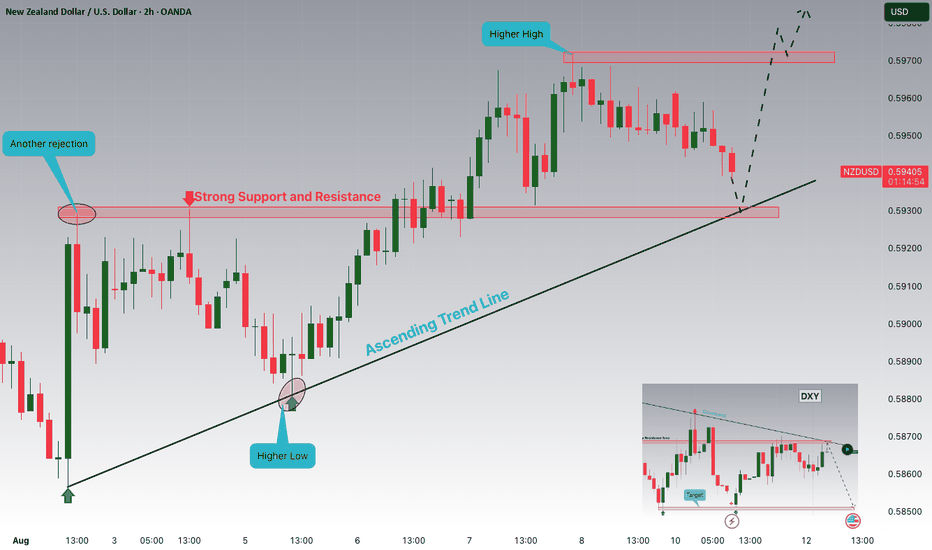

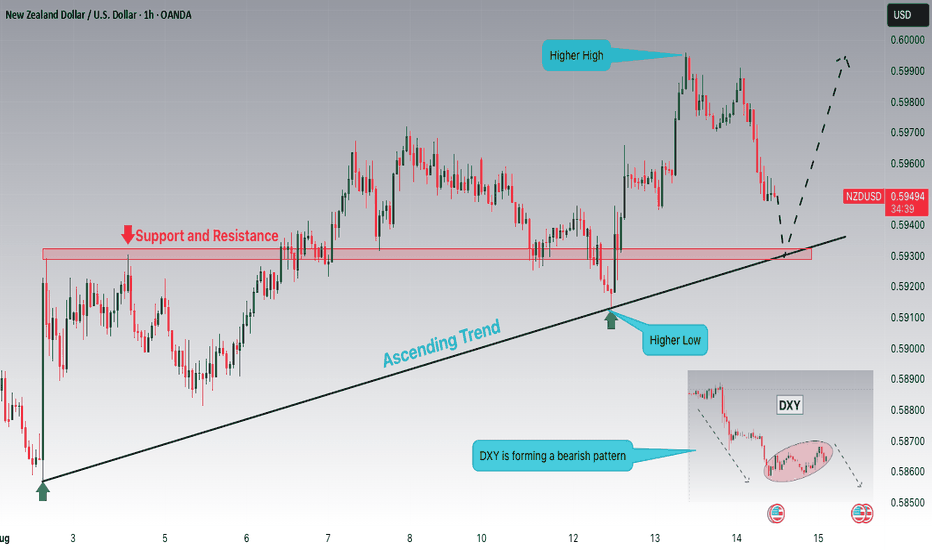

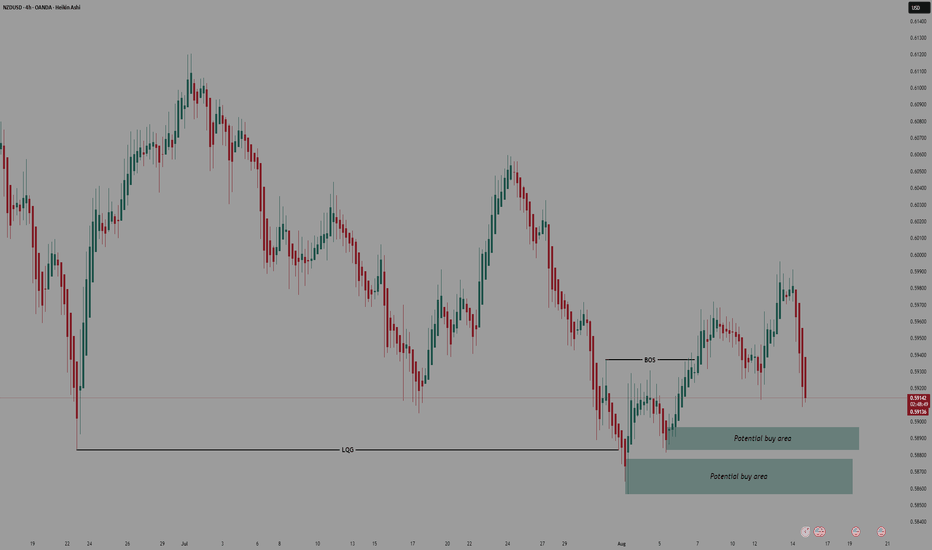

NZDUSD is Nearing an Important Support Area!!Hey Traders, in today's trading session we are monitoring NZDUSD for a buying opportunity around 0.59300 zone, NZDUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 0.59300 support and resistance area.

Trade safe, Joe.

