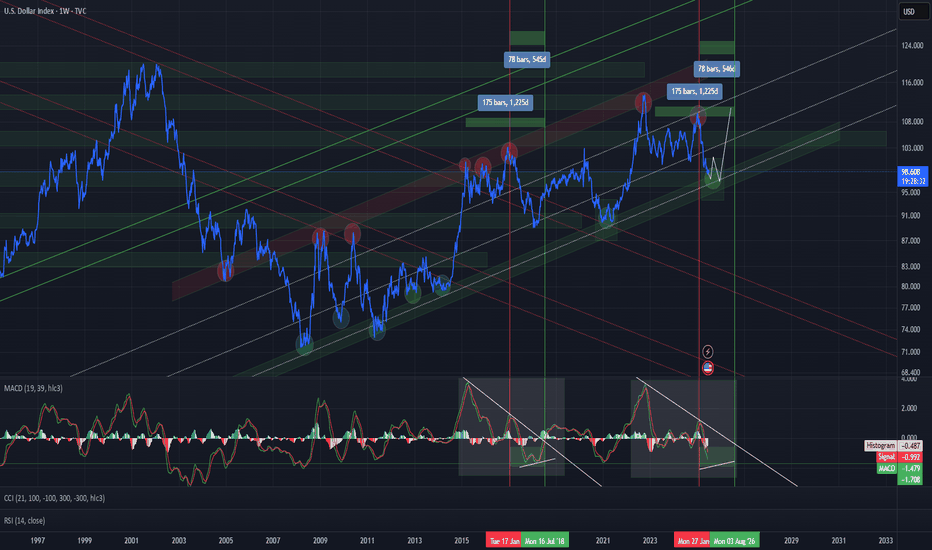

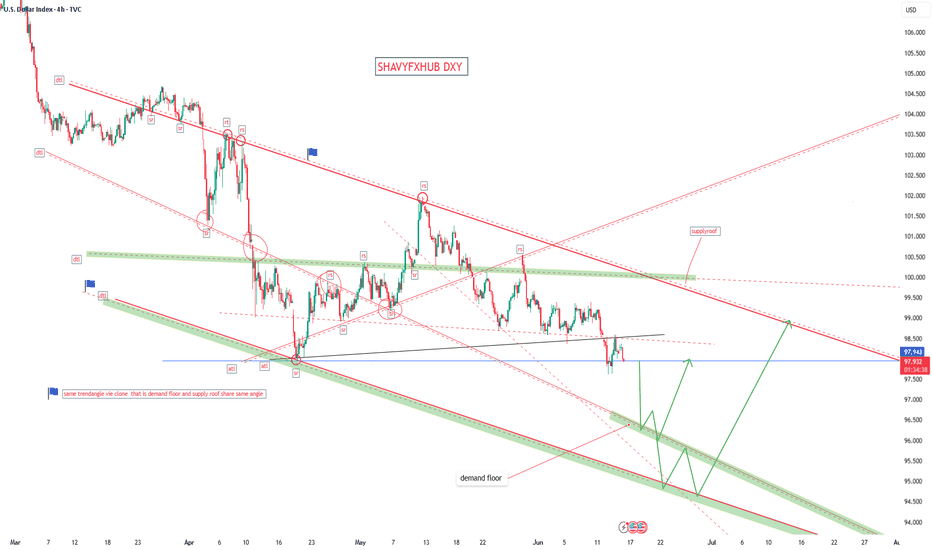

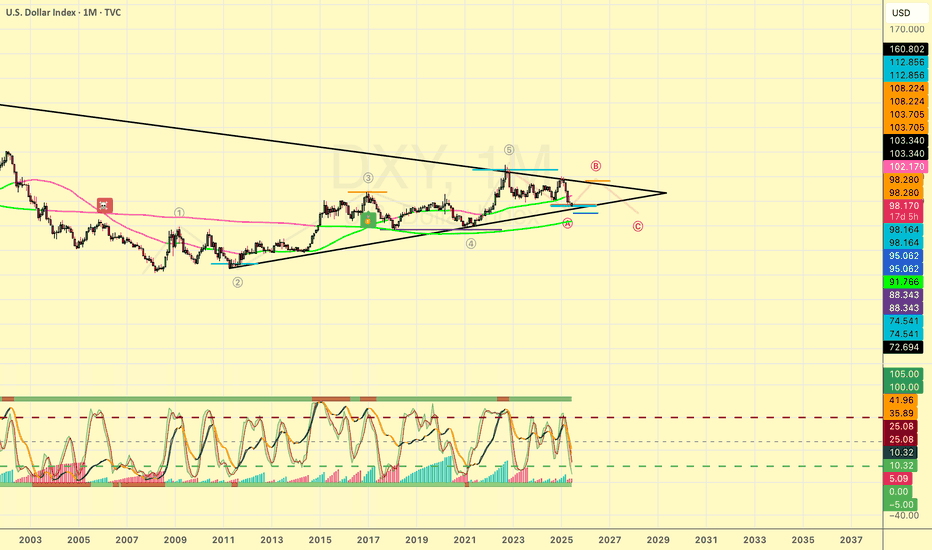

DXY US DOLLAR INDEXAs we can see on the chart, there’s a clear pattern emerging. The current movement of the index closely resembles the price action we saw between April 2015 and August 2018.

Assuming this fractal continues to play out, we could see more sideways movement until the end of the year — before a potential trend reversal kicks in.

USDX trade ideas

US dollar, a potential bullish divergence to watchThe US Federal Reserve (FED) recently updated its economic projections against a backdrop of growing uncertainty. It is now openly concerned about a scenario of stagflation, a combination of weak growth, persistent inflation and rising unemployment. This concern stems in particular from the as yet unquantified impact of the new tariffs imposed by the Trump administration, as well as rising geopolitical tensions, particularly in the Middle East.

