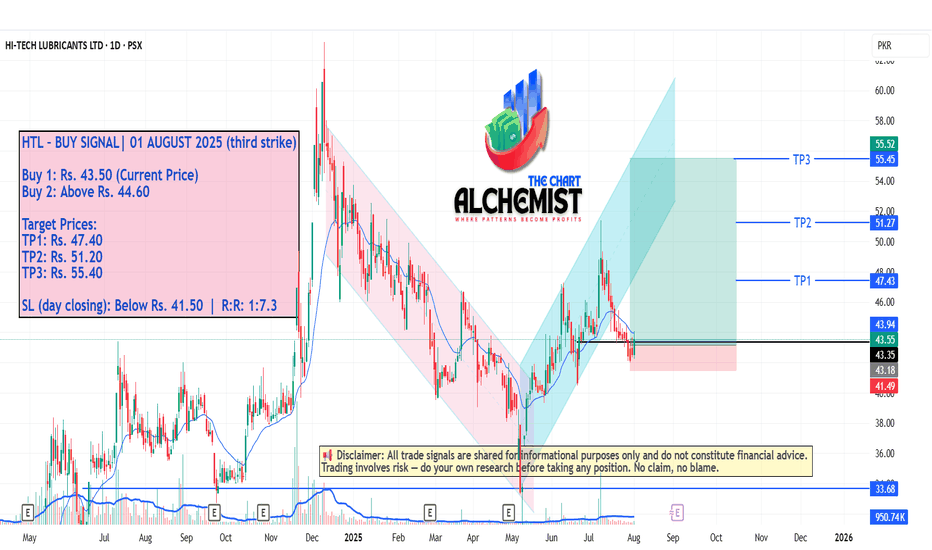

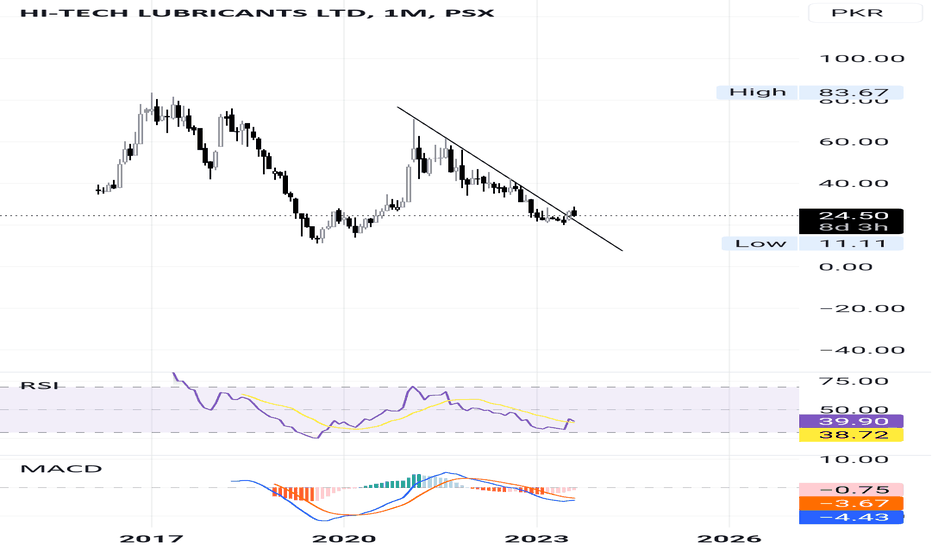

HTL – BUY SIGNAL (3rd strike) | 01 AUGUST 2025 HTL – BUY SIGNAL (3rd strike)) | 01 AUGUST 2025

