RUNEUSDT trade ideas

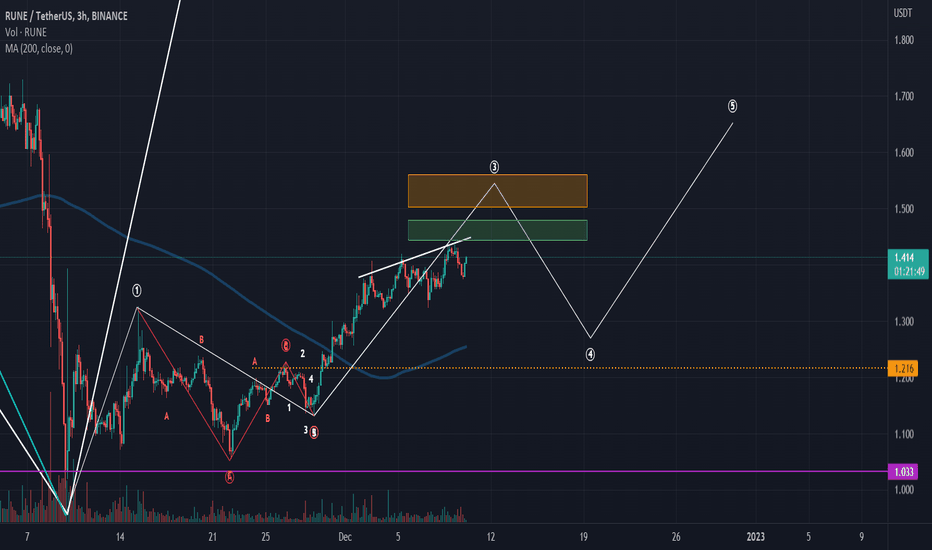

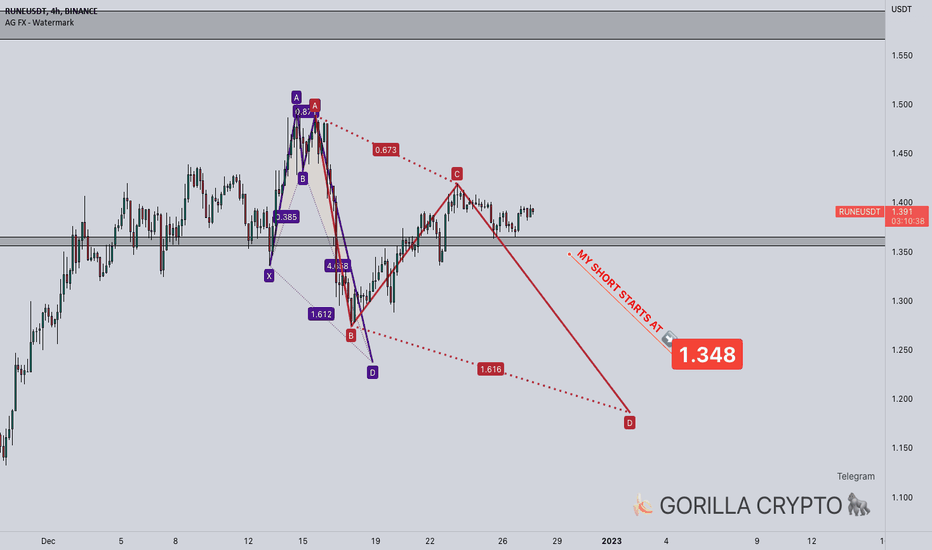

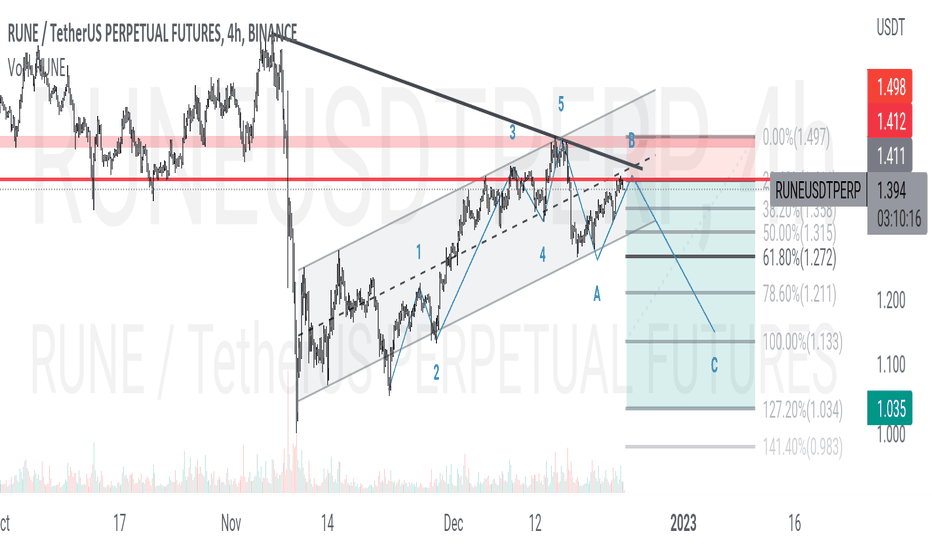

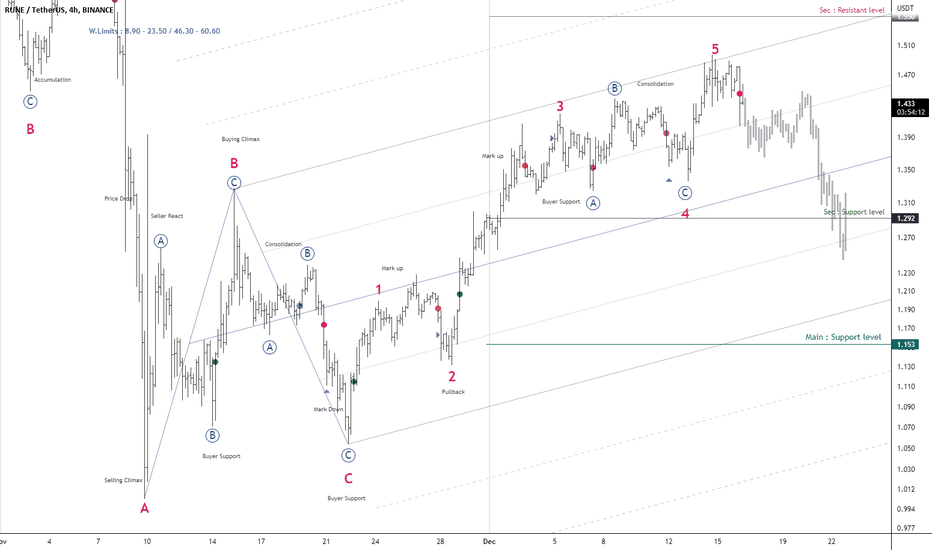

RUNEUSDT ABCDThe ABCD is a basic harmonic pattern. All other patterns derive from it. The pattern consists of 3 price swings. The lines AB and CD are called “legs”, while the line BC is referred to as a correction or a retracement. AB and CD tend to have approximately the same size.

A bullish ABCD pattern follows a downtrend and means that a reversal to the upside is likely. A bearish ABCD pattern is formed after an uptrend and signals a potential bearish reversal at a certain level. The rules for trading bullish and bearish ABCD patterns are the same, you will just need to take into account the direction of the pattern you trade and the movement of the market it predicts.

Likes and comments if you have questions! 🍌

Thanks!

