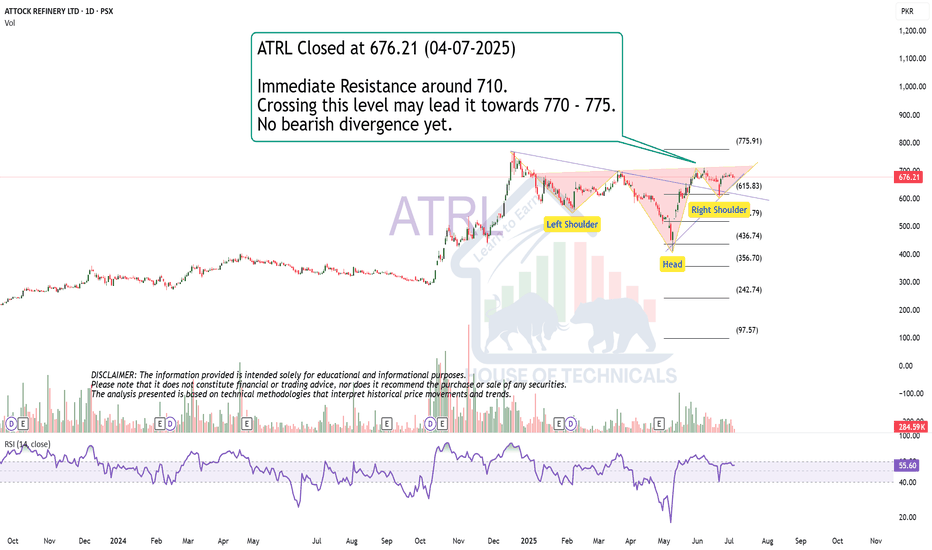

ATRL trade ideas

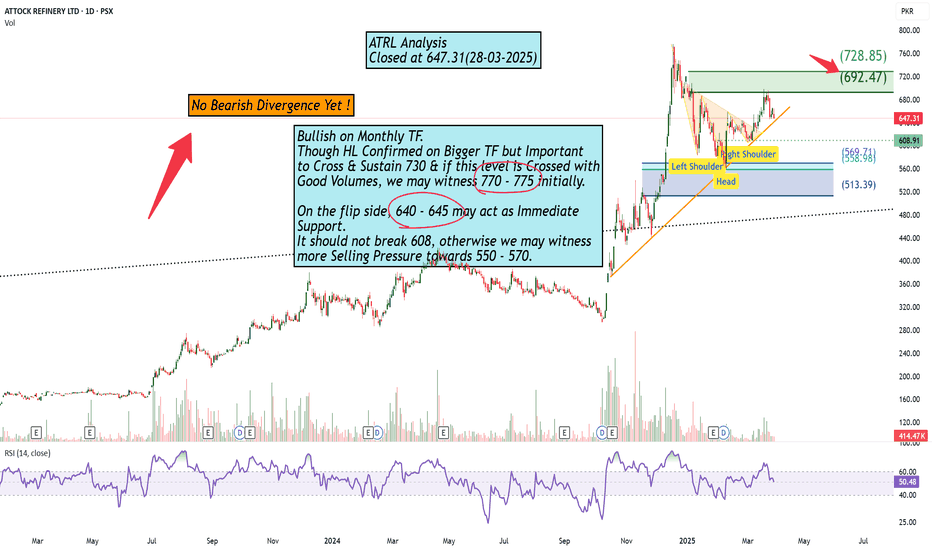

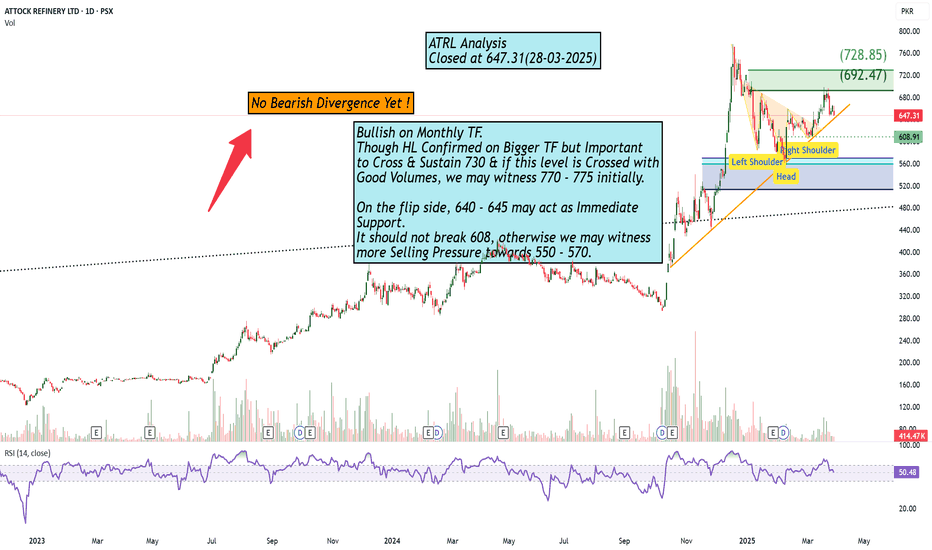

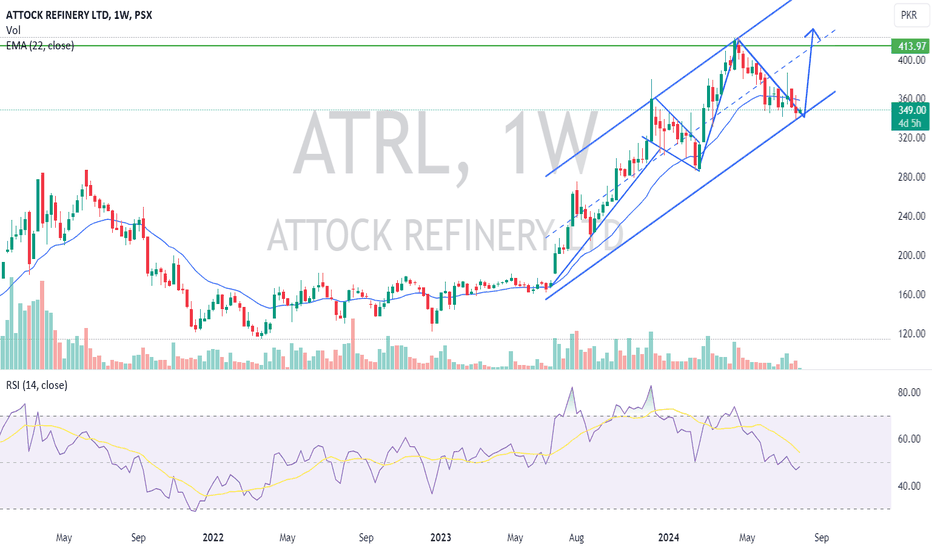

Bullish on Monthly TF.Bullish on Monthly TF.

