AUD/USD Short, NZD/CAD Short, EUR/NZD Long and NZD/JPY ShortAUD/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

NZD/CAD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of interest.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

EUR/NZD Long

Minimum entry requirements:

• Tap into area of value.

• 1H impulse up above area of interest.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

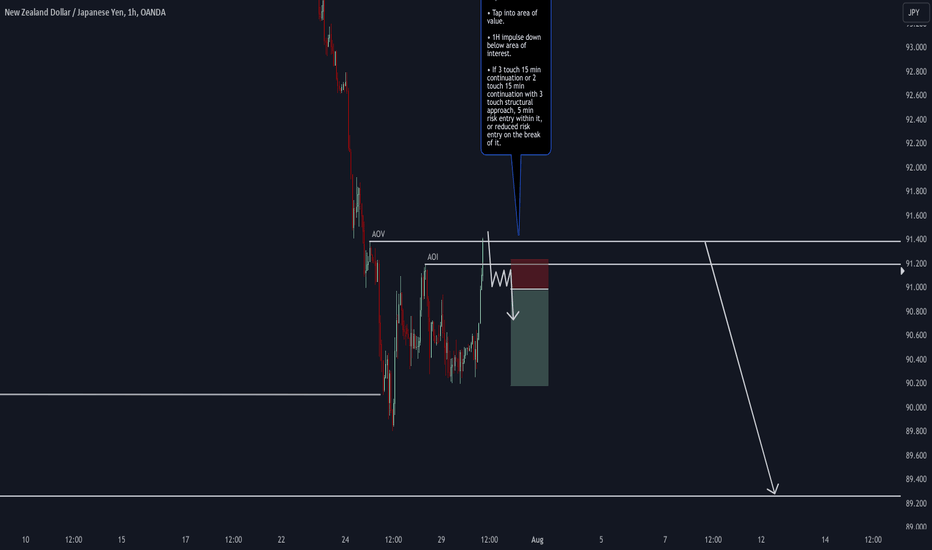

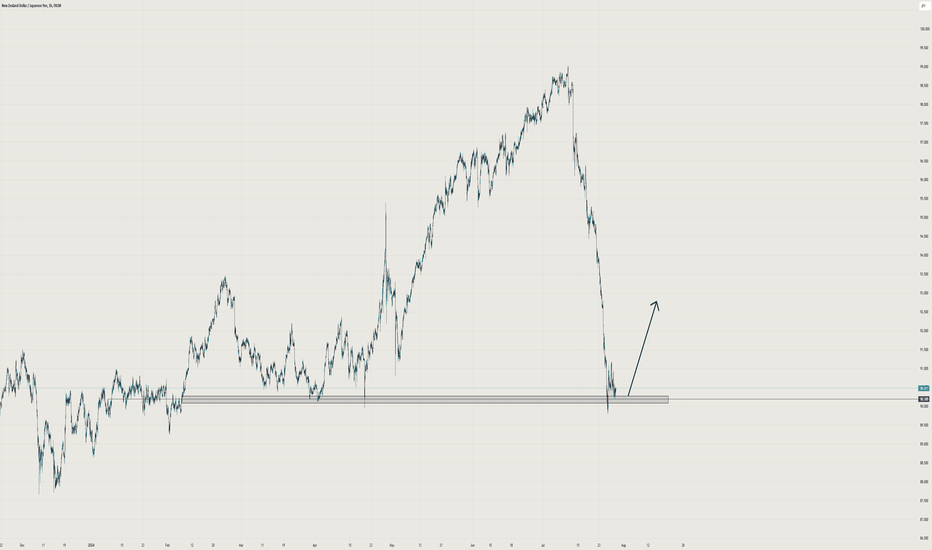

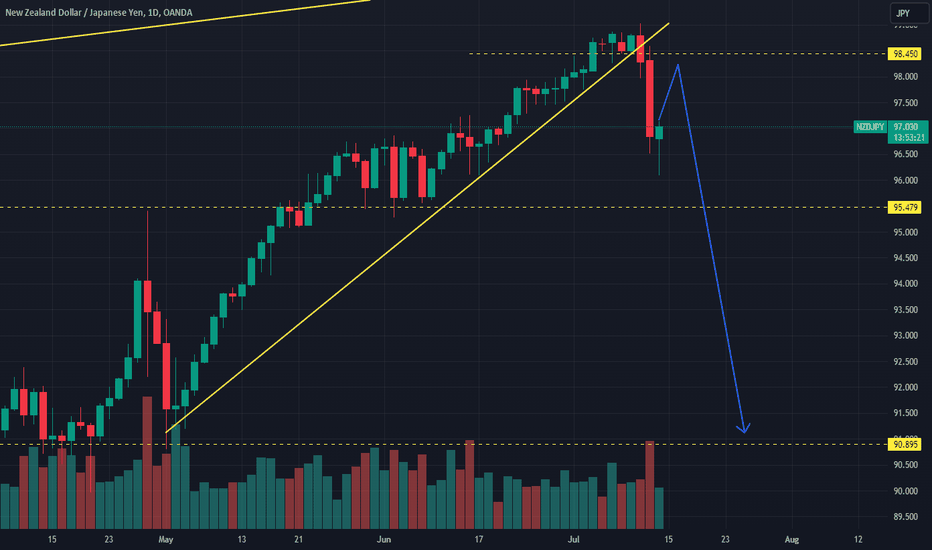

NZD/JPY Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of interest.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

