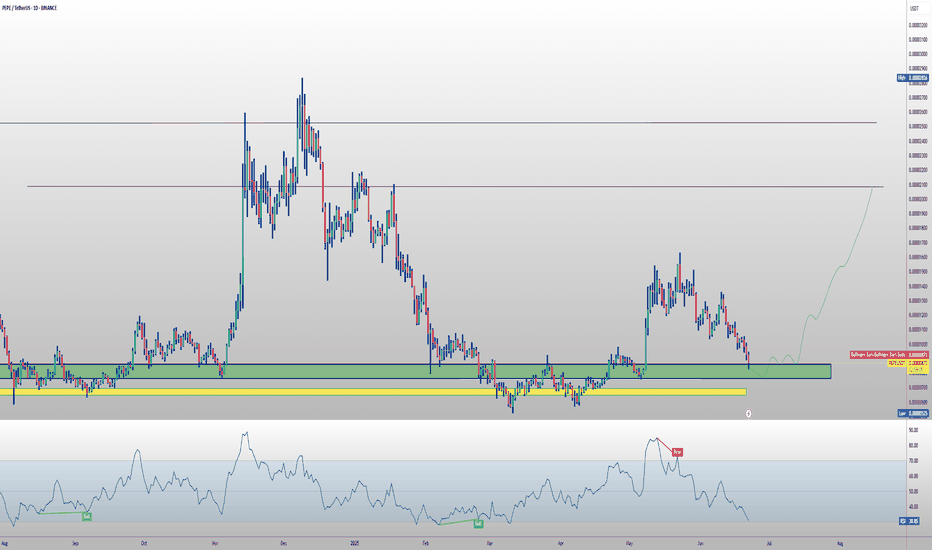

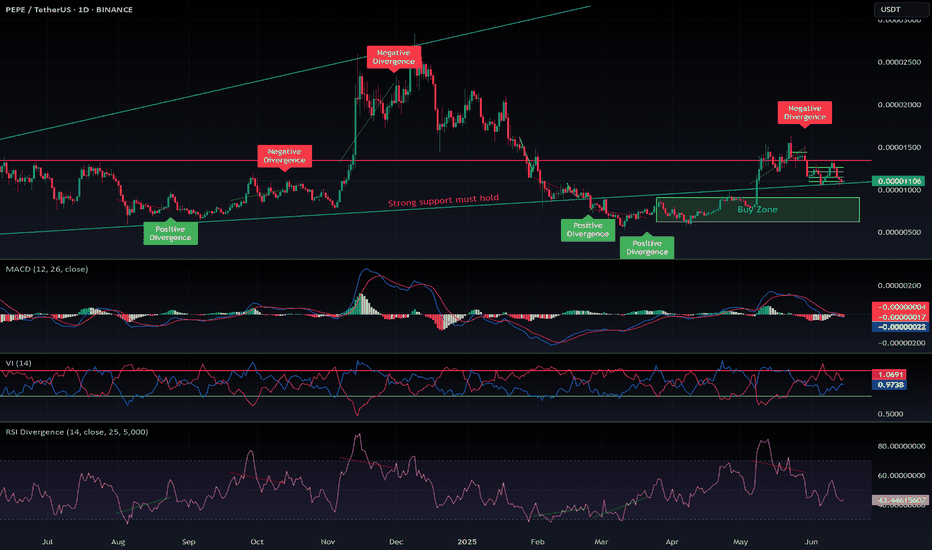

PEPE TARGETS FOR 2025🔥 CRYPTOCAP:PEPE long setup (1 D) 🚀 (#1000PEPE )

✅ Entry Zone: 0.0086 – 0.0077 (year-long demand)

🎯 Targets

• TP-1: 0.00220 (Q4-24 supply flip)

• TP-2: 0.00280 (2024 breakdown block)

