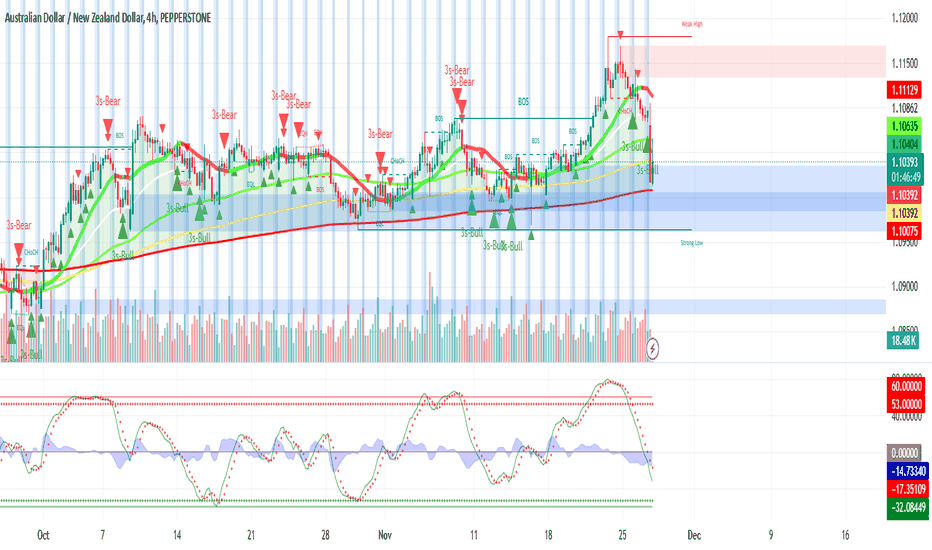

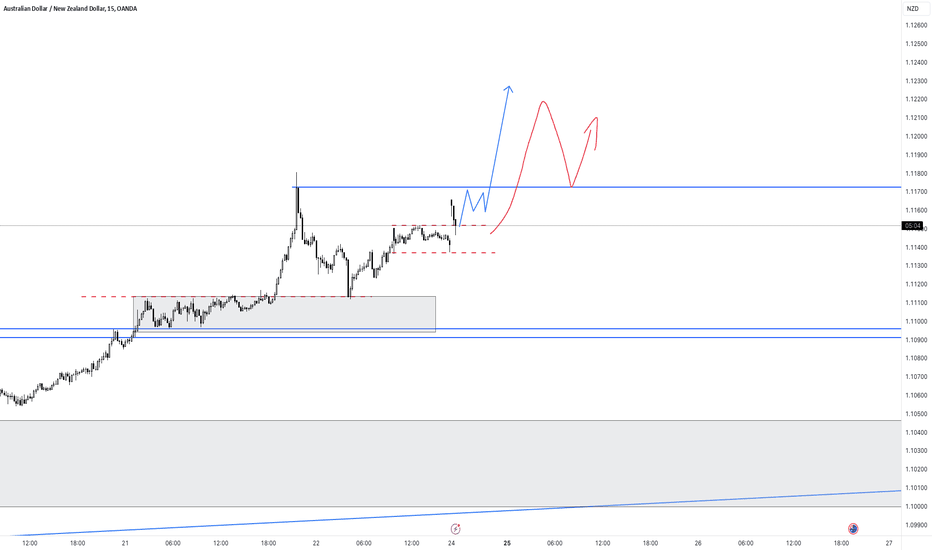

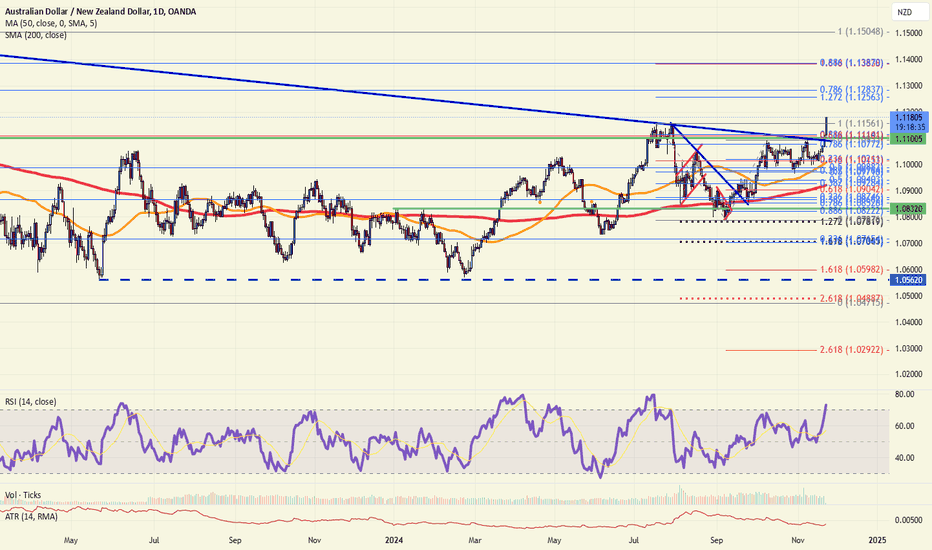

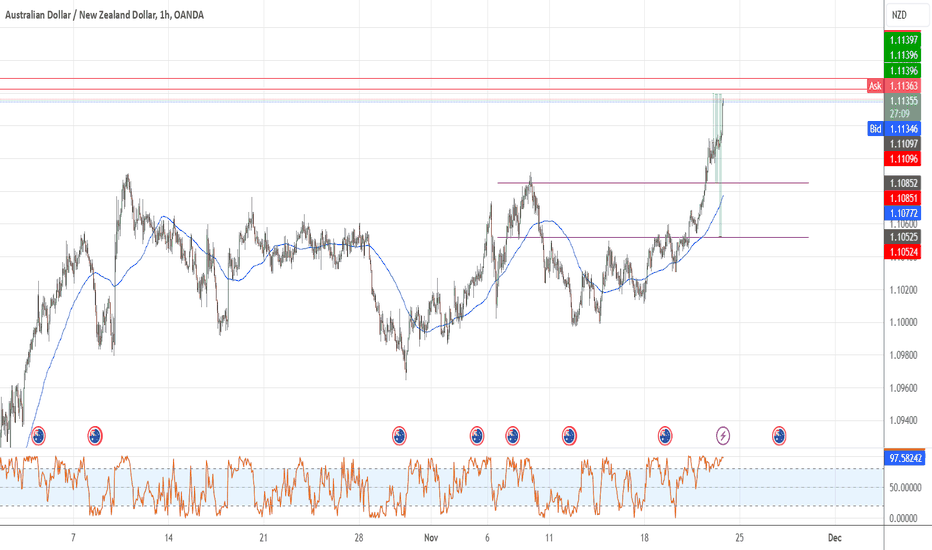

AUDNZD Potential Buy Setup: Rebound from Key SupportThe pair is trading around 1.10388 at this time of posting, presenting a potential buy opportunity as it approaches a significant support zone. Here’s a detailed analysis:

Key Support Zone:

The price is testing the 1.1005–1.1030 support area, which has historically acted as a strong demand zone.

The 200 EMA is providing additional support, increasing the likelihood of a rebound.

Indicators:

The Stochastic RSI is in oversold territory, signaling that the pair might be due for a bounce.

Declining bearish volume indicates weakening selling pressure as the price approaches support.

