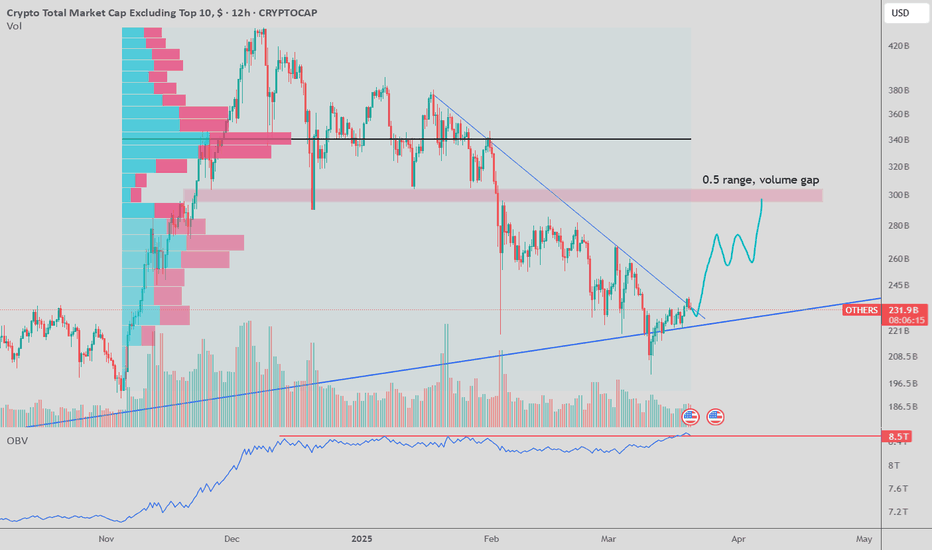

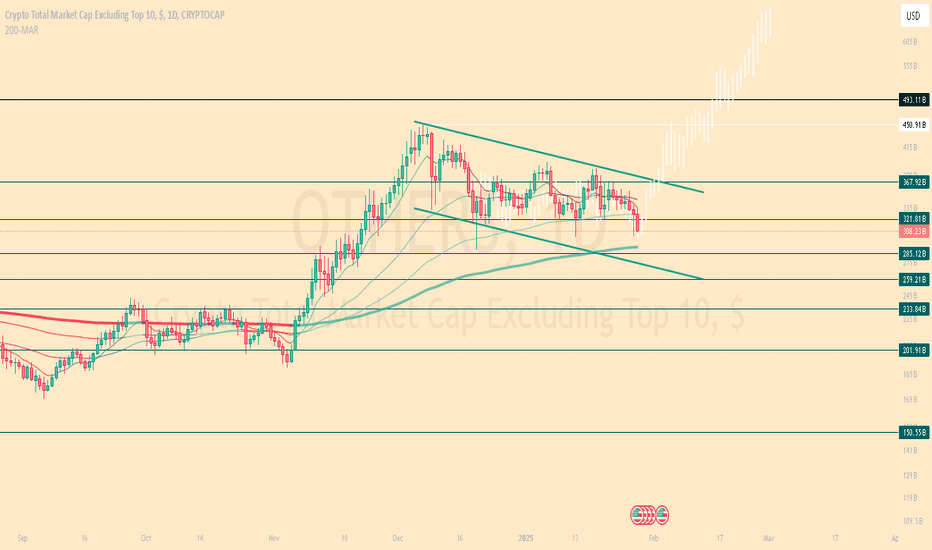

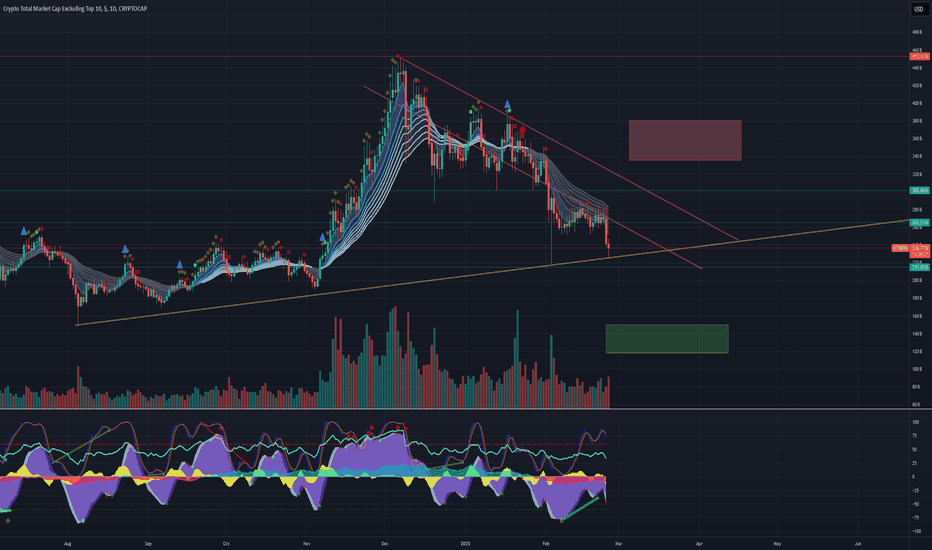

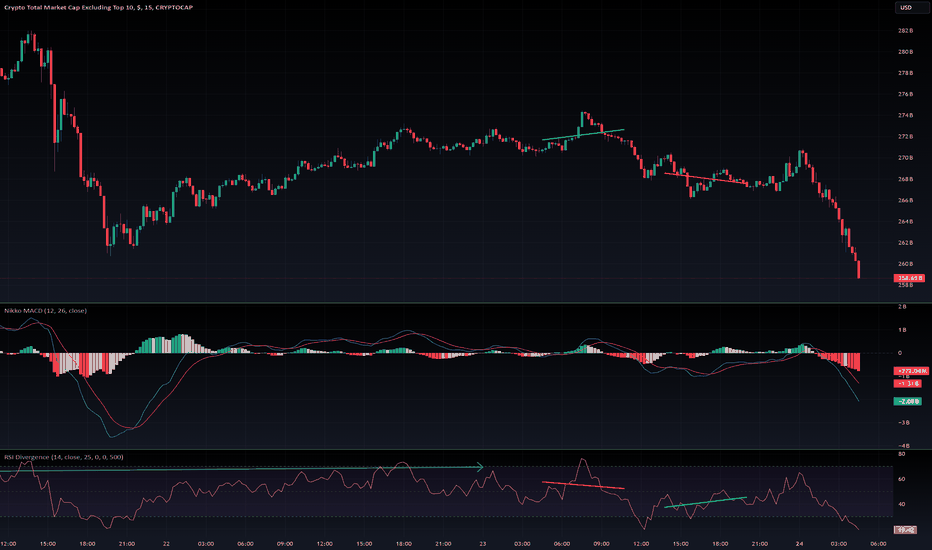

Altcoins Targeting the $300B Mid-RangeHey everyone! Let’s dive into the current state of the altcoin market with this 12H chart of the Crypto Total Market Cap Excluding Top 10 ( CRYPTOCAP:OTHERS ). Here’s what I’m seeing:

🔹 Altcoins Halting the Free Fall: The altcoin market has finally stopped its free fall. We’re seeing a bullish divergence forming on higher timeframes, and while Bitcoin dominance continues its upward trend, it’s likely at or very close to a local top. Of course, a black swan event could change everything, but from a technical perspective, I don’t see this as the start of a bear market—just a correction and another phase of accumulation.

🔹 OBV Signaling Accumulation: Interestingly, the On-Balance Volume (OBV) for CRYPTOCAP:OTHERS has been indicating accumulation despite the decline over the past two months. Even more telling, the OBV on the 12H timeframe has just hit a new higher high, which is a strong bullish signal.

🔹 What’s Next?: Right now, CRYPTOCAP:OTHERS is attempting to break above a diagonal resistance that has been in place since January 25th. If this breakout is successful, I’d feel confident placing my buy orders. I wouldn’t wait for further downside—more likely, we’ll spend a few months in