USDX trade ideas

Highly likely the DXY goes down.Trading the DXY increase in 2022 was my best trade of that year. Specifically on the USD/CAD pair not the whole index. Options worked great for this.

I had call options on USX not the company. It's Options on the US Dollar (USX) on the TMX exchange in Montreal Canada. To gain exposure to a rising dollar, or to hedge existing positions, call options on USX can be an effective tool. If DXY is going down like 2020-2021 it's great for stocks and equities. A falling dollar is also beneficial from the perspective of US national debt, as it makes interest payments cheaper in relative terms. Also many people outside the US have USD debts so example they make CAD but their debts are in USD. Well now their company is worth more as debt went down and revenue up. Otherwise known as currency risk. Very important for companies dealing in multiple currencies regardless of the type of business they do.

The US has incentive for a weaker dollar as the interest payments on their debt are now around $1 Trillion a year.

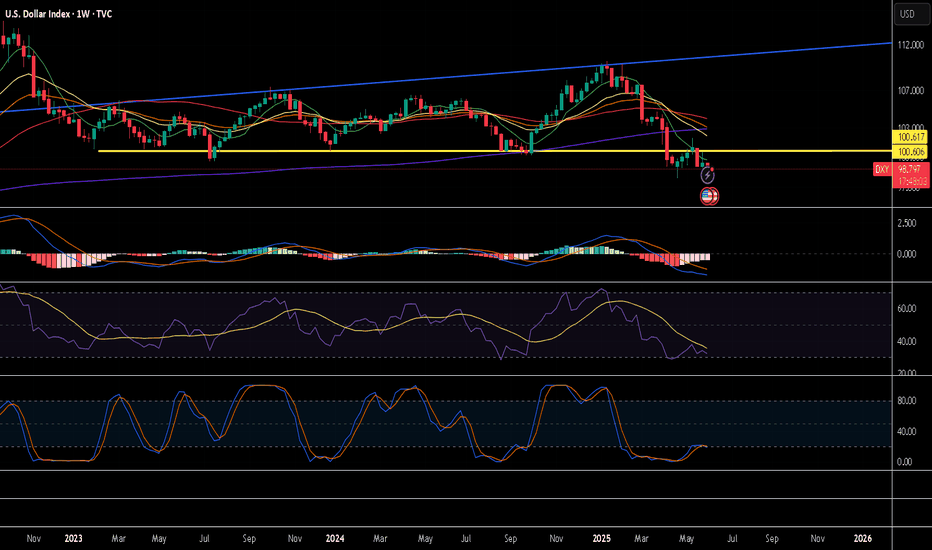

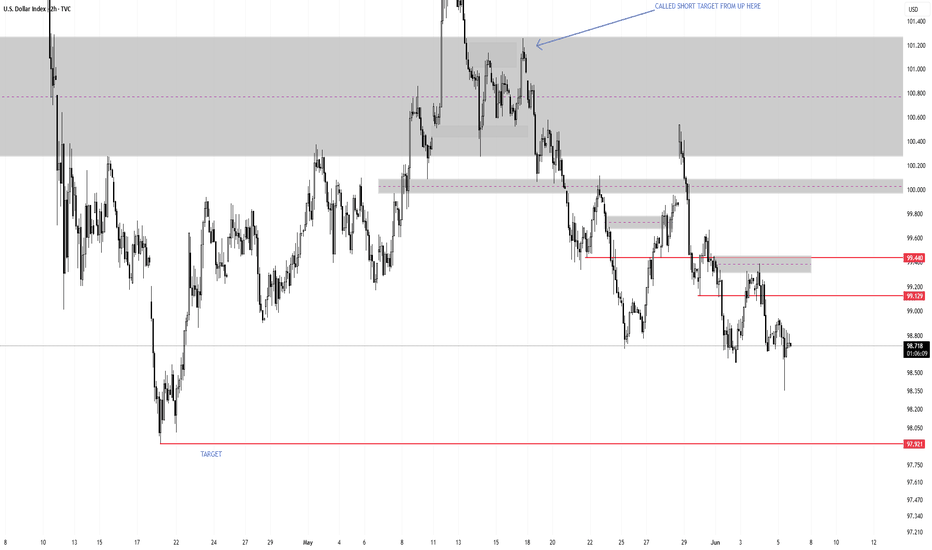

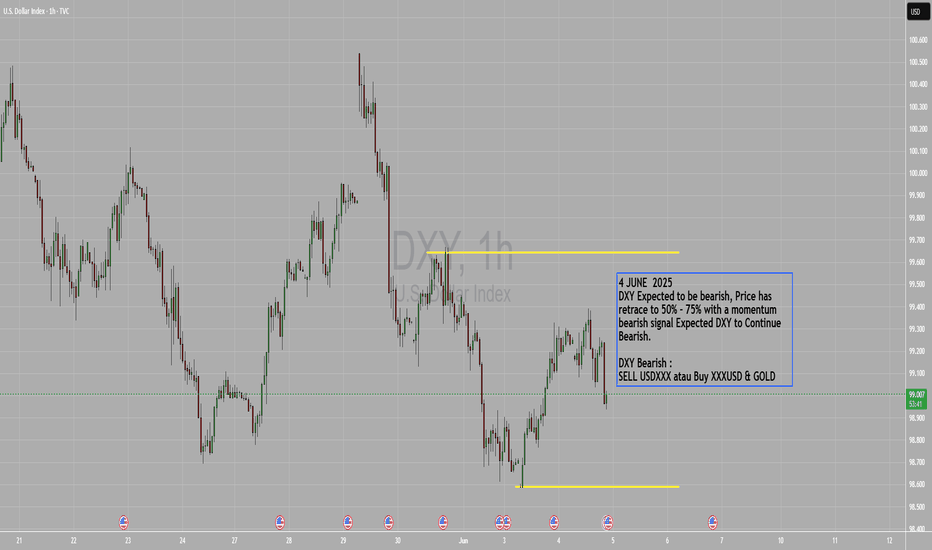

This yellow line represents a significant long-term resistance level. As long as the price fails to break and hold above this zone, the path of least resistance remains to the downside.

The MACD is currently moving down, supporting a bearish bias. However, there are two key bullish signals I am watching that would challenge this view:

The Bullish Crossover: This occurs if the blue MACD line crosses above the orange signal line.

