RVNUSDT.P trade ideas

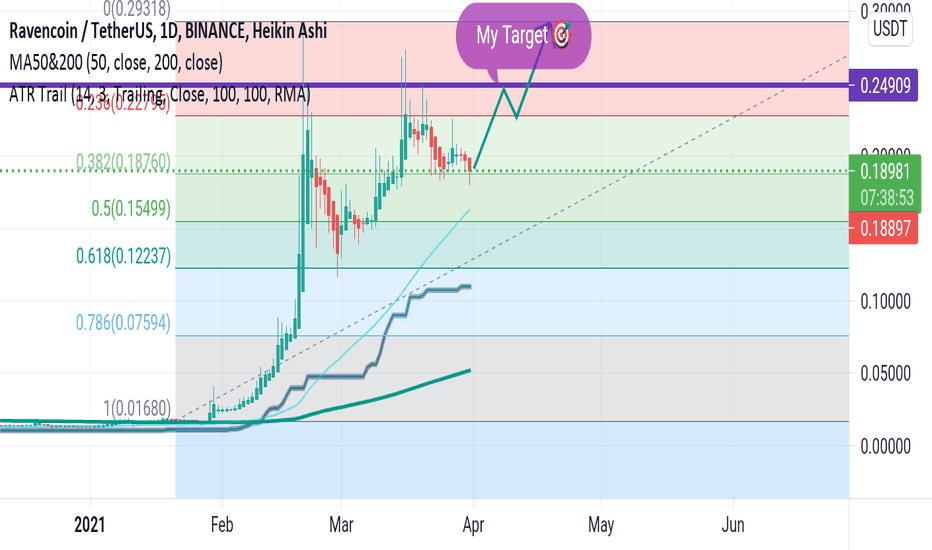

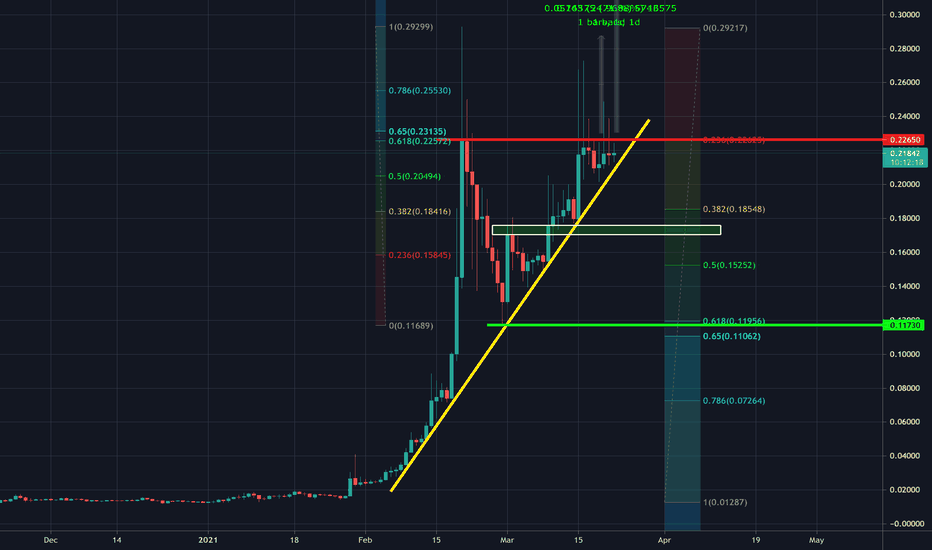

Raven (RVN) Retraced & Ready? 100% - 250% Potential Returns?Thanks again Aymen Krypt for the suggestion