a range. Within this range, the $300B level is particularly interesting because it’s roughly the midpoint of the range, where the price will likely be drawn to at least sweep liquidity. The horizontal volume profile supports this view: the $300B level falls within a Low Volume Node (LVN) zone, indicating a volume gap. This gives the price an additional reason to push toward this level to reclaim it in the near term.

🔹 Potential Scenarios: If we break above the diagonal resistance and reach $300B but then reverse lower, I’ll close my short-term buys and wait for a return to the lower end of the range. In that case, we might be in for a longer consolidation period, potentially following a Wyckoff accumulation schematic. On the other hand, a successful breakout could set the stage for a more sustained move higher toward the Point of Control (POC) level.

Wishing everyone good luck and profitable trades! 🍀📈

OTHERS trade ideas

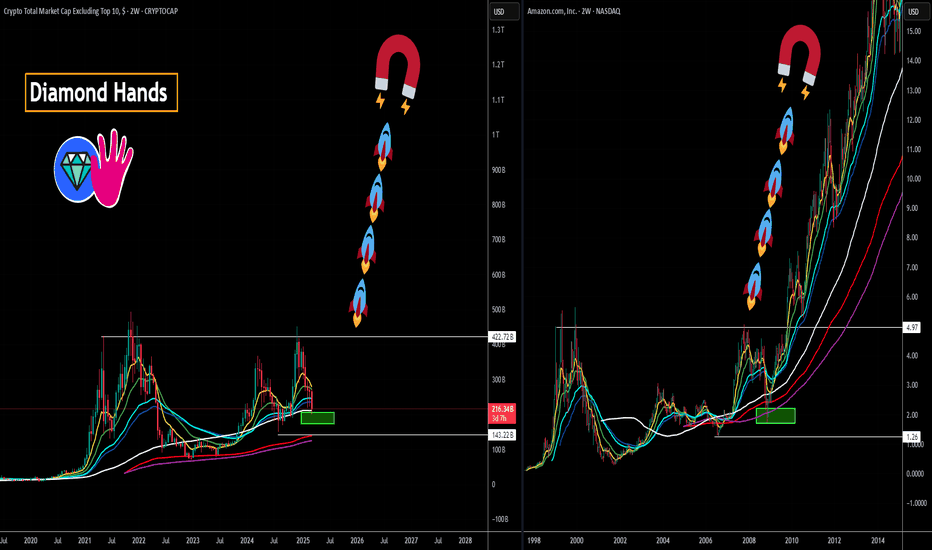

Lets Make Life Changing Money TogetherMartyBoots here , I have been trading for 17 years and sharing my thoughts on CRYPTOCAP:OTHERS .

.

CRYPTOCAP:OTHERS is looking beautiful , absolutely beautiful and a very interesting chart for more upside, it is now getting into support. Just like NASDAQ:AMZN did back in 2008.

Do not miss out on CRYPTOCAP:OTHERS as this is a great opportunity to make life changing money on ALT Coins.

