Ivanhoe Mines - a 50% discount opportunity !The share price of this mining monster has suffered a 50% price decline in the last 6 months.

One of the main reasons for the share price decline is the suspension of underground operations at the Kakula mine due to seismic activity. This suspension has led to a withdrawal of production and cost guidance for 2025, causing investor uncertainty and a subsequent drop in share price 1,2,3 Additionally, the company has faced challenges with its smelter, including a fire that damaged onsite generators and caused a three-month delay in commissioning. These issues, combined with power constraints and grid instability in the Democratic Republic of Congo (DRC), have contributed to a more conservative production outlook.

However there are lots of positive catalysts for Ivanhoe Mines: the upcoming rise in precious metal prices, especially the wake up of the severely undervalued PLATINUM prices.

Platreef PGM project in South Africa contains 7 million ounces of gold (0.25 gpt) and 50 million ounces of AuEq. About 90% of annual production (1 million ounces) will consist of PGMs (platinum group metals), making it the largest PGM mine in the world ! Platreef is expected to have low all-in production costs, though more precise figures will become available after the ramp-up phase, scheduled for the second half of 2025.

Platreef PGM, Kakula-Kamoa (massive copper mine, the largest high grade mine globally) and Kipushi (a high-grade zinc operation); With all three of their mines expected to be in production, 2025 could be a pivotal year for them.