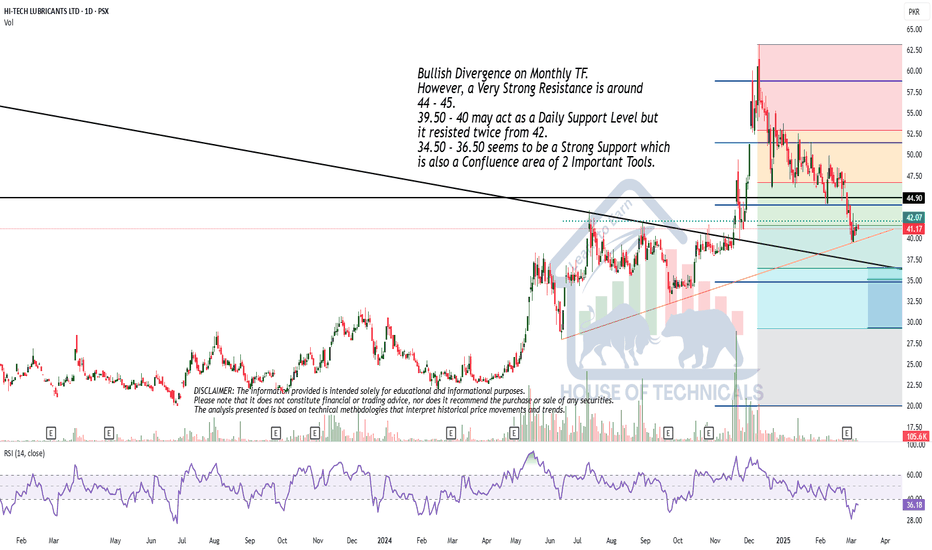

The stock previously made a high of Rs. 63.20 and entered a pullback (marked light pink), which ended at a major support level (marked dark blue). After breaking out of this pullback, HTL began a new uptrend leg. Although it recently dipped below the light blue uptrend channel, the move appears to be a spring before an excess line (marked black), indicating potential for a strong upward reversal.

