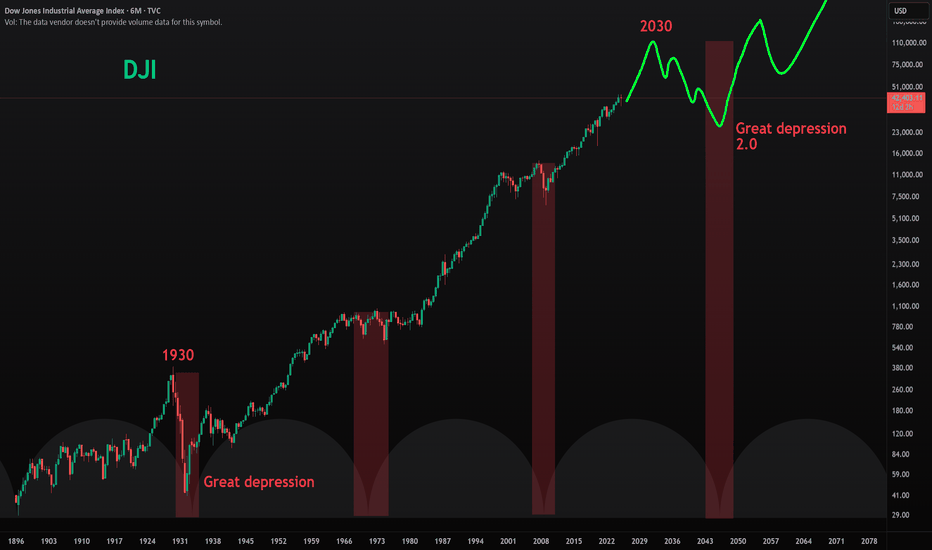

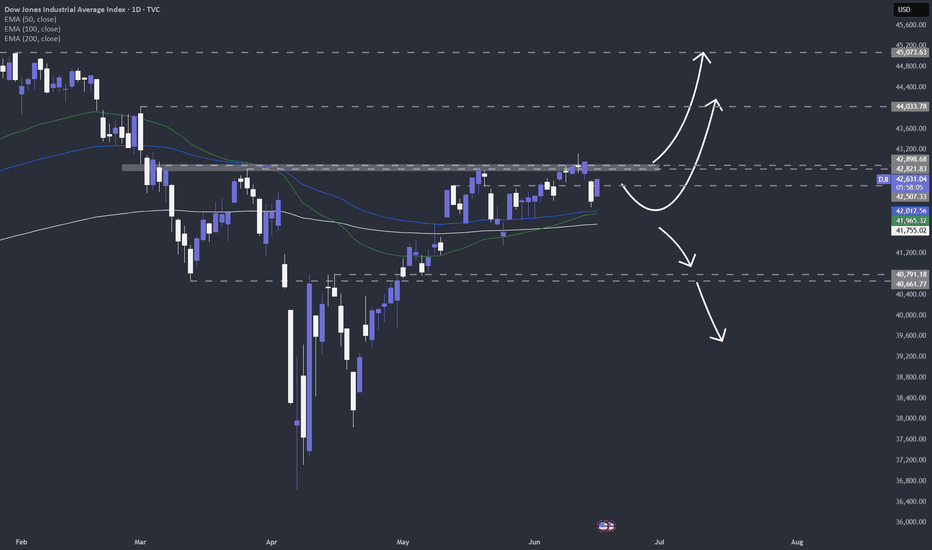

Great Depression 2.0 Starting in 2030?Looking at the Dow Jones, we can see clear cycles forming on this index. I believe we could see one more major run on the Dow between now and 2030, followed by a repeat of the Great Depression. I could easily be wrong, but the charts suggest this is a very real possibility.

So, between now and our potential top in 2030, we have an opportunity to make a significant amount of money in markets like crypto.

As always, stay profitable.

