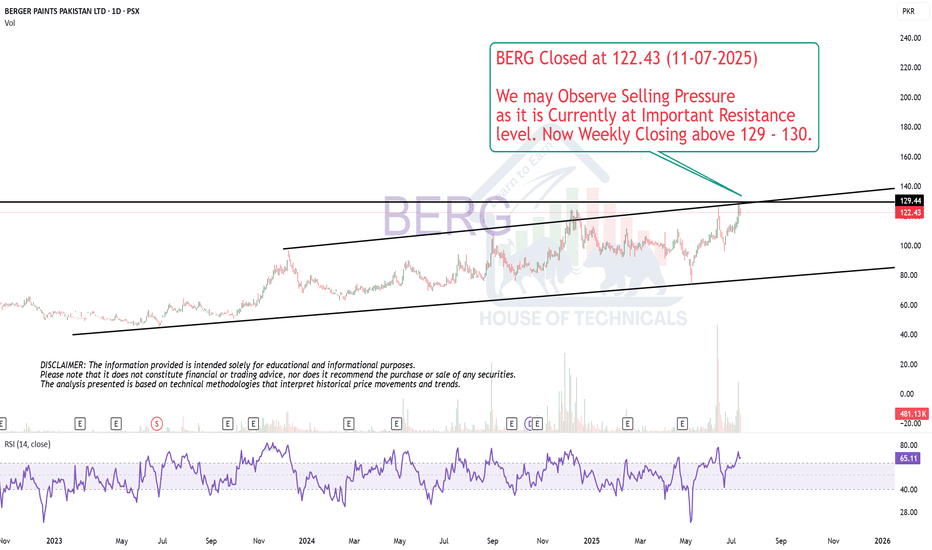

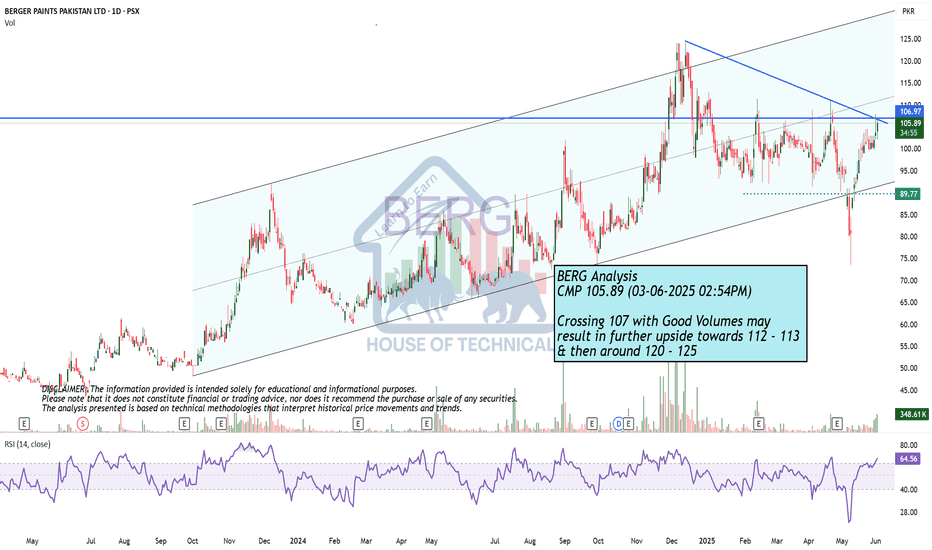

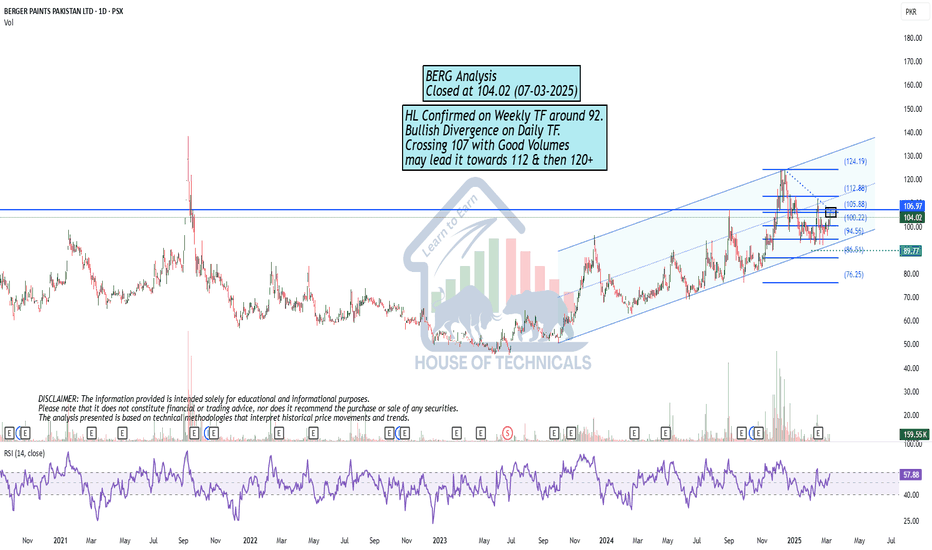

BERG trade ideas

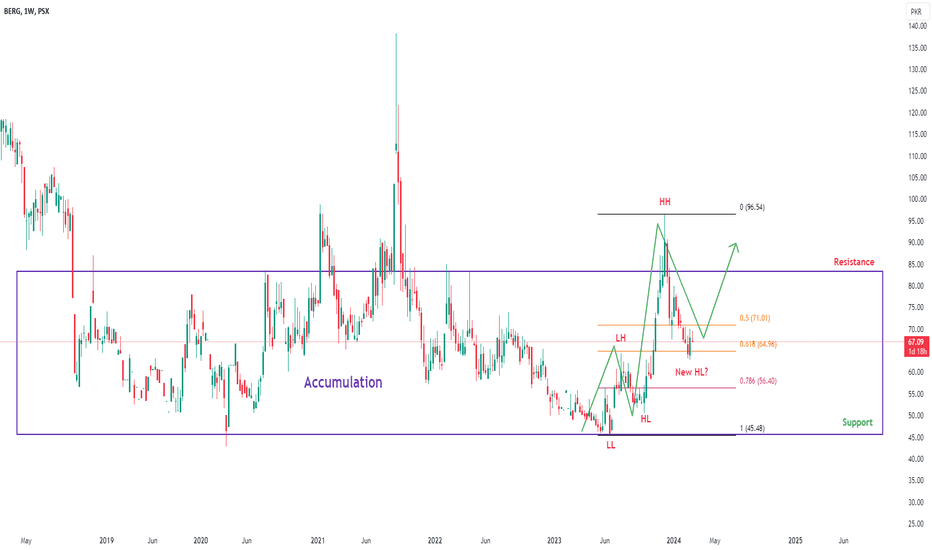

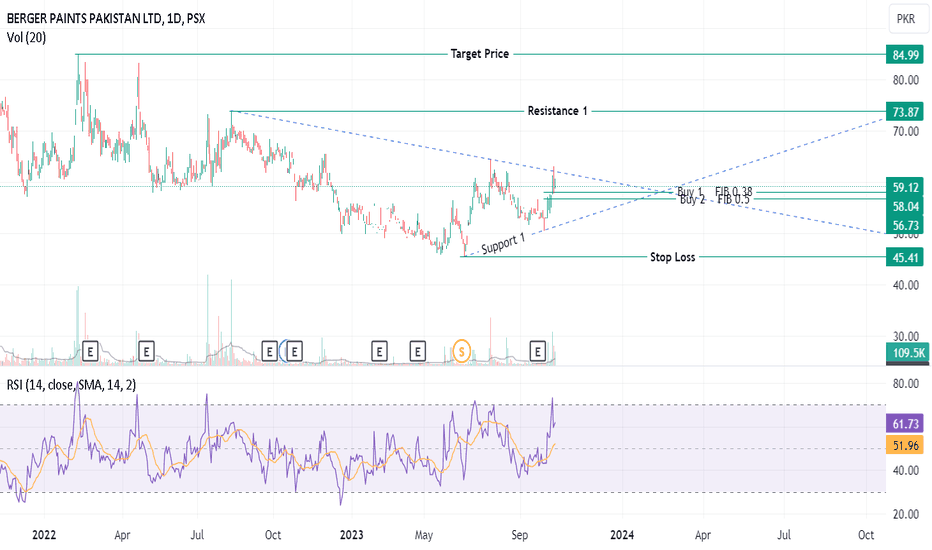

BERG - KSE100- PSX - Possibly new higher low?BERG appears to be consolidating within an accumulation zone, suggesting a potential trade opportunity. Consider buying once the price surpasses 70, setting a stop loss at 60, and targeting a profit of 82. The stock is exhibiting a pattern of higher highs and higher lows, potentially indicating the formation of a new higher low, particularly as the price resides within the Fibonacci golden pocket zone.