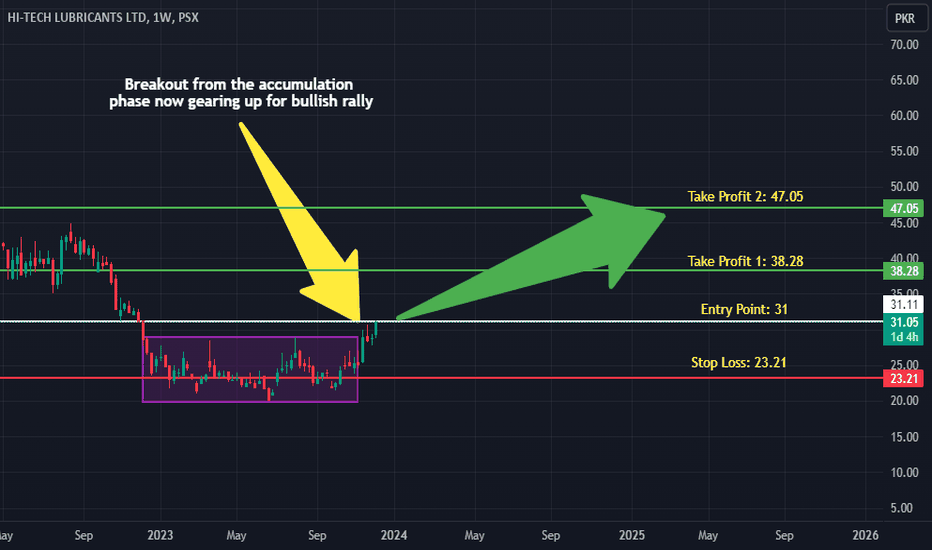

HTL trade ideas

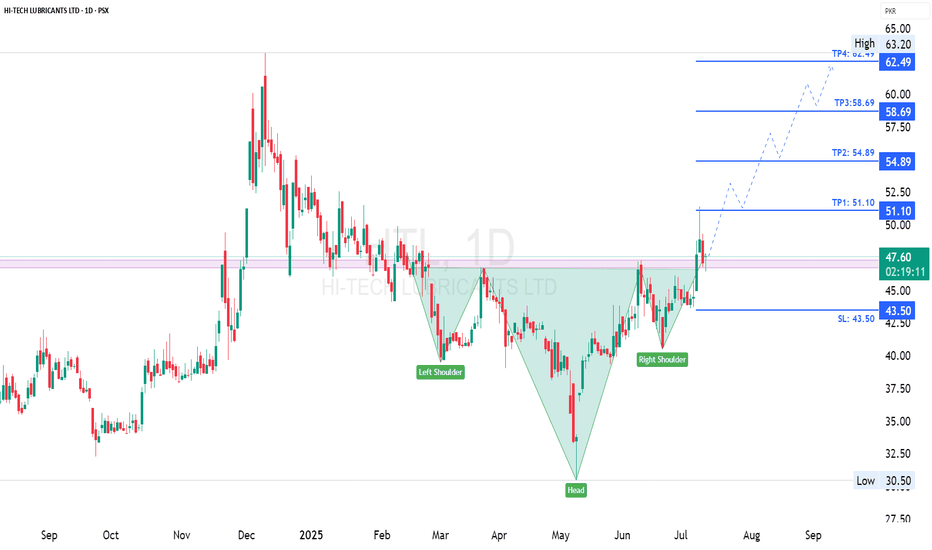

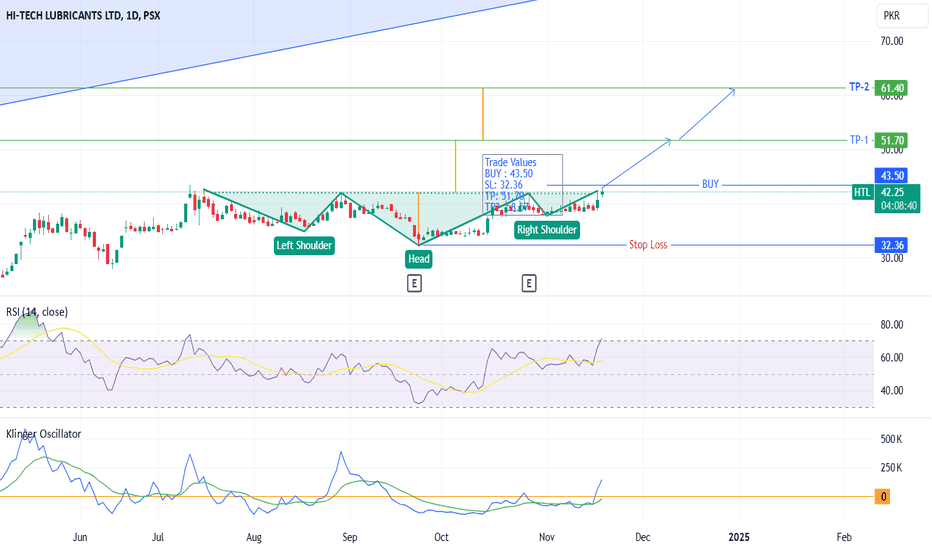

HTL - PSX - Daily TF - Buy Trade CallA textbook Reverse Head & Shoulder pattern has been made by the price candles on Daily time Frame. Neck line of H&S is about to be broken. Once it does so and there is no sign of reversing by making Double Top formation then Buy call is in Order.

Klinger Volume Indicator is above zero level and is facing upward almost vertically, indicating a sharp bull run. RSI indicator also close to 70 line, indicating that bulls are in control.

Trade Values

BUY : 43.50

SL: 32.36 (Just below previous HL)

