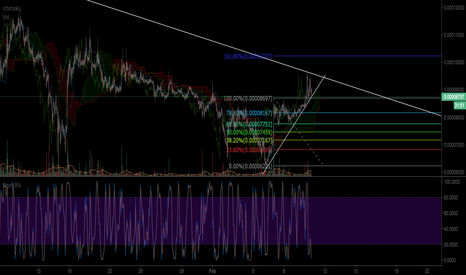

POWR/BTC Volume Analysis Prediction 2/7/2018Power coin made a false break down of strong supoort level 6485.

Also the price break out the trend line.

On intraday chart we have a strong bullish trend.

In summary, buy priority with a great potential.

Trade recommendation:

Entry point: 7890 (buy limit), 8602 (buy stop).

Stop: 7349

Target1: 9850

Target2: 10900

Target3: 11700

Glossary of terms

Point of Control (P O C) – The price level for the time period with the highest traded volume .

Value Area (V A) – The range of price levels in which a specified percentage of all volume was traded during the time period. Typically, this percentage is set to 70% however it is up to the trader’s discretion.

Balance - Accumulation Area.

POWRBTC trade ideas

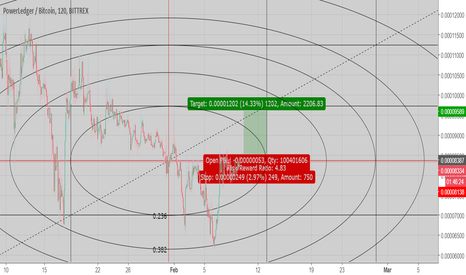

Power Ledger POWR BTC Forecast - PennantPennant seems to be forming on POWR chart. Chart shows converging bullish movement however it lacks volume. If it gets the right volume, targets are as follows:

Target 1 8600

Target 2 9000

Target 3 9400

Support stands at 8,000

Resistance at 8,400

This is not an investment advice, always do your own research.

Power Ledger Power ledger is sitting pretty inside the asymmetrical triangle.

Power will need an increase in volume for the next push upwards, otherwise we should expect to see movement down to the lower support if it continues to test the current trend line support. Power is bullish right now since it is sitting above the red ichimoku clouds.

WHERE I WOULD BUY BACK INTO $POWERWho is bullish on $POWR ? I know I am.

When would I buy back in to it

1. will the first area that I will for price come

back down and test for support. (higher #risk2reward )

2. Most likely will place small bid here better risk2reward and protected some what by 3.

$BTC #BTC

PowerLedger LongSubstantial project with real world demand and successful partnership trials already underway. Longing in the demand zone around 8600-8300 and holding until ~33000 (2.618 fib extension).

Great undervalued project at only 300m USD with a potential growth to >10B in coming years in the 10 trillion USD energy exchange market.

Entry: 8500 sats

Exit: 33000 sats

Stop Loss: 7780 sats

powrbtc - hidden bull divergence and descending volume = ??something im curious and paying attention to is powrbtc, we hardly have any data and i have done little fundamental analysis besides finding out about this particular coin/token through crypto twitter.

BUT, hidden bull divergence and descending volume, with converging bbands = ?

would like to know any other indicators that can help to confirm trend will continue. thanks for looking and any comments or critique is appreciated

POWR/BTC Daily Analysis - 1 February 20183 THINGS WE NEED TO SEE BEFORE WE POWER UP

1. It seems like POWR is done retracing from the most recent run up, to about 0.00008025, between the 61.8 and 78.6 Fibo levels. Now, we need to see higher highs and higher lows to confirm.

2. The MA (50) is acting as a pretty strong resistance. We want to see a break above that.

3. The price has been trailing in the lower Bollinger Bands, gathering more downward momentum. We want to see it trading in the upper Bollinger Bands, for a higher probability of breaking above the short term downtrend line.

**This is just me learning stuff. Feel free to share your thoughts with me. I'd love to learn more.

Powerledger, get to know it.What's there not to like about Powerledger? That's a real question I hope someone actually can answer. From a TA perspective, it simply looks set to make a move in the next few hours or days and one can be safe by waiting for a solid break out upwards.

The idea is great as well. It's basically about sharing local electricity using a cryptographic token. They've attracted funding from the Australian government. They've got a demo location in place where people trade locally generated electricity. They've got what looks like a solid team of true believers and real geeks. There are several good stories in the news

news.google.com

one of which is that they made the top 3 of Richard Branson's Extreme Tech Challenge www.extremetechchallenge.com at CES 2018

Good news that did not really make a positive mark on the coin price, rather the reverse; it plummeted just days after the above announcement. Which is curious and reason why I'm asking if there's anything not to like here.

At any rate, examine the graph, examine their idea powerledger.io I think there's a clear case for this technology to find adaption and a clear first mover advantage in this team.

Not intended as investment advice.

Looking forward to your comments and likes.

POWR SetupSetup looks good following a 3 week consolidation phase.

Right now I'm seeing two scenarios.

1) ABCDE correction is complete and we have seen a primary impulse wave.

We see candles closed in the cloud and sideways consolidation. If volume picks up we might see a secondary wave break the downtrend.

2) ABCDE correction is not complete.

The leading kumo has turned red indicating possible resistance at 9100. In this case we might see the final E wave complete to 8k. This would be an area to watch if the trend line failed it might fall to 5k.

If scenario 2 plays it, POWR still falls into a bull flag pattern and would be set up to retest the 13k range.

Maybe scale your buy orders to be safe.

If you like, hit me with a follow for more analysis updates and find the link to my Telegram in my profile. Happy Trading!