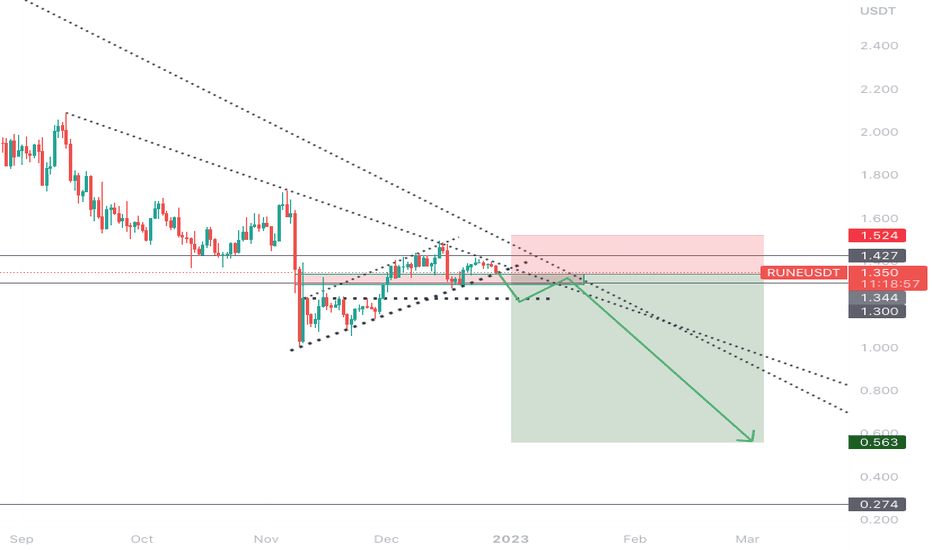

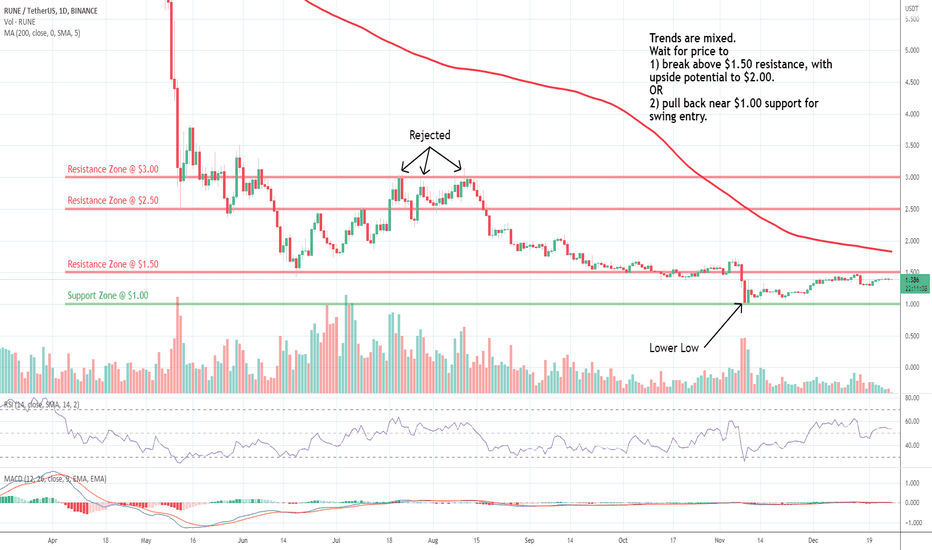

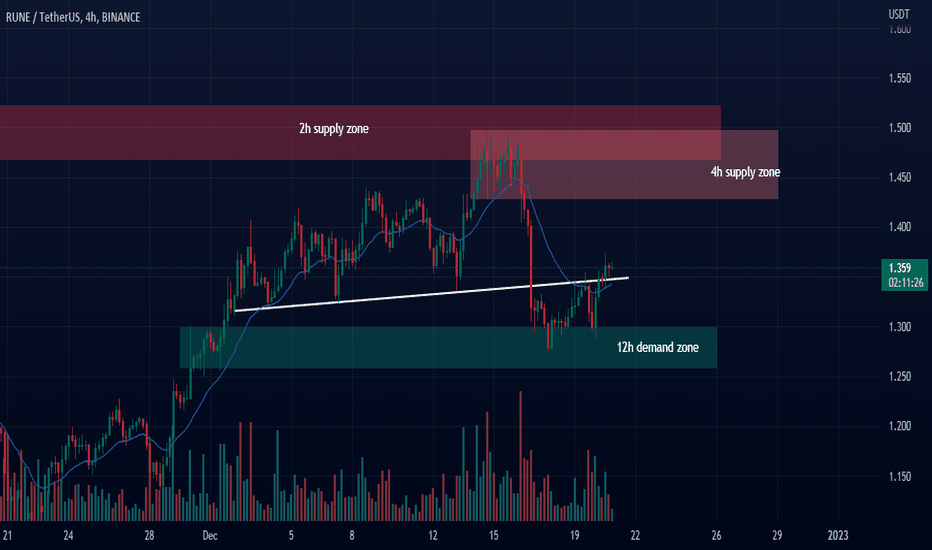

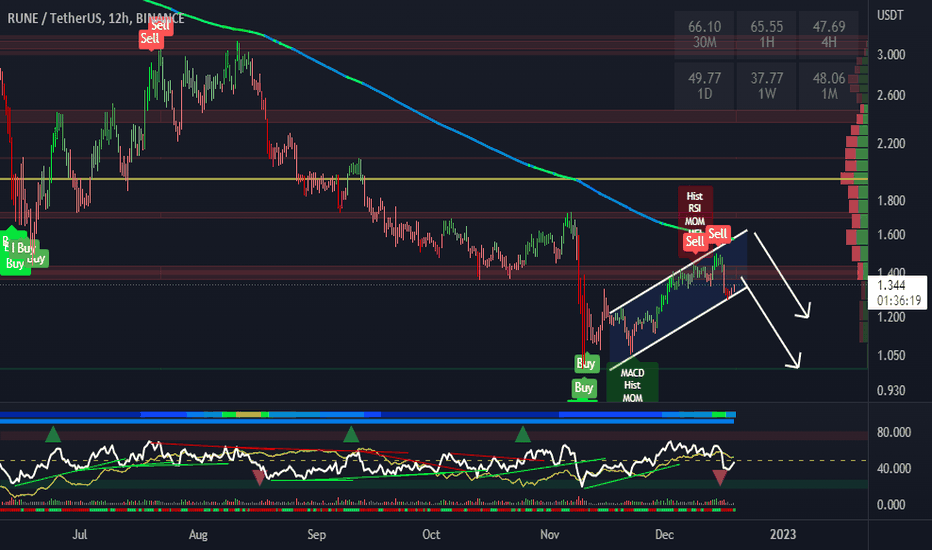

RUNE: Approaching ResistanceTHORchain (RUNE) technical analysis:

Trade setup : Trends are mixed. Wait for price to 1) break above $1.50 resistance, with upside potential to $2.00, or 2) pull back near $1.00 support for swing entry.

Trend : Uptrend on Short-Term basis, Neutral on Medium-Term basis and Downtrend on Long-Term basis.

