KOSM trade ideas

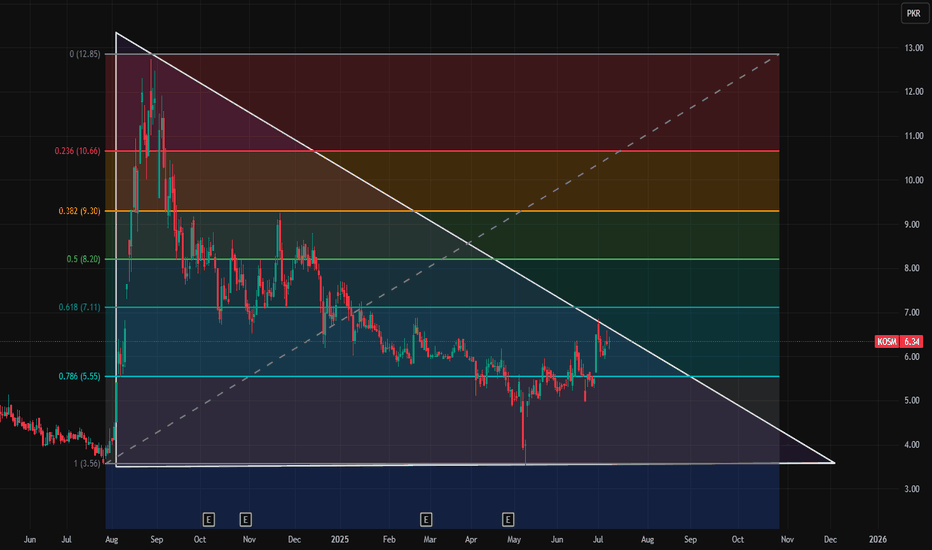

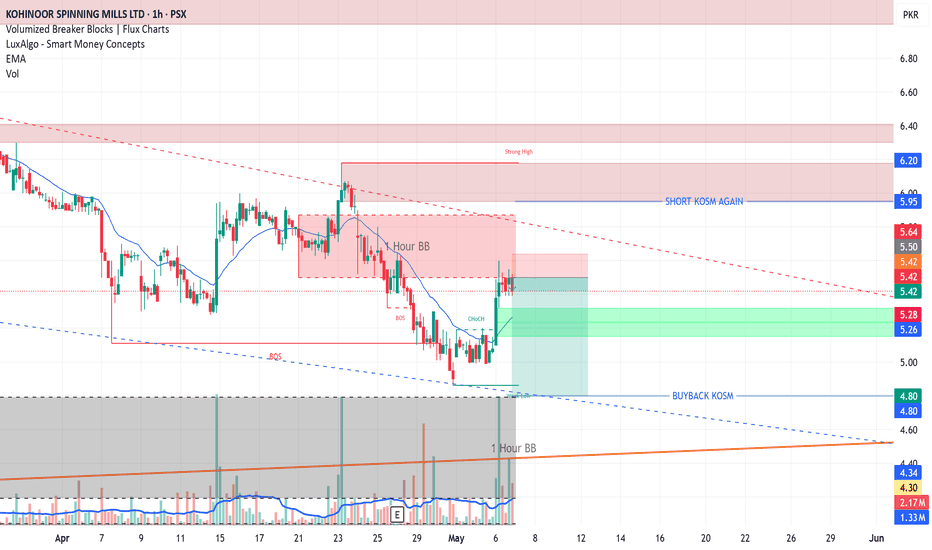

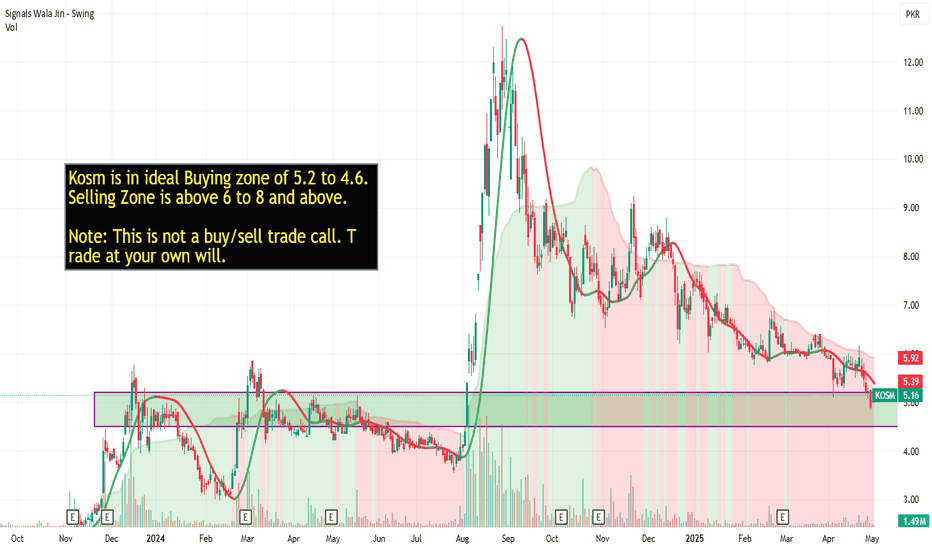

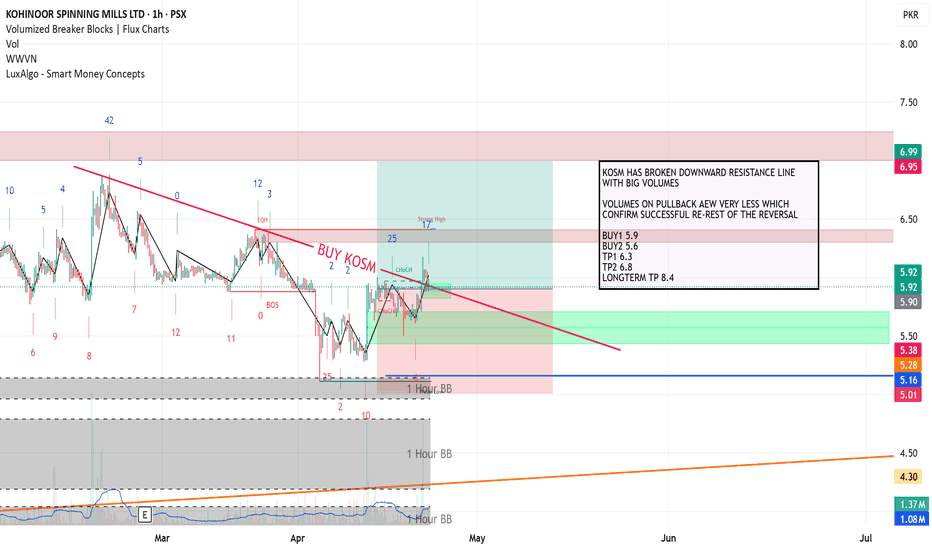

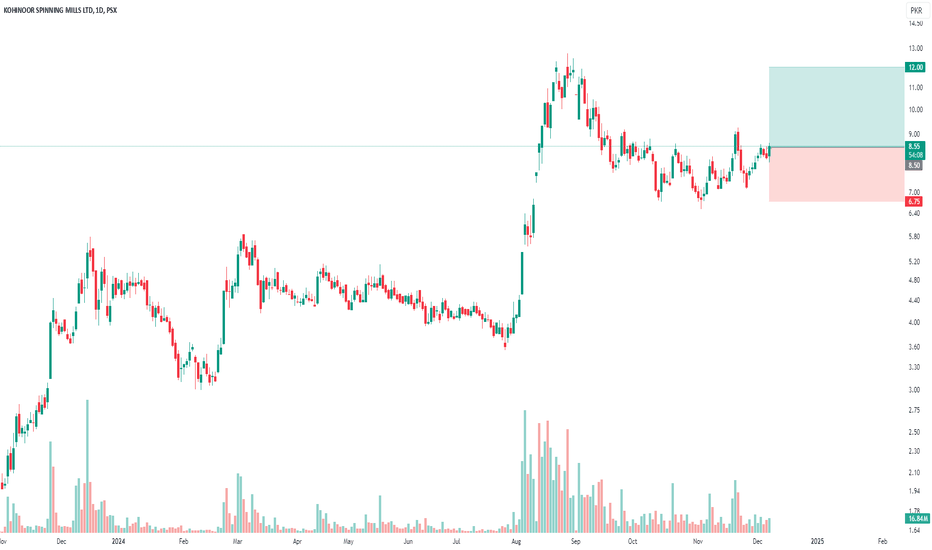

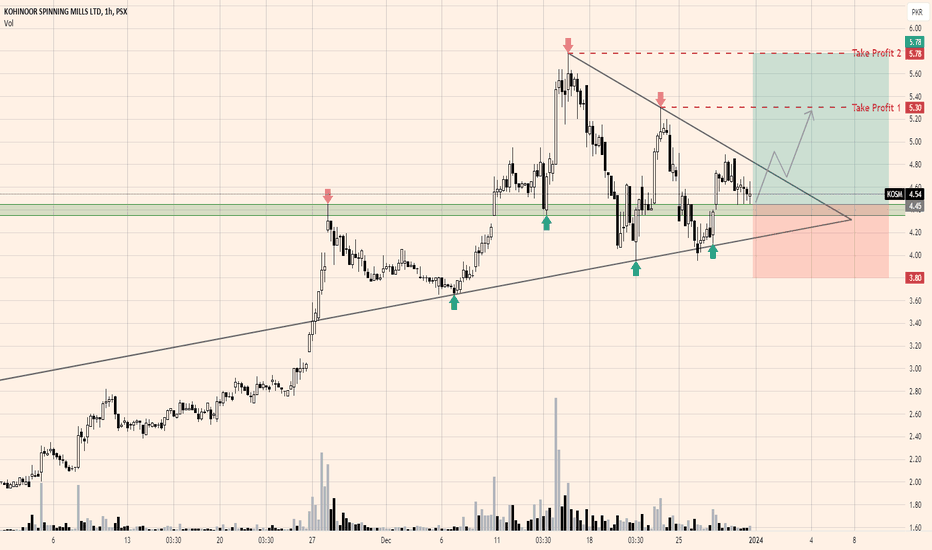

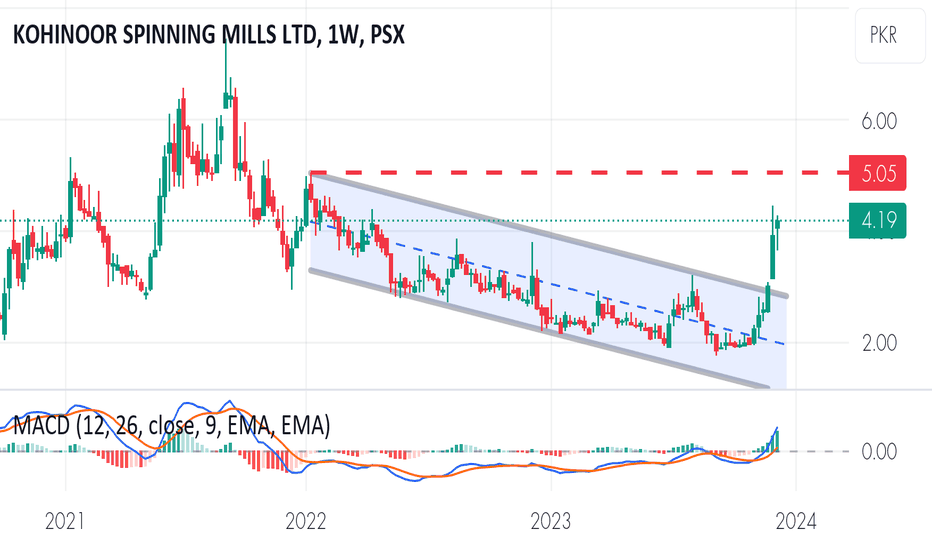

KOSMKOSM has given a breakout from its 200 day EMA in Nov'23 and currently trading above the said moving average considering uptrend in the price. Moving forward, 4.20 acts as support plus the test of 200 EMA, where price needs to sustain and a possible pull back can be expected. On the flip side, initial resistance lies around 5.20 and upon breaking out secondary resistance around 5.85, this will be the third test of the price and bears are very active at the zone, if this major supply zone breaks then price will sky rocket 🚀 and price will be trading above 7 rupees. Upon breaking below 200 EMA, the price will start trading in a down trend.