– Dalin Anderson

US30USD trade ideas

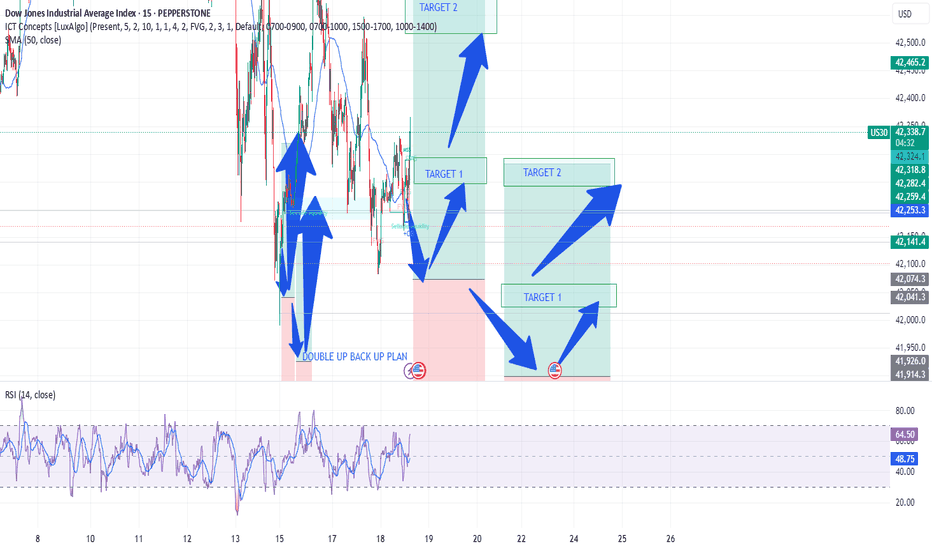

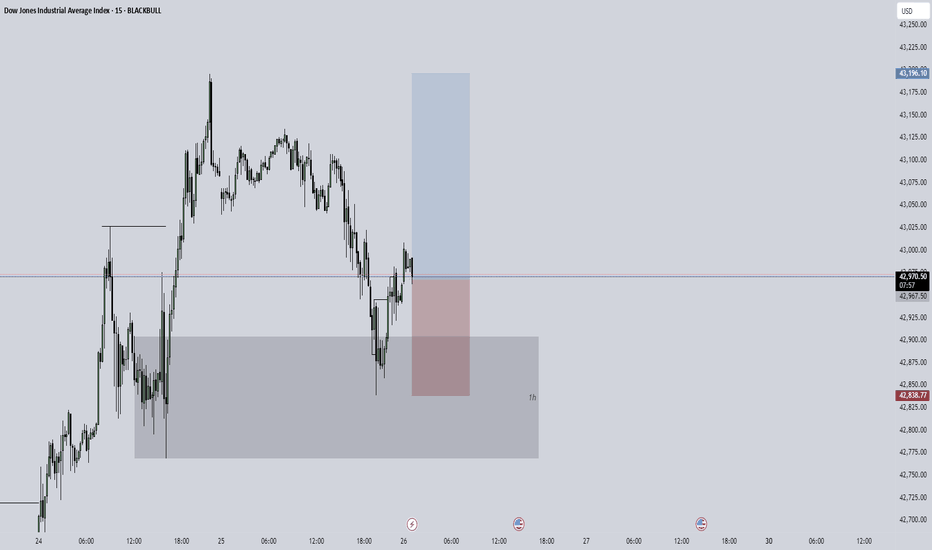

DOW30/US30 - ACTIVE TRADE - PROFITABLE SET UP TRADETeam,

today I have provide LIVE trading today provide you i did a good trade for

NAS100, DOW30 AND DAX30 - in real LIVE trading

OK, I prefer to SET UP my limit order today only. Remember, the market will be very volatile in the next 4 hours.

I expect the RATE should cut 25 points at least. Why

the employment data come out remain the same

inflation last week look under control

Retails is poorly come out today

The FED does not care about the America, they just care about taking advantage of America.

Lets now focus on the SETTING BUY LIMIT ORDER

I order small volume at 41975-42075

However I will double up at LIMIT BUY ORDER

The 1st target are looking at 4227542300

Target 2 - 42575-42675

REMEMBER - IF IT DOES NOT HIT YOUR ENTRY, JUST WALK AWAY.

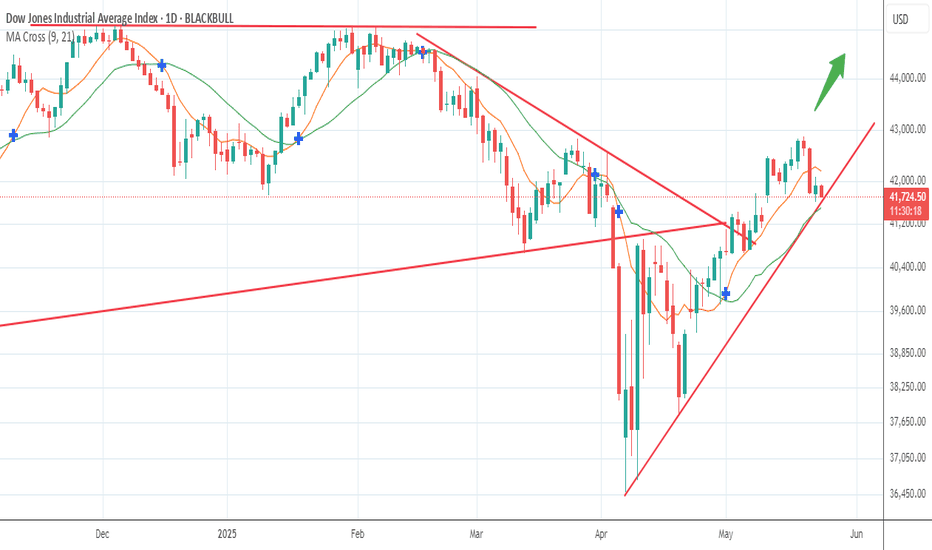

Bull Run To New Highs?The Dow got slammed on Wednesday, down 2%, no follow through yesterday.

Despite all the look of this rally being a bounce to sell, notice the uptrend line of support developed, this is the dynamics of markets, morph and twist to shake out weaker hands.

Would not be surprised to see a resumption of this rally to all time highs into June/July, the tariff wobbles are gone for now, any firm close below the trend line changes the trend.

We buy this market now at support in prospect of a larger rally to resume.

Appreciate a thumbs up, Good Trading & God Bless you all!

