OTHERS trade ideas

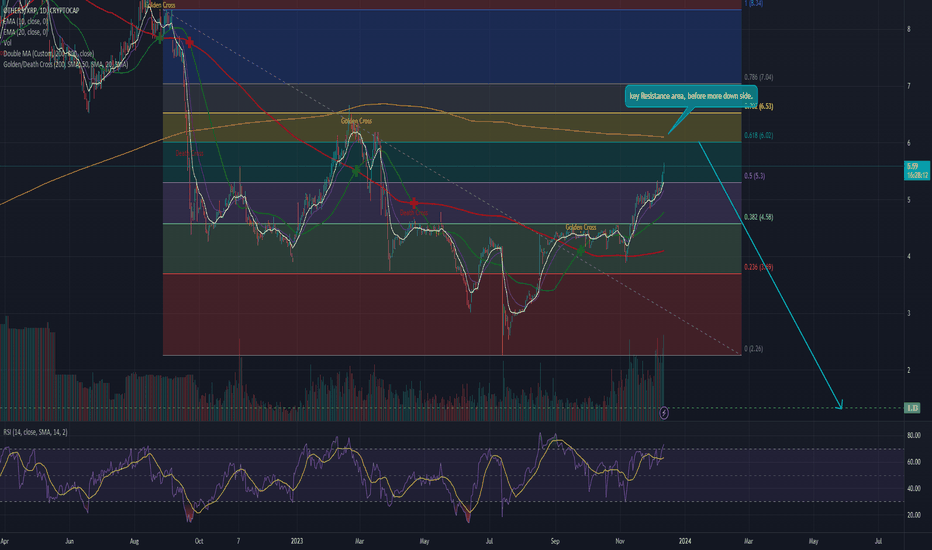

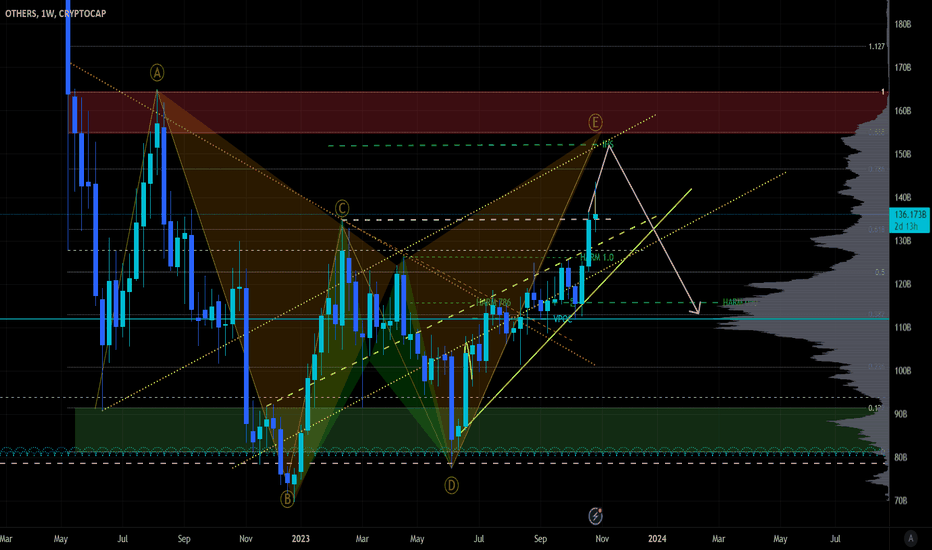

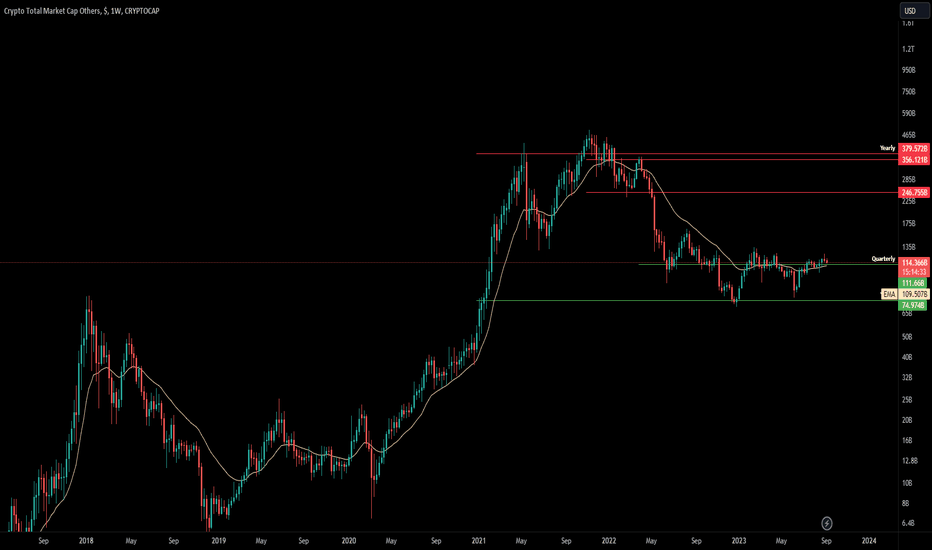

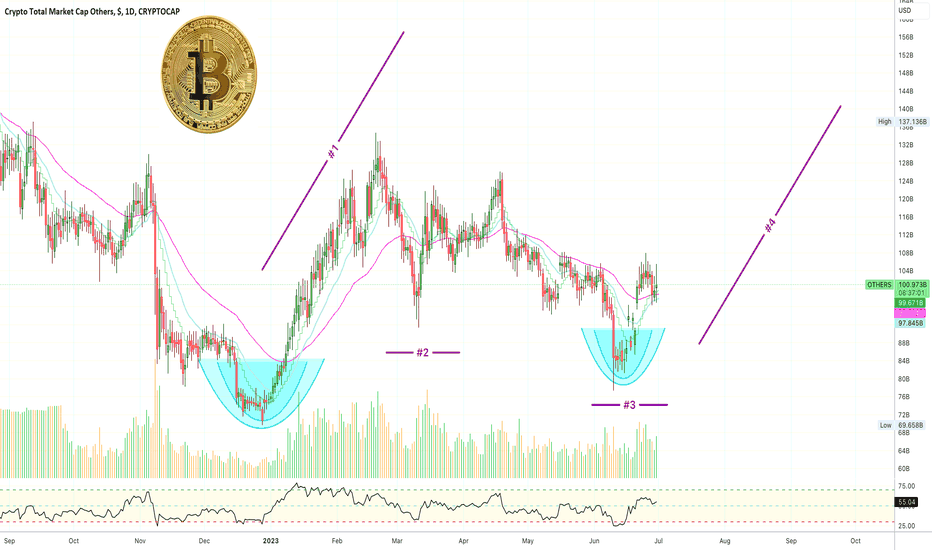

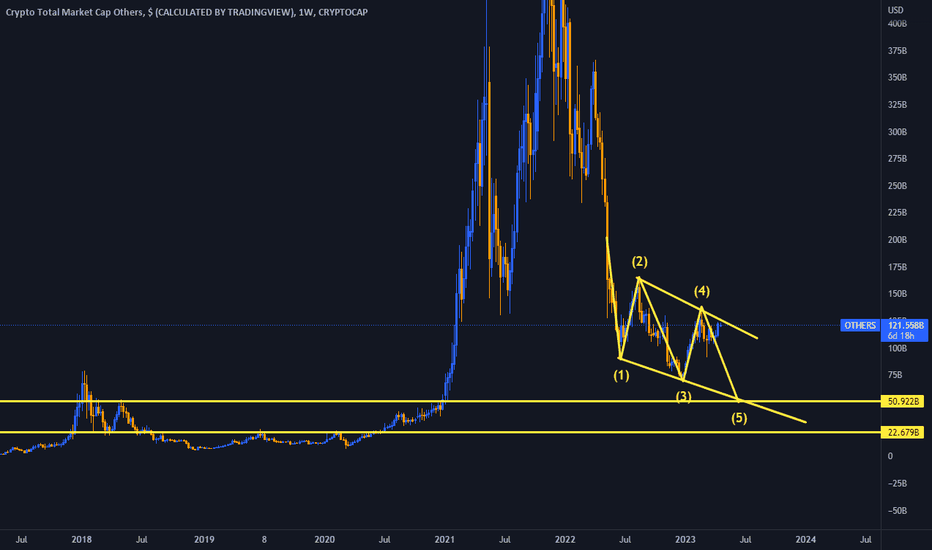

Update OTHERSThere is an Indigo Diagonal pattern forming and about to be executed on the next downside

All data is on the chart

Please clarify that I am helping you with my point of view, which may be right or wrong, and see my previous analyzes of many currencies and forex in order to judge the owner of this analysis with a more accurate look

