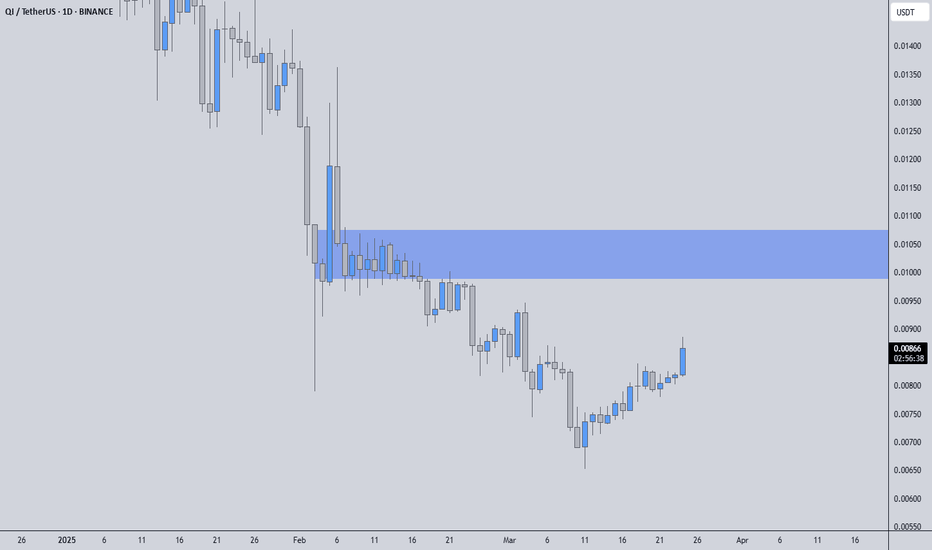

QIUSDT – MASSIVE %284 VOLUME SPIKE!🔥 Key Level Alert: The blue box is a huge resistance zone—we are at a critical decision point. Blind entries = bad trades. Smart entries = profits.

📊 How I’m Approaching This:

✅ Volume Surge = Increased Interest – But where is price heading?