NZDUSD trade ideas

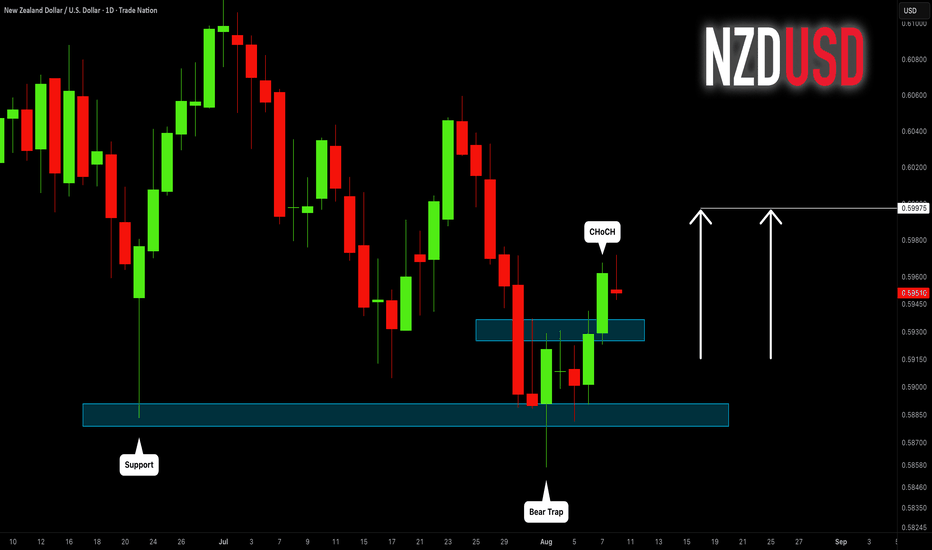

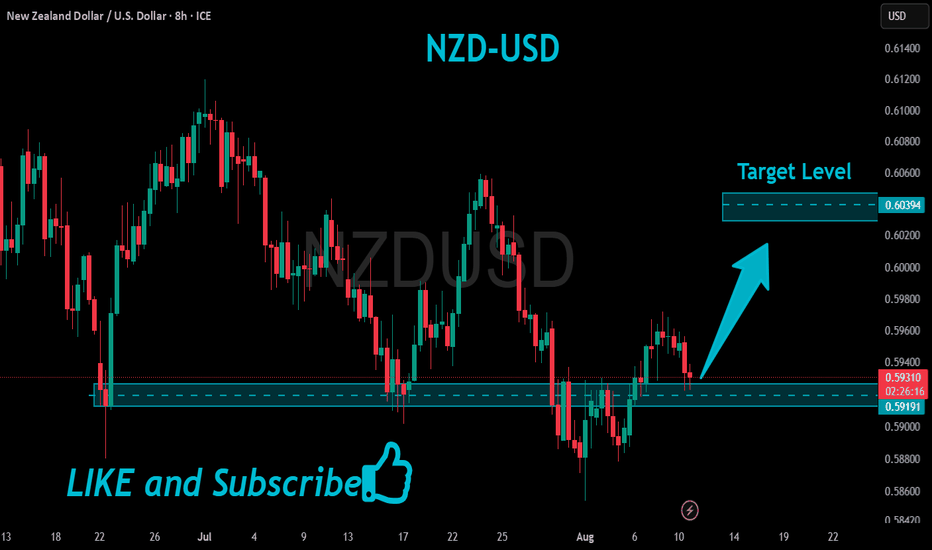

NZDUSD: More Growth Ahead Next Week 🇳🇿🇺🇸

NZDUSD may continue rising next week after a confirmed bullish

trap that occurred following a text of a key daily horizontal support.

A local consequent Change of Character CHoCH indicates

a strength of the buyers and a highly probable growth.

Next resistance - 0.6

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

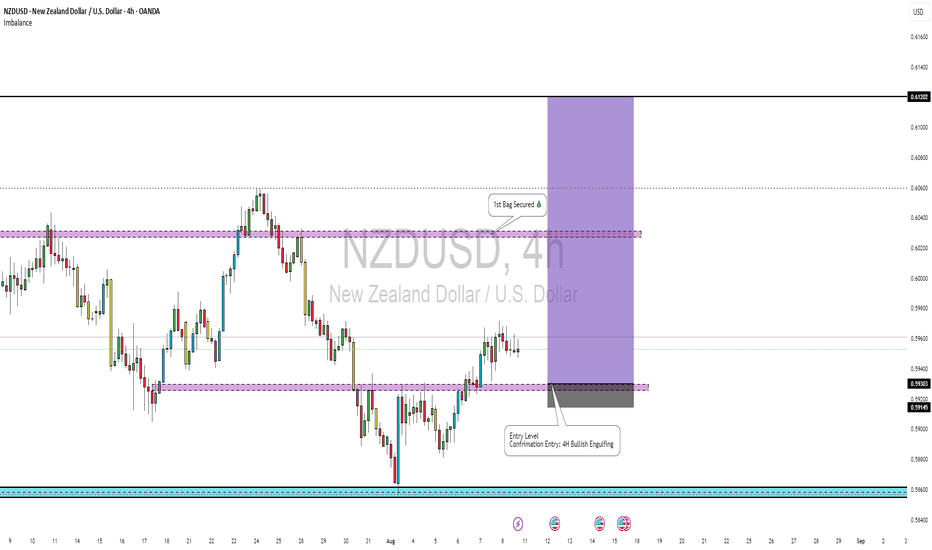

NZDUSD Long Setup: Watching 0.59308 Support ZoneI’m currently watching NZDUSD for a potential buy opportunity.

My anticipation is for price to pull back to the 0.59308 level a zone that aligns with previous structure support and potential bullish reaction.

Why This Level Matters

Previous Support Zone – 0.59308 has acted as a reaction point in recent sessions, indicating buyer interest.

Pullback Play – Waiting for price to retrace into value before looking for bullish confirmation.

