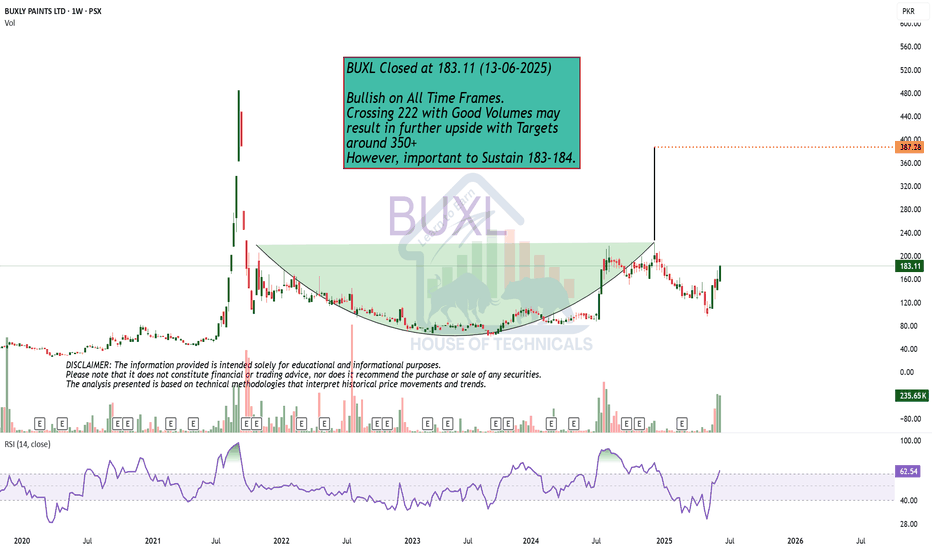

BUXL trade ideas

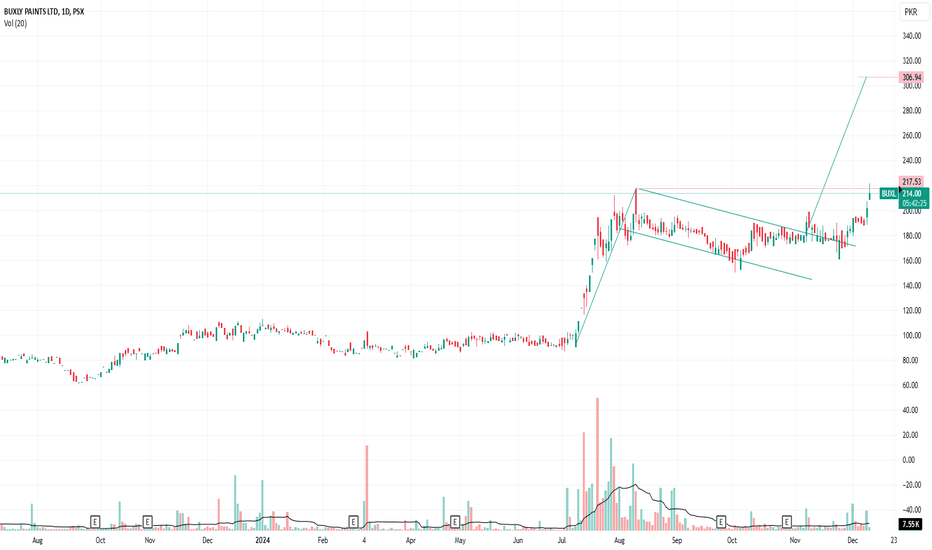

BUXL Offering 35-40% Capital upside from these levelsBUXL if give day's closing above 217 it will be marching towards 306 which is the final projection of the bullish Flag.

However, owing to the current market situation, it will be wise to put your SL in place which is 150.23, Instant Entry can be taken here with first TP at 283 and second TP of 349, however, bear in mind that as per final projections of the Bullish Flag, it will be wise to close your trades @ 300-306 levels

Buying on these levels provide an opportunity for 35-40% capital upside

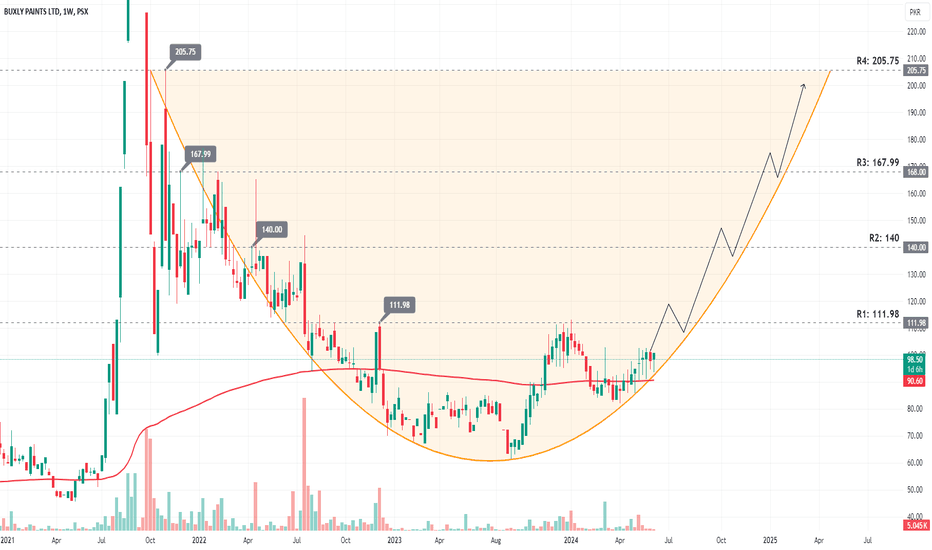

BUXL | An underdog with great long term potential!On the weekly timeframe, the price is hovering above the 200-day EMA line, signifying a robust bullish trend and moving in a cup pattern. Furthermore, the RSI is at the 58 level, indicating potential upside. Upon horizontal analysis, the price was rejected from its resistance level around 111.98 in January 2024, which previously acted as support. Upon breaching this level, the next resistance lies around 140, where selling is expected, and the cycle continues. This idea is based on the long term and applies many factors, such as each time the price faces resistance, selling is expected, and upon breakout, only the next upper side can be expected. On the flip side, if the price breaks below the 200-day EMA, then a bearish sentiment is established. This stock is currently categorized as illiquid, so investors are recommended to perform due diligence fundamentally and technically before entering.