Gloomy forecasts, but monetary policy still flexible

At its last meeting, the FED kept its key rate in the 4.25% - 4.5% range, while publishing gloomy forecasts for the US economy. By the end of 2025, it anticipates PCE inflation at around 3%, unemployment at 4.5% and moderate growth. Despite this worrying picture, the central bank is still planning two rate cuts this year, demonstrating its determination to support economic activity.

Nevertheless, this monetary stance is the subject of debate within the committee: ten members support the cuts, while seven believe that rates should remain unchanged. Jerome Powell, Chairman of the FED, advocates caution, insisting on the need to observe the evolution of economic data before acting, particularly in view of the delayed effects of tariffs.

The FED is faced with a dilemma: it must curb inflation without destroying growth. Its diagnosis of stagflation is harsh, but perhaps too pessimistic if inflation figures remain under control. A rate cut in September is still conceivable, but will largely depend on the evolution of geopolitical tensions and international trade in the weeks ahead.

Below, you can see the table with the latest update of the FED's macroeconomic projections

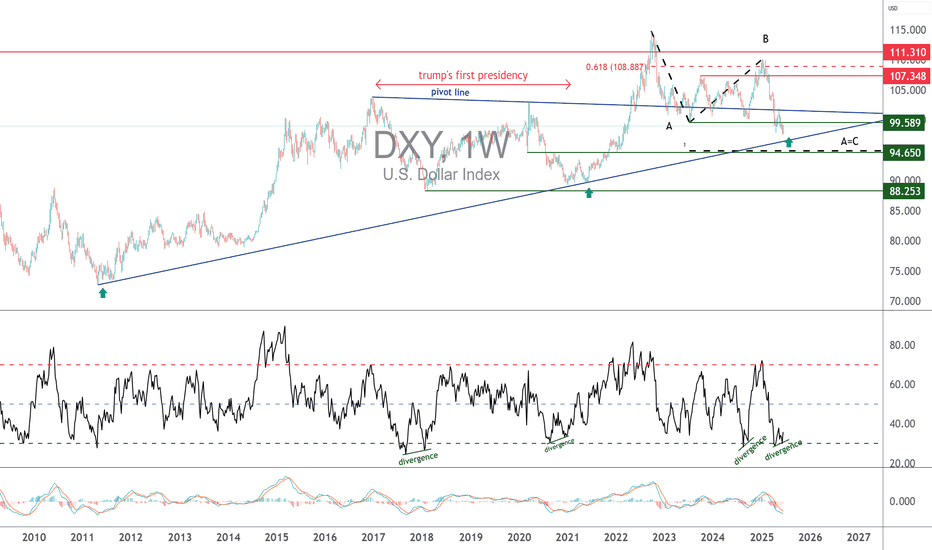

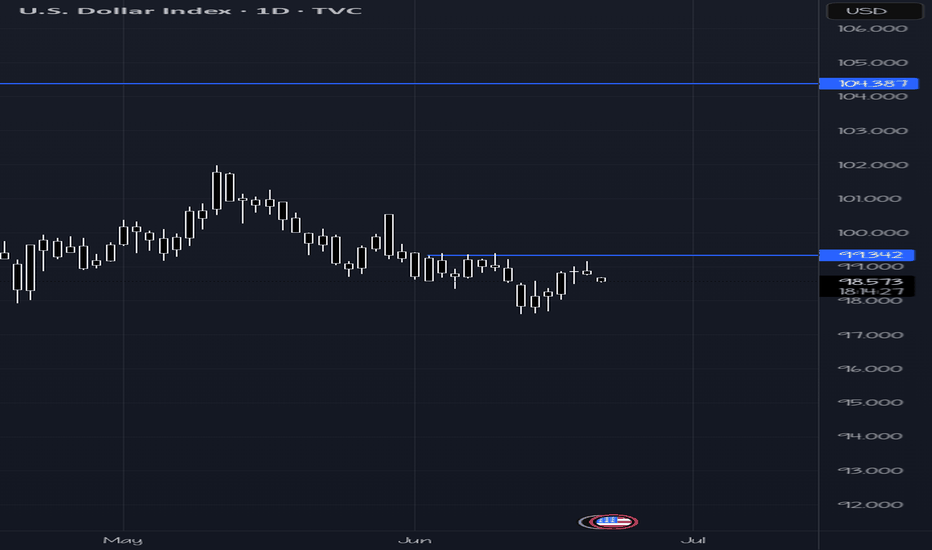

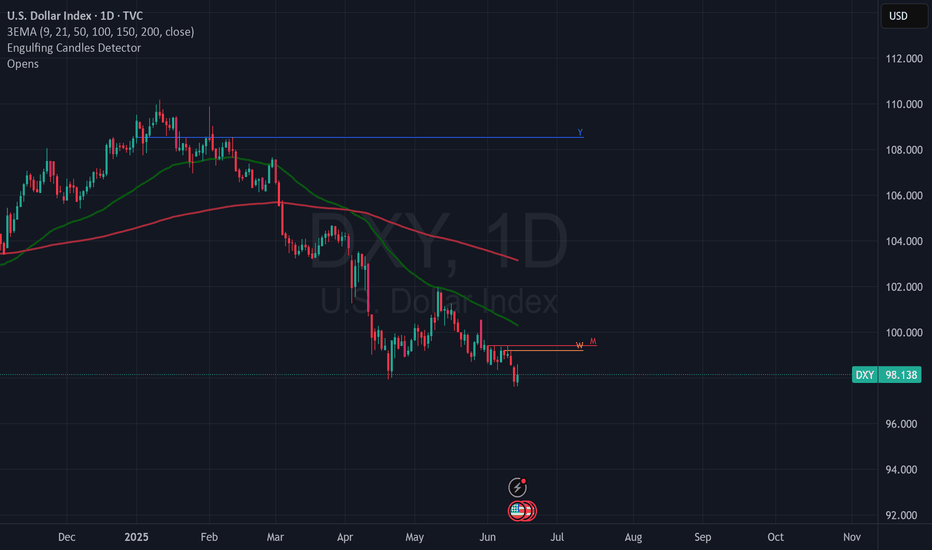

US dollar (DXY), a potential bullish technical divergence to be monitored

The FED's confirmed intransigence is having an impact on the foreign exchange market. While the US dollar has been the weakest Forex currency since the beginning of the year, it has been stabilizing for several weeks now. If the FED maintains its current wait-and-see stance on a resumption of Fed funds rate cuts, the US dollar could be close to a low point on the Forex market.