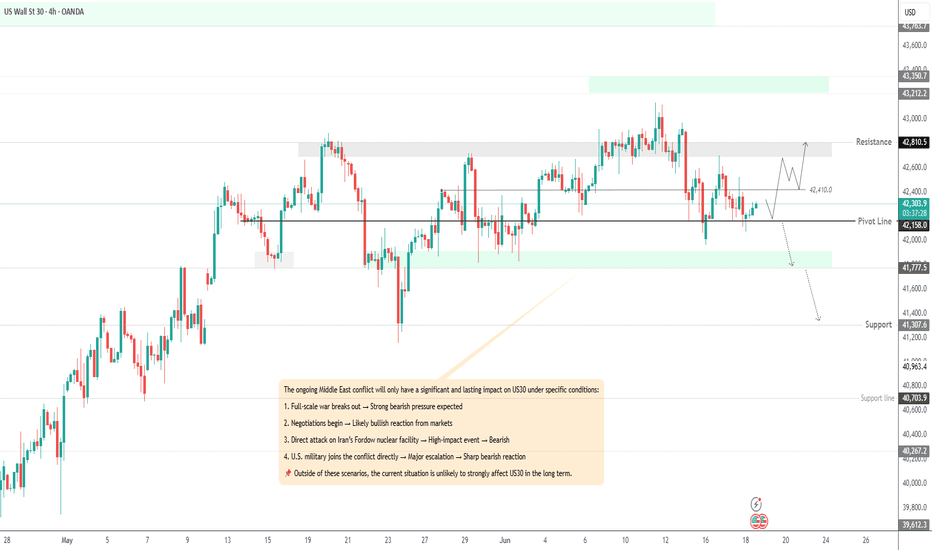

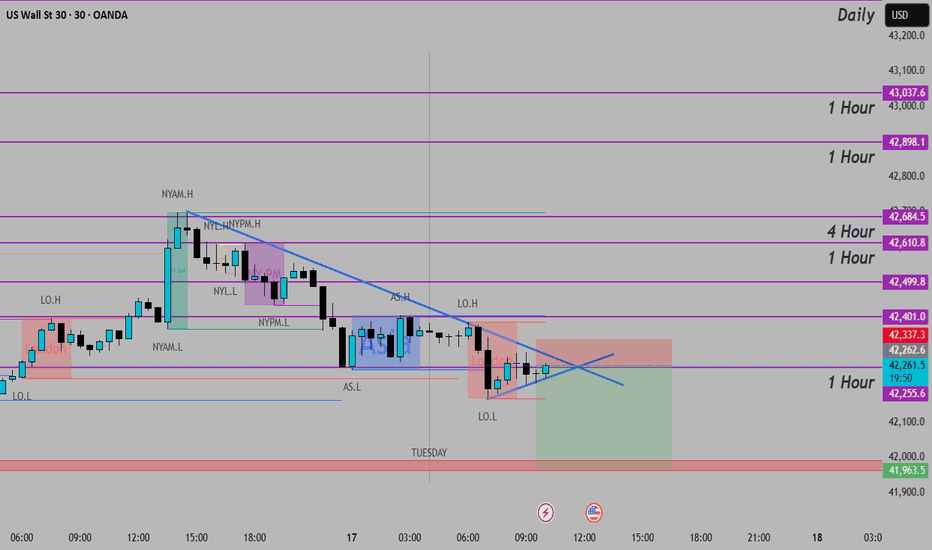

US30 Stabilizes Above Key Support Amid Geopolitical TensionsUS30 – Overview

The price reacted modestly to ongoing Middle East tensions, reaching our previously mentioned pivot zone at 42160, then reversed and stabilized within the bullish territory.

Technical Outlook:

As long as the price holds above 42160, bullish momentum is expected to continue toward 42410.

A 1H close above 42410 would confirm further upside toward 42610 and 42810.

🔻 To shift into a bearish trend, the price must close below 42160 on the 1H or 4H timeframe, which could lead to a move down to 41780.

Key Levels:

• Pivot: 42310

• Resistance: 42410 / 42610 / 42810

• Support: 42160 / 41970 / 41780

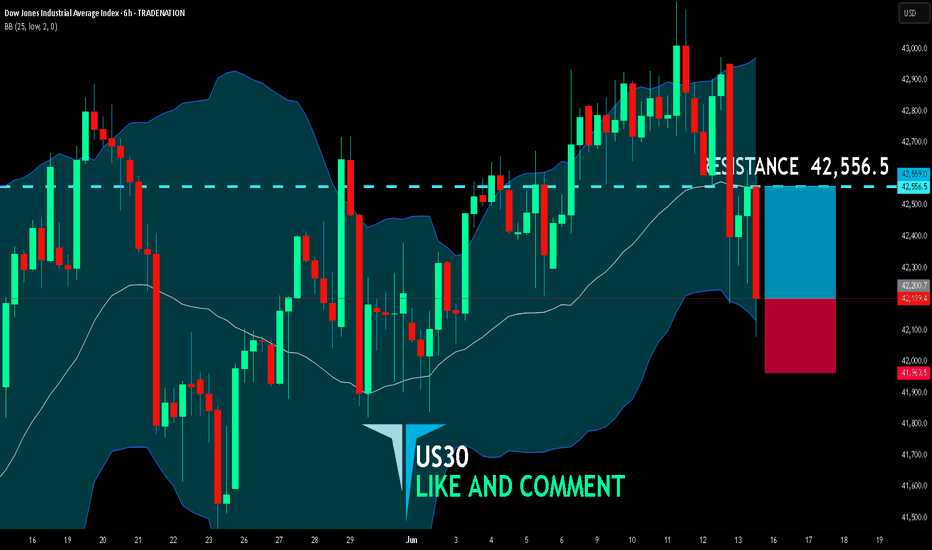

US30 BULLISH BIAS RIGHT NOW| LONG

US30 SIGNAL

Trade Direction: short

Entry Level: 42,200.7

Target Level: 42,556.5

Stop Loss: 41,963.5

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 6h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

