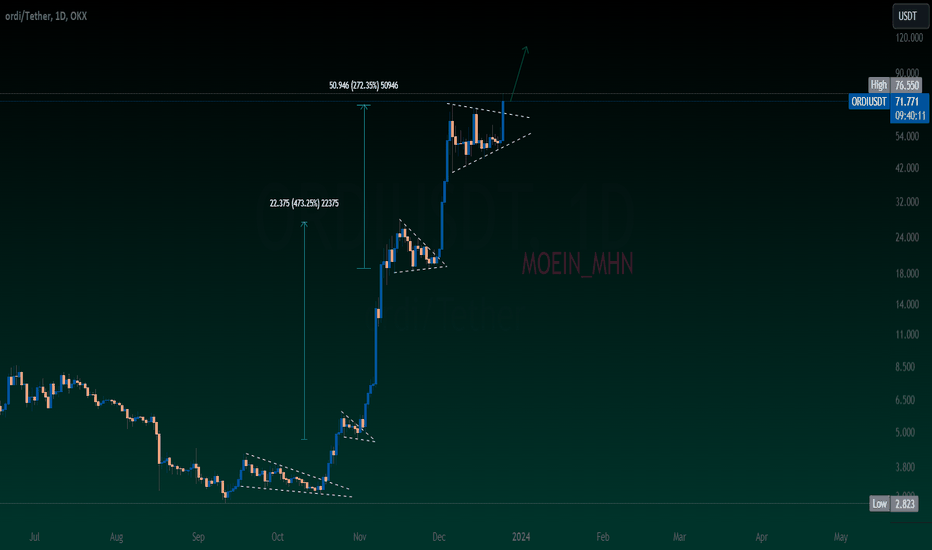

Unlocking ORDI's Potential: A Surge Towards New Peaks?Bias: Bullish

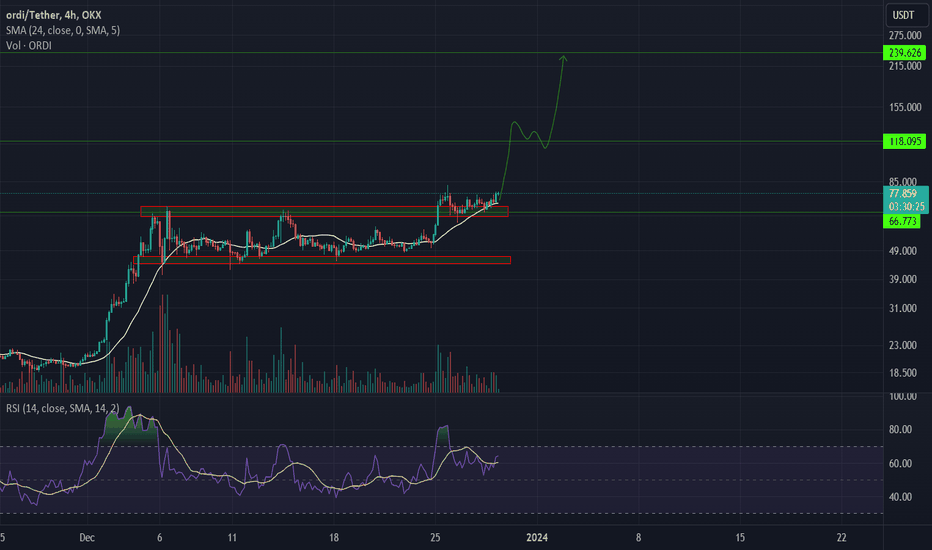

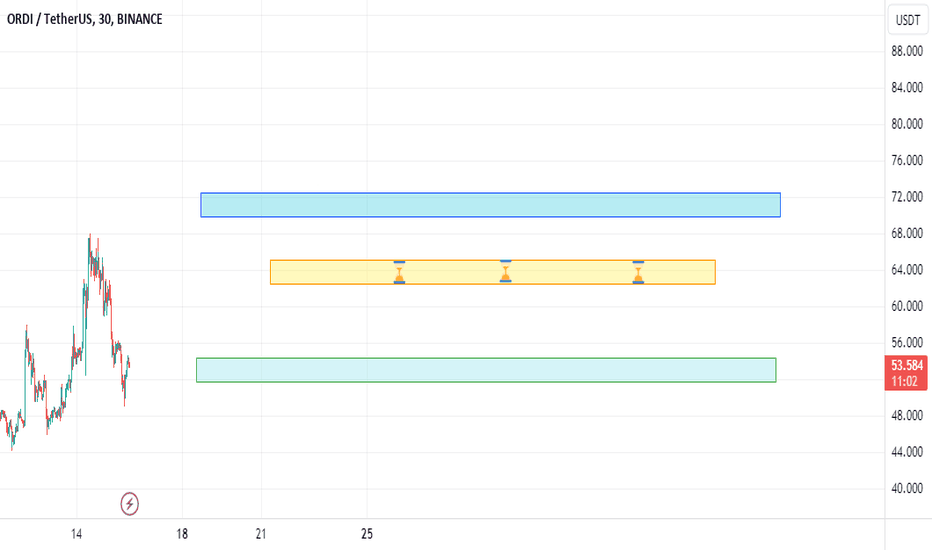

Description: ORDI's price action has been consolidating within a horizontal range, forming a solid base above the SMA line. The RSI is trending positively, suggesting a buildup of buying pressure.

Direction: Upward

Entry: A strategic entry point could be considered if the price sustains above the upper range of the consolidation zone, indicating a potential breakout.

