NZDUSD trade ideas

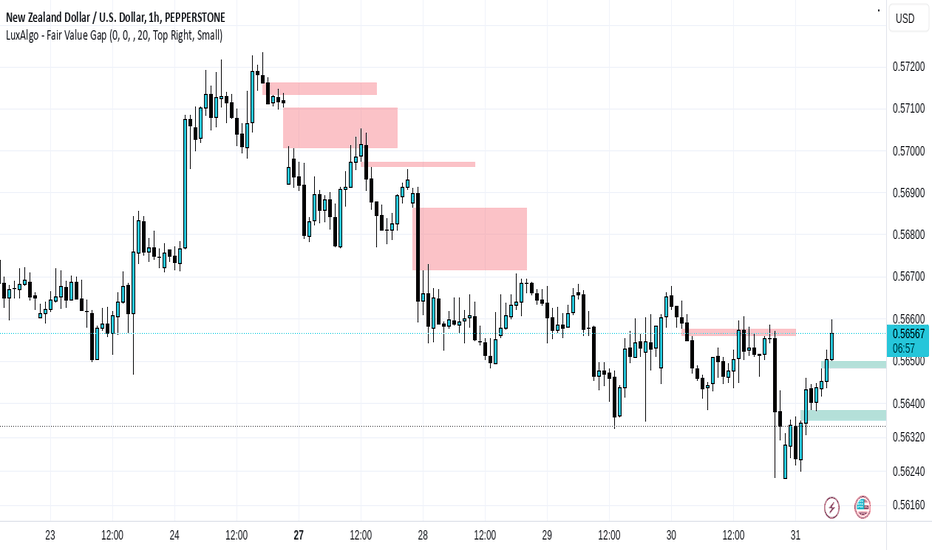

NZD/USD - Market OverviewNZD/USD saw modest gains, but upside momentum remained limited as market sentiment stayed cautious amid renewed tariff threats from Trump ahead of the February 1 deadline.

On Thursday, President Trump stated he would soon decide whether to exempt Canadian and Mexican oil imports from the 25% tariffs set to take effect on Saturday.

He also reiterated that additional tariffs on Chinese goods remain under consideration due to concerns over China's role in the fentanyl trade.

As of (GMT 06:09), the Kiwi dollar was up 0.19%, trading at 0.5646 against the U.S. dollar.

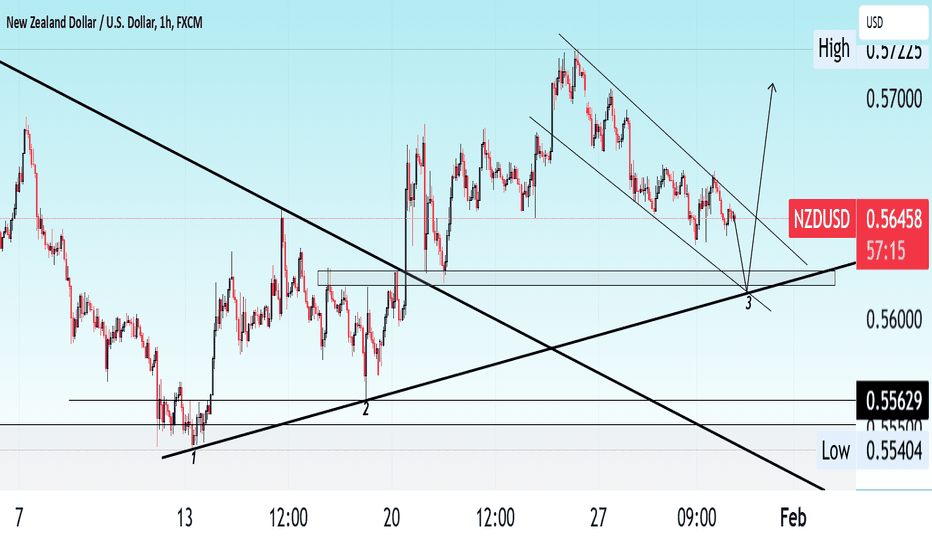

Key technical levels:

Resistance: Immediate resistance is seen at 0.5673 (38.2% Fib); a break above this level could drive the pair towards 0.5720 (50% Fib).