On the daily timeframe, a simple crossover can sometimes be a temporary fake-out (like

the "flip-flopping" seen around April 3rd-9th). While it's a warning, it's not always a

definitive trend changer on its own.

The Bullish Divergence: This is the more powerful signal. If the price has set a new low since

April 2025 but the MACD has formed a higher low, it creates a bullish divergence. A

confirmation of this pattern could signal the end of the long-term downtrend and mark a

serious change in market conditions.

A bullish crossover happening at the same time as a confirmed bullish divergence would be a very strong combination, making a short position on the DXY extremely risky.

**Disclaimer:**

*The information provided in this post is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. All investments involve risk, and the past performance of a security, market, or trading strategy does not guarantee future results. I am not a financial advisor. Please conduct your own thorough research and consult with a qualified financial professional before making any investment decisions. You are solely responsible for any investment decisions you make.*

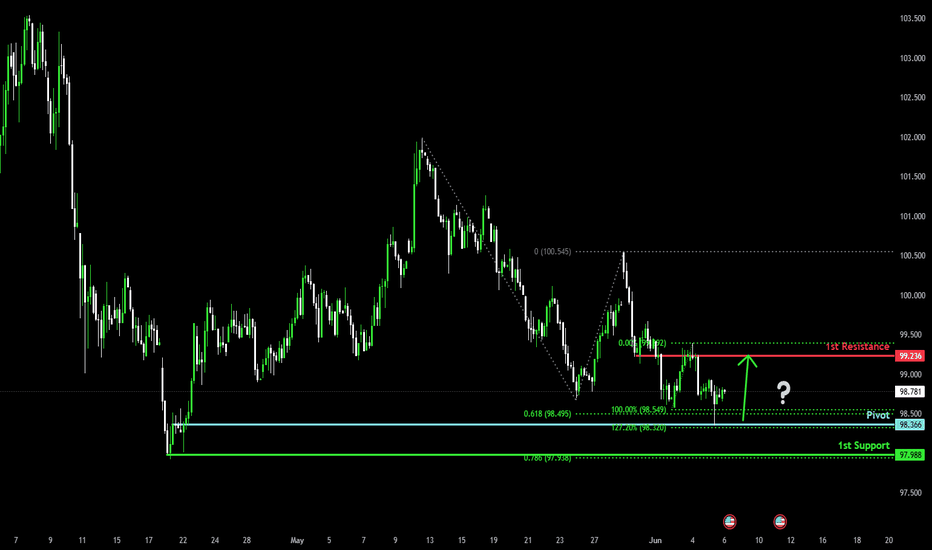

Bullish bounce?US Dollar Index (DXY) has bounced off the pivot and could rise to the 1st resistance.