At present, there are no resistance breaches to suggest this, but a potential bullish technical divergence has appeared on the weekly timeframe. In the past, this signal was a precursor to a future rebound in the US dollar against a basket of major Forex currencies.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

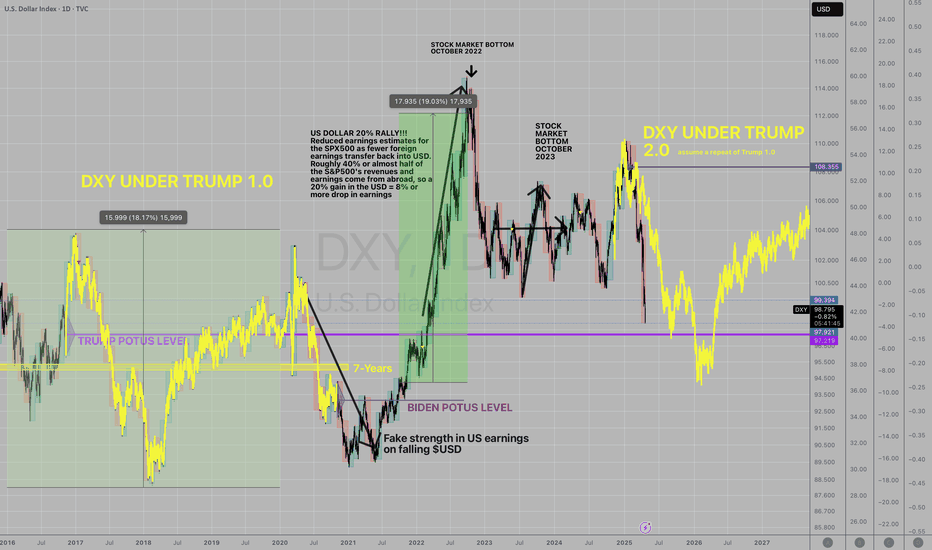

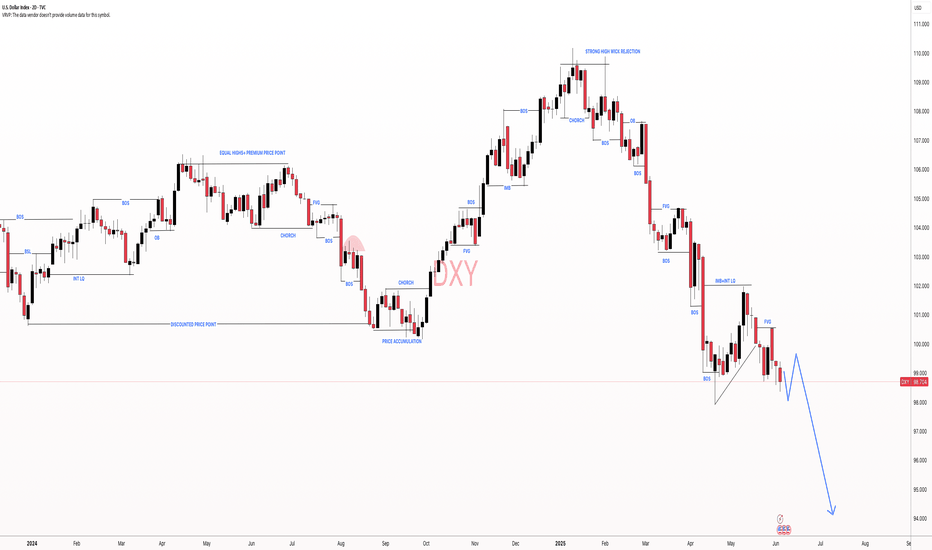

$DXY Repeating 2016 Post-Election I have highlighted the 2016 to 2020 Presidential Elections time period and then pasted that timeframe onto the 2024 election and found that the pattern is going along very similarly to Trump 1.0.

If we assume that the future unfolds the same as last time, which is low probability, of course, then the future will unfold as shown in the yellow bars going into the future, as shown.

Initially in 2016 post election there was a 7% rally in the U.S. Dollar Index and then a 15% retreat for the following year. So far in 2025 we have seen the same rally and a similar decline, but only faster this time.

It would appear as thought the bulk majority of the declines in the TVC:DXY are over at this time with perhaps 4% further downside over the balance of the year.

The Dollar Index has been useful for predicting changes in the earnings estimates for the S&P500 in the USA due to the high percentage of earnings coming back to the US for quarterly reporting. I have posted a few charts in the past which have been helpful at determining the risk in the stock market.

The behavior of the global central banks has certainly had its impact on monetary aggregates and inflation. The policy response since the Covid Pandemic has been for maximum liquidity and maximum Government spending to keep the global economy afloat. The post-Covid response is now coming to a head along with new policy directives to cut wasteful Government spending and to reduce inflation (caused the Gov't spending).

Global investors have flocked to the US for access to high technology stocks and have driven up the value of US assets to extreme levels compared to other markets. This adjustment phase where investors remove money from overvalued, or highly valued, US assets back to other markets has created a wave of selling in the US Dollar and US listed equities.

What does the future hold? We never know but we sure can learn from what happened in the past by looking at charts just like this one to see what may happen. Looks like a bounce in the TVC:DXY from here, followed by a new low and then a rebound into the next few years.