⛔ Stop-Loss

Daily close < 0.0068

📊 Thesis

• 11.7 T #PEPE scooped by whales in late May 🐋

• #Kraken sp

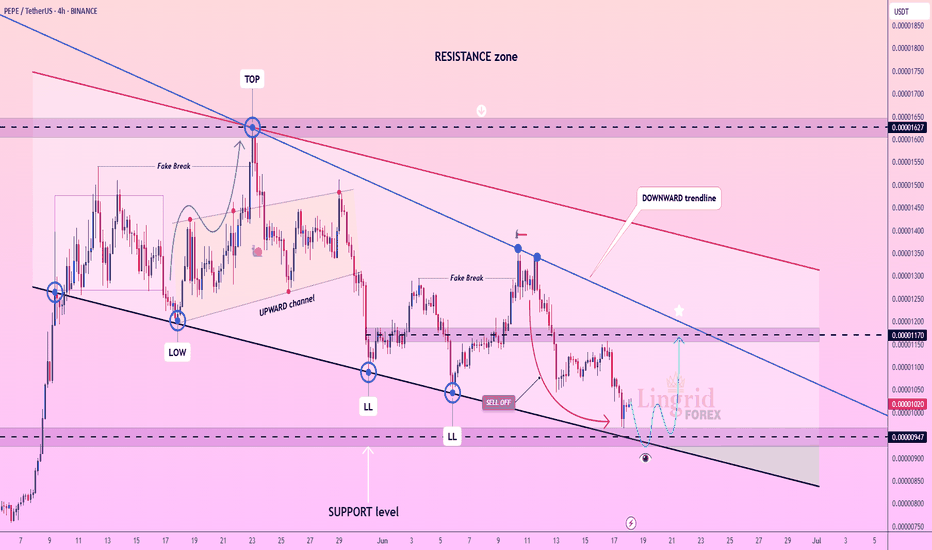

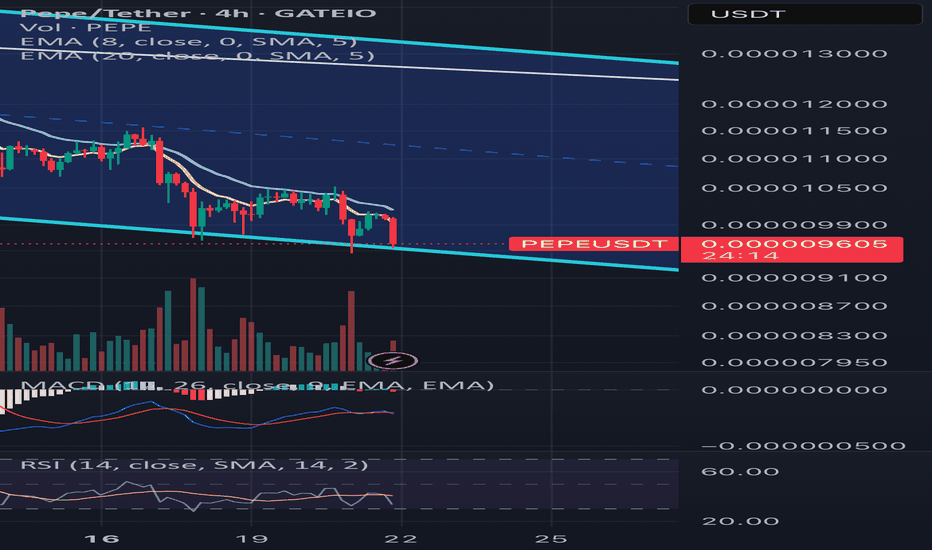

Lingrid | PEPEUSDT buying Opportunity from Support ZoneBINANCE:PEPEUSDT has extended its decline within the broader downtrend, recently forming a new local lower low at the support zone around 0.000000947. Price action is now testing the lower boundary of the descending channel and support level with potential for a short-term bounce. A break above the