Stop Loss: A prudent stop loss can be positioned below the most recent support level within the consolidation range to protect against false breakouts.

Targets: Profit targets might be set at previous resistance levels or at round number psychological levels as the price ascends.

Caution: Investors should monitor for any sudden shifts in market sentiment or volume spikes that could signal a change in trend direction. Additionally, keeping an eye on the broader market trends can be crucial for contextualizing ORDI's price movements.

ORDIUSDT.P trade ideas

ORDI Over?If you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment! Also, check out the links in my signature to get to know me better!

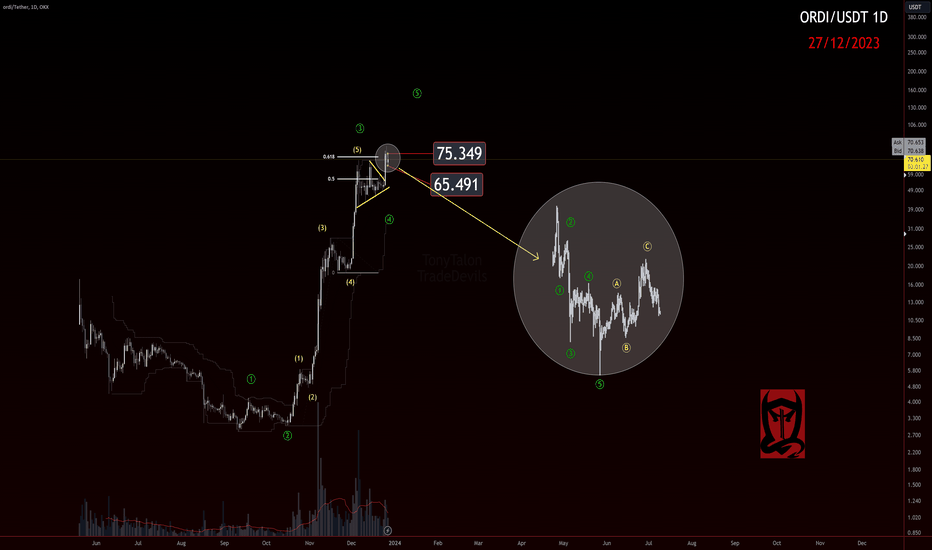

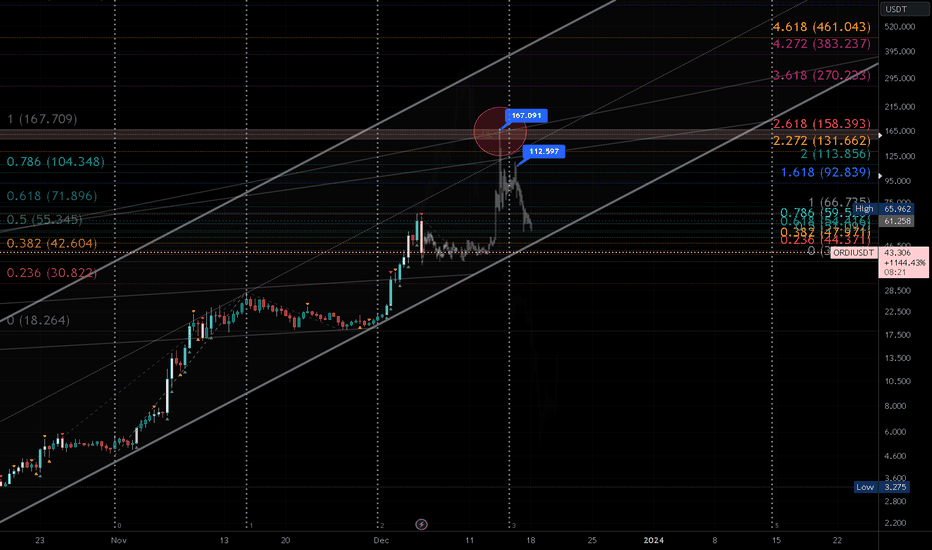

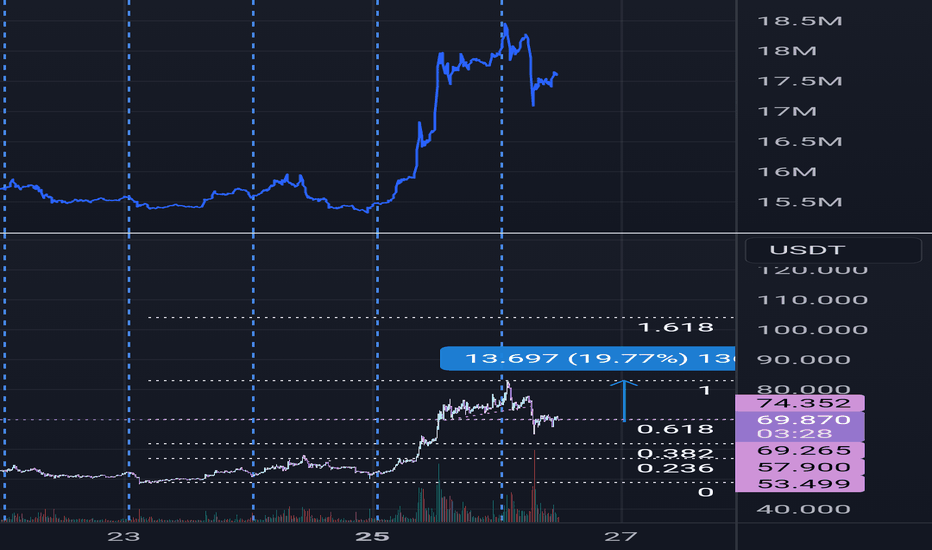

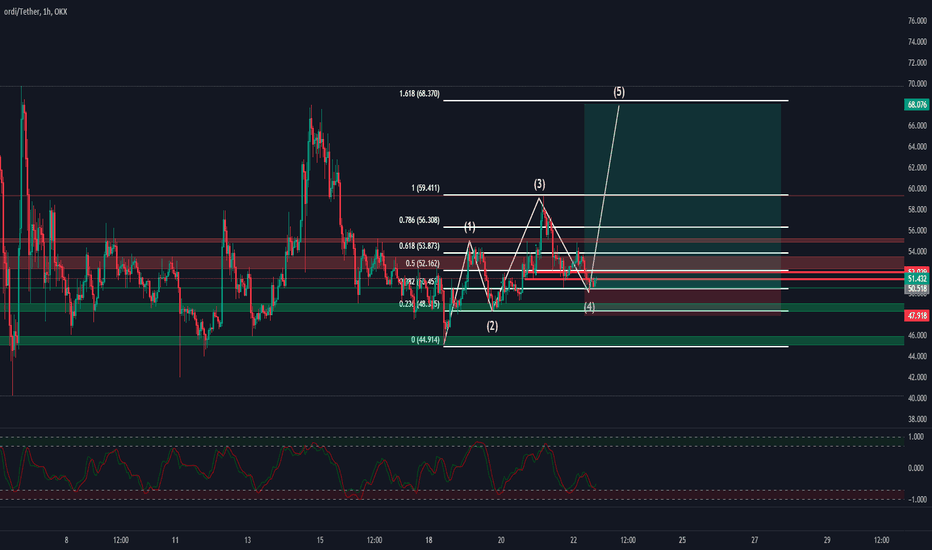

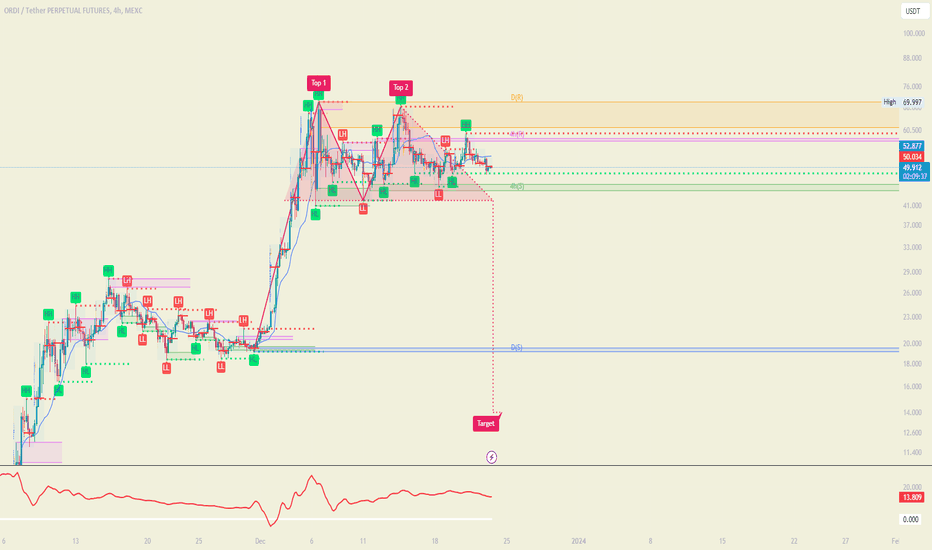

#ORDI update.

Took profit on my $8 entry near the 5 of 3 projections.

Entered more on 52.61.

TP on that here as well.

#Elliottwave and TDU giving some corrective vibes here, circled.

65.491 breaks, looking for min a ZZ.

75.349 kills ideal.