All the best,

Tim

April 22, 2025 1:16PM EST TVC:DXY 98.78 last

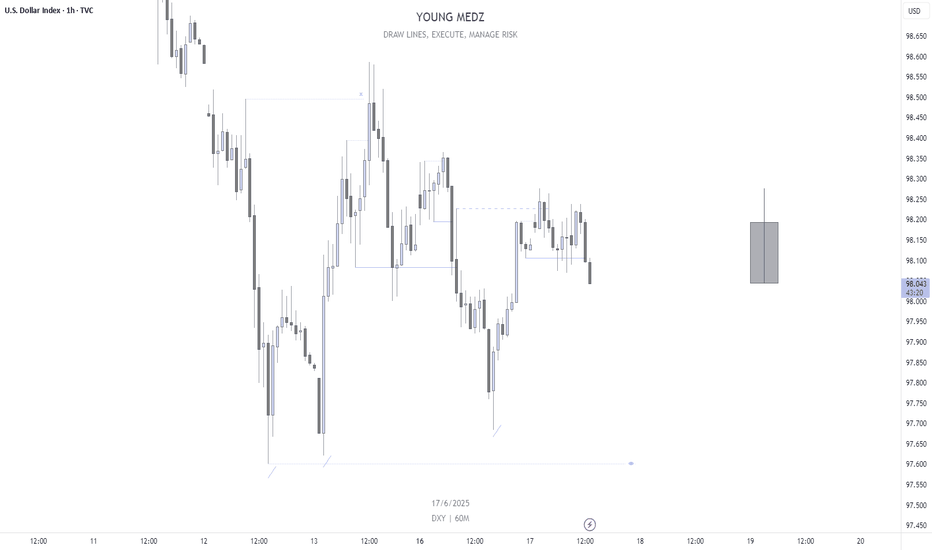

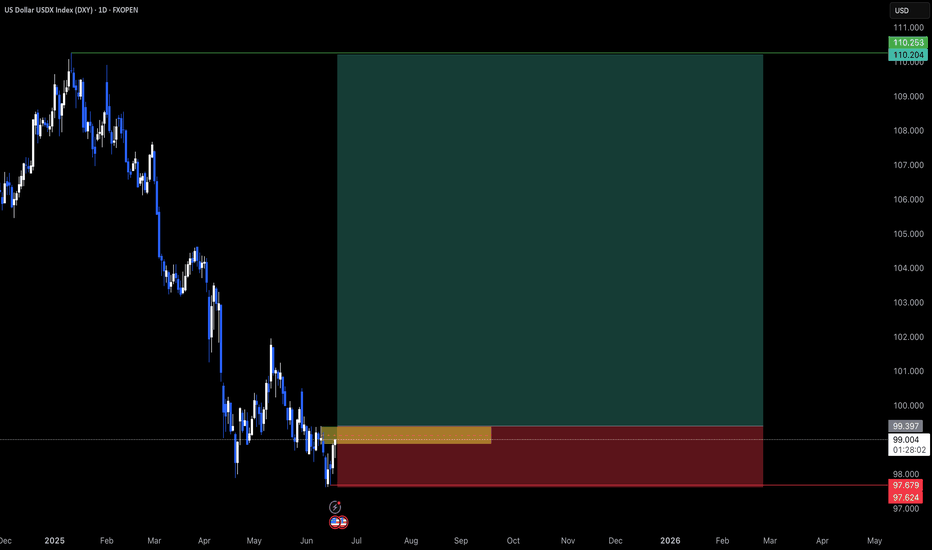

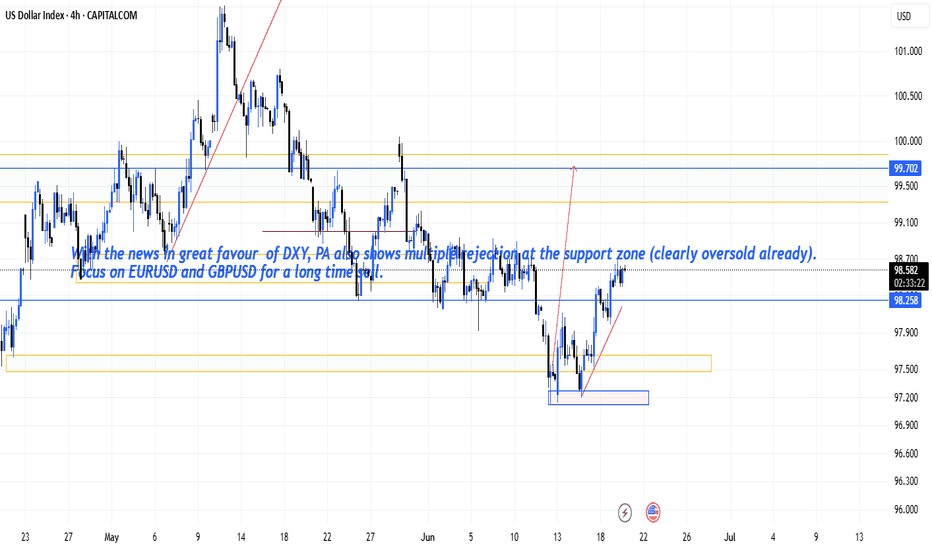

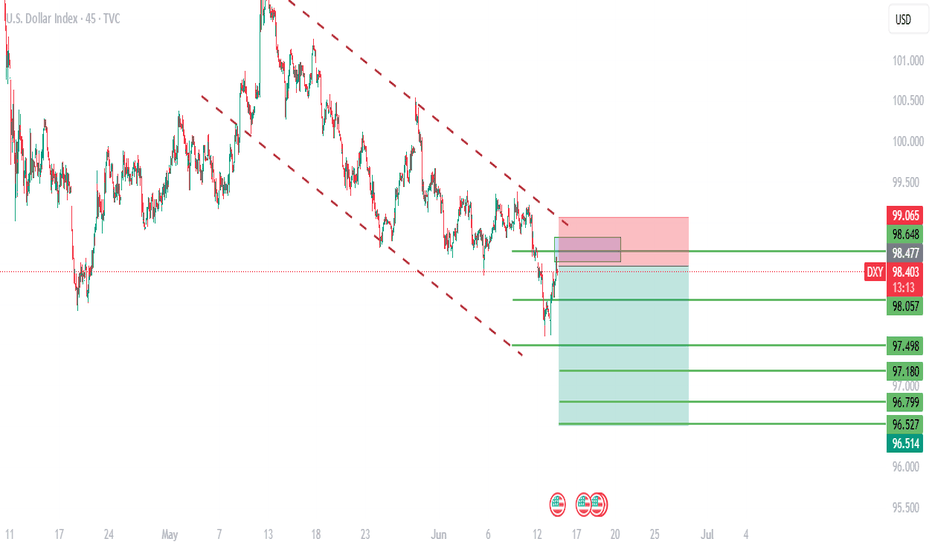

DXYThe DXY has faced severe sell off due to President Trump's policy and idea of how the dollar should be controlled/managed. Though it has fallen, a pullback will happen soon. I will be using the DXY as a good guide for all the USD/XXX or XXX/USD pairs. You as a trader can take what you can from this.

These 4HR FVG'S seem like a very good place where you can do one of two things. First you may be able to manage and hold a trade throughout the whole pullback. Another option is take complete profits instead of partials and enter in at good prices with this pullback in mind for bias.

