MUGHAL trade ideas

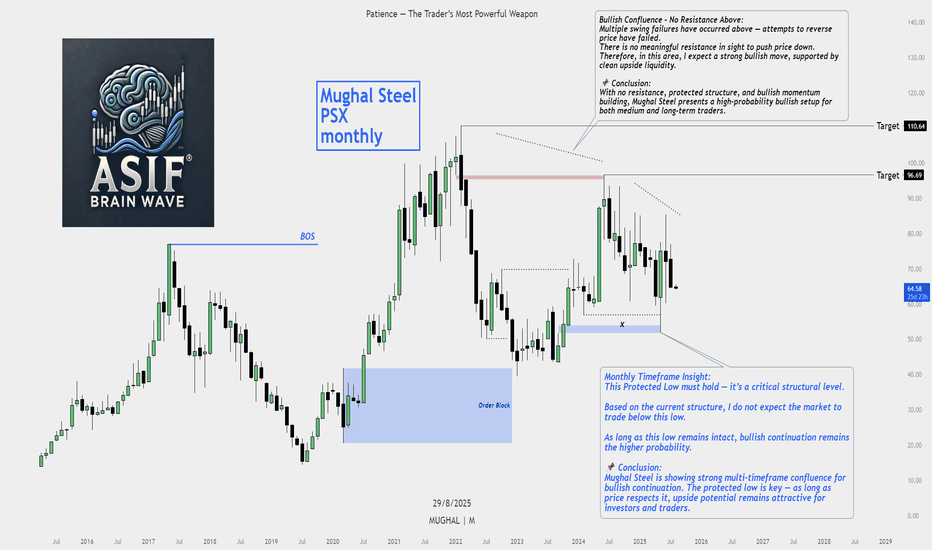

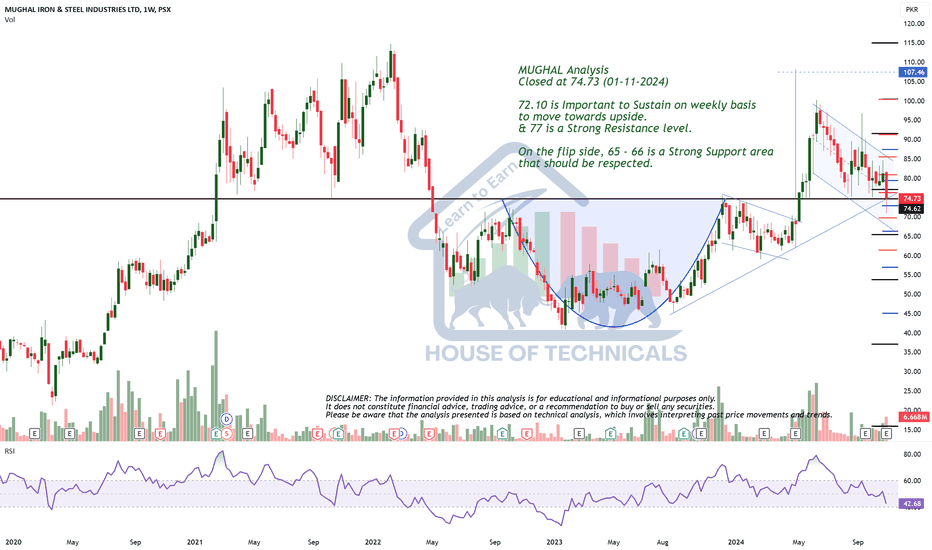

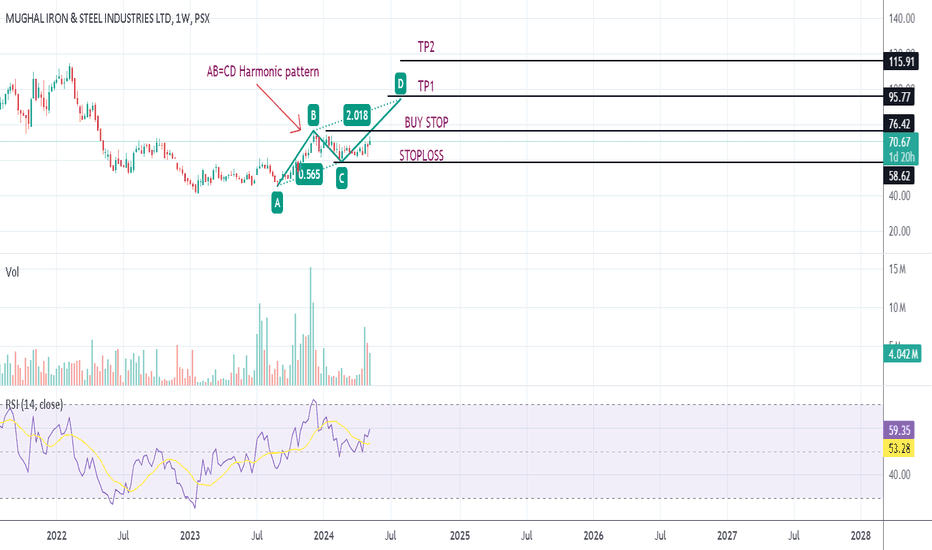

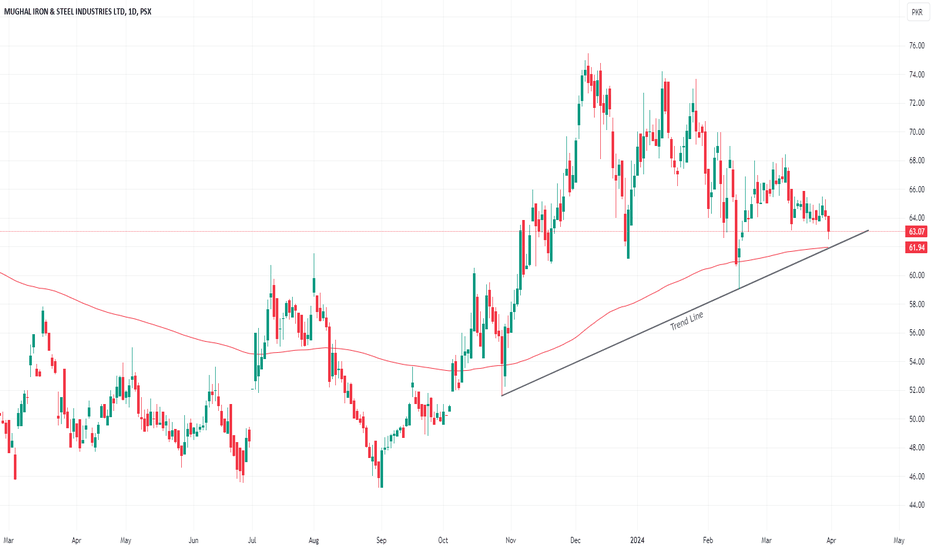

Mughal Steel – Multi-Timeframe Technical Analysis🔍 Mughal Steel – Multi-Timeframe Technical Analysis

I’ve been closely analyzing Mughal Steel, and the current structure across Yearly and Monthly timeframes is showing a strong bullish setup with significant upside potential. Here's a quick breakdown:

📅 Yearly Timeframe Insights:

Price has reacted from a Yearly Bullish Fair Value Gap (FVG) — a key zone where institutional buying often occurs.

A Protected Swing Low is now in place. Based on the structure, I do not expect price to trade below this low.

2023 swept 2022’s low, but closed inside the FVG, suggesting accumulation by smart money.

2024 closed above 2023’s high, confirming a bullish shift.

2025 has swept 2024’s low and is now aggressively moving toward upside liquidity.

Upside Target: 2024 high at 96.69, which would represent a potential 48% move from current levels.

📆 Monthly Timeframe Confirmation:

The protected low must hold — it serves as a critical level for bullish continuation.

I believe price will not revisit this low due to strong structural support.

We’ve seen multiple failed attempts by sellers (swing failures) above — indicating weakening bearish pressure.

No significant resistance exists above, clearing the path for a strong bullish move.

📈 Conclusion:

With no resistance overhead, a protected structure, and bullish momentum building, Mughal Steel is presenting a high-probability opportunity for upside expansion. I'm watching closely as price targets 96.69 in the coming months.

