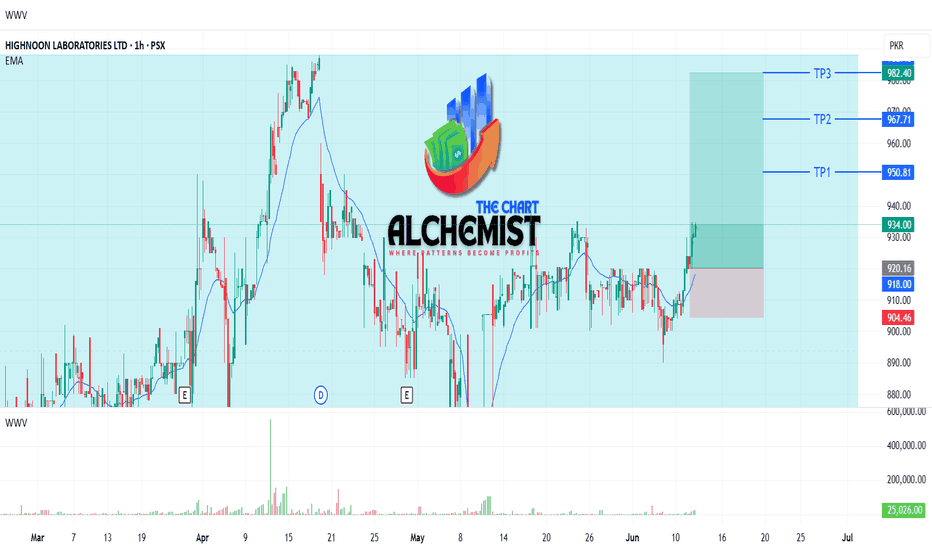

HINOON LONG TRADE 11-06-2025 (1H TF)HINOON long trade

- *Reaccumulation Phase:* HINOON has been trading in a range since 2024, between 798 and 990. After posting a spring below this consolidation zone, the stock quickly rebounded and continued in an absorption area for a month.

- *Current Setup:* Today, the stock created an IFDZ at the 1-hour timeframe, indicating short-term upward movement. Volume distribution also supports this upward momentum.

🚨 TECHNICAL BUY CALL – HINOON🚨

- Buy levels:

- Buy 1: Current level (934)

- Buy 2: 920

- Targets:

- TP1: 950

- TP2: 968

- TP3: 982

- Stop Loss: Below 900

- Risk Reward Ratio: 3.9

Caution: Please buy in 3 parts in buying range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