DXY OUTLOOK - SWING SETUPThe dollar has been on a six-month decline, but I anticipate a recovery. This is primarily due to the current economic climate, geopolitical landscape, and the dollar's traditional role as a safe-haven currency during periods of significant uncertainty

"May fortune attend thee, and thy trade prosper." .......L2Earned

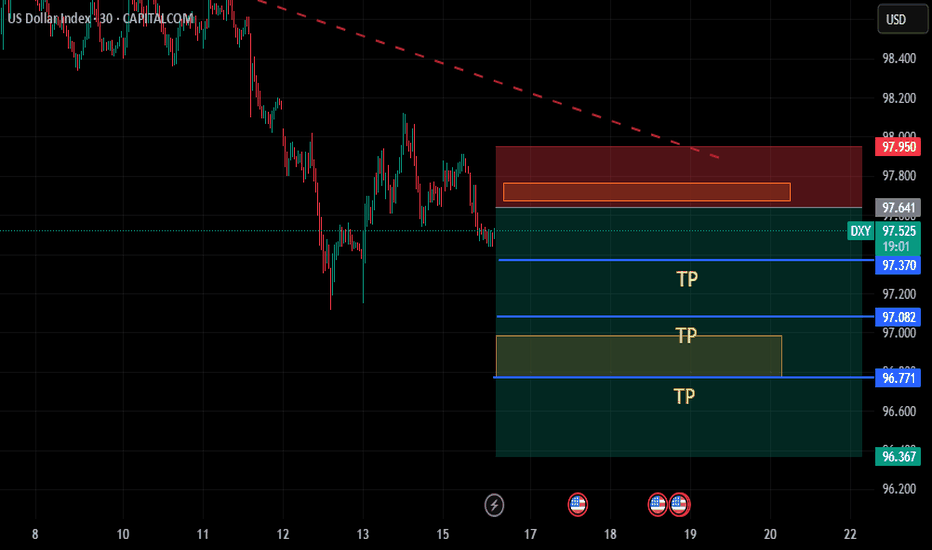

My Thoughts #015My Thoughts

Are that the pair will sell in this manner.

The pair is in a bearish pattern

Currently the pair is making a new LL

Meaning that on the lower time frame the pair is in a bearish pattern.

As you can see that pair just made a new LL a new LH is expected

It could buy and invalidate the set up.

Just use proper risk management

Let's do the most

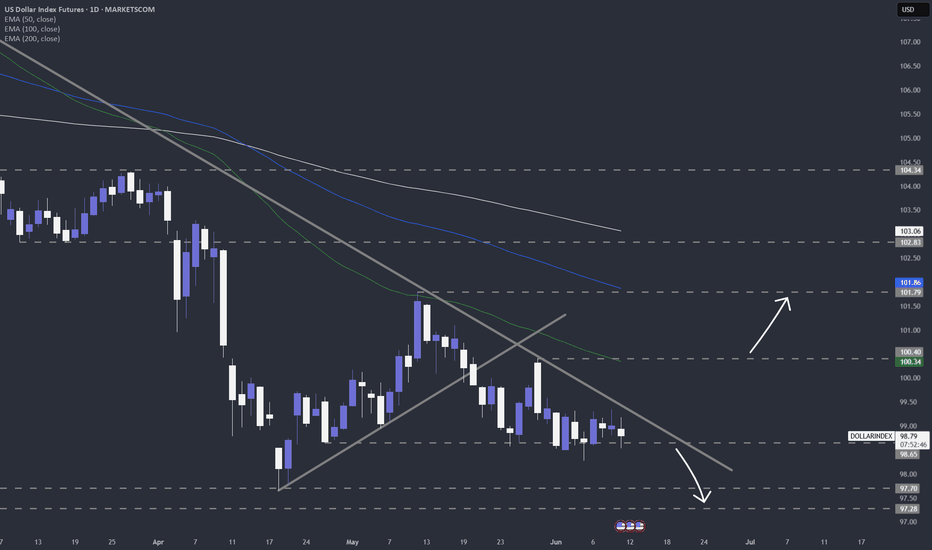

Just got the May US CPIs. PPIs next...Here is the reaction in the US instruments to the numbers. Let's dig in.