✅ Blue Box = Key Resistance – If we reject, I’ll look for

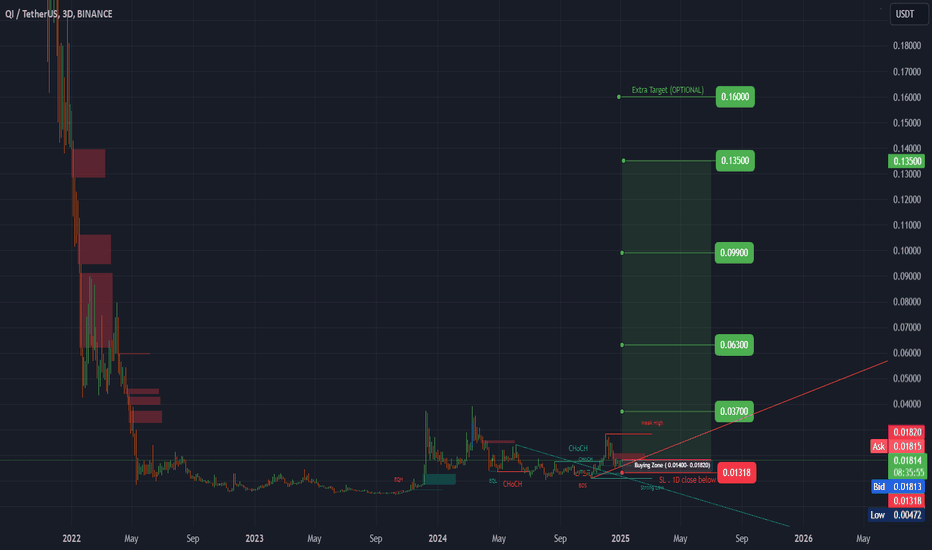

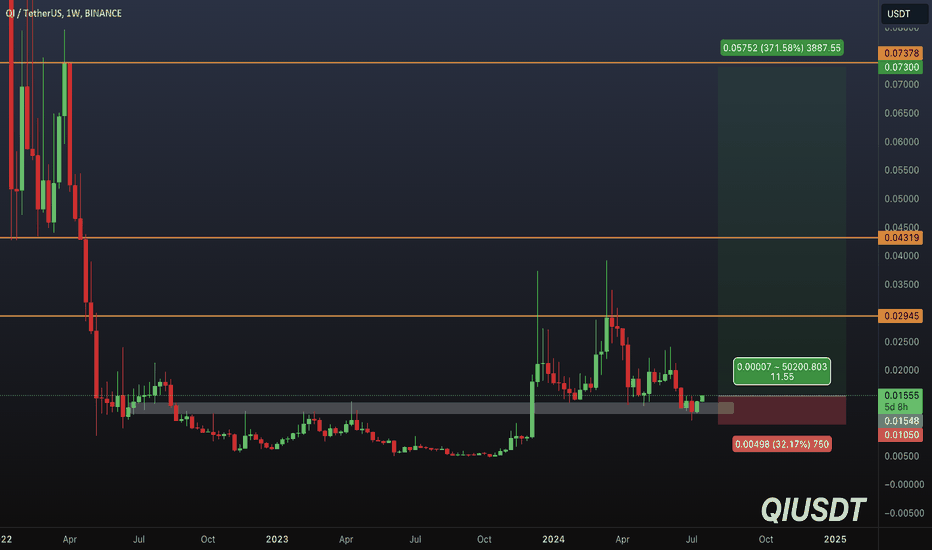

#QI (SPOT) IN( 0.01400- 0.01820) T.(0.13500) SL(0.01318)BINANCE:QIUSDT

#QI / USDT

Entry( 0.01400- 0.01820)