Trend Context – On the higher timeframes (W1/D1), price is holding above key swing lows, suggesting buyers may defend this area.

Trading Plan

Wait for Pullback – Price to approach 0.59308.

Look for Confirmation – Bullish candlestick patterns (engulfing, pin bar) or rejection wicks.

Entry – Only after confirmation.

Stop Loss – Below recent swing low / invalidation zone.

Targets – First target near recent swing high, with partial profits taken along the way.

Risk Management Reminder

This is not financial advice — always manage your risk, as market conditions can change quickly.

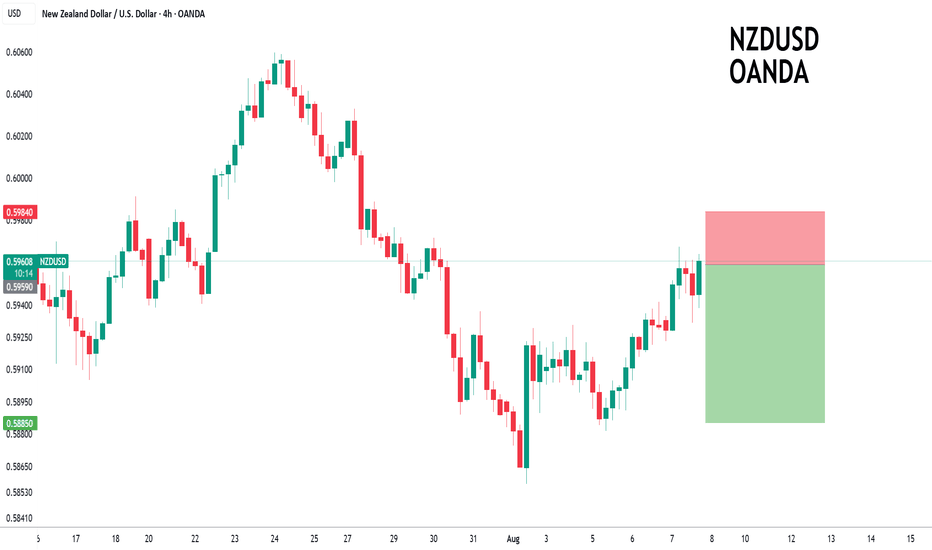

$NZDUSD CPI Week Bullish ContinuationPEPPERSTONE:NZDUSD retraced slightly on the weekly chart into a weekly Imbalance and price rejected. My outlook is to see if we can drop into that Daily Imbalance that was formed and shot higher towards that Daily Balanced Price Range.

My first target is that 4H Balanced Price Range.

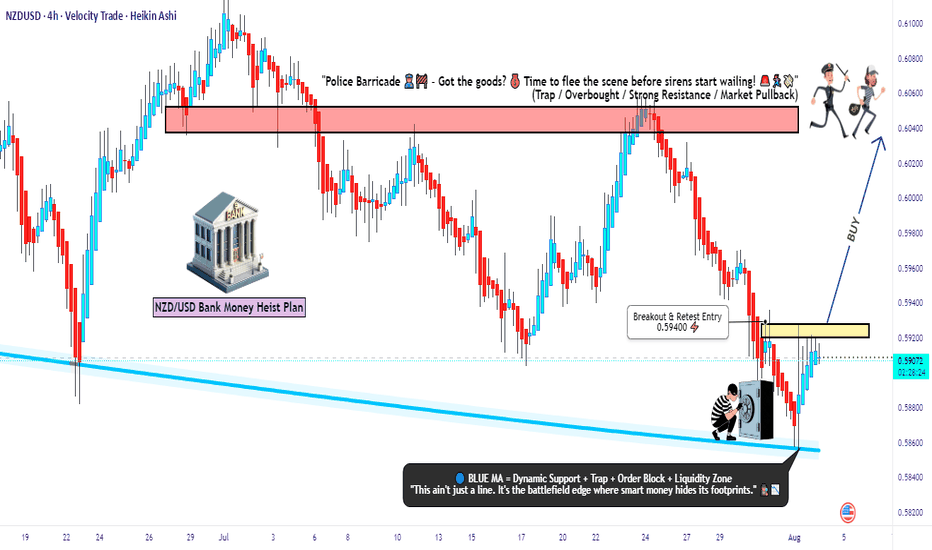

Ready to Rob the Kiwi? NZD/USD Bullish Breakout Plan🥝💚 NZD/USD Bullish Breakout Heist Plan 🟢💰 (Thief Trader Style)

🎭 Robbery Mission Activated – Code: Kiwi Uprising 💣📈

💥 Asset: NZD/USD

📍 Entry: 0.59400 (Breakout confirmed – the vault door’s open!)

🔐 Stop Loss: 0.58300 (Thief exit point – avoid the trap zone)

🎯 Target: 0.60500 (Cash-out point – grab the bags and vanish!)

🧠 Strategy: Layered Limit Orders a.k.a “Precision DCA Infiltration”

🧤 The Thief Trader is sneaking into the forex vaults once again — this time with eyes locked on Kiwi (NZD/USD). The bulls are loading up, and the breakout zone is showing green flags 🟢 — time to strike hard and clean 💰

🔥 Operation Details:

We’re stacking multiple limit orders like a pro thief would place decoys – distraction + precision = execution! Entry at 0.59400 is our main gate breach. Orders set in layers to trap liquidity zones below.

🚨 Stop Loss @ 0.58300 – tight enough to avoid getting caught, but wide enough to dodge fake traps.

🏆 Target: 0.60500 – that’s where the loot vault is sitting. Clean exit once we’re loaded with profits!

👀 Swingers & Scalpers Alert!