TVC:DXY

TVC:DJI

MARKETSCOM:US500

MARKETSCOM:US100

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

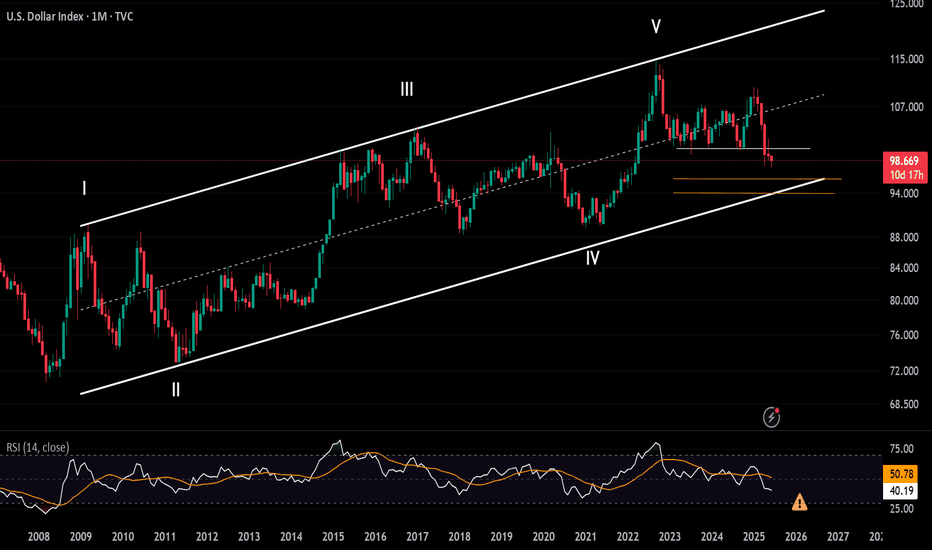

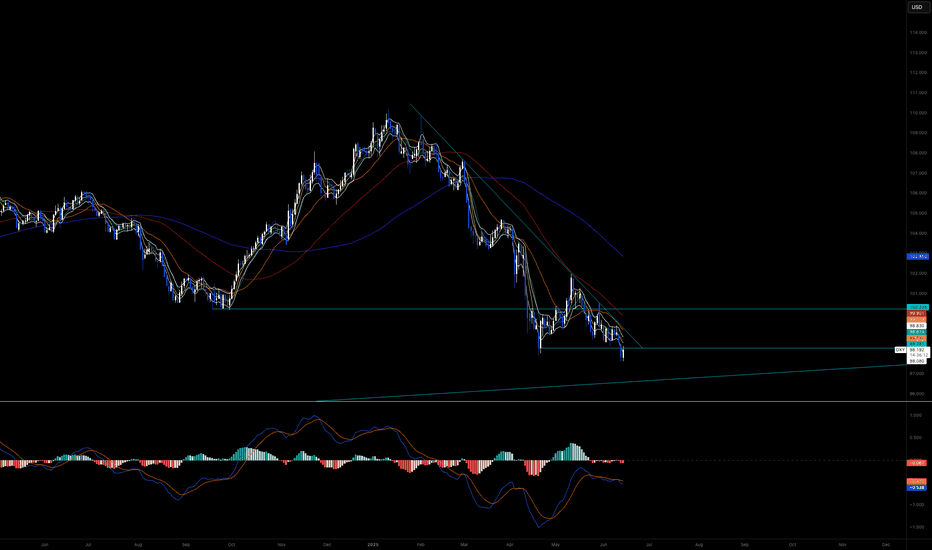

DXY Eyes Key Long-Term Support from 2008The U.S. Dollar Index (DXY) is currently trading near three-year lows, reflecting concerns over economic fragility and heightened geopolitical tensions.

If price action holds below 97, the DXY could face additional pressure, potentially descending toward the lower boundary of a long-term channel that has held since the 2008 lows. Key support levels at 96 and 94 may offer potential rebound zones.

Monthly RSI reflects more downside potential towards oversold conditions last seen in 2021. To reverse the current bearish momentum, the index would need to regain and hold above the 100-mark, which could shift sentiment back toward a bullish rebound outlook against the markets.