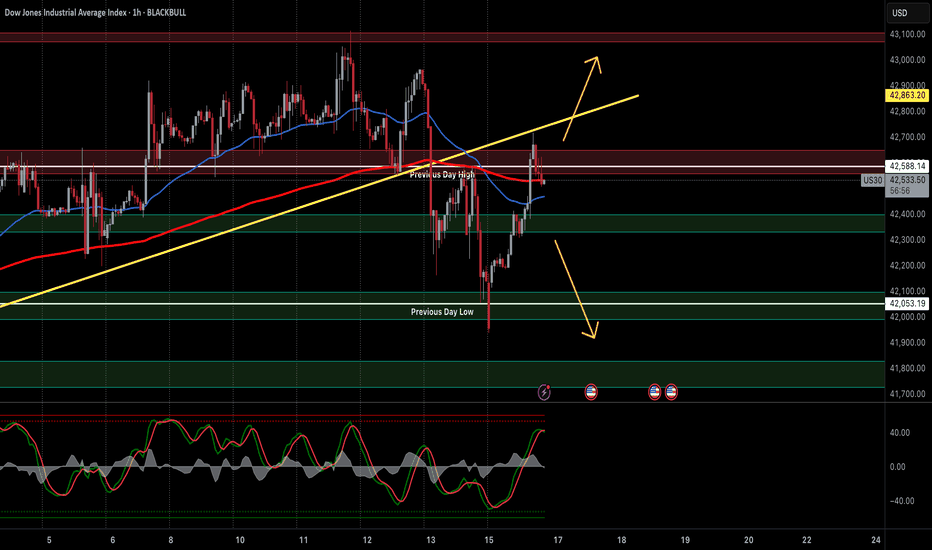

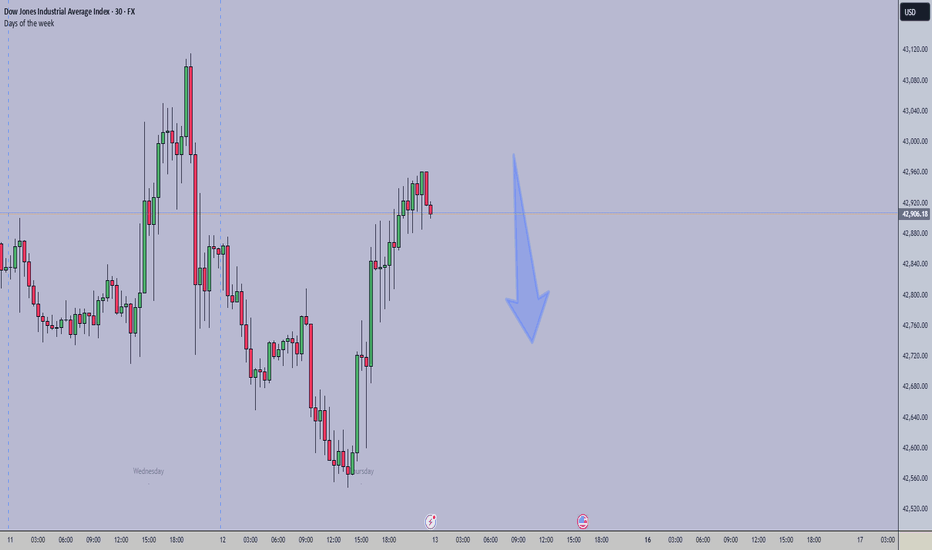

Wall Street Eyes Volatility: Dow Jones Tests Reversal ZoneUS30 (Dow Jones Index) — Clashing Forces of Risk & Reality

Technical Outlook — 16 June, 2025 | 1H Chart

Current Market Condition:

The Dow Jones (US30) has staged a recovery from the recent dip, but price is stalling at the Previous Day High (~42,588), a key confluence zone with the broken rising trendline, 50 EMA, and overhead supply.

This hesitation comes amid heightened global risk aversion triggered by the intensifying Iran–Israel conflict, adding pressure to global indices as investors rotate into safer assets like treasuries and gold. Despite intraday rebounds, equity bulls are showing signs of fatigue at resistance zones.

Markets are also bracing for upcoming US economic data and Fed commentary, which may further amplify intraday volatility.

Key Technical Highlights:

Price rejected from the confluence of PDH (~42,588), horizontal supply zone, and old rising trendline (yellow).

Currently hovering just under the 50 EMA; failure to hold could initiate a rotation back toward PD Low.

Stochastic RSI nearing overbought — suggests possible local top if no momentum breakout follows.

EMA 200 and the Previous Day Low at ~42,053 remain critical intraday supports.

Overall structure forming potential lower high under bearish macro cloud.

Trade Plan:

🔼 Bullish Breakout (Intraday Long):

Trigger: Break and sustained hold above 42,600 with rising volume

Target: 42,900 → 43,100

Stop Loss: Below 42,450 (to avoid whipsaws)

🔻 Bearish Rejection (Intraday Short):

Trigger: Clean rejection from PDH + trendline with bearish engulfing

Target: 42,100 → 42,050 → 41,850

Stop Loss: Above 42,650

⚖️ Neutral / Range Trade:

Play the range between PDH (~42,588) and PDL (~42,053) until breakout.

Scalp based on price reaction at either boundary with tight stop loss.

🛡️ Risk Management Note:

Global uncertainty tied to war escalation and Fed policy expectations make this a headline-driven market. News risk can spike volatility and invalidate technical setups. Trade with reduced size and increased caution, especially around US market open and geopolitical news cycles.

📢 If you found this analysis valuable, kindly consider boosting and following for more updates.

⚠️ Disclaimer: This content is intended for educational purposes only and does not constitute financial advice.

Quick take US indices and the Fed's interest rate decisionQuick look at what can we expect from the Fed's rate decision and press conference on Wednesday.

TVC:DJI

TVC:SPX

TVC:NDQ

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

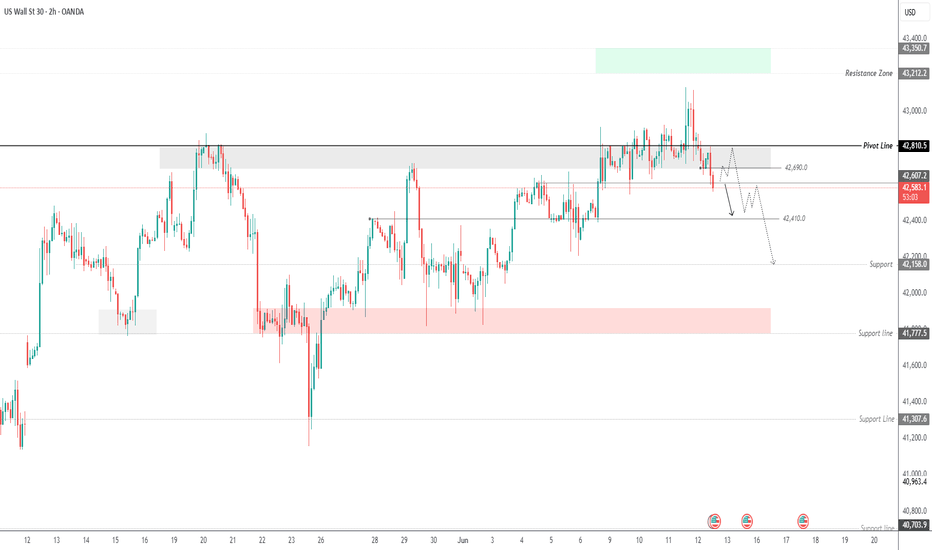

US30 | Bearish Below 42610, Eyes on 42410 and 42160US30 | OVERVIEW

The price has reversed and is now under bearish pressure, following stabilization below the 42690 – 42610 zone.