Only look LONG – no short robbing here!

🔁 Use trailing SL once in profit – protect your gold like a pro.

💡If cash is low – no panic, join the swing gang and glide in with patience & alerts. Smart robbers wait 🧠💼

📣 News Risk ⚠️

Avoid jumping during major news blast-offs.

Lock profits with trailing SL.

No panic entries — only sniper moves.🕵️♂️💥

❤️ Smash That BOOST Button 💥💪

Support the squad! More boosts = more heist plans, more clean money from the market streets 🚀📈

🎭 Stay sharp, rob smart — see you in the next plan, robbers 🤑🐱👤🎯

~ Thief Trader

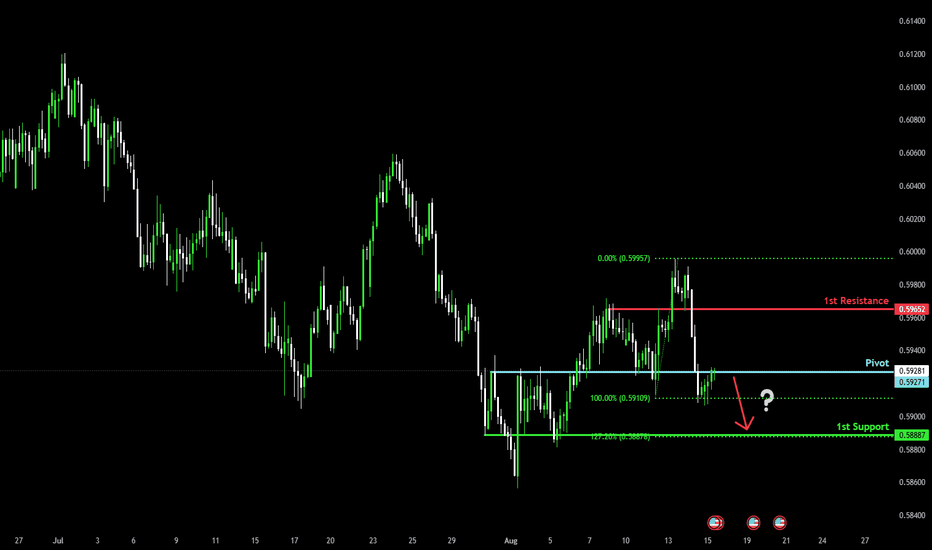

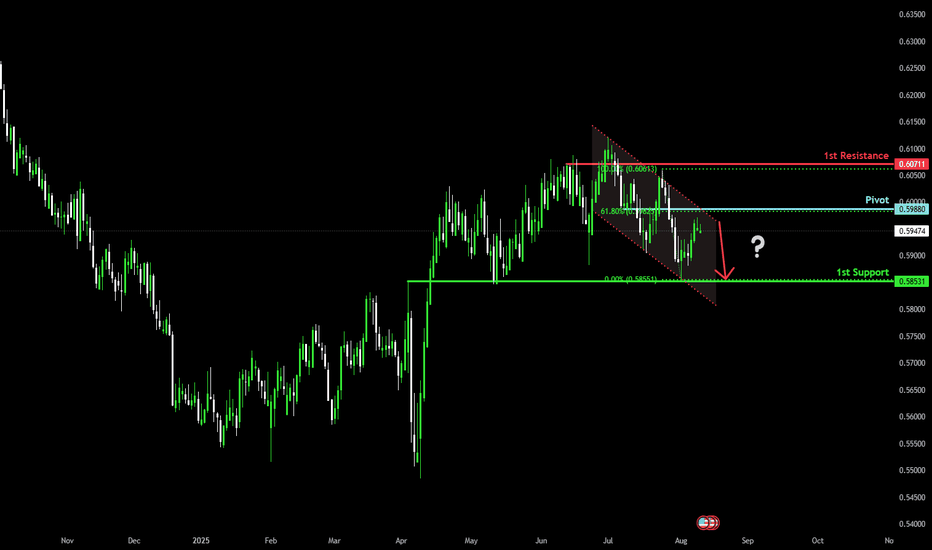

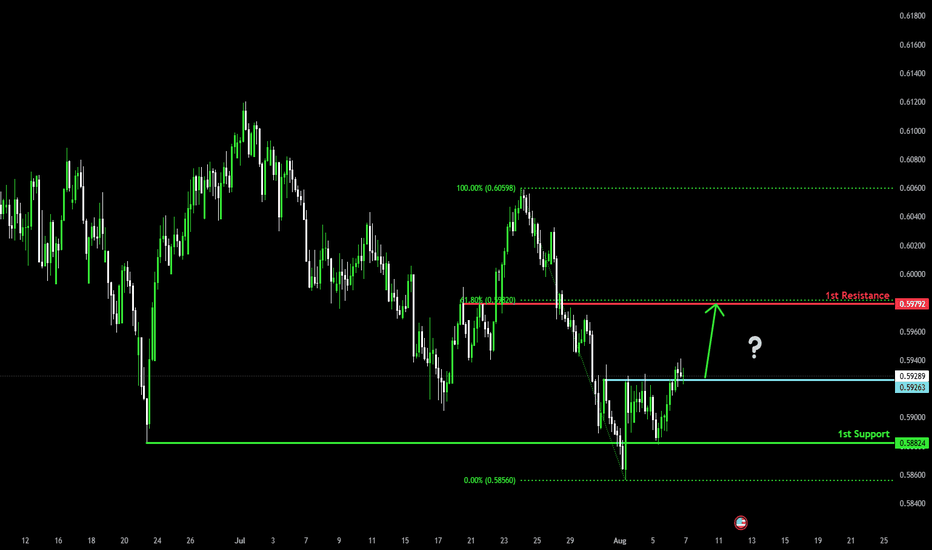

Could the kiwi reverse from here?The price is reacting off the pivot and could drop to the 1st support which lines up with the 127.2% Fibonacci extension.