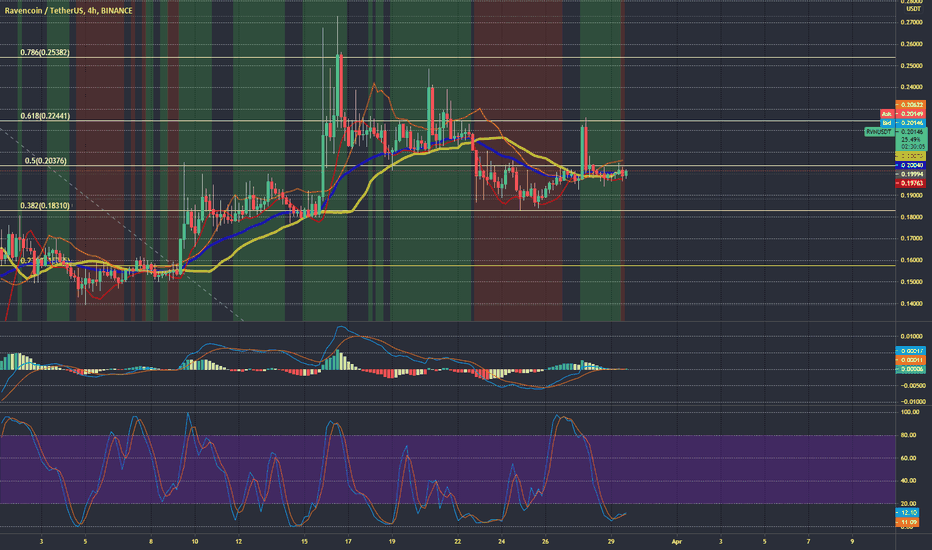

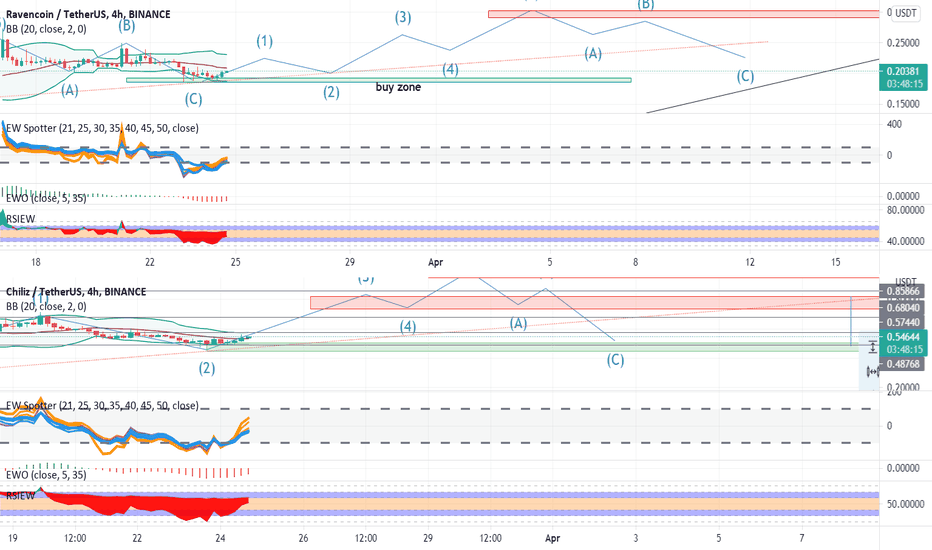

We already have a healthy retracement. We are looking at confirming the 50% fib level at the moment or test and confirm eh 61% fib level. Then we can load up towards our targets. KEep in mind might see resistance at the 38% fib level