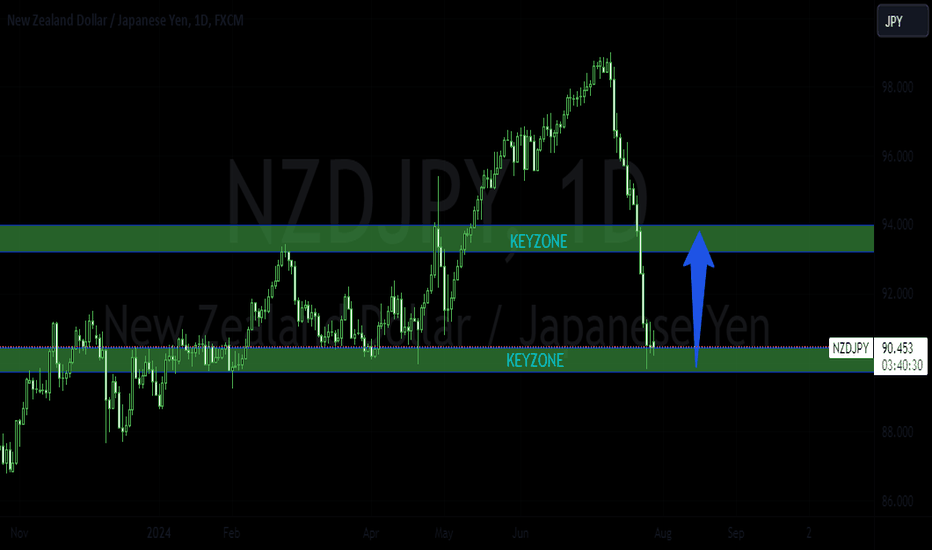

NZDJPY trade ideas

NZDJPY BUY | Idea Trading AnalysisNZD/JPY is falling towards a support level which is a pullback support and could bounce from this level to our take profit.

We expect a decline in the channel after testing the current level which suggests that the price will continue to rise

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great BUY opportunity NZDJPY

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

[NZDJPY] Second long entry for swingOn this asset, I already took on entry as published previously. It was a very anticipated entry, I then just had the confirmation for my long entry with more confidence on this trendline break so it was time to "load the boat" heavy.

I am expecting a huge upside move for the next days/weeks so let's manage this trade properly.

Great Trade !

Watch out for BoJ tomorrowThe BoJ will be coming out with its interest rate decision tomorrow. Be careful with your yen positions, if you have any.

#nzdjpy FX_IDC:NZDJPY EASYMARKETS:NZDJPY

Disclaimer:

easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

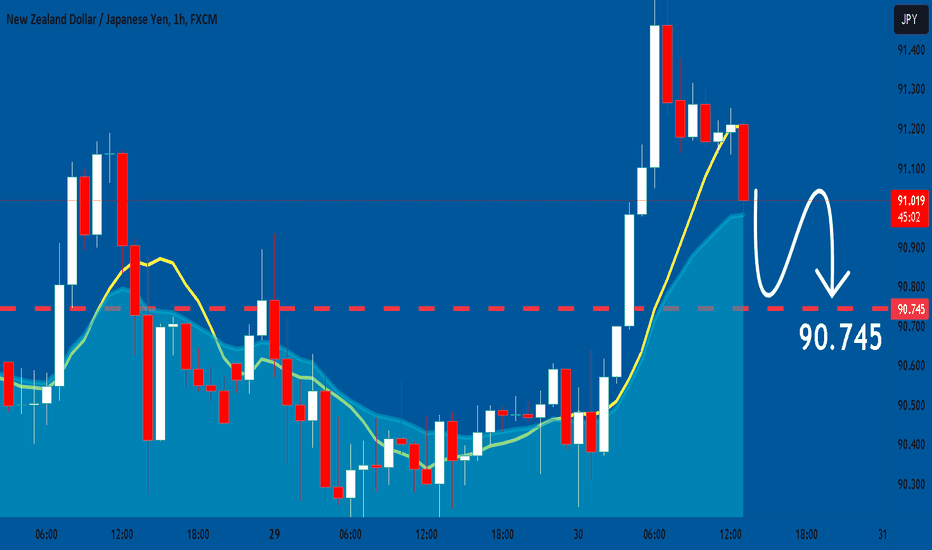

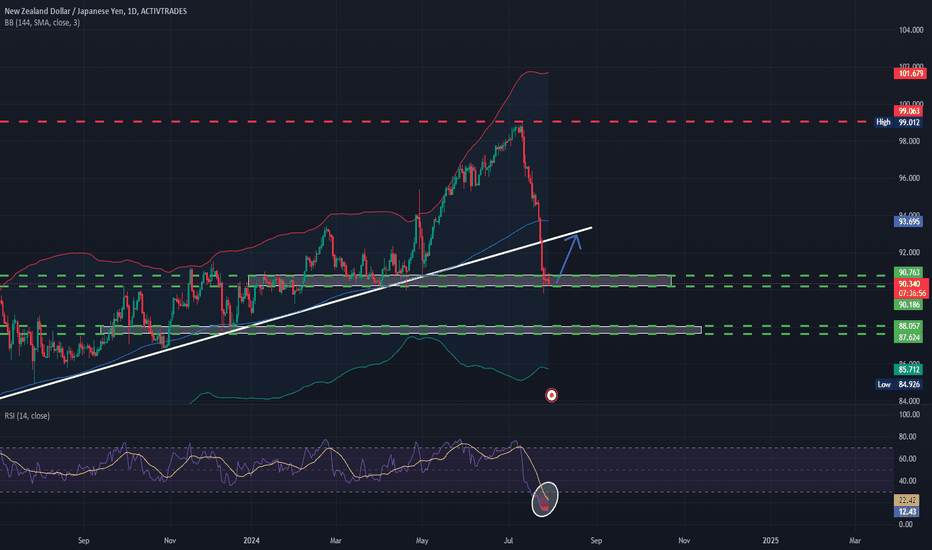

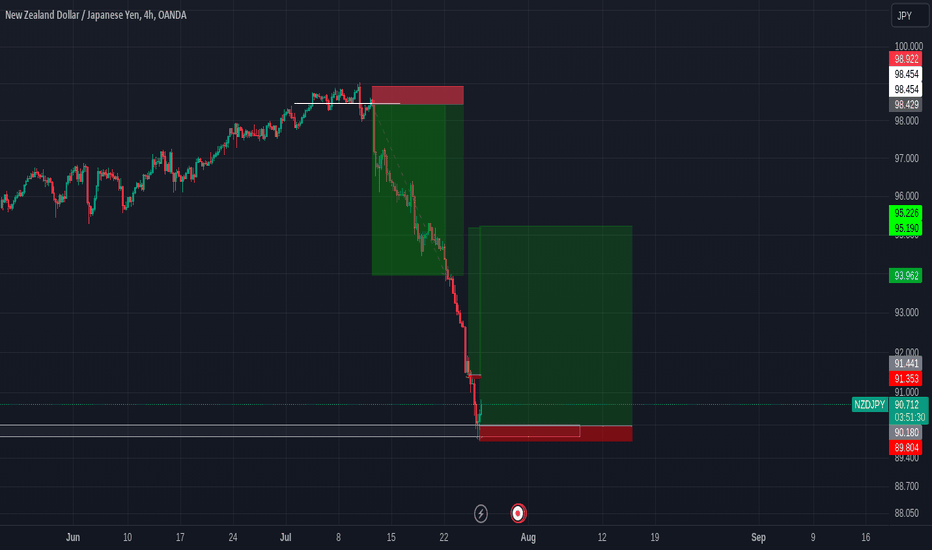

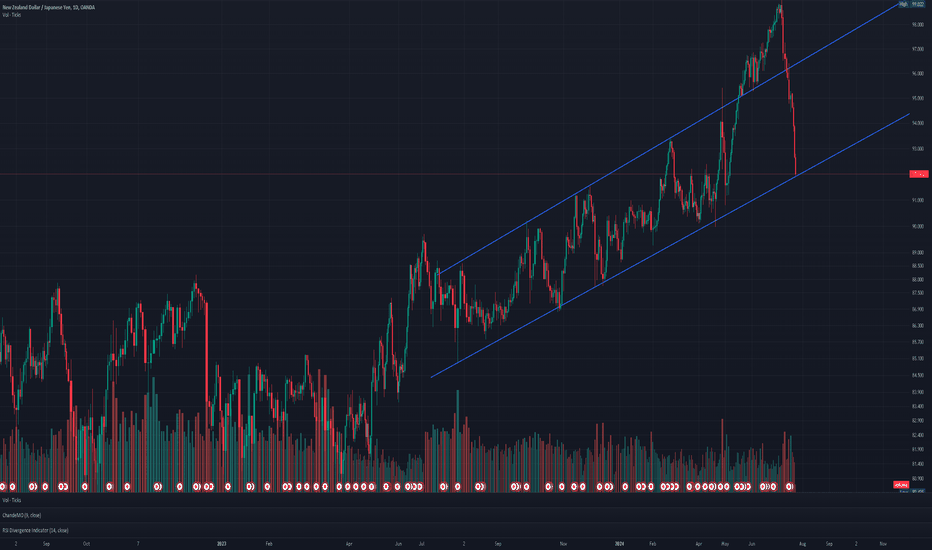

TECHNICAL BOUNCE EXPECTED ON NZDJPYDespite a drop of almost 10% from the all-time high of 99 reached on 10 July 2024, the pair's long-term trend remains bullish.

However, a break of the medium-term uptrend line could open the door to a much larger correction and threaten the uptrend.

The price is currently in a key support zone at 90.186 - 90.763. This zone has been worked by both buyers and sellers between 9 January 2024 and 21 April.

Technically, we can expect a buying bounce that could take the price back to the uptrend line for a perfect technical pullback.

With the RSI at 12.60 at the time of writing, a technical rebound could also be confirmed by the RSI returning to its neutral zone. However, it would be better to wait for a buy signal on the smaller TFs before confirming this move.

On the other hand, a confirmation of a break of the support zone would allow the sellers to take control and drive the price even lower towards the 88 level.

Maxime Dominguez - Analyst for Activtrades

The information provided does not constitute investment research. The material has no been prepared in accordance with the legal requirements designed to promote the independence of investment research and such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