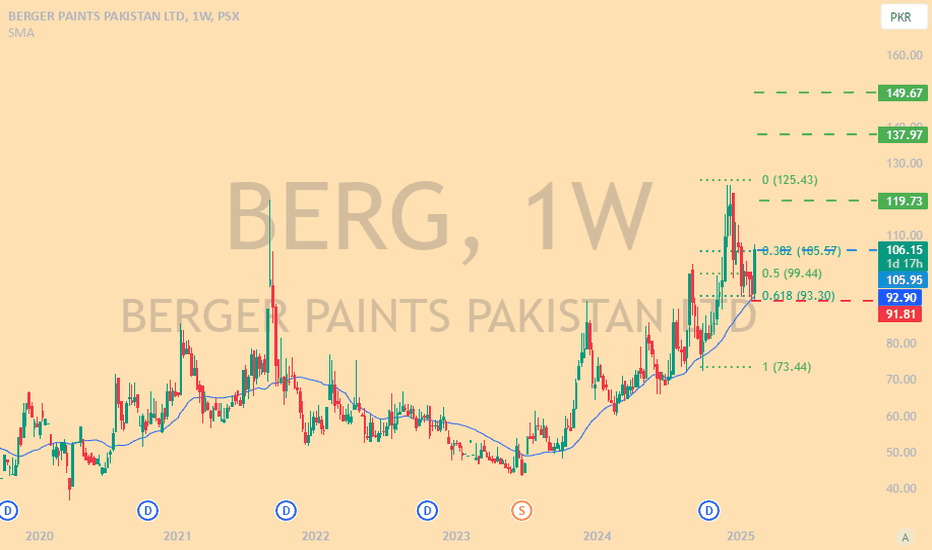

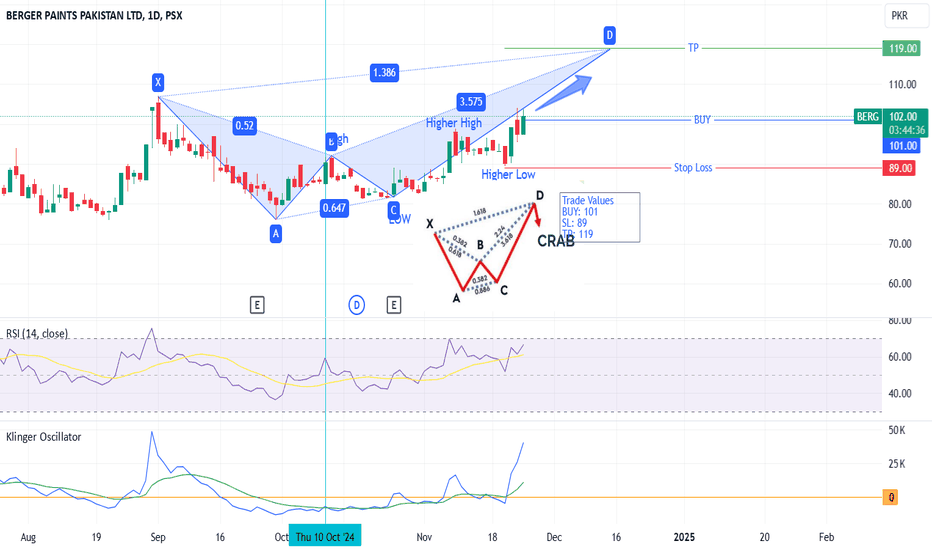

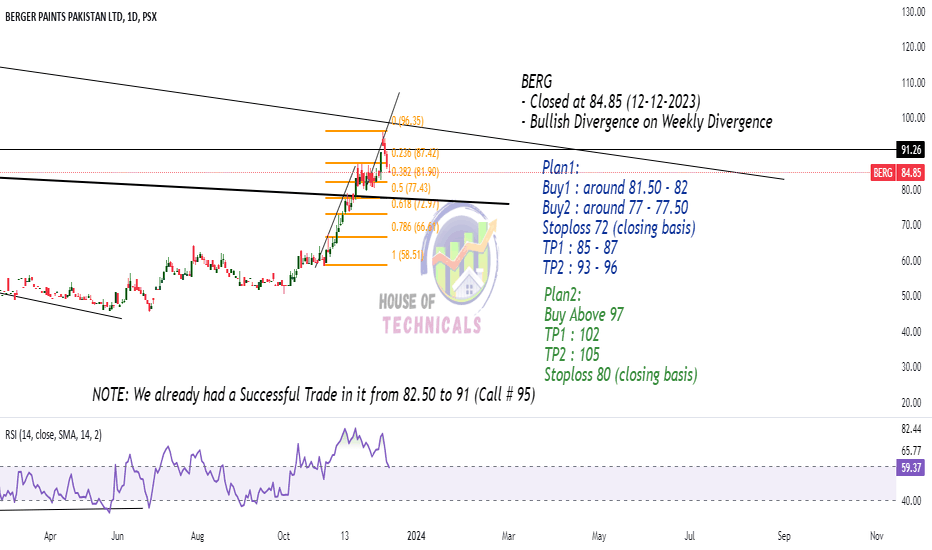

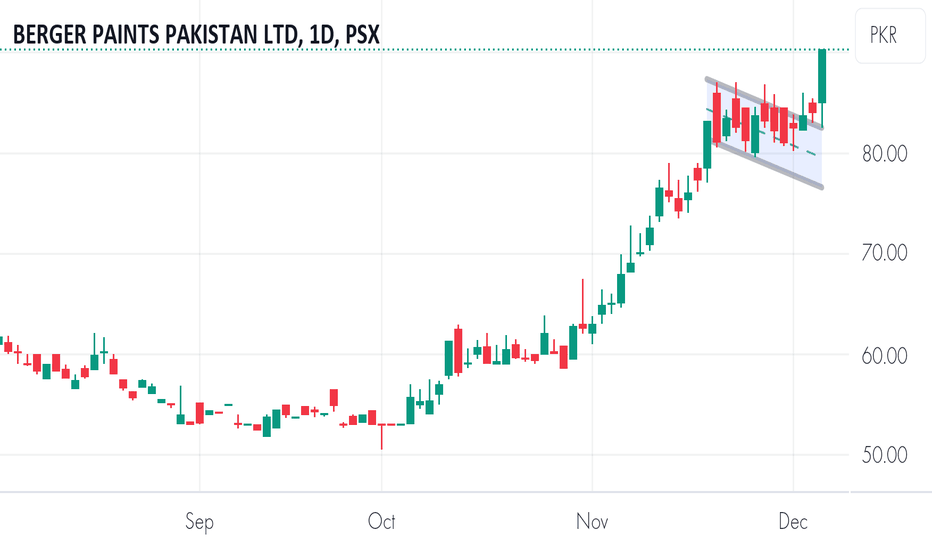

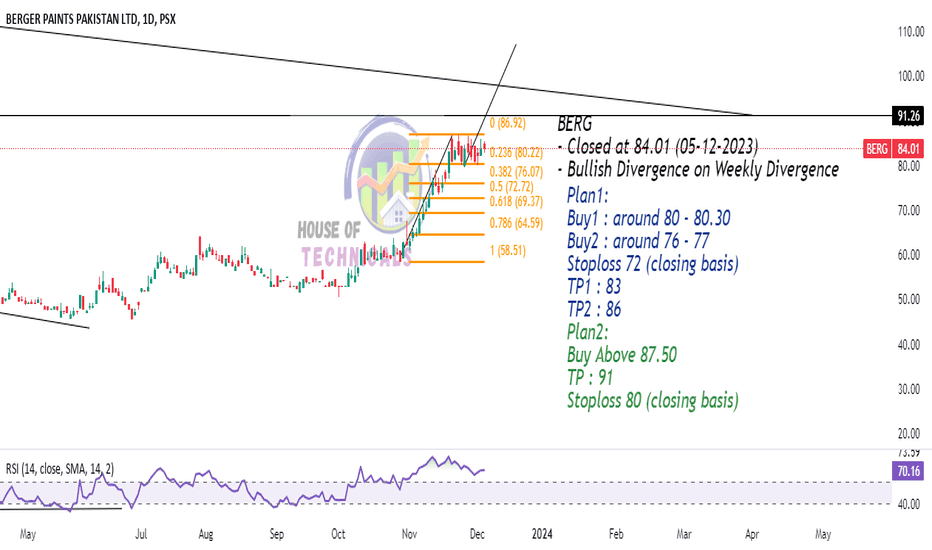

PSX: BERG Gearing up for travel to North.BERG has been steadily moving upward for quite sometime. It has been facing the resistance thus forming a triangle. We have two strategies to trade the triangle 1. take position at the Breakout of price above the triangle . 2 is buy the support.

for those who want to buy at discount the fib. levels has been identified along with the stop loss levels.