NCL LONG TRADE 14-06-2025NCL LONG TRADE

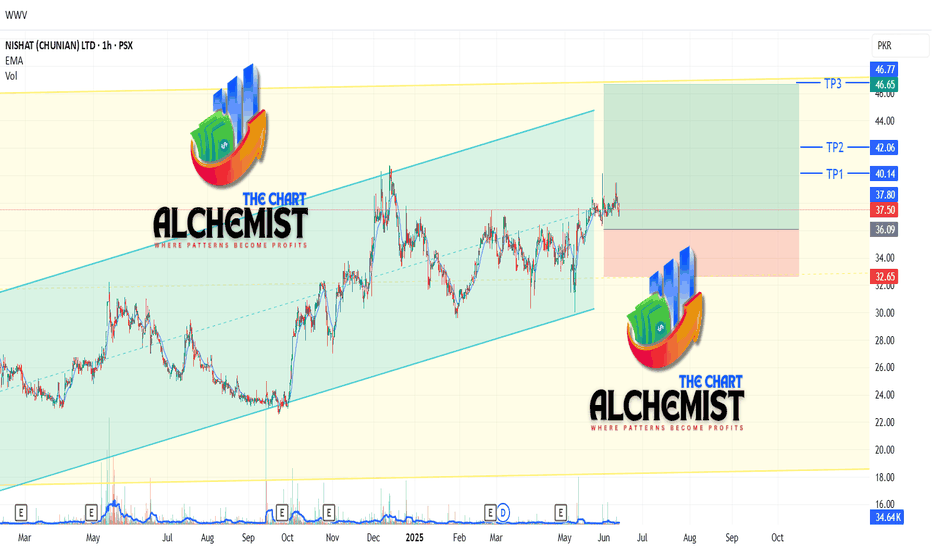

NCL has been in a long-term uptrend, marked by a yellow channel. After touching the bottom of the channel, the stock is currently in an up leg within the channel, further bound by a light blue channel. A mitigation block and price imbalance offer a potential entry opportunity.

🚨 TECHNICAL BUY CALL – NCL🚨

- *Buy 1*: Rs. 37.6 (current level)

- *Buy 2*: Rs. 36.3

- *Buy 3*: Rs. 34.7

- *TP 1*: Rs. 40.1

- *TP 2*: Rs. 42.1

- *TP 3*: Rs. 46.6

- *Stop Loss*: Below Rs. 32.5

- *Risk-Reward Ratio*: 3.1

Caution: Please buy on levels in 3 parts. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

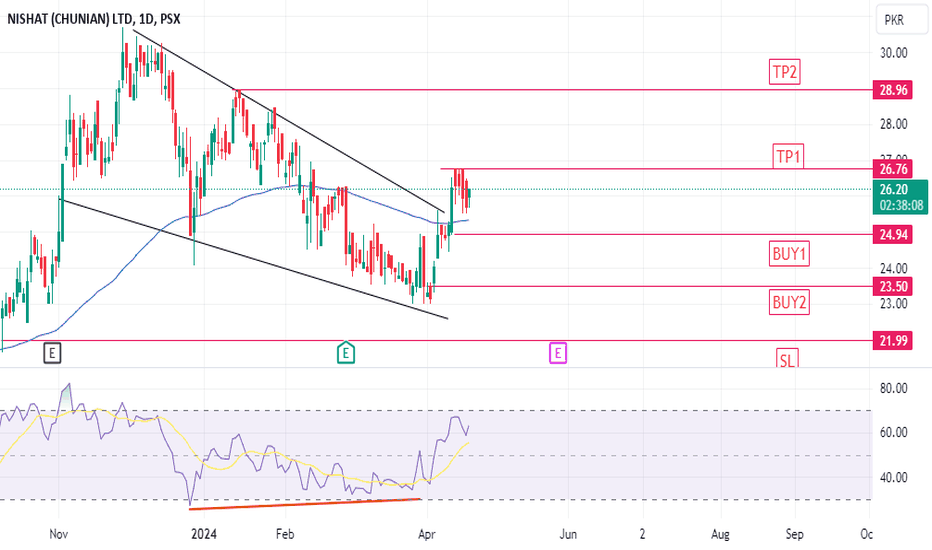

NCL trade ideas

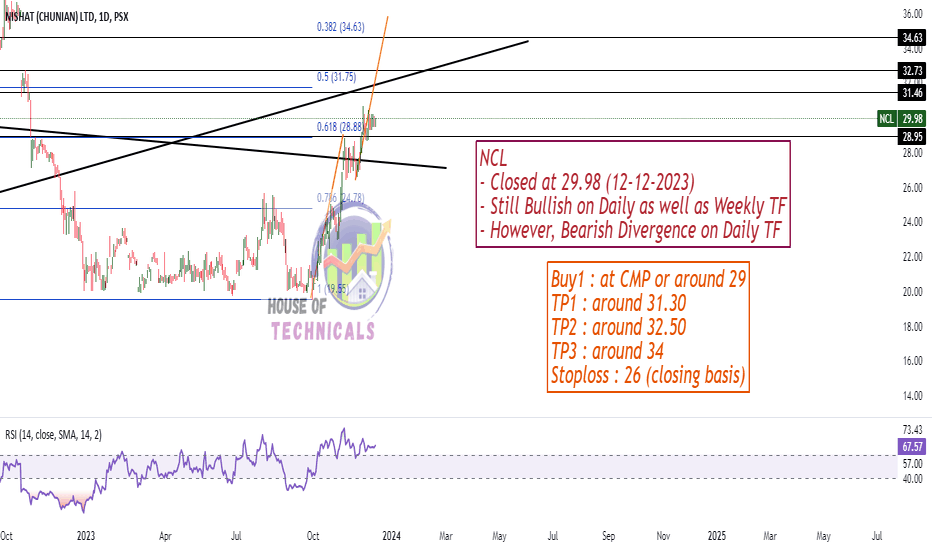

NCL | Flag PatternNishat (Chunian) Limited is forming flag pattern which is the sign of bullish momentum. Currently price has shown break out from its flag and according to pattern its final approach lies around 35. The stock can be accumulate around 29.50 with the stop loss of 28 (5% risk) and initial target 32.24 which is previous top, where selling is expected. Upon breaching said resistance level, second target lies around 33.24 and final target at 35 which is 18% gain.