🥂

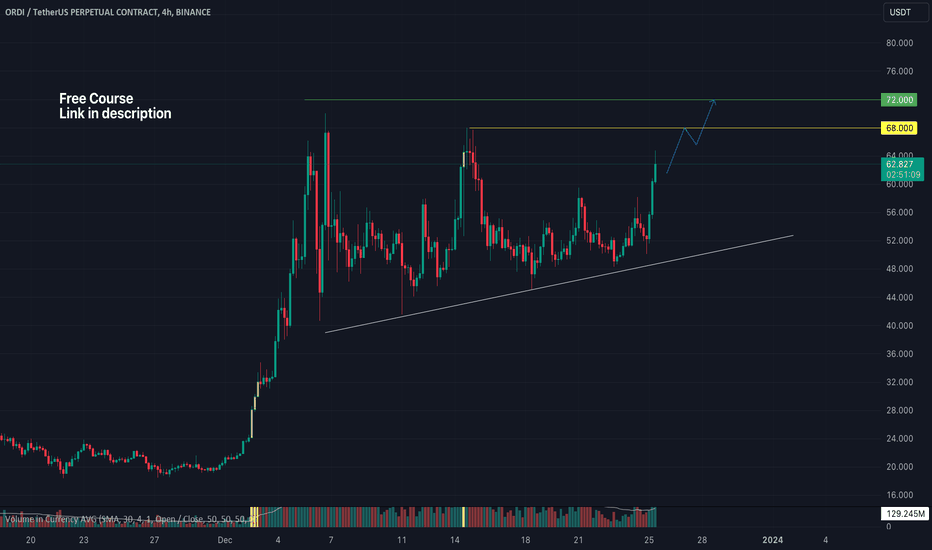

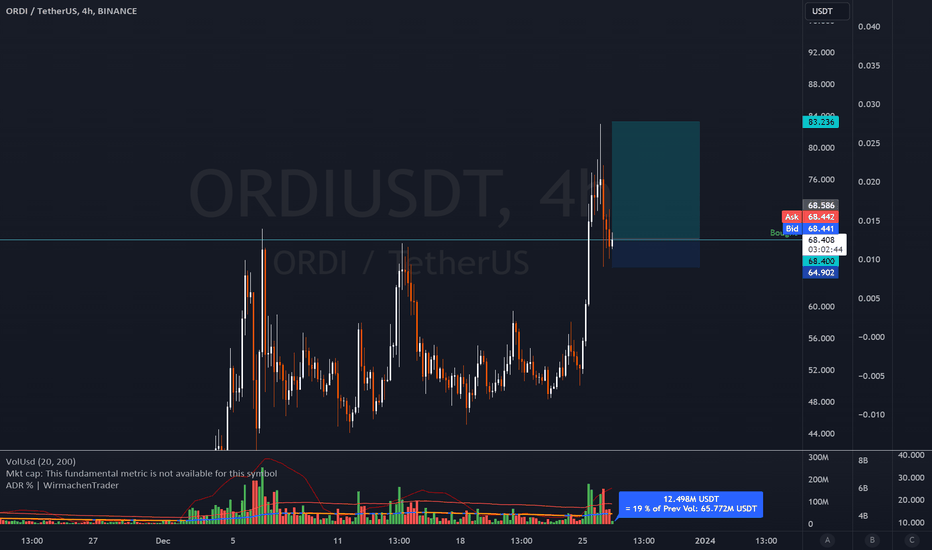

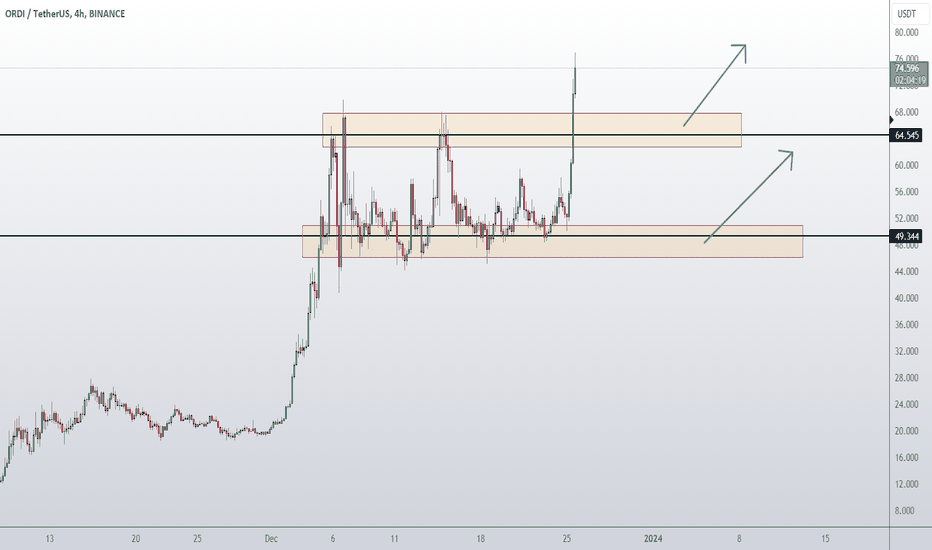

impulse exit to long #ORDIUSDT The instrument is in the game, is in the growth leaders and is trading at increased volumes, the traded volume per day is more than 1 billion, after an upward movement, it entered a 20-day consolidation, as a result of which it formed a cascade of resistance levels on round numbers, the closest near VAH, in a glass large prints for purchase and densities at levels in ideally, I would like to see a local trading and another touch to the level, with a smooth approach, preloading and increasing activity in the glass, I expect an impulse exit to the long with the withdrawal of liquidity beyond the levels. The first take is 72

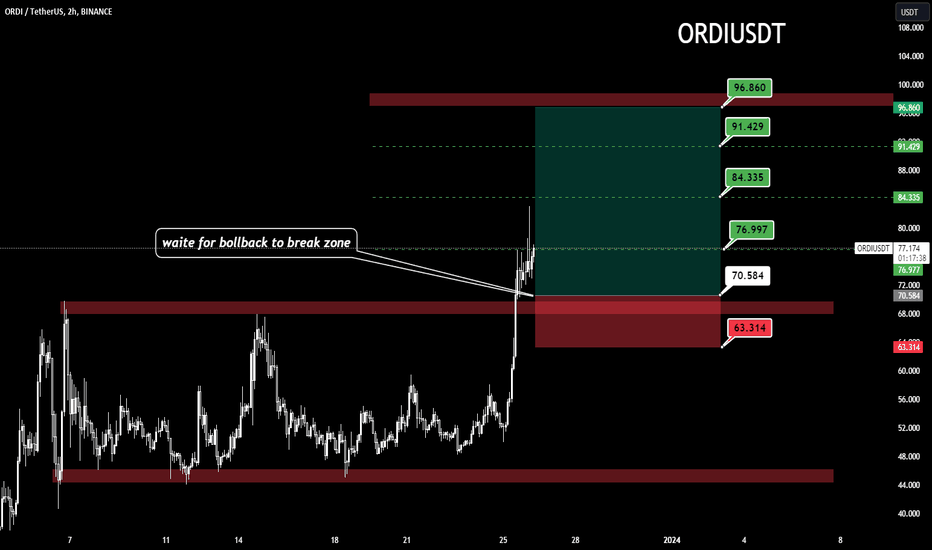

Polback by continues uptrend(ORDI)❤️❤️Thanks for boosting 🚀 and supporting us!