Good luck

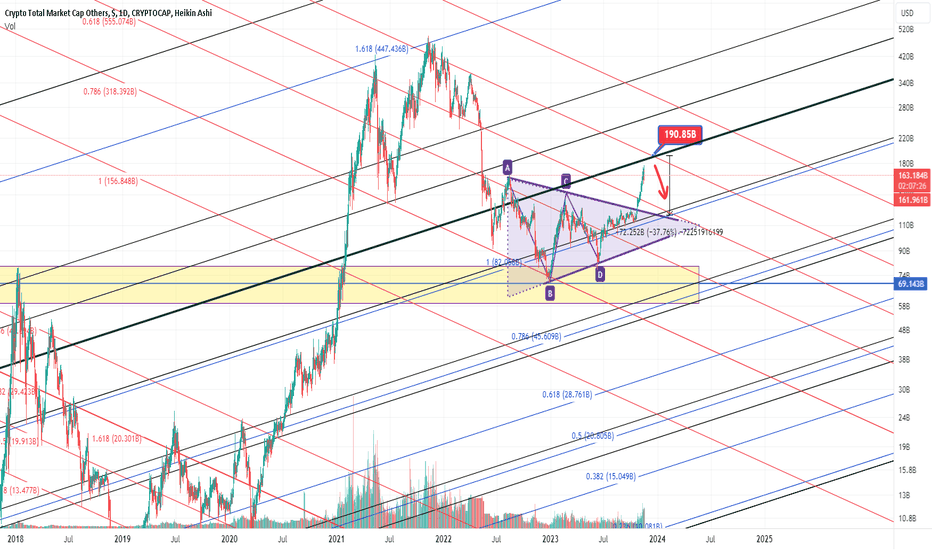

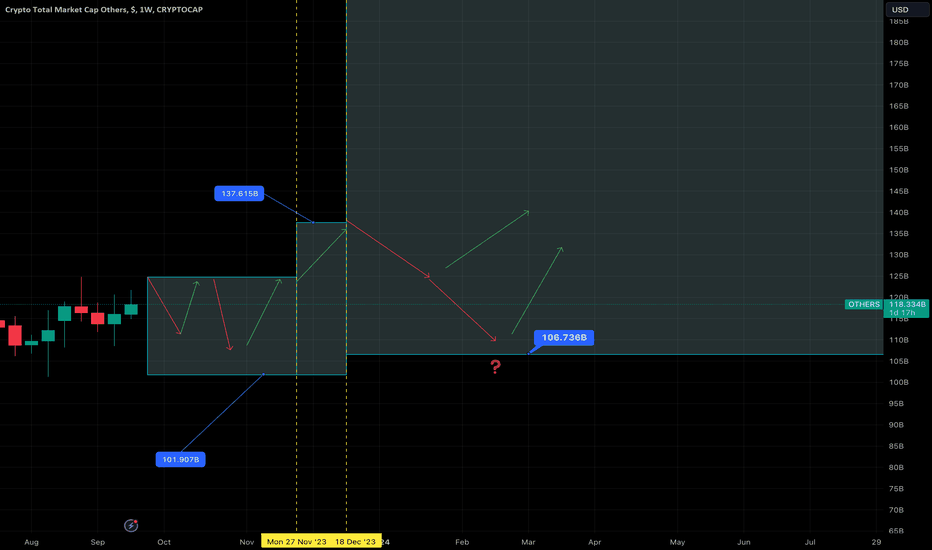

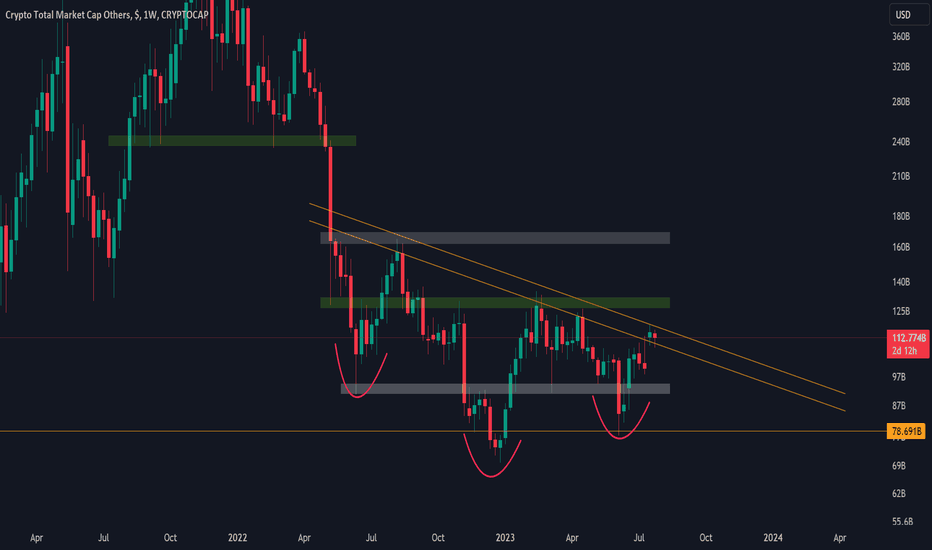

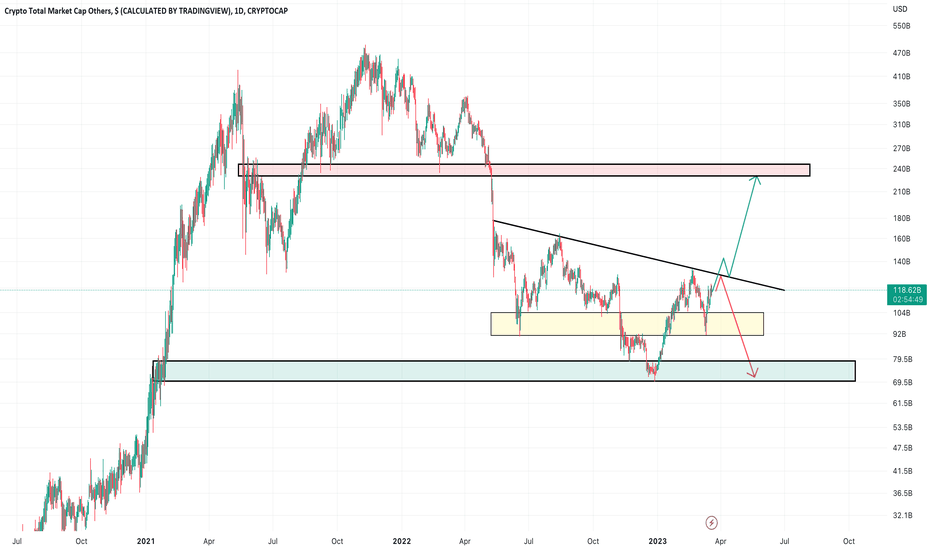

Others 1W (Crypto Total Market Cap) until end of 2023Sideways until the end of November between 101B and 124B. In December Others Market Cap may jump up to 137B - (false)breakout? Followed by (probably unsuccessful) retest in the second half of December (end of January 2024) falling down to 124B or even lower to 106B.

To be updated in January 2024...