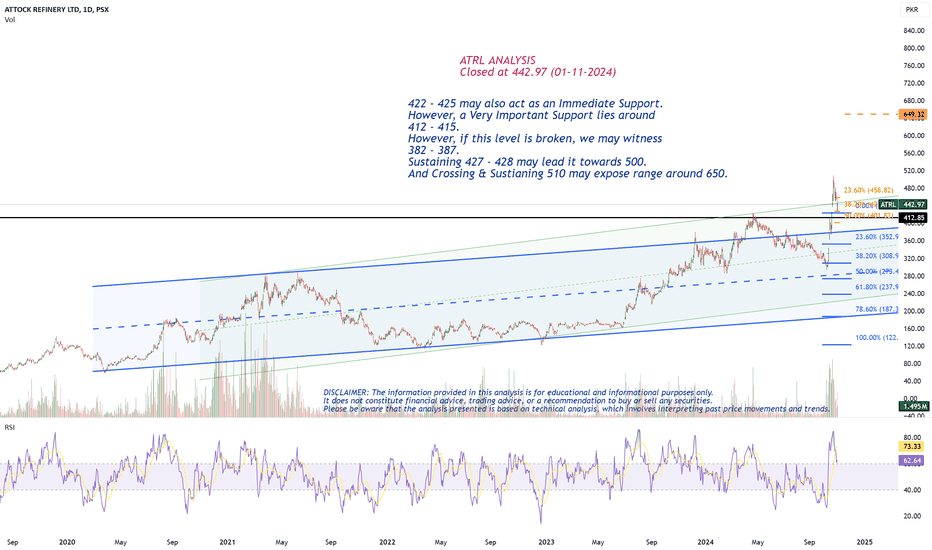

Though HL Confirmed on Bigger TF but Important

to Cross & Sustain 730 & if this level is Crossed with

Good Volumes, we may witness 770 - 775 initially.