📉 As long as the index trades below this zone, the bearish trend is expected to continue toward 42410, and a 1H candle close below that level could extend the move to 42160.

📈 Alternative Scenario:

A clear stabilization above 42810 would shift momentum to bullish, targeting higher levels.

Pivot: 42610

Support Levels: 42410, 42160

Resistance Levels: 42690, 42810, 43080

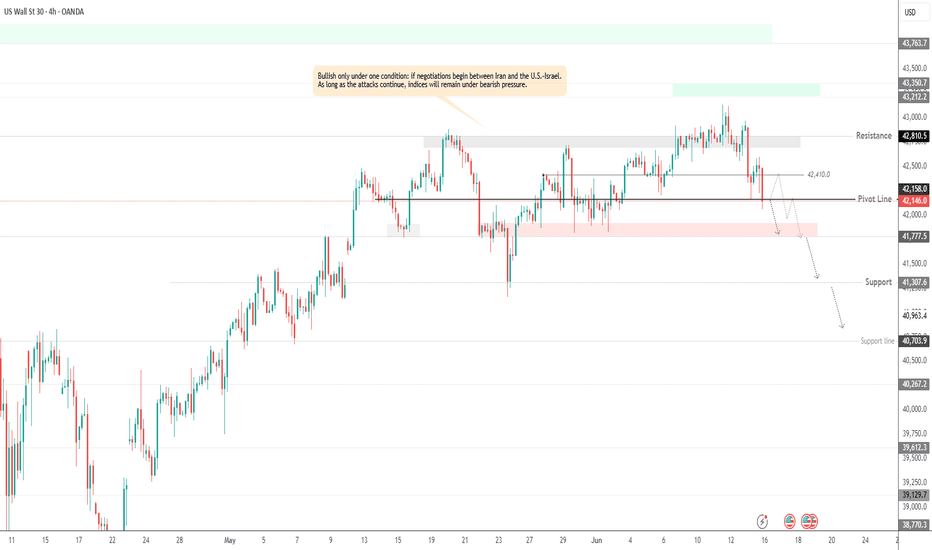

US30 – Bearish Bias Amid Escalating Middle East TensionsUS30 – Bearish Bias Amid Escalating Middle East Tensions

U.S. indices, particularly the Dow Jones (US30), are under sustained bearish pressure due to intensifying geopolitical tensions between Israel and Iran. With no signs of de-escalation or negotiation, market sentiment remains risk-off.

Technical Outlook:

As long as the crisis continues, US30 is likely to maintain its downward momentum. The price appears set to test the 41770 level, with potential continuation toward 41310.

Only a clear signal of de-escalation or diplomatic engagement may reverse this trend, possibly triggering a recovery toward 42810.

For now, the directional bias remains bearish.

Key Levels:

• Pivot: 42160

• Support: 41770, 41310, 40700

• Resistance: 42410, 42810, 43210

Click to see the Previous idea

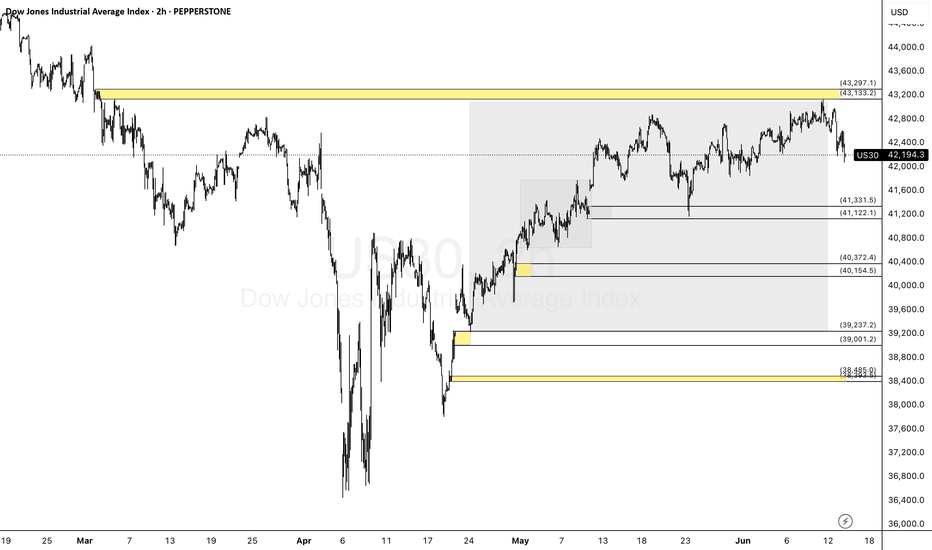

us30 outlook US30 Supply & Demand Outlook (1H–2H)

The market is currently trading within a fair value range (highlighted in yellow), with no clear edge for high-probability entries.

I'm waiting for price to move out of this range and into one of the fresh supply or demand zones marked above and below.