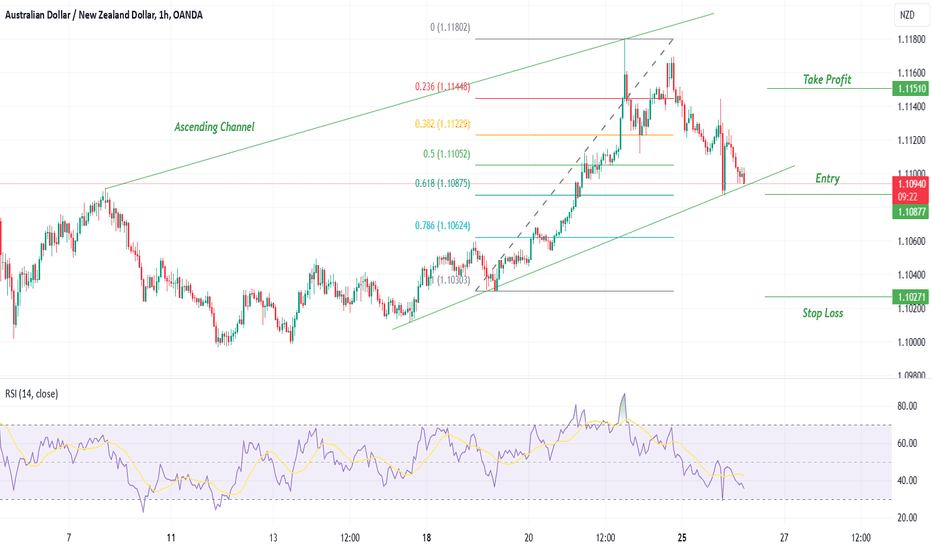

Entry Point:

Enter a long position around 1.1030–1.1040 once bullish confirmation (e.g., a hammer or bullish engulfing candle) is observed.

Stop Loss:

Place the stop loss slightly below the support zone at 1.0990 to protect against a false breakout.

Take Profit:

Target 1: 1.1080 (recent resistance level).

Target 2: 1.1110 (major resistance near the previous swing high).

Risk-Reward Ratio:

This setup offers a favorable risk-reward ratio of at least 1:2, making it a viable trade with proper risk management.

Note:

If the price breaks and closes below 1.1000, the bullish scenario will be invalidated, and the pair may continue its bearish momentum. Ensure to monitor price action closely and adjust your trade plan accordingly.