📈We are in bullish trend with latest movement at break resistance .

📊 (Entry) : 70.58

🔴 Stop Loss : 63.314

🎯 Take Profit : 76.99-84.33-91.42-96.86

🔗 For more communication with us, In the footnote and send a message in TradingView.

👨🎓 Experience and Education: Our trading team has five years of experience in financial markets, especially cryptocurrencies.

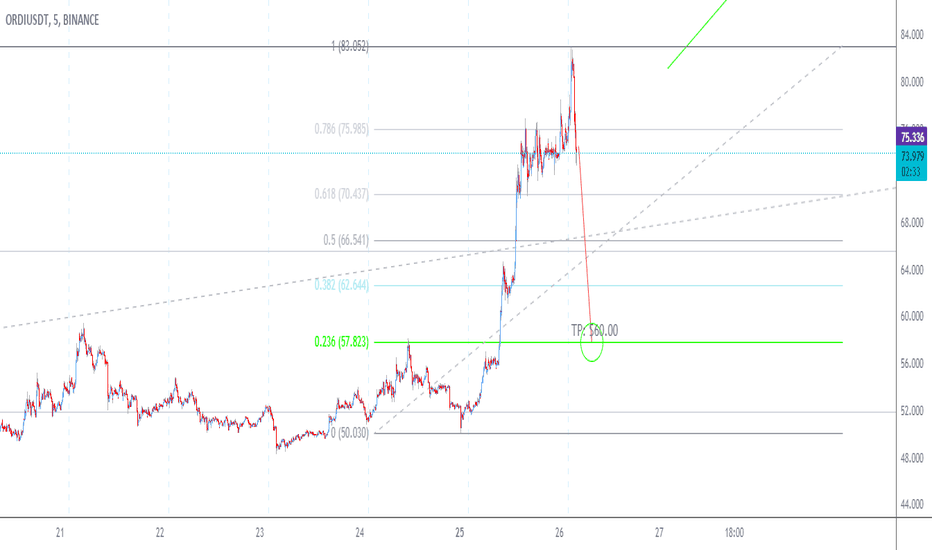

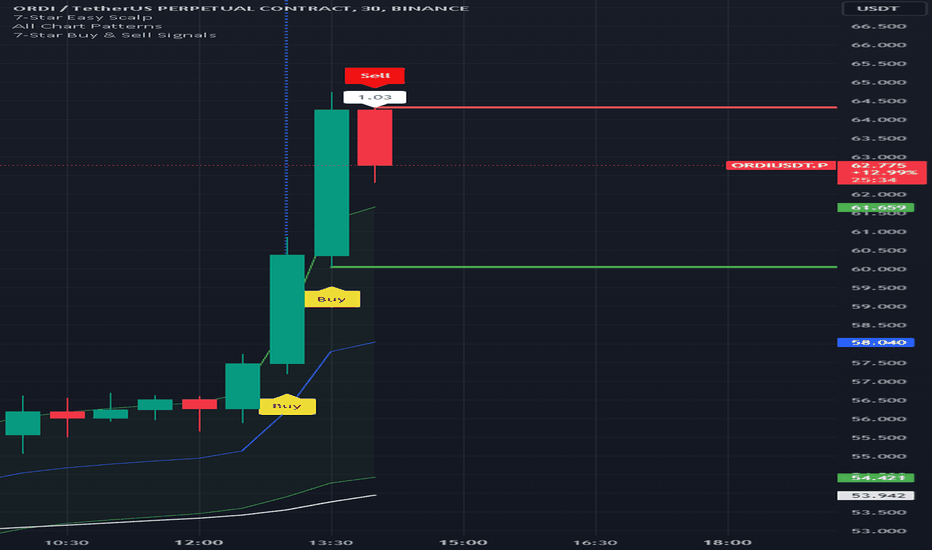

ORDIUSDT SHORT SCALP : SELL SIGNALLol.. Couldn't have timed my experimental previous post worse.

Immediately after I posted it, ORDI creates a double-top and starts retracing.

This doesn't look like the end-of-run pattern I'd have expected, so not going to suggest that it's entirely done.

It is retracing some, though, so, enjoy.

