GD1! trade ideas

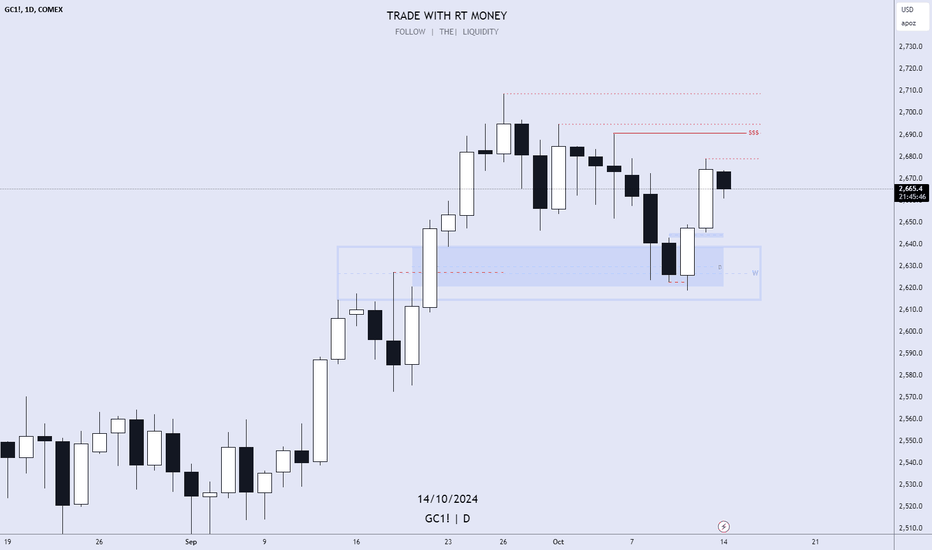

WEEKLY FOREX FORECAST OCT. 14 - 18th: GOLD | XAUUSD Gold is still bullish, and BUYS are still the best bet. There is the potential for an overdue retracement, but I suspect it will be limited. The formation of a +FVG will support higher prices, and we may get that on Monday's close.

Patience....

Check the comments section below for updates regarding this analysis throughout the week.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