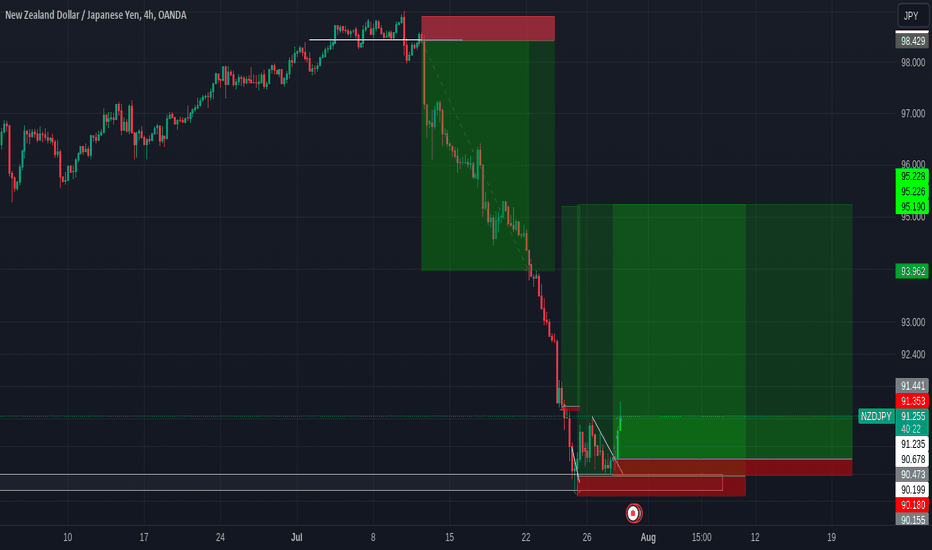

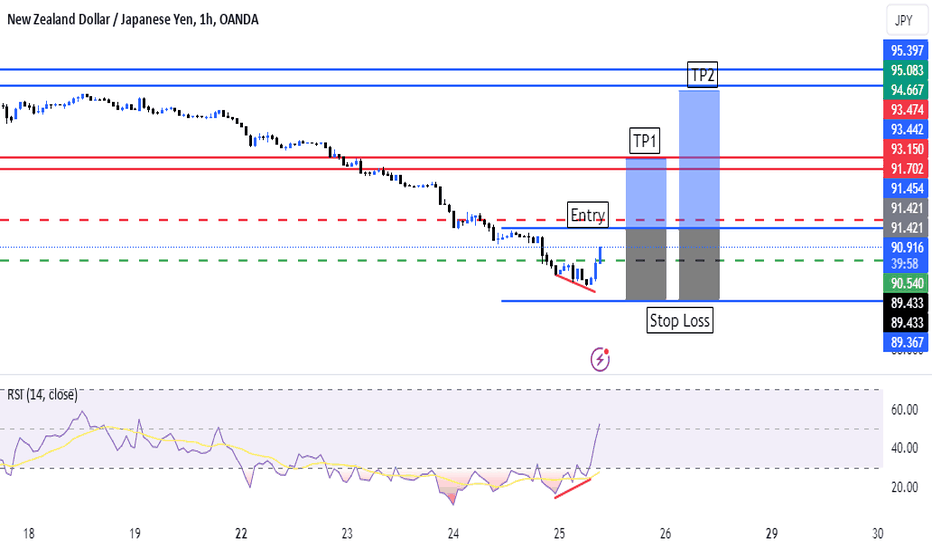

NZD/JPY Buy AnalysisNZD/JPY Buy Analysis

Trade Idea: Sell NZD/JPY

Entry: 90.800

1st Take Profit: Up to 94.479

2nd Take Profit: Up to 96.170

Rationale:

Technical Analysis: NZD/JPY has faced Support near the 89.864 level, indicating potential for a Upward movement.

Bullish Momentum: Recent price action suggests a High from recentlow, supporting a Bullish bias.

Long-Term View: This trade reflects a broader bullish outlook on NZD/JPY, considering both technical indicators and market sentiment.

Risk Management: Implement a well-defined risk management strategy, including stop-loss orders, to mitigate potential losses in volatile market conditions.

Disclaimer: Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The analysis provided is for informational purposes only and should not be considered as investment advice.

