POWRBTC trade ideas

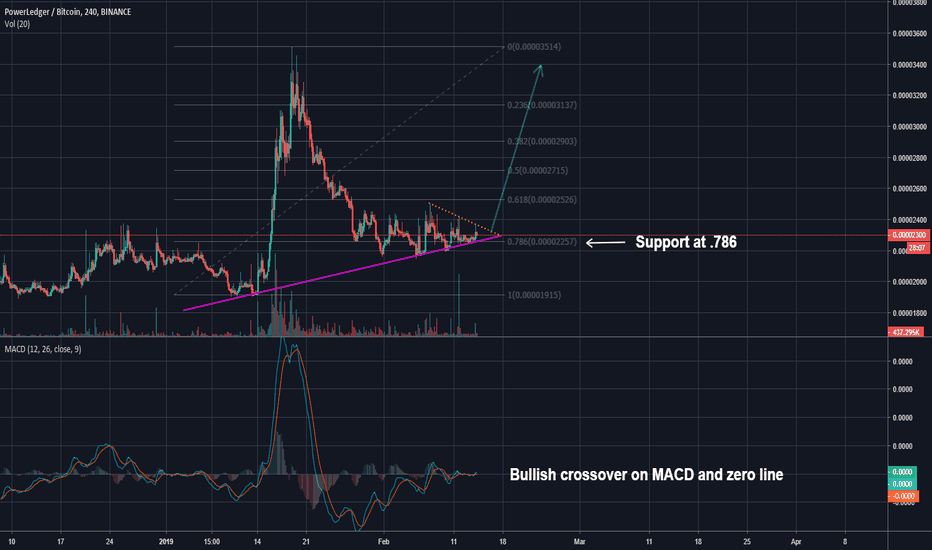

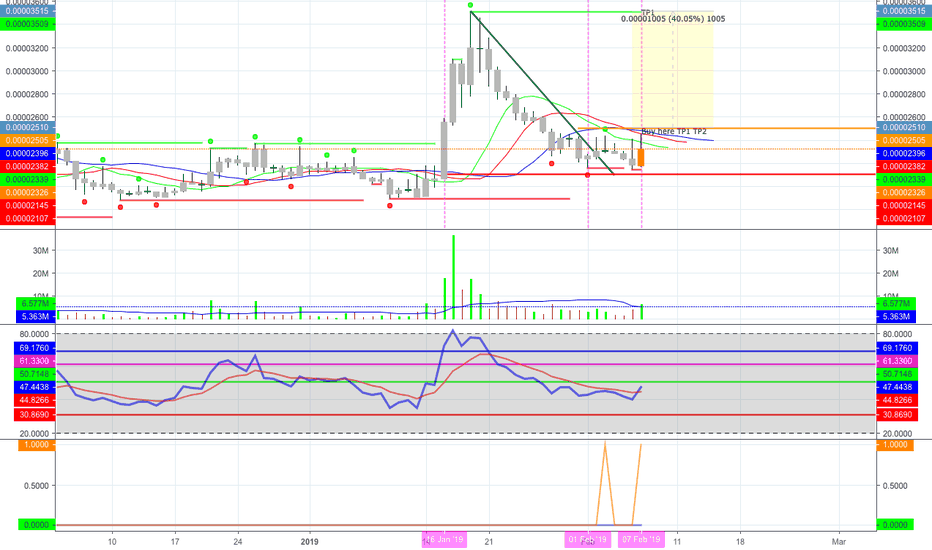

POWER Bullish UptrendStrong bullish momentum building on POWER. There has been good movement on this coin for the past few weeks, however there seems to be strong resistance between 3200-3300 level range. The resistance has existed since about September last year. For the breakout to occur this resistance needs to be broken. A bullish triangle wedge is building for the short term and is like highly likely to go up. Stoich RSI and RSI levels are neutral. Good time for a long trade. Targets to take profits are 2700, 2900, 2950 levels. Stop loss should be around 2350.