Pivot: 0.5927

1st Support: 0.5888

1st Resistance: 0.5965

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

NZDUSD; Heikin Ashi Trade Idea📈 Hey Traders!

Here’s a fresh outlook from my trading desk. If you’ve been following me for a while, you already know my approach:

🧩 I trade Supply & Demand zones using Heikin Ashi chart on the 4H timeframe.

🧠 I keep it mechanical and clean — no messy charts, no guessing games.

❌ No trendlines, no fixed sessions, no patterns, no indicator overload.

❌ No overanalyzing market structure or imbalances.

❌ No scalping, and no need to be glued to the screen.

✅ I trade exclusively with limit orders, so it’s more of a set-and-forget style.

✅ This means more freedom, less screen time, and a focus on quality setups.

✅ Just a simplified, structured plan and a calm mindset.

💬 Let’s Talk:

💡Do you trade supply & demand too ?

💡What’s your go-to timeframe ?

💡Ever tried Heikin Ashi ?

📩 Got questions about my strategy or setup? Drop them below — ask me anything, I’m here to share.

Let’s grow together and keep it simple. 👊

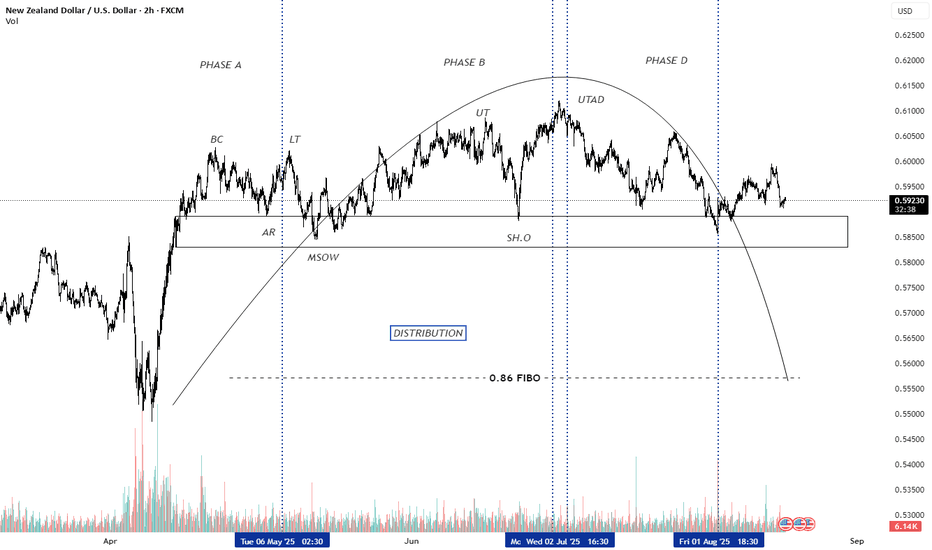

NZDUSD Forming Bearish ContinuationNZDUSD is carving out what appears to be a bearish continuation setup on the daily chart. The pair is forming lower highs and lower lows, guided by a clear corrective structure. As price breaks below the mini-leg retracement and edges lower, it suggests a potential slide toward the larger support zone around 0.5800–0.5820—an area that previously held as resistance and now flips to demand.

On the fundamentals front, the spotlight is on an increasingly dovish Reserve Bank of New Zealand. Inflation has remained within the RBNZ’s target band, with annual CPI rising just to 2.7%—slightly below forecasts—while labor data shows the unemployment rate creeping up to 5.2%, and labor force participation dipping to multi-year lows. Markets are now pricing in an 88% probability of another rate cut in August, Further weighting the scales against the kiwi.

Political and economic headwinds also cast a shadow over the NZD. The housing market is under pressure; prices are retracing sharply, rents are falling, and migration is declining. While the government is pushing fiscal stimulus via infrastructure spending, the momentum remains fragile—and it adds to bearish pressure on NZD.

Technically, this setup offers a defined structure and clean risk-to-reward. A violation below the last swing low around 0.5930 opens the path to 0.5800–0.5820. If that level gives way, the next logical target lies closer to 0.5700. For now, traders should be watching for confluence near 0.5950 for potential entry, aiming lower with stops tight above recent swing highs.

Market Analysis: NZD/USD Much Higher—Uptrend Shows StrengthMarket Analysis: NZD/USD Much Higher—Uptrend Shows Strength

NZD/USD is also rising and might aim for more gains above 0.5970.

Important Takeaways for NZD/USD Analysis Today

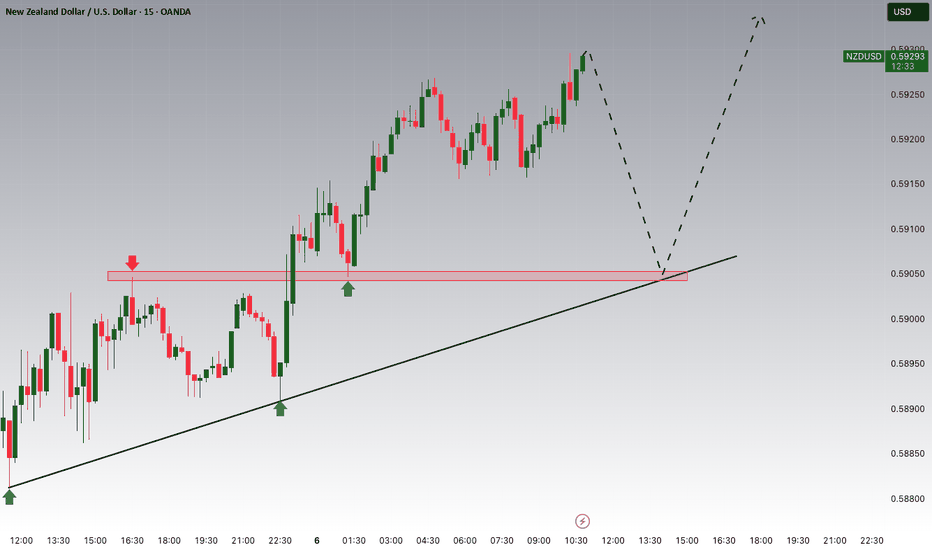

- NZD/USD is consolidating gains above the 0.5940 zone.