On the flip side, 640 - 645 may act as Immediate

Support.

It should not break 608, otherwise we may witness

more Selling Pressure towards 550 - 570.

No Bearish Divergence Yet!Bullish on Monthly TF.

Though HL Confirmed on Bigger TF but Important

to Cross & Sustain 730 & if this level is Crossed with

Good Volumes, we may witness 770 - 775 initially.

On the flip side, 640 - 645 may act as Immediate

Support.

It should not break 608, otherwise we may witness

more Selling Pressure towards 550 - 570.

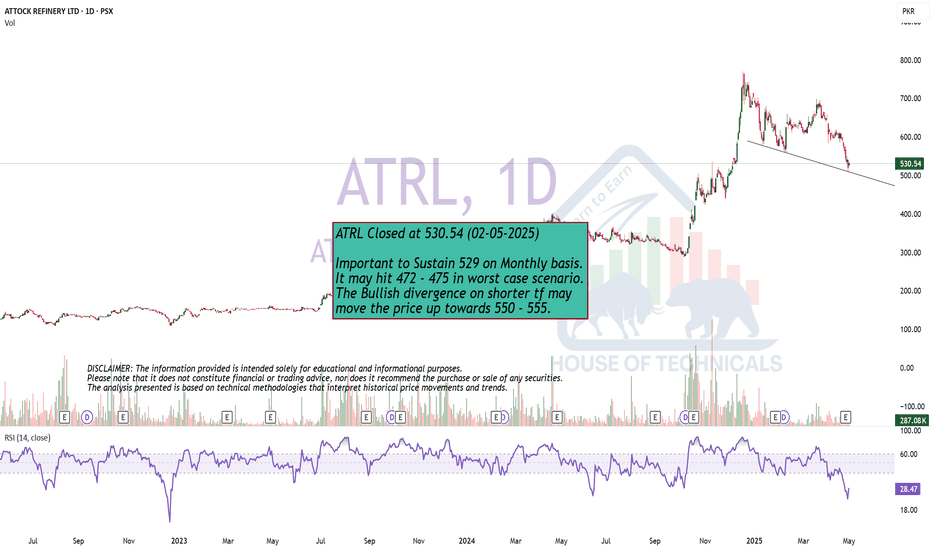

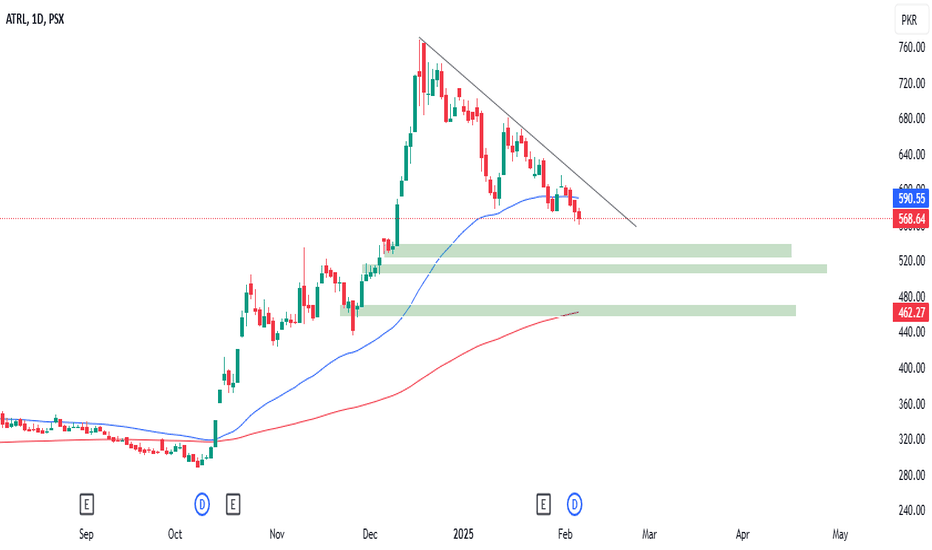

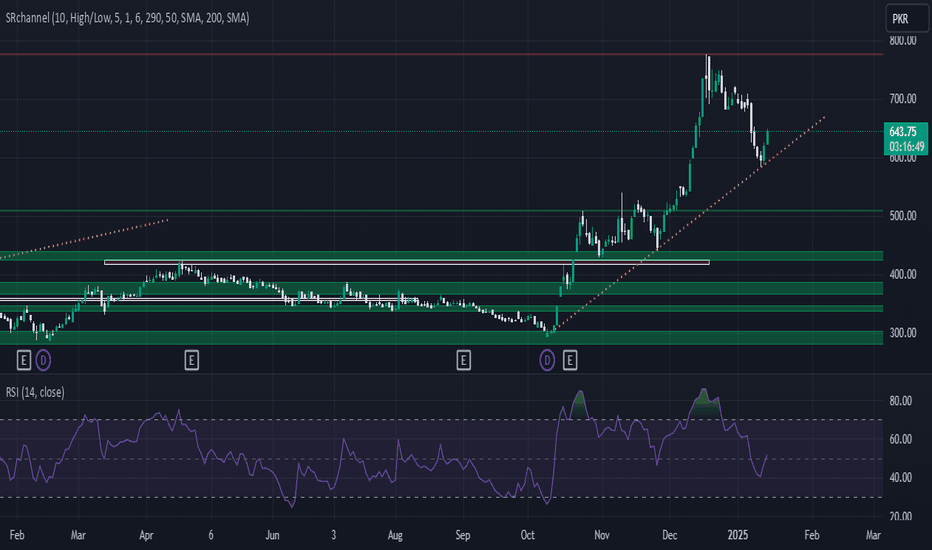

Bullish on Bigger TFImmediate Support is around 605 - 610

