PUMPUSDT trade ideas

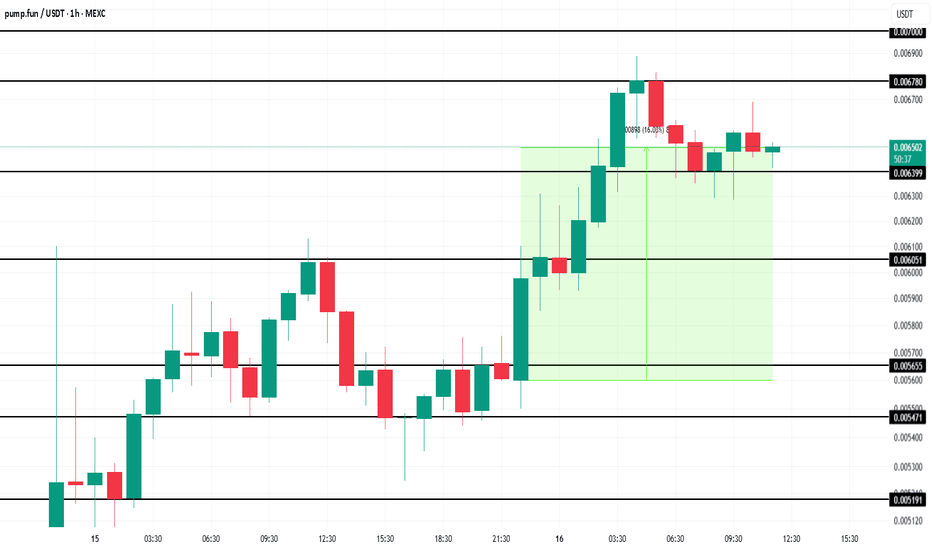

Pump.Fun (PUMP) Token Nears Milestone $1 Billion OI In 3 DaysMEXC:PUMPUSDT price stands at $0.0065 after bouncing off the $0.0063 support level. The token has gained 16% in the last 12 hours , showing that the demand for PUMP is strong.

The valuation of Pump.Fun has skyrocketed in just two days, reflecting a surge in demand. In only 48 hours since its launch, the altcoin has amassed 45,500 holders .

The macro momentum behind Pump.Fun is undeniable, with open interest in MEXC:PUMPUSDT nearing $913 million. It is on track to hit the $1 billion mark by day three of its launch.

Given the ongoing momentum and investor confidence, the token is likely to continue pushing upwards in the near future.

With the current market conditions and growing support, MEXC:PUMPUSDT could breach the $0.0067 resistance and reach as high as $0.0070 in the coming days. This would mark a significant achievement for the altcoin, continuing its impressive upward trajectory.

However, if MEXC:PUMPUSDT faces a sudden wave of selling or broader market bearishness, the token could lose the $0.0063 support level. A decline below this point would likely see PUMP slipping to $0.0060, invalidating the bullish outlook and signaling a potential market correction.