- There is a short-term declining channel forming with resistance at 0.5960 on the hourly chart of NZD/USD.

NZD/USD Technical Analysis

On the hourly chart of NZD/USD on FXOpen, the pair started a steady increase from the 0.5880 zone. The New Zealand Dollar broke the 0.5925 resistance to start the recent increase against the US Dollar.

The pair settled above 0.5940 and the 50-hour simple moving average. It tested the 0.5970 zone and is currently consolidating gains. There was a move below the 23.6% Fib retracement level of the upward move from the 0.5881 swing low to the 0.5971 high.

The NZD/USD chart suggests that the RSI is stable above 50. On the upside, the pair might struggle near 0.5960. There is also a short-term declining channel forming with resistance at 0.5960.

The next major resistance is near the 0.5970 level. A clear move above the 0.5970 level might even push the pair toward the 0.6000 level. Any more gains might clear the path for a move toward the 0.6020 resistance zone in the coming days.

On the downside, immediate support is near the 0.5940 level. The first key support is near the 0.5925 level. It is close to the 50% Fib retracement level of the upward move from the 0.5881 swing low to the 0.5971 high.

The next major support is near the 0.5900 level. If there is a downside break below it, the pair might slide toward 0.5880. Any more losses could lead NZD/USD to 0.5820.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

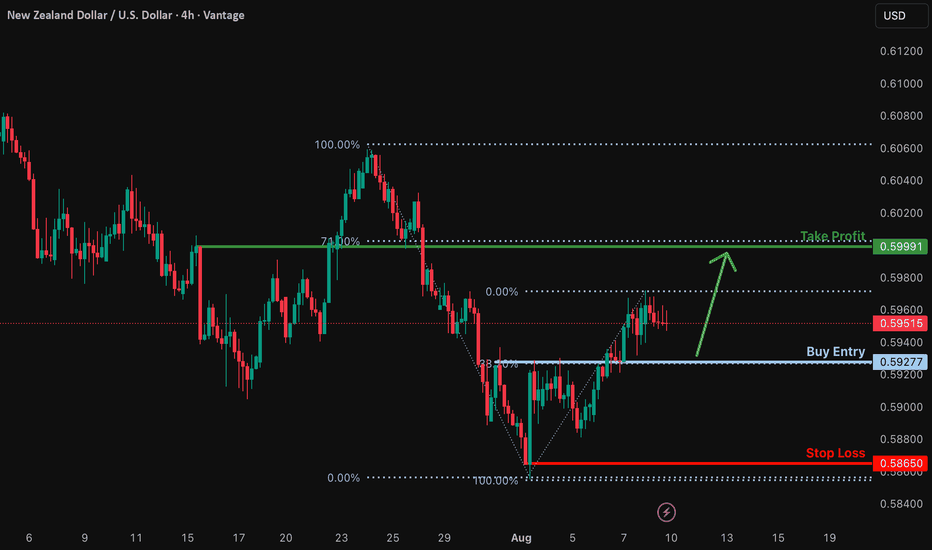

Bullish bounce for the Kiwi?The price is falling towards the support level, which is a pullback support that aligns with the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 0.5927

Why we like it:

There is a pullback support that lines up with the 38.2% Fibonacci retracement.

Stop loss: 0.5865

Why we like it:

There is a swing low support.

Take profit: 0.5999

Why we like it:

There is a pullback resistance that lines up witht he 71% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish drop for the Kiwi?The price is rising towards the pivot and could reverse to the 1st support, which is an overlap support.