Momentum is Mixed as MACD Line is below MACD Signal Line (Bearish) but RSI ~ 50 (Neutral).

Support and Resistance : Nearest Support Zone is $1.00. The nearest Resistance Zone is $1.50 (previous support), then $2.50, and $3.00.

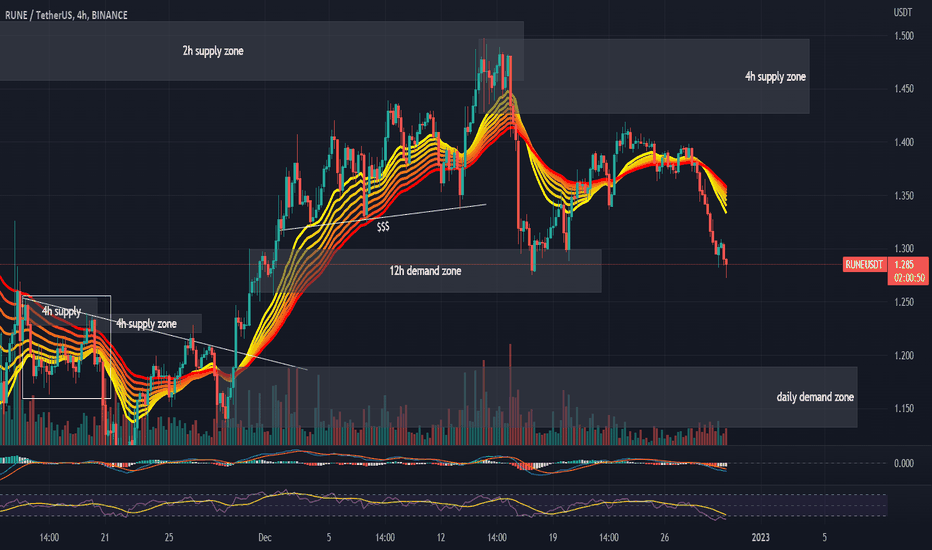

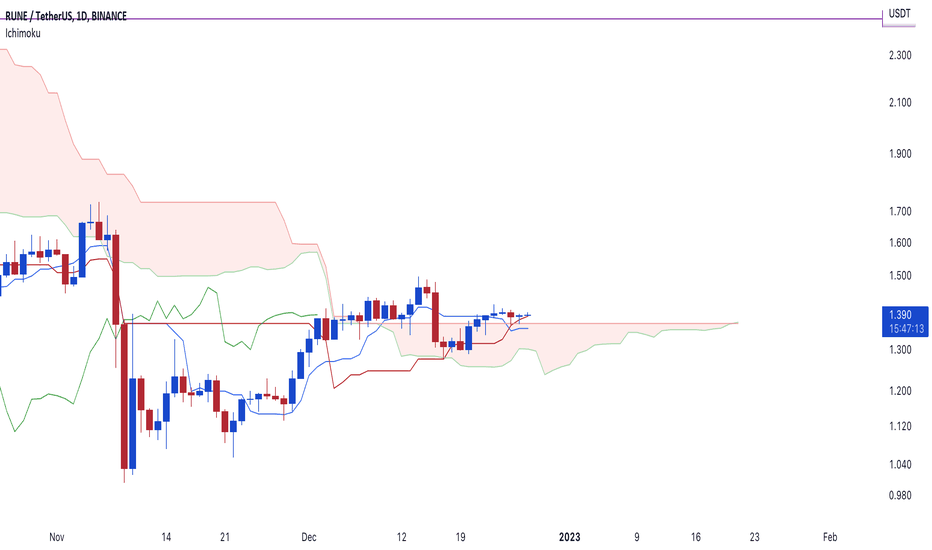

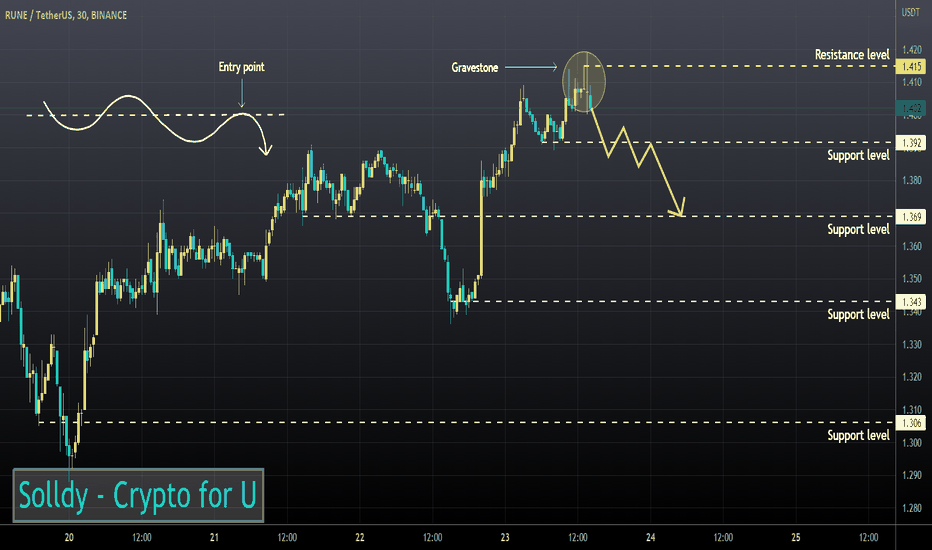

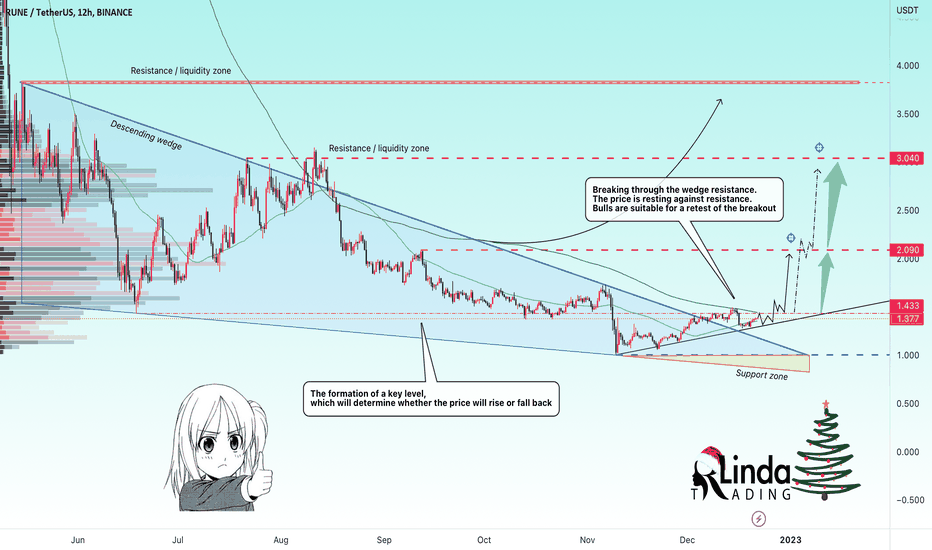

RLinda ! RUNEUSD-> Bulls break through resistance. What's next?RUNEUSDT shows the position of the bulls, who are trying to overcome the resistance of the bears. The price breaks through important resistance and moves into the long zone

On the chart we see the formed "descending wedge" pattern, a break of which resistance can activate quite a strong bullish impulse.

Now the price touches the resistance at 1.433 and is in the consolidation phase between 1.433 and 1.282.

I expect the formation of a local ascending triangle to the level of 1.433, breakthrough of which will send the price to 2.09 (medium-term target), and after that - to 3.04.

Regards, R. Linda!