Pivot: 98.36

1st Support: 97.98

1st Resistance: 99.23

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

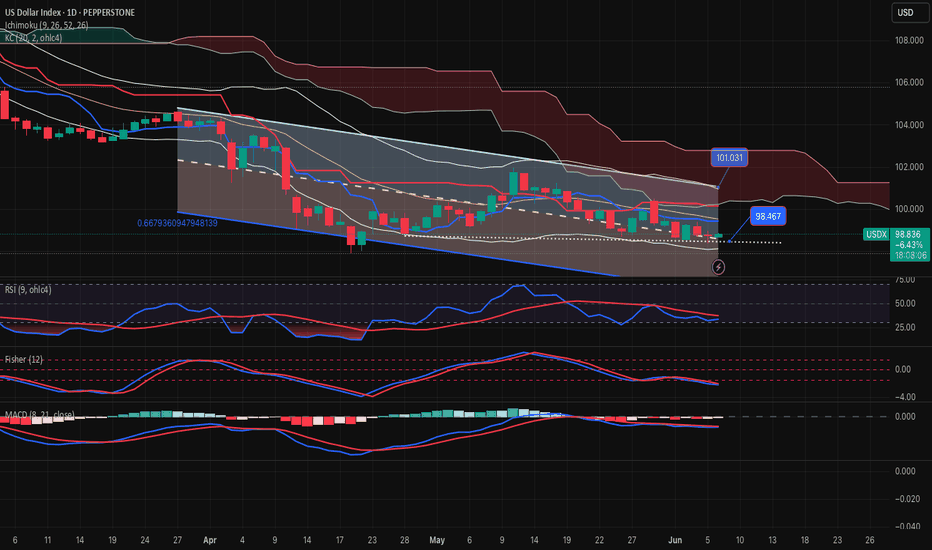

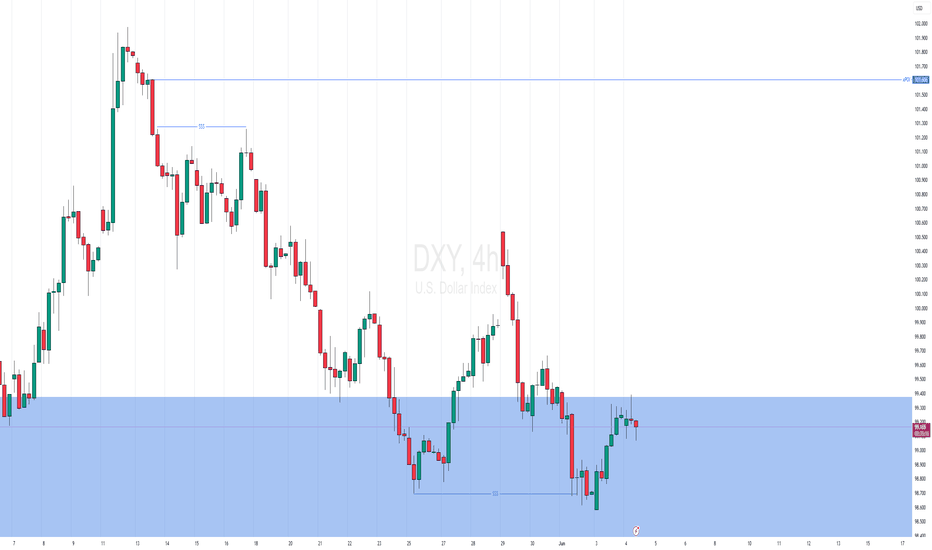

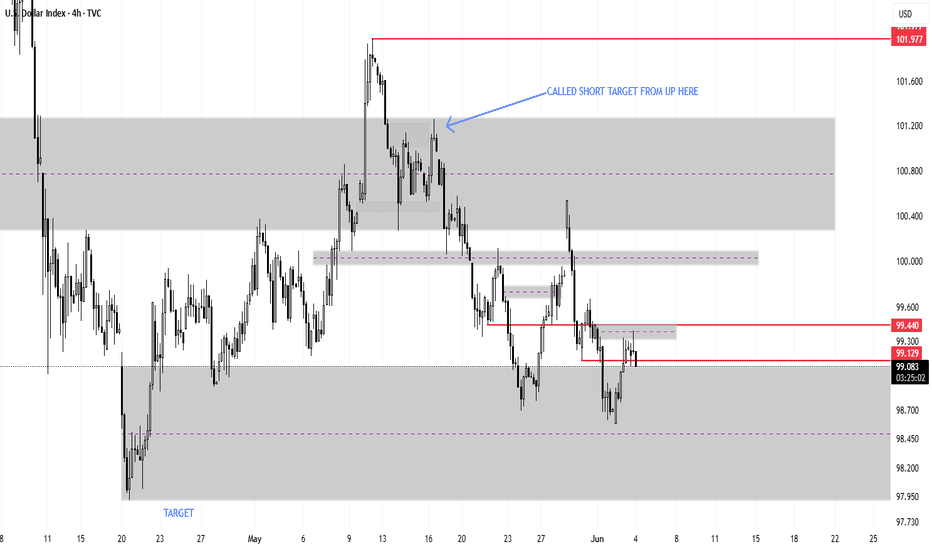

USDX-NEUTRAL BUY strategy Daily chart Reg.ChannelThe index is still under pressure, but am slightly cautious on SELL as we are near support 98.40 area, and as long it holds we should expect some recovery. Channel wise we have room further down.

Strategy BUY 98.60 - 98.75 and take profit near 99.75 for now. However, break below mentioned support opens 96.50 and lower.

DXY POTENTIAL LONG|

✅DXY will soon retest a key support level of 98.000

So I think that the index will make a rebound

And go up to retest the supply level above at 99.088

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DOLLAR INDEX The higher-than-expected US Unemployment Claims (247K actual vs. 236K forecast) suggest emerging softness in the labor market, increasing the likelihood of Federal Reserve rate cuts in 2025. Here’s how this data impacts the Fed’s policy outlook:

Key Implications for the Fed

Labor Market Cooling:

The uptick in claims aligns with recent trends of slowing payroll growth (Q1 2025 average: 152K jobs/month vs. Q4 2024: 209K) and a stagnant unemployment rate near 4.2%.

Fed projections already anticipate unemployment stabilizing around 4.3% in 2025, but persistent claims increases could signal risks to their "maximum employment" mandate.

Rate Cut Probability:

The Fed has maintained rates at 4.25–4.50% since May 2025 but emphasized data dependence. Weak labor data strengthens the case for cuts, with markets now pricing in a ~60% chance of a September rate cut (up from ~50% pre-data).

The Fed’s March 2025 projections flagged rising unemployment as a risk, with some participants favoring earlier easing if labor conditions deteriorate.

Inflation Trade-Off:

While unemployment claims rose, wage growth remains elevated (ADP reported 4.5% YoY pay gains in May). The Fed will weigh labor softness against sticky inflation, particularly in services (ISM Prices Paid index at 68.7).

A cooling labor market could ease wage pressures, aiding the Fed’s inflation fight and enabling cuts without reigniting price spikes.

Market Impact

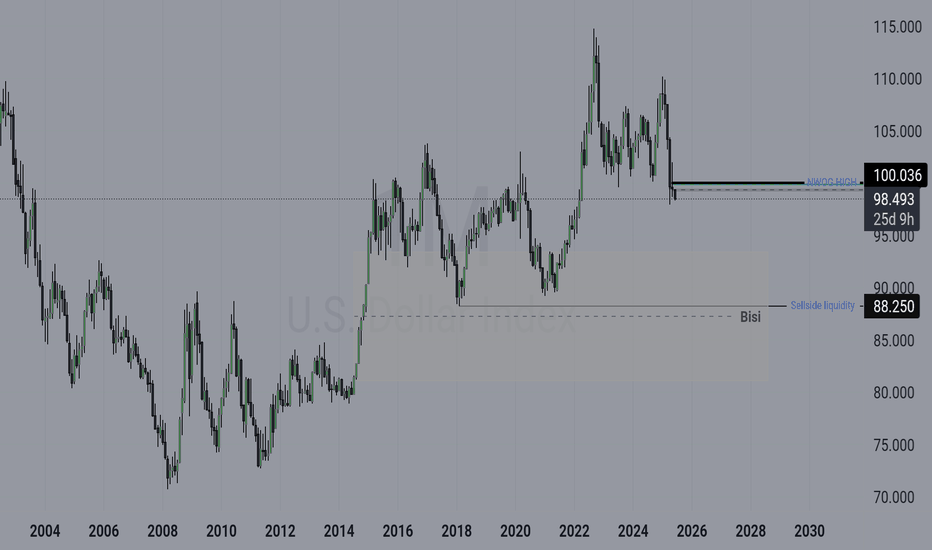

DXY (Dollar Index): Likely to weaken further as rate cut expectations rise. Immediate support at 98.40, with a break targeting 97.00

Equities/Gold: Potential gains as lower rates boost risk assets and non-yielding gold.

Bond Yields: 10-year Treasury yields may retreat below 4.40% if markets price in dovish Fed action.

What’s Next?

June 6 NFP Report: A weak jobs number (<150K) would solidify rate cut bets.

June 11 CPI Data: Lower inflation could give the Fed confidence to cut sooner.

Fed Decision (July 31): Odds of a cut rise if labor data continues to soften.

Conclusion

The Fed is likely to prioritize labor market stability over inflation concerns if unemployment claims persist above 240K. While a July cut remains possible, September is the most probable start date for easing, contingent on confirming data.