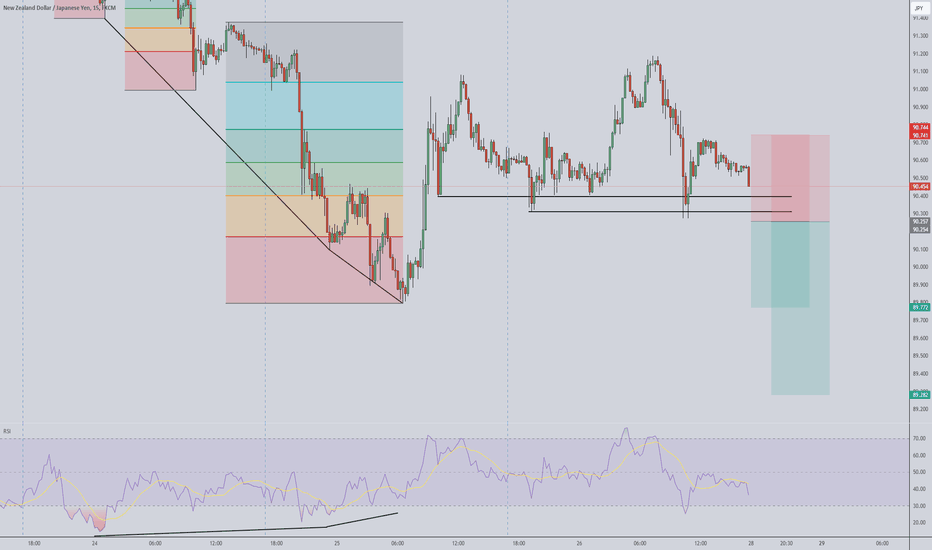

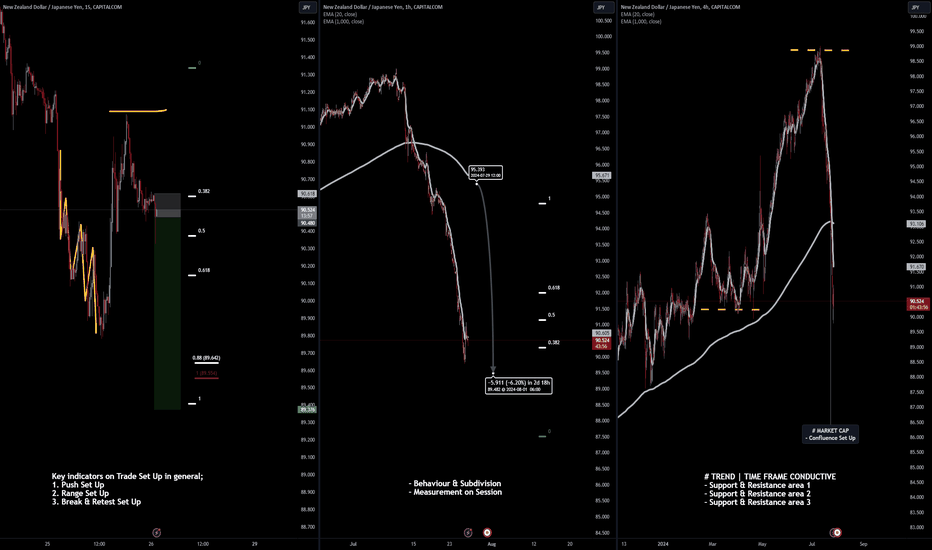

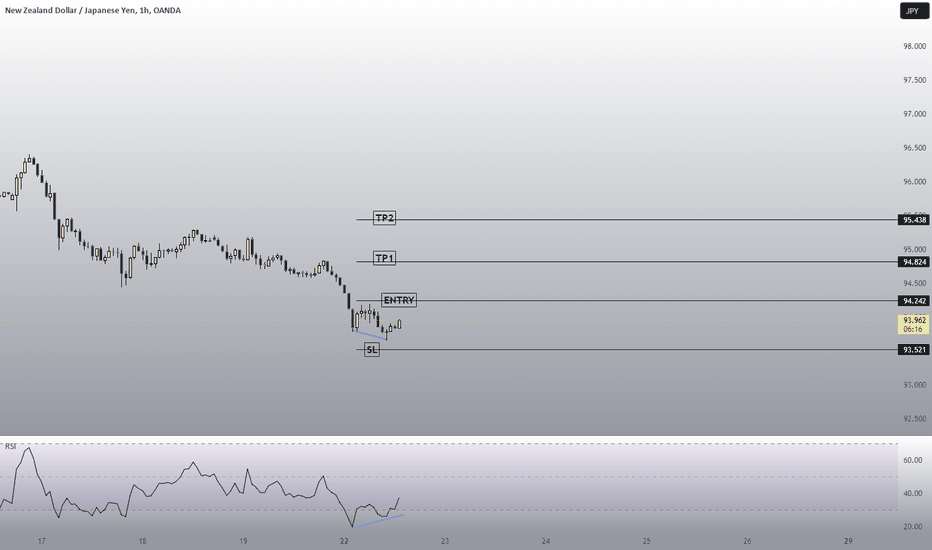

New Zealand Dollar / Japanese Yen | Range Idea | Asian SessionKey indicators on Trade Set Up in general;

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

# HIGHER DEGREE | 4 Hour Time Frame

- Behaviour & Subdivision

- Measurement on Session

* 20 EMA

* 1000 EMA

* Signpost | Market Cap | Confluence Set Up

# POSITION & Risk Reward | 1 Hour Time Frame

- Measurement on Session

* 20 EMA

* 1000 EMA

* Retracement

# POSITION & Risk Reward | 15 Minutes Time Frame

- Measurement on Session

* Retracement | 0.5 & 0.618

* Extension | 0.88 & 1

Active Sessions on Relevant Range & Elemented Probabilities;

* Asian(Ranging) - London(Upwards) - NYC(Downwards)

* Weekend Crypto Session

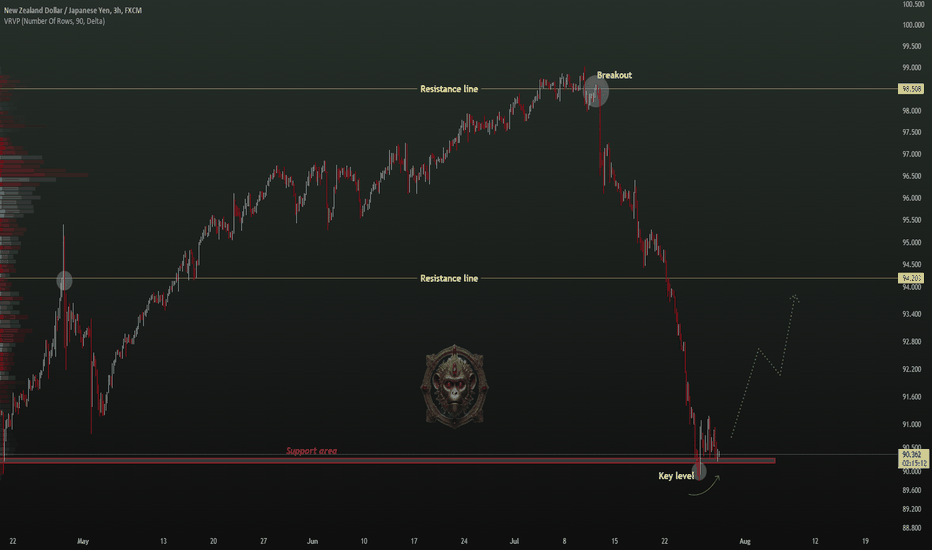

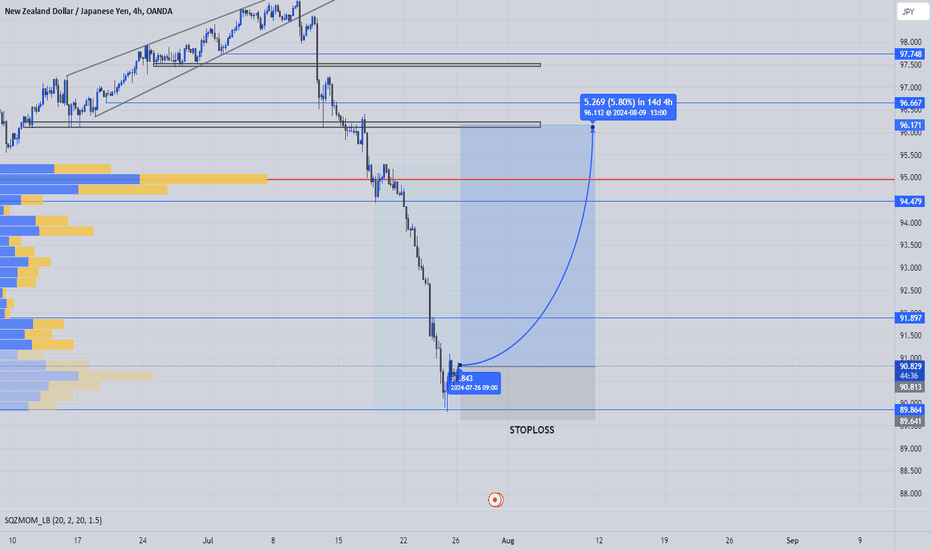

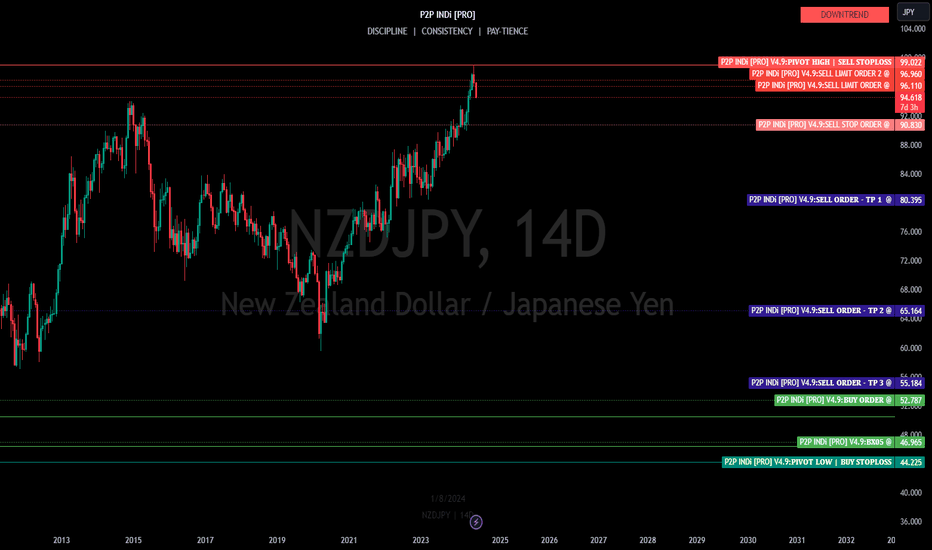

NZDJPY: HTF CURVE ANALYSIS (14D) - DT WEALTH TRADE✨ NZDJPY: HTF CURVE ANALYSIS (14D) ✨ (DOWNTREND)