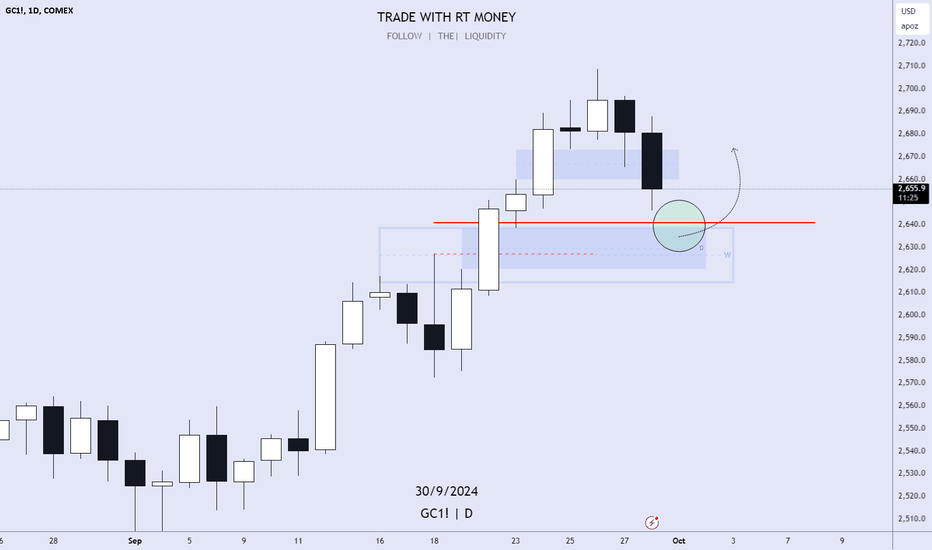

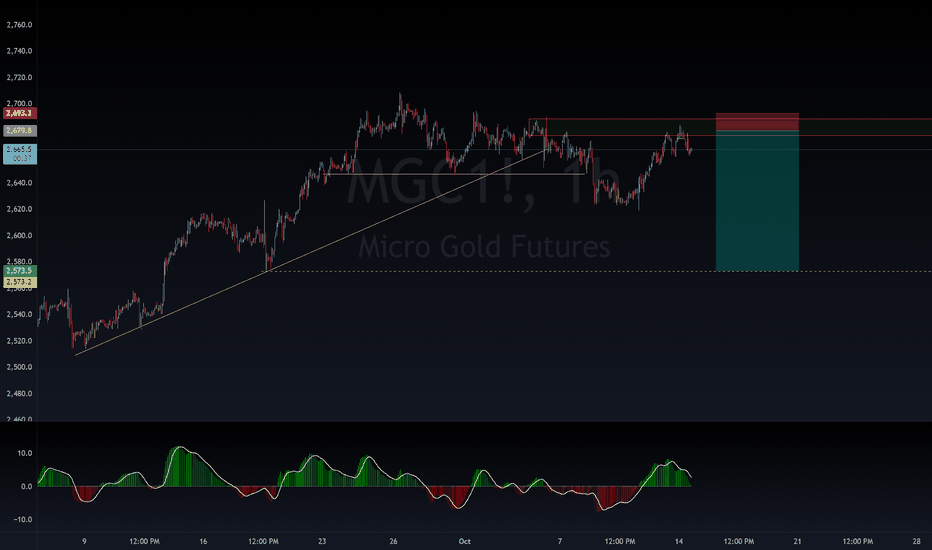

GOLD is Setting Up For LONGS! Prepare to BUY!Price is pulling back to the Daily +FVG, which is nested in the Weekly +FVG, which is intersected by the Swing High. Three strong confluences for a high probability LONG.

Be patient, look for price to contact the POI, and then let your valid buy setup form.

Let the rest unfold.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

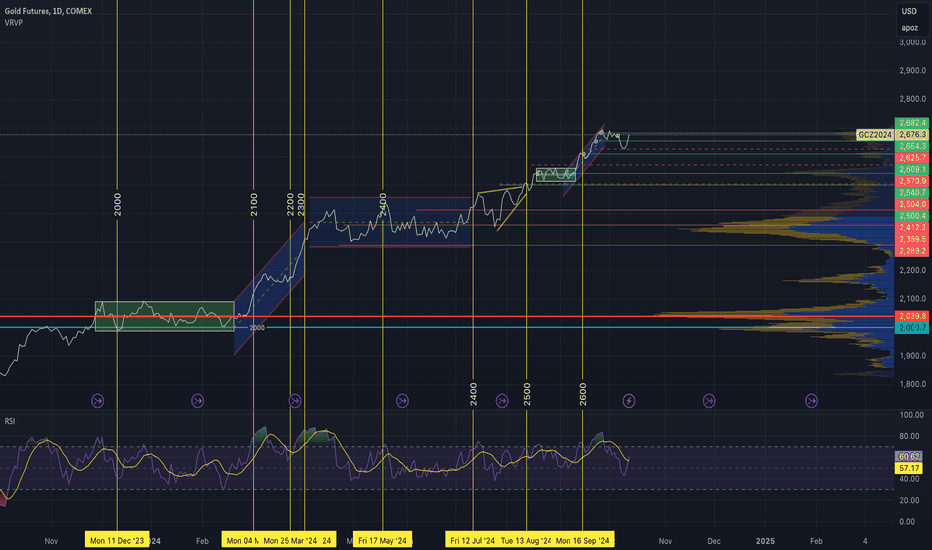

2024-10-16 - priceactiontds - daily update - goldGood Evening and I hope you are well.

