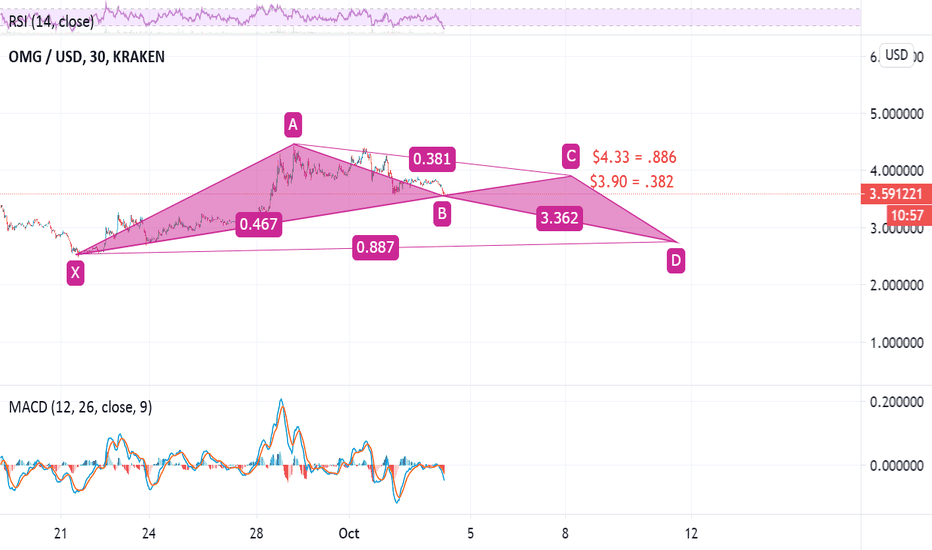

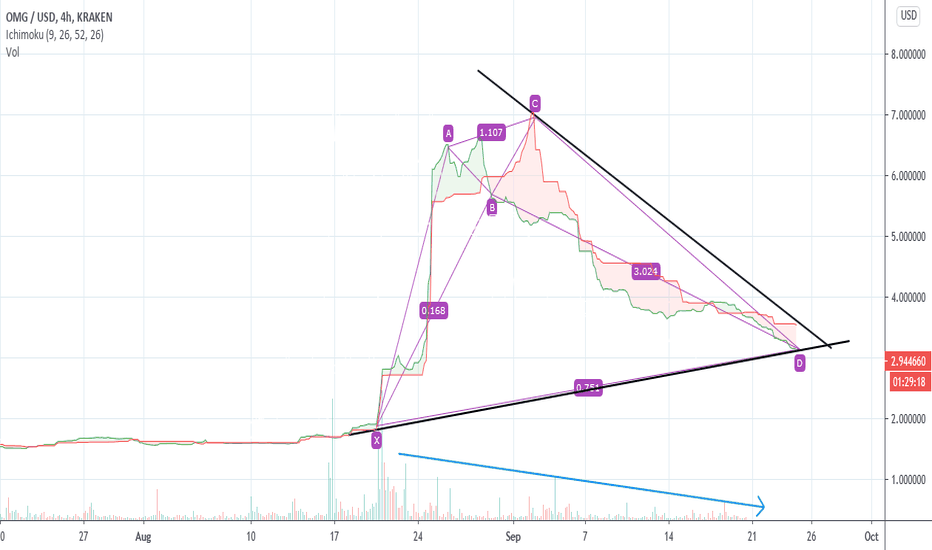

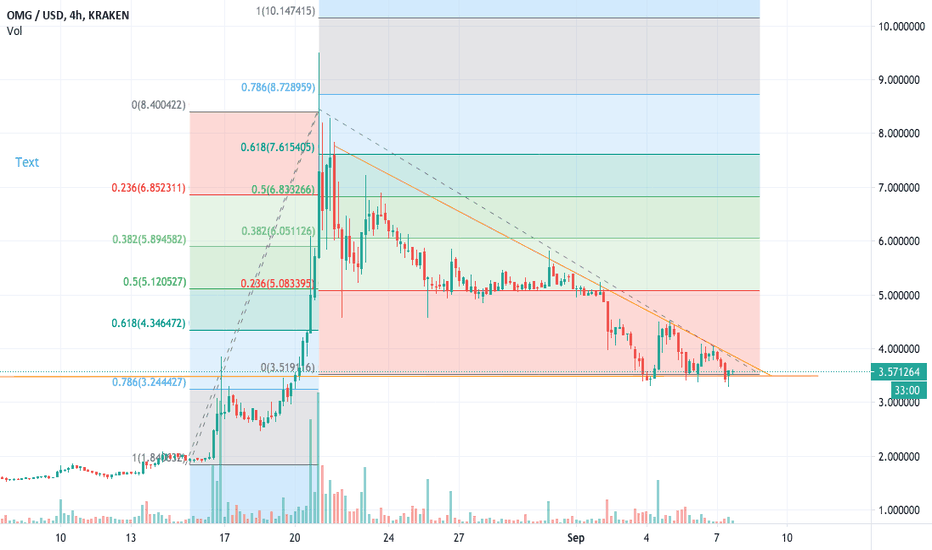

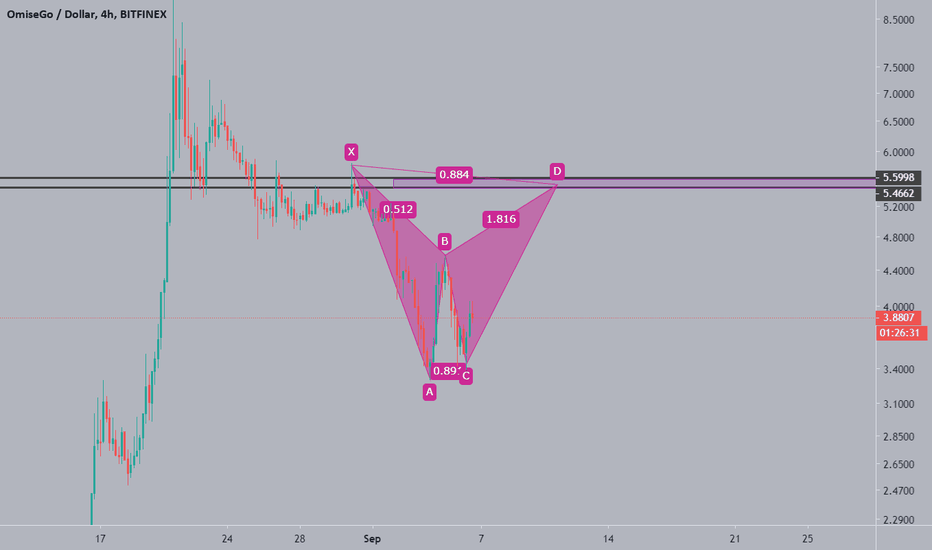

Bullish Bat or CrabThis may take a couple days to play out. It should rebound from the $3.60 mark up to between $3.90 & $4.33 is it's a bullish bat or crab for a quick in/out trade. I'll be putting in a sell at $3.89 to make sure I'm out. Quick profit, the big opportunity is when it hits the D. The drop to D should be $2.75ish if it's a bat. $1.33 if it's a crab. You'd want to see it stabilize and start to rebound at $2.75 before buying in, because it could keep going to the crab.