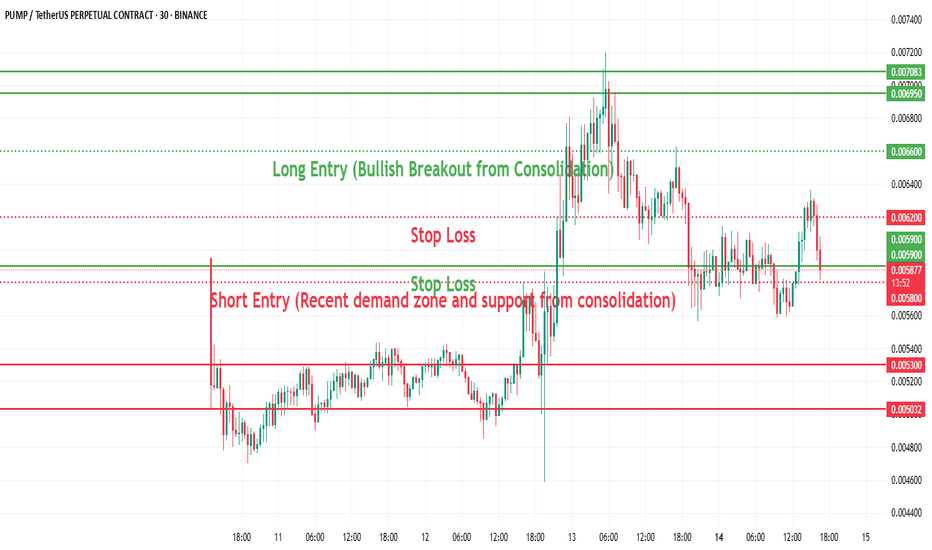

PUMP/USDTCurrent Market Structure

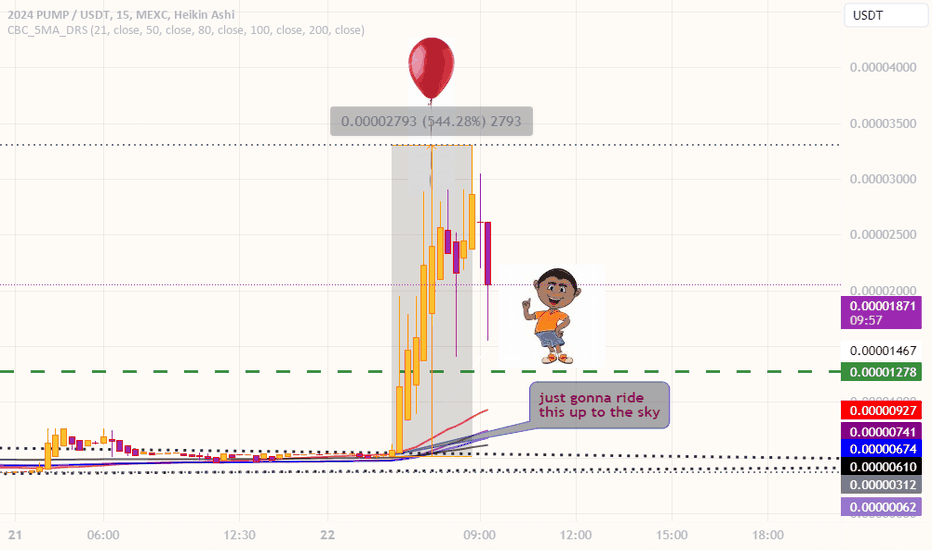

Strong pump occurred around July 13th, peaking above 0.0072.

Price retraced and is now ranging between 0.00580 – 0.00640.

Appears to be forming a consolidation or flag pattern, which can break either way.

Volume is declining, indicating potential for breakout buildup.