Pivot: 0.5988

1st Support: 0.5853

1st Resistance: 0.6071

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

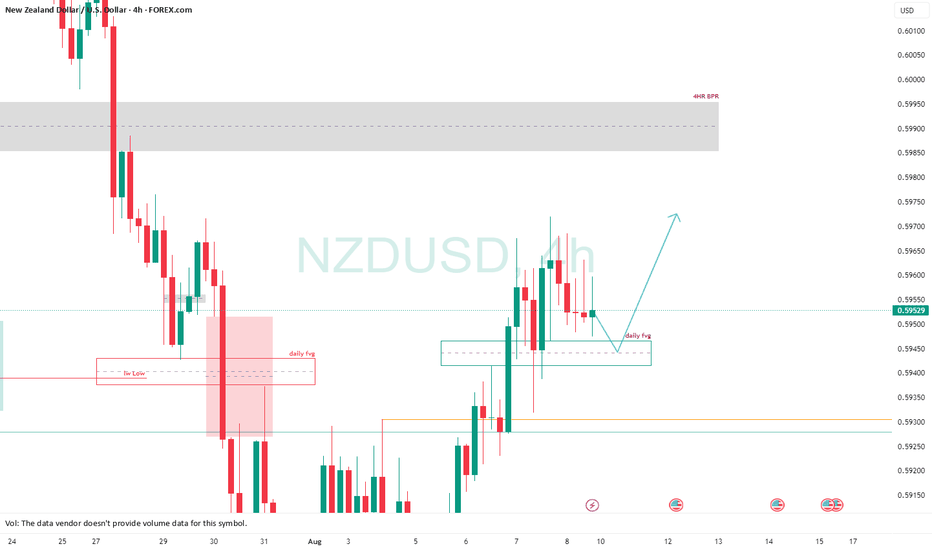

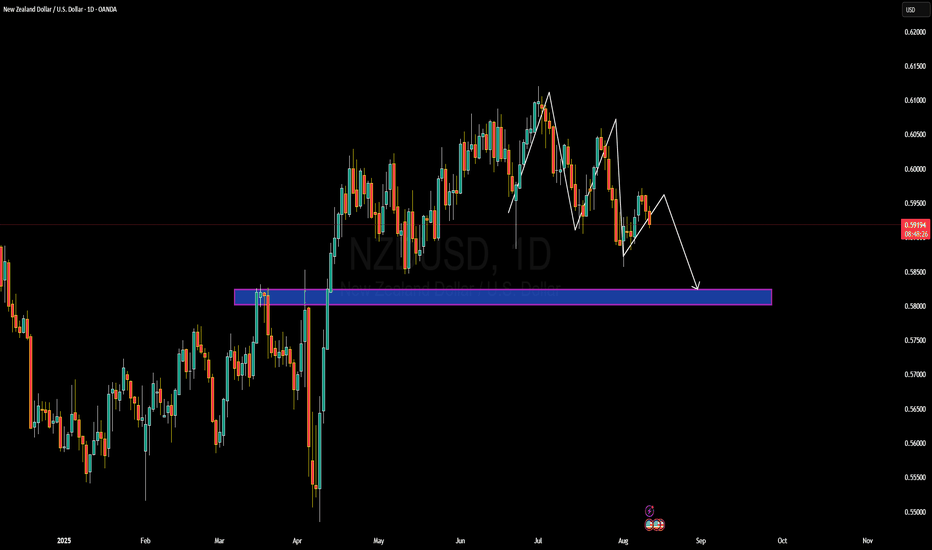

NZDUSD: Amid 15% Tariffs & Rate Cuts Looming, Time To Sell?Welcome back to the Weekly Forex Forecast for the week of Aug 11 - 15.

In this video, we will analyze the following FX market: NZDUSD

NZDUSD is dealing with new 15% tariffs from the US and signs of a rate cut coming in the next RBNZ meeting. Not to mention price mad a bearish impulsive move, and correcting into a bearish FVG. This would be the perfect premium array for the retracement to end, and the establishment of a lower high, followed by the start of the new bearish leg.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