tl;dr

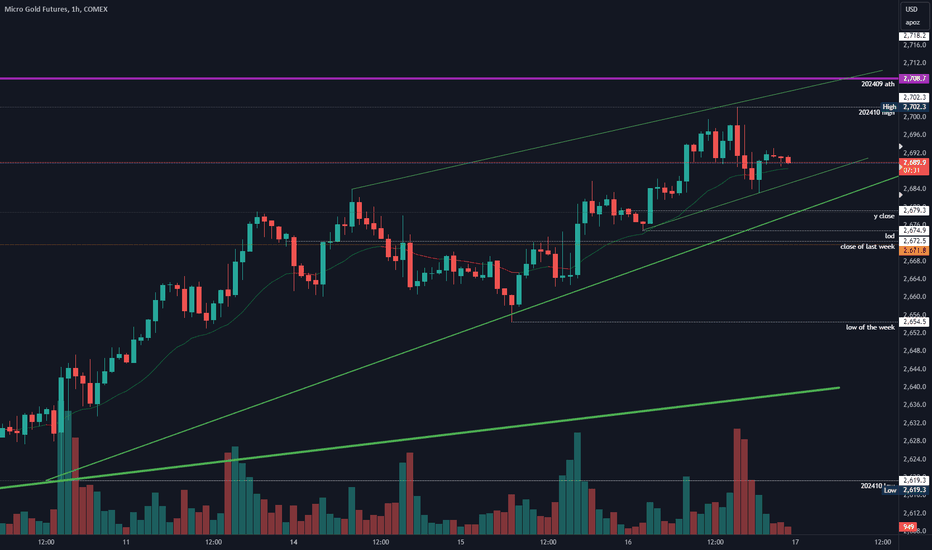

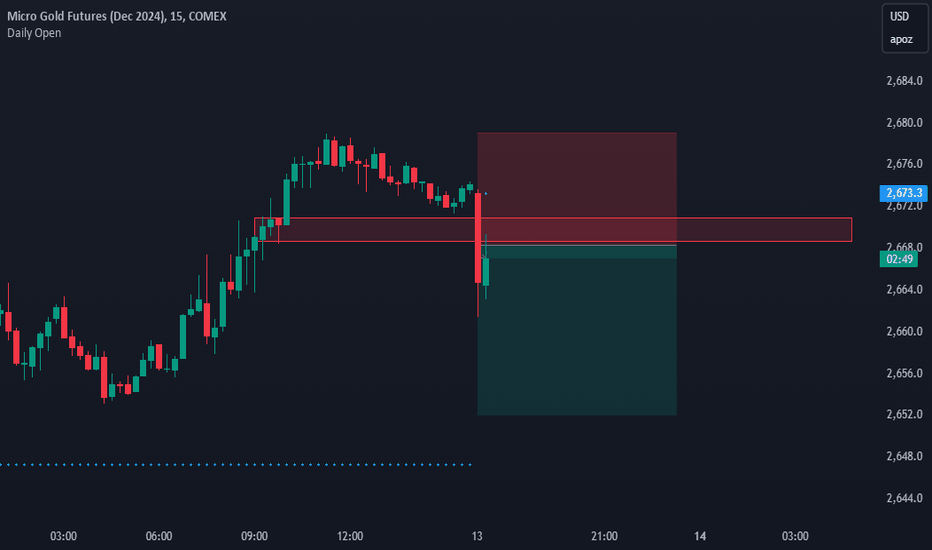

Gold - Bulls got the breakout above and got rejected at 2700 again. I think we will spend a bit more time at the highs until bulls give up or we find more buyers willing to buy above 2700. Right now I still favor the bulls for continuation but only willing to buy on strong momentum.

comment : Retest 2700 is done, now what? We have a proper channel, so trade it. 2690 right now is not a good spot. Wait for a closer price to the lower trend line or look for shorts near 2700, if bulls show weakness again. New highs inside the channel are getting sold, so you should not buy into strength but rather on pullbacks.

current market cycle: bull trend (also trading range on the daily chart - 2619 - 2710)

key levels: 2670 - 2710

bull case: Bulls will likely retest 2700 tomorrow. Can they get another big breakout above it? I think so but right now it does not look like it. I expect more sideways until the bull trend line on the daily chart is closer. Bulls still in full control and I would not look for shorts on this.

Invalidation is below 2670.

bear case: Bears selling new highs but thats about it. Market is grinding higher again and we are near the ath. Nothing bearish about this. Bears can start a case if they close below 2670 again.

Invalidation is above 2720.

short term: neutral - I would not buy 2700 in hope of 2710 but rather buy decent pullbacks inside the current channel.