OMGUSD trade ideas

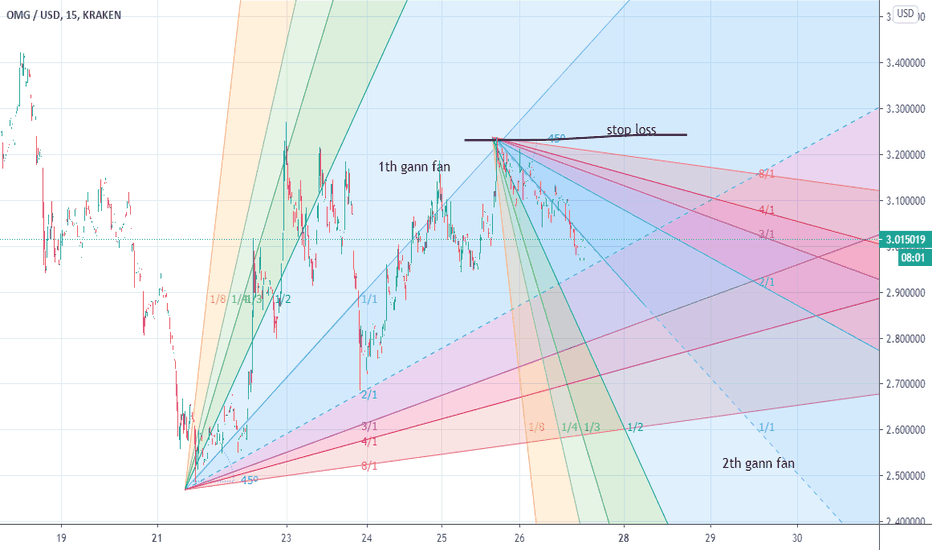

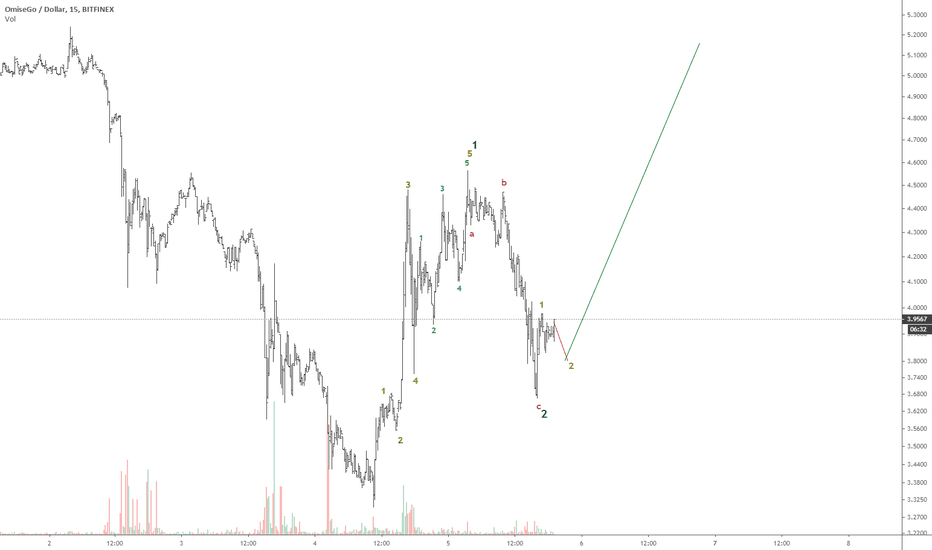

sell OMG with Gann system (tutorial)sell OMG when break out dash 2/1 line SL 3.25 TP dash cross 1/1 + 2o pips

trade base on Gann Fan

on gann fan trading sell setup need to find swing low and draw angle 45 degree trend line then mount gann central line 11/1 to dash 45 degree line then wait price break below line1/1 line and break out 2/1line

then will find swing high again draw 45 degree trend line and mount 2th gann fan on dash 45 degree

and follow price to break above 2th gann 1/1 line by more 20 pips as as tp

stop loss last swing high ,where we draw 2th gann.