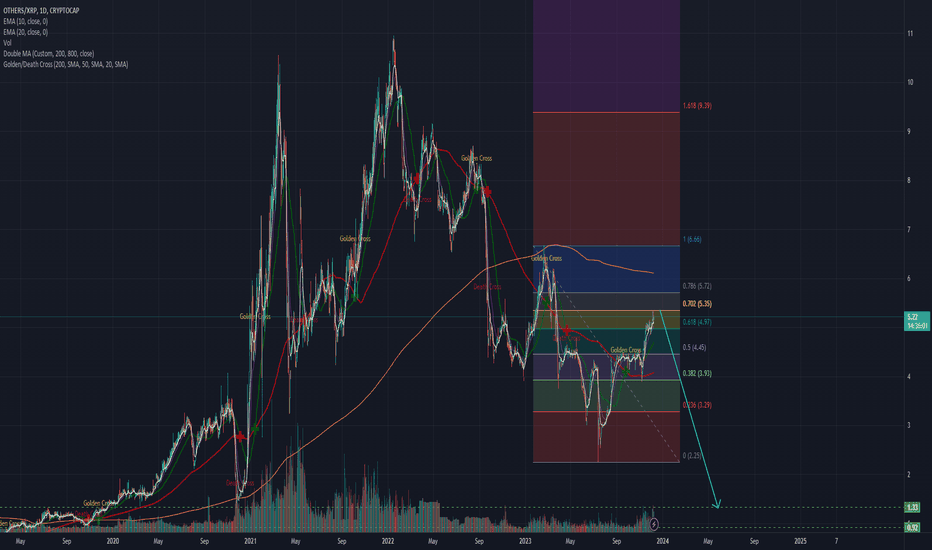

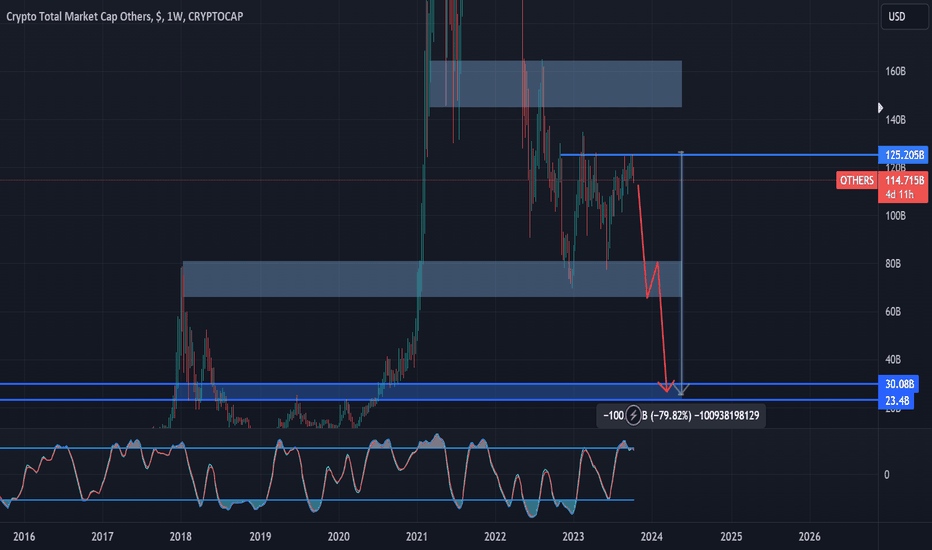

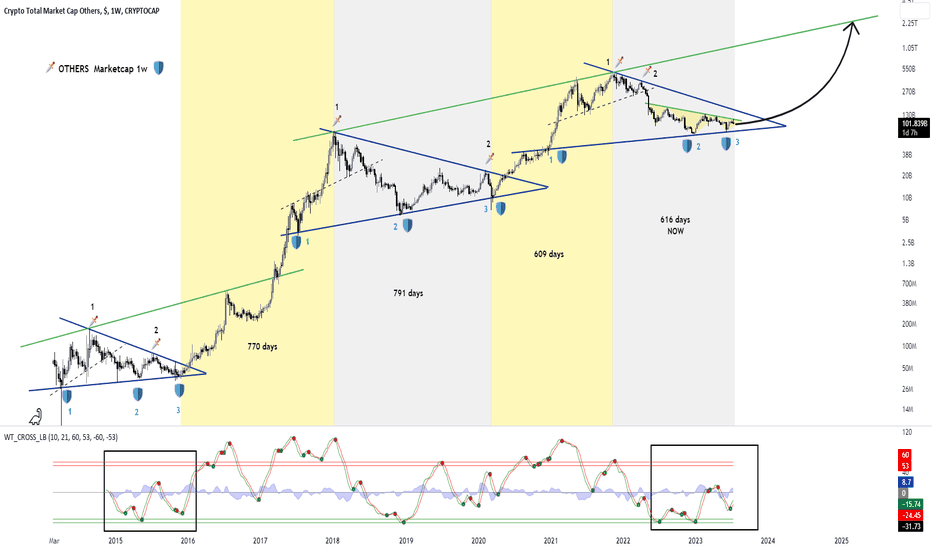

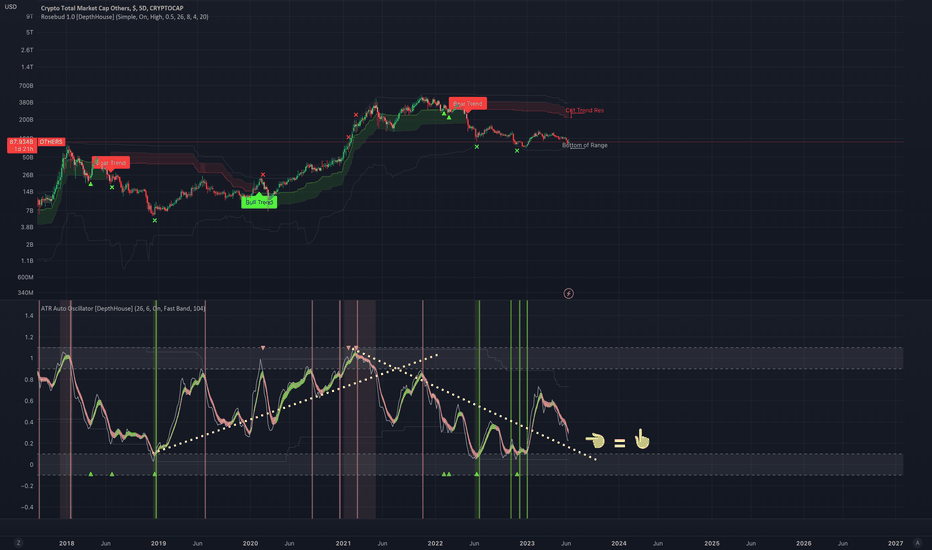

OTHERS Marketcap 1w to BULLRUN !!Others Marketcap (Altcoins) 1w Longterm

Exclude top 10 altcoins marketcap. 2015-2023 chart

1-2-3 / sword and shield

In my opinion; btc dom. uptrend will end within maximum of 1-2 months, we already know others dom. is at the bottom.

When will the ALT-SEASON come?

So how do we understand this?

To understand this, we should chech these:

The most important charts are:

1-) Btc Dominance

2-)Eth/Usd

3-)Eth/btc

4-)Total, Total2, Total3 marketcap

5-)Others dominance

6-)Others marketcap

7-)dxy

8-)Usdt dominance

9-)Btc/usd

10-)XRP/BTC

I recommend you to check all my charts to fully understand.