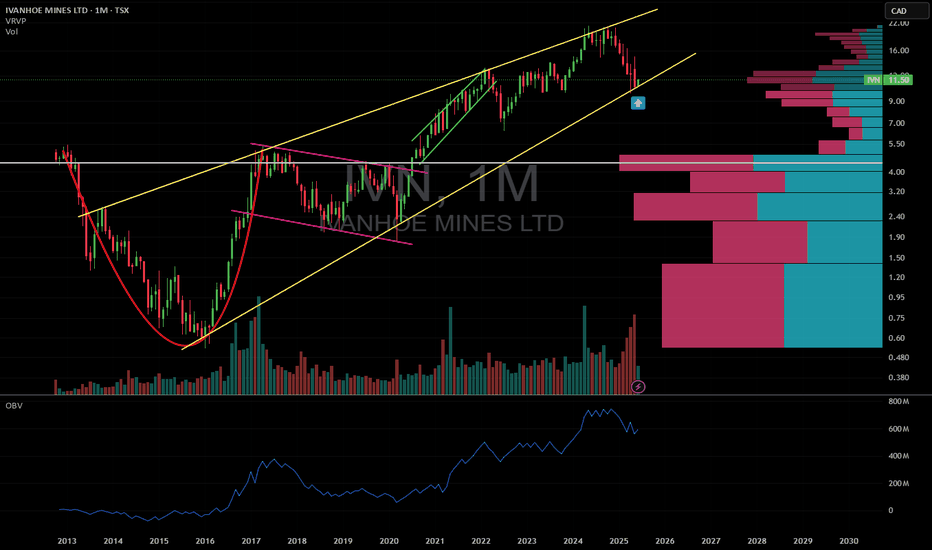

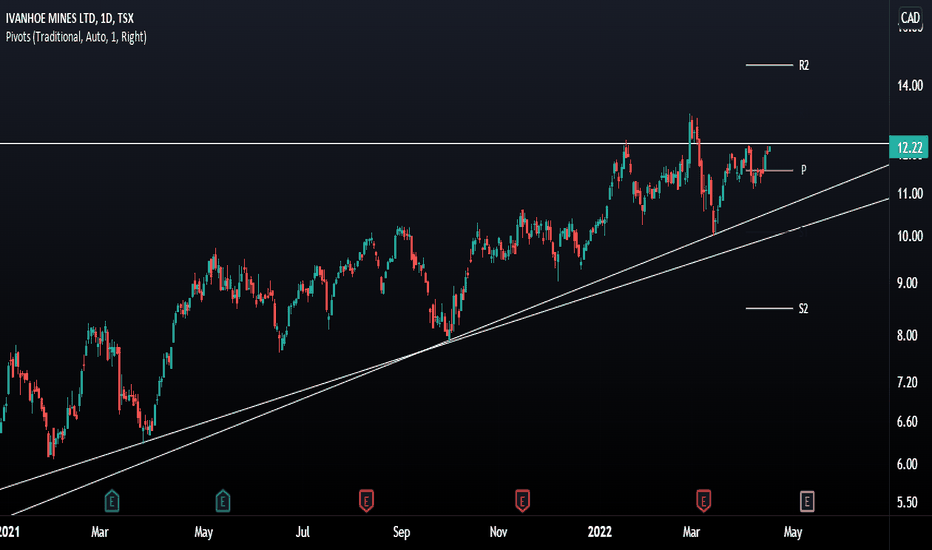

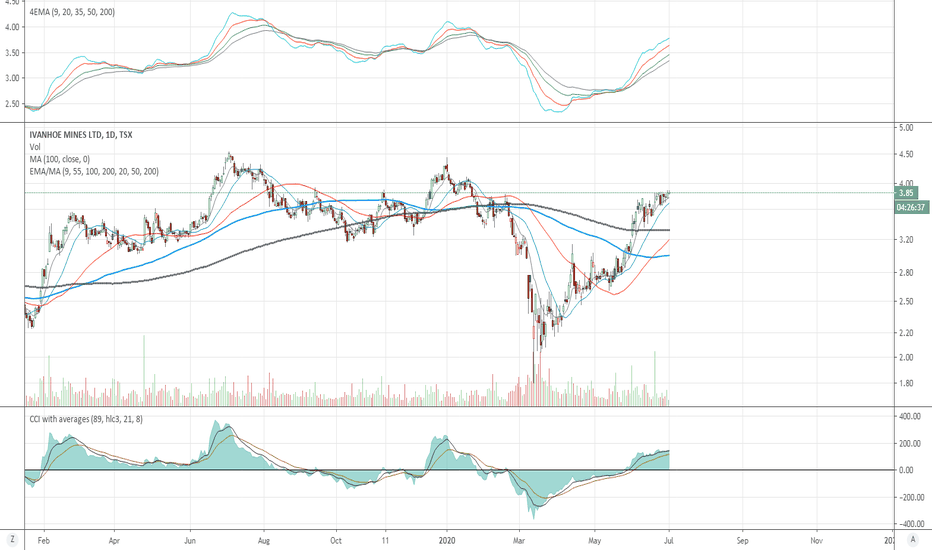

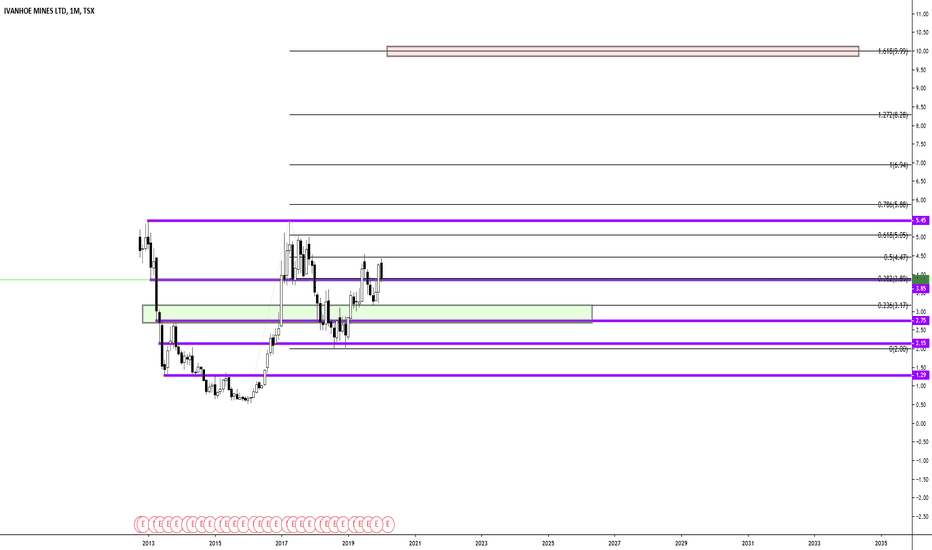

Chart wise, the price is still rising in a long term rising wedge. Price just found support on the lower resistance and is bouncing strongly. OBV on balance volume is still on a steady rise. I own Ivanhoe Mines since I got in at sub 1$ (thanks to Rick Rule's reccomandation - God may bless him). and I am not willing to let go before we reach 50$, which is my long term target.

IVPAF trade ideas

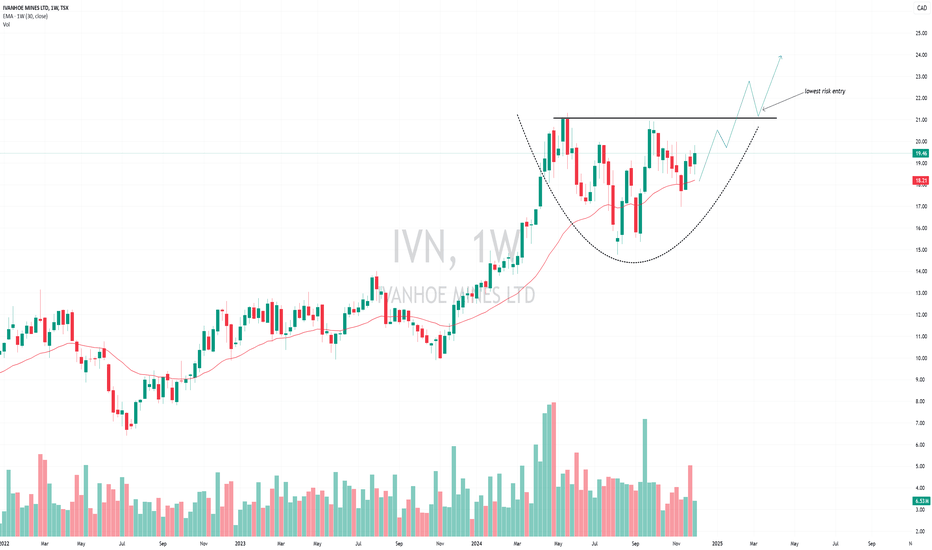

Looks like good set upPosted this for a follower on twitter:

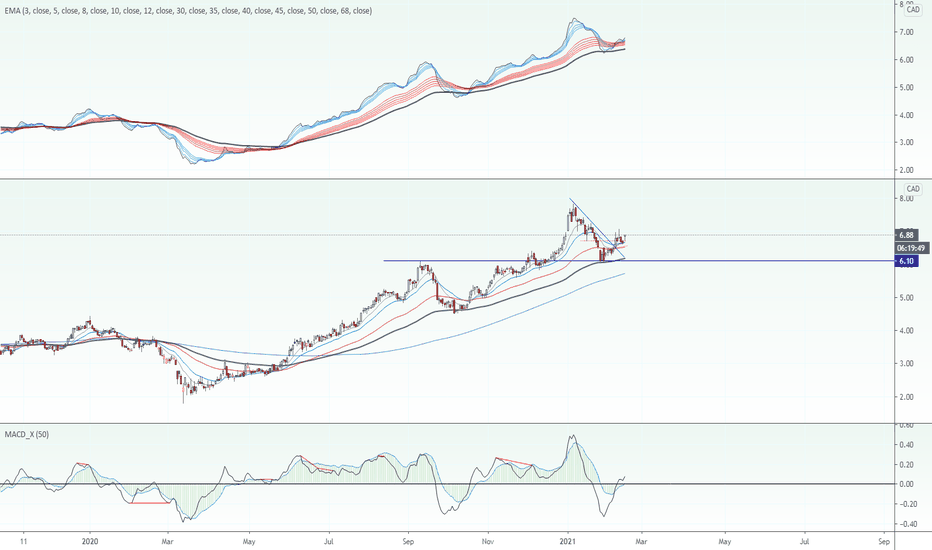

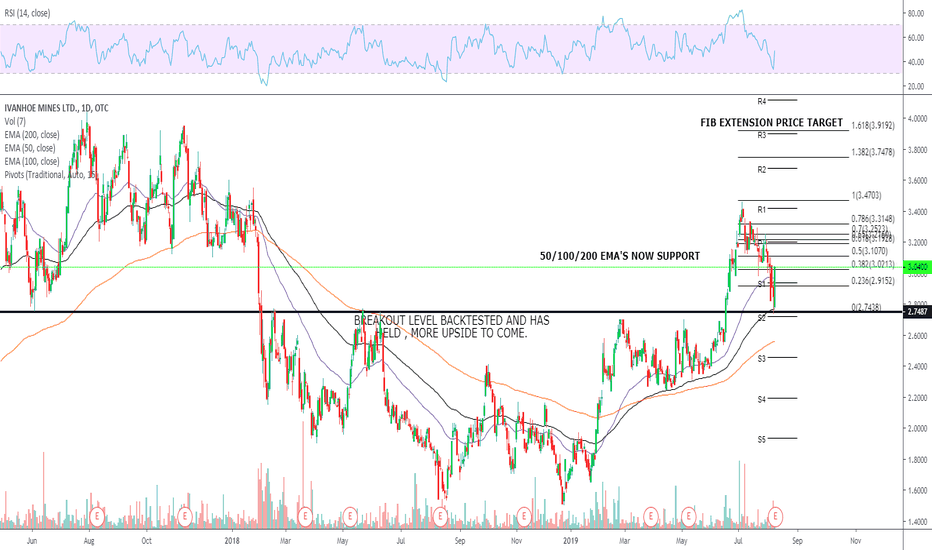

I'm default bullish when price is over weekly EMA30. I've seen a lot of charts with this set up recently. If you think price can higher than all time highs (upcoming catalysts, macro), then buying anywhere here would be a good DCA starting point.

Lowest risk entry shown.