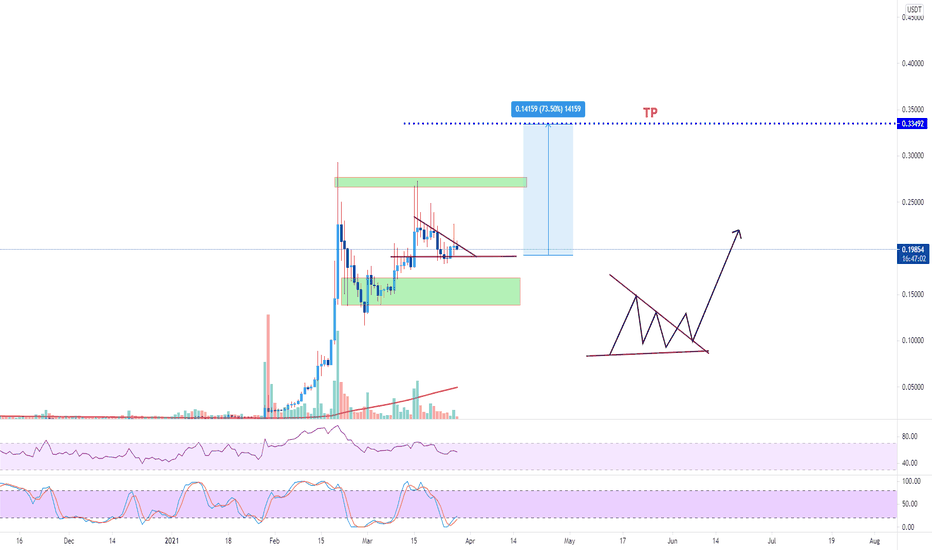

rvnusdtThis is my personal view of this currency - also the market has high risks. If you do not know anything about these risks, I do not advise you to enter or exit any deals - and you bear responsibility for that -

Please support the idea by clicking the like button and expressing your opinion in the comment box