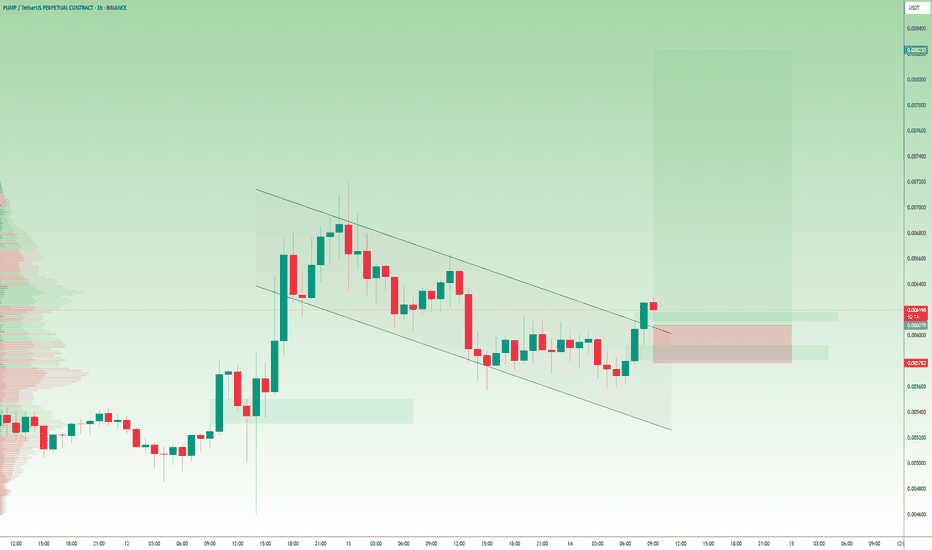

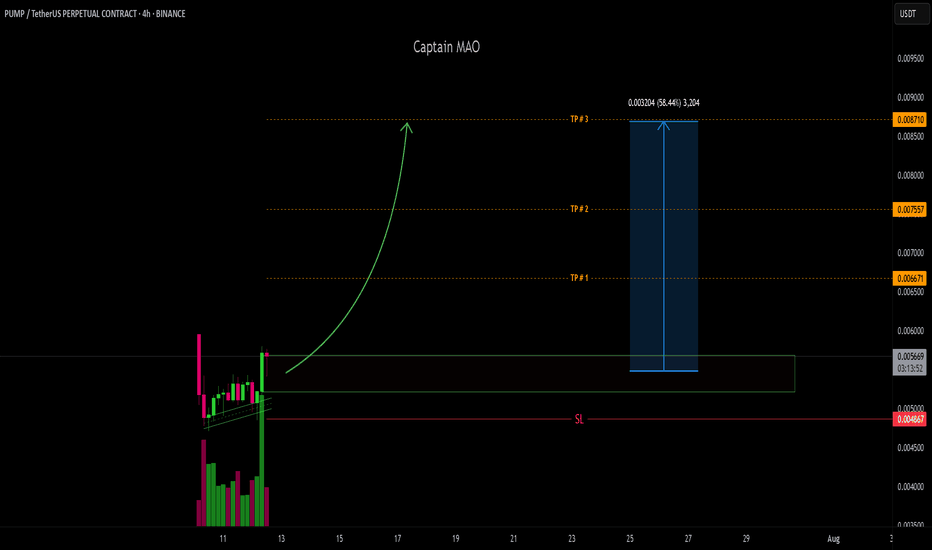

#PUMP is trying to break out of the falling channel! #PUMP Our previous trade setup, SL, got hit.

Currently, it is trying to break out of the falling channel on the 1H chart.

If it holds above the breakout zone, it could push toward $0.0082 📈

Entry: 0.0060 – 0.0063

Stop Loss: 0.00578

Targets:

TP1: 0.0068

TP2: 0.0074

TP3: 0.00795

TP4: 0.00823

Classic breakout setup, strong R: R potential ahead

DYOR | NFA

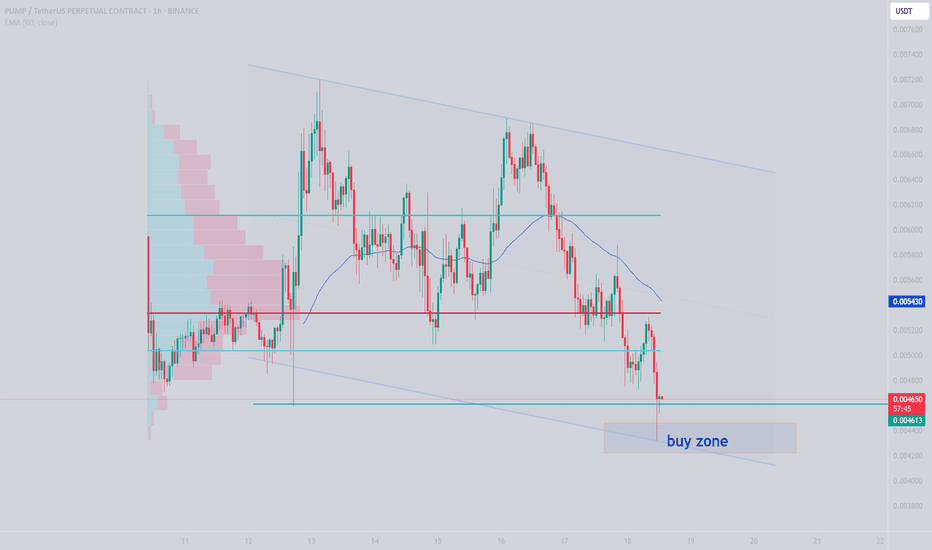

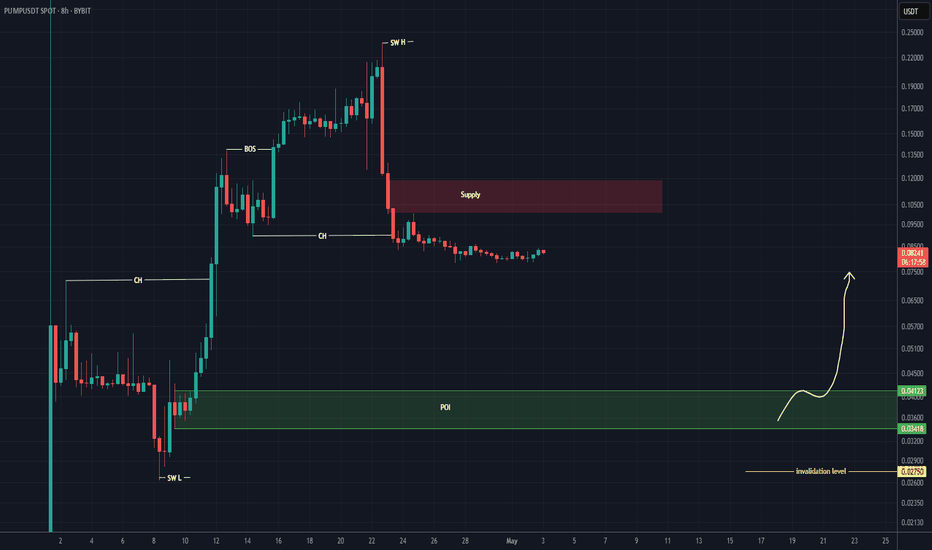

Where Should We Rebuy The PUMP? (8H)With the large bearish master candle formed at the top, the structure has turned bearish.

The green zone is the best and lowest-risk area for long positions or rebuys.

Reaching this zone may take some time, but you can already add this symbol to your watchlist and wait for it to reach the area before entering a position.

A 25%–45% return can be expected from this zone.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