SLO2 @ 96.96 ⏳

SLO1a @ 96.11 ⏳

SLO1 @ 95.01 ⏳

SSO1 @ 90.83 ⏳

TP1 @ 80.395

TP1a @ 70.25

TP2 @ 65.164

TP4 @ 55.184

BLO1 @ 52.787 ⏳ (DO NOT SET!!! PLACE PRICE ALERT)

BLO2 @ 46.965 ⏳ (DO NOT SET!!! PLACE PRICE ALERT)

🔑

BLO = BUY LIMIT ORDER

HTF = HIGH TIME FRAME

SLO = SELL LIMIT ORDER

SSO = SELL STOP ORDER

TP = TAKE PROFIT

NOTE: Based on my evaluation, I don't anticipate PA going above 95.60, however if it does, I'll have orders waiting for it up there! I believe a conservative DCA approach will serve this trade the best. This is a wealth opportunity. It will take some time to play out but if managed well, it will pay out well.

Long-term time frames (1 week to 1 year):

— Shows the big picture, revealing major trends and economic factors.

— Less volatile, price movements are slower and smoother.

— Suitable for long-term trend trading and position trading.

— Requires less frequent monitoring but may offer fewer trading opportunities.

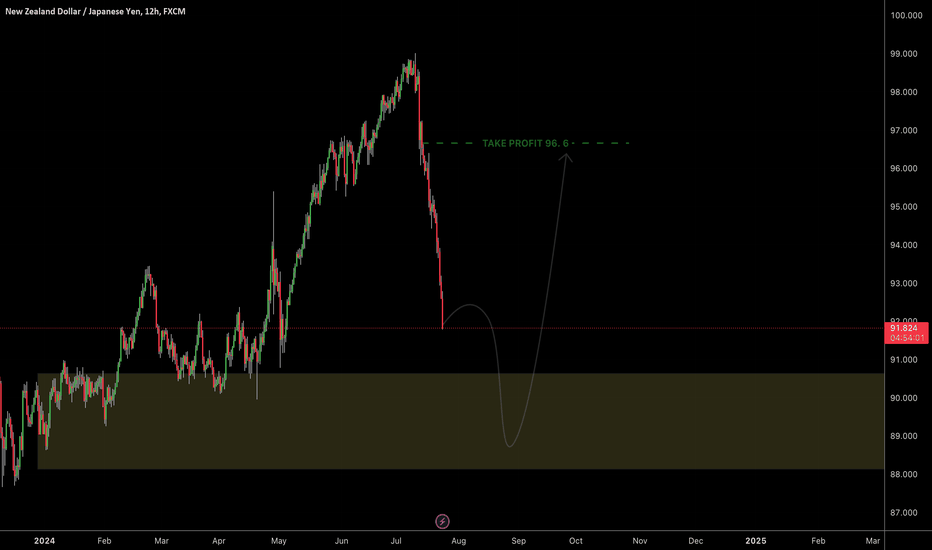

[NZDJPY] Big anticipation on this corrective moveHere is a big anticipation of the correction for this very bearish asset.

So let's take a little risk for a swing position to hold as much as possible.

I don't want now to see the price pushing to the downside at all or I will leave the position for the next opportunity. What is sure, is I want to long this asset on the next days.

Great Trade !

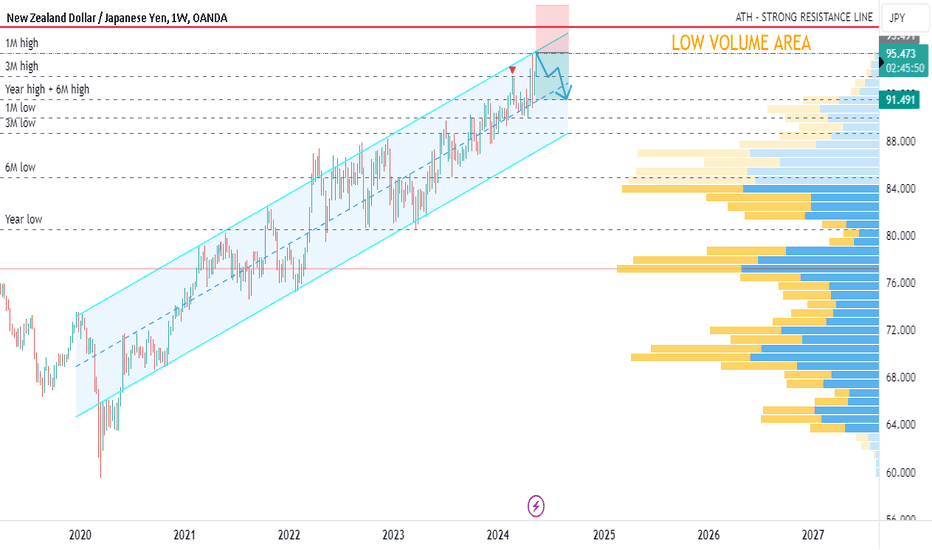

OPPORTUNITY FOR SELL NZDJPYWe have these indicators for SELL opportunity:

- Low volume to continue the current direction

- Reflection from the top of the parallel channel

- Return/re-test to 3M high (min. for TP1)