Regulation is going to moon this market

Be Ready

Watch video for more details

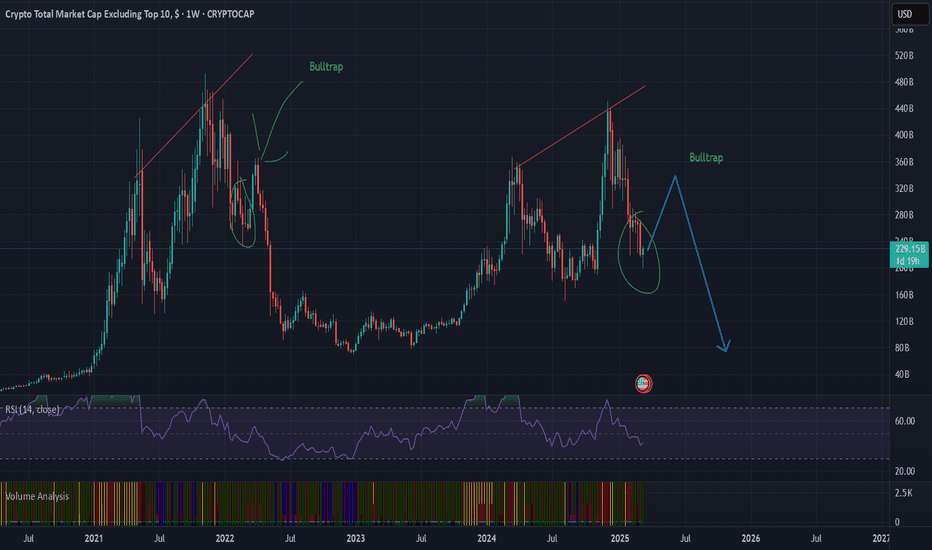

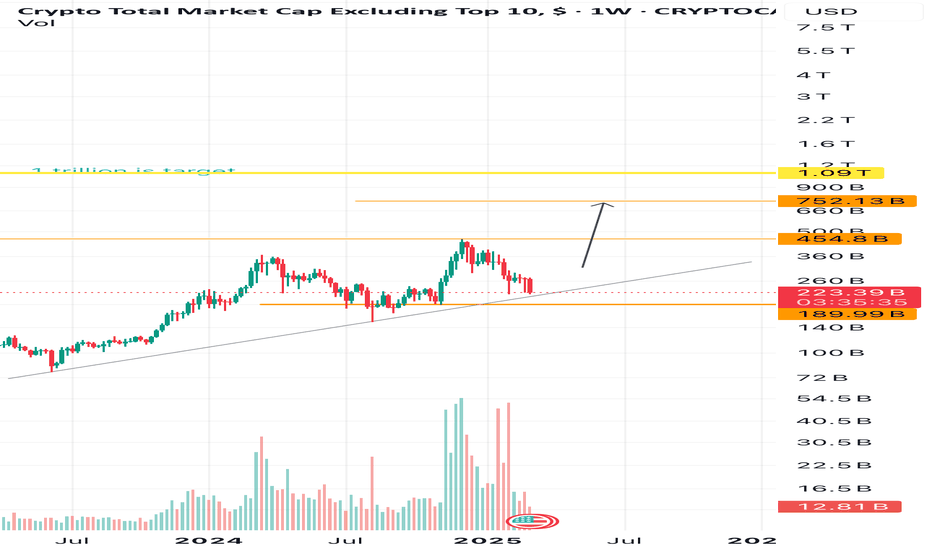

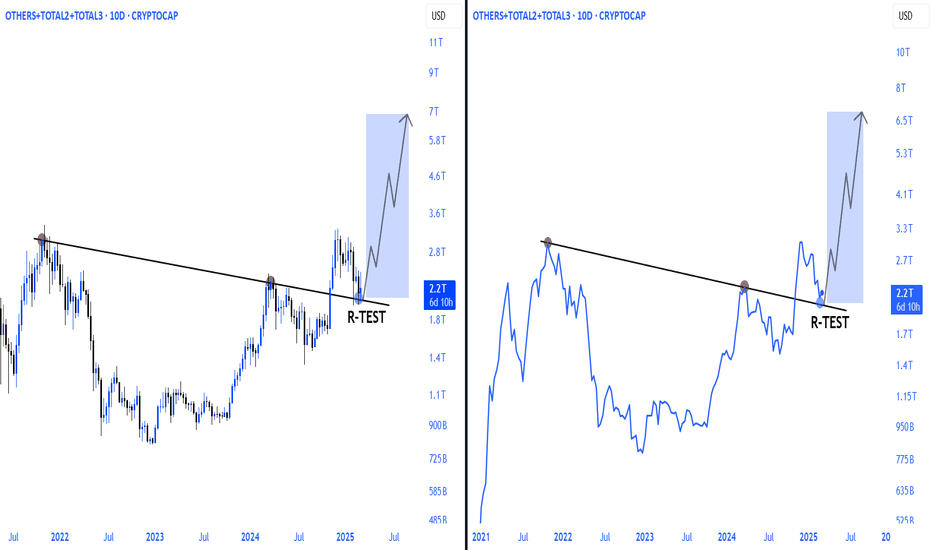

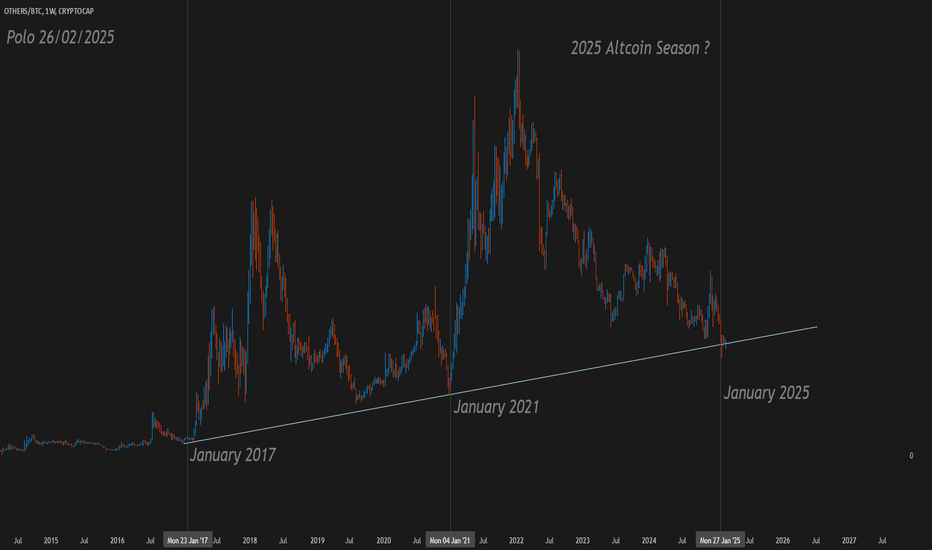

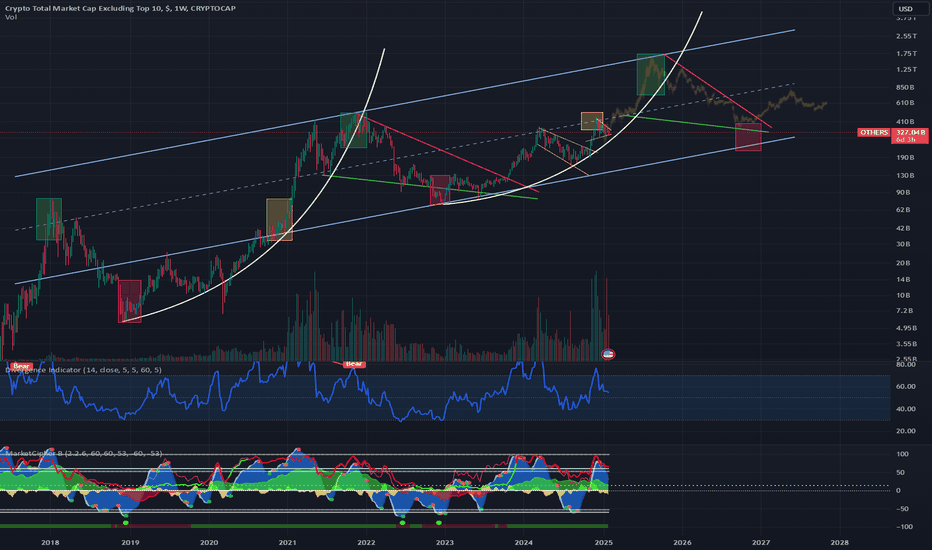

ALTS Brutal altseason is about to start.The altcoin market cap just hit its 1week MA200, right at the bottom of the 2.5 year Channel Up.

This has completed a -57.89% decline from the most recent High, the same decline percentage as the ones that formed the August 5th 2024 and December 26th 2022 bottoms.

The 1week RSI has also almost hit its 2 year Support.

If bullish waves are as symmetric as bearish waves, we can expect at least a rapid rise / ALTSEASON to 575 B (+199.05%).

If the market structure follows the June 2023 - March 2024 bullish wave, we can expect a more brutal rally to the 2.0 Fibonacci extension at 865 B.

Follow us, like the idea and leave a comment below!!