else, around 590 - 591

2 Possibilities:

1. If reverses from the current level, it may

touch 690 - 730 range.

2. If it does not sustain 590, it should come

down towards 570 ~ 555 range.

Weekly Support 558 should not break as this is

also the HL.

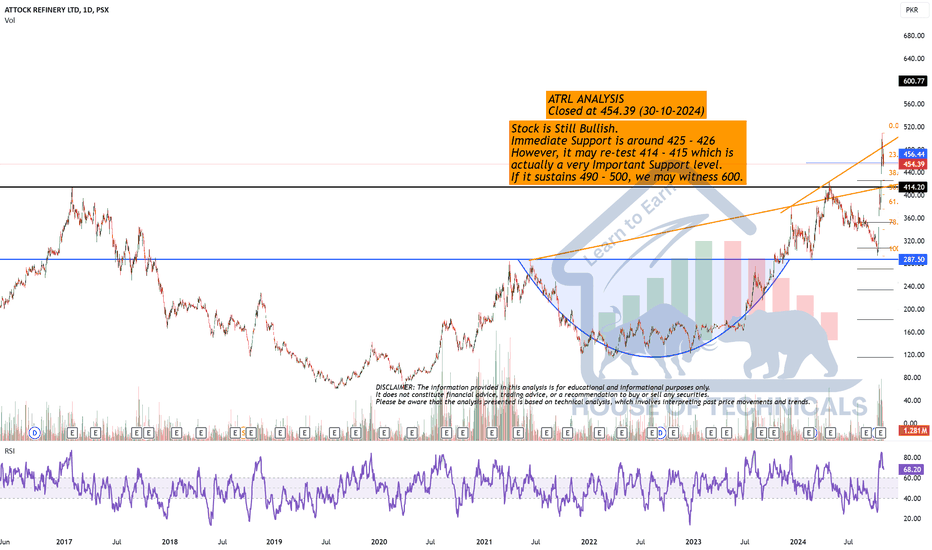

ATRL - Attock Refinery Ltd. 1DBased on my analysis, ATRL is showing weakness and approaching crucial support levels.

- The descending triangle pattern suggests potential bearish continuation.

-it could be take support from 550 to 520 zoon looking partial buying in that area

This is my personal view and not financial advice. Trade accordingly.