NZDAUD trade ideas

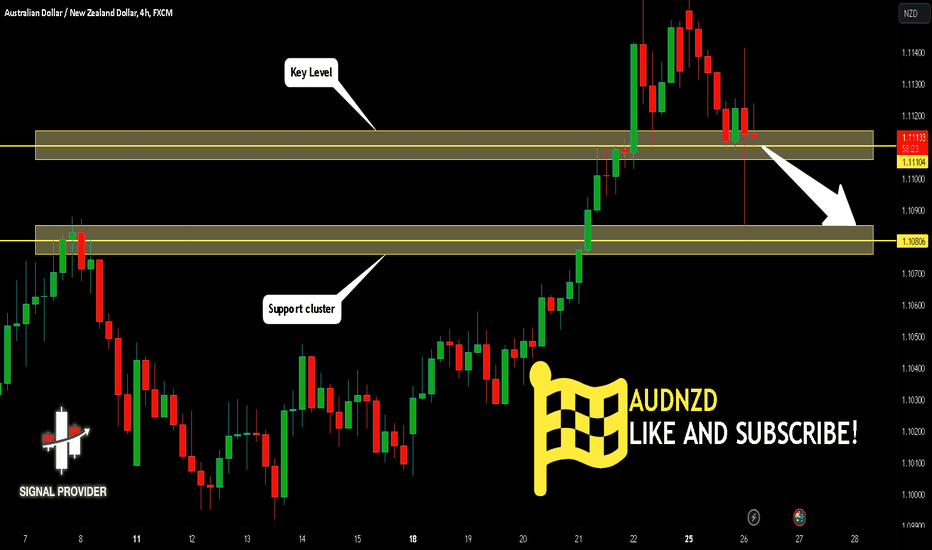

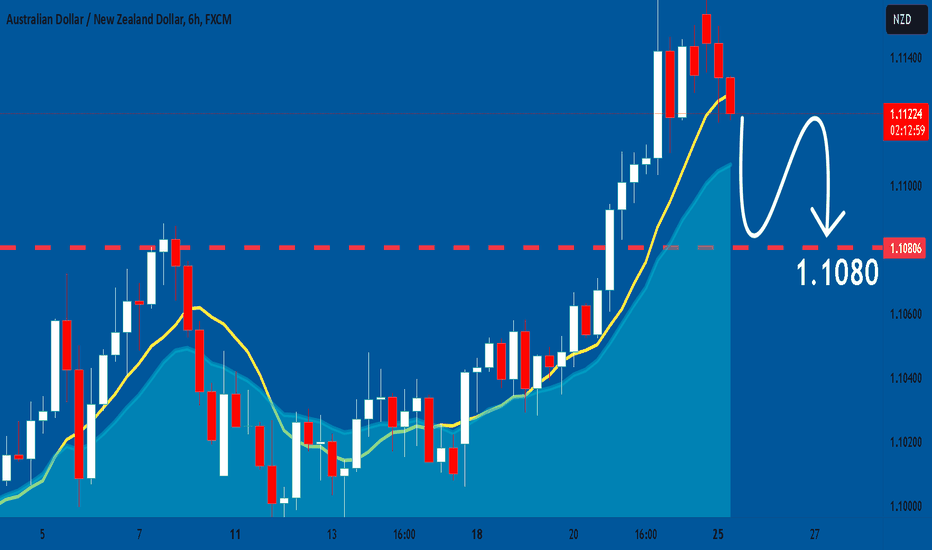

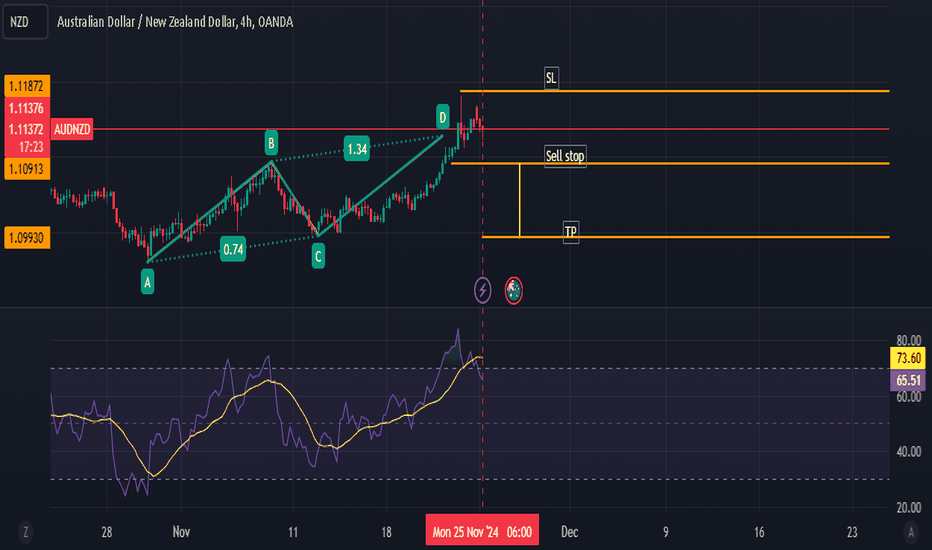

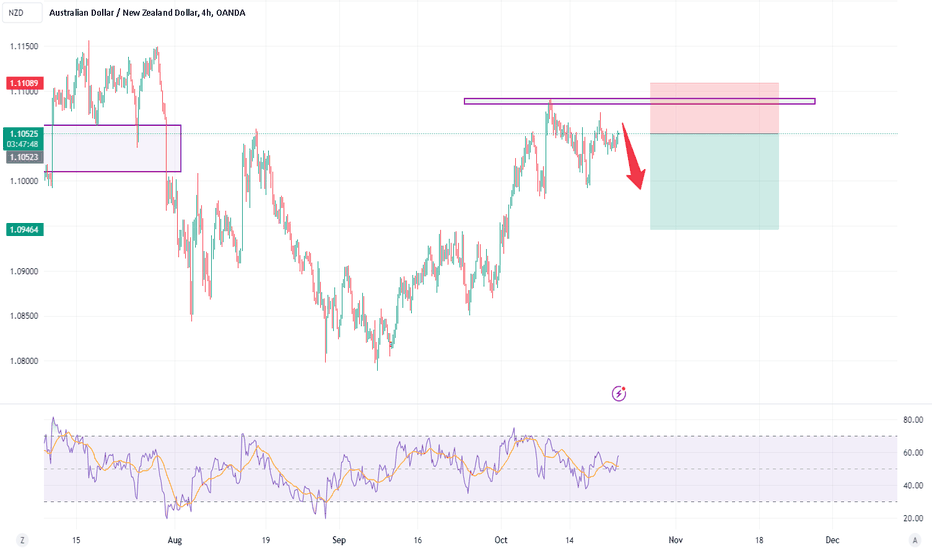

AUDNZD Is Going Down! Sell!