#DOLLAR #GOLD #DXY

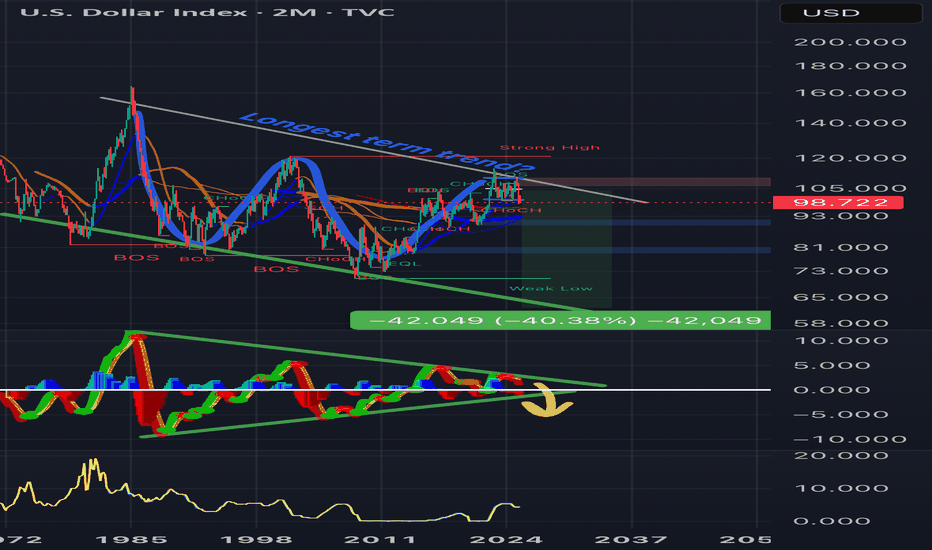

Bretton Woods 2.0?Examining the long-term trend of TVC:DXY since the 1980s, we might be facing a staggering 40% reduction in valuation, potentially landing us around 60. If the US were to devalue the dollar this drastically, could it effectively erase the national debt? 🤔 Is Trump bold enough to consider such a move?

We know the FED is going to cut eventually, the question is when and by how much? Initial claims came in higher than estimated, with cracks beginning to show in the labor market, how much longer can JPow hold out?

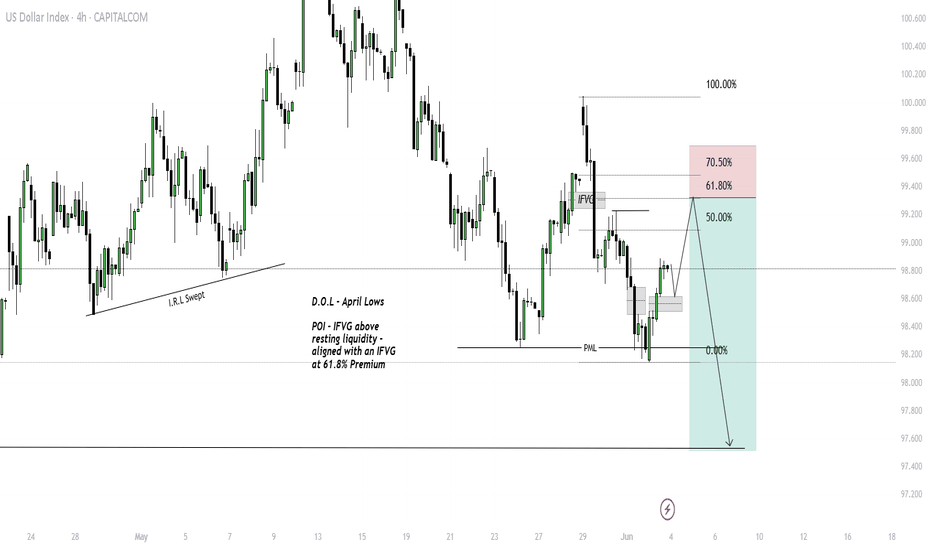

DXY: Local Bearish Bias! Short!

My dear friends,

Today we will analyse DXY together☺️

The market is at an inflection zone and price has now reached an area around 98.335 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 98.090..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

DXYDXY price is near the support zone 98.74-97.87. If the price cannot break through the 97.87 level, it is expected that the price will rebound. Consider buying the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

DOLLAR INDEXCorrelation Between DXY, Bond Yields, and Bond Prices

1. Bond Prices and Bond Yields: Inverse Relationship

Bond prices and bond yields move inversely: when bond prices rise, yields fall; when bond prices fall, yields rise.

This happens because bonds pay fixed coupons; if market interest rates rise, existing bonds with lower coupons become less attractive, pushing their prices down and yields up.

2. DXY and 10-Year Treasury Yield: Generally Positive Correlation

The US Dollar Index (DXY) and the US 10-year Treasury yield typically move in the same direction. When the 10-year yield rises, the dollar tends to strengthen, and vice versa.

This is because higher yields attract foreign capital seeking better returns, increasing demand for the dollar.

Historically, this correlation has been strong, with a rolling correlation averaging around 44.5% and recently rising to about 75% in early 2025.

However, this relationship can break down temporarily due to shifts in market sentiment or safe-haven flows. For example, in mid-2025, the correlation briefly turned negative amid changing investor preferences.

3. DXY and Bond Prices: Indirect Inverse Correlation

Since bond prices and yields are inversely related, and yields and DXY are positively correlated, DXY tends to move inversely to bond prices.

Rising bond prices (falling yields) often coincide with dollar weakness, while falling bond prices (rising yields) support dollar strength.

4. Interest Rates and Their Role

Central bank interest rates influence bond yields and the dollar.

Rate hikes generally push bond yields higher and strengthen the dollar, while rate cuts do the opposite.

Interest rate expectations are a key driver behind the bond yield-DXY relationship.

Summary Table

Relationship Direction/Correlation Explanation

Bond Price ↔ Bond Yield Inverse Fixed coupon bonds lose value when rates rise

10-Year Yield ↔ DXY Positive (usually) Higher yields attract capital, boosting USD

Bond Price ↔ DXY Inverse (indirect) Bond prices up → yields down → USD weakens

Interest Rates ↔ Yield & DXY Positive Rate hikes raise yields and strengthen USD

Conclusion

The US Dollar Index (DXY) generally rises with increasing 10-year Treasury yields because higher yields attract investment flows into US assets, boosting demand for the dollar. Conversely, bond prices move inversely to yields, so rising bond prices tend to coincide with dollar weakness. While this relationship is strong historically, it can fluctuate due to market sentiment, safe-haven demand, and geopolitical factors.