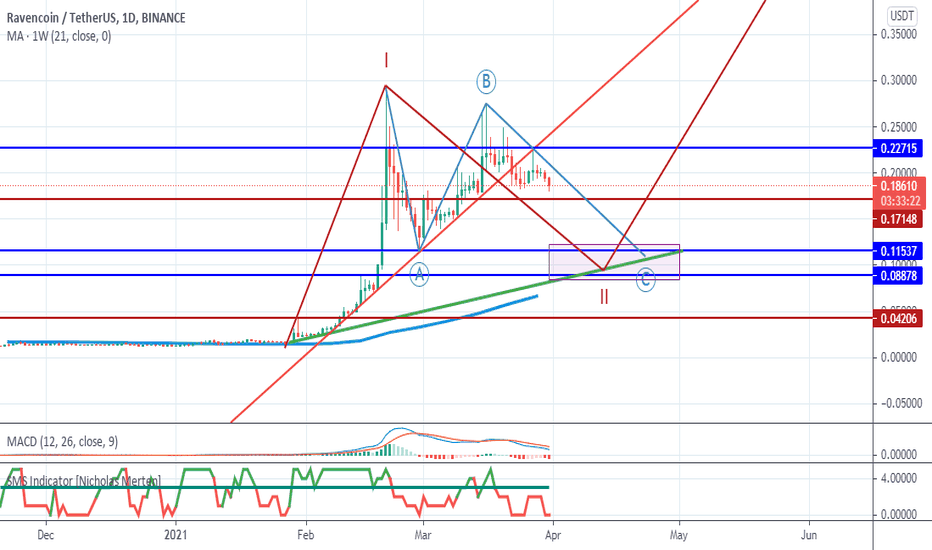

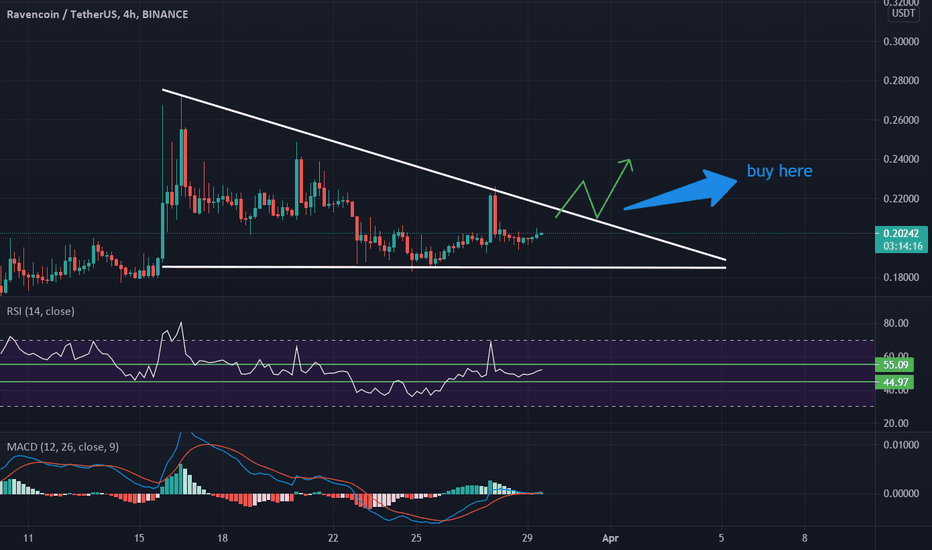

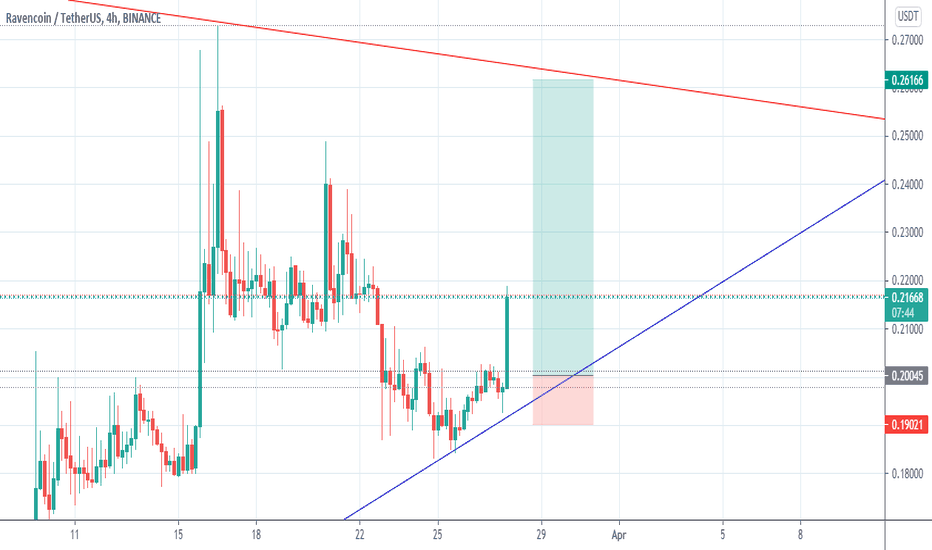