Support: The nearest support is at 0.5630 (38.2% Fib), with a break below exposing downside potential towards 0.5573 (23.6% Fib).

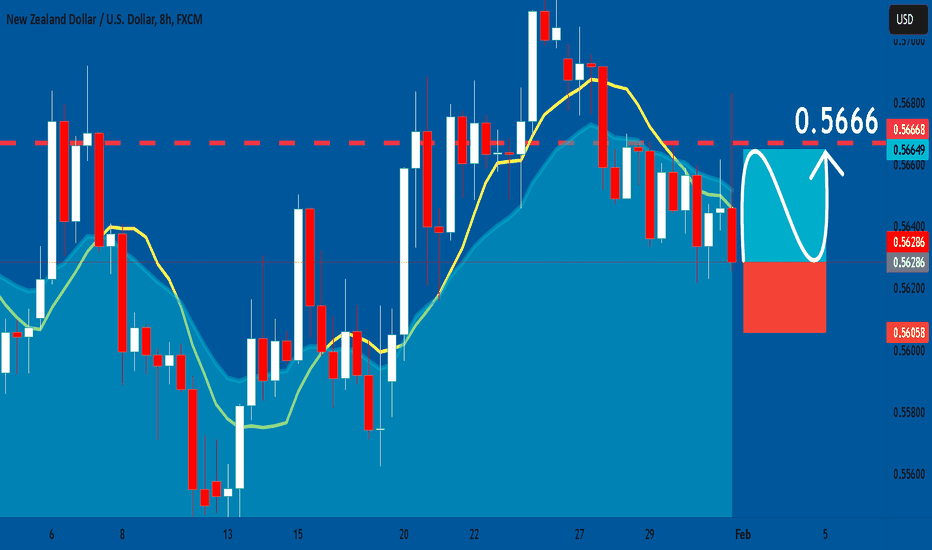

📉 Trade Setup:

🔹 Sell around 0.5660

🔹 Stop-loss: 0.5700

🔹 Target: 0.5550

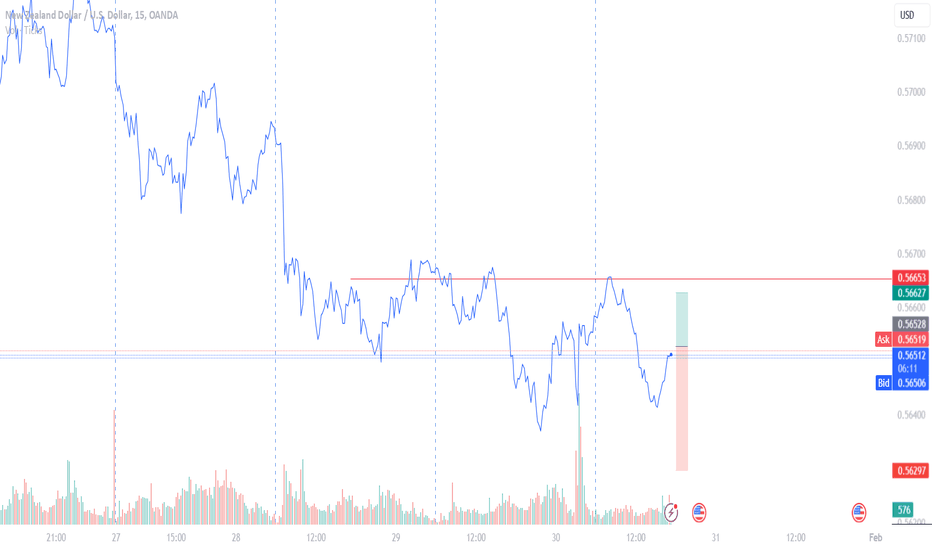

#005 NZDUSD Obvious Range BuyBuying into obvious uptrend now on 15 Minutes.