#DOLLAR #DXY

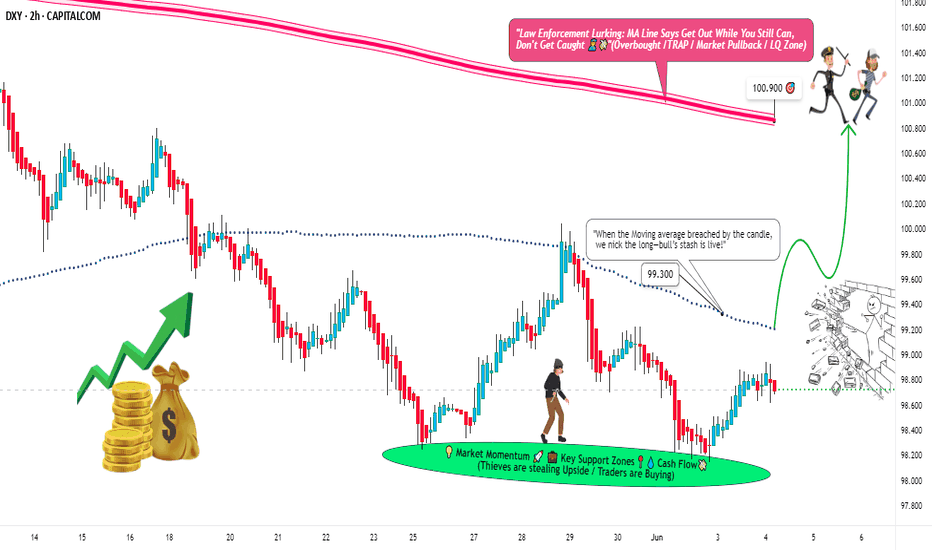

DXY BANK VAULT BREAK-IN: Your Dollar Index Profit Blueprint🚨 DXY BANK HEIST: Dollar Index Breakout Robbery Plan (Long Setup) 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention, Market Robbers & Dollar Bandits! 🏦💰💸

Using the 🔥Thief Trading Style🔥, we’re plotting a DXY (Dollar Index) bank heist—time to go LONG and escape near the ATR danger zone. Overbought? Yes. Risky? Absolutely. But the real robbery happens when weak hands panic. Take profits fast—you’ve earned this loot! 🏆💵

📈 ENTRY: BREAKOUT OR GET LEFT BEHIND!

Wait for DXY to cross 99.300 → Then strike hard!

Buy Stop Orders: Place above Moving Average.

Buy Limit Orders: Sneak in on 15M/30M pullbacks (swing lows/highs).

Pro Tip: Set a BREAKOUT ALARM—don’t miss the heist!

🛑 STOP LOSS: DON’T GET LOCKED UP!

For Buy Stop Orders: Never set SL before breakout—amateurs get caught!

Thief’s Safe Spot: Nearest swing low (2H chart).

Rebels: Place SL wherever… but your funeral! ⚰️

🏴☠️ TARGET: 102.300 (Bank Vault Cracked!)

Scalpers: Long only! Trail your SL like a pro thief.

Swing Traders: Ride this heist for maximum payout.

💵 MARKET CONTEXT: DXY IS BULLISH (But Traps Await!)

Fundamentals: COT Reports, Fed Plays, Geopolitics.

Intermarket Sentiment: Bonds, Gold, Stocks—all connected.

Full Analysis: Check our bio0 linkks 👉🔗 (Don’t trade blind!).

⚠️ ALERT: NEWS = VOLATILITY = TRAP ZONE!

Avoid new trades during high-impact news.

Lock profits with trailing stops—greed gets you caught!

💥 SUPPORT THE HEIST (OR GET LEFT BROKE!)

Smash that Boost Button 💖→ Stronger team = bigger scores!