$ivn.to

OTC:IVPAF

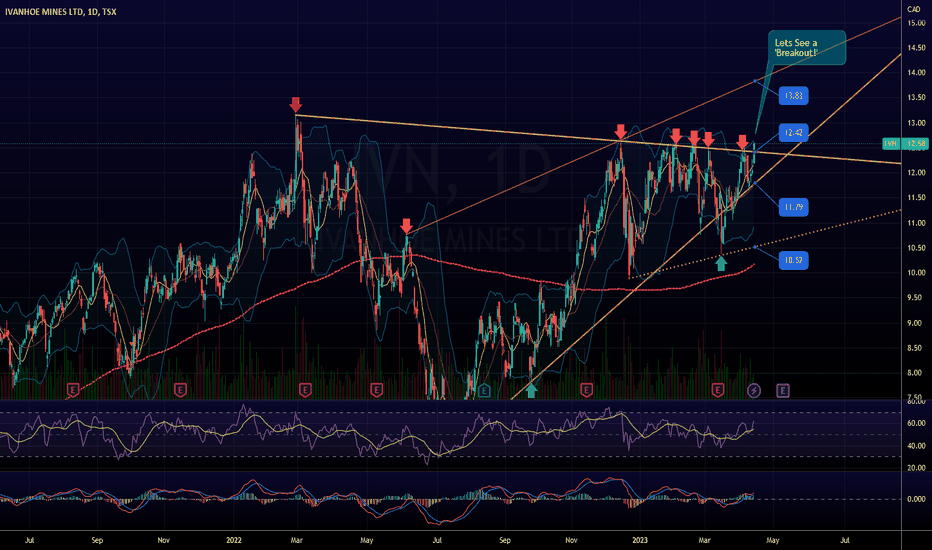

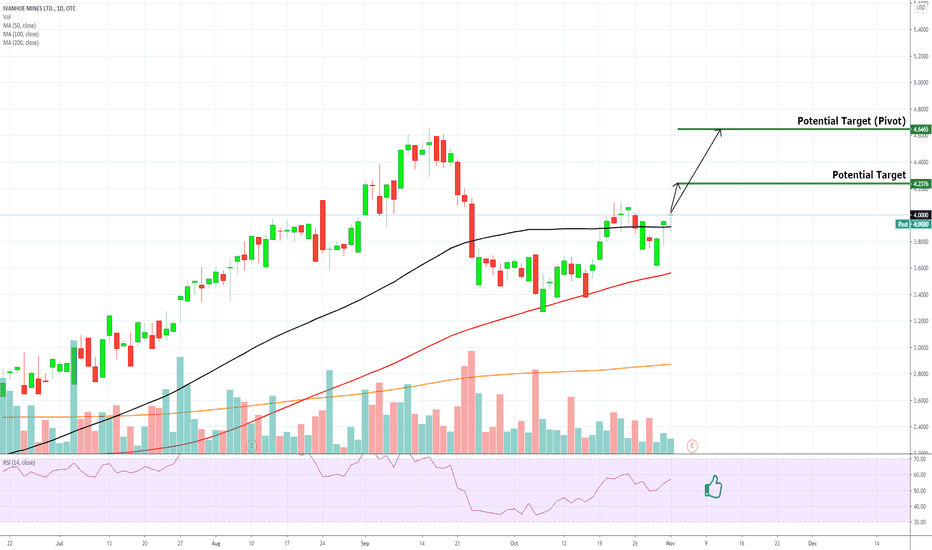

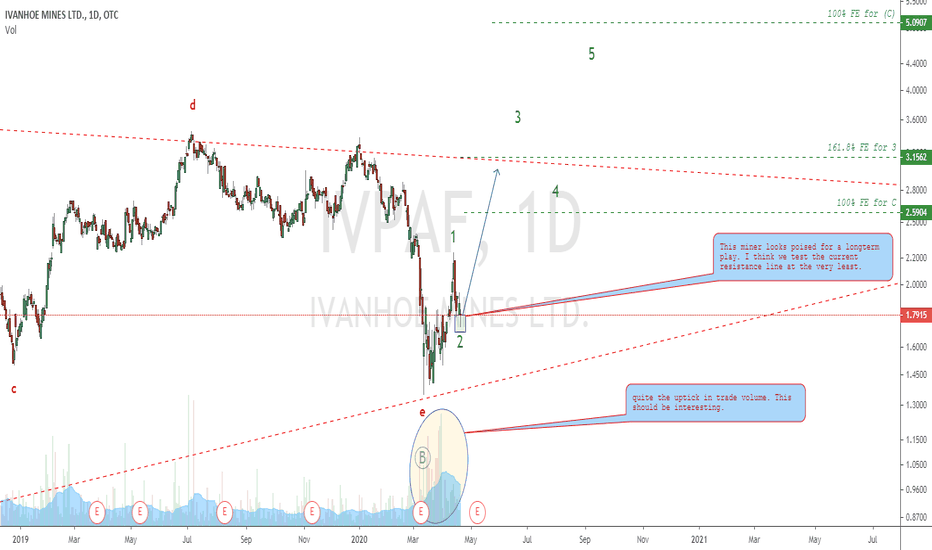

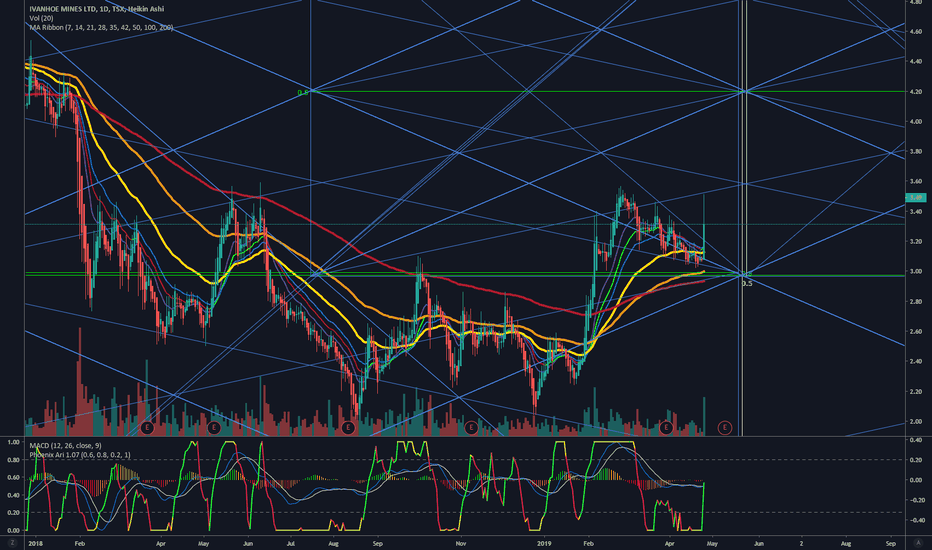

IVN on the move againAs you can see from my markups on the Daily chart, Ivanhoe Mines (#IVN) is on the on the move again however has a couple of major milestones to break through... As you can see we have two trend-lines we are approaching, one being a shorter term ascending trend-line, the other being a longer term descending trend-line. Historically, IVN trades well when working with trend-lines so I am anxious to see this round how we respond to the upcoming/approaching trend-lines. Overall I am bullish on IVN. I am looking to make a higher-high to the ascending trend line. Lets wait to see how this pans out. Cheers everyone and remember, trade safe!