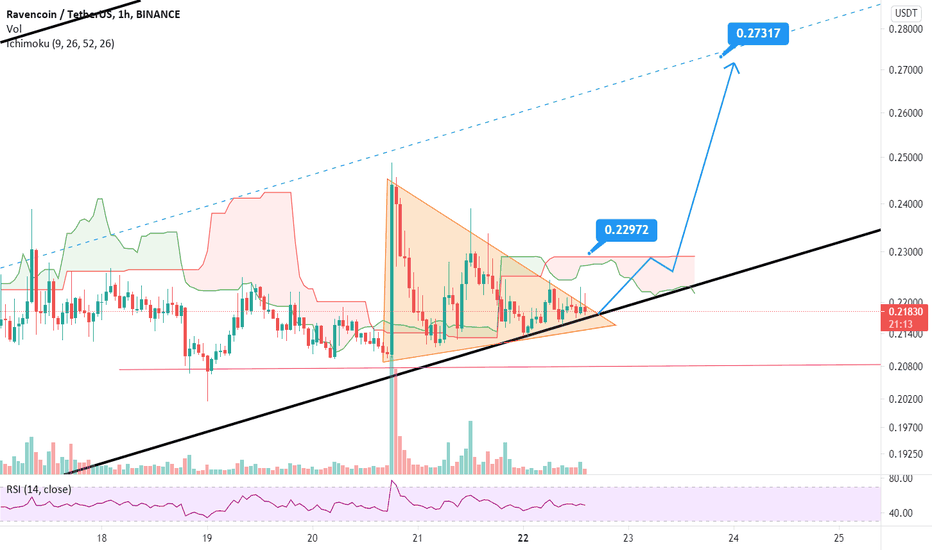

RVN/USDT Descending triangleWe can see a descending triangle on 4 hour chart of RVN/USDT (Binance).