- Razan Hilal, CMT

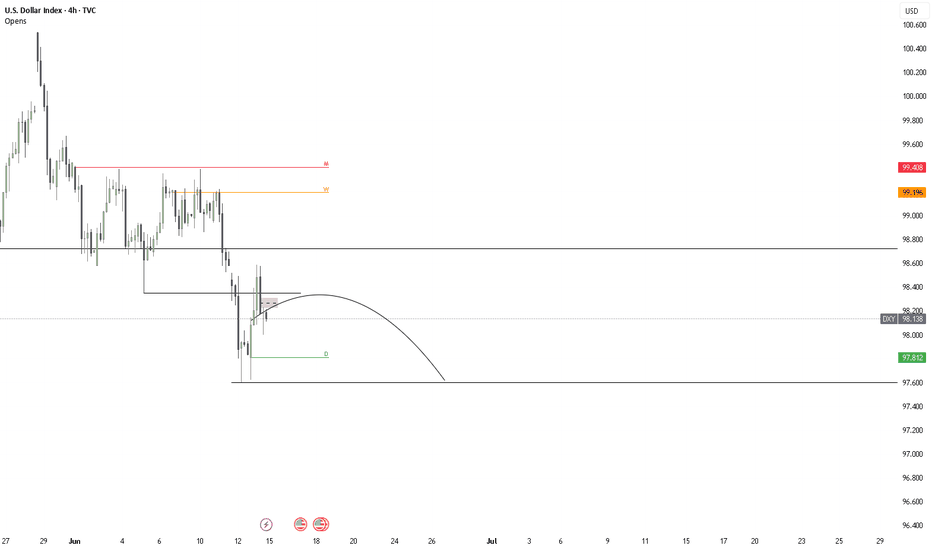

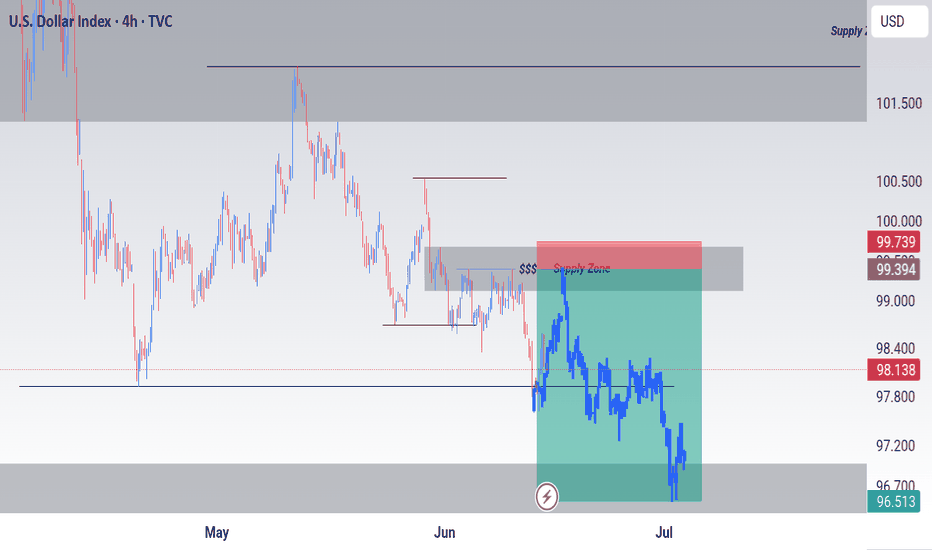

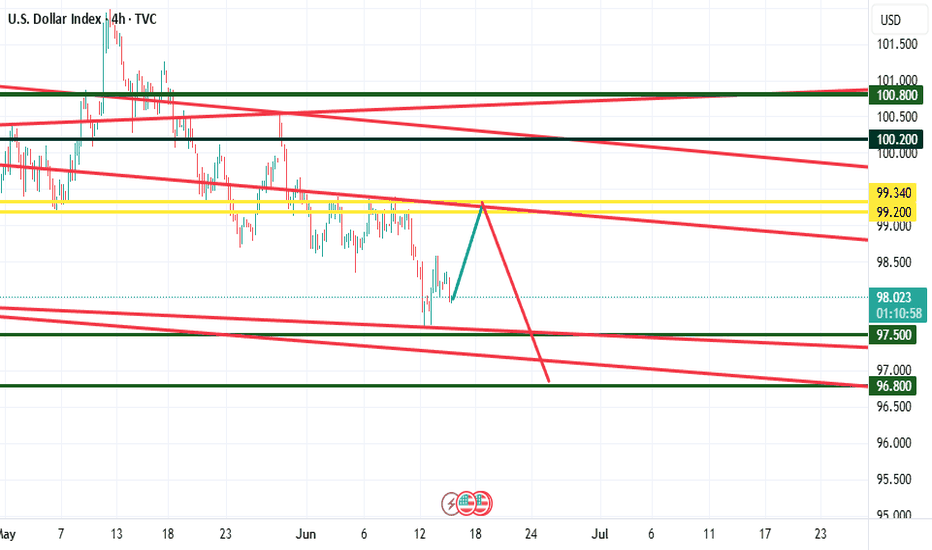

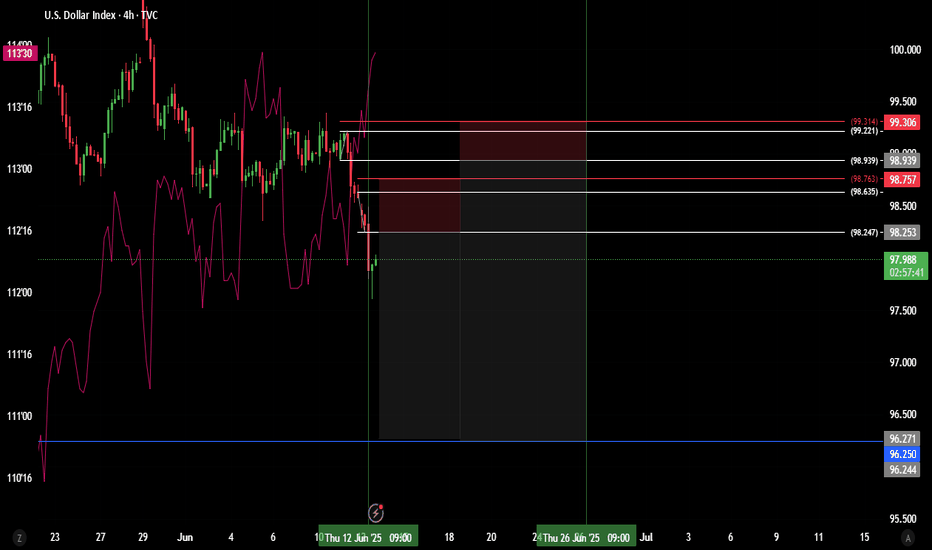

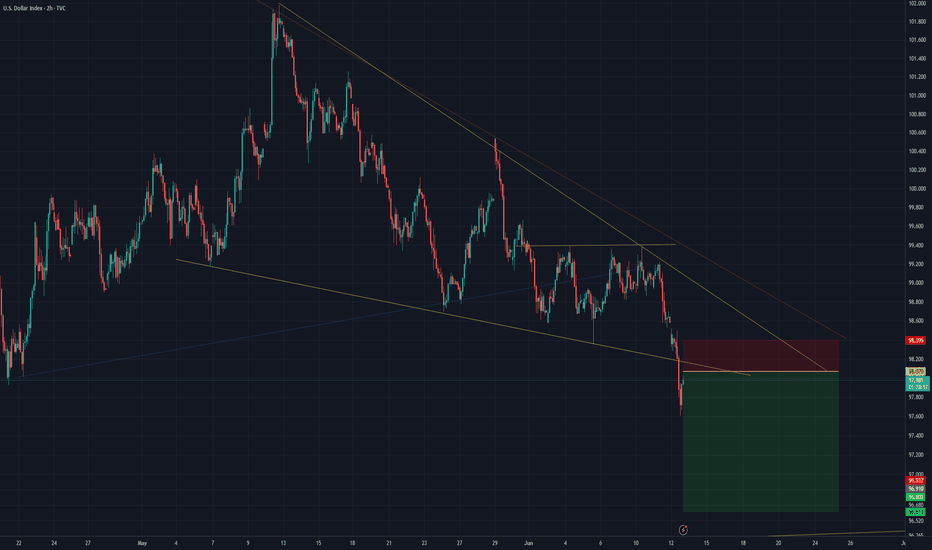

DXY OVERVIEW AND ANALYSIS - SELLOFF AT FOMC PRESS CONFERENCE 🟣DXY🟣 H4 CHART

As we witness the unfolding of a conflict in the Middle East this week I expect the commodities of OIL and GOLD to raise more after a pullback that will offer buy entries.