- Stong resistance line – zone with ATH

We define 3 goals:

TP 1 = 80 pips

TP 2 = 200 pips

TP 3 = 400 pips

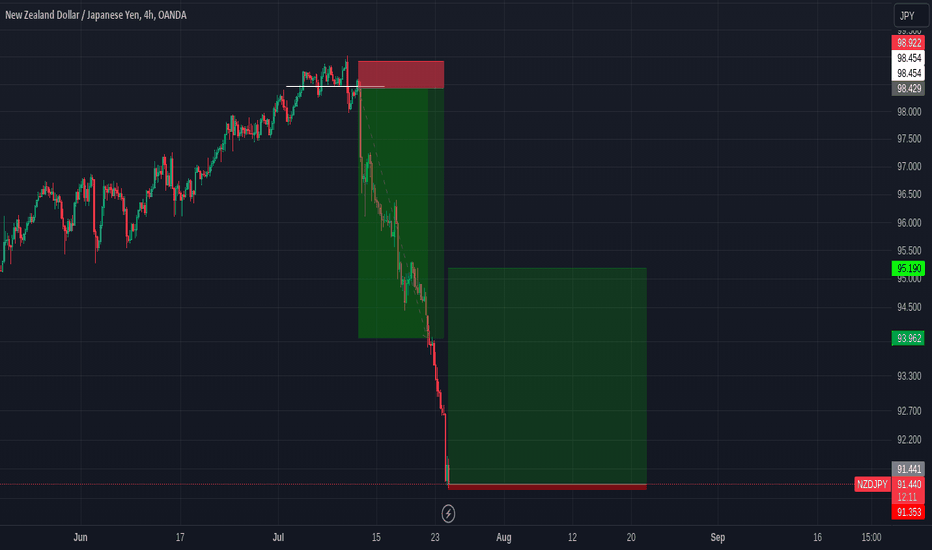

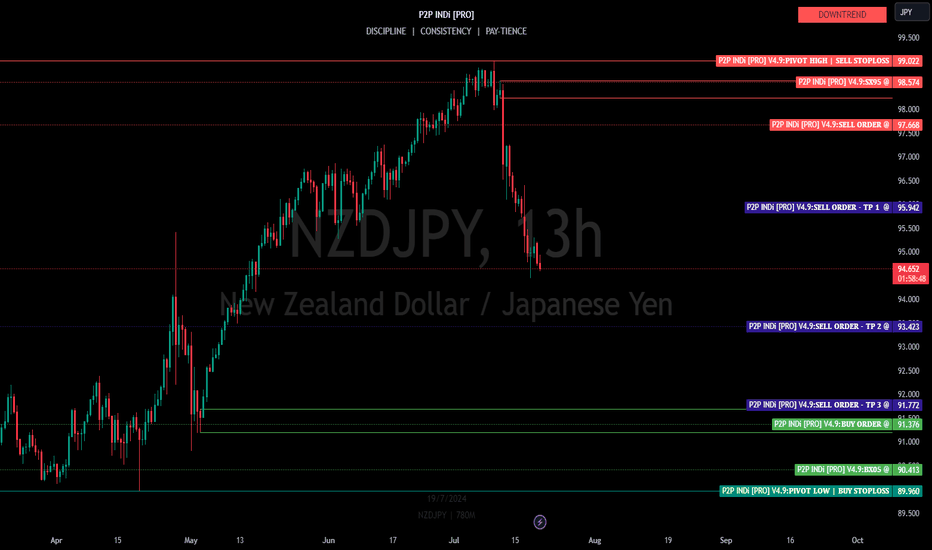

NZDJPY: ITF CURVE ANALYSIS (13H/14H) ITF-DT✨ NZDJPY: ITF CURVE ANALYSIS (13H/14H) ✨ (DOWNTREND)

SLO2 @ 97.886 ⏳

SLO1a @ 97.077 ⏳

SLO1 @ 95.01 ⏳ (ANTICIPATED TURN BETWEEN 94.70 & 95.20)

TP1 @ 95.942 - BANKED

TP1a @ 95.05 (Secret TP)

TP2 @ 93.423

TP3 @ 91.772

BLO1 @ 91.376⏳ (DO NOT SET) WILL EVALUATE LATER

🔑

BLO = BUY LIMIT ORDER

ITF = INTERMEDIATE TIME FRAME

SLO = SELL LIMIT ORDER

TP = TAKE PROFIT

NOTE: Secret sauce, if used in tandem with the wealth trade, I believe there is a great opportunity on this pair. It's paid out well so far with TP1 being hit already.

Intermediate time frames (4 hours to 6 day):

— Offer a clearer picture of the underlying trend compared to short-term frames.

— Provide more opportunities for confirmation signals and technical analysis.

— Allow for more flexible trading schedules, trades can be held overnight.

— Suitable for swing traders and some positional traders.

Riding the Waves: NZD/JPY's Rollercoaster JourneyTechnical Analysis

Technical analysis also supports a long position in NZD/JPY:

Market Bottom Formation: Recent technical analysis indicates that the short-term downtrend has halted, and the price is starting to create a market bottom. A recent market high has been broken, suggesting a potential bull run .

Key Structure Levels: The pair is about to retest a key structure level of 95.24, implying a high likelihood of a move up .

Economic Calendar and Upcoming Events

Upcoming events on the economic calendar can also influence the NZD/JPY pair:

Japan’s FY 2024/2025 Annual Wage Negotiations: Preliminary results on March 15 could impact the JPY .

BOJ’s Monetary Policy Outcome: Scheduled for March 19, this event could provide further insights into Japan's economic stance .

Fed FOMC Meeting: The release of the latest dot plot on March 20 could influence global market sentiment .

Conclusion

Longing NZD/JPY is supported by a combination of high-interest rate differentials, strong macroeconomic indicators, favorable technical analysis, and institutional investor sentiment. While risks remain, the overall outlook suggests that a long position in NZD/JPY could be a profitable strategy.