DESCENDING TRIANGLE has bearish reversal interpretation.

If it breaks it support line it will breakdown to the marked point.

Red lines represents major resistances while green are showing major supports.

We can clearly see 2 valid taps on resistance line and support line inside the formed triangle.

Dial indicator showing ( Bought indicator ) means that the current volume is at sell signal.

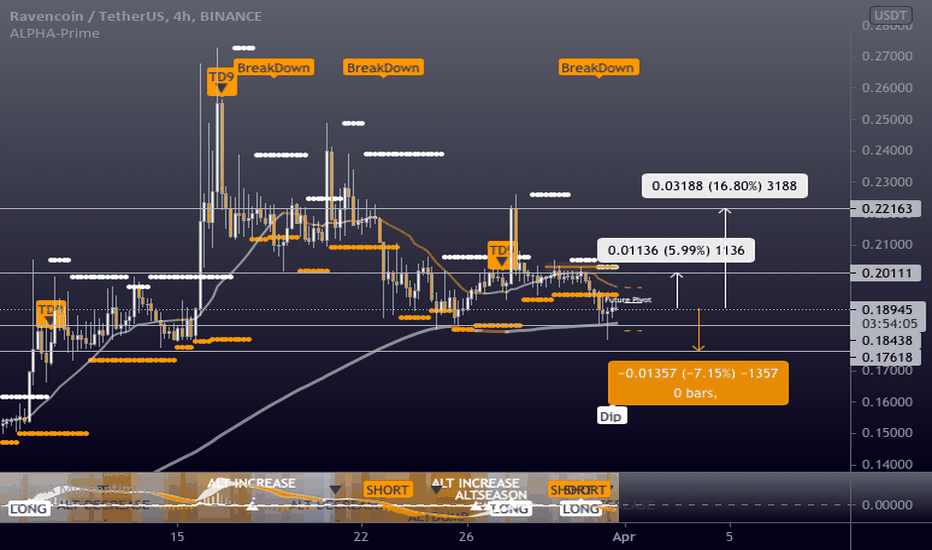

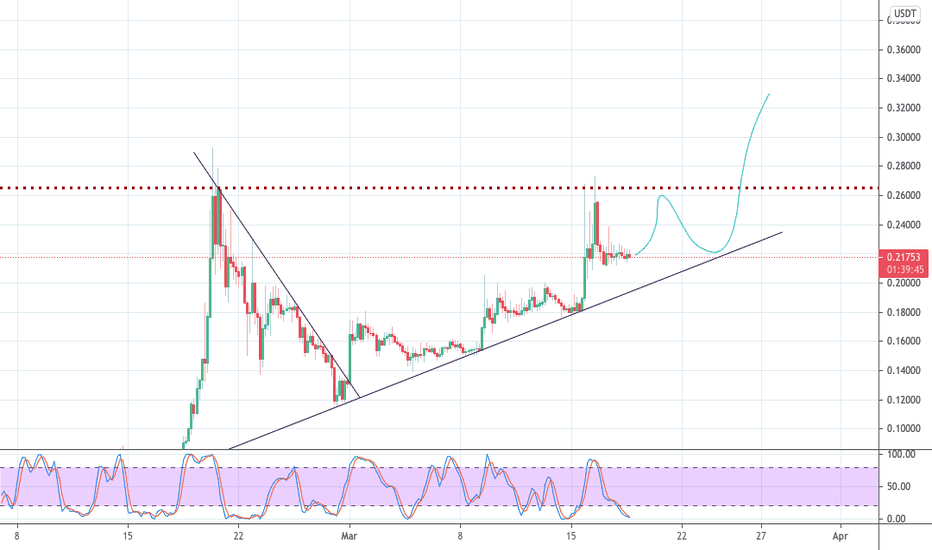

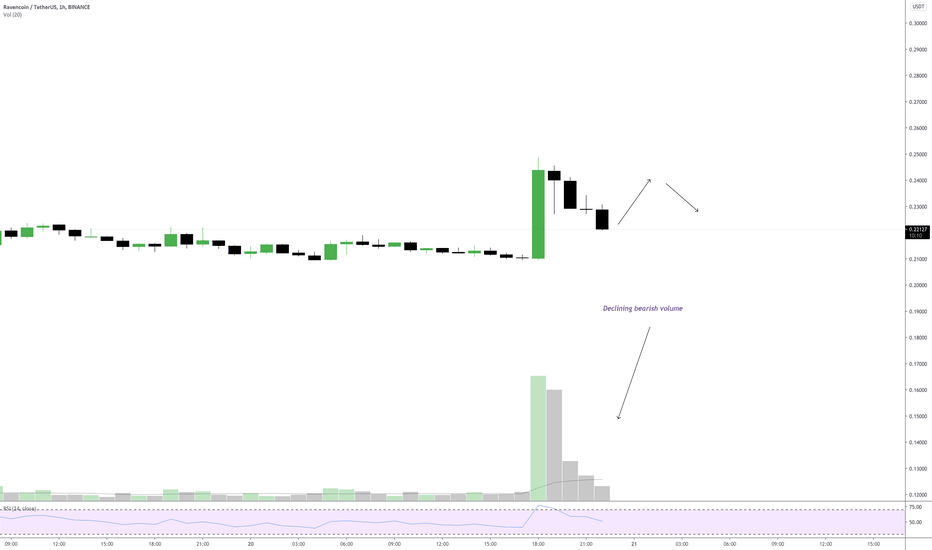

🆓Ravencoin/USDT Analysis (23/3) #RVN $RVNThe buying force has come into RVN at its support at 0.18$ zone and RVN will come back to retest the 0.23$ zone, which rejected RVN several times in the last few days.

If it can conquer this 0.23$ zone, it will keep moving up to retest the last peak at 0.28$ or even 0.35$ and 0.45$ zone in next April

📅NEWS

👉Apr 9 : Austin Blockchain Week

👉Jan 31, 2022 : Halving Block Reward

📈BUY

-Buy: 0.18-0.19$. SL if B

📉SELL

-Sell: 0.225-0.235$. SL if A

-Sell: 0.28-0.29$. SL if A

-Sell: 0.34-0.35$. SL if A

-Sell: 0.45-0.47$. SL if A

♻️BACK-UP

-Sell: 0.18-0.19$ if B. SL if A

-Buy: 0.145-0.155$. SL if B

❓Details

Condition A : "If 1D candle closes ABOVE this zone"

Condition B : "If 1D candle closes BELOW this zone"