Coming back at 9pm Singapore Time.

Today is day 2 of CNY but I didn't hear a single beat of the lion dance drum, live.

I think culture across the board in Singapore is dead, with the broad strokes painted by the authorities. If you know you know.

1723SGT 30012025

1R SL to 0.43R TP.

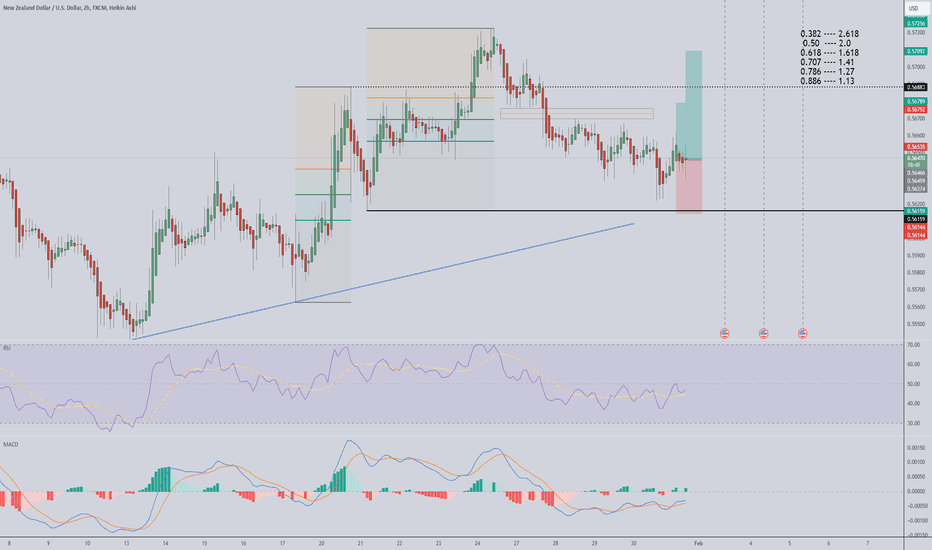

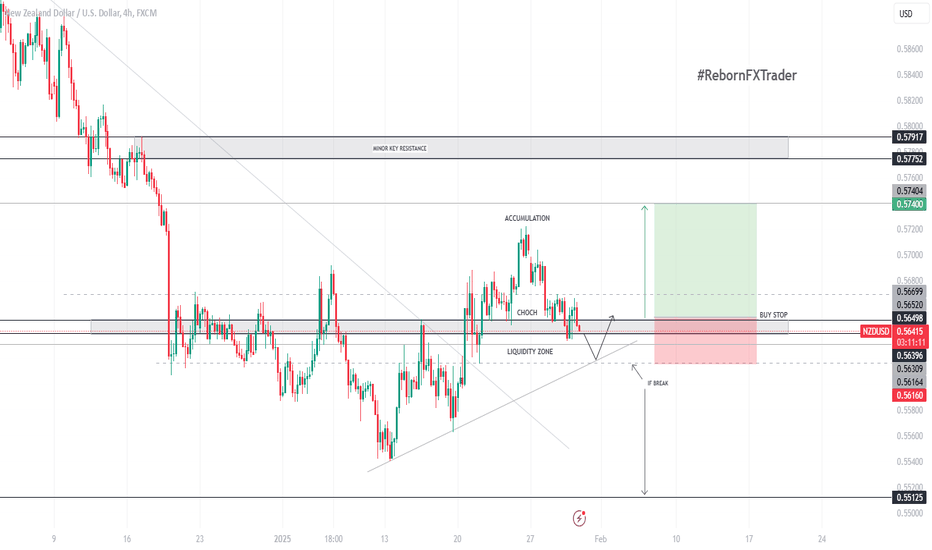

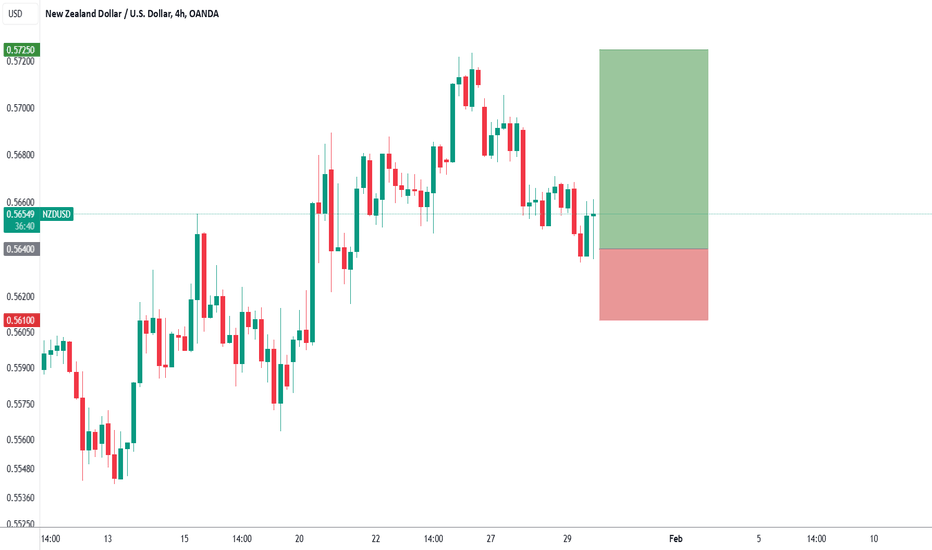