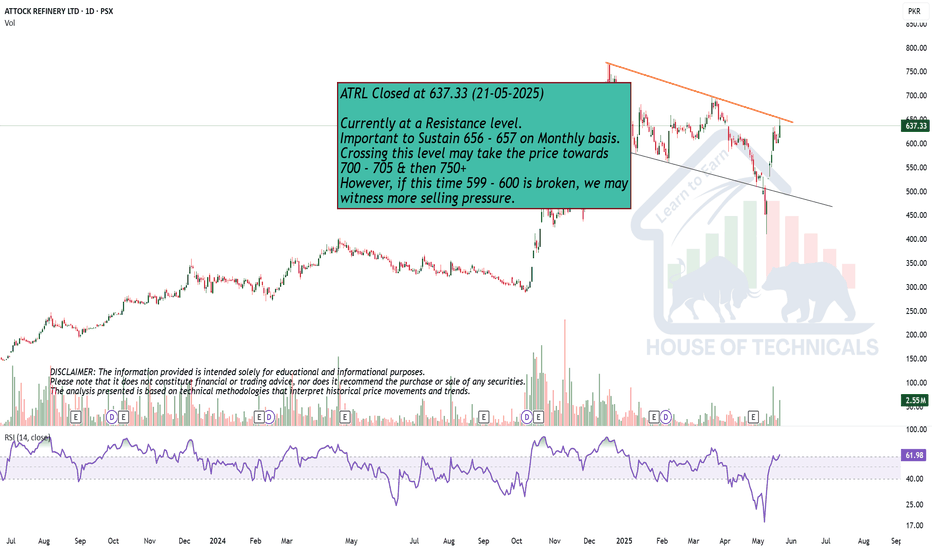

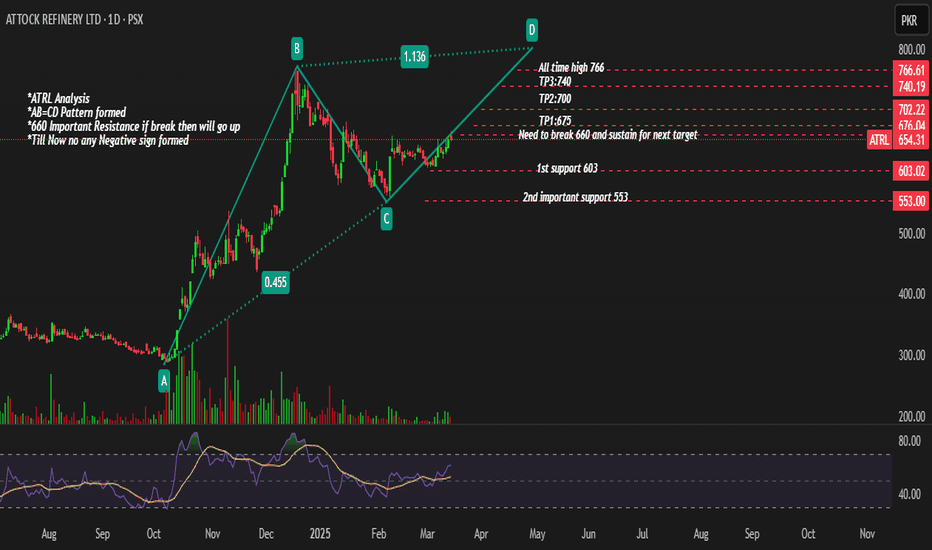

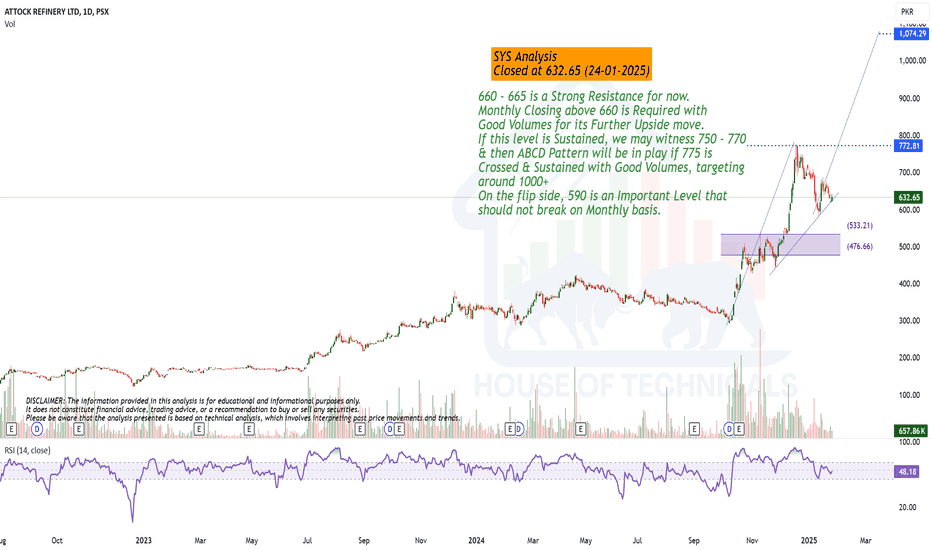

660 - 665 is a Strong Resistance for now.660 - 665 is a Strong Resistance for now.

Monthly Closing above 660 is Required with

Good Volumes for its Further Upside move.

If this level is Sustained, we may witness 750 - 770

& then ABCD Pattern will be in play if 775 is

Crossed & Sustained with Good Volumes, targeting

around 1000+

On the flip side, 590 is an Important Level that

should not break on Monthly basis.