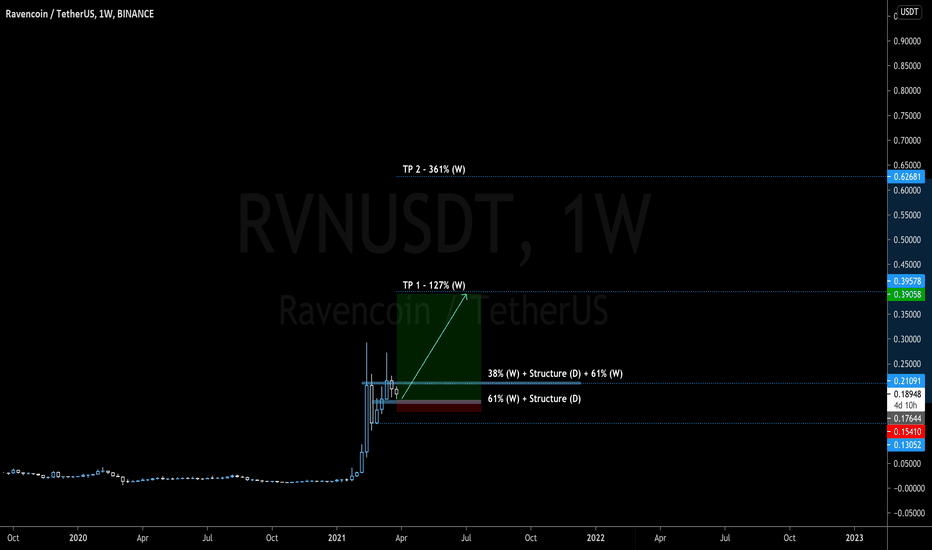

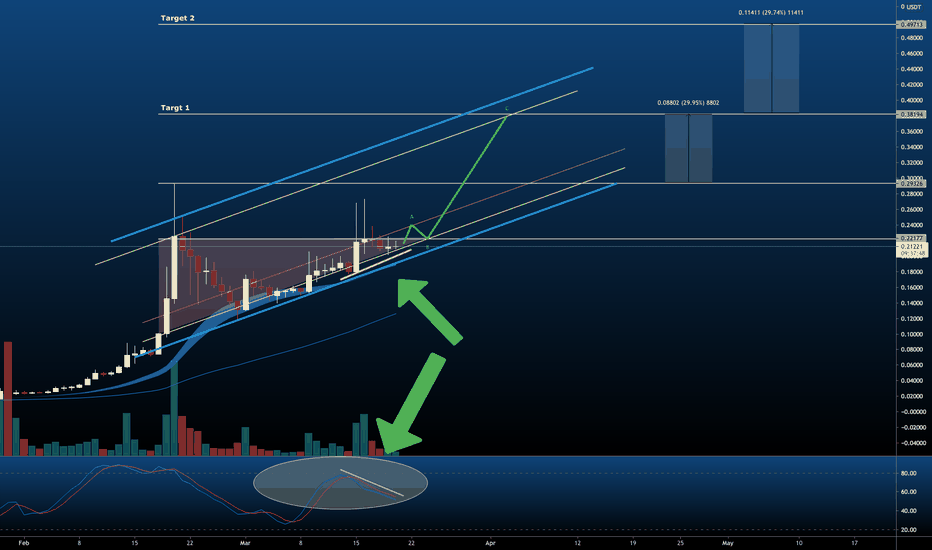

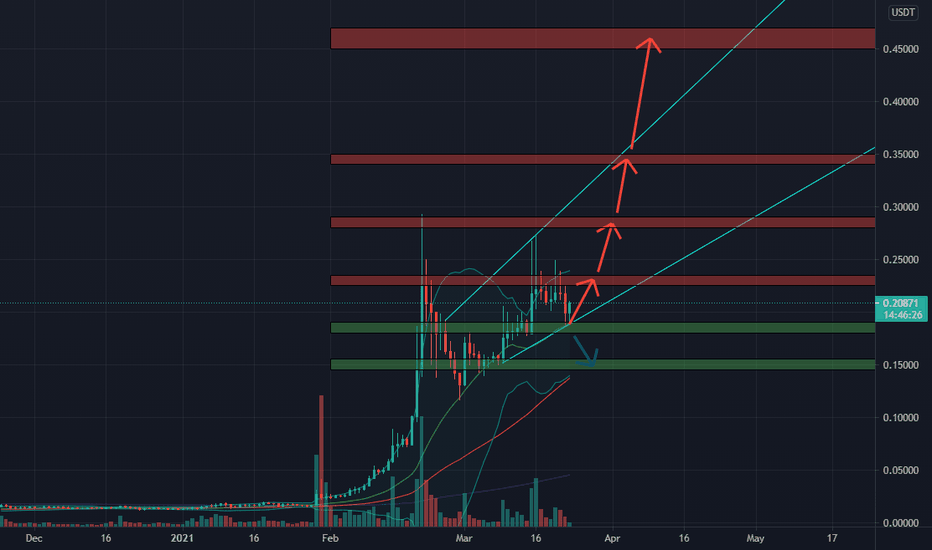

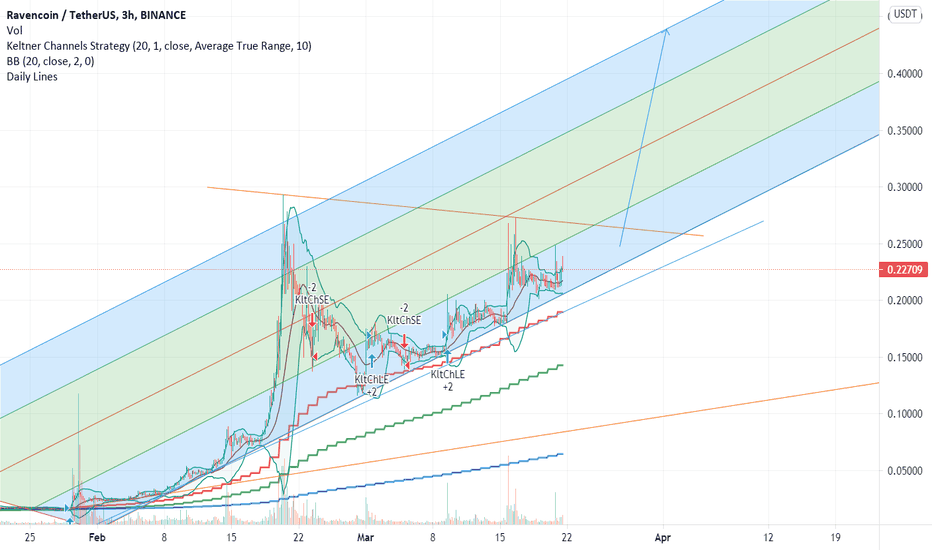

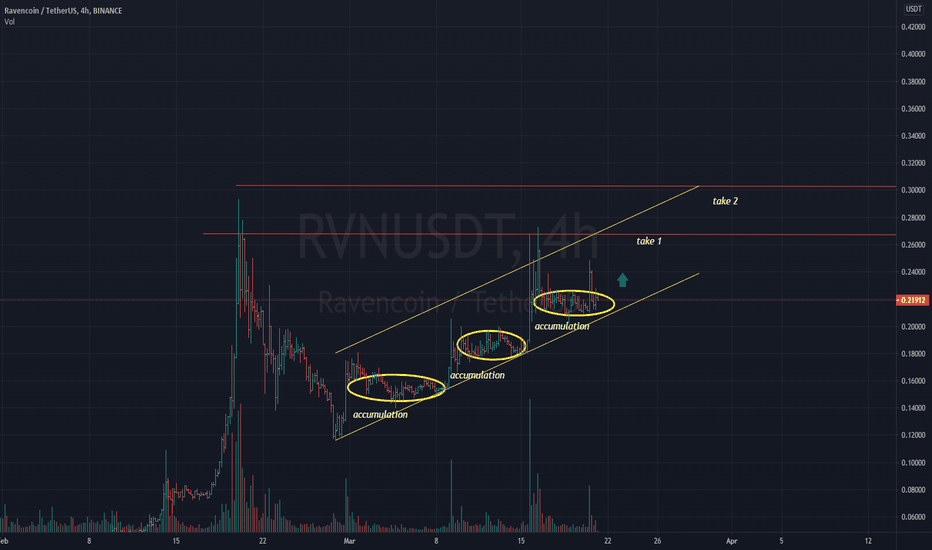

Explosion movementHi guys, the chart is moving in an upward trend in the channel, which has hit the bottom of the channel again.

From the point of view of Price Action, the studies performed, including the slope of the chart and the speed and appropriate correction, with respect to the damage limit, are prone to reach the canal ceiling.

Thanks