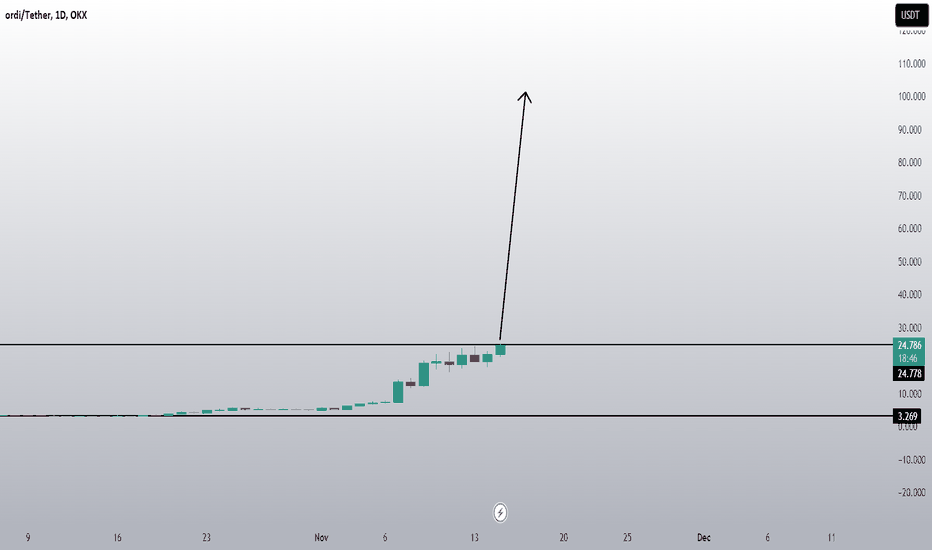

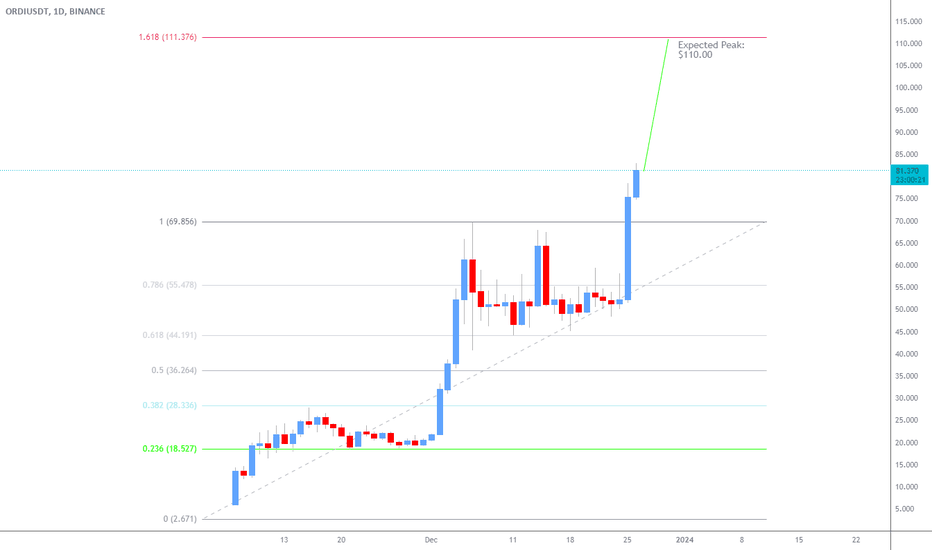

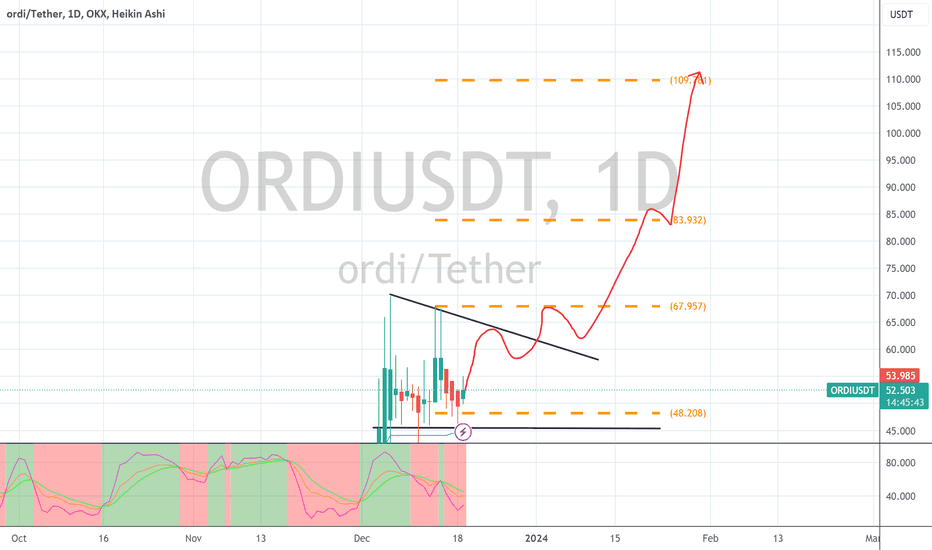

ORDI:USDT WHERE'S THE TOP?This post is based on the little information available at the time of its posting, so it's to be taken as speculative. There's not enough previous chart information to make a decent call, but based on the one method I do have that might suggest the best exit level, $110.00 appears to be it.

This is only an exercise in prediction, not trading advice.

I'll update this post if and when it reaches that level or in the event that it runs out of steam before getting there.

PS: THIS IS NOT A BUY SIGNAL!