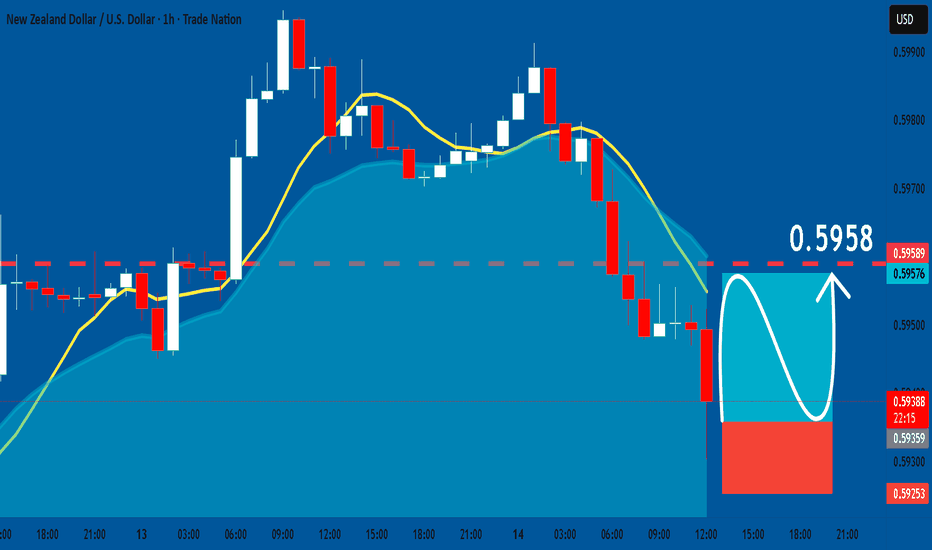

NZDUSD: Long Trade Explained

NZDUSD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long NZDUSD

Entry - 0.5934

Sl - 0.5929

Tp - 0.5958

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

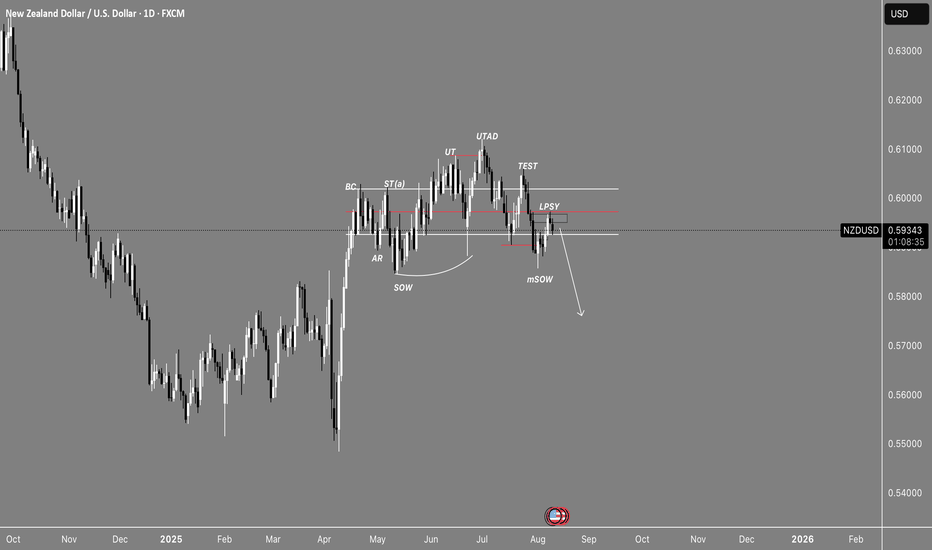

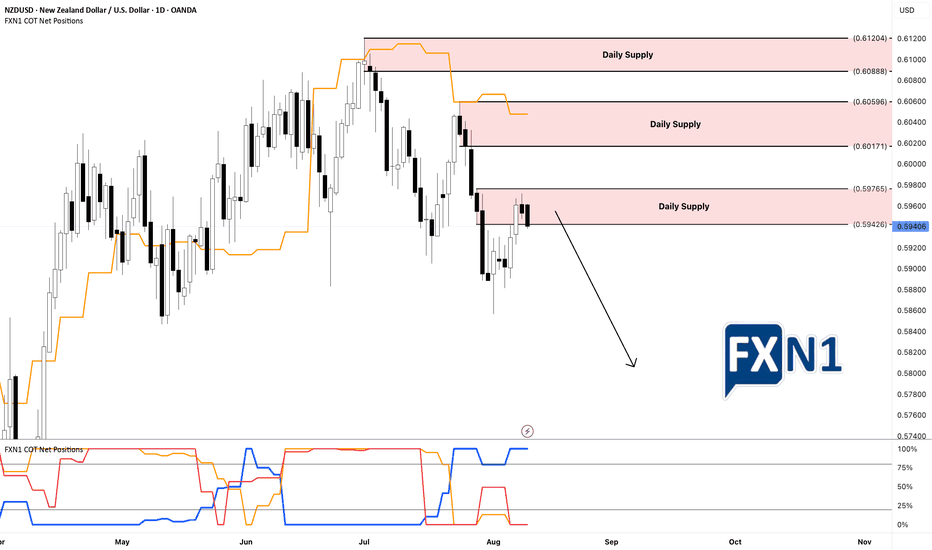

NZD/USD Faces Resistance at Daily Supply Zone Amid Rising Short On the daily chart, the NZD/USD pair has approached and responded to a significant supply zone. Notably, there has been a marked increase in short positions among non-commercial traders. These initial short entries were established in July, and current market dynamics suggest a potential continuation of the bearish trend. If, throughout this week, the Dollar Index gains momentum and sees an increase in long positions, it could further drive the NZD downward.

✅ Please share your thoughts about NZDUSD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

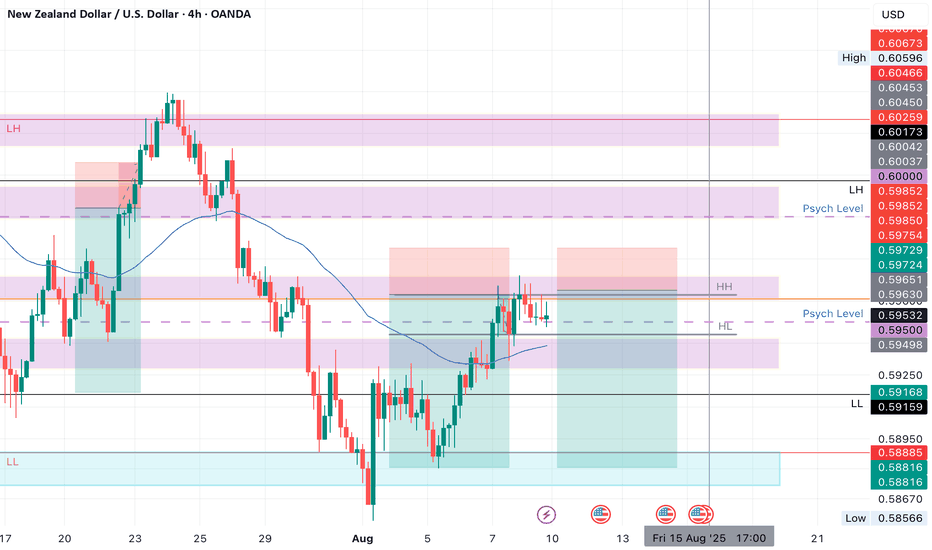

NZDUSD SHORTMarket structure bearish on HTFs DW

Entry on Weekly and Daily AOi

Weekly Rejection at At AOi

Daily Rejection at AOi

Daily EMA retest

Previous Structure point Daily

Around Psychological Level 0.59500

H4 Candlestick rejection

Levels 4.15

Entry 90%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

NZDUSD to find sellers at current market price?NZDUSD - 24h expiry

The bearish engulfing candle on the weekly chart is negative for sentiment.

Daily signals are mildly bearish.

20 1day EMA is at 0.5956.

Offers ample risk/reward to sell at the market.

The sequence for trading is lower lows and highs.

We look to Sell at 0.5959 (stop at 0.5984)

Our profit targets will be 0.5885 and 0.5875

Resistance: 0.5967 / 0.5986 / 0.6000

Support: 0.5943 / 0.5920 / 0.5900

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Could the Kiwi bounce from here?The price is falling towards the pivot, which is a pullback support and could potentially rise to the 1st resistance which aligns with the 61.8% Fibonacci retracement.

Pivot: 0.5926

1st Support: 0.5882

1st Resistance: 0.5979

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.