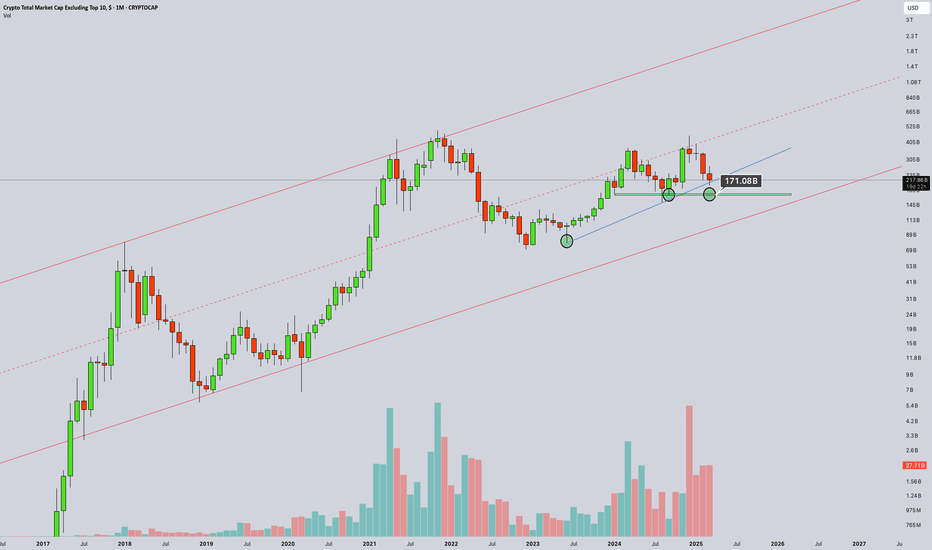

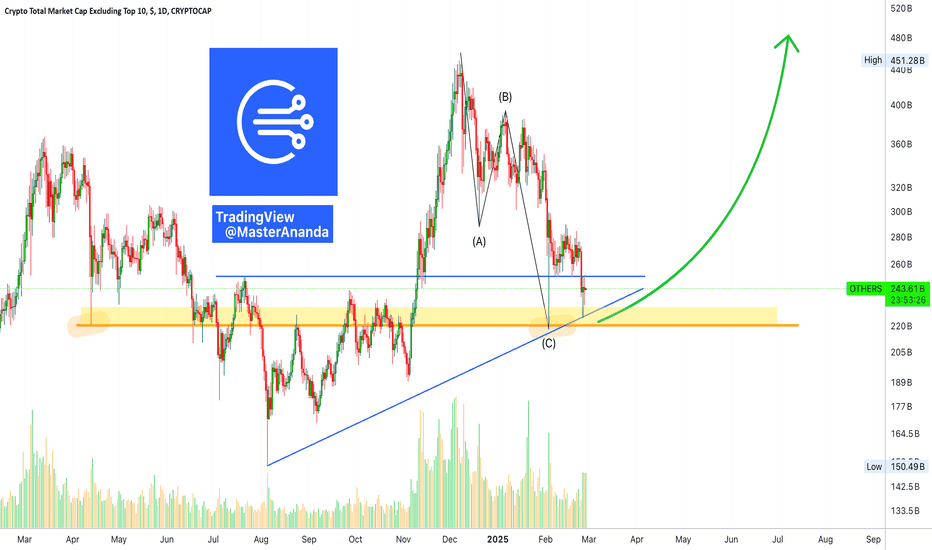

Crypto Total Market Cap Excluding Top 10 (CRYPTOCAP:OTHERS)The Total Market Cap of altcoins (excluding top 10) is showing a promising setup at 171.08B. Here’s the breakdown:

Price has bounced off a long-term ascending trendline (red) that’s been in play since 2017 – a historically strong support.

We’re currently testing a key resistance around 171B (blue line), with a recent volume spike supporting the move.

A break above 171B could open the door for a push toward the next major resistance at 217.88B in the coming months.

On the downside, if this level rejects, watch for a retest of the trendline around 148B.

💡 Trading Idea: Look for a weekly close above 171B to confirm bullish momentum. Volume will be key – sustained buying pressure could signal a breakout.

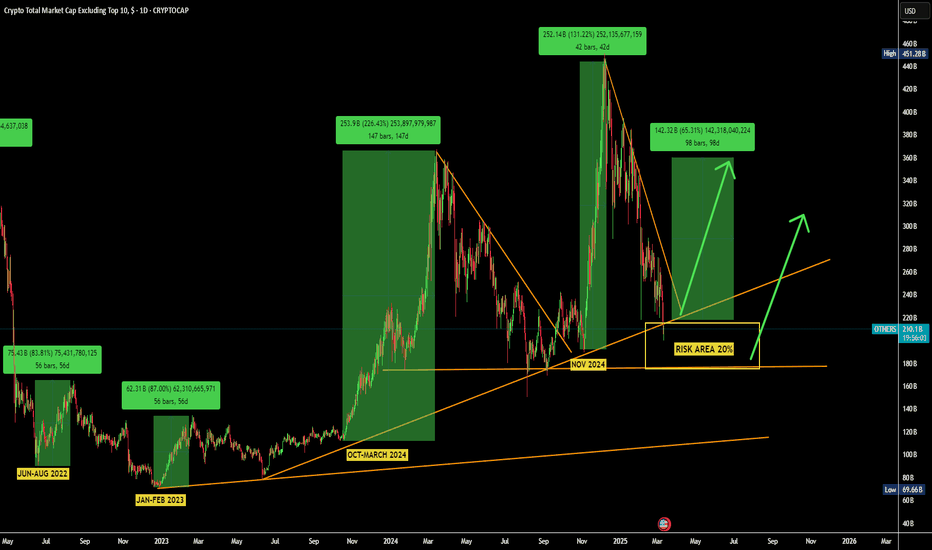

#ALTS market: What is next#ALTS market: ALTS market enter in 20% risk zone as NASDAQ drop 4% in first day week.

Understand the key Level: BTC support zone $77k, FWB:73K , $69k as of now. We expect local bottom around it.

Nasdaq drop near 13% from its high and it can be more if uncertainty continue.

Bitcoin and ALts market oversold and they will bounce if Nasdaq give a relief rally.

So understand that 20% risk box if btc visit towards FWB:73K and reward will be minimum 2x as a relief rally from this point.

CPI number will come tomorrow which can again give volatility.

But all Major eye on FOMC meeting on March 19 which decide next move of market.