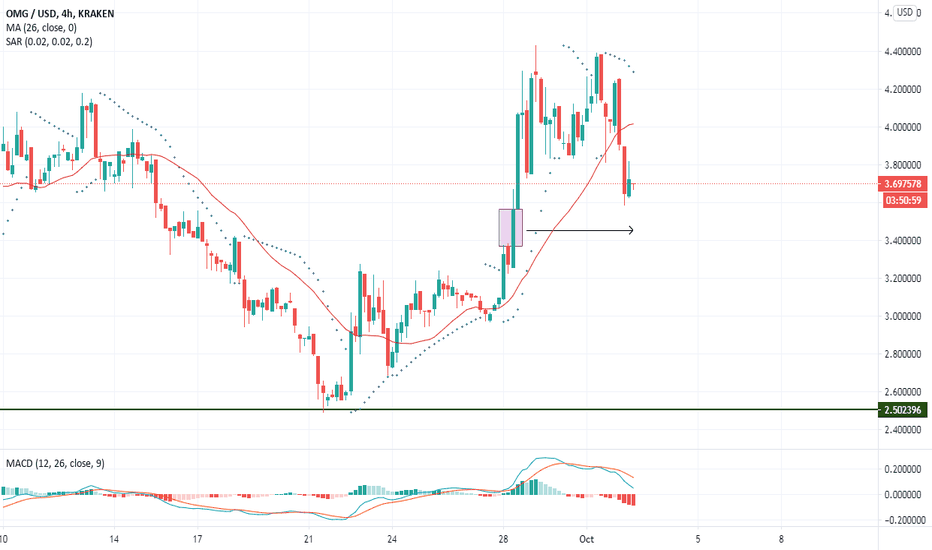

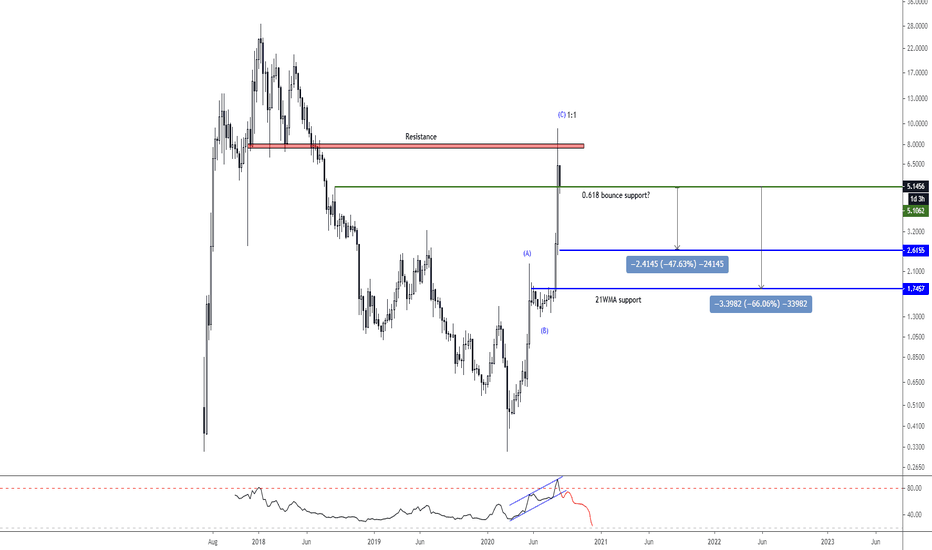

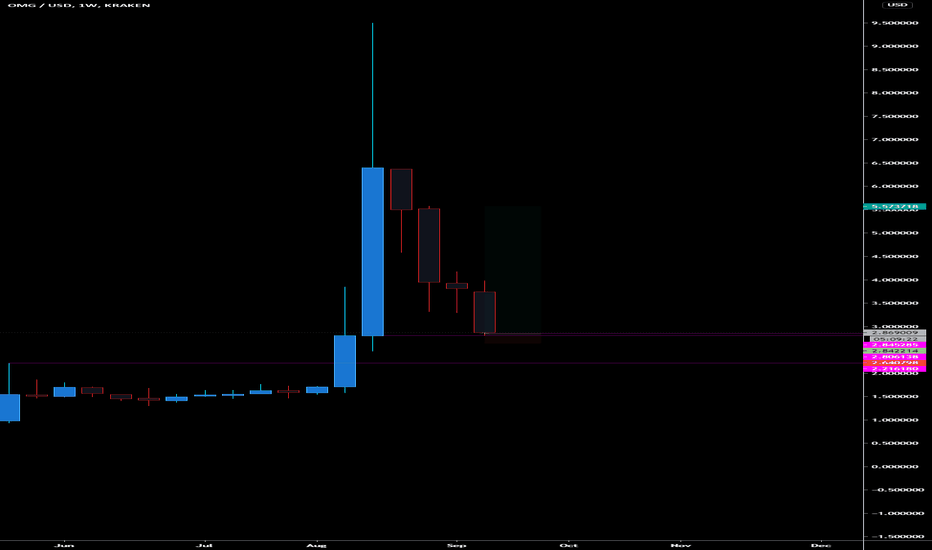

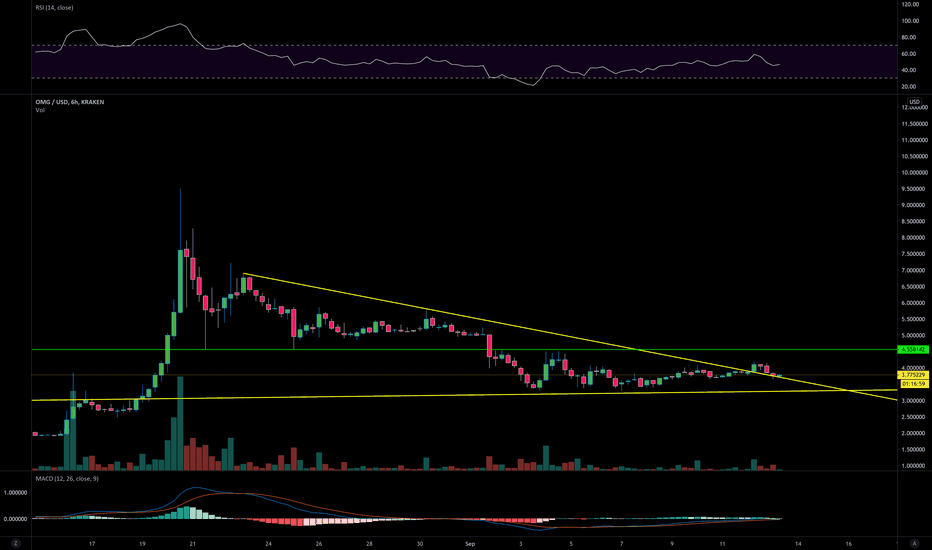

$OMG - Almost 3000% in 6 months, needs to cool downAt a first glance, this entire move looks like an ABC where A= C. The price also rejected hard from the red resistance zone, if the current support level is lost (this is the confirmation for this idea) , I expect the correction till below 2 targets