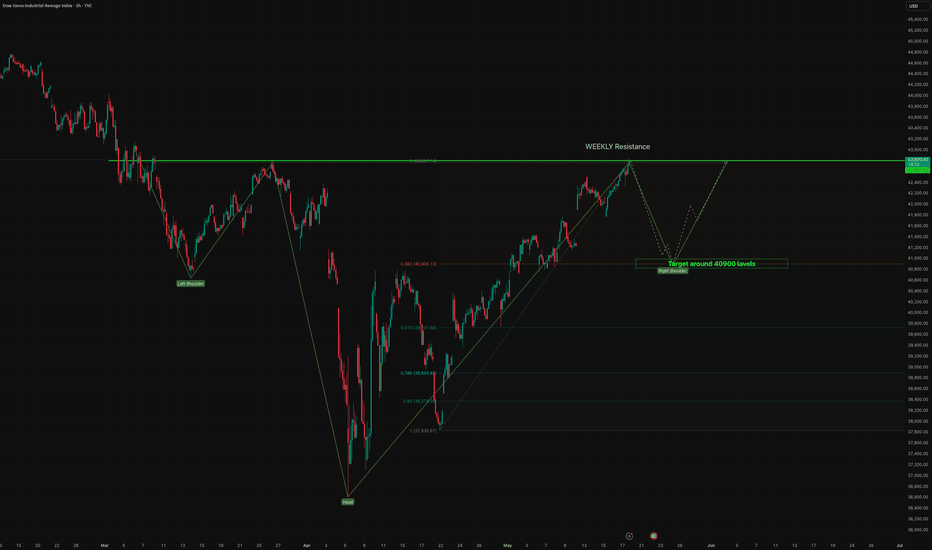

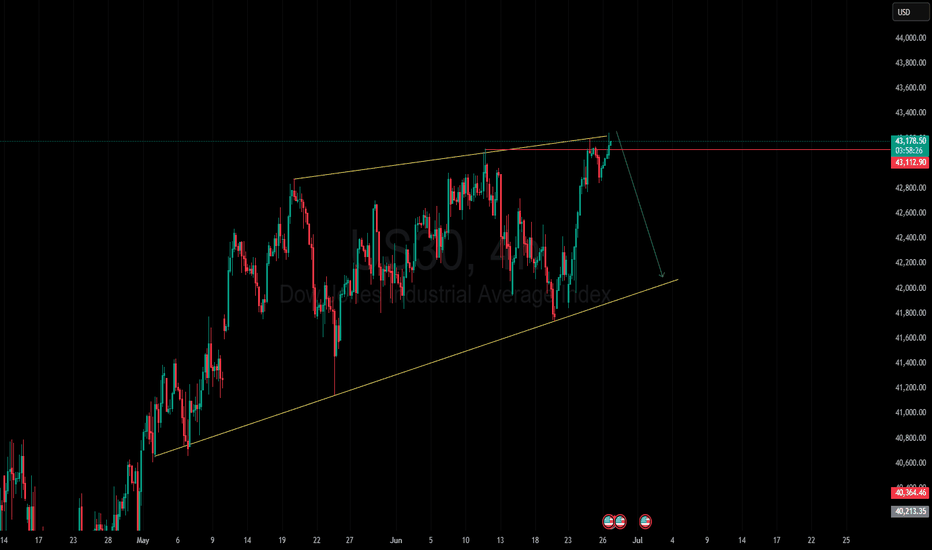

DOW - H&S is getting progressed. 📉 DOW JONES – Head & Shoulders Pattern Formation (Right Shoulder in Progress)

The chart illustrates a clear Head & Shoulders (H&S) pattern, a classic bearish reversal signal, forming on the higher timeframe.

🧠 Pattern Breakdown:

Left Shoulder: Formed in early March.

Head: Sharp dip and recovery formed during early April.

Right Shoulder: Currently in the making, aligning with a weekly resistance near 42,880 levels.

Price is expected to reject this resistance and complete the right shoulder.

📌 Technical View:

Strong rejection expected near the weekly horizontal resistance.

If the right shoulder completes and breaks below the neckline (around 41,500–41,600), it may trigger a measured fall.

Fibonacci levels also align, with the 0.382 and 0.5 retracement acting as potential reaction zones.

🎯 Target:

Target: 40,900 levels (Right Shoulder support zone).

This is a confluence zone where buyers may reappear.

Also forms a neckline test, critical for breakout confirmation or reversal.

🔔 Trade Setup Insight:

Short bias activated near 42,880 resistance zone.

Watch for confirmation via bearish engulfing candles or lower time frame breakdowns.

Targeting 40,900 initially. Further downside possible if neckline breaks decisively.

⚠️ Disclaimer:

This analysis is for educational purposes only and does not constitute investment advice or a recommendation. All trading involves risk. Please perform your own due diligence or consult a certified financial advisor before making trading decisions.