SL 1D close below 0.01318

T1 0.03700

T2 0.06300

T3 0.09900

T4 0.13500

1 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

______________________________________________________________

Golden

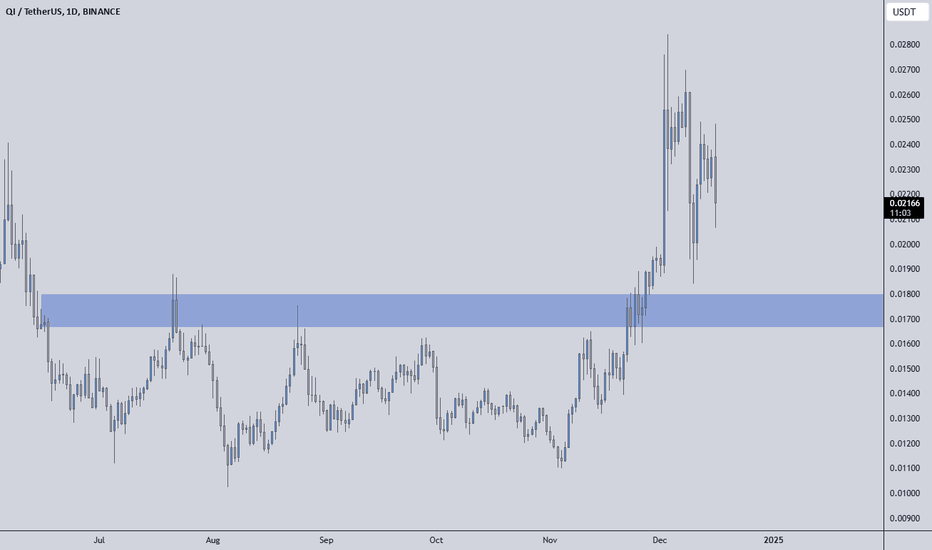

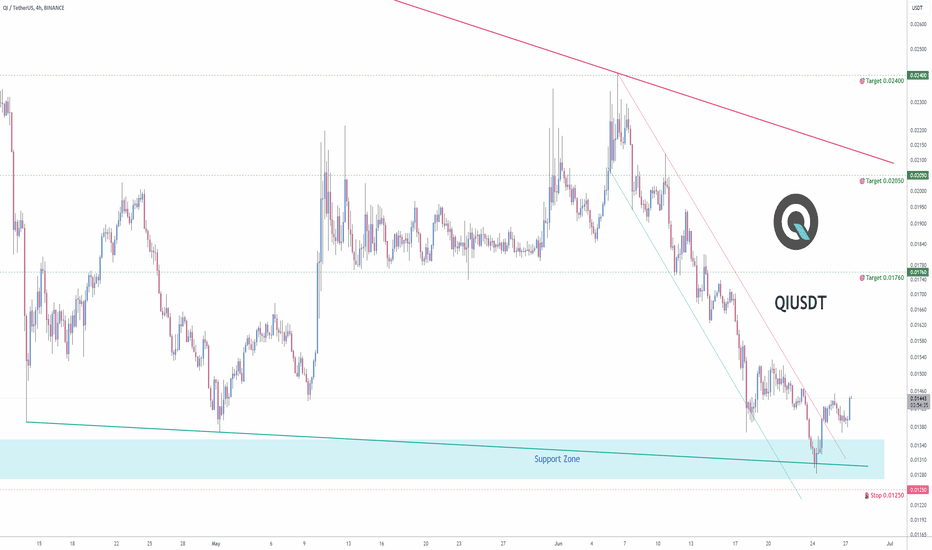

QIUSDT: %215 Volume Surge and Buyer ActivityQIUSDT: Significant Volume Surge and Buyer Activity

There is a 215% increase in volume in QIUSDT, indicating heightened market activity. This suggests buyers are stepping into the market and adding pressure. However, given the dynamics of the market, I will focus on evaluating specific breakout opp

Trade Signal Alert: QIUSDT MovementAttention traders! We have a new trading signal for the QIUSDT pair. According to the analysis from our cutting-edge strategy, EASY Quantum Ai, a buying opportunity has emerged.

Direction: Buy

Enter Price: 0.0149

Take Profit: 0.01518333

Stop Loss: 0.01453333

Our forecast is based

See all ideas

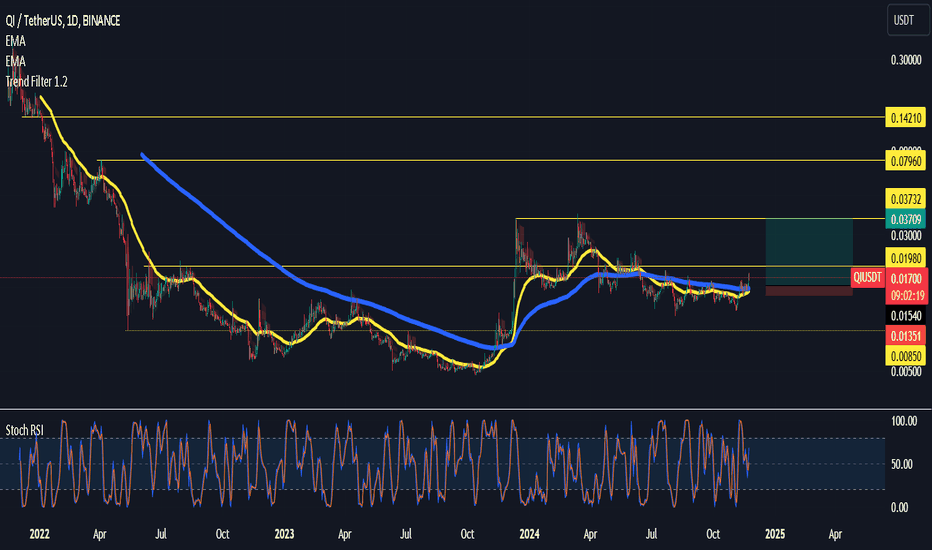

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.