RSI weekly was heavily oversold and if it breaks blue channel, expect a sell of

Take care

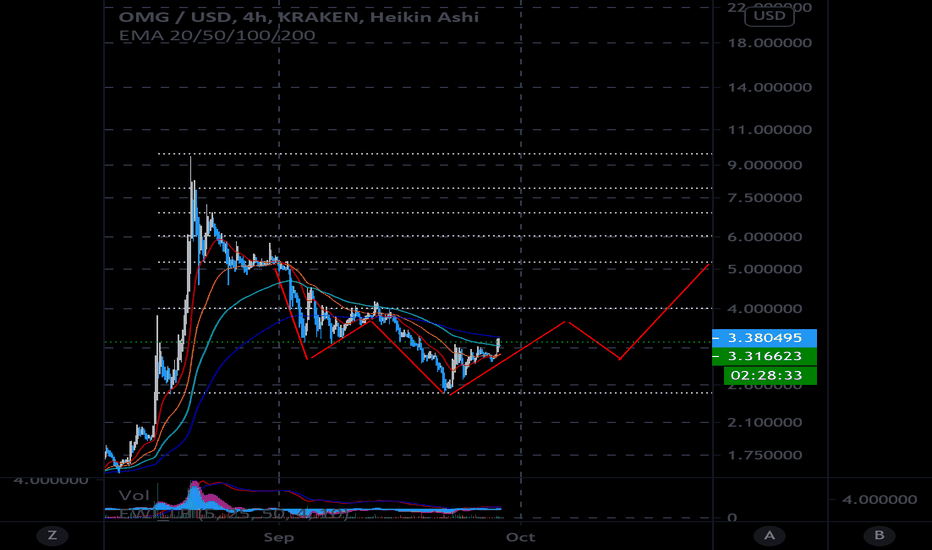

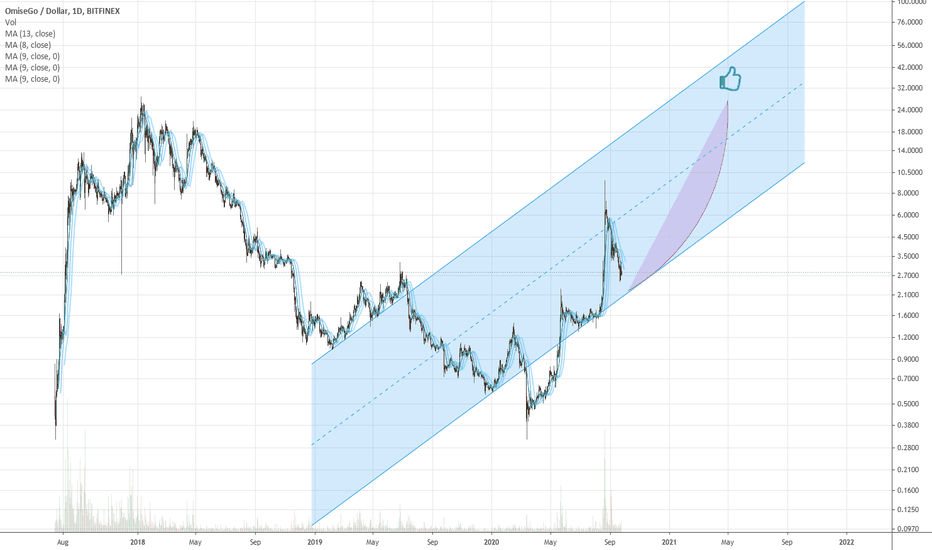

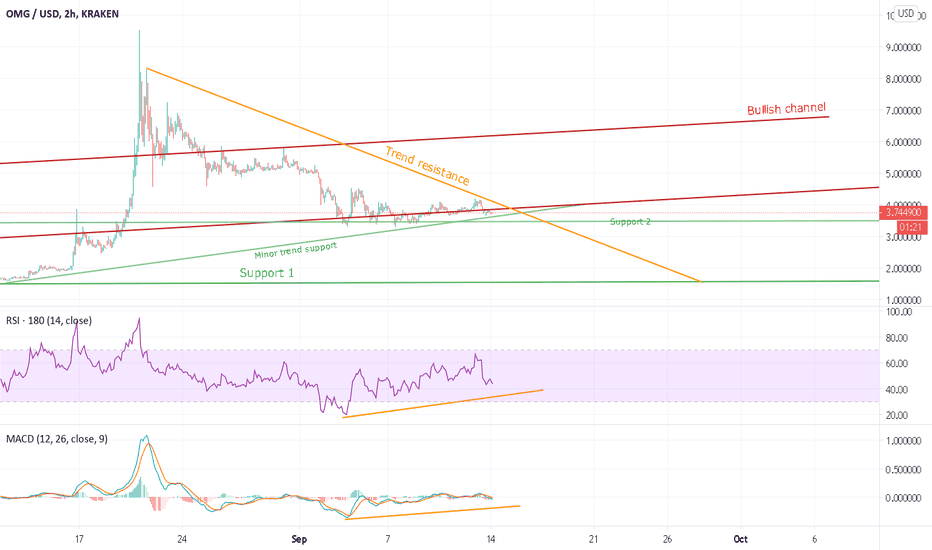

OMG Back to the start againInsufficient longs to break the overall trend resistance created from a whale pump,

your first support has been testing nicely but is overall in a bearish condition

The chance to break bearish circumstances within the bullish channel has not been met.