TP: 51.70

TP2: 58.57

HTLHTL - Buy Call

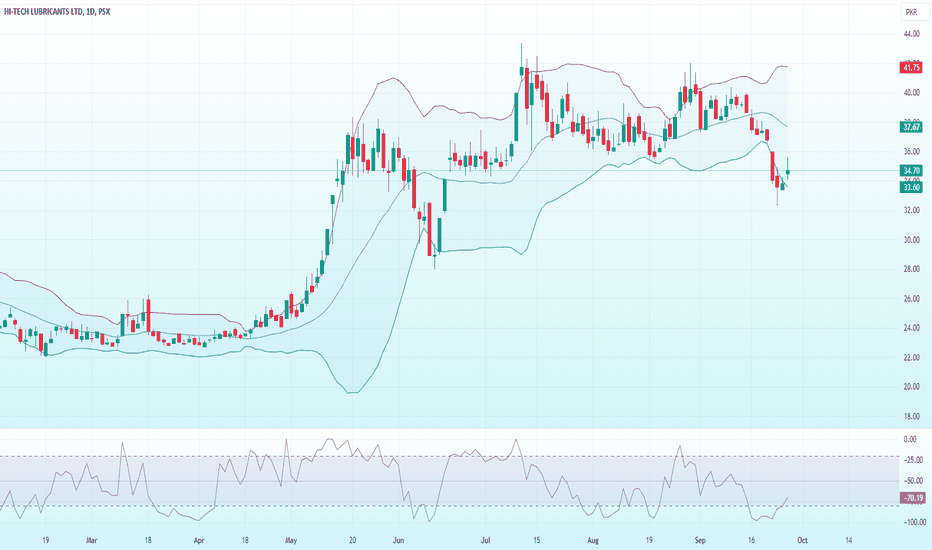

Stock Summary : HTL closed at PkR34.70 and suggests a potential bullish reversal. It’s approaching the lower Bollinger Band, indicating that the downside may be limited, while the William percentage indicator suggests that the stock is 70% oversold, indicating a reversal stance.

Recommendation : Initiate buying positions on weakness or near the support zone and set stop losses below PkR33.23 to manage risk effectively. Initial target is at 35.52 and secondary target is at 36.33