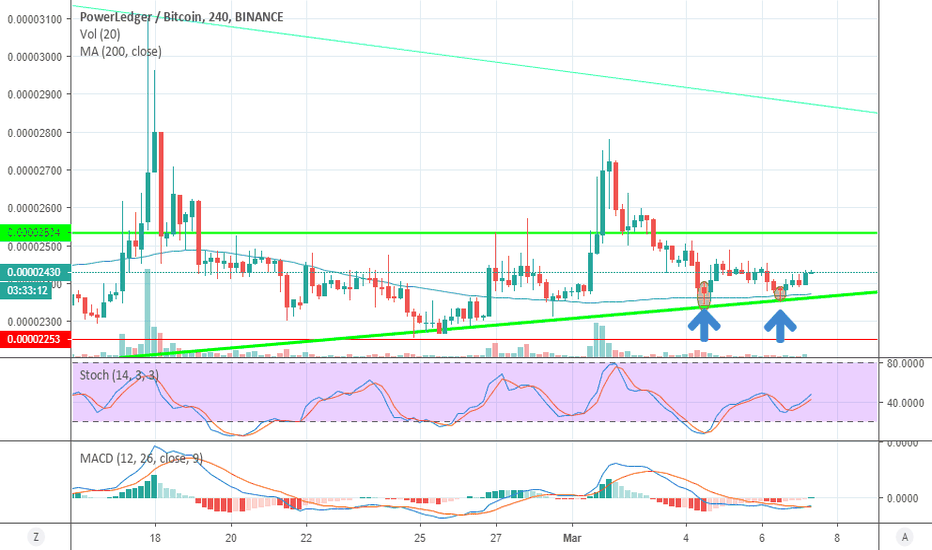

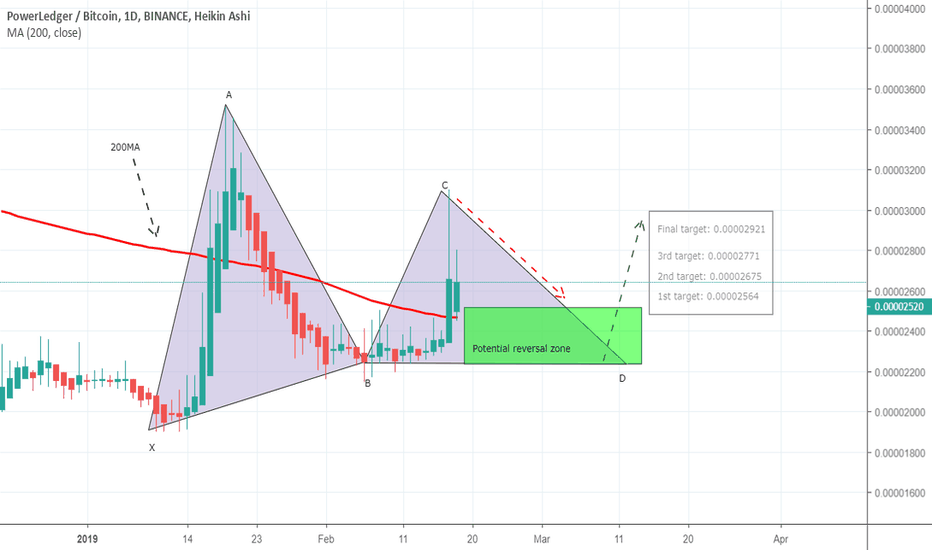

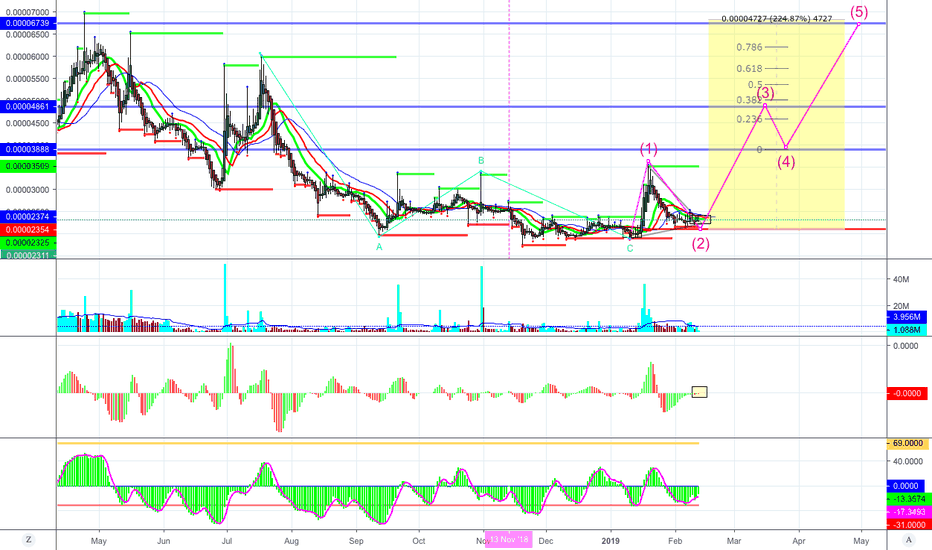

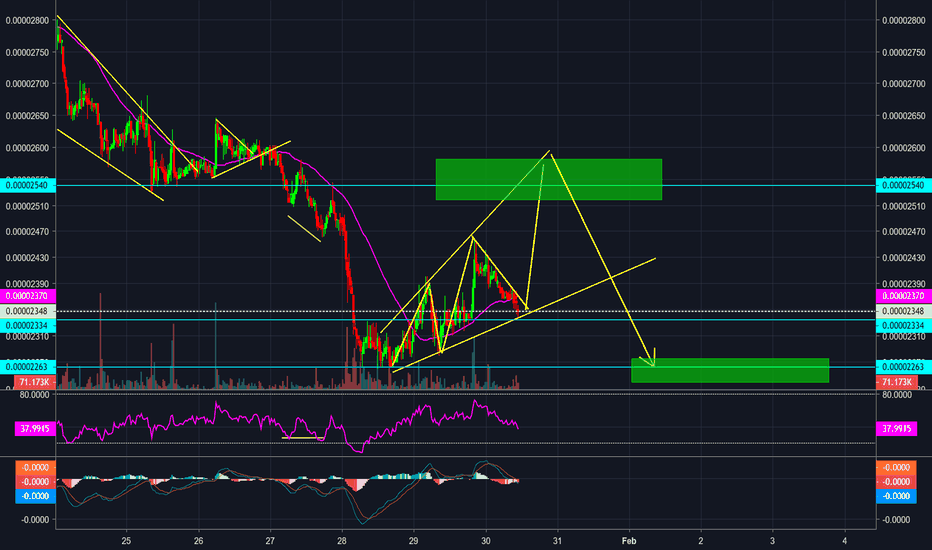

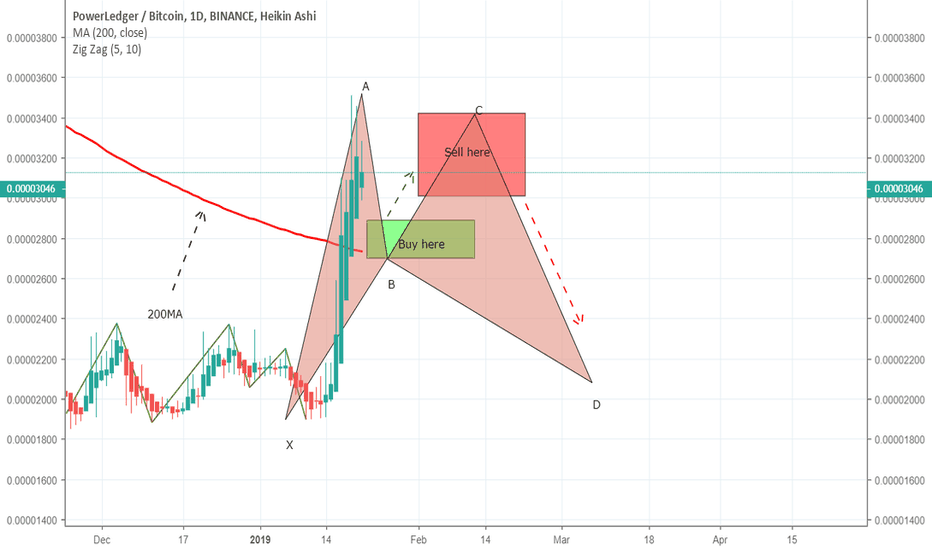

POWRBTC a completion of gartleyBy the grace of Allah the most high the previous idea:

generated more than 35 percent profit.

Now the same pattern is showing its continuity and the C to D leg formation is going to start.

The 200MA is already in PRZ to provide firm support for bullish divergence insha Allah.

The targets are defined accordingly plz find on chart.

Regards,

Atif Akbar (moon333)