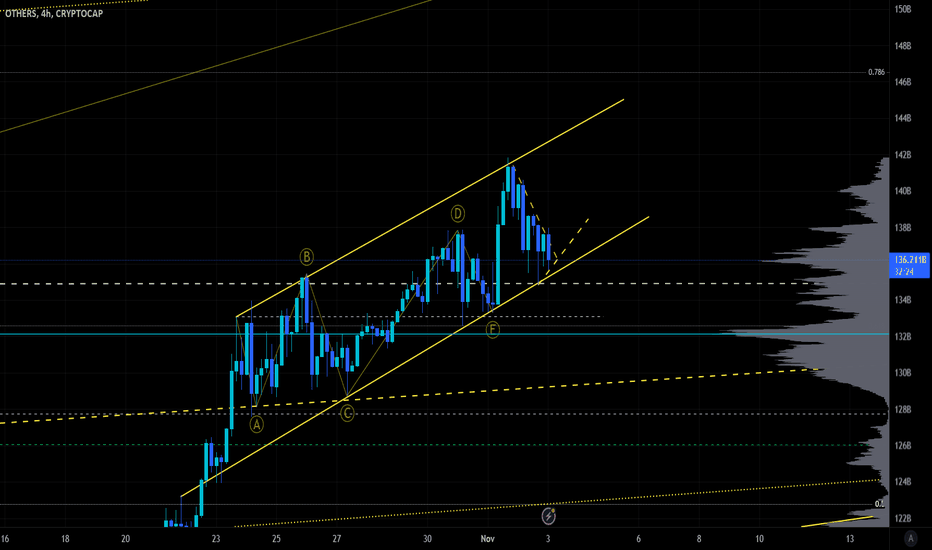

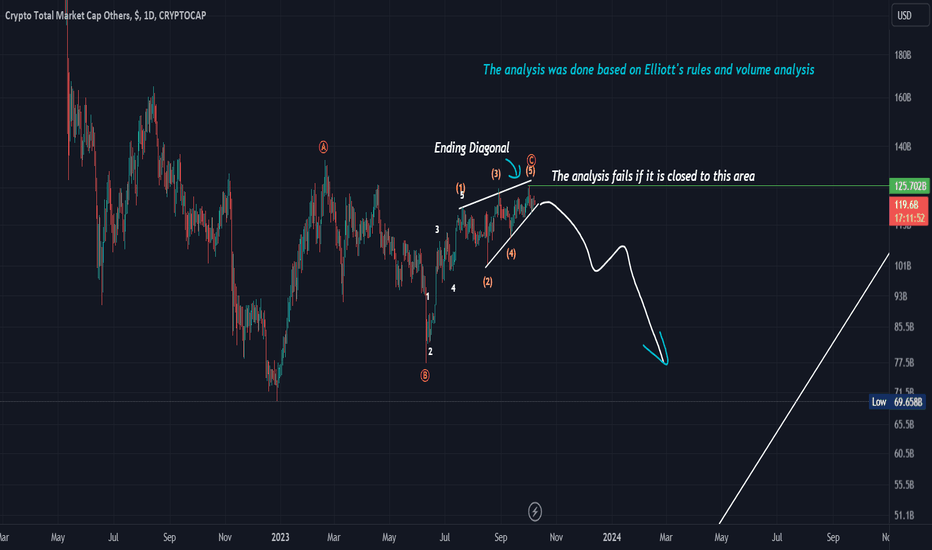

📈 Retraces & Corrections = Buy Opportunity (Think Long-Term)The bullish bias has been confirmed. Here we can see the Total Market Capitalization for the Altcoins market trading daily above EMA50 after a very strong higher low.

When we are in a bullish trend, an uptrend, all retraces and corrections can be used as an opportunity to buy-in, rebuy and reload.

Keep the bigger picture in mind.

Focus on the long-term.

Short-term noise will always happen, wild swings, FUD, shakeouts, stop-loss hunt and more... This is not enough to make you fold.

The easy and best strategy for Cryptocurrency is buy and hold.

Think long-term!

How high will the Altcoins and Bitcoin be 1 or 2 years into the future?

Namaste.