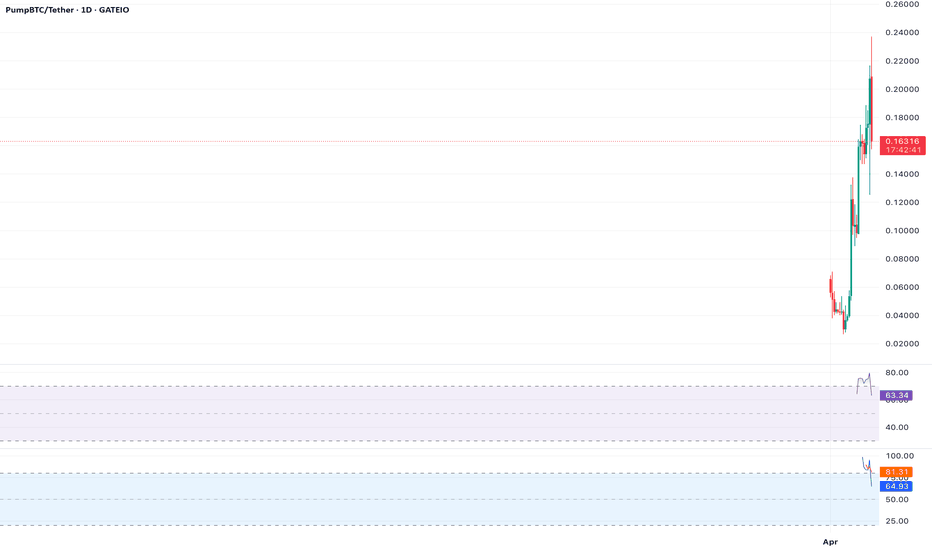

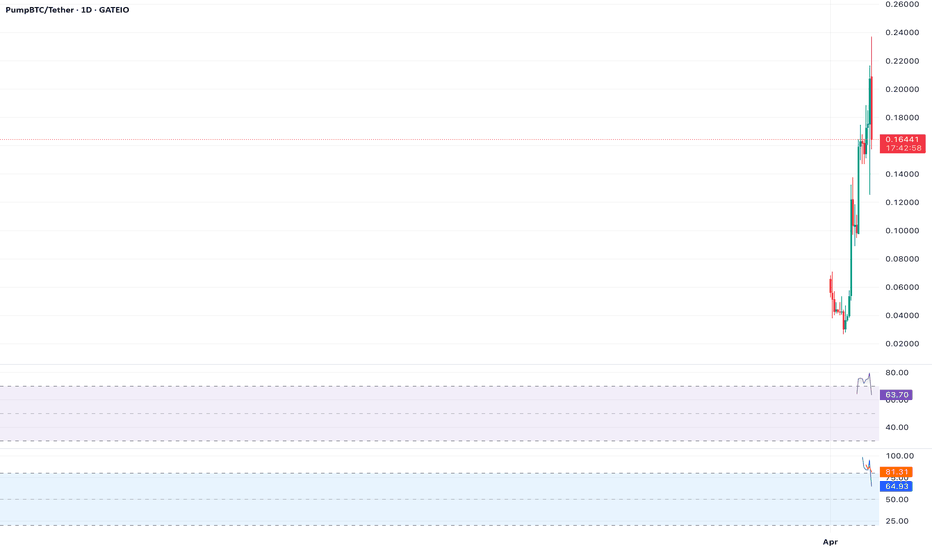

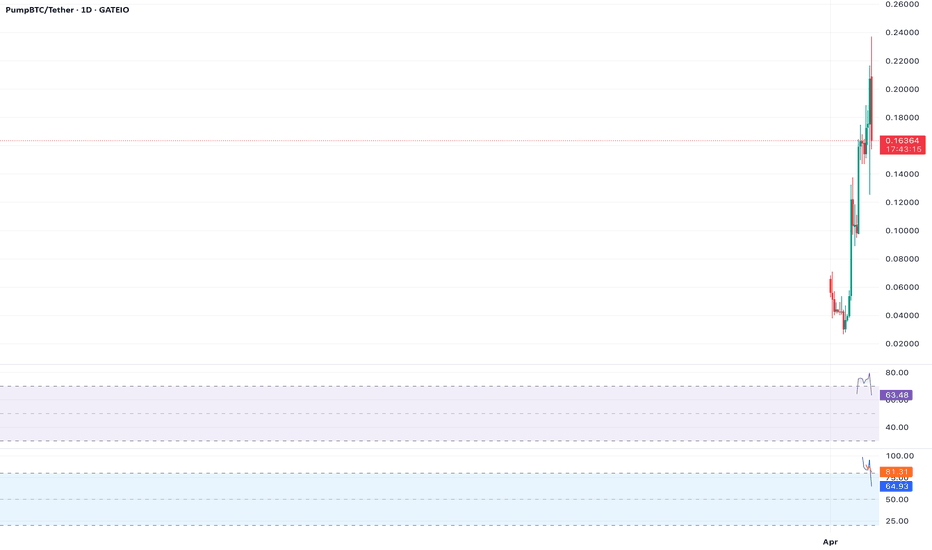

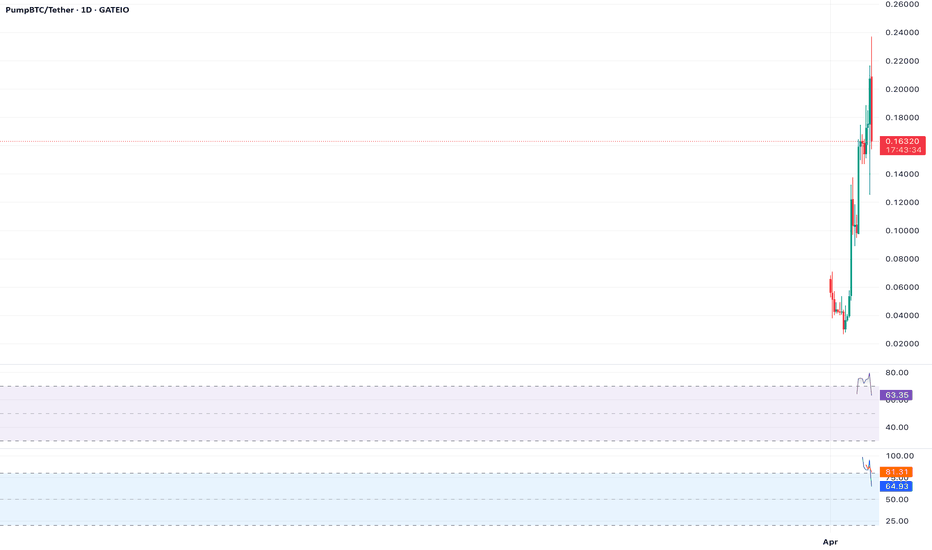

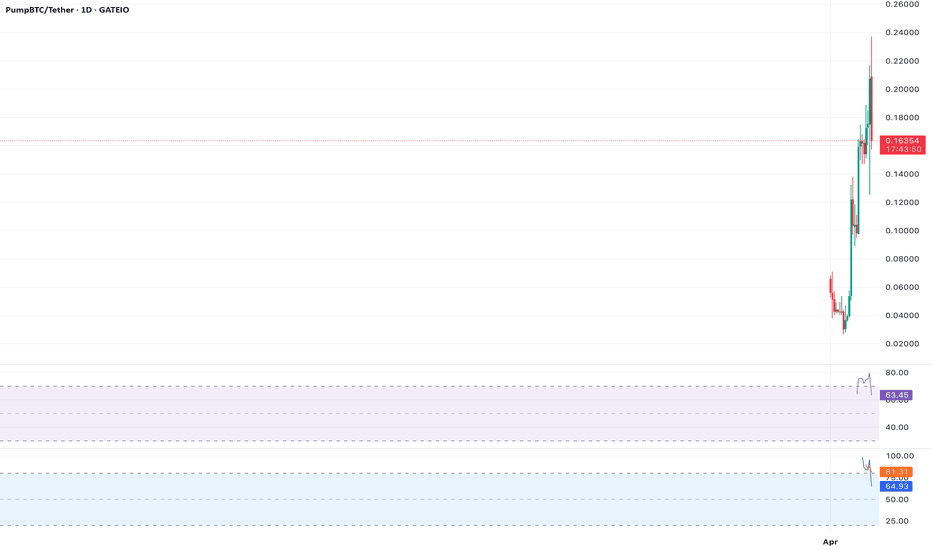

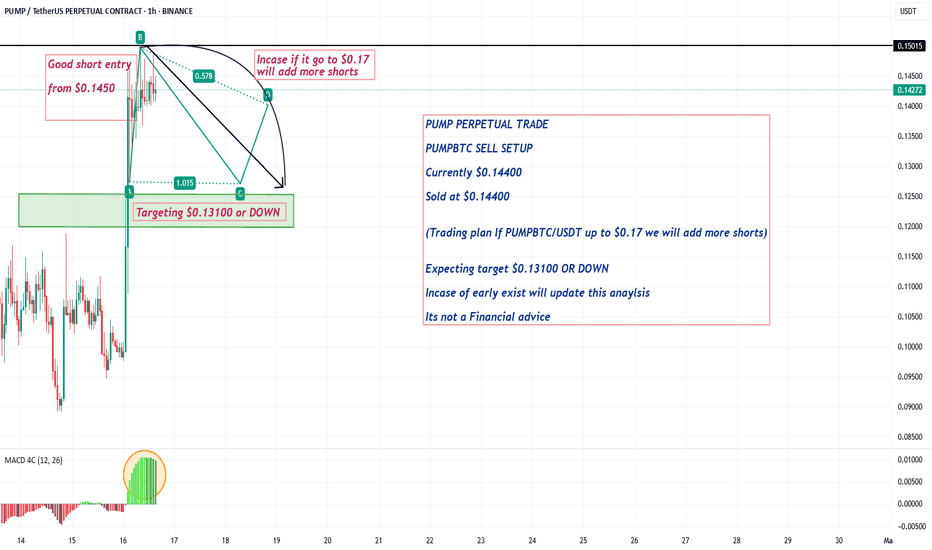

$PUMP’s Stochastic at 60 – Room for Growth?Analysis: At $0.167, NYSE:PUMP ’s Stochastic Oscillator is at 60 on the daily chart, suggesting room for upside before overbought levels. Resistance at $0.17 is critical; support at $0.15 holds. Recommendation: Long on a break above $0.17; stop below $0.15.

$PUMP Consolidates at $0.167 – Key Support at $0.15Analysis: NYSE:PUMP is consolidating between $0.16 and $0.17 after a 153% rally (per X posts). The 20-day moving average at $0.15 is critical support. Bollinger Bands are tightening, signaling a big move soon. Recommendation: Buy dips near $0.15; sell if it breaks below.

$PUMP Nears Overbought RSI at $0.167 – Pullback Looming?Analysis: NYSE:PUMP ’s RSI on the 1-hour chart is at 69, nearing overbought territory at $0.167. The price is testing resistance at $0.17, with low volume on recent pushes. A rejection could see a dip to $0.15 support. Watch for RSI divergence. Recommendation: Short on a failed breakout above $0.17; stop above $0.175.