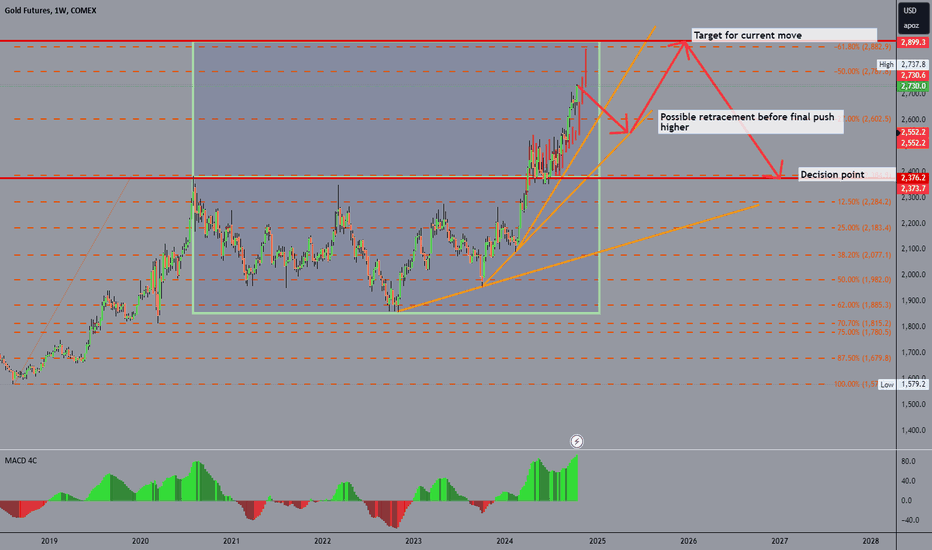

medium-long term - Update from 2024-09-22: Very strong breakout above, again. Market currently has no ceiling. Most likely 2700 next and I do think 3000 could be a potential target if we continue. There is certainly an argument for a measured move based on the bull rally from 2018-08 to 2020-08.

current swing trade: None

trade of the day: Selling 2700.