#crypto #ALTSEASON

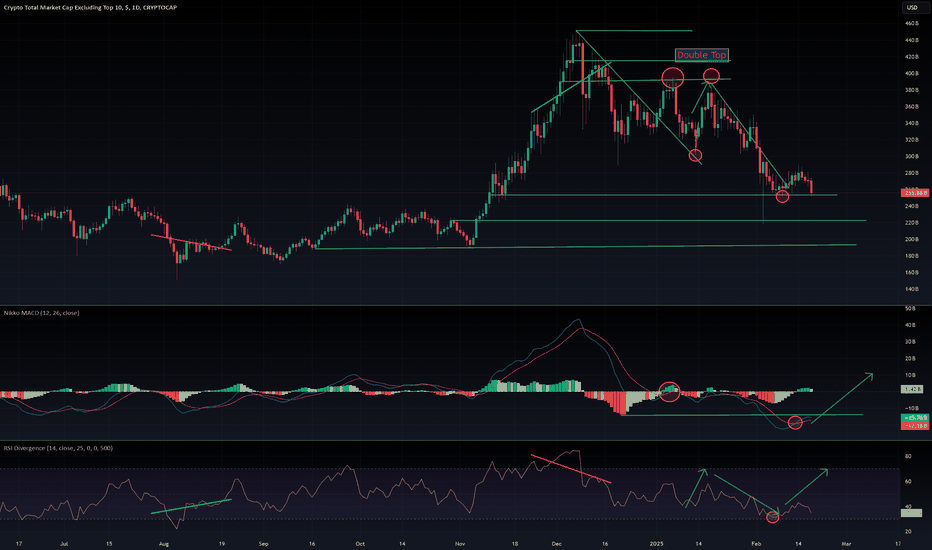

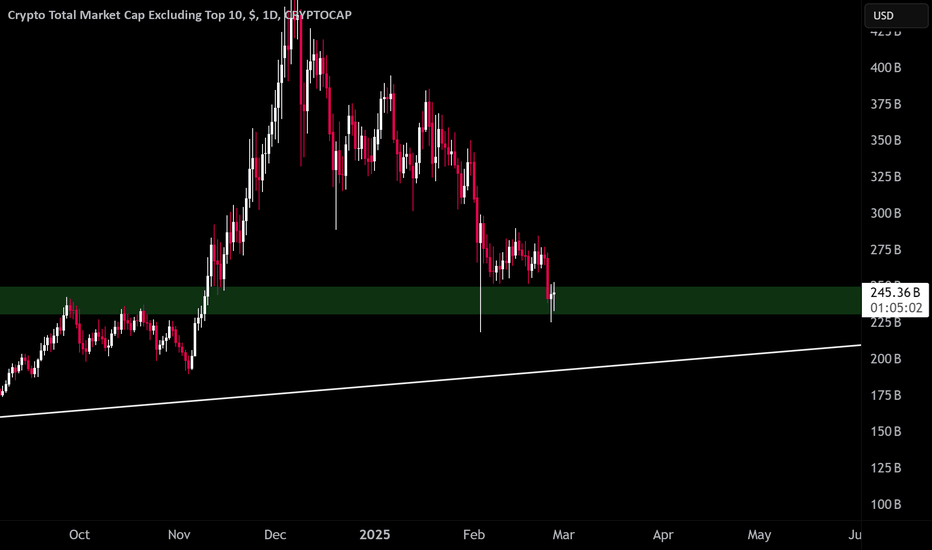

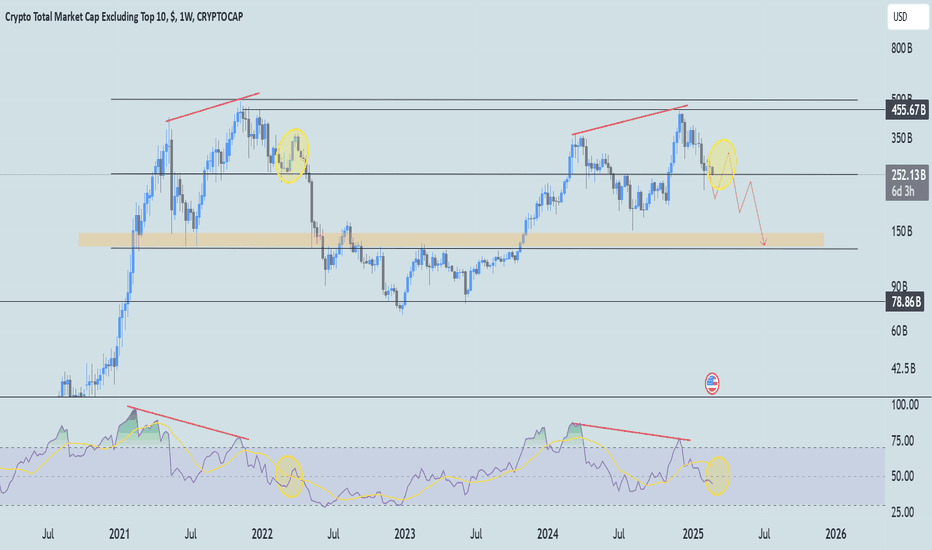

$OTHERS seems to have reached the bottom,Has CRYPTOCAP:OTHERS Finally Bottomed? Is It Time for Altcoins to Recover?

CRYPTOCAP:OTHERS has been struggling with a bearish double top and a negative divergence, leading to a massive sell-off. The altcoin index (excluding the top 10 cryptos) lost half of its market cap, bottoming out at $255B—a critical support level.

Breaking below this support would be a disastrous scenario. However, signs of recovery are emerging:

✅ RSI is at the bottom, indicating a potential rebound.

✅ MACD (daily) has made a bullish crossover, hinting at momentum shift.

These signals suggest the bleeding might be over, and capital could soon flow back into riskier altcoin assets.

DYOR!

OTHERS looking very interesting..I think OTHERS is about to show some strength personally. The Daily is rounding to the bottom and price action is showing steeper upward movement. These are the targets is either side breaks. I would like to see at least a quick capitulation down to the green area before I would recommend diversifying into these assets/memes/god only knows.