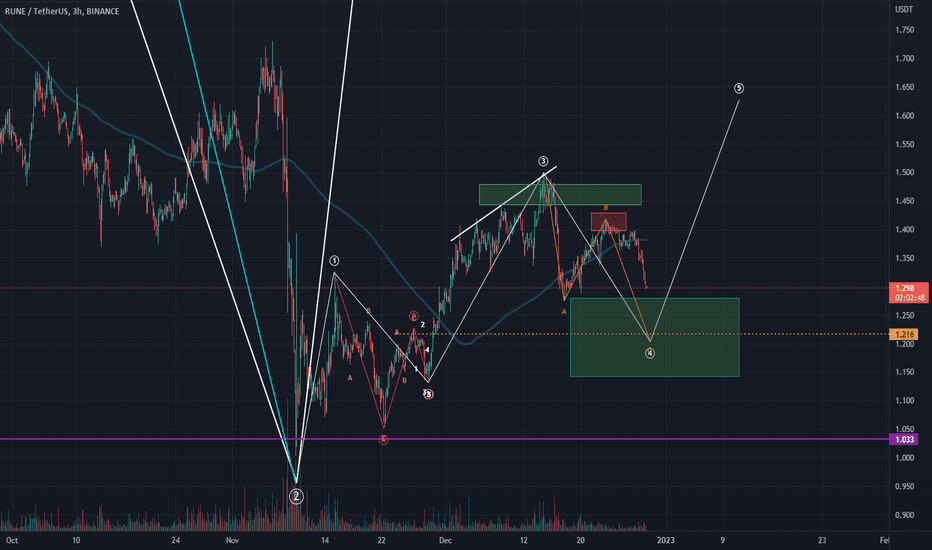

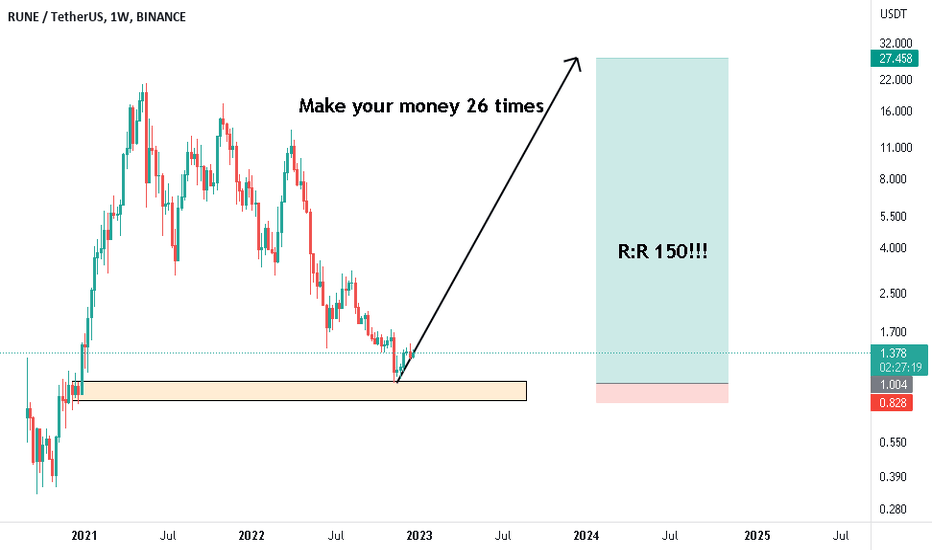

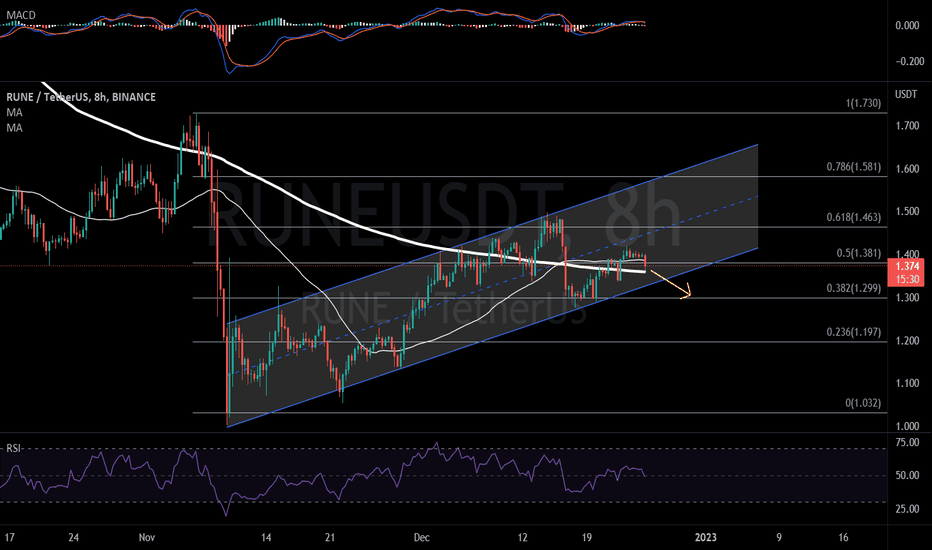

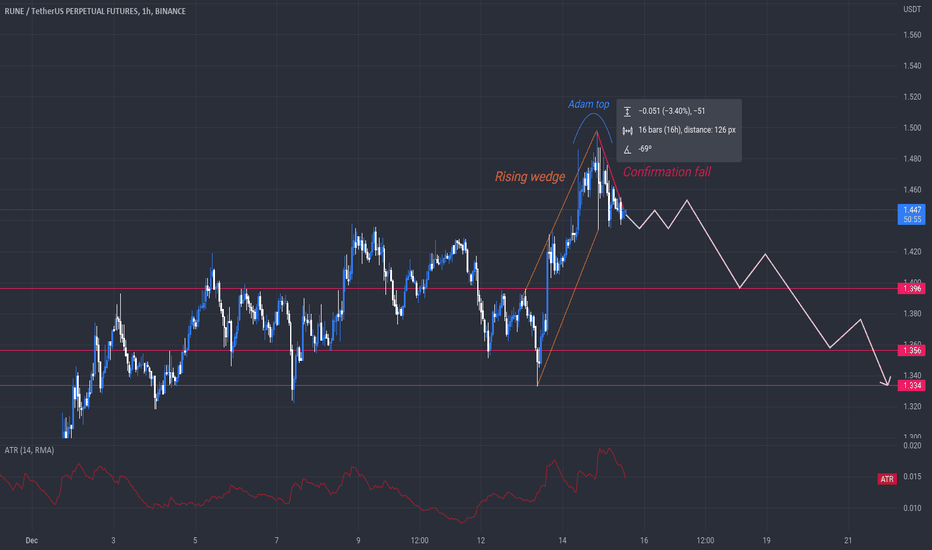

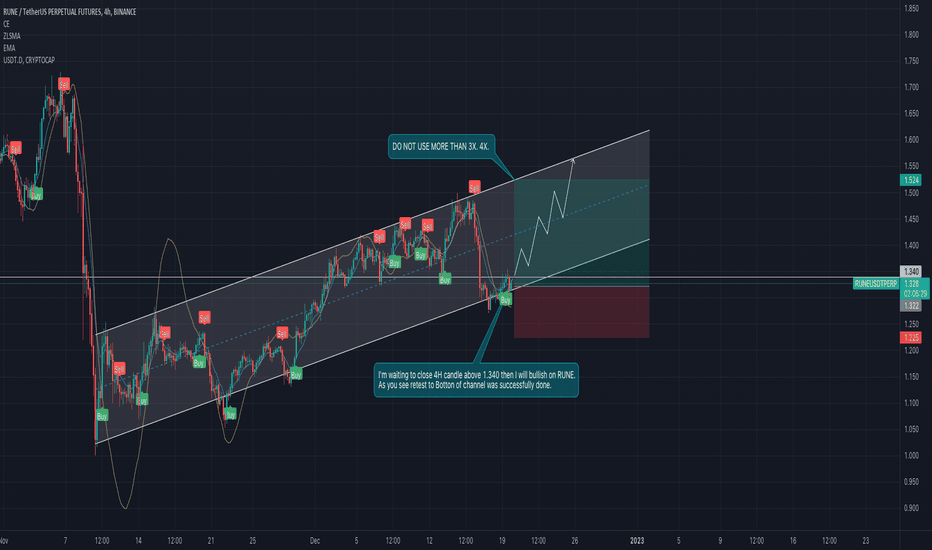

RUNE 21.12.22 (Short-Term)RUNE continues to move in the price range I expected. If it continues like this, it is likely to reach the price range of $1.44 - $1.45 , the upper level of the channel.

I'm thinking of making a short position from the area specified in the chart to the bottom of the channel. If the price comes to the $1.44 level, it should be watched carefully.

If there is a pump in BTC in terms of a possible liquidity cleanup, there is a possibility that RUNE will break the channel. Therefore, I will wait for the return indicator before opening a short.

What I write here serves as a note to myself. Does not include investment advice.