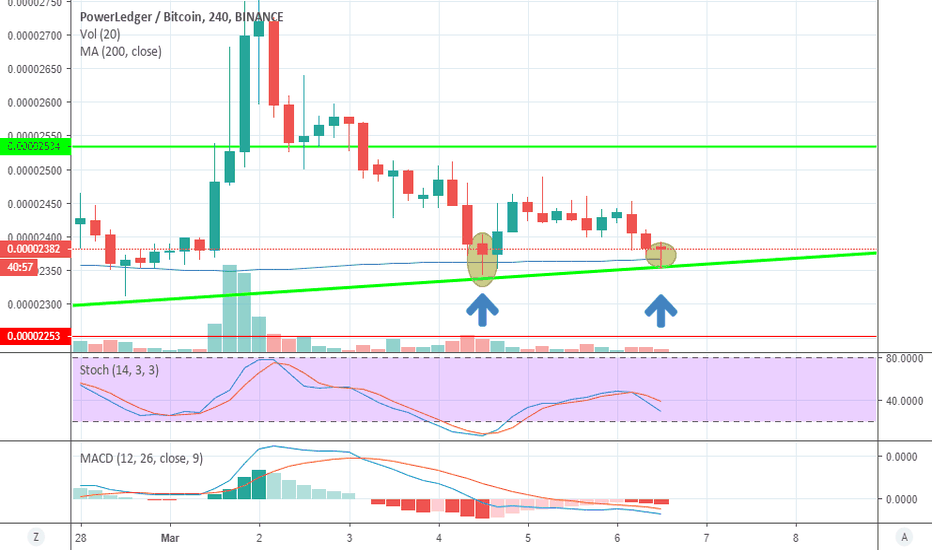

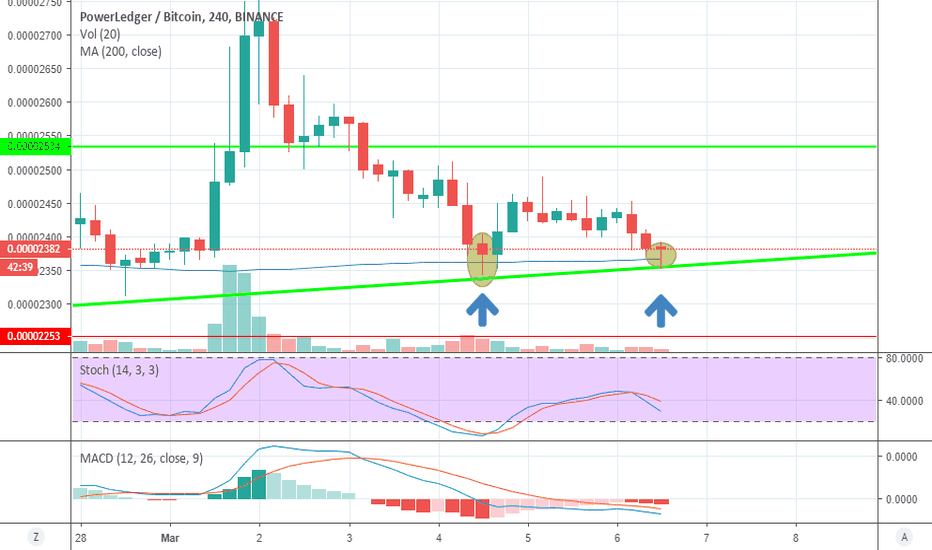

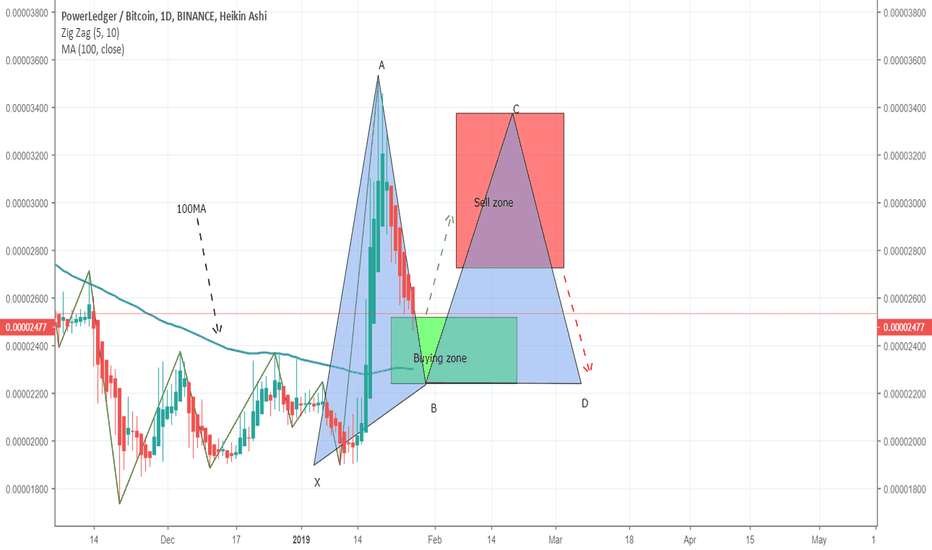

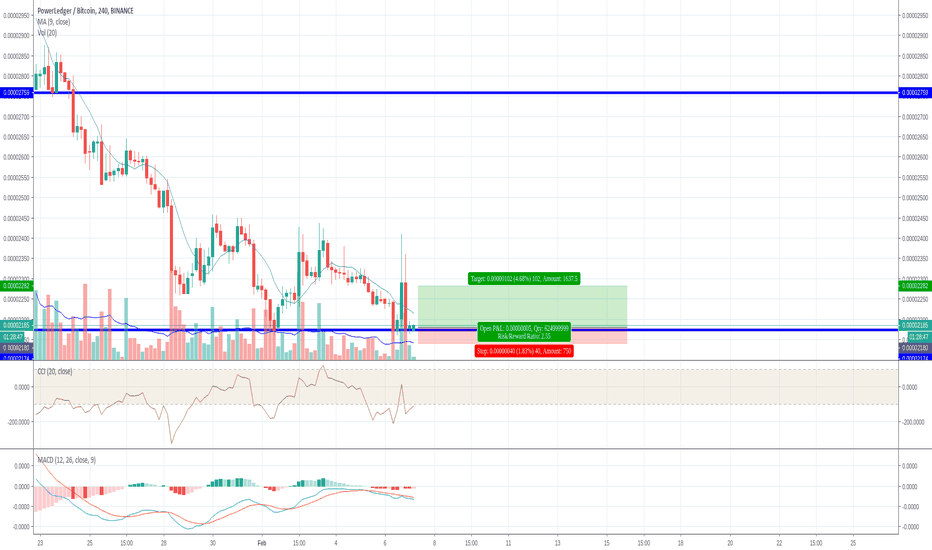

POWRBTC has entered in buying zoneThe price action has broken the 200MA support and now it has 50 and 100MA supports which seems to be firm insha Allah.