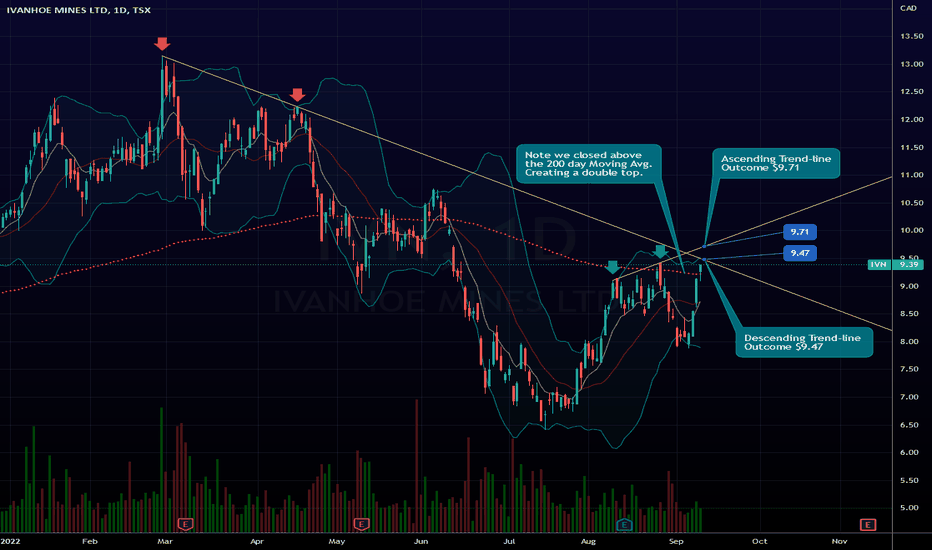

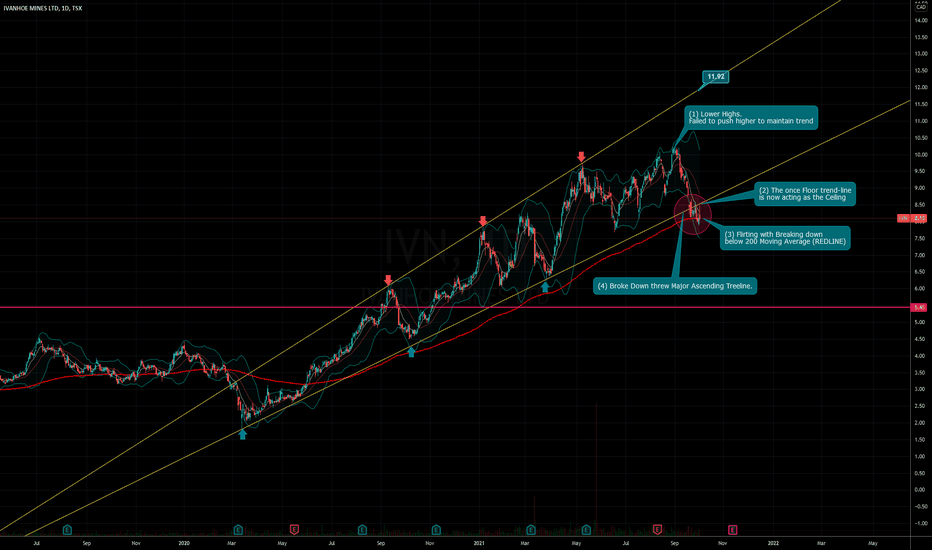

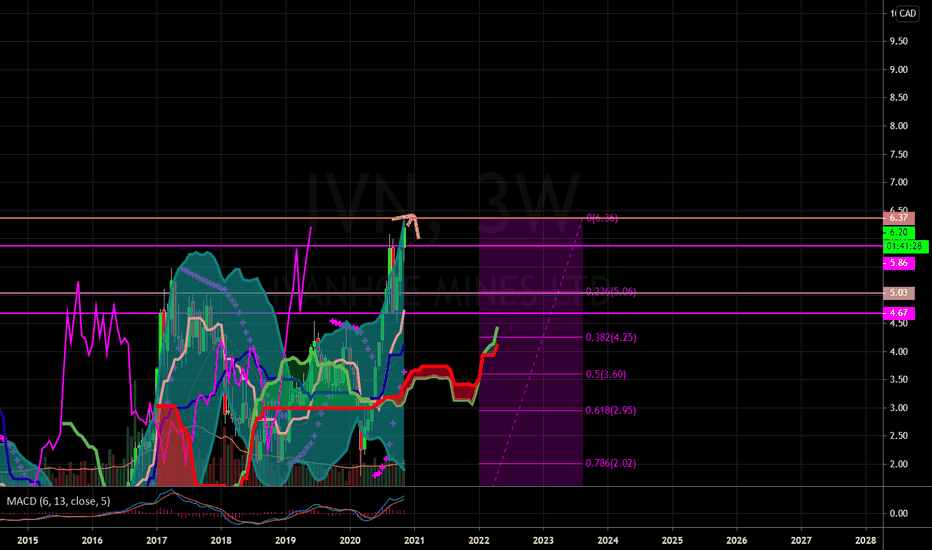

Trendlines Tell a Story... IVN Updates#IVN has been an interesting stock to trade with large swings to the upside and as well to the downside. HOWEVER non the less, we have been on an uptrend journey... For a very long time; since March 2020! BUT what about now? I'm showing some concern here for the longs out there as we can see some pretty clear evidence of possible breakdown or the start of a transition. As you can see from my updated technical analyses, we have (4) different factors to show signs of weakness. The question to be held; Will the 200EMA be the comfort bounce we need to see this back up to the 10 dollar zone? Or with this pierce the 200 with no forgiveness. Opinion accepted!

Ivanhoe Mines - Minimum Retracement Almost ReachedInternational mining consultant Wood Mackenzie has ranked the Kamoa-Kakula Copper Project as the world's fourth-largest copper discovery, with copper grades that are the highest by a wide margin of the world's top 10 copper deposits.

The company has 3 principal projects in Southern Africa: the development of new mines at the Kamoa-Kakula copper discoveries in the Democratic Republic of Congo (DRC) and the Platreef palladium-platinum-nickel-copper-rhodium-gold discovery in South Africa; and the extensive redevelopment and upgrading of the historic Kipushi zinc-copper-germanium-silver mine, also in the DRC.

Friedland is executive co-chairman. For more than 25 years, Friedland has been recognized by leaders of the international financial sector and mineral resource industries as an entrepreneurial explorer, technology innovator and company builder. He has successfully developed a portfolio of respected public and private companies whose initiatives have led to several of the world’s most significant mineral discoveries and mine developments, applications of disruptive technologies and contributions to significant economic growth in established and emerging markets in the Asia Pacific Region, Southern Africa and the Americas.

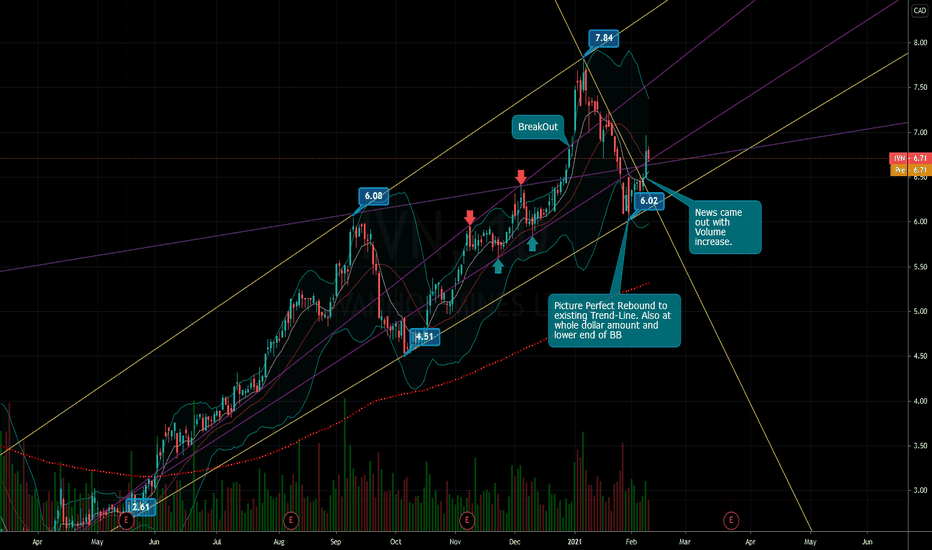

Power of Trend-Lines on IVN.TOHere is another case study of the Power of Trend-Line technical trading. If you start from the far left and work you way to the right, you will see where I have connected milestone price points and have created Trend-Line connecting points both on a larger macro time frame (in Yellow) and as well as a micro time frame (in purple).