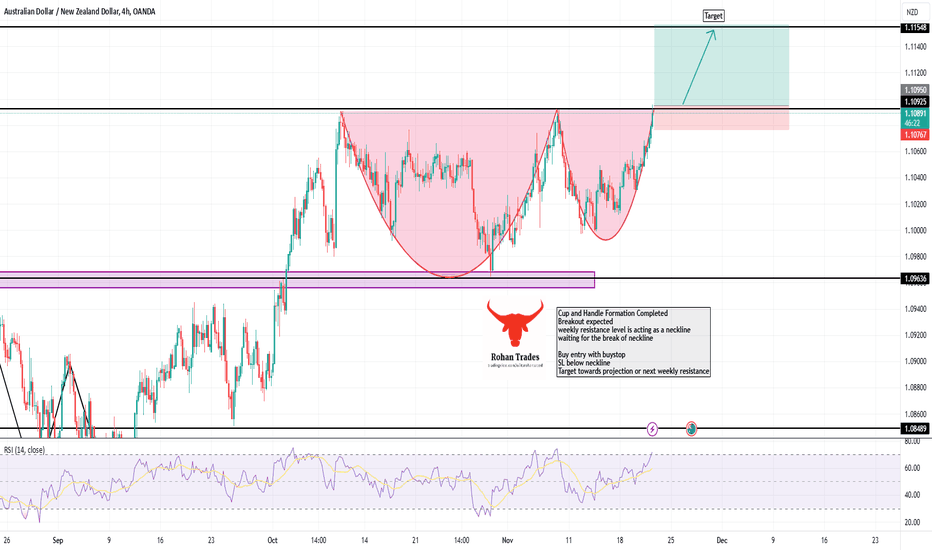

Please, check our technical outlook for AUDNZD.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 1.111.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.108 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