NZD/USD 4-Hour Timeframe AnalysisNZD/USD 4-Hour Timeframe Analysis

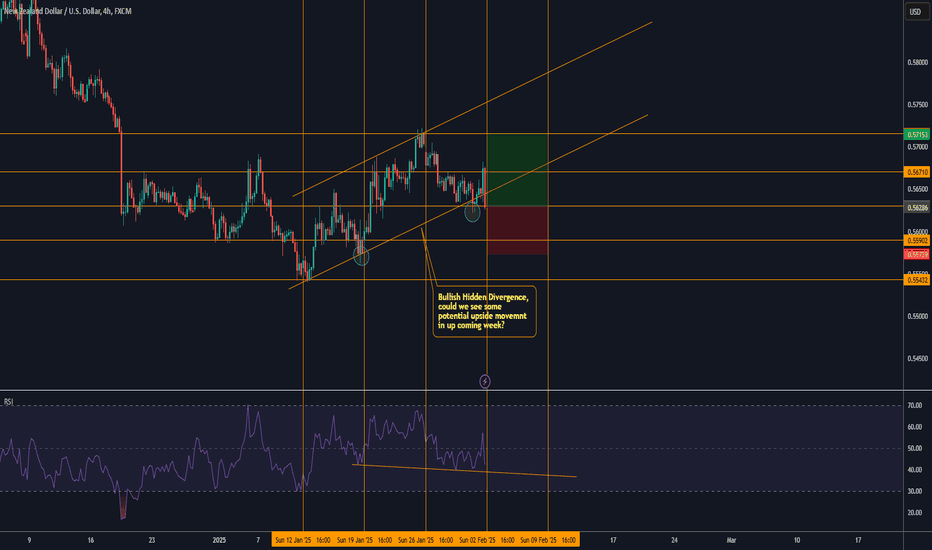

Trend Analysis

On the 4-hour timeframe, the price is in a major downtrend, with ongoing consolidation creating uncertainty in the market. We have identified some minor key levels, one of which is at 0.56400, which has already been broken. After the breakout, a large volume of sellers accumulated, and we observed a liquidity grab formed below this minor key level.