Steal profits daily with the Thief Trading Style. 🎯🚀

Next heist coming soon… stay ready! 🤑🐱👤🔥

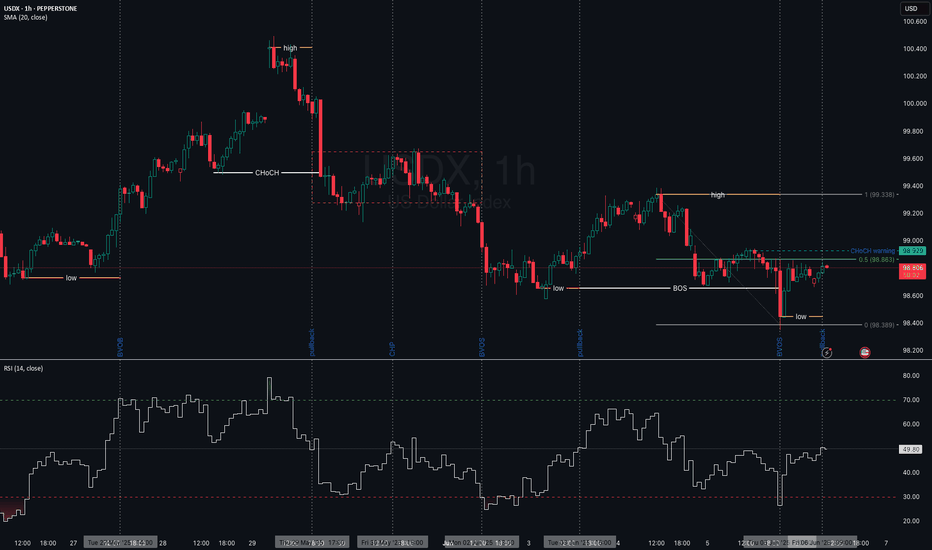

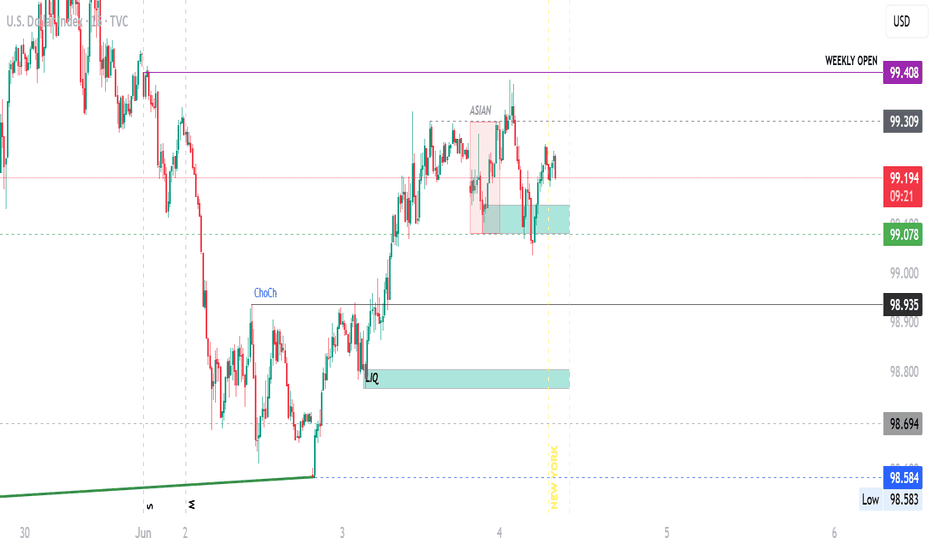

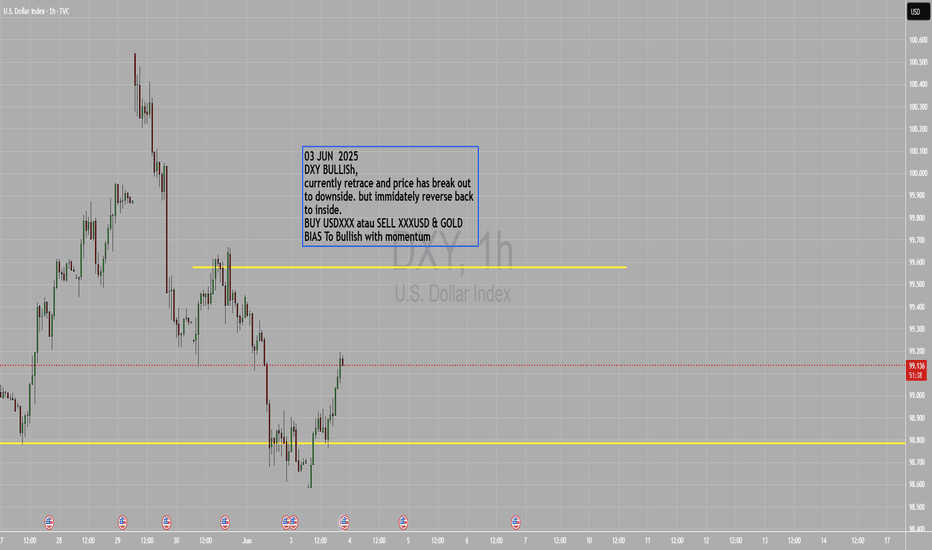

DXY BULLISH Lets wait for High Impact news first.03 JUN 2025

DXY BULLISH,

currently retrace and price has break out to downside. but immidately reverse back to inside.

BUY USDXXX atau SELL XXXUSD & GOLD

BIAS To Bullish with momentum.

There is high impact news in 1 hours may change the outlook.

Lets wait and see.

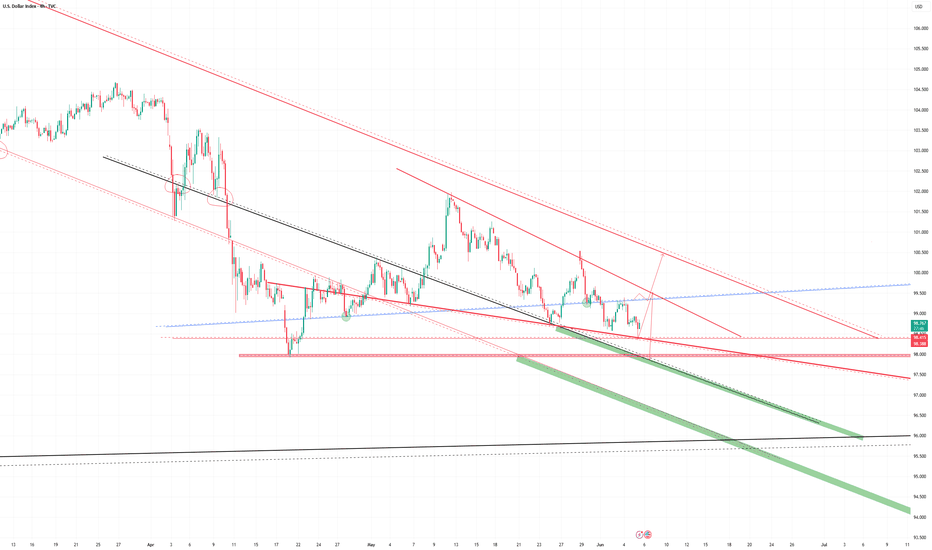

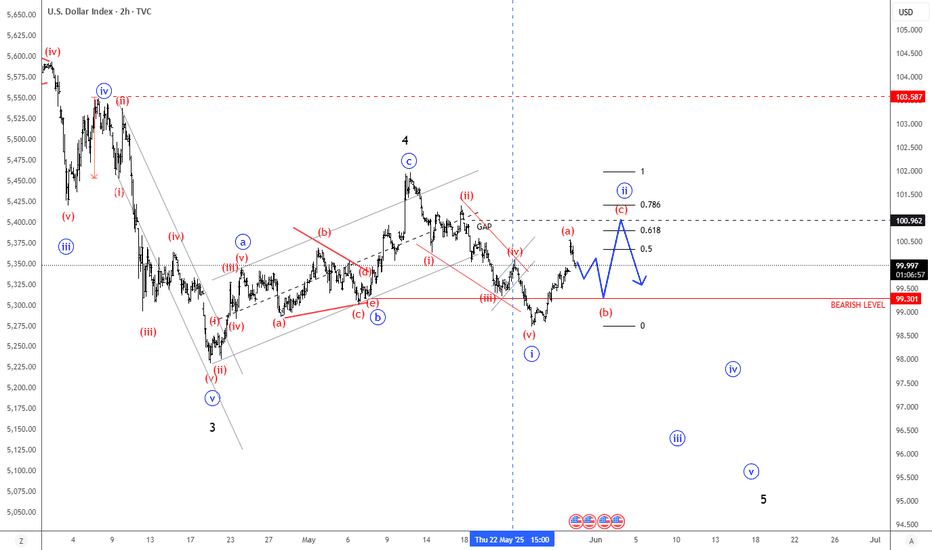

USDollar Is Making An Intraday Pullback Within DowntrendGood morning traders! Stocks keep pushing higher along with yields, so it looks like 10Y US Notes could still see lower support levels, and that’s why USdollar is in a bigger intraday correction. What we want to say is that while the 10Y US Notes are still searching for support, the DXY can stay in recovery mode or at least sideways. In the meantime, stocks can easily see even higher levels after NVIDIA surpassed earnings.