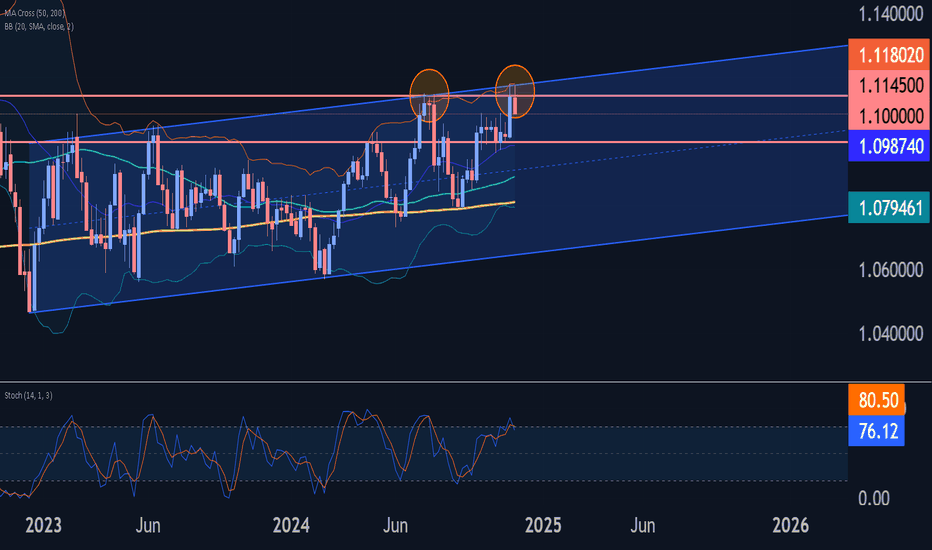

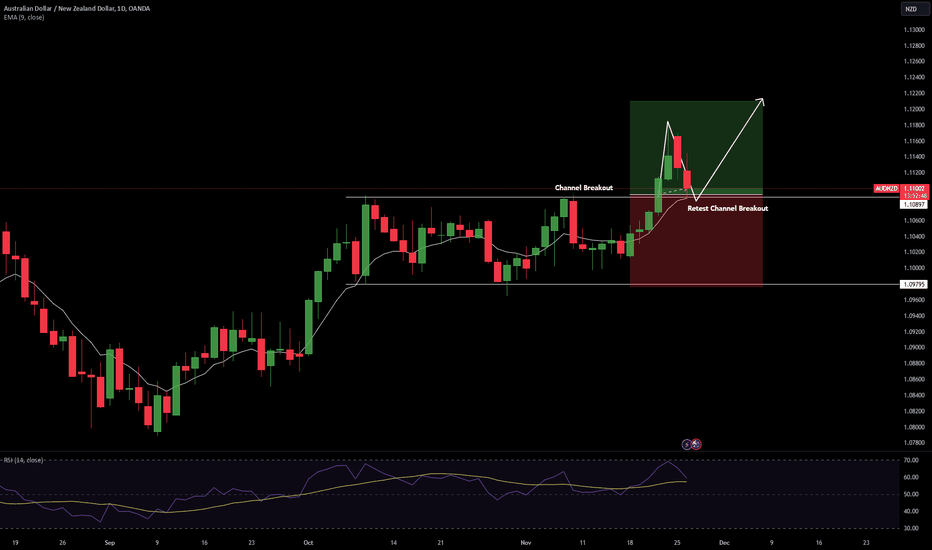

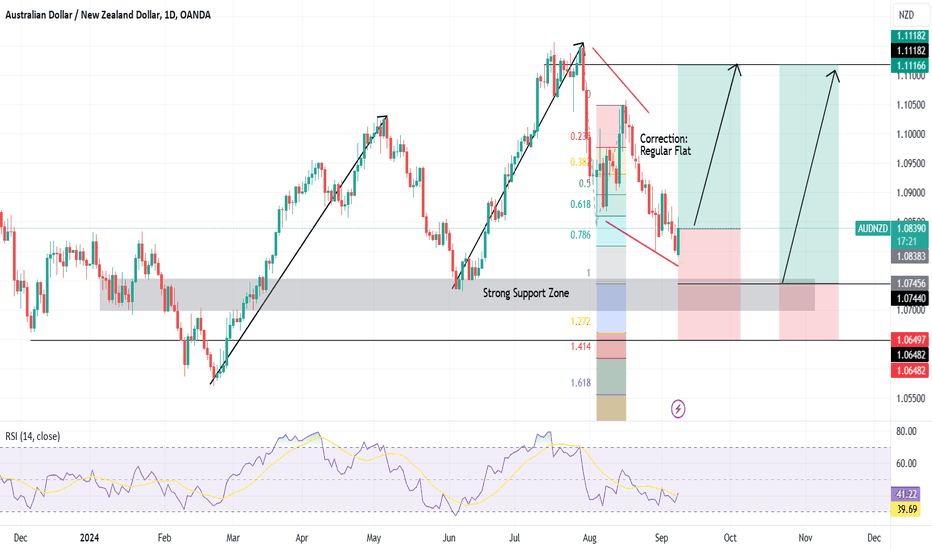

AUDNZD Wave Analysis 26 November 2024

- AUDNZD reversed from resistance zone

- Likely to fall to support level 1.1000

AUDNZD currency pair recently reversed down from resistance area located at the intersection of the resistance level 1.1145 (former top of the weekly impulse wave 1) and the upper weekly Bollinger Band.

This resistance area was further strengthened by the resistance trendline of the weekly up channel from the end of 2022.

Given the strength of the resistance level 1.1145 and other overbought weekly Stochastic, AUDNZD currency pair can be expected to fall to the next support level 1.1000.

AUDNZD at support ahead of a massive 24hrs ahead!Intraday Update: Ahead of the Australian CPI and the RBNZ highly anticipated 50bhp cut in less than 24 hours the AUDNZD is back at key support at 1.1085. Conventional wisdom and technical support would argue this is a good place to be long the AUDNZD. However, what if CPI comes in below expectations, or the RBNZ gives the market a "hawkish cut?" A double top/false breakout could be brewing on a failure lower.

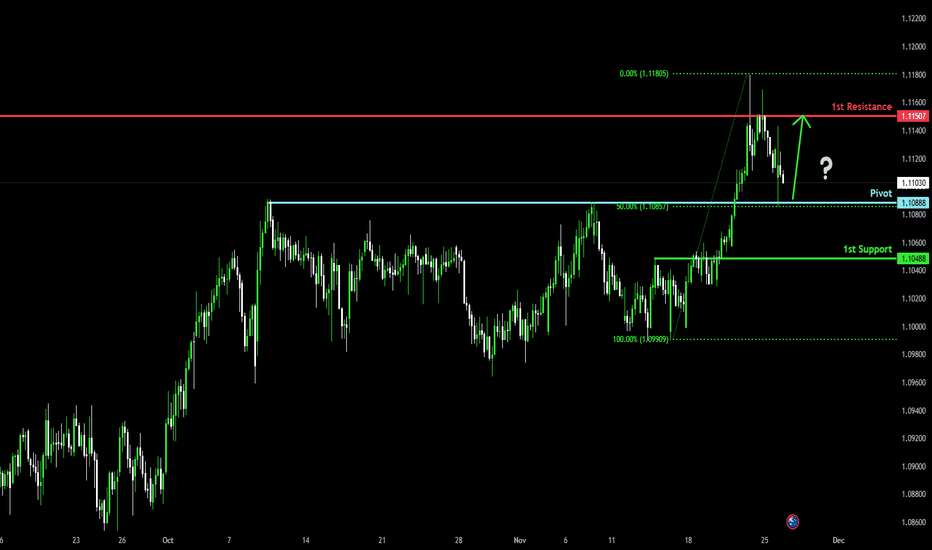

Bullish bounce off 50% Fibonacci support?AUD/NZD is falling towards the pivot which has been identified as a pullback support and could bounce to the 1st resistance which is a pullback resistance.