A nicely held bounce nearing the whole dollar mark of 6$ for a LONG position consideration with a 20 cent stop buffer. Lets see how this one pans out on the bullish side as addition recent news came out as of this mornings posting pre-market. Follow the Trend-lines to consider partialing out.

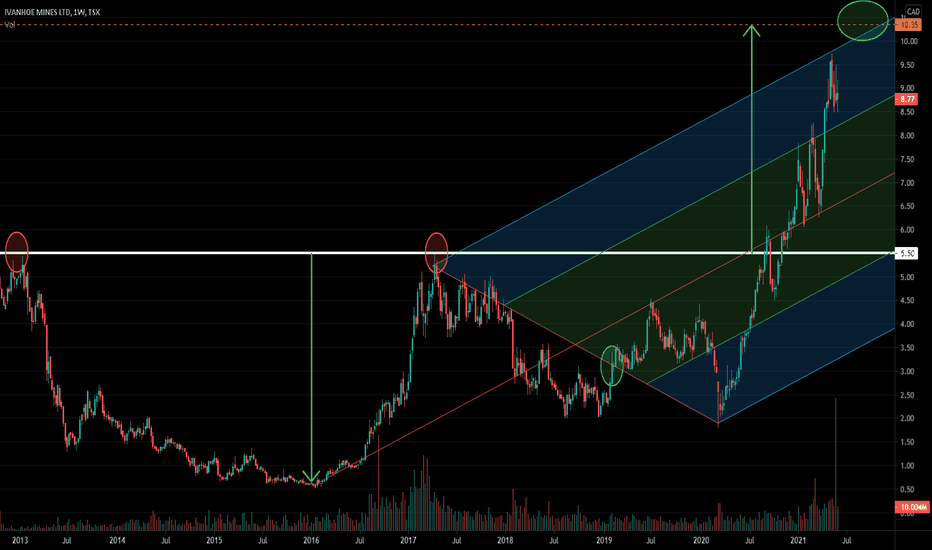

Ivanhoe Mines Ltd. Back to Highs Ivanhoe Mines Ltd. is a mining development company, which engages in the exploration and development of mineral properties. Its projects include Platreef Project, Kamao-Kakila Project, Western Foreland Project, and Kipushi Project. The company was founded by Robert Martin Friedland on April 29, 1993 and is headquartered in Vancouver, Canada.

Ivanhoe Mines Ltd Ready for more gains. Vancouver, British Columbia--(Newsfile Corp. - August 7, 2019) - Ivanhoe Mines (TSX: IVN) (OTCQX: IVPAF) announced today that the company is not aware of any company-specific reason that might be contributing to the recent decline in the company's share price.

CITIC Metal Africa Investments Limited's (CITIC Metal Africa) C$612 million ($464 million) second equity investment in Ivanhoe Mines is scheduled to close on August 16, 2019. The private placement transaction at a price of C$3.98 per share now has received all necessary internal approvals, as well as recordals and registration with Chinese government regulatory agencies. CITIC Metal Africa is a direct subsidiary of CITIC Metal Co., Ltd. (CITIC Metal).

Ivanhoe's joint-venture partner at Kamoa-Kakula, Zijin Mining Group Co., Ltd., exercised its existing anti-dilution rights on May 15, 2019, at a price of C$3.98 per share, which will yield additional proceeds to Ivanhoe of C$67 million (approximately $51 million) to be received concurrently with the CITIC Metal Africa private placement.

Upon closing, the additional funds from CITIC Metal Africa and Zijin Mining will position Ivanhoe to fully finance its share of the capital costs to bring the Kakula Copper Mine to commercial production.

AVERAGE ANALYSTS PRICE TARGET $7.71

AVERAGE ANALYSTS RECOMMENDATION BUY

P/E RATIO 71

SHORT INTEREST

COMPANY PROFILE

Ivanhoe Mines Ltd. is a mining development company, which engages in the exploration and development of mineral properties. Its projects include Platreef Project, Kamao-Kakila Project, Western Foreland Project, and Kipushi Project. The company was founded by Robert Martin Friedland on April 29, 1993 and is headquartered in Vancouver, Canada.