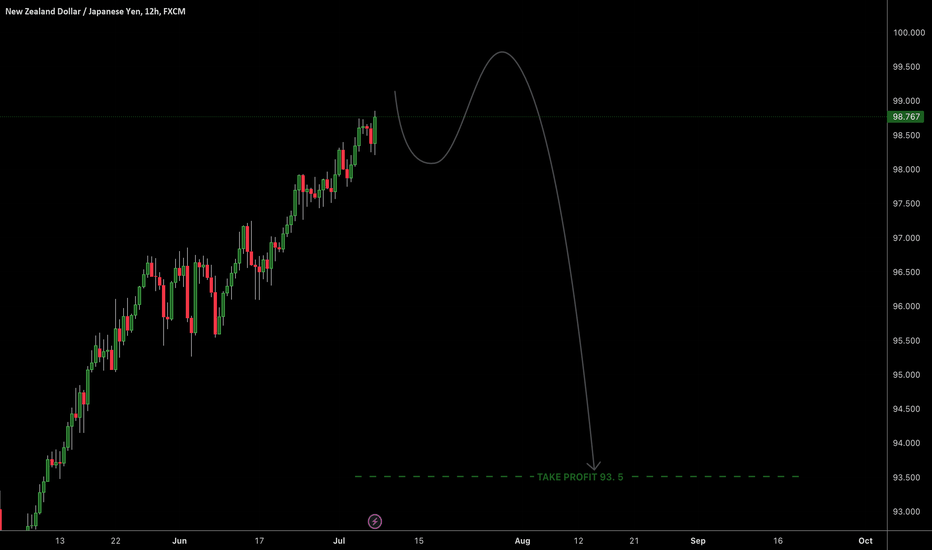

BIG BOUNCE SETTING UP IN NZD/JPYA monster rally in the Yen is creating some extreme technical readings across the entire JPY complex. Of note is the Kiwi/Yen cross (NZD/JPY)

A pullback of 7 cents from 99 to 92 has brought prices back into trendline support from 2020. Not suggesting you try to catch falling knives, but in the forex space, a methodic and patient building of a position of size could lead to one of those 7 figure profitable trades in a few days.

Anticipating NZDJPY DeclineFundamental Reasons:

Diverging Monetary Policies: A significant factor influencing currency pairs is the divergence in monetary policies between the two countries. If the Reserve Bank of New Zealand (RBNZ) adopts a more dovish stance compared to the Bank of Japan (BoJ), it could weaken the NZD relative to the JPY.

Commodity Prices: As a commodity-driven economy, New Zealand is susceptible to fluctuations in commodity prices. A decline in prices of key exports like dairy, meat, and wool can negatively impact the NZD.

Global Risk Sentiment: The NZD is often considered a riskier currency. Periods of increased global uncertainty or risk aversion can lead to investors seeking safer havens like the JPY, causing NZDJPY to decline.

Trade Relations: New Zealand's reliance on international trade makes it vulnerable to trade tensions. Deteriorating trade relations with major partners can negatively impact the NZD.

Economic Calendar Events:

The economic calendar provides crucial data points that can influence currency movements. Key events to watch for potential NZDJPY weakness include:

New Zealand Economic Indicators:

GDP growth: A slowdown in economic growth can weaken the NZD.

Employment data: Rising unemployment or declining wage growth can negatively impact consumer spending and the overall economy.

Inflation figures: Lower-than-expected inflation could lead to expectations of interest rate cuts, weakening the NZD.

Trade balance: Persistent trade deficits can indicate economic weakness.

Global Economic Indicators:

Global risk sentiment: Events like geopolitical tensions, trade disputes, or economic slowdowns can increase demand for safe-haven currencies like the JPY.

US economic data: As the US is a major global economy, its economic performance can impact global risk sentiment and currency markets.

Central Bank Statements and Interest Rate Decisions:

RBNZ interest rate decisions and forward guidance: Any indication of a more dovish stance or potential rate cuts can weaken the NZD.

BoJ monetary policy decisions: While the BoJ is expected to maintain an ultra-loose monetary policy, any unexpected shifts could impact the JPY.

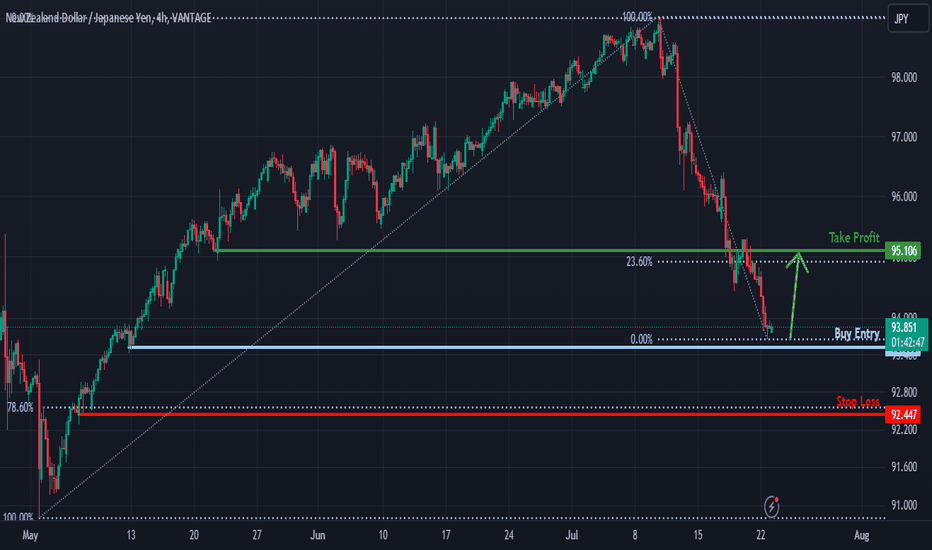

Falling towards pullback support?NZD/JPY is falling towards a support level which is a pullback support and could bounce from this level to our take profit.

Entry: 93.53

Why we like it:

There is a pullback support level.

Stop loss: 92.44

Why we like it:

There is a pullback support level which aligns with the 78.6% Fibonacci retracement.

Take profit: 95.10

Why we like it:

There is an overlap resistance level which lines up with the 23.6% Fibonacci retracement.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.