Pivot: 1.10888

1st Support: 1.10488

1st Resistance: 1.11507

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

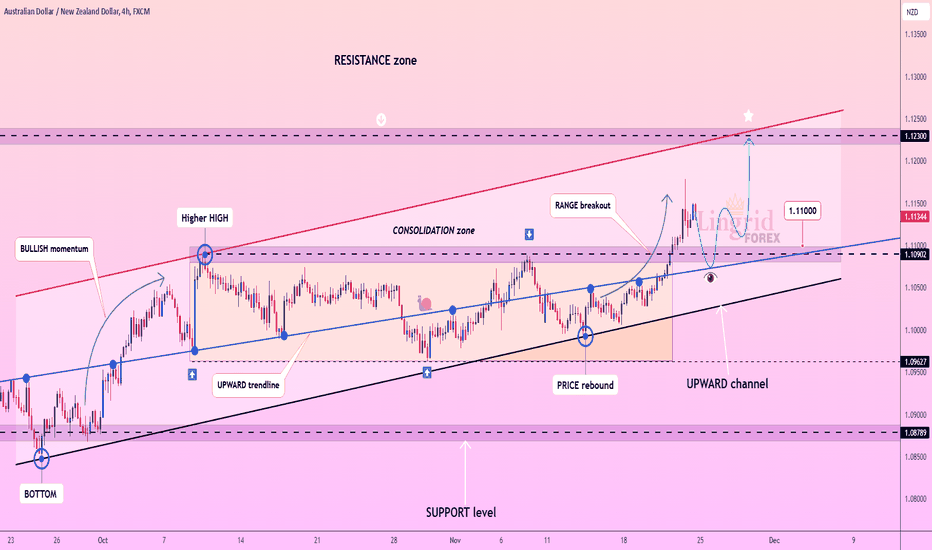

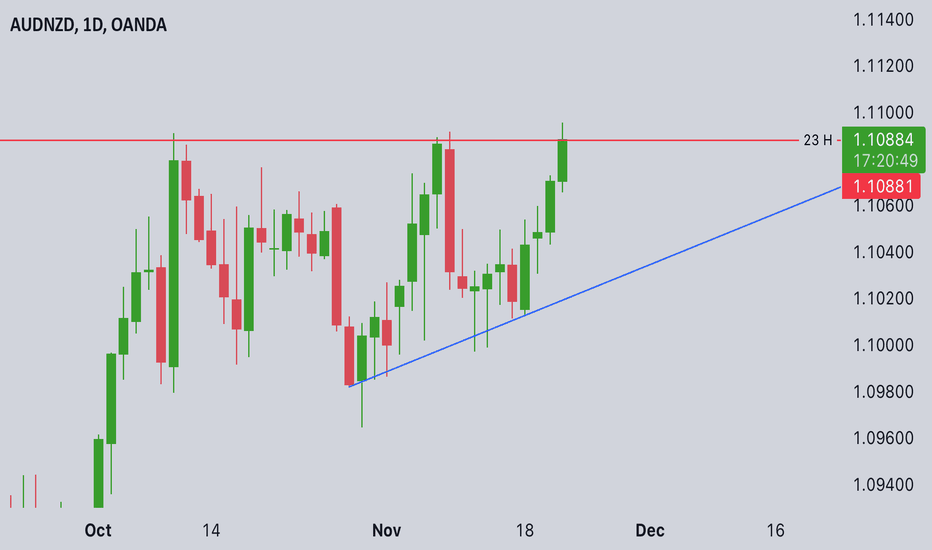

Lingrid | AUDNZD consolidation EXPANSION marketFX:AUDNZD has been in a consolidation phase since October, but the recent breakout and close above this range. This price made higher lows and higher highs, aligns with a bullish trend, suggesting a continuation of upward momentum. The support level at 1.11000 has been respected on two occasions, which emphasizes its importance in the current price structure. I expect a potential breakout-pullback-continuation scenario. If the price respects this support during the retest, we could see a bullish move follow. My goal is resistance zone around 1.12300