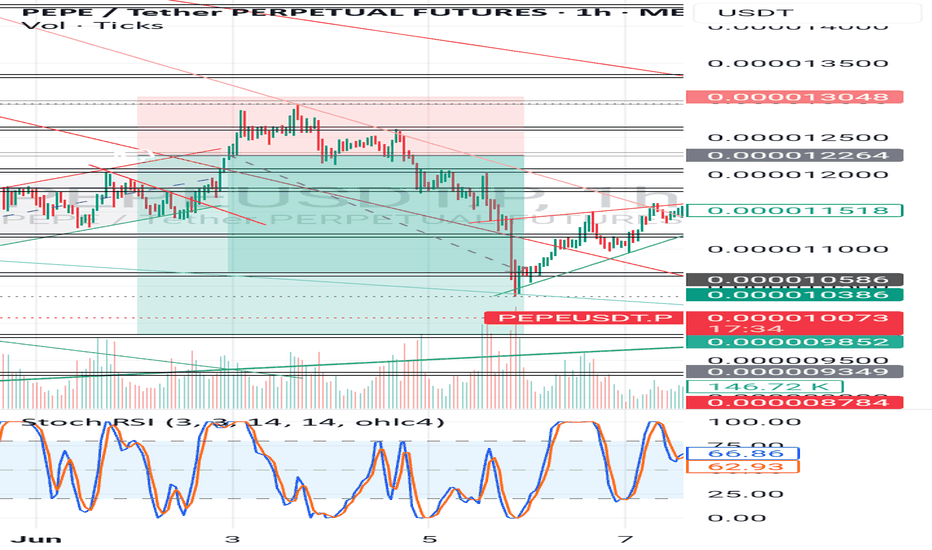

PEPE Drops -8.09% — Point of Control Becomes Key BattlegroundPEPE has posted a sharp -8.09% daily correction, confirming a new lower low in the ongoing downtrend. Price action remains bearish after rejecting from the value area high, where it tapped into the 0.618 Fibonacci retracement and failed to break higher.

This rejection triggered a rotation back towa

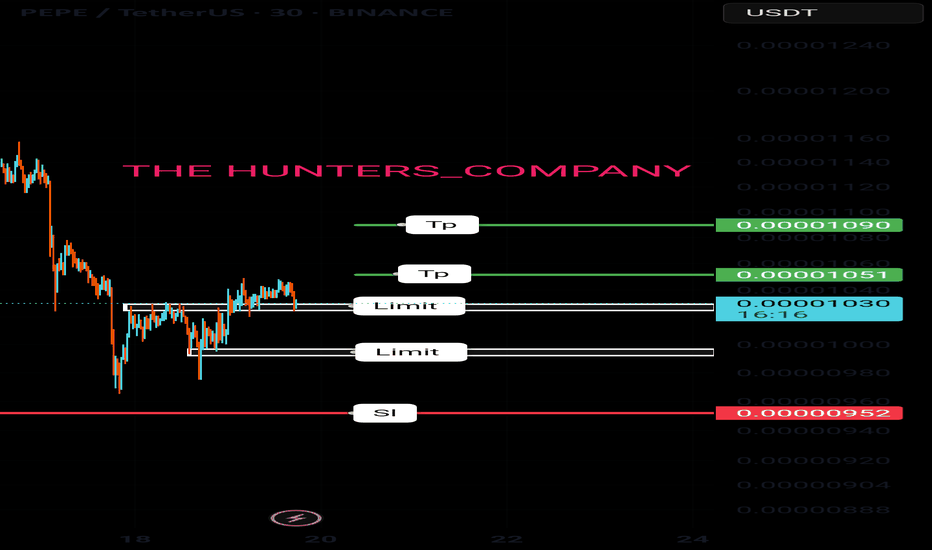

Pepe update hello friends✋️

Considering the drop we had, you can see that the price was well supported in the specified area and buyers came in. Now in the return of the price, we can buy step by step in the specified support areas and move with it until the specified goals, of course, with the management of sh