Looking at the intraday USDollar Index – DXY chart, we see a leading diagonal formation, so we are tracking now an intraday abc correction before a bearish continuation, thus keep an eye on GAP from May 18 around 101 level that can be filled and may act as a resistance before a bearish continuation.

DOLLAR INDEXRelationship Between the Dollar Index (DXY), 10-Year Bond Yield, Interest Rates, and Carry Trade

1. Dollar Index (DXY) and 10-Year Bond Yield

The DXY and the US 10-year Treasury yield generally have a direct (positive) relationship:

When the 10-year yield rises, the dollar tends to strengthen.

When yields fall, the dollar usually weakens.

This is because higher yields attract foreign capital seeking better returns, increasing demand for the US dollar and pushing up its value.

However, this relationship is not perfect and can be influenced by other factors like economic data, geopolitical risks, and monetary policy expectations.

2. Interest Rates and Their Impact

Interest rates set by central banks (e.g., Fed funds rate) influence bond yields and currency values.

Higher interest rates generally lead to higher bond yields, attracting capital inflows and strengthening the currency (USD).

Conversely, lower rates tend to weaken the currency as investors seek higher yields elsewhere.

The interest rate differential between countries is crucial: it reflects the relative attractiveness of holding one currency over another, driving capital flows and currency movements.

3. Carry Trade and Its Role

The carry trade involves borrowing in a currency with low interest rates and investing in a currency with higher yields to earn the interest rate differential.

For example, investors may borrow in Japanese yen (low rates) and invest in US dollars (higher rates), buying US bonds or assets.

This strategy increases demand for the higher-yielding currency (USD), pushing up its value and often correlating with rising bond yields in that country.

Carry trades are typically based on short-term interest rate differentials, but recent research indicates that the entire yield curve (including long-term yields) also affects currency returns and carry trade profitability.

The uncovered interest rate parity (UIP) theory suggests carry trade returns should be zero after adjusting for exchange rate changes, but empirically, carry trades have yielded excess returns, partly due to risk premia and market inefficiencies.

what is UIP???

Uncovered Interest Rate Parity (UIP) is a fundamental economic theory that relates the difference in nominal interest rates between two countries to the expected change in their currency exchange rates over the same period. It asserts that the expected depreciation or appreciation of a currency will offset the interest rate differential, eliminating the possibility of arbitrage profits from borrowing in one currency and investing in another without hedging exchange rate risk.

Key Points about UIP:

Interest Rate Differential Equals Expected Exchange Rate Change:

The difference between the interest rates of two countries should equal the expected percentage change in the exchange rate between their currencies. For example, if Country A has a higher interest rate than Country B, its currency is expected to depreciate relative to Country B’s currency by approximately the interest rate difference.

No Arbitrage Condition Without Hedging:

Unlike covered interest rate parity (which uses forward contracts to hedge exchange rate risk), UIP assumes investors do not hedge their currency exposure. Therefore, the expected spot exchange rate at the end of the investment horizon adjusts to offset potential gains from interest rate differences.

Implication:

If a country offers higher interest rates, its currency is expected to depreciate to prevent riskless profit opportunities. This reflects foreign exchange market equilibrium.

Relation to Law of One Price and Purchasing Power Parity (PPP):

UIP is connected to the law of one price, which states that identical goods should cost the same globally when prices are expressed in a common currency. Similarly, UIP ensures that returns on investments in different currencies are equalized once exchange rate changes are considered.

Practical Use:

UIP helps explain and forecast currency movements based on interest rate differentials but is often violated in the short term due to market imperfections, risk premiums, and investor behavior.

In summary, Uncovered Interest Rate Parity states that the expected change in exchange rates between two currencies offsets the interest rate differential, so investors earn the same return regardless of the currency in which they invest, assuming no hedging of currency risk.

4. Bond Prices and Interest Rates

Bond prices and interest rates have an inverse relationship:

When interest rates rise, bond prices fall.

When interest rates fall, bond prices rise.

This dynamic affects currency values indirectly, as falling bond prices (rising yields) attract capital inflows, strengthening the currency and the DXY.

Summary Table

Factor Relationship with USD / DXY Explanation

10-Year Bond Yield Positive correlation Higher yields attract foreign capital, boosting USD

Interest Rates Positive correlation Higher rates increase returns on USD assets

Interest Rate Differential Drives carry trade and currency flows Larger spread favors higher-yielding currency

Carry Trade Supports USD when borrowing low-rate currency and investing in USD Increases demand for USD and US bonds

Bond Prices Inverse to yields; indirectly affects USD Falling bond prices (rising yields) strengthen USD

Conclusion

The US Dollar Index (DXY) generally moves in tandem with the 10-year Treasury yield and interest rates because higher yields and rates attract capital inflows, strengthening the dollar. The carry trade exploits interest rate differentials, further supporting the dollar when investors borrow in low-rate currencies to invest in higher-yielding US assets. Bond prices inversely relate to yields, and their fluctuations indirectly influence the dollar through these mechanisms.