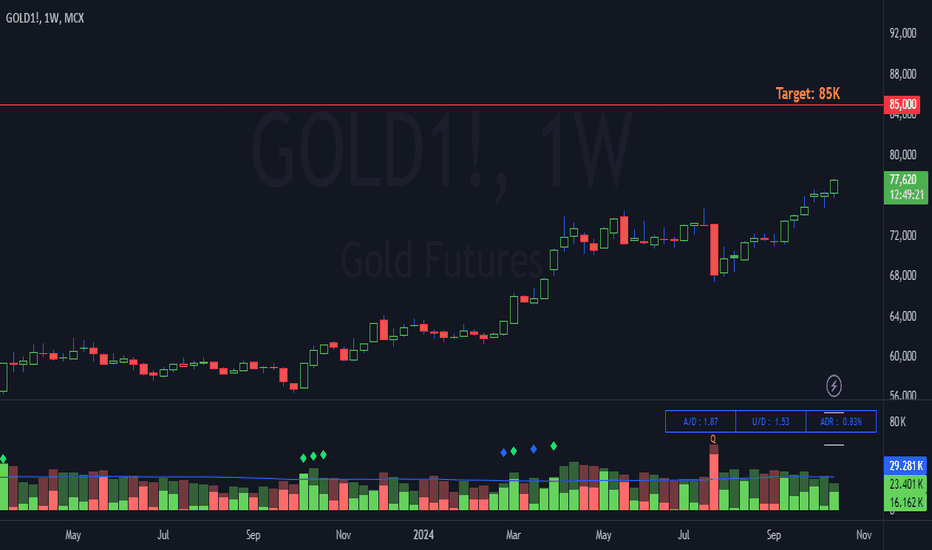

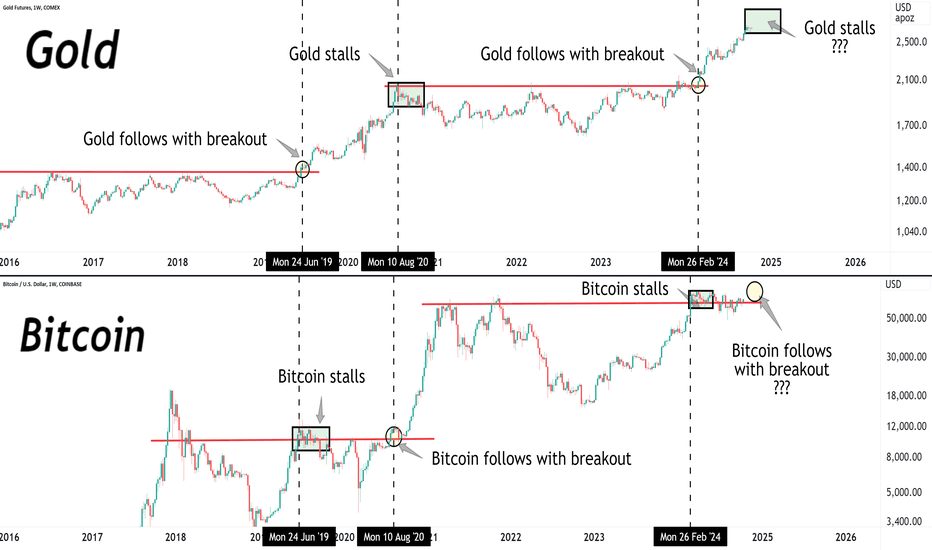

Dxy gold silver Weimar Republic 10 16 24. here the dxy may be coming to sellers and this is where I would expect a reversal. the dxy and the metals have been going higher which is not typical. this is probably a signal that the metals are bullish which means there are buyers. on the other hand if the gold or the silver trade lower.... that would be possibly a good time to buy the metals, and I explain this in the video. this is a very dangerous time and a lot of people feel that the US must change its strategy because the dollar cannot be sustained with The amount of spending that has occurred.