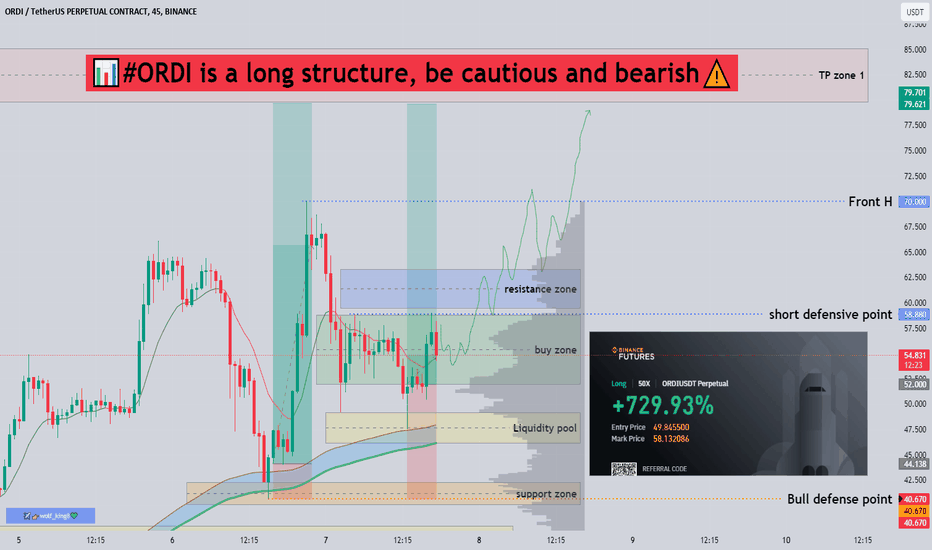

📊#ORDI is a long structure, be cautious and bearish⚠️➡️In yesterday’s analysis, I mentioned that we broke through the short defense point and the previous high, so we can look forward to a higher target range. When we pulled back to the buy zone, I also made a reminder, The most difficult thing about trading is to overcome your inner fear. When you are dominated by the fear caused by violent fluctuations, you will not strictly implement your trading system. Therefore it is difficult for you to make money in the trading market.

🧠Currently we have encountered certain resistance here, but we have successfully broken the short defense point, so we will continue to maintain the bullish view unchanged. If we are more conservative, we can lock the main profit near the previous high, and then leave a little Some positions are risk-free to expect more. 🙏🎯

⚠️Because we have increased our positions twice, we reduced part of our positions when it was near 58.88, so that we can look forward to the remaining targets without pressure. ☕️

🔥Congratulations to all the friends who followed us to print money🎉💰🍻I have helped everyone make money, so I hope you can also help me. Please remember to like❤️share my analysis posts and channels. 📤

💕 Follow me so you don't miss out on any signals and analyze 💯

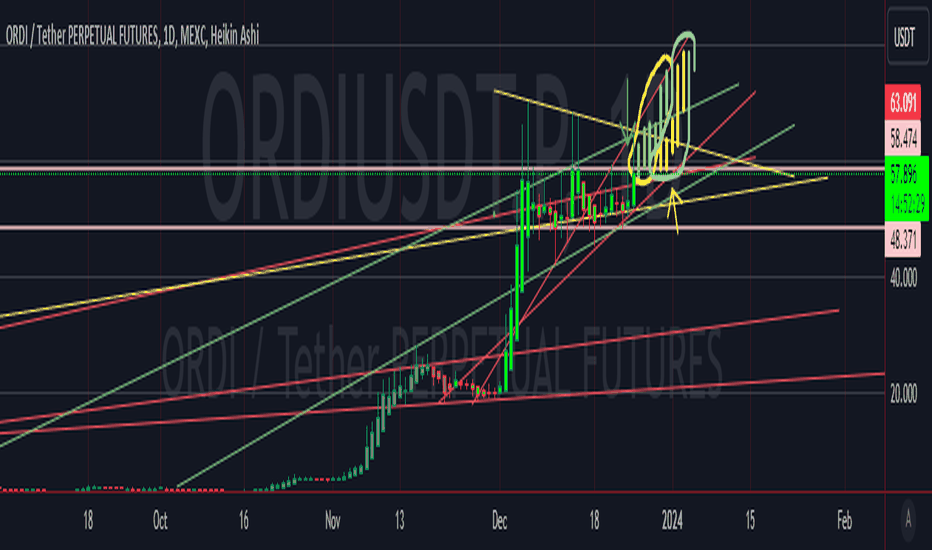

ORDINALS/USDTMy idea is that at the end of wave 4 we could be at the beginning of wave 5 in the trend . The elioti trend could break and become invalid with a break of the $48.5 resistance . target price min the fibo 1.68 level could be around $68-69 .

This is my own opinion , not business advice . Always do your own research in your investments .