However, after the liquidity grab, the price failed to push higher and struggled to reach the next minor key resistance. Sellers pushed the price back down to the minor key level, and now we are waiting for another liquidity formation to confirm the next move.

Price Action Expectation:

Our objective is to wait for the price to form another liquidity zone and then look for a break above the minor key level. If this break occurs, we will place a Buy Stop entry.

Fundamental Outlook:

USD Advance GDP q/q: The forecast for Q1 GDP growth is 2.7%, a slowdown from the previous 3.1%. A lower GDP growth rate might indicate weaker U.S. economic strength, which could dampen the bullish pressure on USD and increase the likelihood of a weaker USD in the short term. This could potentially make NZD/USD more favorable for a buy setup, as a weaker USD would likely result in upward pressure on the NZD.

USD Unemployment Claims: The forecast for unemployment claims is 224K, slightly higher than the previous 223K. An increase in unemployment claims could signal weakening labor market conditions in the U.S., further contributing to the potential weakness of the USD and supporting upward momentum for the NZD.

The combination of these news events suggests a potential weakening of the USD, which could lead to increased bullish momentum for NZD/USD, aligning with the buy setup that we are anticipating.

Trade Setup:

Trade Type: Buy Stop

Entry: 0.56520 (after the price breaks above the minor key level)

Stop Loss: 0.56160 (below the minor key, providing protection from false breakouts)

Take Profit: 0.57400 (targeting the next minor key resistance)

Conclusion:

The setup aims to capitalize on a bullish breakout after the liquidity zone forms and the price breaks above the minor key level. Given the weakening USD due to the latest economic data (lower GDP growth and rising unemployment claims), there is a higher probability for NZD/USD to rise. The buy stop entry at 0.56520 targets a move toward 0.57400, with risk managed by placing the stop loss at 0.56160.

Disclaimer: Trading involves substantial risks. Always consult a financial advisor before making trading decisions.

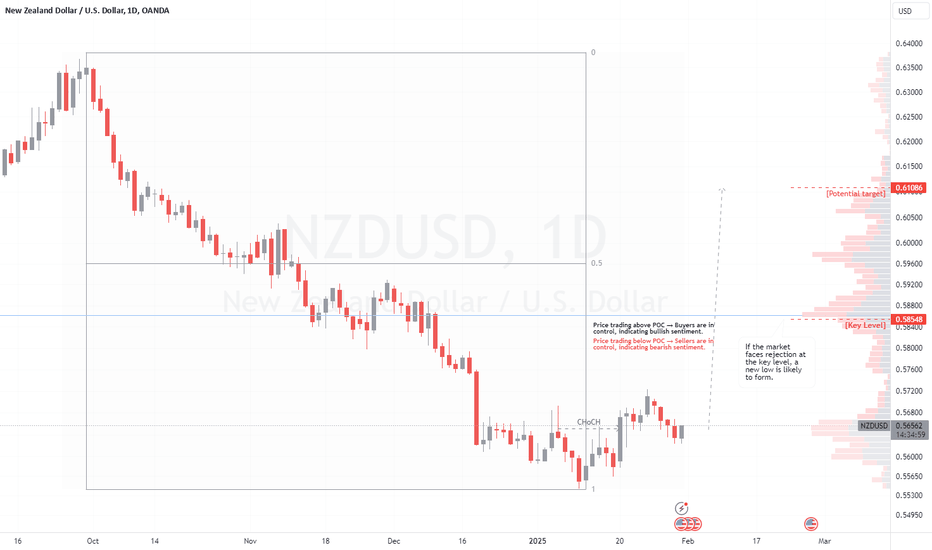

BUY NZDUSD - Deja Vu, prefer the daily candle now!!Trader Tom, a technical analyst with over 16 years’ experience, explains his trade idea using price action and a top down approach. This is one of many trades so if you would like to see more then please follow us and hit the boost button.