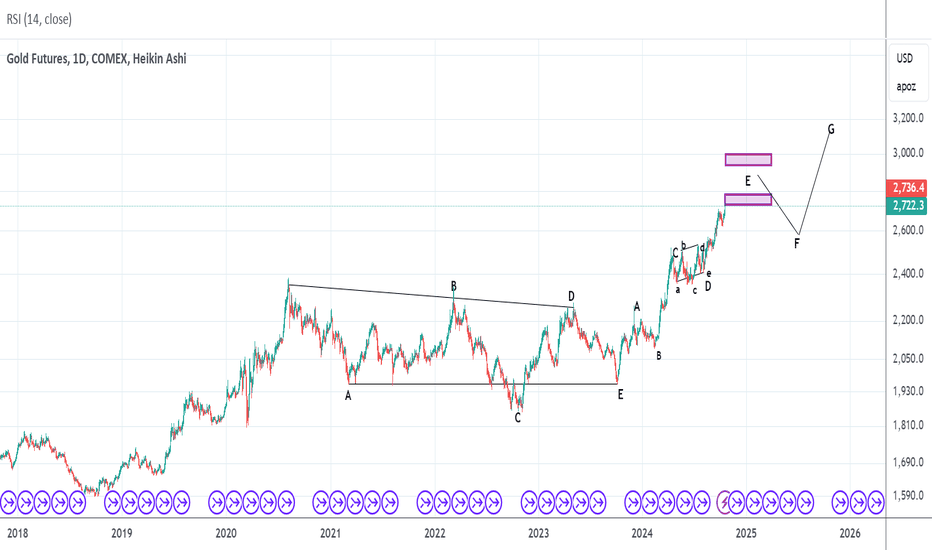

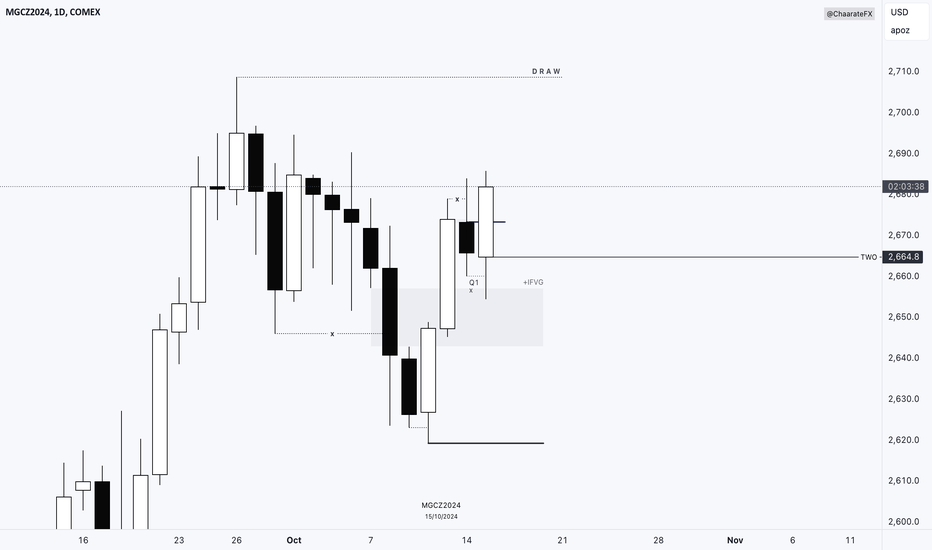

Gold looks to be drawing to the upside... My conviction for gold is that it is drawing towards the upside... I'm noticing daily failure swings that price seems to be very interesting in buy side liquidity. Plus price has reacted nicely off a +IFVG and has formed a daily CISD. I'll be looking for a OLHC daily candle formation for tomorrow trading toward the weekly draws.

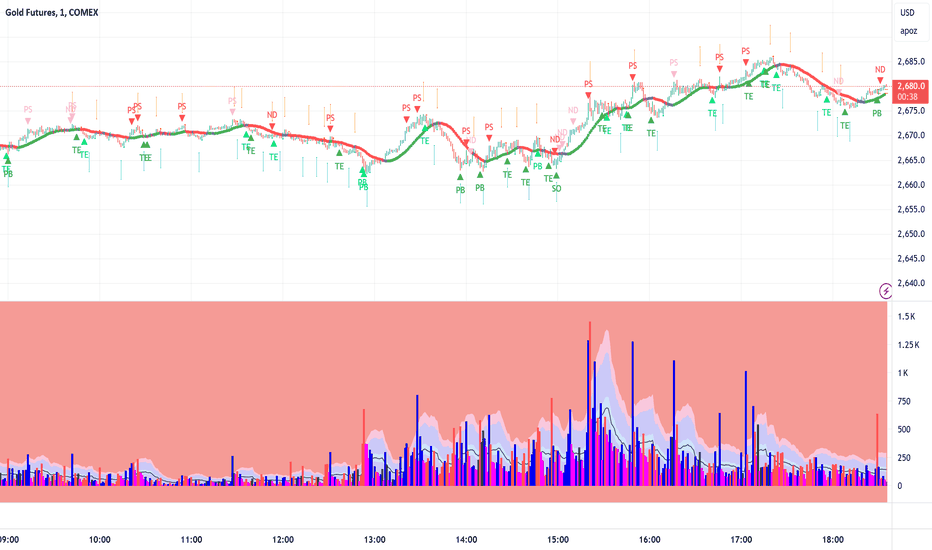

The Wyckoff VSA Method Showing Selling and No Demand In this short video, Author of "Trading in the Shadow of the Smart Money", Gavin Holmes, explains one of the most important trades to the short side, and ironically it works in any timeframe as shown. This is Gold Futures, but if you look at the NQ today as I filmed this it also set up early to the short side in NVIDIA, ARM and the NQ Futures.