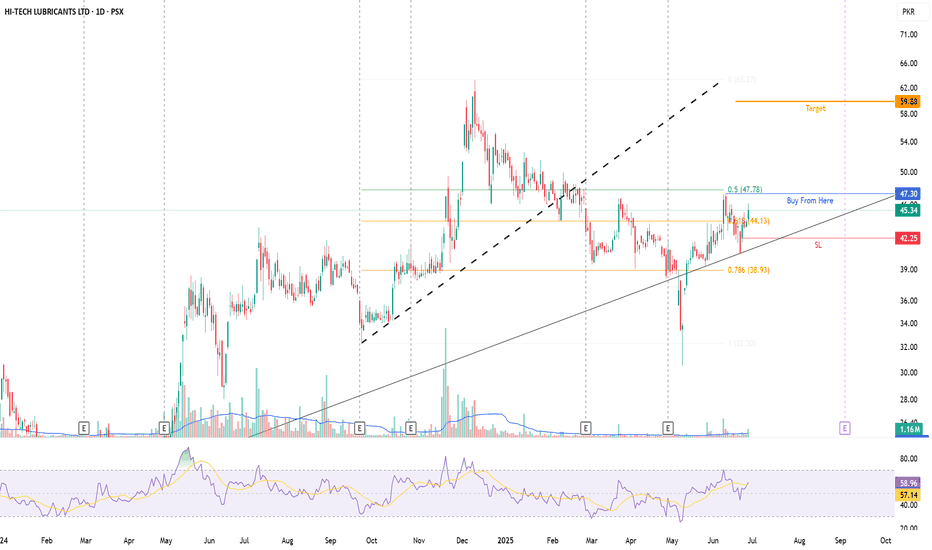

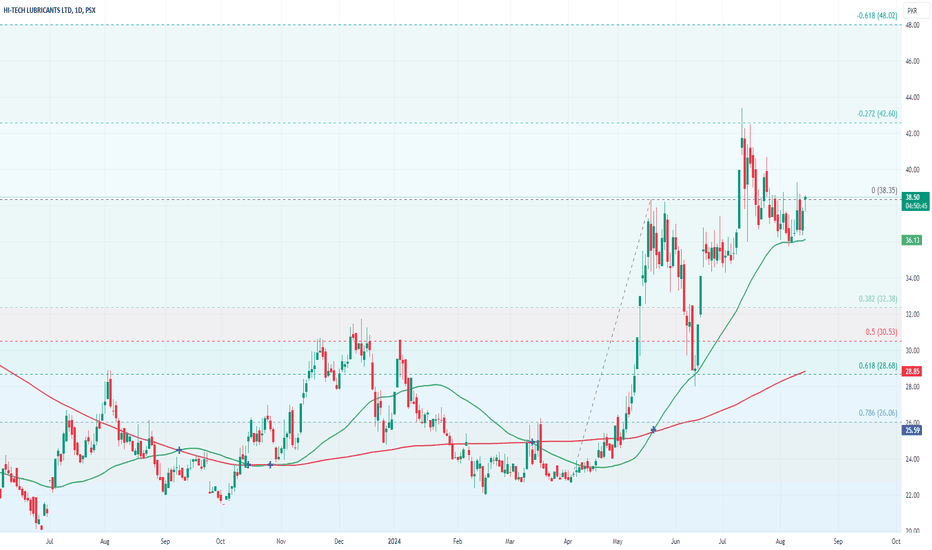

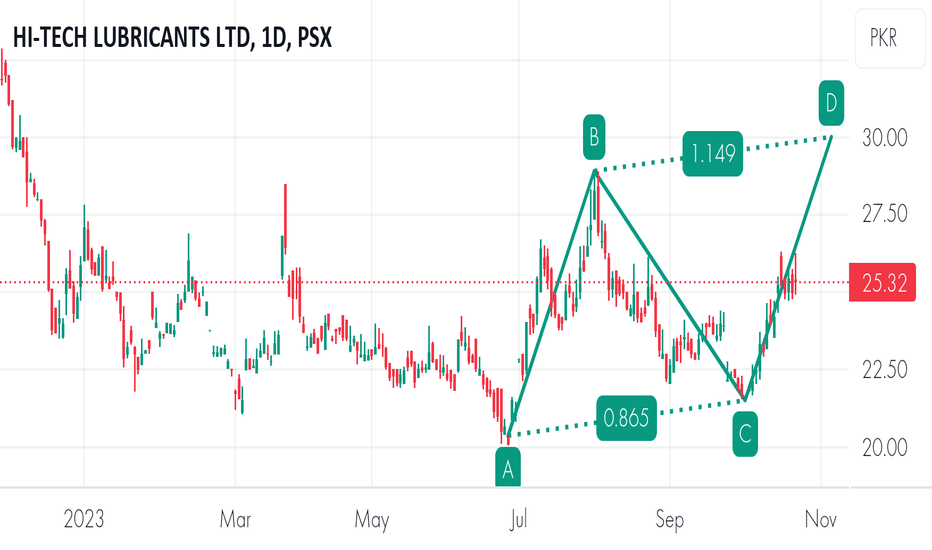

HTL | Bullish TrendHTL Swing Trade Setup - Daily Time Frame:

The price action is in uptrend making higher highs and higher lows. Whenever the price tests 50-day Moving Average its bounce back and currently it hovering above it. Long position can be consider for the target of 42.60 and upon break & sustain condition it can test 48. Use stop loss just below previous swing low at 35.