$PUMP’s Ascending Triangle Signals Potential 20% Rally – Risks tAnalysis: At $0.167, NYSE:PUMP is trading within an ascending triangle on the daily chart, characterized by higher lows converging toward a resistance at $0.17. This pattern suggests accumulation, with bulls defending the $0.15 support zone (aligned with the 50-day moving average). The 200-day moving average at $0.13 provides additional support, reinforcing the bullish structure. The Stochastic Oscillator is at 60, indicating room for upward movement before overbought conditions. However, the token’s volatility, driven by Pump.fun’s meme coin ecosystem, warrants caution—24-hour trading volume has surged recently, but meme coins are prone to sharp corrections. A breakout above $0.17 could drive NYSE:PUMP to $0.20–$0.22, a 20–30% move, but a drop below $0.15 risks invalidating the pattern, targeting $0.13. On-chain activity on Solana and Pump.fun’s platform adoption are key drivers to monitor. Use tight risk management given the speculative nature of $PUMP.

Key Levels:

Resistance: $0.17, $0.20, $0.22

Support: $0.15, $0.13

Recommendation: Enter longs on a breakout above $0.17 with confirmation; scale out near $0.20 to lock in profits.

$PUMP at $0.167 Tests Key Resistance – Breakout or Rejection?Analysis: NYSE:PUMP is currently trading at $0.167, approaching a significant resistance zone around $0.17, which has acted as a ceiling in recent trading sessions. On the 4-hour chart, the price is forming higher highs and lows, indicating a bullish trend since breaking above the $0.13 support in early April (as suggested by X posts). The Relative Strength Index (RSI) is at 68, close to overbought levels, signaling caution for short-term longs. However, the Moving Average Convergence Divergence (MACD) shows a bullish crossover, with the MACD line above the signal line, supporting potential upside. Volume analysis indicates a 24-hour spike, aligning with increased market activity on Solana-based tokens. A breakout above $0.17 could target $0.20, the next psychological level, but failure to hold $0.16 may lead to a pullback toward the 50-day moving average at $0.14. Traders should monitor Solana’s ecosystem sentiment and set stop-losses below $0.15 to mitigate downside risk.

Key Levels:

Resistance: $0.17, $0.20

Support: $0.15, $0.14

Recommendation: Watch for a close above $0.17 with strong volume for long entries; avoid chasing if RSI exceeds 70.