#TechnicalAnalysis #MughalSteel #StockMarket #TradingInsights #PriceAction #Investing #PakistanStockExchange

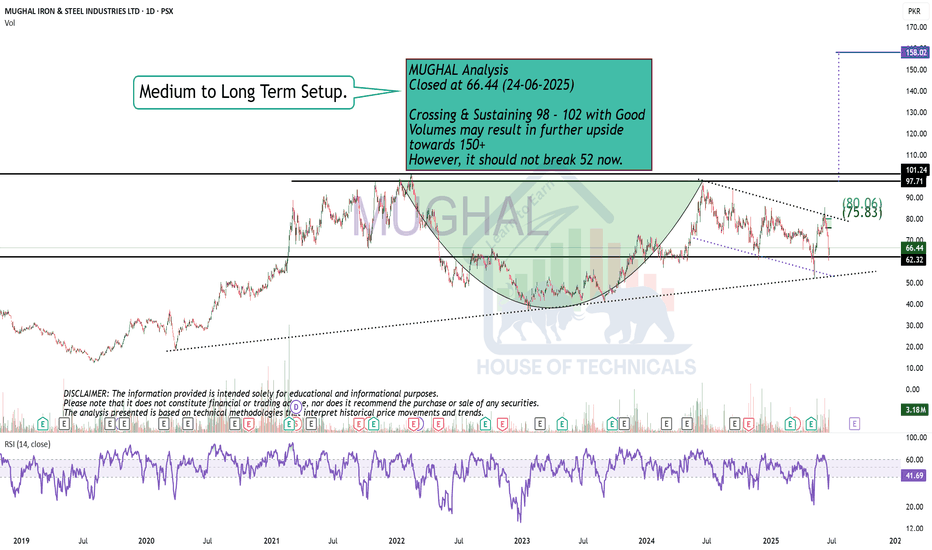

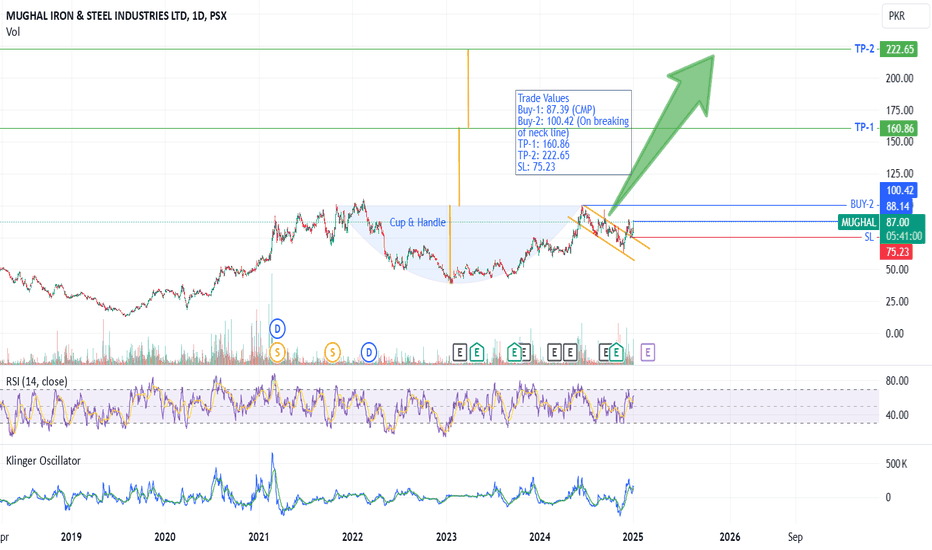

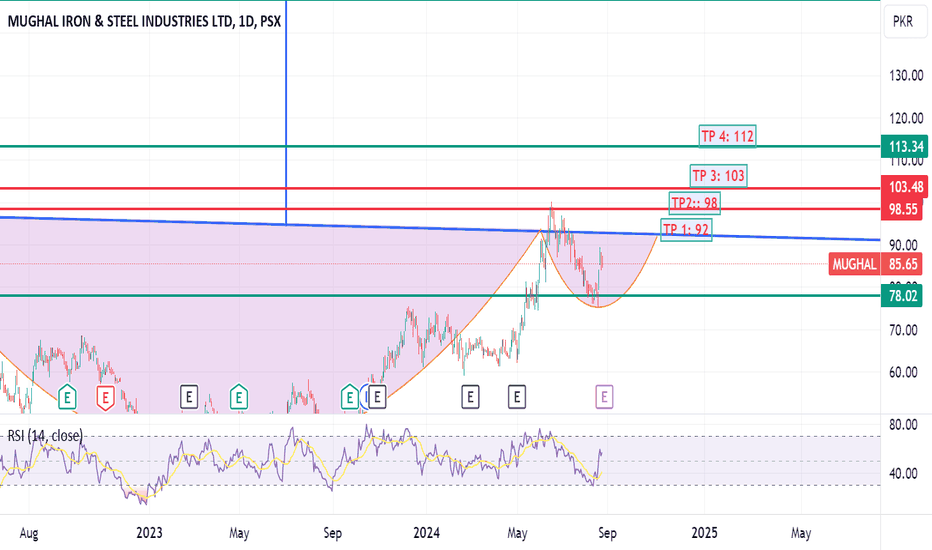

MUGHAL - PSX - Technical Analysis - Cup & Handle PatternOn daily TF, after making the cup and handle pattern, now the price is moving in upward direction.

Buying at CMP (to gain more profit) and after breaking of neck line (technically better entry) is recommended.

Trade Values

Buy-1: 87.39 (CMP)

Buy-2: 100.42 (On breaking of neck line)