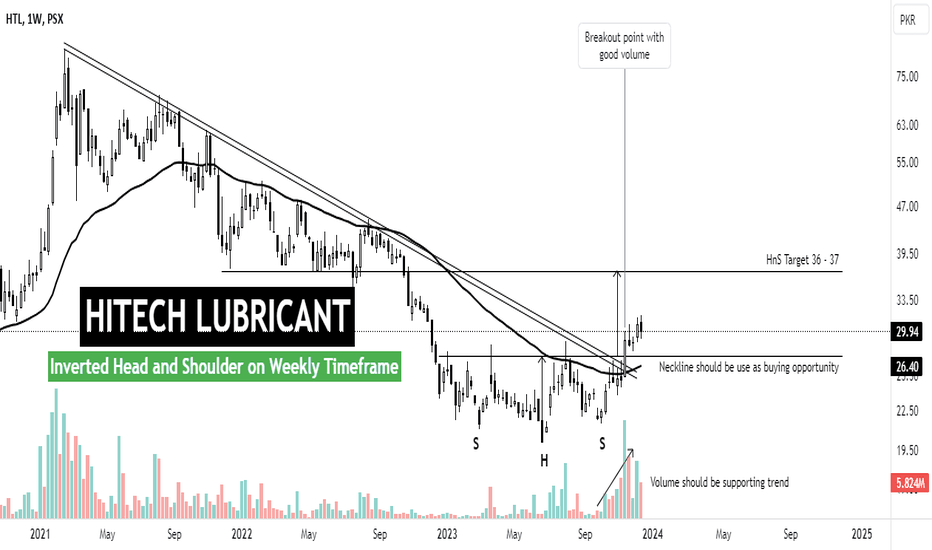

HITECH LUBRICANT | Weekly Scale | Inverted HnS PatternHTL has just broken its downward trend after the formation of an inverted head and shoulder pattern (bullish reversal). We are currently witnessing a bullish trend with a first upside target of 36 and 37.

Dynamic support (EMA) can be used as a stop-loss for any long position.