#NFA #Godspeed

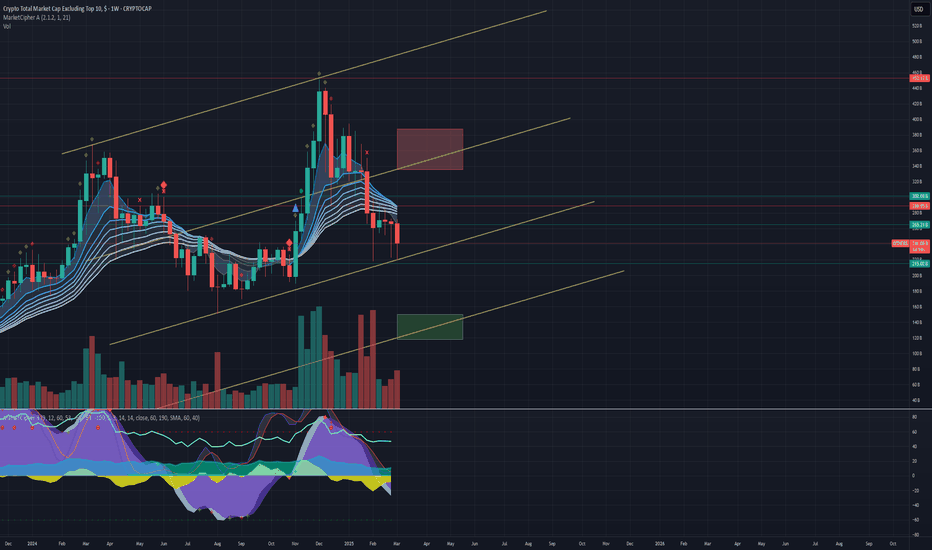

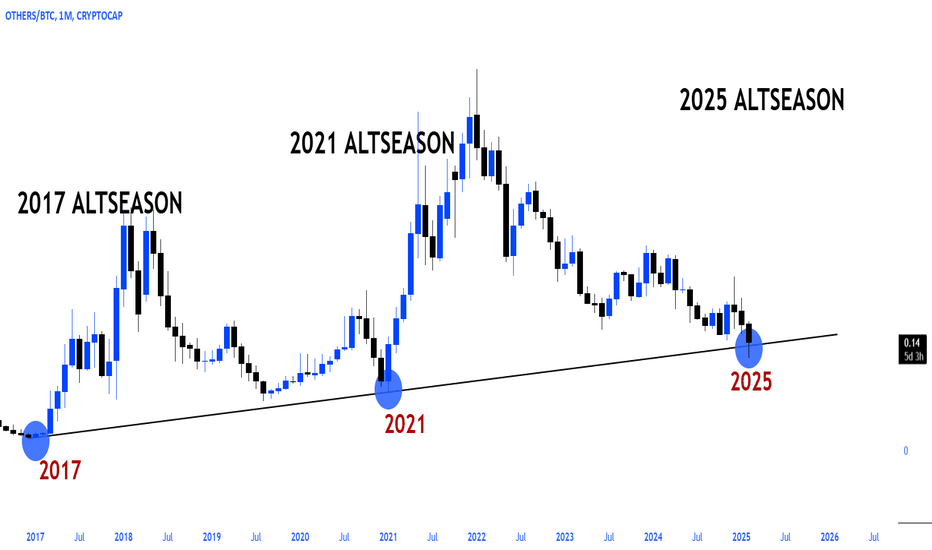

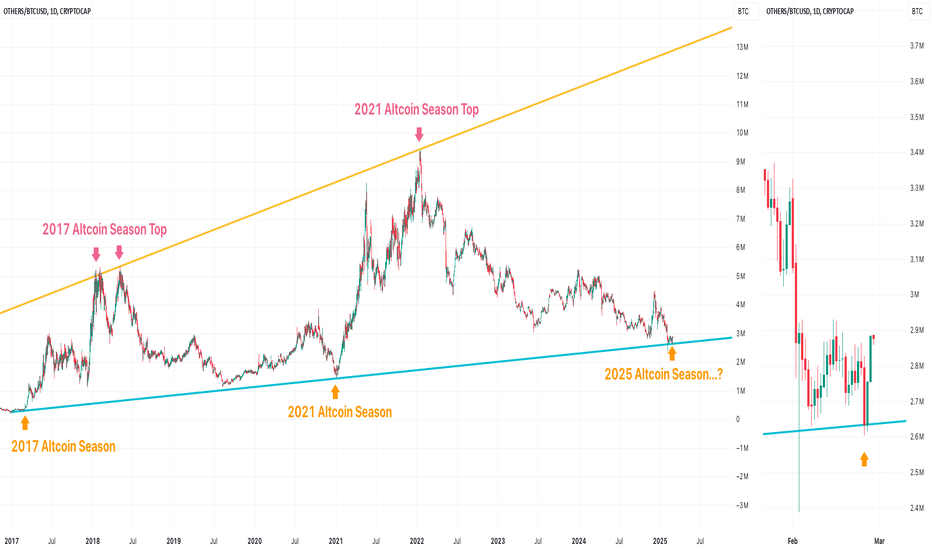

Altseason Might Still Come...? Here's Why:A contrarian take—altcoin season could still be on track, and the script hasn’t been broken.

🔥 Left chart:

Before the past 2 altcoin seasons, the market touched the trendline (light blue) and consolidated at the lows.

🔥 Right chart:

Over the past two days, BINANCE:BTCUSDT saw a sharp drop, yet altcoins ( CRYPTOCAP:OTHERS.D ) gained against BTC for two consecutive days, showing a decoupling from BTC’s price action.

One key characteristic of altcoin season is when altcoins rally with CRYPTOCAP:BTC but don’t drop when BTC falls.

What do you think?

Leave a comment!

🔴 Read my signature & publications for more info you don’t want to miss.

🔥 for more future "guesses" like this!

Do Not Sell Anything: BUY or HOLD!I don't know why but there is always something that inspires us to sell at the bottom and buy at the top. Why is this?

Do not sell anything. Do HOLD now and hold easily and patiently because very soon we are going up.

If you are feeling anxious or panicky or just shaky in whatever way, feel free to disregard this feeling because this tends to happen when the market shakes.

Here we have the OTHERS index chart. Notice how trading volume continues to move lower; how the current daily action is sideways; and how today compared to the 3-Feb. low we have a higher low. This is all you need to know.

Bullish volume is also dominant; bearish volume is very low.

This all means that the bottom is already in. We are at the bottom, close to the bottom and this only means one thing; Once the bottom is hit we can only go up.