I forecast a return back down to 1.50 with weak hands selling at 3.50.

The project is still doing well but under the overall market conditions we will see an accumulation at a cheaper price.

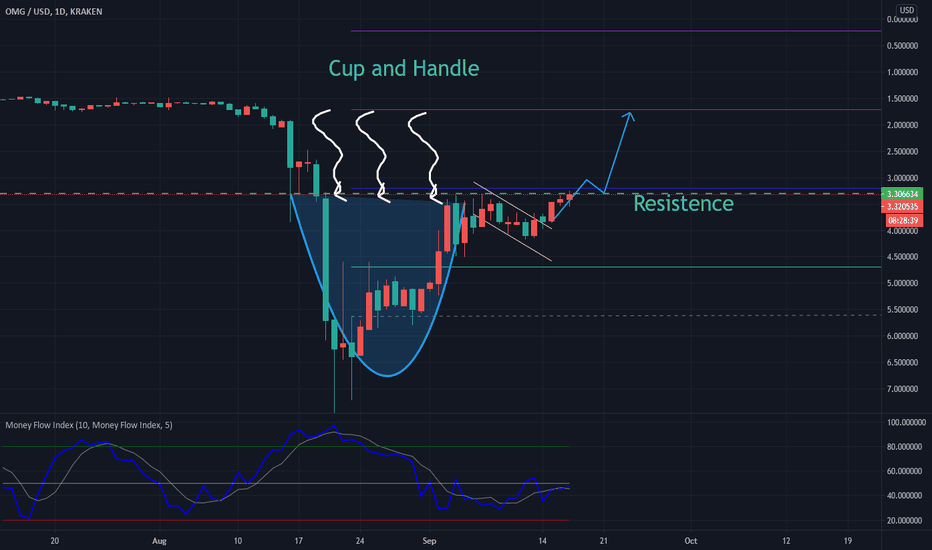

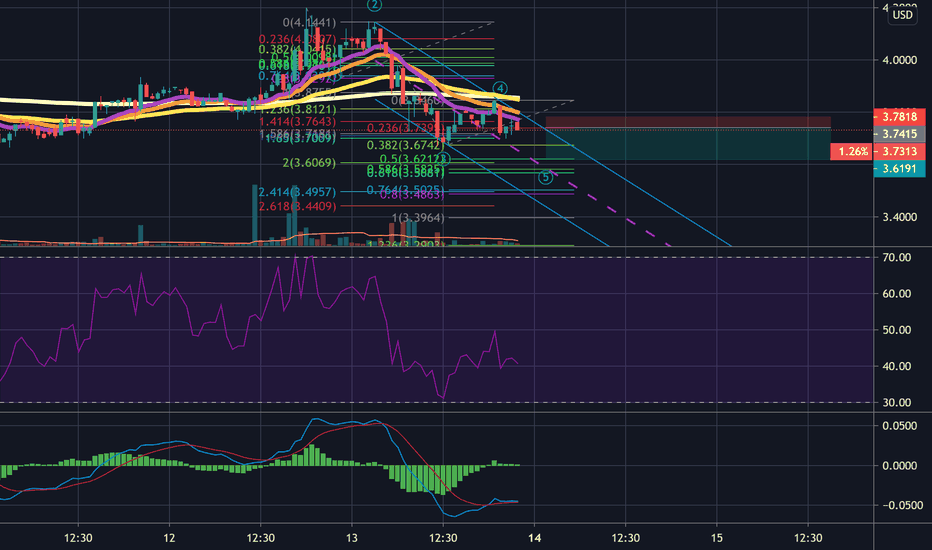

OMGUSD Trade setupHello everyone, I know this is different from my usual style of trading, but I figured that since I am doing so well in the stock and currency markets, I would like to test my skills in the Crypto markets, A.K.A the wild west. Fun fact, crypto is what brought my into technical analysis, so it holds a special place in my heart, but it has been a year since I've touched it so forgive me if I'm a little out of sync with the market.