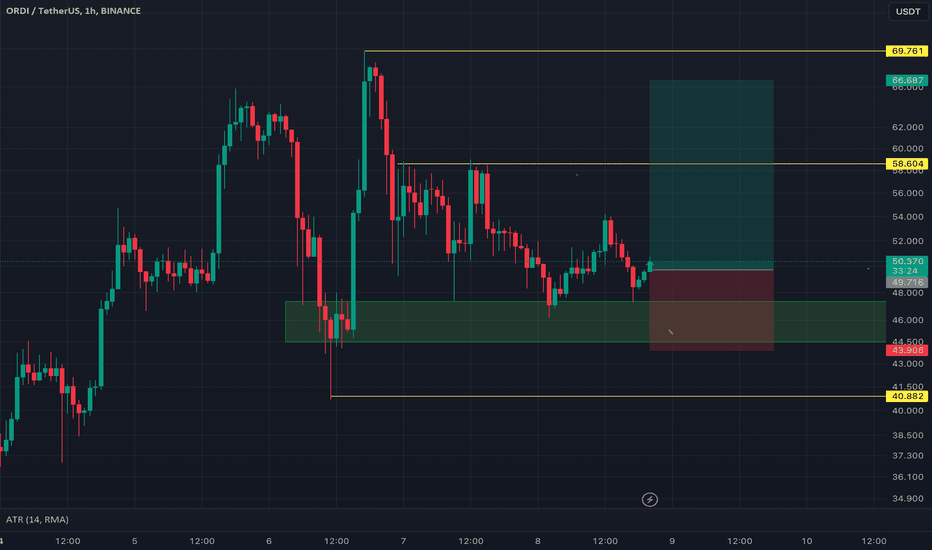

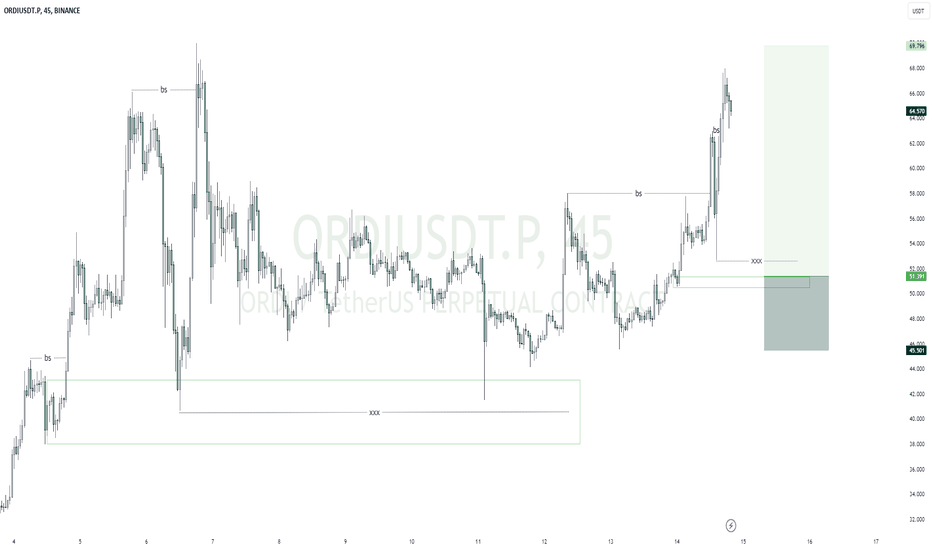

ORDIUSDTmy entry on this trade idea is taken from a point of interest BELOW an inducement (marked as xxxx).. I extended my stoploss area to cover for the whole swing as price can target the liquidity there before going as i anticipate.. same idea Ive always been using.. just a trade idea, not financial advise

Bullish on ORDII am Bullish on ORDI, It's kind of a proxy play to BTC but I feel it has more upside.

In my chart you well see not only the T.A. supports a bullish case but the fact that it seems the miners or starting to see the kind of TX fees they can make on top of BTC rewards. In a side note I feel that TX fees can reduce selling pressure for BTC that can make the price go up because less BTC is on the market, but it could make the price go down; because the miners can stay whole with out having to get top dollar for BTC. Anyways; If you notice in the chart not only the T.A. is bullish, and if in fact; it's a proxy play to BTC the then time to hold any BRC-20s is from 12\25\23 in to 1\15\24 do to the ETF hype that may come from now to the middle of January. So PLZ let me know what you think of my take.

P.s. The green bars are one option, and the yellow are another.

Ordinals (ORDI) BTC up, ORDI upOrdinals (ORDI) is a cryptocurrency that works on a technology called Ordinals Protocol and brings NFT (Non-Fungible Token) capability to the Bitcoin blockchain. This protocol allows various information such as text, images, audio and video to be added to Satoshi, the smallest unit of Bitcoin.

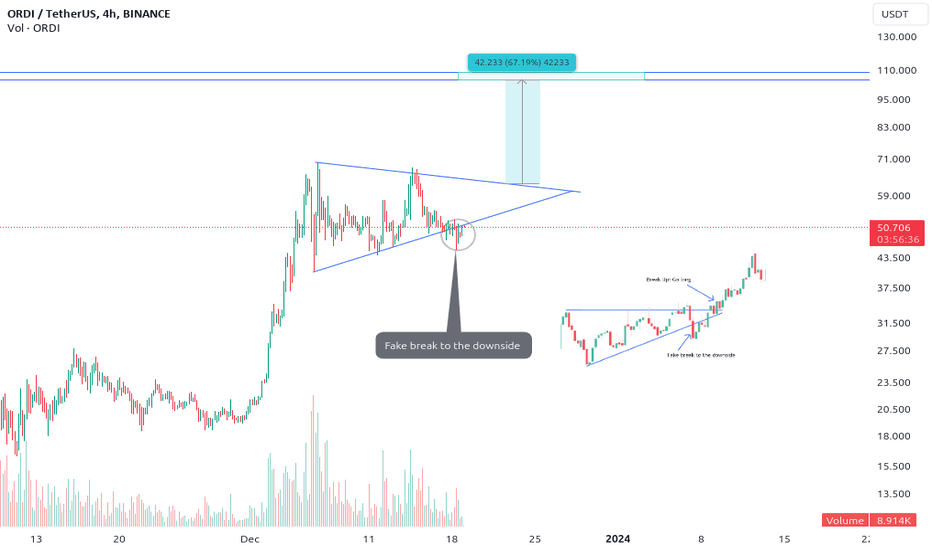

ORDI/USDT is in a bullish trend.Based on the chart, there are several bullish patterns that could suggest the price of BINANCE:ORDIUSDT is poised for further upward movement. Here are a few indicators:

Ascending Triangle : The price action is forming an ascending triangle, which is a continuation pattern that typically indicates a potential breakout to the upside.

Rising Volume: The volume of trading has been increasing over the past few hours, which often accompanies bullish breakouts.

Price Breaking Above Support : The price has recently broken above a key support level at 48.905 USDT. This level was previously acting as a constraint on the uptrend, and its breakout suggests that the upward movement may have gained momentum. If the price can sustain its gains above this level, it could further bolster the bullish sentiment.

In the event of an upward breakout, the target price ranges from $105 to $110.

Good Luck