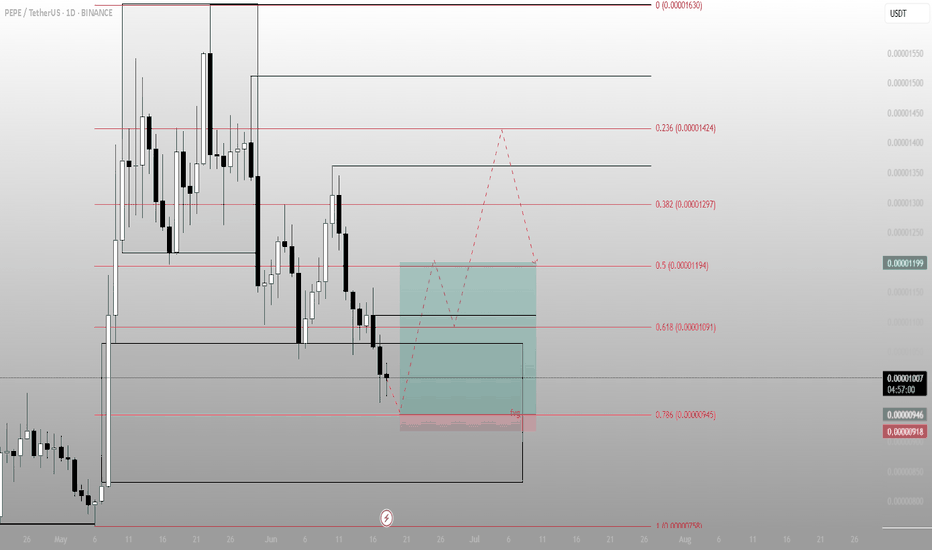

Most see capitulation. I see clean premium-to-discount deliveryPEPE just swept deep into the 0.786 retracement — right where most fear sets in. But Smart Money? This is where they reaccumulate. The structure isn't broken — it's resetting.

Here’s what the chart tells me:

Price dipped straight into the FVG + 0.786 (0.00000945) zone

That's the deepest discount

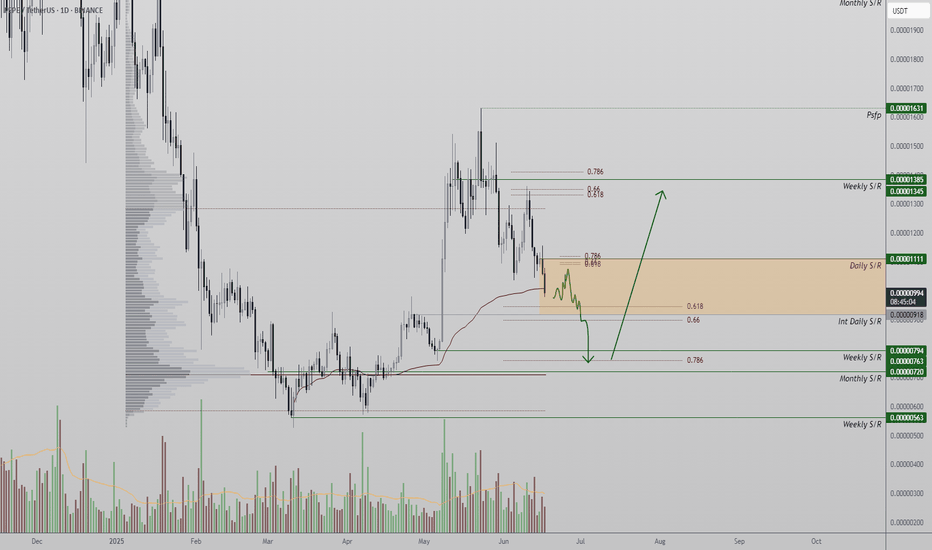

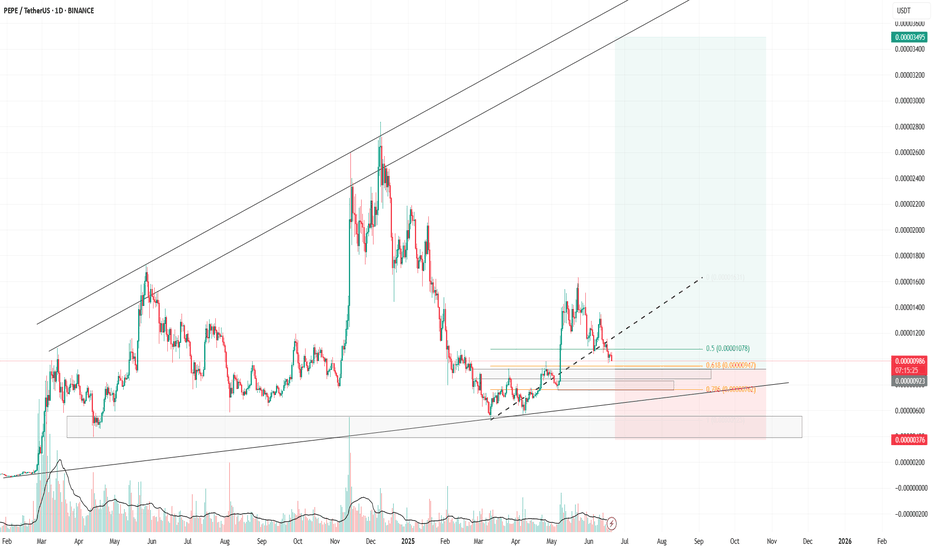

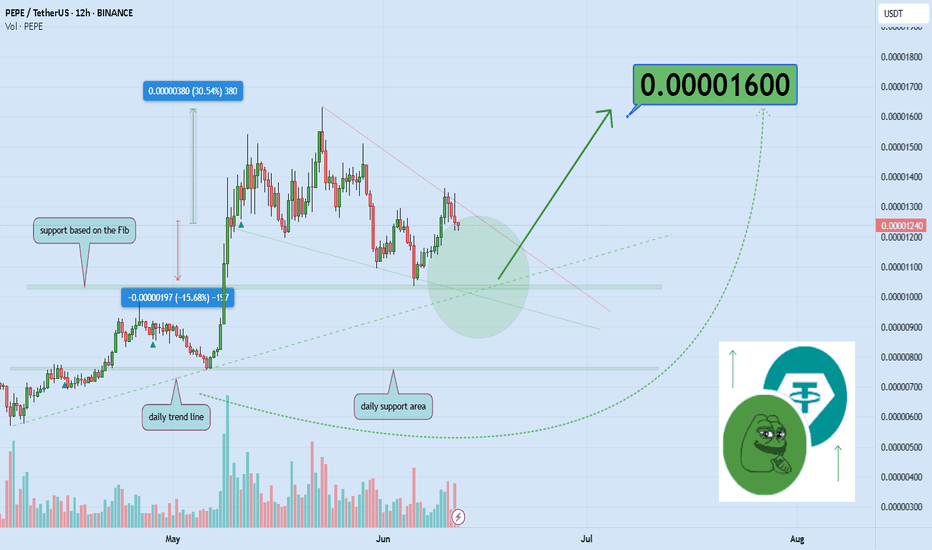

$PEPE follow up for June 2025Follow-up on my previous CRYPTOCAP:PEPE analysis — it played out exactly as expected.

CRYPTOCAP:PEPE remains my top meme coin, backed by some of the strongest tokenomics in the space. When altseason hits — if it hits — this one is primed to pump hard.

Like most altcoins right now, CRYPTOCAP:P

Minimize Big Losses by Managing your EmotionsHow many times have your emotions taken control in the middle of a trade? Fear, greed, or stress can be a trader’s worst enemy.

This analysis teaches you how to manage your emotions to avoid big losses and look at the crypto market with a more professional eye.

Hello✌

Spend 3 minutes ⏰ reading

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.