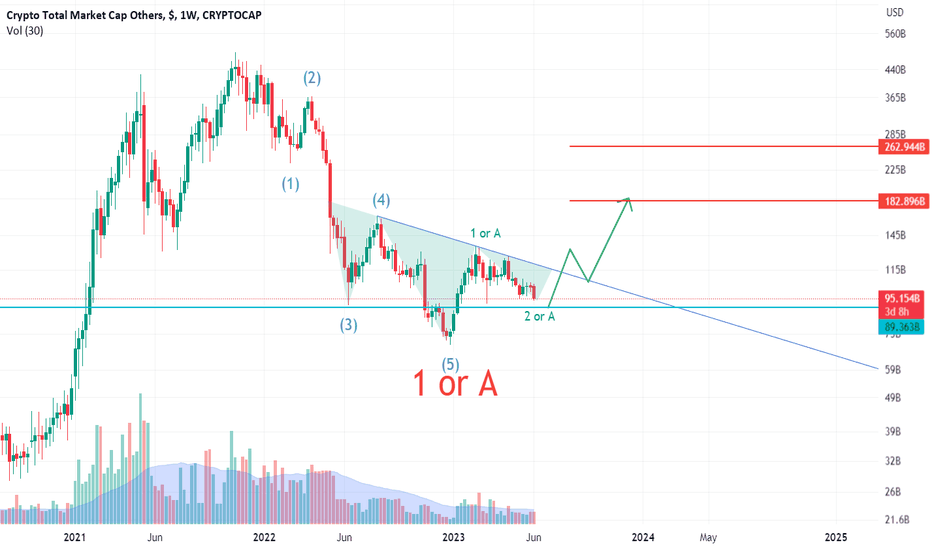

possible up-trendi hope its clear on chart

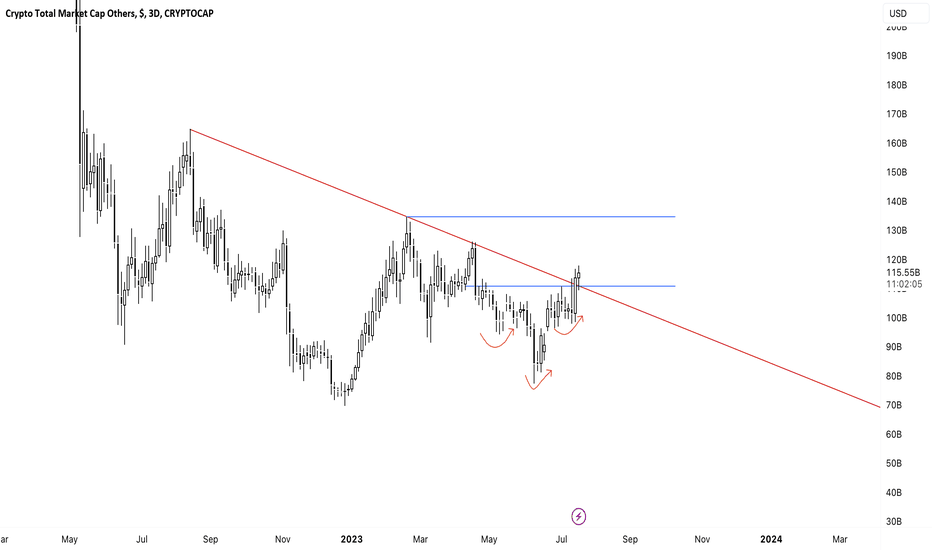

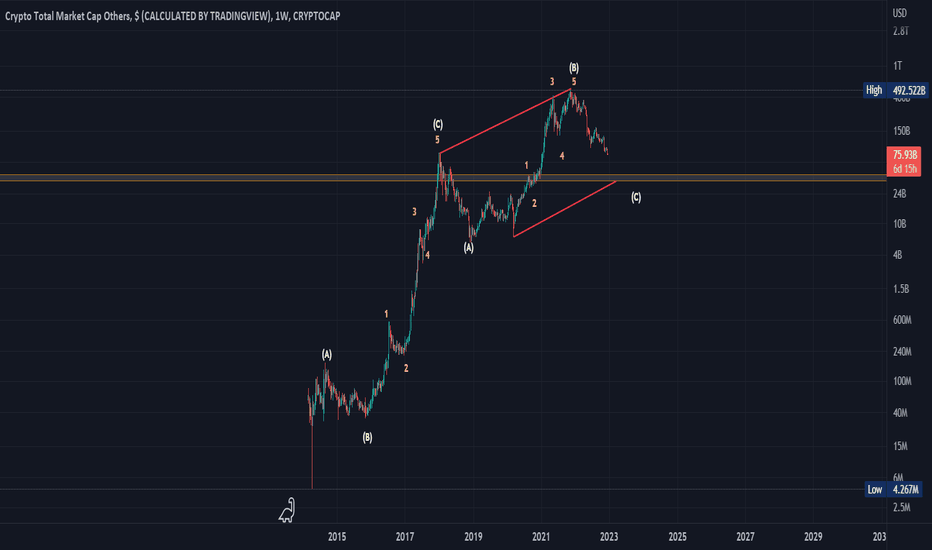

after a 5-wave descend, price has made 2 waves:( 1 or A ) and ( 2 or B )

from this point it need to make ( 3 or C ) wave that can go up to 180 - 260

if we also want to approach this from a classic point of view there is also

a possibility for a bottom head and shoulders with a tp of 260 - 300

i am telling you this to get ready because if there is an uptrend with 100% - 200% gain,