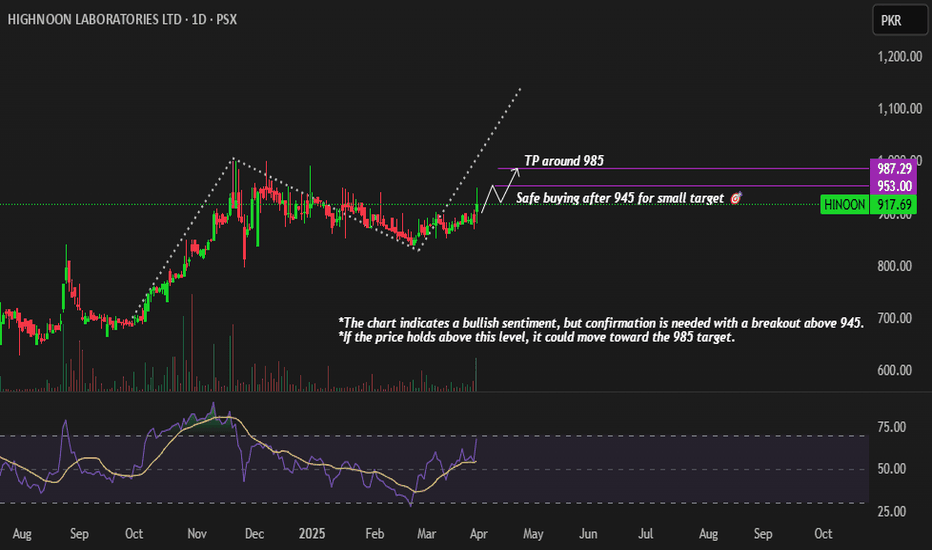

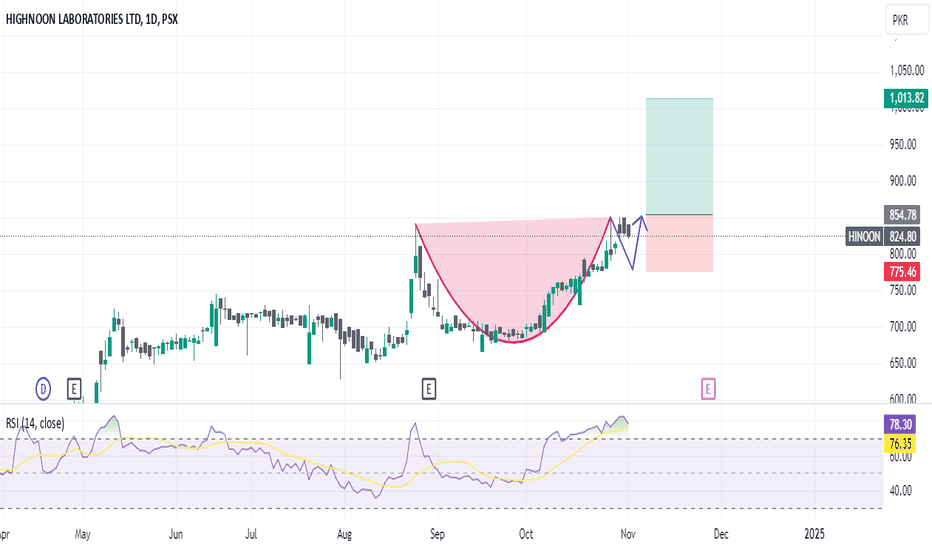

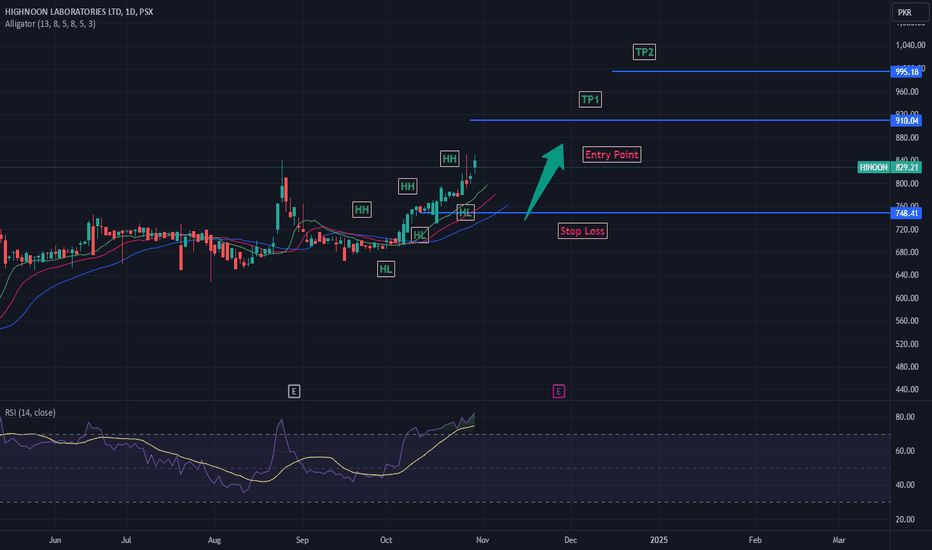

HINOON trade ideas

HINOON: Flag and Pole pattern on 1D TF. Potential rally likelyHINOON is in uptrend printing HHs and HLs on 1D timeframe. Recently the chart has formed a Flag and Pole pattern. It is likely that break of previous LH (941.62) shall result in another rally that may take the price upto level of 1207.30. SL is placed below lowest point of the flag (831.72).

It is pertinent to mention that previous all time high of 1,000.00 may act as a major resistance and we may need to be careful for any reversal indications at this point. However, at this point there is no apparent indication of reversal from current price level.

TPs may be broken as per following:

TP1=1051.52

TP2=1161.42

TP3=1207.30