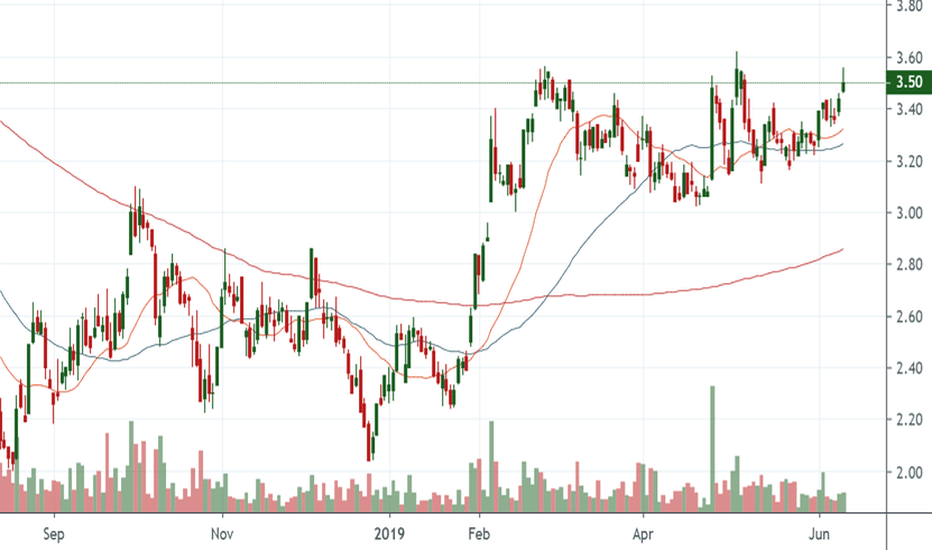

IVANHOE MINES LTD - TSX: $IVN Builds Its Right-SideSince recapturing its 200DMA back in February, IVANHOE MINES LTD - TSX:IVN has been trending sideways and in the process, building-out a massive base as we can observe from the Daily chart above.

Additionally, IVN continues to trade above all of its important moving averages 20/50/200 and remains in fine technical shape.

Furthermore, if one were to zoom-out to both the Weekly and Monthly time-frames, you can see that IVN is in the process of building-out a potential inverted H&S pattern that should such pattern materialize and complete, would suggest a measured move to the $5 - $5.25 zone.

Thus, both investors/traders may want to pay close attention to the action in the days/weeks ahead for if IVN can clear the $3.65 hurdle, such development would likely trigger its next meaningful advance into northern territory.

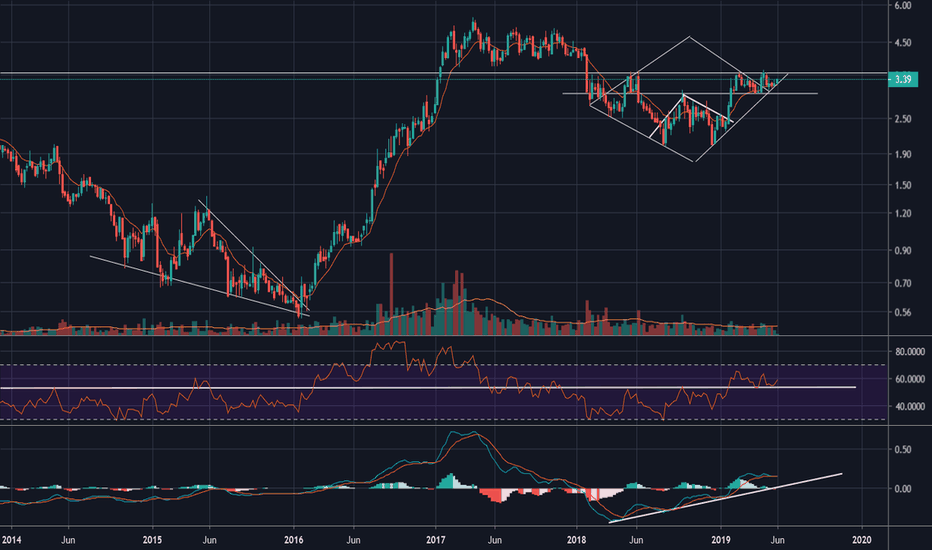

A diamond in the roughThe market is getting pretty beat up, but this copper play is holding up well. If we can get a bounce in the market, I'm looking for this pattern to play out.

Last big reversal was a falling wedge, now this time there is a diamond within a diamond.

Bullish trend in weekly MACD, now well above zero. Looking for RSI support around 50 to hold, and an eventual break above price of 3.60 with heavy volume to confirm breakout.

Long term outlook.

