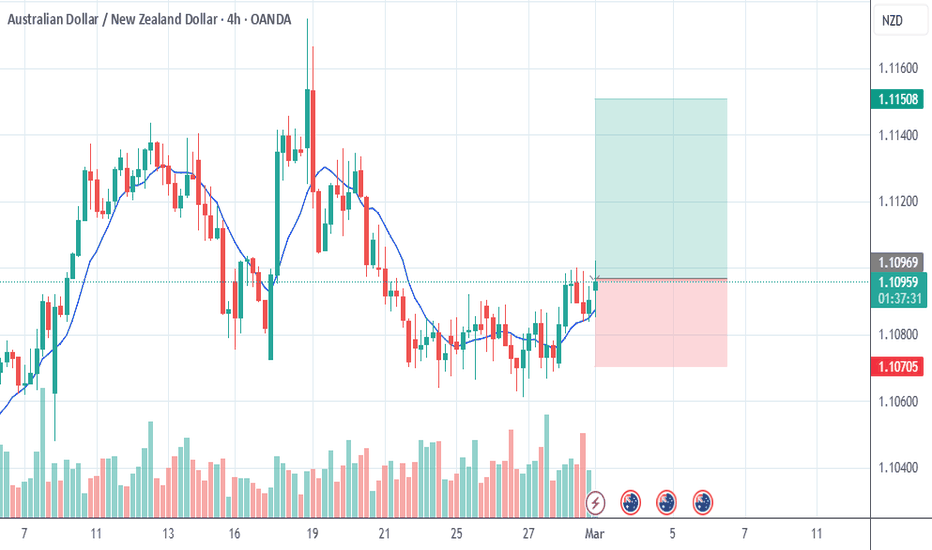

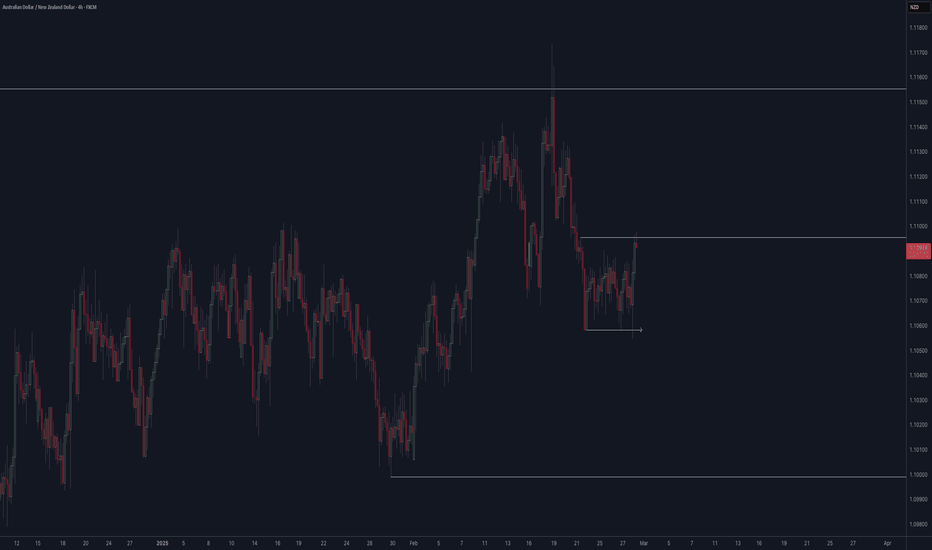

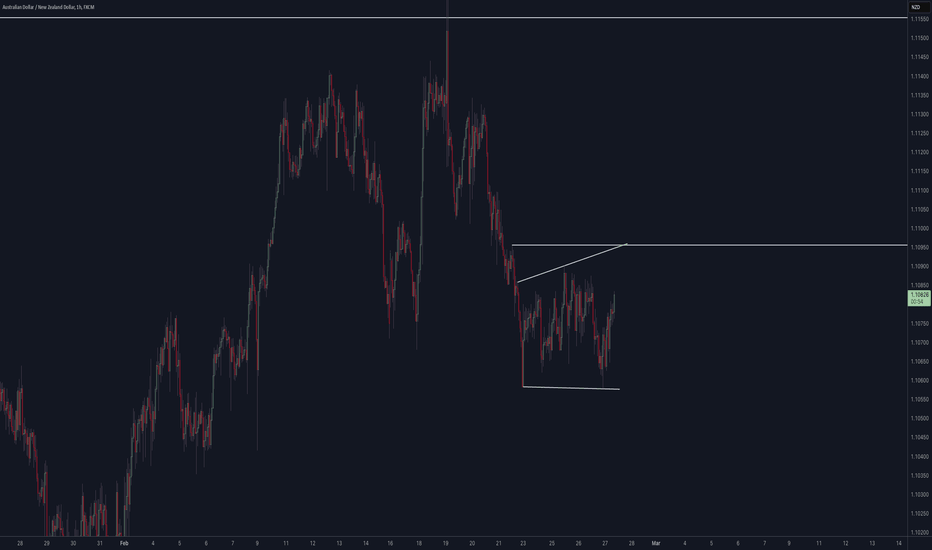

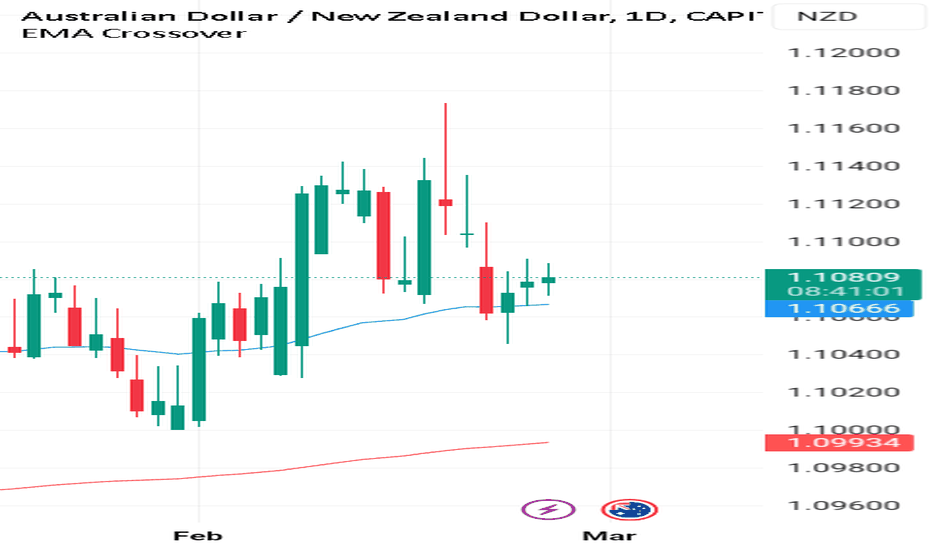

This chart CAPITALCOM:AUDNZD

Follows the 3 Step-Rocket Booster Strategy:

1️⃣ The Price has to be above the 50 EMA

2️⃣The Price has to be above the 200 EMA

3️⃣The Price has to Gap up

The last step is confirmed on a candlestick pattern called "the rising 3 soldiers"

This is according to Steve Nissan's Book Japanese Candlestick Patterns

Which is Where I learnt it from.

After a recommendation from Tim Sykes

If you want to learn more 🚀 Rocket Boost This Content

Trade safely.

Disclaimer ⚠️ Trading is risky please learn Risk Management And Profit Taking Strategies.Also feel free to use a simulation trading account.