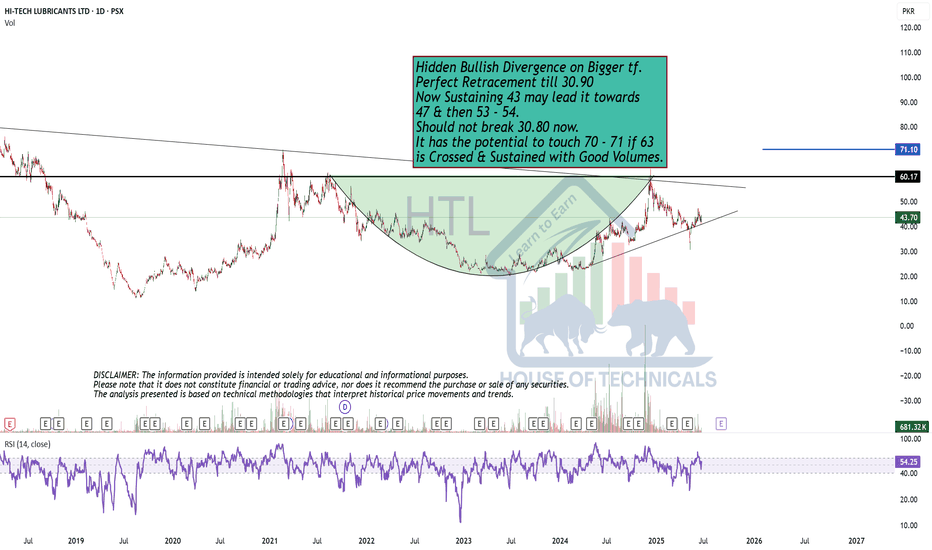

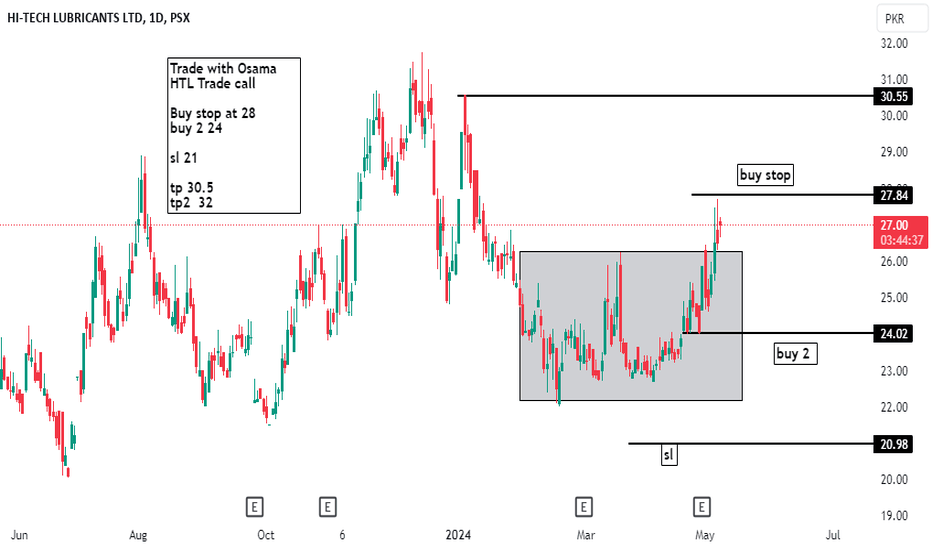

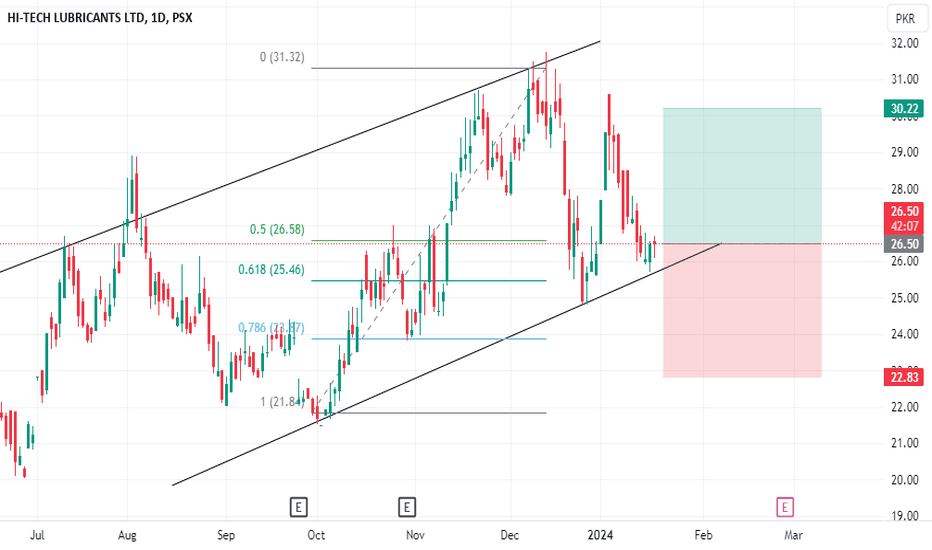

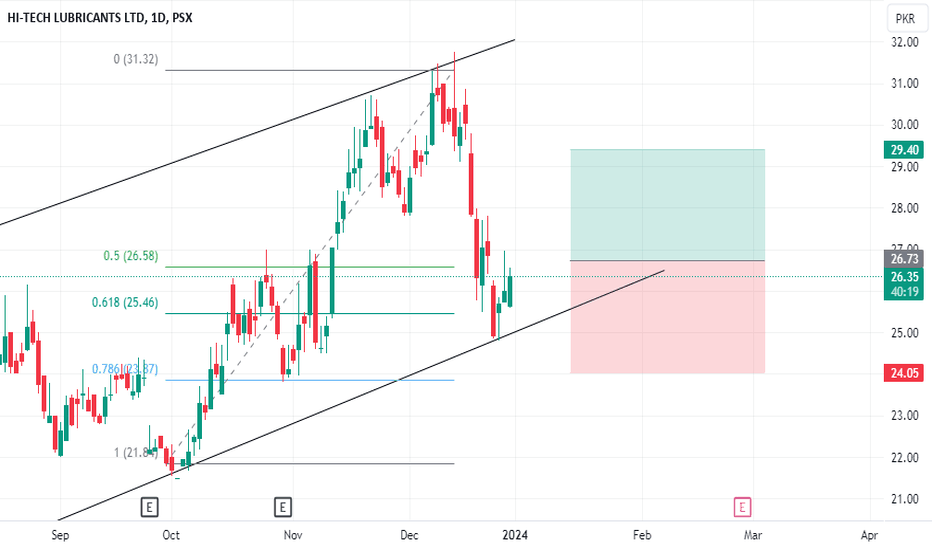

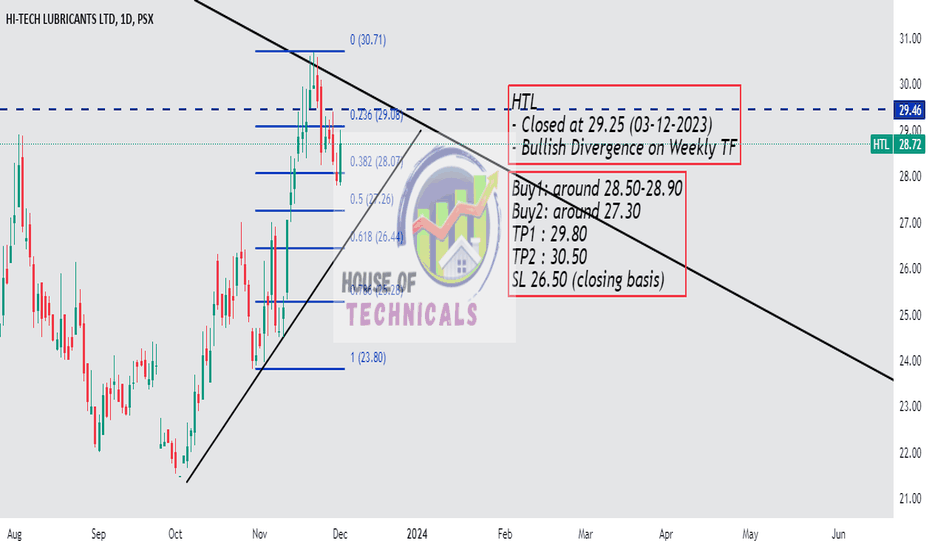

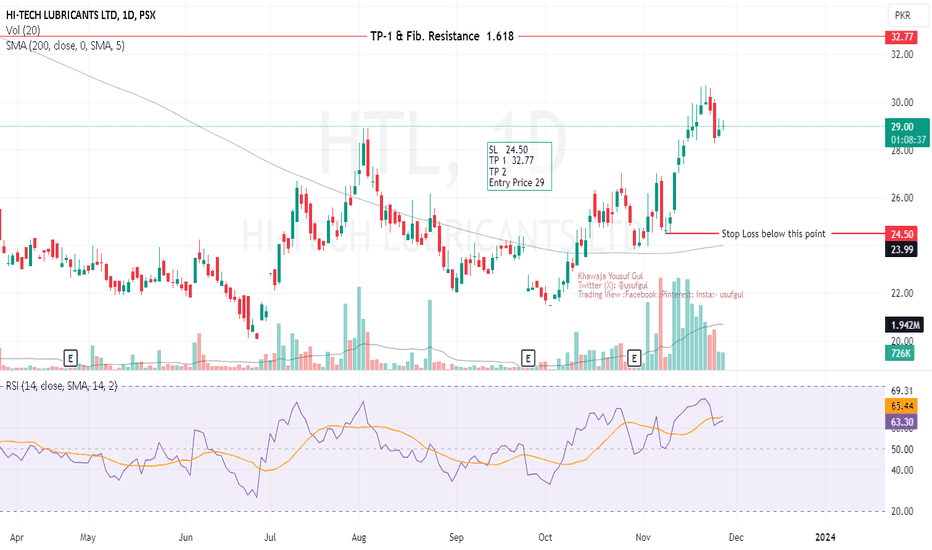

PSX: HTL Retracement is ending.On daily time frame the Hi-Tech Lubricant showed a recovery after long down trend at the start of October 2023. From around 22 it gained more than Rs.8 . It than went into retracement phase. Yesterday It printed a green candle and today ( 2:30 pm) still in green zone. The volume has been very thin for the day on hourly chart, Wyckoff-ians can understand the significance,

so it induces the idea it is coming out of clouds and this can be a good time to take position in it.

Trade Plan

SL 24.50

TP 1 32.77

TP 2

Entry Price 29