The price line also has retraced between 0.618 to 0.786 fibonacci and entered in buying zone of harmonic pattern this will be a bullish reversal zone insha Allah.

I have defined the targets accordingly plz find on chart.

Regards,

Atif Akbar (moon333)

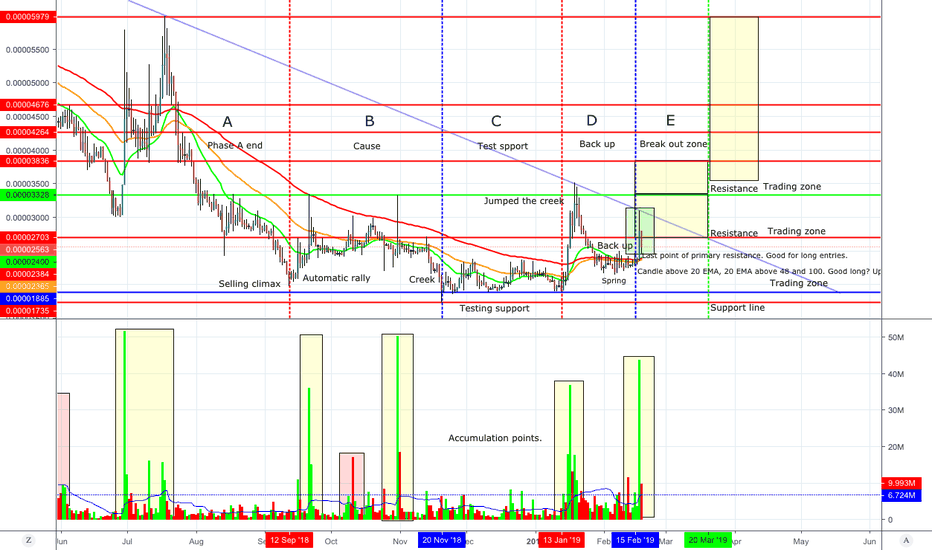

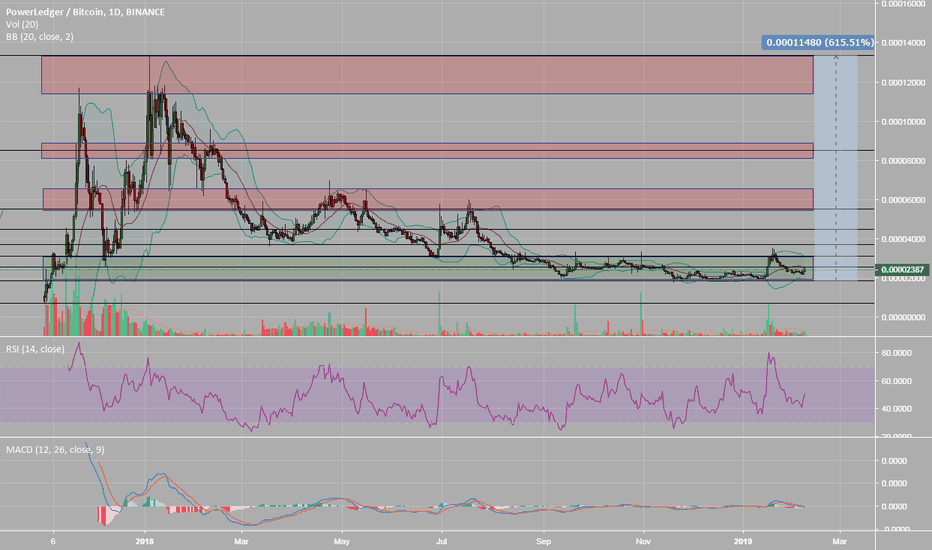

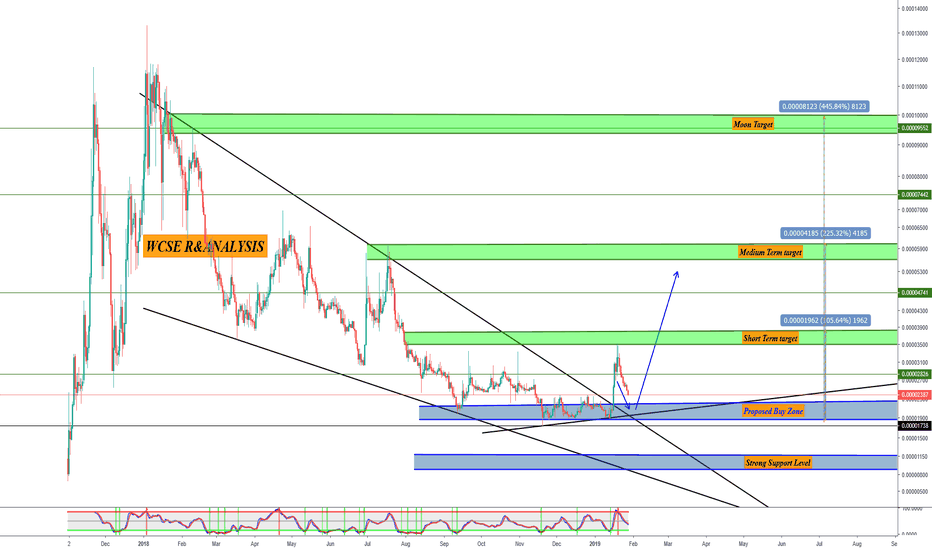

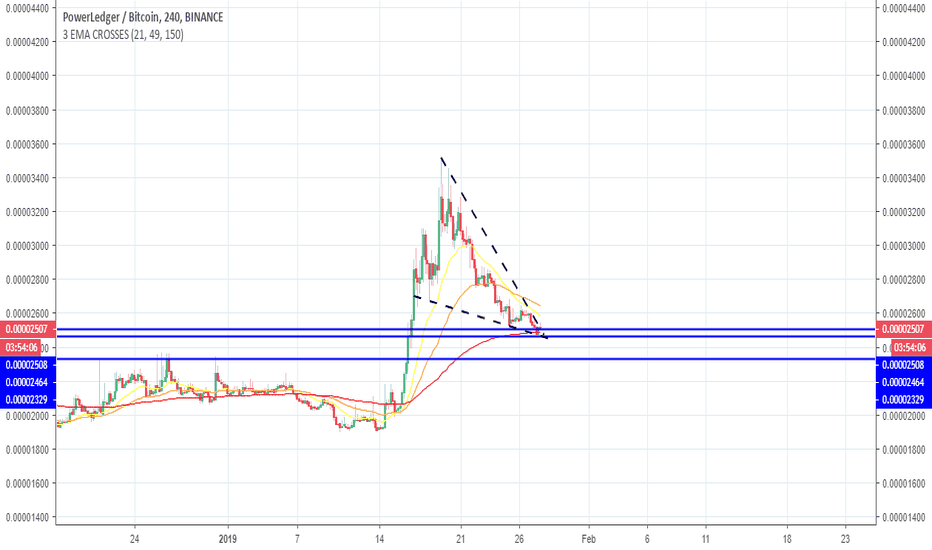

PowrBtc Potential Buy opportuity (70-250)%Hi guys if we could remember the huge falling wedge on powr which broke out some weeks ago, right now we have major re-test ongoin and I believe this will just be a re-test with bounce, this pave serious Buy opportunity for us to ride the coin upside.

Kindly follow the suggested accumulation zone on the chart and always remember to apply stop loss.

Level to watch for are:

POSSIBLE ENTRY ZONE

Possible Support LEVEL

SELL TARGETS

Do know that I appreciate you taking the time to read my posts and Please leave a LIKE and FOLLOW us for more updates.

Thank you

Note:

It will be good to always understand risk involve in trading. Always trade with stop Loss in place.

Set up an entry/exit strategy for every trade, with good risk/reward ratio.