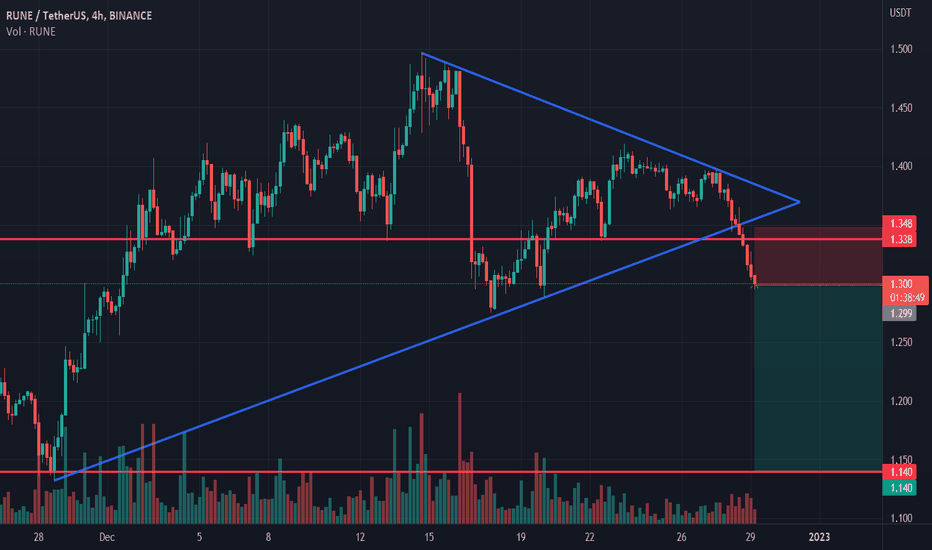

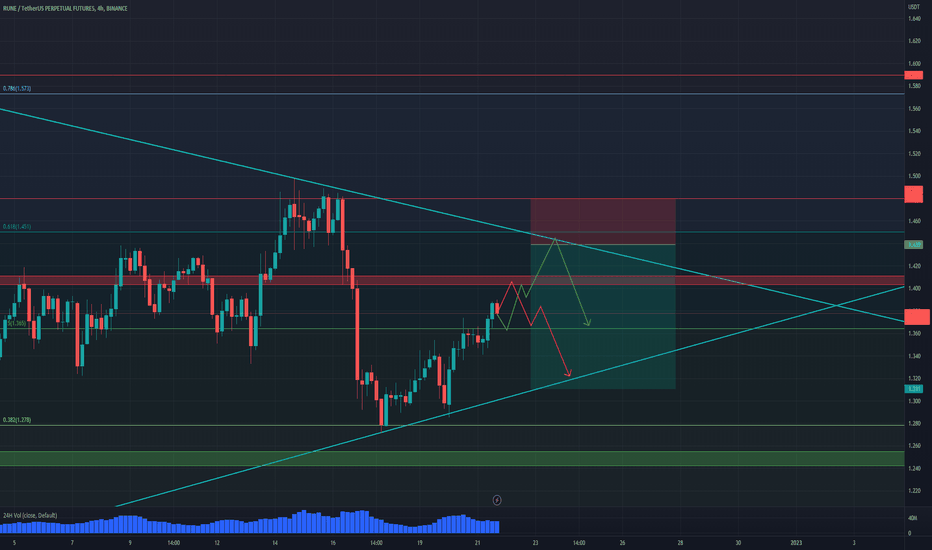

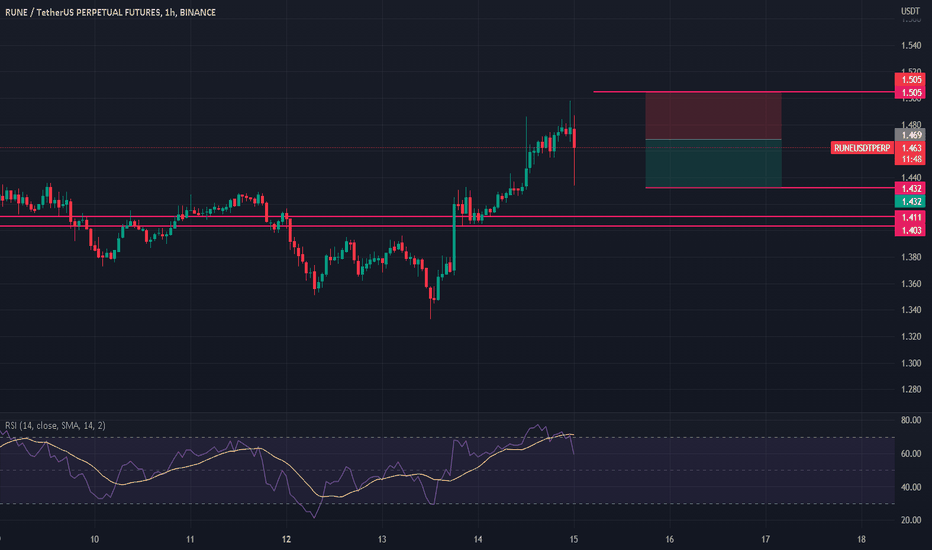

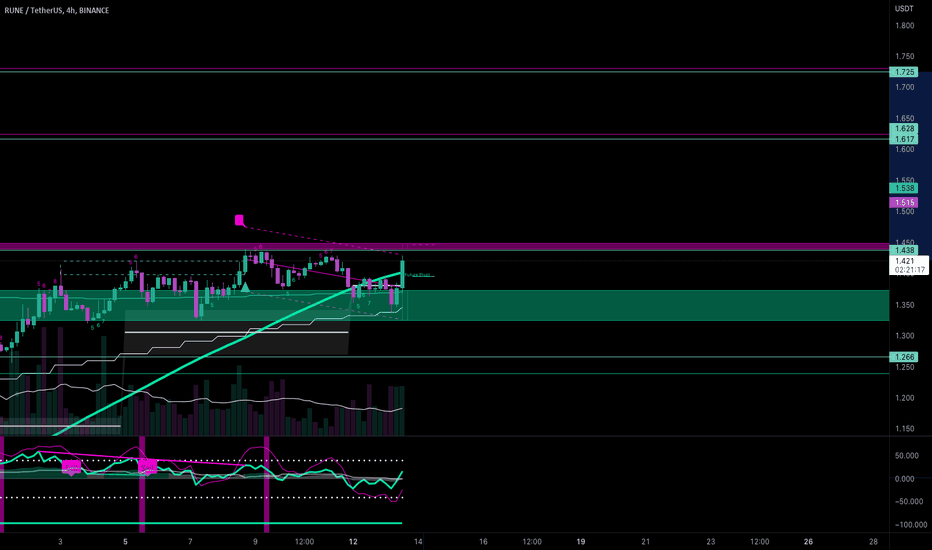

#RUNE/USDT - Long - Potential 21.35%#RUNE/USDT provided by the pro trader BlockParty SPOT|USDT

Strategy: Long

Exchange: Multi-Exchange

Account: Spot

Entry mode: Market order in range

Invest: 5%

Exit:

Target 3 : 1.725 22.25%

Target 2 : 1.617 14.6%

Target 1 : 1.438 1.91%

Entry: 1.365 ⌁ 1.422

Current market price: 1.419

Stop: 1.266 (-10.28%)

Technical indicators:

24h Volume: 5074936.3455

Satoshis: 1.411

Primed to pump from support following CPI data coming in bullish at 7.1% YOY

Trade: RUNEUSDT 13/12/2022 13:33

Account: SPOT

Volume last 24h: 5074936.35 USDT

Volume in buy range: 8147.63 USDT