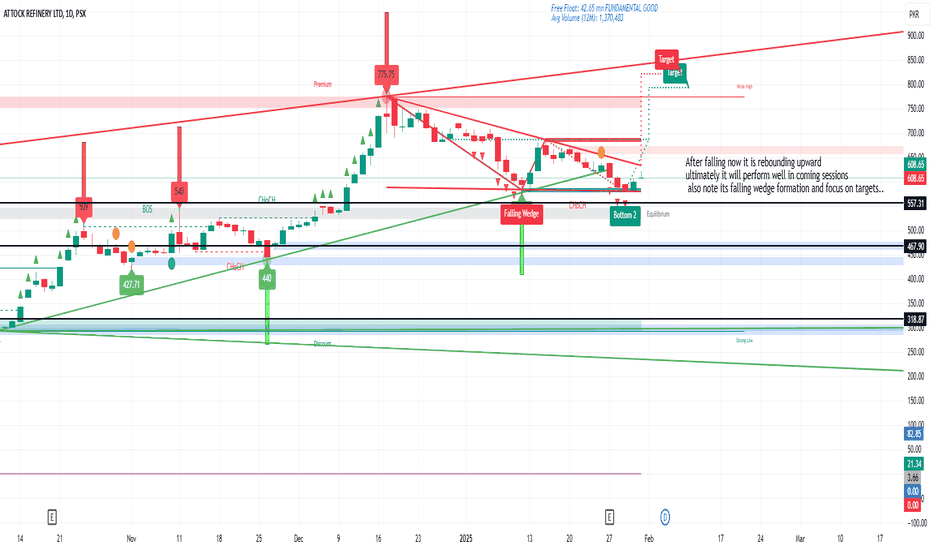

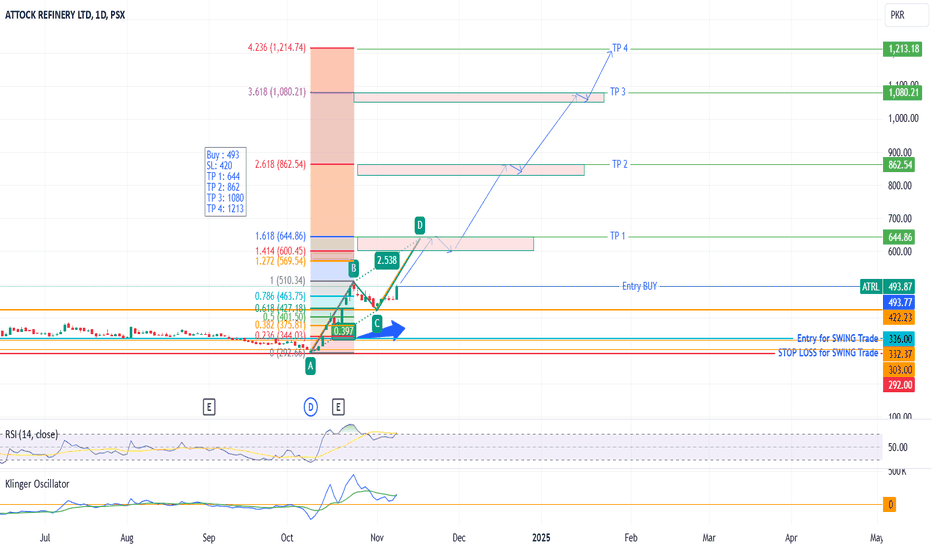

ATRL - Technical Analysis - Buy Call for Long-term HoldingOn Daily TF, price has already made its all time high and as such there is no sign of reversal. RSI shows no divergence and Klinger also suggests continuation of sharp uptrend.

With good news surfacing wrt refineries, share prices are likely to go up sharply.

Therefore, it is strongly recommended to initiate Buying immediately. Fib Extension tool has been used to identify potential first profit booking area marked as TPs. This Bull run is expected to run till end Sep~Dec, 2026 ; therefore, long term holding may also be considered.

Trade Values

Buy : 493 , SL: 420 , TP 1: 644, TP 2: 862 , TP 3: 1080 , TP 4: 1213

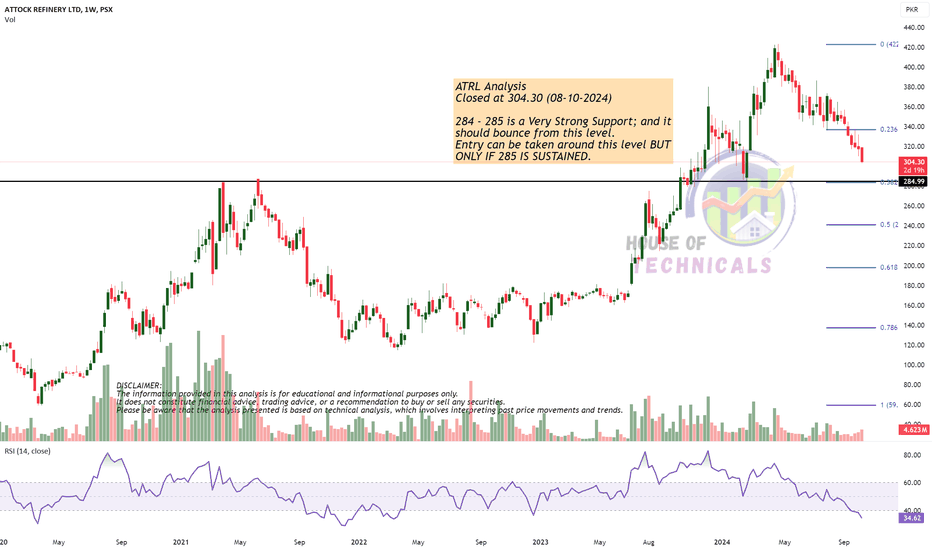

ATRL is BullishATRL seems to be gearing up for another bullish move, as bullish RSI divergence has emerged and matured at daily time frame, indicating the strong hold of bulls on the price action. If previous lower high is broken and a higher high is printed, we can expect a bullish rally as per Dow theory. Targets are mentioned on the chart.

ATRL 1D IN PSX MAKE BULLISH DIVERGENCECertainly! Here's a description for **Attock Refinery Limited (ATRL)**:

Attock Refinery Limited (ATRL) has formed a bullish divergence on the 1-day chart, indicating potential upward momentum. The recommended **entry level** is at the current price, with a **stop loss** set at 340 to manage risk. The **take profit** targets are 388 and 413, suggesting a favorable risk-reward ratio. 📈💼

Happy trading! 🚀💰

ATRL:- BULL SHALL TAKE THE GAME TO NEXT LEVEL.ATRL has been in tremendous bull run which started last year.

From May 2024 to onward the security was forming a triangle, which denotes the continuation of the bull trend.

The triangle has successfully breached and price is coming back to test its support. bullish divergence has already been formed on RSI, thus forming the confluence in favor of bulls.

SL, in this scenario shall be 330 and TP is 450. Whereas the long position may be opened at current market price.

Due diligence and strict money management is solicited.

Have a profitable trading.