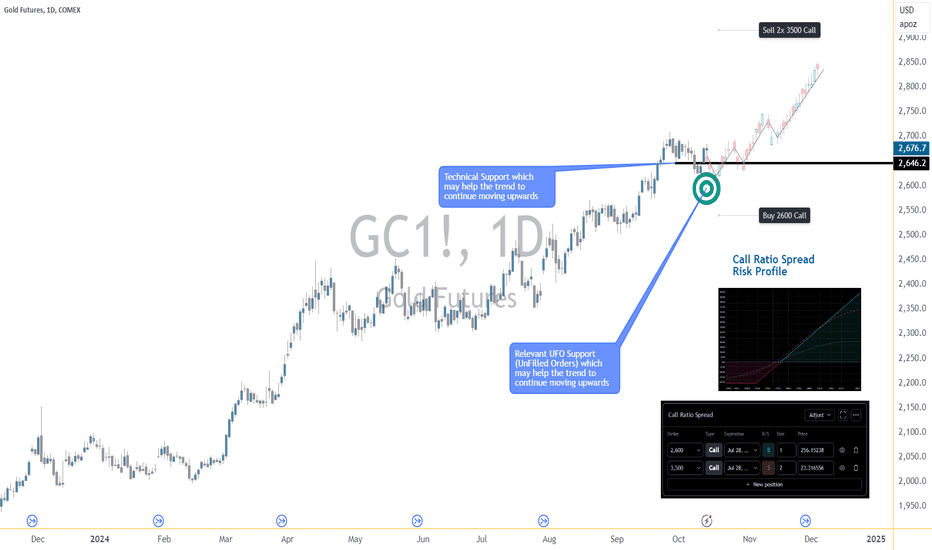

Options Blueprint Series [Intermediate]: Vega-Neutral Gold Play1. Introduction

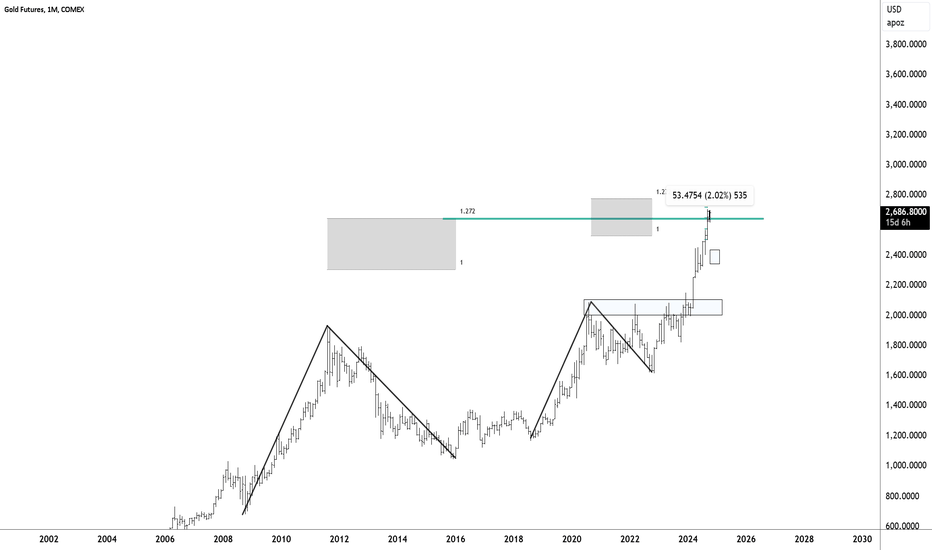

Gold is currently in an uptrend, presenting a potentially favorable environment for bullish traders. However, with implied volatility (IV) sitting around its mean, there’s uncertainty about whether IV will rise or fall in the near future. In such a scenario, traders may want to neutralize their vega exposure to avoid being negatively affected by changes in volatility.

This article focuses on setting up a Call Ratio Spread, a bullish option strategy that provides positive delta while allowing for further adjustments that could keep vega neutral. This allows traders to capitalize on Gold’s potential uptrend while minimizing risk from changes in implied volatility.

2. Current Market Context

The Gold futures market shows strong levels of support, which reinforces the bullish outlook. On the continuous Gold futures chart above GC1!, we observe key support levels at 2646.2 and 2627.2-2572.5. These levels could act as price floors, helping the uptrend continue if tested.

Similarly, when examining the contract-specific below chart for GCQ2025, we identify supports at 2725.4 and 2729.5-2705.5. These levels provide solid ground for bullish trades on this specific contract, giving traders additional confidence in entering long positions.

With implied volatility near its average (see the chart below), the market’s future volatility direction is unclear. Traders using options may choose adapt to this environment, ensuring that changes in volatility do not work against them.

3. Options Strategy: Call Ratio Spread

To take advantage of Gold’s uptrend while neutralizing the risk from changes in volatility, we could employ a Call Ratio Spread. This strategy offers a bullish stance while maintaining vega neutrality, protecting the trader from swings in implied volatility.

Setup:

Buy 1x 2600 Call at 256.15

Sell 2x 3500 Calls at 23.32

Expiration: July 28, 2025

This configuration generates positive delta, meaning the strategy will benefit from upward price movement. At the same time, by selling two calls at a higher strike, we offset the vega exposure, ensuring that changes in volatility won’t dramatically affect the position.

The strike prices and expiration selected help create a risk profile that works well in a bullish market. The maximum gain potential occurs if Gold continues to rise but stays below the higher 3500 strike, while the vega neutrality minimizes any volatility risks as the trade begins.

Notice the breakeven point for this strategy is 2809.5, meaning the trade becomes profitable if Gold exceeds this level by expiration.