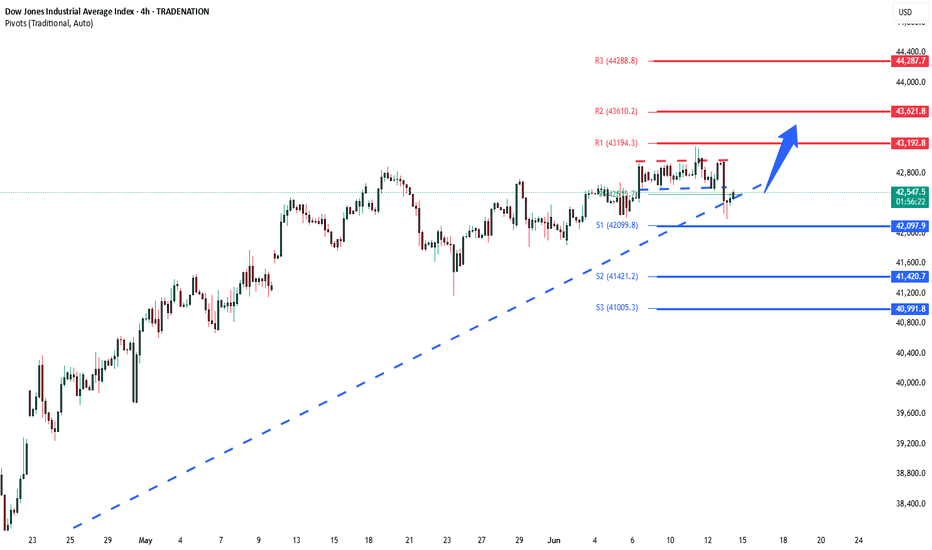

DowJones uptrend retest Key Support and Resistance Levels

Resistance Level 1: 43192

Resistance Level 2: 43620

Resistance Level 3: 44290

Support Level 1: 42100

Support Level 2: 41420

Support Level 3: 40990

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

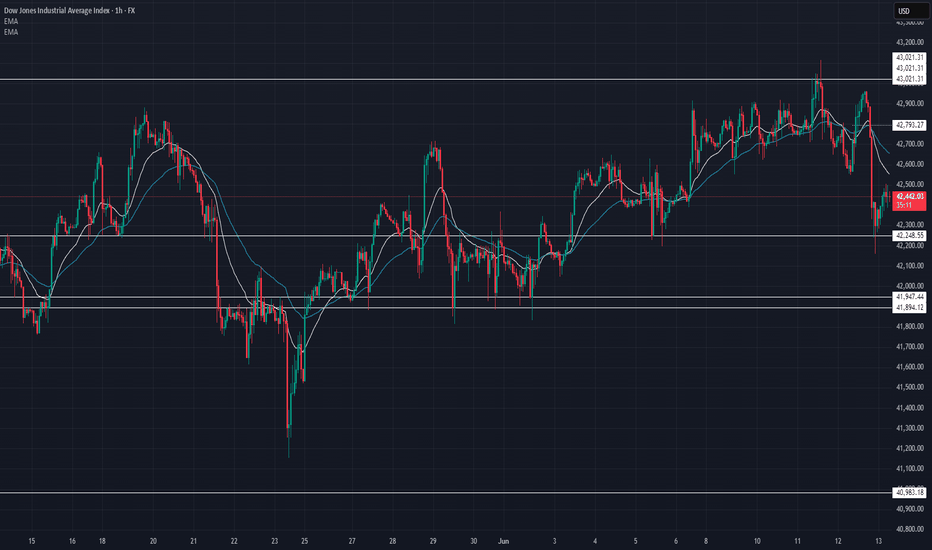

US30 Trade Update – 06/13/2025 🚨 US30 Trade Update – 06/13/2025 🚨

📊 Market Structure & Key Levels

US30 broke below the key support at 42,605 and continued to slide, tapping into the 42,248 demand zone. Price is currently rebounding off this level, but sellers remain in control under EMAs.

✅ Key Observations:

Failed to hold above 42,605 ❌

Strong selloff to 42,248 zone ✅

Below both EMAs → bearish pressure

📍 Key Levels:

Resistance: 42,605 → 42,793

Support: 42,248 → 41,947

🎯 Trade Plan:

🔹 Long Setup:

Buy above 42,605

→ Target: 42,793 → 43,021

🔻 Short Setup:

Breakdown below 42,248

→ Target: 41,947 → 41,894

⚠️ Market showing weakness – wait for retest or breakout to confirm next move!

US30(Dow Jones)The combination of the COT data showing a shift towards more short positions and the technical picture suggests that bearish momentum could continue. Sell/Short: Consider entering a short position at current market levels, ideally on any retracement or rally towards the resistance zone.