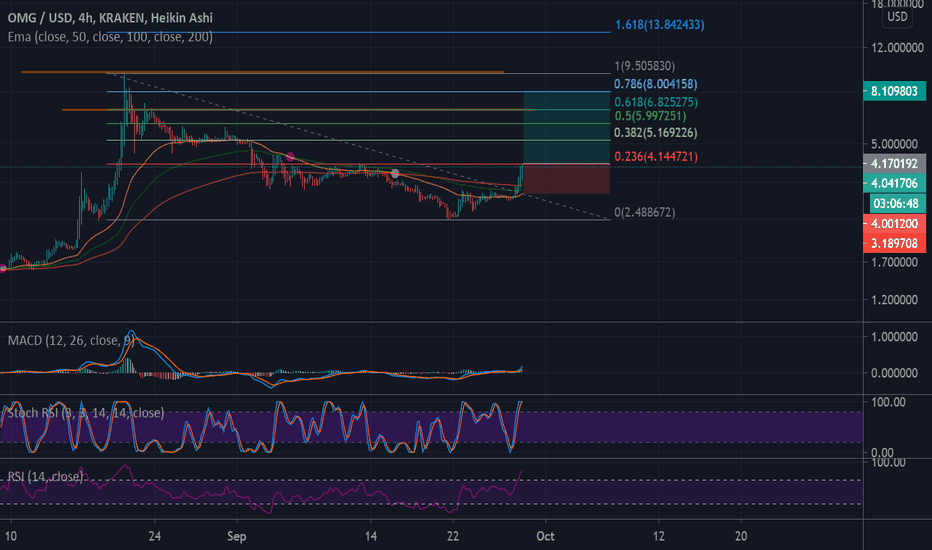

Elliottwave analysis: I strongly believe that we are in the last wave of a 5 wave move to the downside. As you can see from my chart, we have made a very impulsive move to the downside, the wave three rebounding almost perfectly off of the 1.63. This perfect rebound is something to take note of for future charting. I am curious to see if crypto will bounce off of the technical resistances a lot more accurately than a stock. In addition to this, we are contained in a BEAUTIFUL channel. I am aiming for the 2.0 extension of the wave 1 which is conveniently the 0.5 extension of the waves 1-3-4.

Moving average analysis: On the thirty minute, take notice of how the 4th wave seems to have bounced hard off of the 200ema. This leads me to believe that we are still not done our move to the downside, and it likely marks the end of the wave 4. In addition, take into account how on the 30 minute, the 55 ema is crossing over the 200 ema, which is a huge bearish sign.

Macd analysis: The macd is really testing me for this trade. I can see that on the one hour, although it hasn't crossed their is some bullish divergence on the histogram, indicating a cross might be on its way. Although, I strongly trust my wave count for this coin, and that we will see a rebound off of the 14 moving average for the macd.

RSI analysis: The RSI isn't telling me a bearish or a bullish story. Right now it is in bearish territory, but there is nothing that screams bearish. Judging by the 45 minute, I think that we will see the fifth wave down, but this will show us some bullish divergence, meaning that the rsi probably won't go below the previous low. If the divergence does appear as we hit the wave 5, I immediately recommend taking a position to the top side.

All in all, the trade setup is as mentioned:

Target: 3.6069

Stop loss: 3.81

R:R is 3.04!!!

ETH fee expensive lose VS Who buy OMGnumber 1. omg eat volume from crypto another such as BTC, number 2. USD do give crypto down according crypto/USD not OMG, now coin another will buy OMG Plasma Network go use not no, by buy pay enter OMG do give volume add, part at USDT not yet pay buy OMG Network 100% because ?