TP-1: 160.86

TP-2: 222.65

SL: 75.23

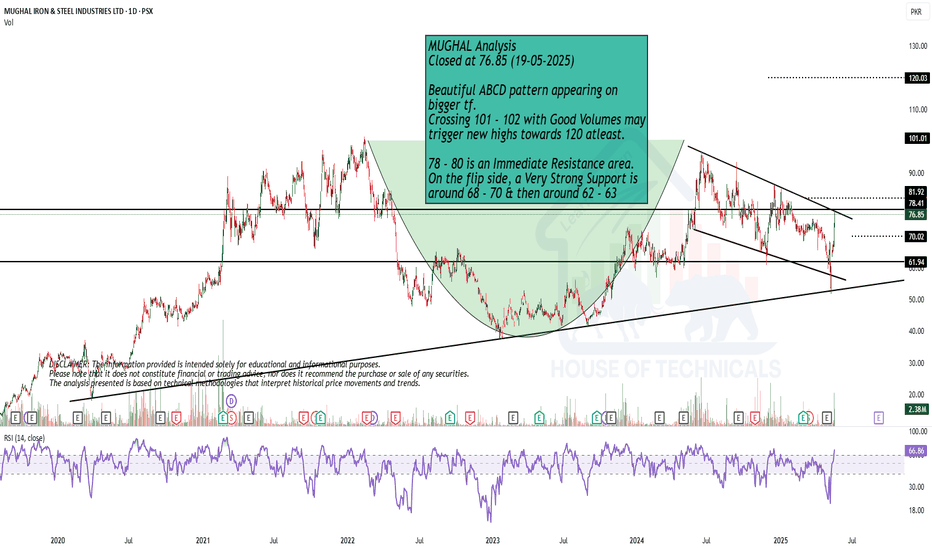

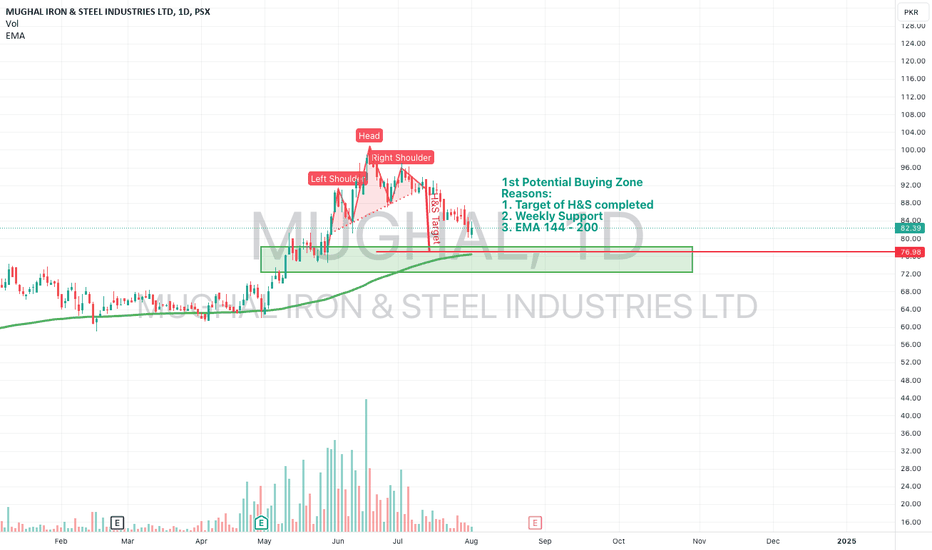

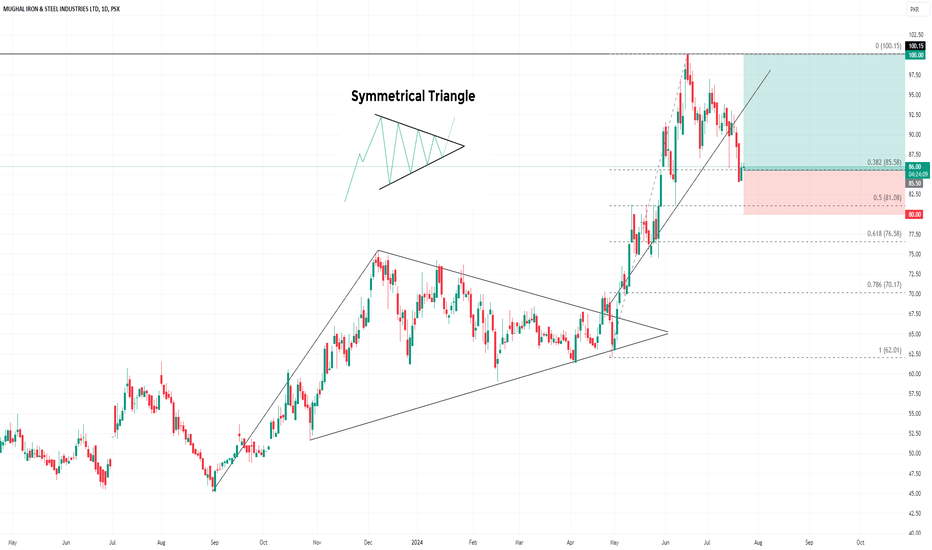

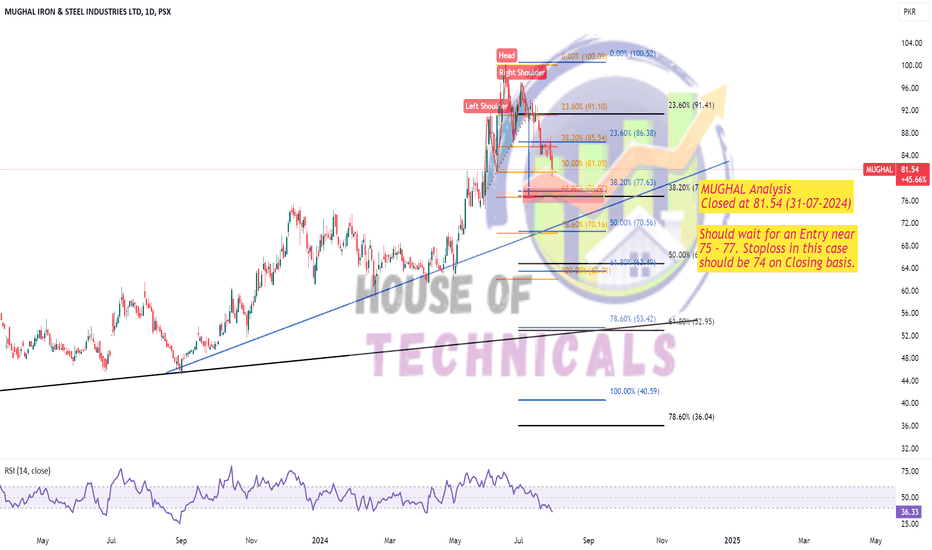

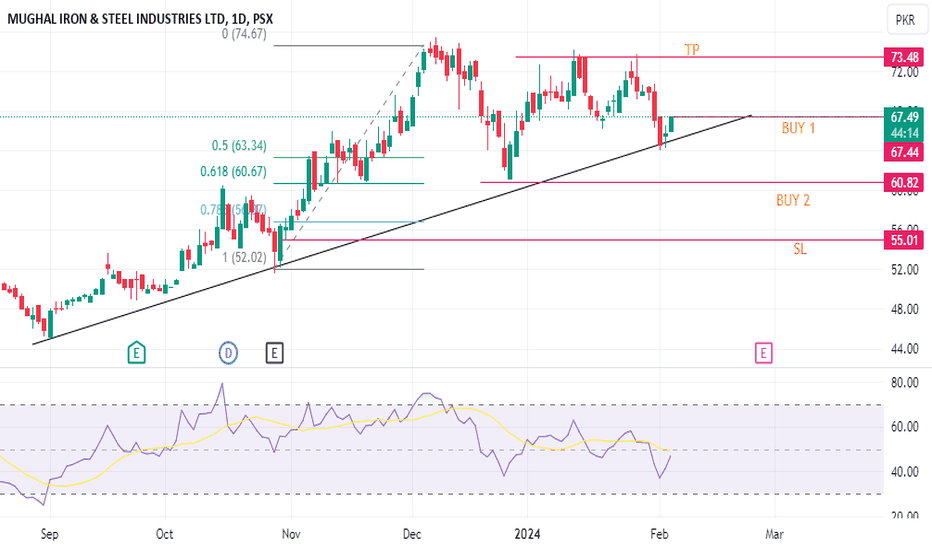

Potential Buying Zone (Daily)This might be a potential buying zone (small chunk) for the following reasons:

1. Target of H&S completed.

2. Weekly support.

3. EMA 144 - 200.

Note: I'm a learner and I'm reusing my learned tools after a very long time. Let me know if I can improve or if you have any suggestions.