then you should be able to earn way more than that in altcoins

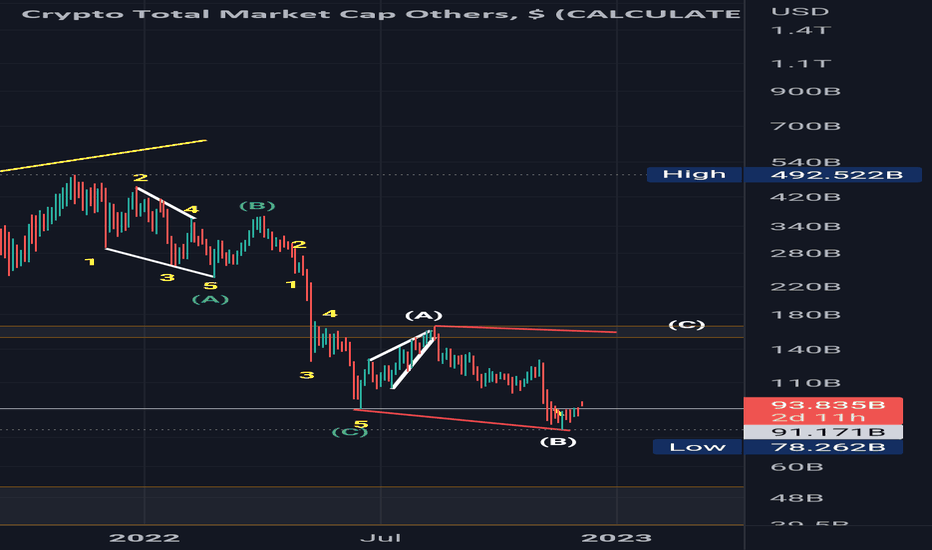

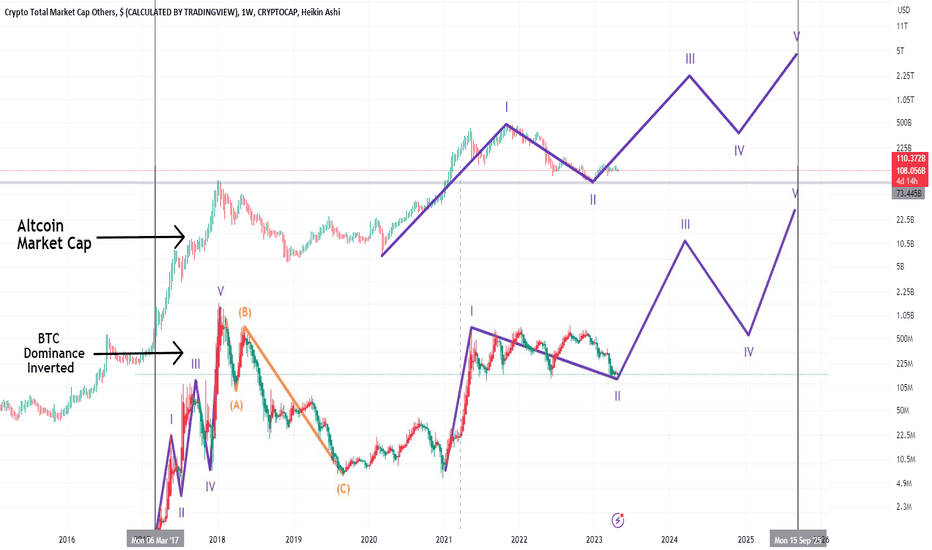

Send the 3rd!!!!This is the correlation between the BTC.D (inverted) with the altcoin market cap chart. It's hard to deny that both only had the 1st wave of their supercycle and are gearing up for the 3rd wave (the tsunami).

My theory is that the altcoin market cap and the BTC.D charts are one impulse wave below the BTC price wave count. So, BTC is having the 1st wave of its supercycle and the BTC.D (inverted) and the Altcoing Market cap are finishing the 2nd correction wave and entering their 3rd wave.

BTC pumping in the 3rd wave of the 5th supercycle wave = Altcoins pumping in the 3rd wave of their supercycle = BTC.D falling (3rd wave)

BTC correcting in the 4th wave of the 5th supercycle wave = Altcoing correcting in the 4th wave of their supercycle = BTC.D rising (4th wave)

BTC pumping in the 5th wave of the 5th supercycle wave = Altcoing pumping in the 5th wave of their supercycle = BTC.D falling (5th wave)

BTC starts correcting from the Bullcycle top = Altcoins still pumping in the 5th wave = BTC.D rising (correcting if looking the inverted)

We are having an altseason soon, and that will surprise a lot of people, I mean a lot!

OTHERSDisclaimer

High Risk Investment

Trading cryptocurrencies and Forex carries a high level of risk, and may not be suitable for all investors. Before deciding to trade cryptocurrency you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with cryptocurrency and Forex trading, and seek advice from an independent financial advisor. Since Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary, and does not constitute investment advice. The Bibres will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. All opinions expressed are owned by the respective writer and should never be considered as advice in any form.

A qualified professional should be consulted before making any financial decisions.

-----------------------------------