raders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

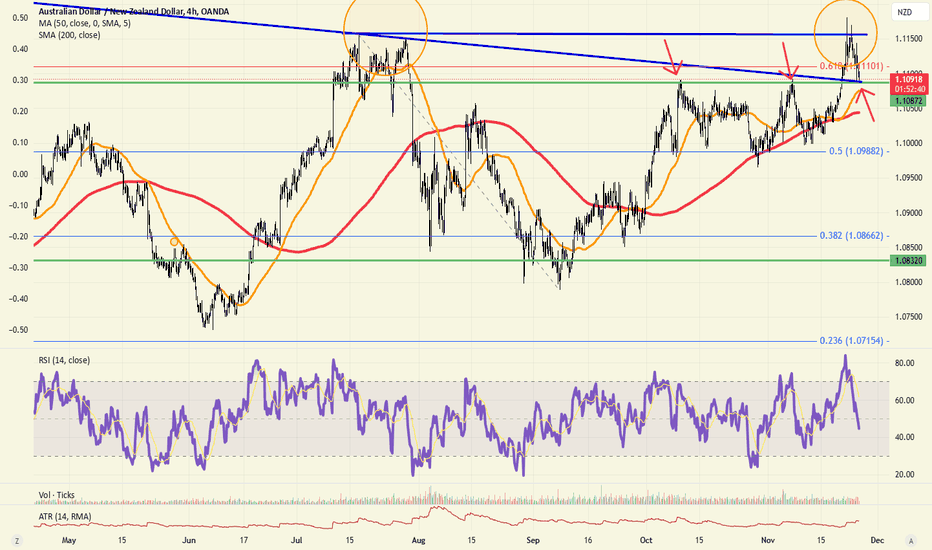

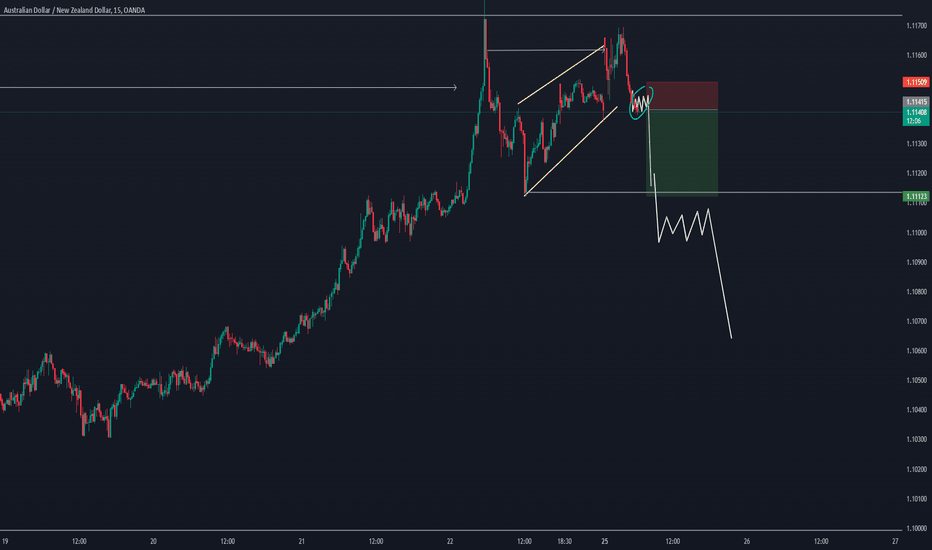

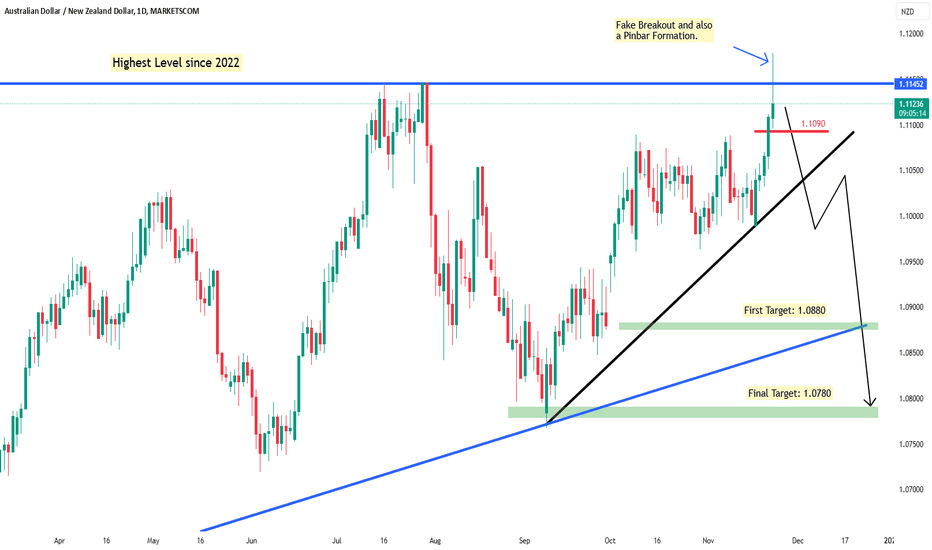

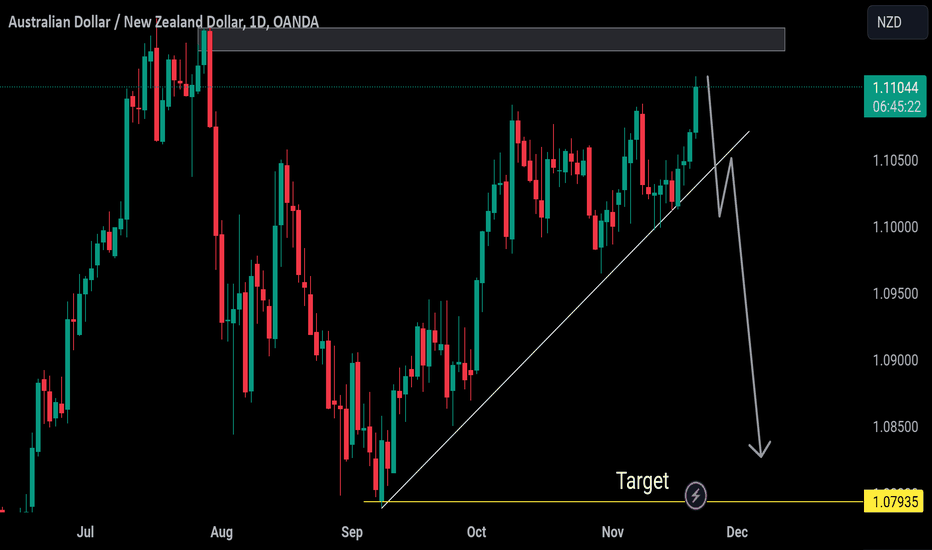

AUD/NZD: Potential Short Opportunity: False Resistance BreakoutThe AUD/NZD pair is currently exhibiting signs of a false breakout at the resistance level of 1.1145, subsequently forming a rejection Pinbar, which indicates that sellers may be regaining control in the short term.

What is a False Breakout?

A false breakout occurs when the price briefly exceeds a key support or resistance level, only to swiftly reverse and return to the opposite side. In this instance, the price momentarily broke above the 1.1145 resistance, yet the insufficient buying pressure led to an immediate rejection. This behaviour suggests that sellers were poised above this level, ready to enter the market. False breakouts can often result from market manipulation, where institutions and major players seek to trigger stop-loss orders from traders positioned near support and resistance levels. By instigating an initial breakout, they create liquidity for large contrarian positions.

Reversal Signal

A false breakout, particularly when accompanied by candlestick formations like the Pinbar, often indicates a potential trend reversal. In this case, the failed breakout signifies that buyers who attempted to sustain the move upwards were unsuccessful.

Current Scenario : Has the False Breakout Been Confirmed?

The 1.1145 level represents the highest price since 2022, establishing it as a significant resistance zone. The initial breakout above this level was swiftly followed by a strong rejection, illustrated by the long wick at the top of the Pinbar candlestick. This pattern underscores the weakness among buyers and suggests renewed strength among sellers.

Possible Short Opportunity

If the price breaks below 1.1090, we may expect a more substantial downward movement over the following days.

First Target: 1.0880

This target corresponds to a notable support zone, aligning with previous lows and the projection of the rising trend line established since February.

Final Target: 1.0780

This represents a significant area, marking an important horizontal support level observed over recent months.

Stop Loss:

A suitable stop loss could be placed above the Pinbar high at around 1.1180 to protect against an unexpected reversal.

Alternative Scenario: Resistance Broken

The recent sequence of green candles with elongated bodies and minimal upper shadows suggests a potential alternative scenario, wherein there may be sufficient buying pressure to breach the resistance level in the coming days.

A buying opportunity could materialise if the price breaks above 1.1200.

Next Targets:

In the event of a breakout, the first target could be around 1.1300, with a final target at 1.1450, where the AUD/NZD would encounter significant resistance on the weekly chart.

The AUD/NZD pair is at a critical technical juncture at 1.1100, indicating a potential false breakout of resistance. It is essential to monitor price action closely in the upcoming sessions. A sustained downward movement, particularly a break below 1.1090, would reinforce the selling pressure, while a breakout above 1.1200 could signal a continuation of the upward trend towards 1.1450.

Disclaimer:

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK.