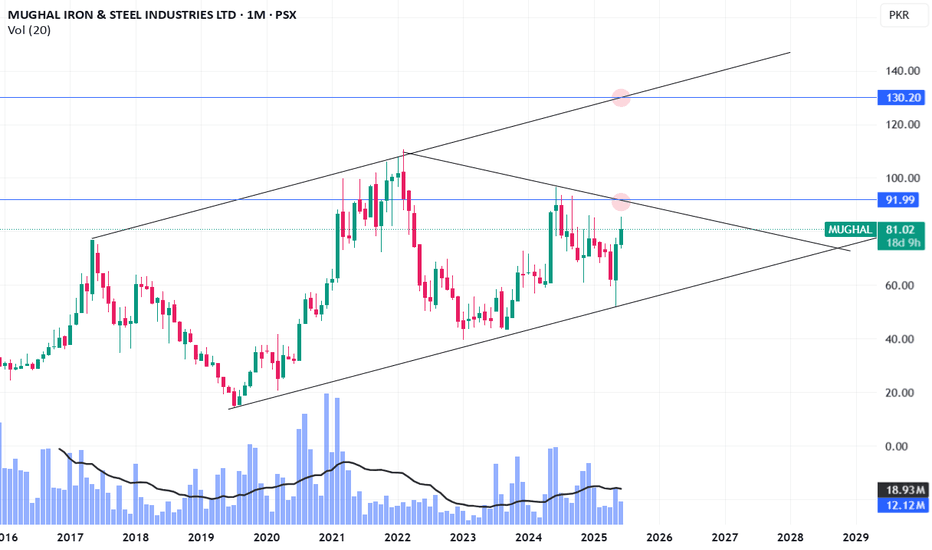

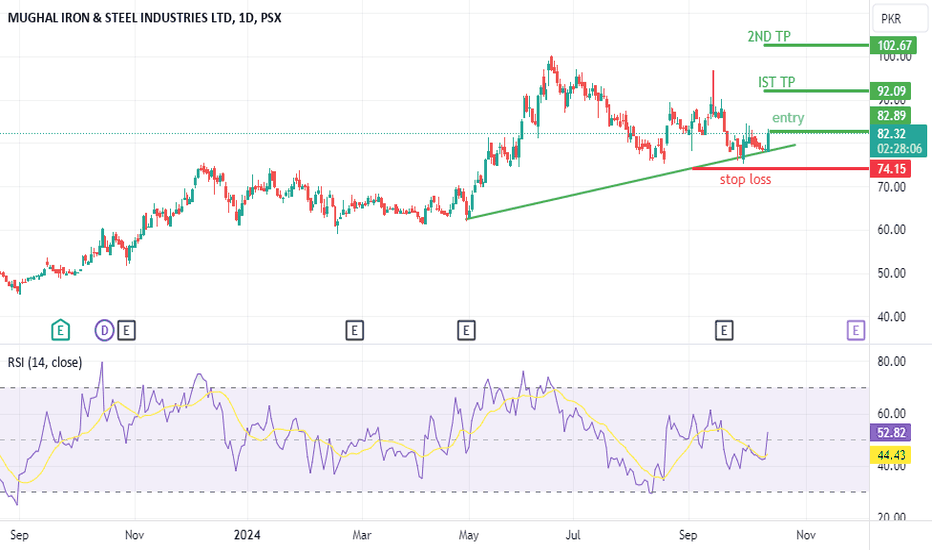

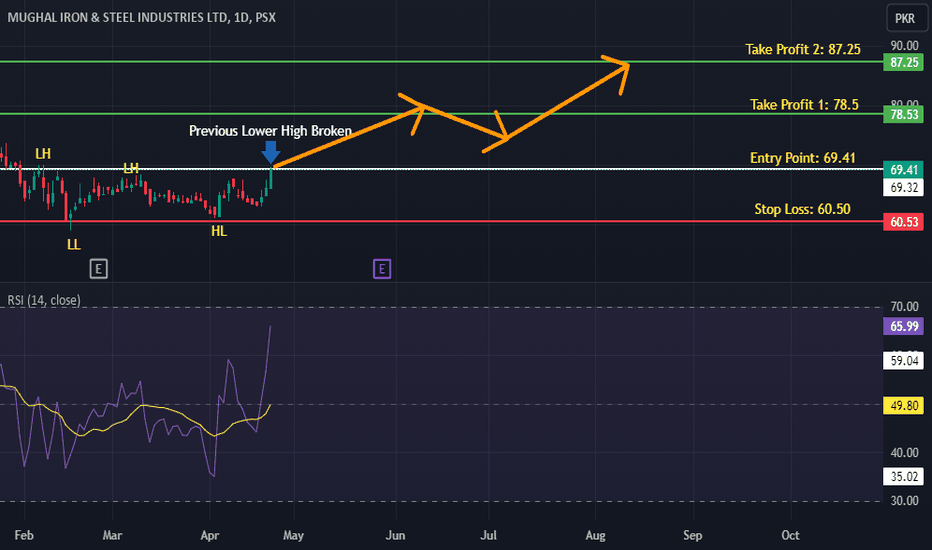

MUGHAL🚀 Stock Alert: MUGHAL

📈 Investment View: Technically Bullish 📈

🔍 Quick Info:

📈 Entry Range: 61.50 - 62.50

🎯 First Targets : 65

🎯 Second Targets : 67.50

⚠ Stop Loss: 59.50

⏳ Nature of Trade: Scalping

📉 Risk Level: Medium

☪ Shariah Compliant: YES

💰 Dividend Paying: NO

📰 Technical View: MUGHAL is presently undergoing testing of its 200-day moving average (DMA) and is approaching its channel trendline support level near 62. Vigilance and close monitoring are advised; a failure to sustain this level may precipitate further downside movement. Conversely, in the event of a pullback, initial and secondary resistance are situated around 65 and 67.50, respectively.