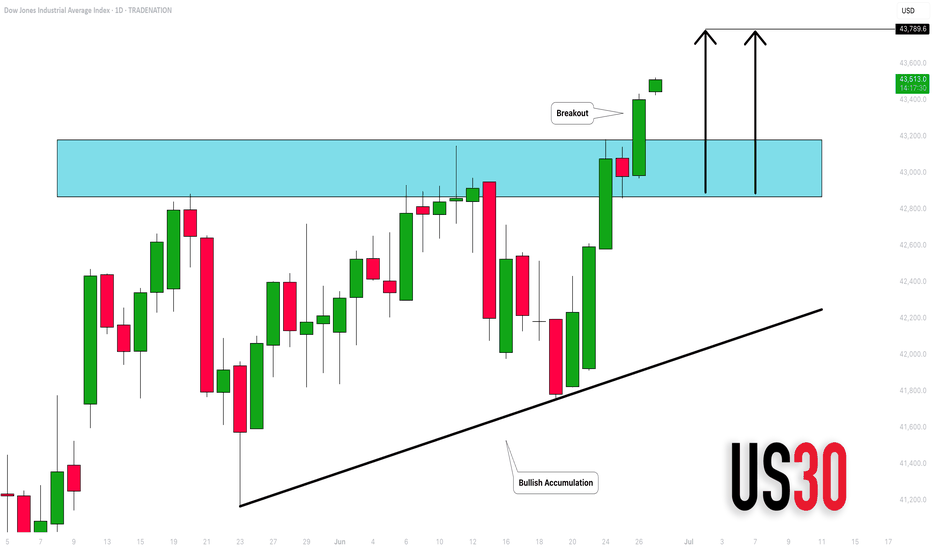

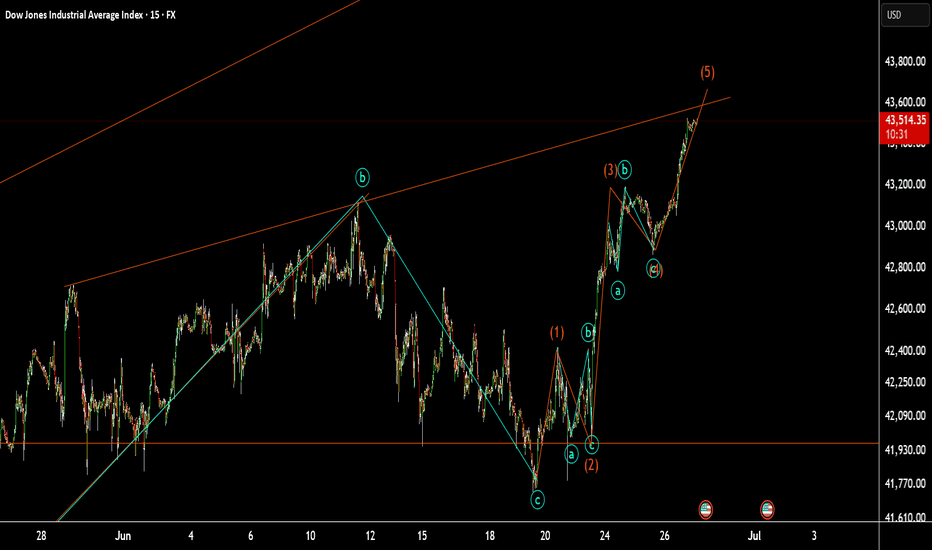

DOW JONES INDEX (US30): Consolidation is Over

Dow Jones Index completed a bullish accumulation on a daily.

The price violated a key horizontal resistance cluster and closed above that.

Next goal for bulls is 43790.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

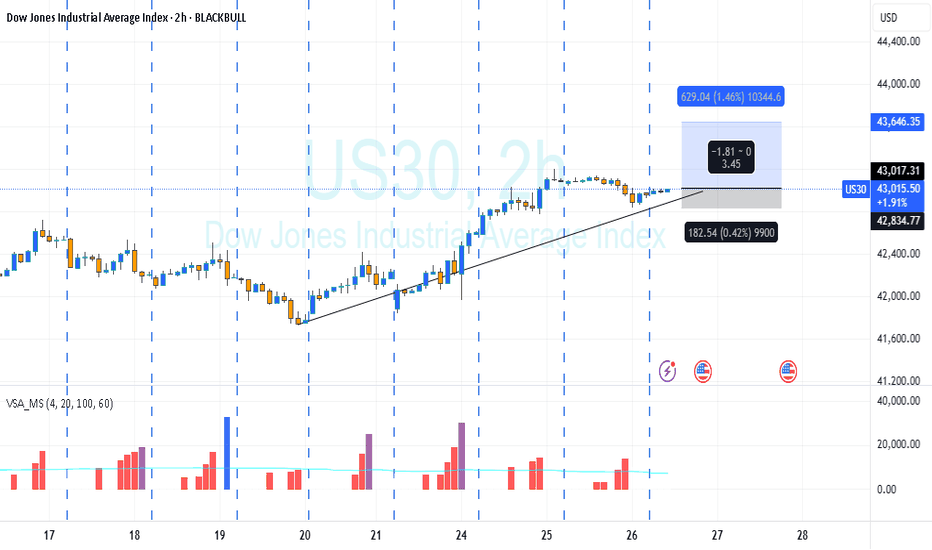

US30 Technical Outlook – 06/25/2025📍 US30 Technical Outlook – 06/25/2025

Big move! 🚀 Price broke out of the 42,054–42,100 consolidation and rallied aggressively into the key 43,100–43,150 resistance zone.

🧠 Key Observations:

Clean bullish breakout above 42,100 ✅

Price now sitting at 43,120–43,150 supply 🛑

EMAs sharply turned bullish (42,808 and 43,038 levels)

📊 Key Price Zones:

🔼 Major Resistance: 43,150 → 43,300

🔽 Support: 42,800 → 42,600 → 42,100

📈 Trade Setup Ideas:

🔹 Long Bias:

Pullback into 42,800–42,600 support

→ Look for bullish structure & continuation signals

→ Target: 43,150 → 43,300

🔻 Short Bias:

Look for strong rejection candles at 43,150–43,300

→ Intraday scalp short back toward 42,800

→ Break below 42,800 could target 42,600 or even 42,100

‼️ Momentum is clearly bullish for now, but this is a major supply zone so caution on chasing late longs.

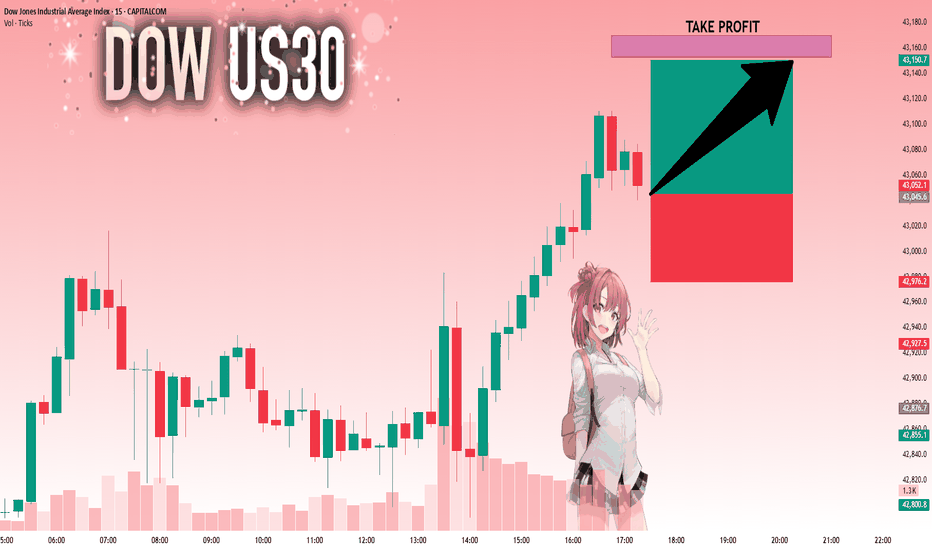

US30: The Market Is Looking Up! Long!

My dear friends,

Today we will analyse US30 together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 43,045.6 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 43,152.9.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️