On my view the DXY index will pullback to the previous broken support now resistance in the 99.200 - 99.340 area and selloff to the weekly targets 97.500 and 96.800.

FOMC on Wednesday should catalyse this move and I expect the pullback to take place between the first days of the week

DXY: US dollar To Drop Further Around 95?The US dollar has been steadily declining since the new president was elected in the USA. This decline has been accompanied by the ongoing trade wars. Numerous economic indicators have supported this trend, and we anticipate further depreciation in the coming days or weeks. Before trading, it’s essential to conduct your own analysis and gain a comprehensive understanding of the market.

We wish you the best of success in trading. Good luck and trade safely.

Like and comment for more, and as always, happy trading!

Team Setupsfx_

DOLLAR INDEXThe DXY (U.S. Dollar Index) is a measure of the U.S. dollar’s value relative to a basket of six major foreign currencies: the euro (57.6%), Japanese yen (13.6%), British pound (11.9%), Canadian dollar (9.1%), Swedish krona (4.2%), and Swiss franc (3.6%). It serves as a benchmark for the dollar’s global strength and is influenced by macroeconomic factors like interest rates, trade flows, and inflation expectations.

10 years bond yield Correlations with DXY

1. 10-Year Bond Yield

Positive Correlation: The DXY and U.S. 10-year Treasury yields generally move in the same direction. Higher yields attract foreign capital into U.S. bonds, increasing demand for dollars and strengthening the DXY.

Current 10-Year Yield (June 12, 2025): 4.36%, down slightly from 4.41% the previous day but up 1.16% year-over-year.

2. Bond Price

Inverse Relationship with Yields: Bond prices fall when yields rise (and vice versa). Since DXY and yields are positively correlated, the dollar tends to strengthen when bond prices decline.

3. Interest Rates

Direct Link: Higher U.S. interest rates increase the dollar’s appeal as investors seek higher returns, boosting DXY. Conversely, rate cuts weaken the dollar.

Example: The Federal Reserve’s rate hikes in 2023–2024 contributed to DXY strength, while recent rate-cut expectations have moderated its gains.

Current 10-Year Treasury Yield

As of June 12, 2025, the 10-year Treasury yield is 4.36%, below its long-term average of 5.83%.

Key Drivers of DXY in 2025

Federal Reserve Policy: Markets are pricing in potential rate cuts later in 2025, which could limit DXY upside.

Global Risk Sentiment: Safe-haven dollar demand rises during geopolitical or economic uncertainty.

Inflation Trends: Persistent U.S. inflation could delay Fed easing, supporting DXY

technical level to watch is the support level at 97,949

DXY; MARKETS JITTERS AND UNCERTAINTIES.The DXY did not hold a successful break above 99.000 which was our bullish signal. Furthermore, we had US banks closed for yesterday's NY session which did not do us any good as there was minimal movements in our charts. Without volatility there is little room for profit chasing as much as our USDJPY signal was on point.

Today's session started with a gap lower towards 98.50. I don't expect a mover lower before filling the gap so that will be our first objective before any further movement. My bias still remains the same ,a clean break and hold above 99.00 will signal a healthier dollar for the short term despite the war tensions.

Follow up on DXY Short post from 2022The DXY follows Fib levels quite accurately on macro movements using the monthly chart. Both on retracement and extension. It has recently tagged the .618 retrace of the last bullish wave 5 movement that started its decline.

I would suppose it is close to completion of wave A of a ABC correction that will play out over the next several months. As it tagged the .618 mentioned above, it has also tagged the .786 extension of what is likely the c wave of the abc structure (of the larger A).

B wave trade to the upside has good probability now in my opinion. I took the trade this morning with a 3-1 RR in place. It could fall to the trend line which is fine, but if it breaks in earnest and closes a few sessions below then my stop would be triggered.

There was a bullish divergence prior to the April lows on the Daily TF and one is developing at the current lows. A close above 99.40 would confirm.

Long term the dollar is likely still going to weaken and go much lower as QE inevitably comes back into the market picture. TP levels are at 99.40, 100.54, 101.25 and 101.76.

Caution for Dollar Shorts with Middle East Tensions FlaringMy educated guess is that the dollar is moving similar to the first time trump was elected. I am expecting dollar weakness to abate early next year. A major swing low formed in early 2018 one year after Trump was elected first round. Let us see if a similar situation forms next year. For now with DXY structured bearish caution is warranted with Oil up and 10 yr remaining elevated. There is a prior up move in April and until a decisive break below the current area Price Action and circumstances in the middle east warrant caution for dollar shorts.

"Inflation Drops, Jobless Claims Jump — What’s Next for DXY, Gol🚨 Markets are shifting fast. CPI and PPI both came in lower than expected, while jobless claims hit an 8-month high. This triple data combo could mark a turning point for the US economy and the Fed’s next move.

In this video, I break down:

🔹 What soft inflation and rising unemployment mean for monetary policy

🔹 How DXY is reacting to weakening USD sentiment

🔹 Key levels for XAUUSD as rate cut bets rise

🔹 Where BTCUSD may head next with risk-on momentum building

📊 Technical + Fundamental insights — all in one session.

👉 Drop your thoughts in the comments and follow for more real-time market breakdowns!

#DXY #XAUUSD #BTCUSD #Inflation #FedWatch #TradingViewAnalysis #MacroUpdate #Forex #Crypto #Gold