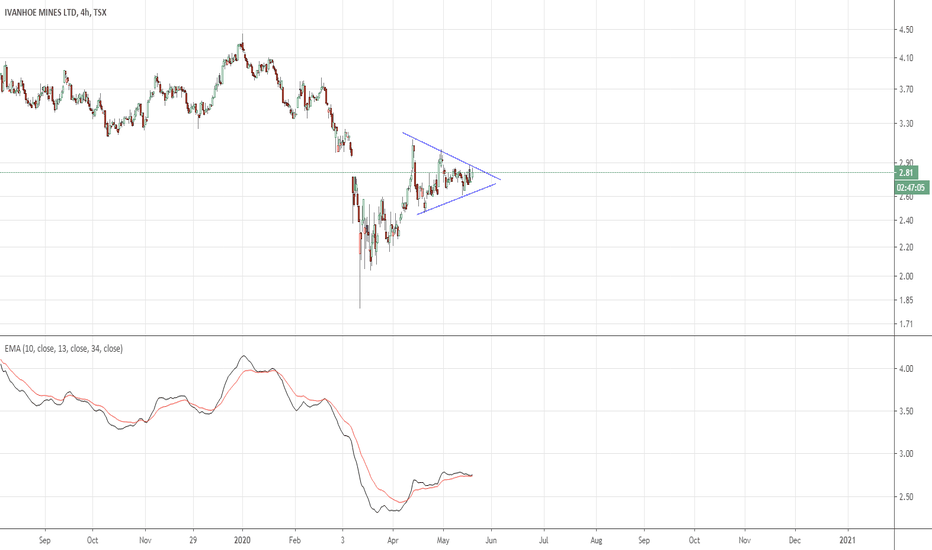

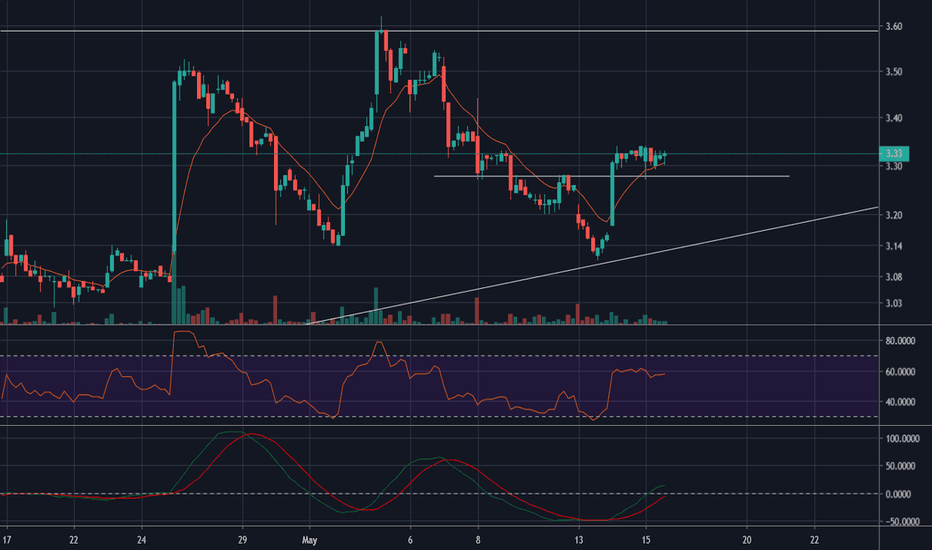

Daily trend reversalPrevious resistance of 3.28 now being tested as support, and a nice little hourly bull flag is being formed. On the larger scale this is a possible ascending triangle with overhead resistance around 3.60. Could be a nice break if we can push through that level.

Also, Musk says that copper is going to be in short supply with electrification. And this company has a massive copper mine coming online.

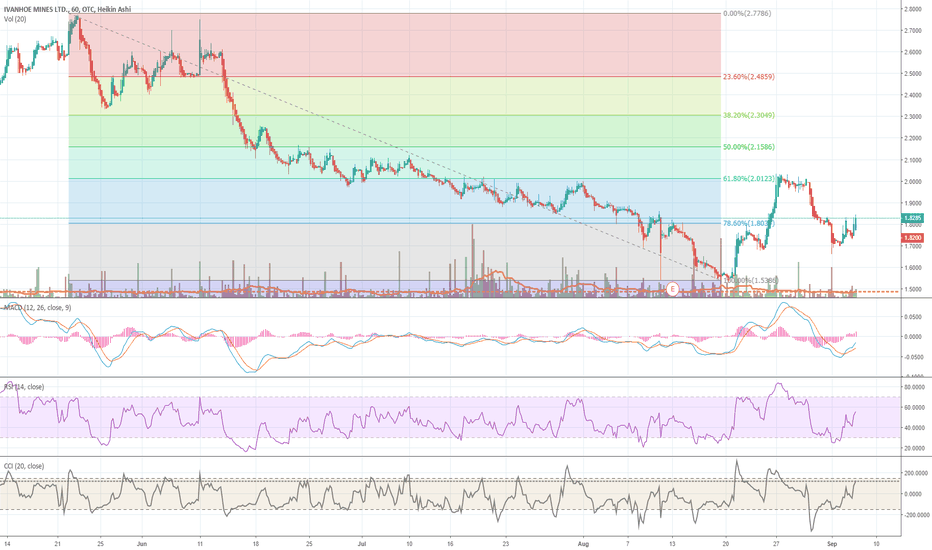

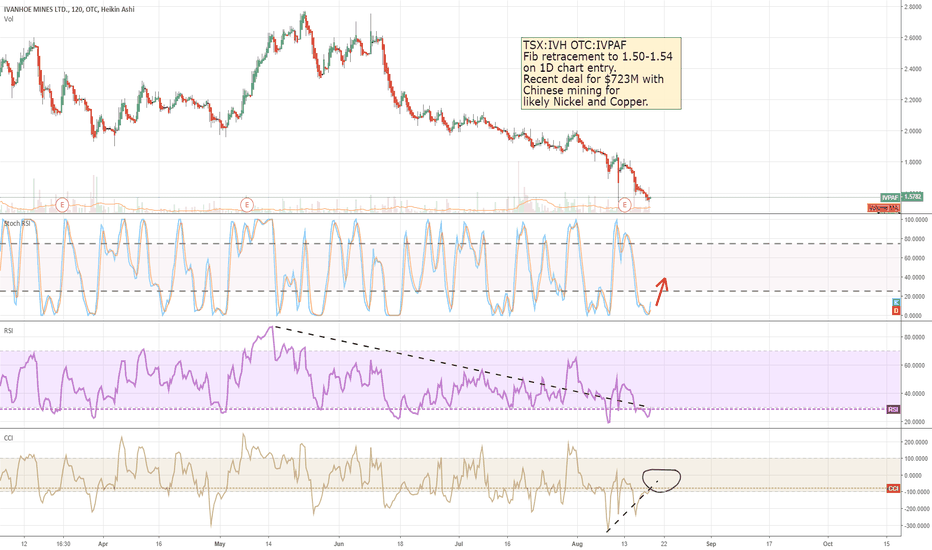

CSX:IVH OTC:IVPAF Ivanhoe MinesSmall-cap: IVH or OTC: IVPAF showing potential entry. Shown here is 2h chart.

* Fib retracement on 1D indicates entry at near 1.50-1.54 and currently at 1.57.

* CCI coming up to entry zone

* Falling wedge coming to Fib resistance zone .768 (1.50-1.54)

* Relative Strength nearing breakout, or if falls below 1.48 review position

* Copper prices were strong in 2017 and weakened in 2018. investingnews.com

* Nickel is byproduct of copper mining and likely behind deal with CITIC. investingnews.com

investingnews.com

* Zinc also potential driving this one back up.

* IVH chart from Investing News Network investingnews.com

* Active projects in CAN and South Africa

Hit copy, make mine and change to 1D and 1W and add Fib retracement.

This is mining small-cap/micro-cap stock, so risk beware and make own conclusions.