We are proud to be an OFFICIAL Trading View partner so please support the channel by using the link below and unleash the power of trading view today!

tradingview.sweetlogin.com

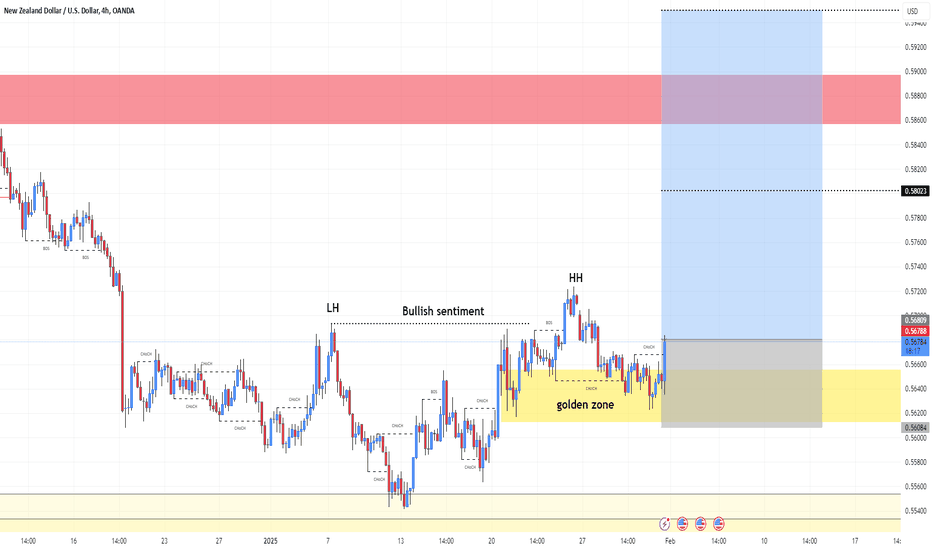

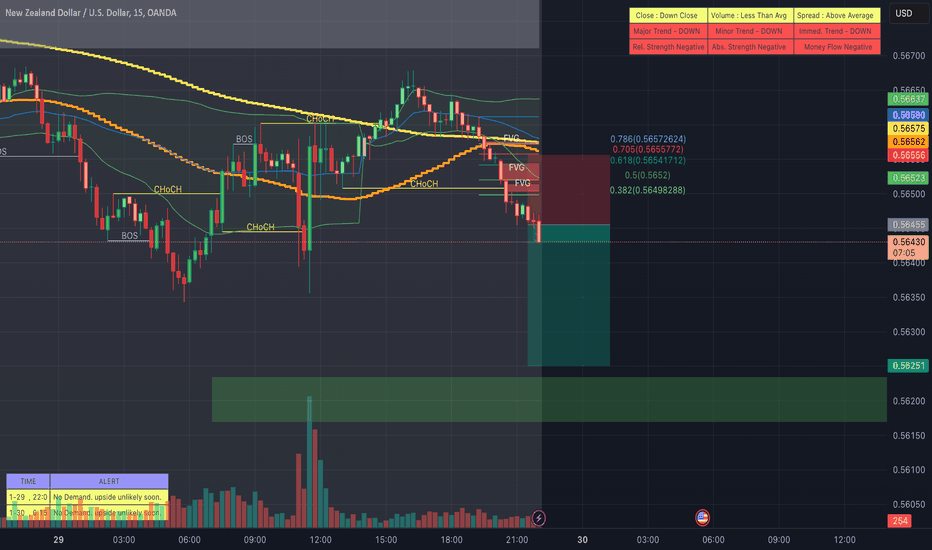

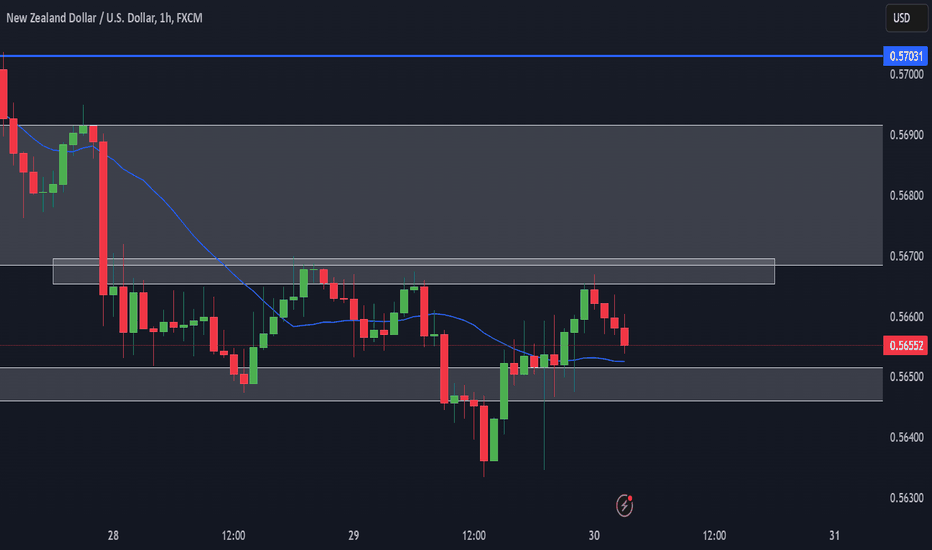

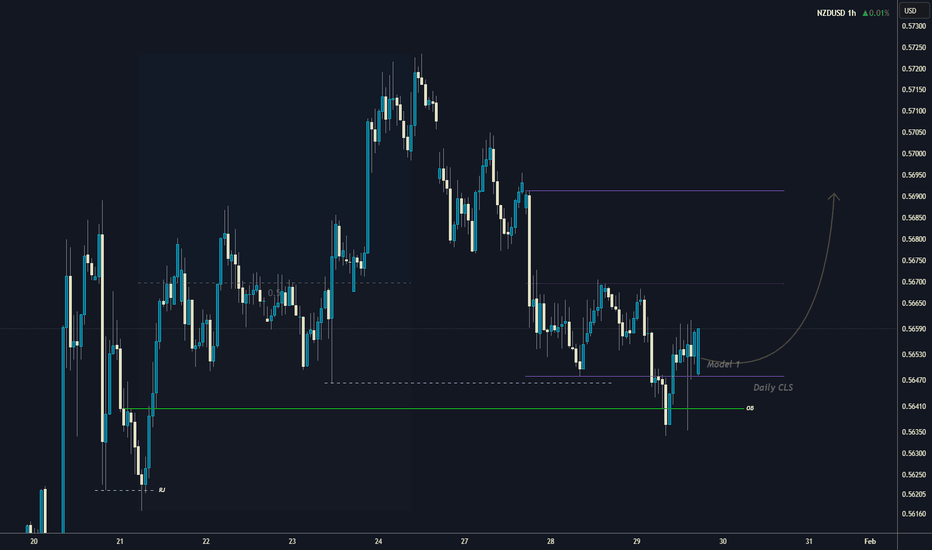

Daily CLS, Key Level OB in the discount, Model 1Daily CLS, Key Level OB in the discount , Model 1

you are welcome to comment with your thoughts and share your charts or questions below, I like any constructive discussion.

What is CLS?

This company is trading for the biggest investment banks and central banks. They trade over 6.5 trillion daily volume. They are smart money of the all markets.

CLS operates in the specific times which will give you huge advantage and precisions to you entries. Focus on that. Its accuracy is amazing.

Good luck and I hope this educational post helps to become better trader

“Adapt what is useful, reject what is useless, and add what is specifically your own.”