The worst time to sell is now. The time is now to either buy or hold!

What are you doing today my dear friend?

I am buying Cryptocurrencies at a discount. This is awesome.

Thanks a lot for your continued support.

Namaste.

OTHERS/BTCDoes the smaller cap crypto market bounce here or are we setting up for one more leg down?

Me personally I think this is a huge bounce zone. If the line gets broken to the downside I expect a very quick wick recovery within a week.

BTC Dominance looks like it's about to put in a Daily Bearish Divergence which would align with a temporary altseason to bring in the early retail before the summer lull of the markets. Be Prepared For Anything!

#NFFA #GodSpeed

Altseason 2025: Bitcoin’s Next Phase, Thrill and Euphoria So, it seems that we are on track with the 4-year cycle, with our target to at least 150k for BTC, and entering the next phase: thrill, euphoria and altseason.

Of course, it’s not “up only” from here, and we do have specific market conditions that must align for this scenario to play out:

Bitcoin follows the 4-year cycle: Maintaining historical trends of market phases.

We remain in a crypto bull market: A rising tide lifts all boats.

Altseason begins: A period of intense growth and volatility for altcoins.

Retail money floods in: Increasing mainstream interest and participation.

Global markets are "healthy-ish": No major economic black swans.

Monetary policy shifts to QE (quantitative easing): A return to liquidity-friendly environments.

🌊 Our high risk altcoin picks for this altseason

#1 Glacier Network - best characterized as a Infrastructure, Smart Contract Platform and Layer 2 project.

#2 Karlsen Network - best characterized as a Smart Contract Platform, Layer 1 and Proof of Work project.

#3 Guacamole - best characterized as a Meme and DeFi project.

#4 Picasso Network - best characterized as a Smart Contract Platform, Layer 1 and Bridge Governance Token project.

#5 Three protocol - best characterized as a Smart Contract Platform and Payment Solution project.

#6 Octavia - best characterized as a Artificial Intelligence and AI Agent project.

#7 ZeroLend - best characterized as a DeFi, Governance and Lending/Borrowing Protocols project.

#8 LightLink - best characterized as a Infrastructure, Smart Contract Platform and Layer 2 project.

#9 enqAI - best characterized as an Artificial Intelligence project.

#10 AIT Protocol - best characterized as a Artificial Intelligence project.

#11 Juno Network - best characterized as a Smart Contract Platform and Juno Ecosystem project.

#12 UFO Gaming - best characterized as a GameFi project.

#13 AgentLayer - best characterized as an Artificial Intelligence and AI Agents project.

#14 Blendr Network - best characterized as an Artificial Intelligence and DePIN project.

#15 HyperGPT - best characterized as an Artificial Intelligence and AI Agents project.

💬 What is your top picks for this altseason?

This is not financial advice. Always do your own research before investing.

Tokenomics: How to avoid scams and fake projects?I've decided to write about the scams, Ponzi schemes, and fake projects in the crypto industry.

I'm a developer with 30+ years of experience in Web2, gaming (Unity, Unreal), and Web3. With this background, I can quickly spot fake projects riding a hot narrative that will never deliver or that mislead investors about their business model.

Meme Coins vs. Big Projects – Who's the Real Scam?

The common belief is that meme coins are scams. While some are, others have better tokenomics and fundamentals than major Layer 1 projects. On the other hand, big funded projects aren’t necessarily more honest—their scams are just more sophisticated, preying on investors' lack of technical knowledge.

Most Common Crypto Scams & Red Flags

1️⃣ Coins promising cheaper services using their own token 🚩

Many projects claim that using their token will make their services cheaper (e.g., Filecoin, Render). Why is this a scam?

If the coin succeeds and its price rises, then the service becomes more expensive—making it worse than the competition.

This contradicts their entire business model, proving it's unsustainable.

2️⃣ DeFi protocols without 1:1 backing 💰💀

Many bridges and lending protocols use their own token as collateral—this is a disaster waiting to happen (e.g., Thorchain, Thorswap).

As long as the token holds value, the system works.

But if FUD spreads, a bank run will wipe out liquidity and make the protocol insolvent—there’s no safety net.

3️⃣ Gaming projects claiming to use AI agents 🎮🤖 (It’s a lie!)

It is technically impossible to have AI-powered NPCs in a game at scale (e.g., Astra Nova).

AI agents require 12GB+ of VRAM per instance—you cannot have hundreds running in a game.

Many GameFi projects slap "AI" on their marketing because investors don’t know better.

🔍 How to spot a fake GameFi project:

No shadows on characters (e.g., BigTime, Valhalla) = outdated pre-2000s tech

"Arcade games" = nobody cares about them

League of Legends clones = LoL is 15+ years old!

Claims of 80+ devs = At EUROTLX:4K + per dev, that’s $380K/month in salaries—do the math!

Legit Meme Coins Can Be Better Than "Big Projects"

Example: CRYPTOCAP:PEPE 🐸

Despite being a meme, CRYPTOCAP:PEPE has better tokenomics than most of the top 200 projects.

✔️ No staking = No inflation (fixed supply, no endless token dilution).

✔️ No central ownership = No rug pulls (tokens distributed to the community).

✔️ Strong market makers (e.g., Wintermute).

✔️ No fake narrative—it’s just a meme, no BS.

✔️ Huge liquidity & low slippage on major exchanges.

Final Thoughts

🚫 Don’t judge a project by its marketing—check its fundamentals!

✅ Avoid inflationary projects

✅ Avoid projects with too many insiders

✅ Avoid narrative-based scams that sell you fairy tales

💡 Hope you found this post insightful!

DYOR! 🧐