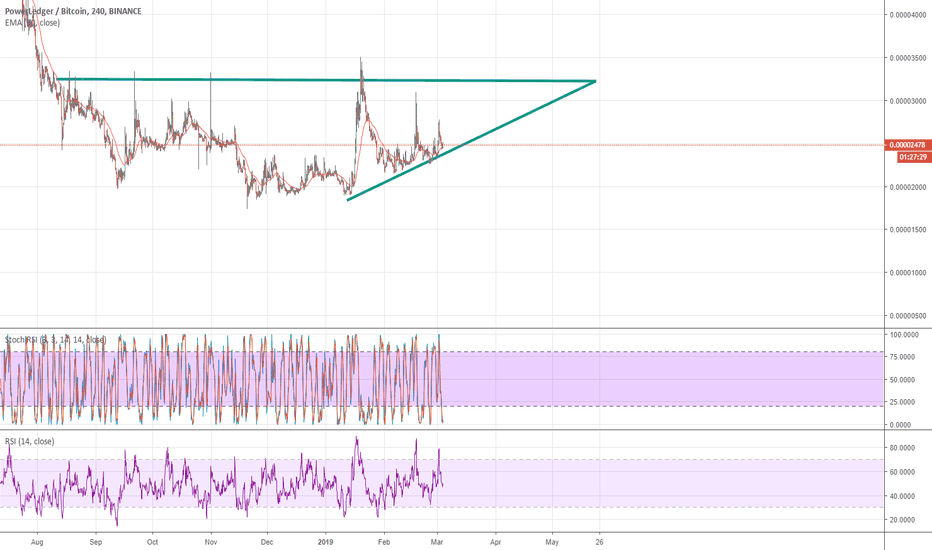

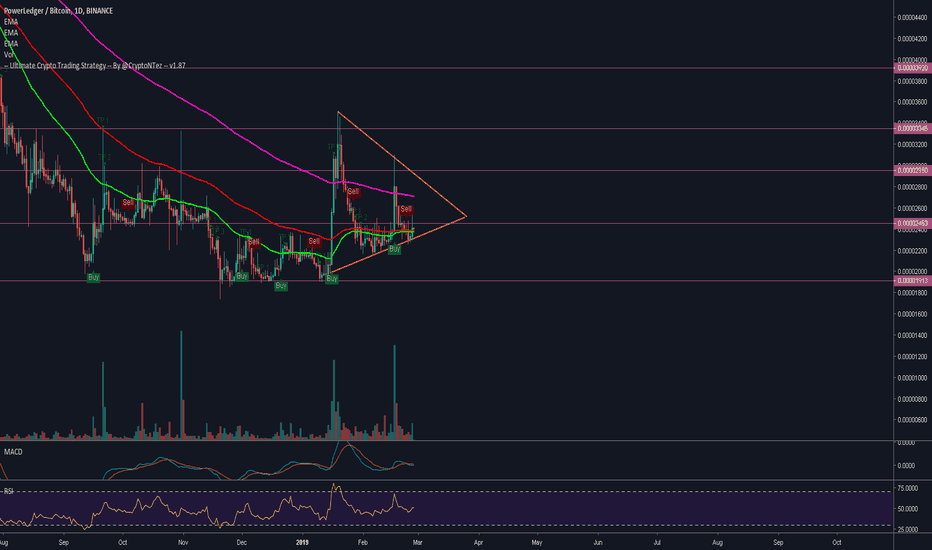

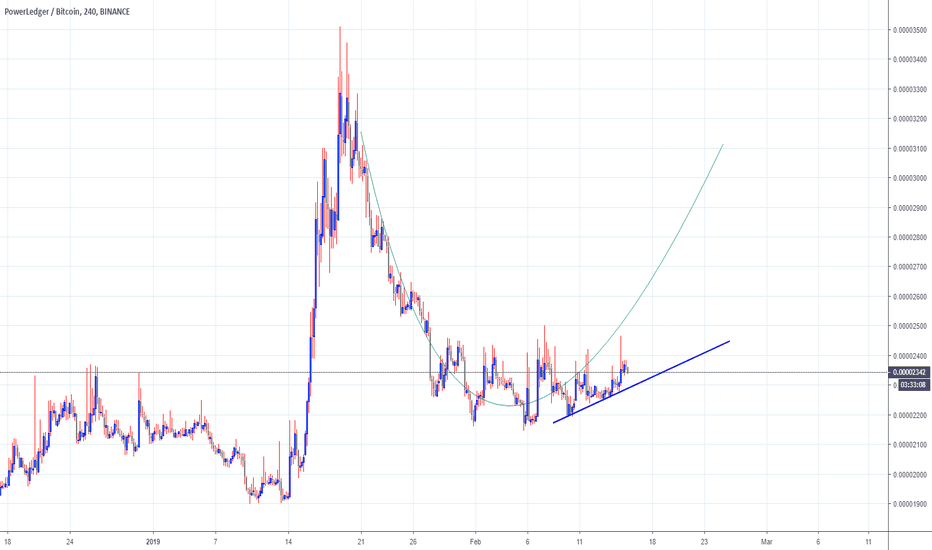

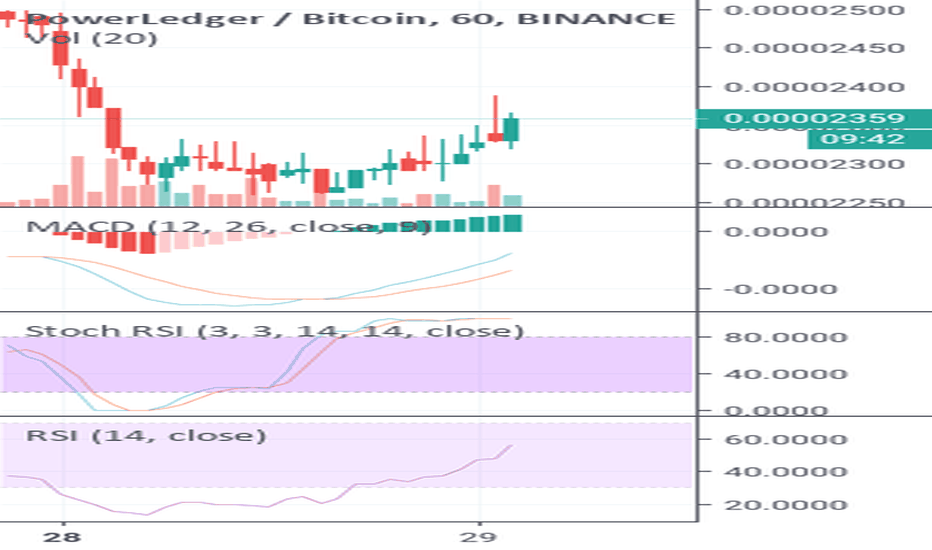

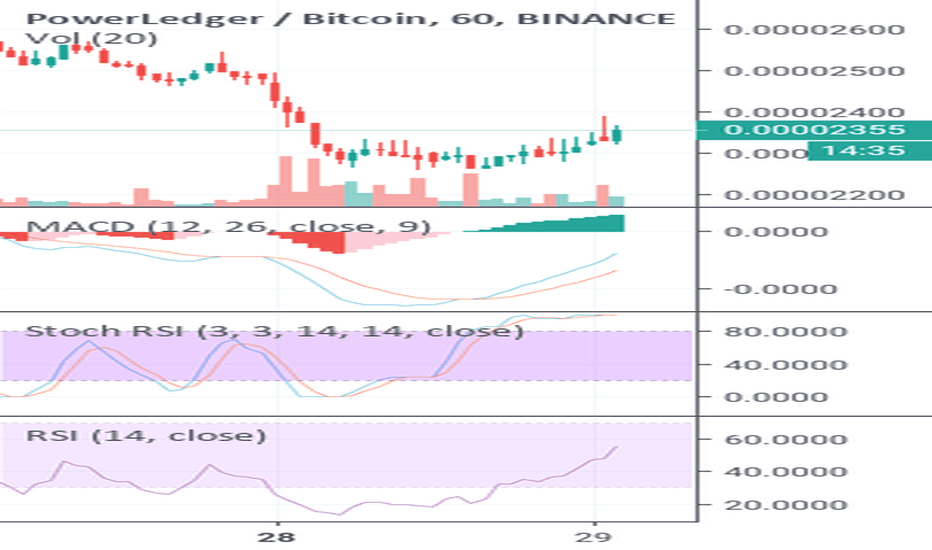

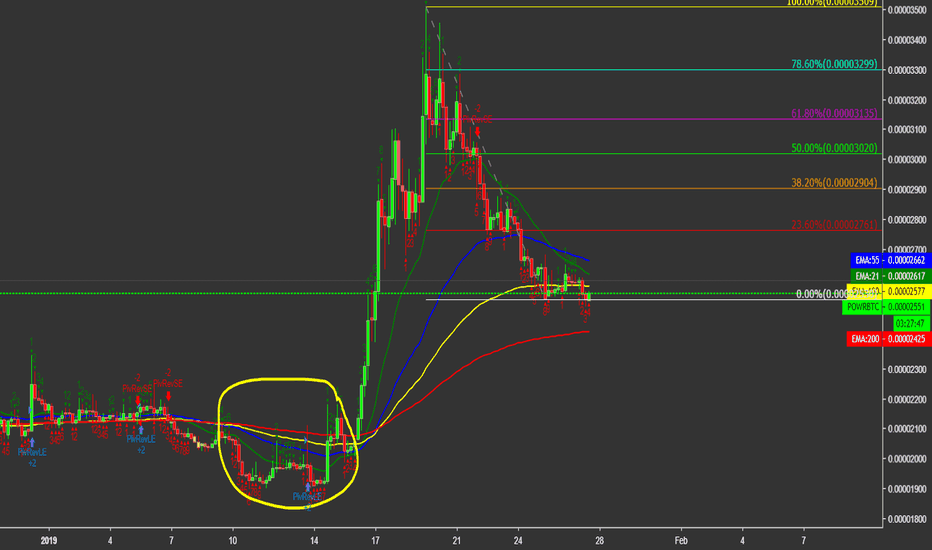

POWRBTC POWR expecting bounce back from 200 EMA 30% profit soonDont forget give like to this chart & share with others, doing so will encourage me share more charts with you.

Looking at #POWR 4Hr chart, its all set to give next rally. Its nice completion of TD Sequentional, around 22nd of Jan, EMA 55 did able to hold it and it drop back to next support at 2537 & now EMA 100 tried to hold but failed.

Finally our 200 EMA is at 2425, and before that POWR will launch to moonshot.

Last time full EMA reversals happened around 10th to 15th Jan (CIRCLE WITH YELLOW COLOR) and moment crossed 200 EMA huge bounce back. So all i can see its matter of days before its rocket launch.

TA

RSI, MACD, CYCLIC INDICATOR ALL BULLISH & PERFECT.

BUY AROUND 2425-2577

TARGETS

(1) 2761

(2) 2904

(3) 3020

(4) 3299 (MOON-SHOT 30%)

STOP-LOSS

2310

DISCLAIMER: For Educational Purpose only, make sure you do full study and analysis before making or doing any type of investment.