Dave FX Hunter ⚔

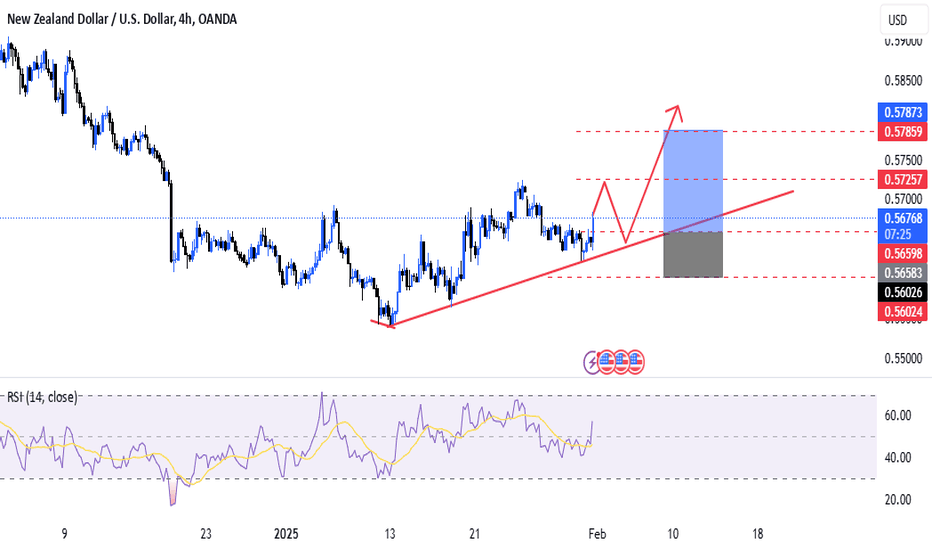

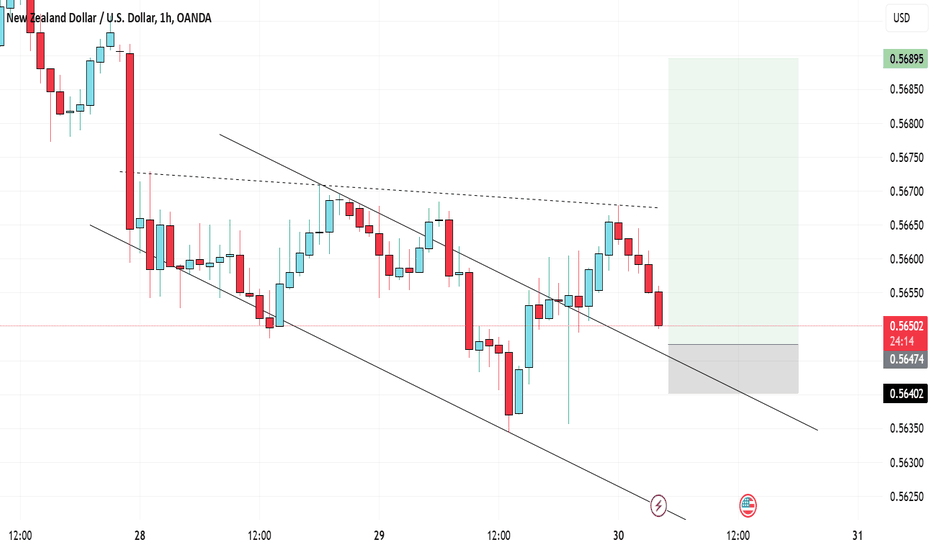

NZDUSD to remain mixed?NZDUSD - 24h expiry

Pivot support is at 0.5640.

Risk/Reward would be poor to call a buy from current levels.

Short term RSI has turned positive.

A move through 0.5675 will confirm the bullish momentum.

The measured move target is 0.5750.

We look to Buy at 0.5640 (stop at 0.5610)

Our profit targets will be 0.5725 and 0.5750

Resistance: 0.5675 / 0.5700 / 0.5750

Support: 0.5640 / 0.5625 / 0.5600

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.