#DOLLAR #GOLD #

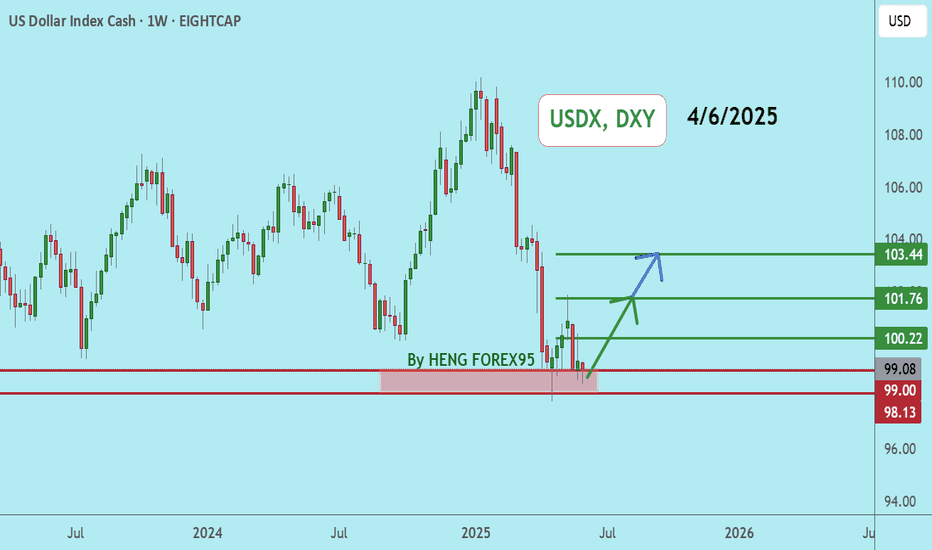

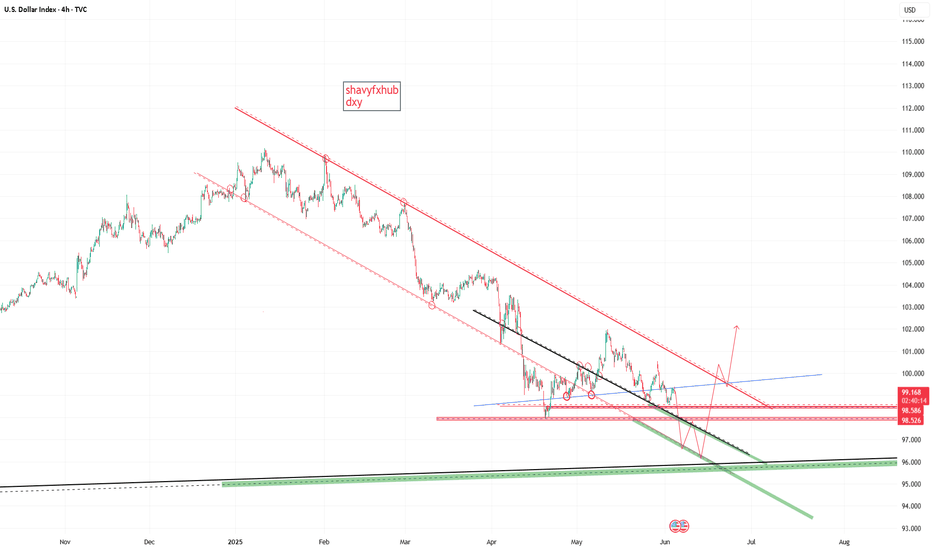

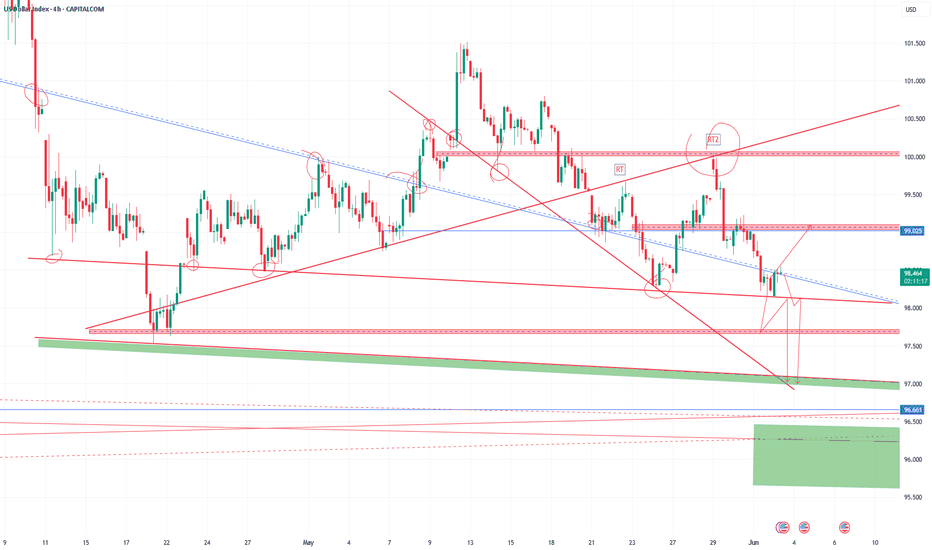

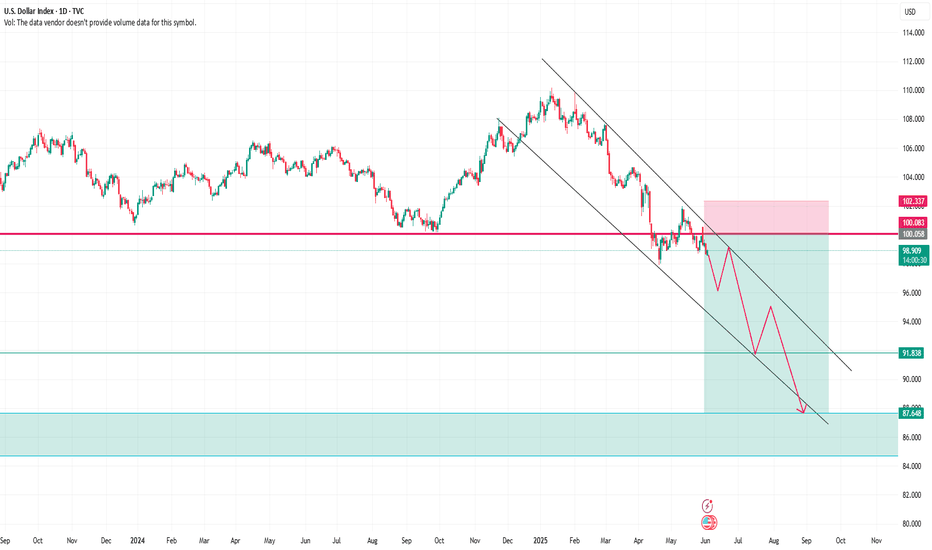

USD Index (DXY) –

🔧 Technical:

Trading in a clear downtrend channel

Key resistance: 100.08

Target: 91.83, then 87.64

Bearish bias remains unless price breaks above 102.33

🌍 Fundamentals:

Fed rate cut expectations weighing on the dollar

Weak U.S. data and slowing inflation support downside

Global shift away from USD adds pressure

📉 Headline:

“DXY Weakens Below 100 – Bearish Pressure Builds Toward 91.83”