4. Why Use Micros?

Traders looking for a more flexible approach can consider using Micro Gold Futures (symbol: MGC) instead of standard Gold futures contracts. Micro Gold Futures offer smaller contract sizes, which translate into lower margin requirements and a more precise way to control risk. This makes them an attractive alternative for traders with smaller accounts or those looking to scale into positions gradually.

Additionally, Micro Gold Futures allow traders to fine-tune their exposure to Gold without the larger capital commitment required by standard contracts. For those implementing strategies like the Call Ratio Spread, Micros provide a cost-effective way to execute similar trades with a lower financial commitment.

Contract Specs and Margin Requirements

Gold Futures (symbol: GC) represent 100 troy ounces of gold, and their margin requirements can vary depending on market volatility and the broker. Typically, the initial margin requirement for a standard Gold futures contract is around $10,000 to $12,000, but this can fluctuate. For traders seeking more flexibility, Micro Gold Futures (symbol: MGC) offer a smaller contract size, representing 10 troy ounces of gold. The margin requirement for Micro Gold Futures is significantly lower, usually in the range of $1,000 to $1,200, making it a more accessible option for those with smaller accounts or those looking to fine-tune their exposure.

5. Risk Management

As with any options trade, managing risk is essential. In the case of a Call Ratio Spread, the primary risk comes from the naked short calls at the 3500 strike price. If Gold rallies aggressively beyond 3500, the trader faces unlimited risk due to the uncovered nature of the short positions.

To mitigate this risk, traders should consider using stop-loss orders or adjusting the trade if Gold's price approaches the 3500 level too quickly. Another way to eliminate the unlimited risk component to the upside would be to convert the Call Ratio Spread into a Call Butterfly by buying an additional call above the 3500 strike price, effectively capping the risk. This adjustment still allows for positive delta exposure while limiting potential losses if Gold moves sharply higher.

Additionally, monitoring implied volatility is key. While the position starts with neutral vega exposure, this will change as the underlying asset price moves and time passes, especially as expiration approaches. The vega exposure can increase or decrease depending on these factors. If maintaining the vega-neutral characteristic is a priority, further adjustments—such as rolling options or modifying strike prices—could be made to keep the position aligned with the trader’s volatility outlook.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.sweetlogin.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

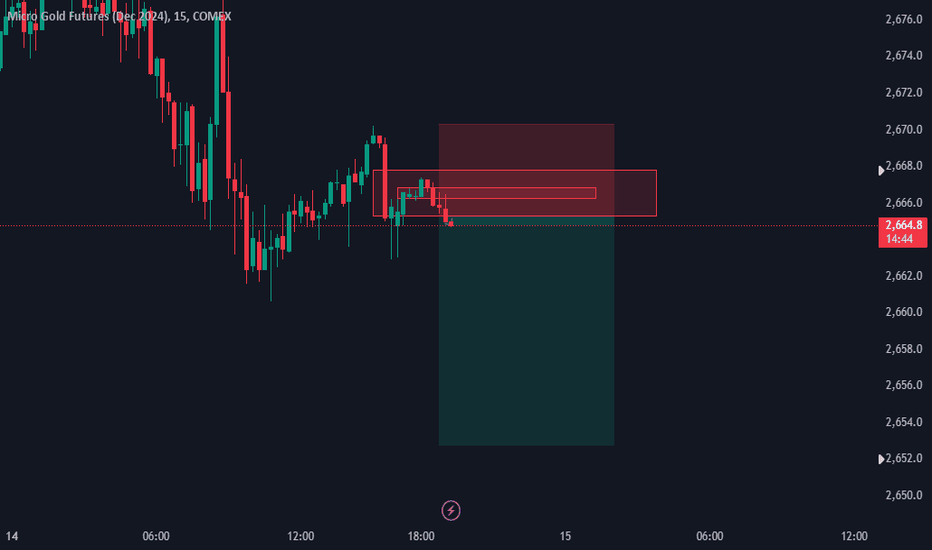

Bearish Gold on the Intraday Charts I’m looking for potential short opportunities as sellers begin to step in. My approach here is to capitalize on the expected pullback, with a target toward the next support zone. Given the current global market uncertainty and dollar strength, I anticipate further downside pressure on gold.