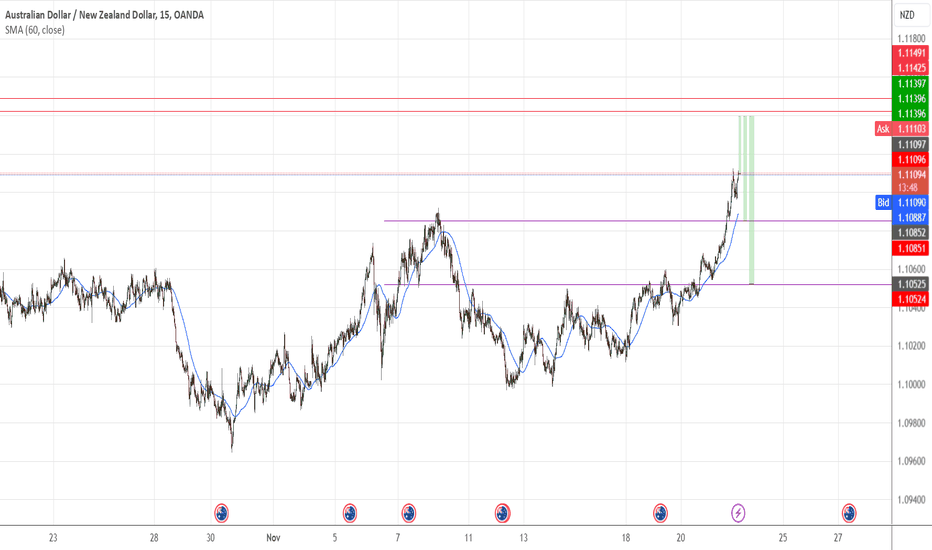

#007 AUDNZD DCA BuyAs seen on the chart, I have placed 2 buy limits which I tried to spread them out as evenly as I could. I left the 3rd position wider, than the 2nd position because I think to myself, if price were to come down this far, and if it touches and rebound, I would have a higher chance of exiting for some profit on that position.

I picked the AUDNZD because price on the 4H, 1H and 15 Minutes are aligned with the 60SMA's direction, and based on the price alone, it is very strong.

If I could, I would rather enter on XAUUSD now, instead of AUDNZD, but due to margin issues, that's not possible, and AUDNZD is one of the pairs that is not clashing with my other open positions (correlation).

That's all for now, and I will update later when anything happens.

1945SGT 21112024

#008 DCA AUDNZD 1HI was wavering yesterday because of the loss I took on USDCHF, and so, I didn't think to publish this AUDNZD trade I took. But on retrospect, it all worked out. I think that some basic protective mechanism should still be in place such as shifting price to breakeven (maybe) (and, there there. overthinking again.)

I am just 2 cents away from TP and I think after I publish this post, I would be taking profit manually because why would I allow price to hover and collapse back down when I do not have a fixed RR?

I also think that I should trade on the higher time frames, maybe. (There there, again here it comes.)

I think I think I think. I think too much. Add too much thoughts which with efects becomes emotions. While on the other hand, I have another strategy running which I don't give much thoughts about, doing not bad. Not like it is making big money, or high % per month, but it is providing. 1%+ 2%+ as long as I continue to not think about it.

As I was trying to sleep last night, I thought that distractions is good, so that I can un-focus on doing the right things, while I have other wrong things to distract me, preventing me from overly observing or giving attention to the right thing.

Too much observations lead to too much thoughts which leads to too much action, which will increase the amount of wrongful actions taken, which leads to stress, and changing of minor rules, or aspects about the trading method, which leads to deviation and eventual profit turning into losses and closing the month on a bad note, hoping that the next month would be different, and wishing that I wouldn't have done some things I have done.

0932SGT 22112024

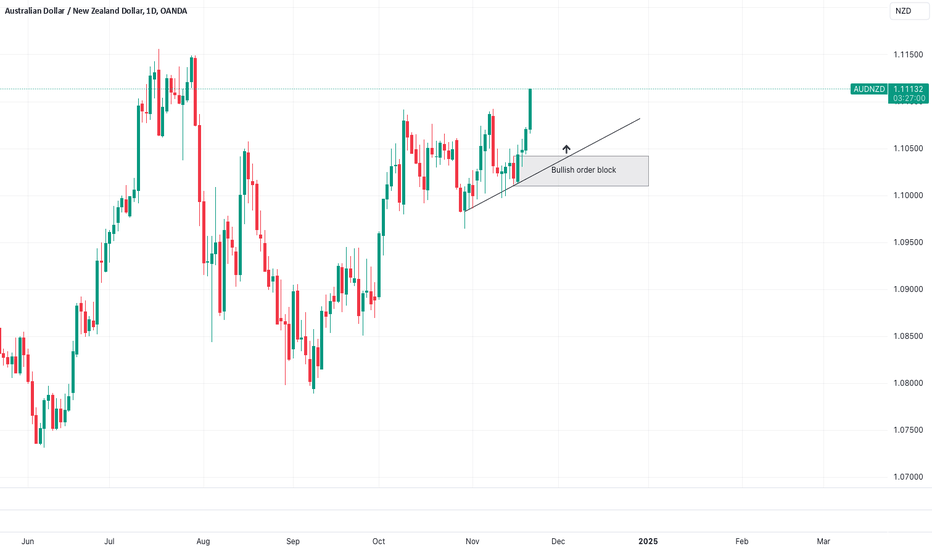

AUDNZD - Long from trendline !!Hello traders!

‼️ This is my perspective on AUDNZD.

Technical analysis: Here we are in a bullish market structure from daily timeframe perspective, so I look for a long. My point of interest is rejection from trendline + bullish OB.

Like, comment and subscribe to be in touch with my content!