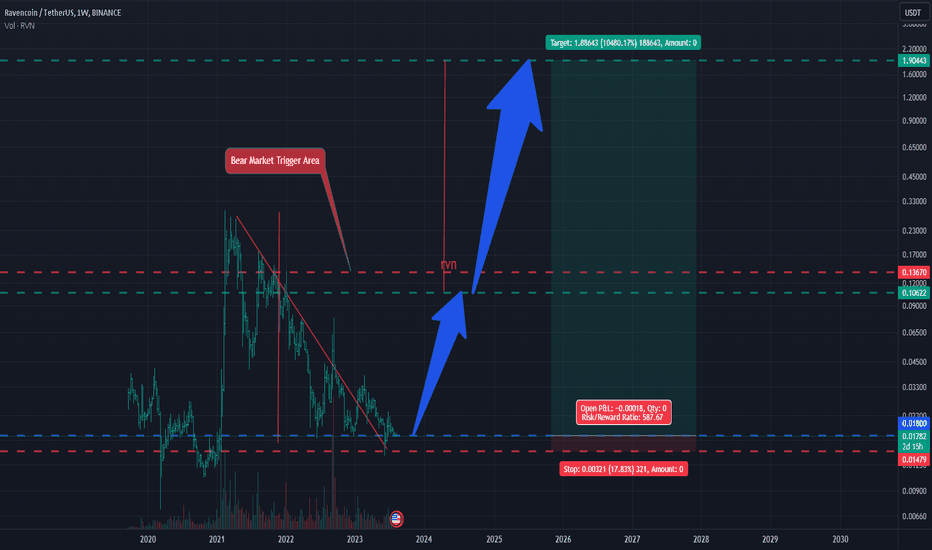

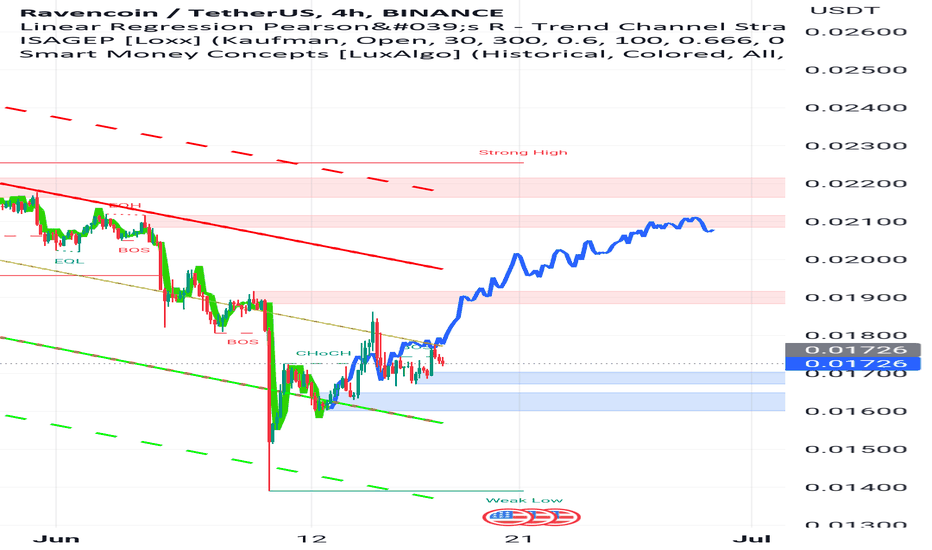

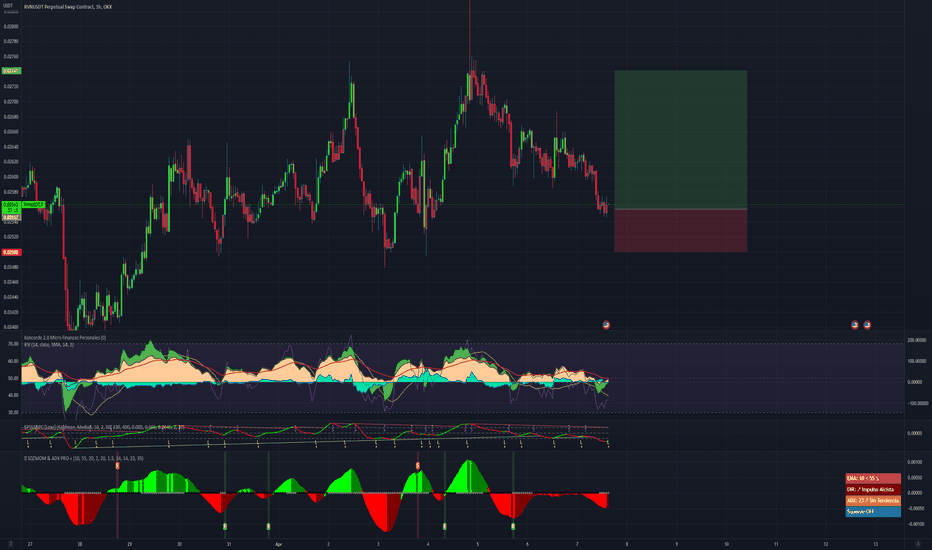

The Crow coin is ready for upside moveRVN COIN on the best altcoins to trade which can make you easy money, Has just tapped the weekly demand zone and is ready for an upside move.

Me and my team have already loaded our bags for an easy 2x from here.

If you have any questions, Just simply dm me on trading view. I would be happy to help

RVNUSDT trade ideas

RVN (Ravencoin) Coin Analysis 01/04/2021Fundamentals:

Ravencoin is a digital peer-to-peer (P2P) network that aims to implement a use case specific blockchain, designed to efficiently handle one specific function: the transfer of assets from one party to another. Built on a fork of the Bitcoin code, Ravencoin was announced on Oct. 31, 2017 and released binaries for mining on Jan. 3, 2018 with what is called a fair launch: no premine, ICO or masternodes. It was named in reference to a TV show Game of Thrones.

As a fork of the Bitcoin code, Ravencoin features four key changes: modified issuance schedule (with block reward of 5,000 RVN), block time reduced to one minute, coin supply capped at 21 billion (ten times more than BTC) and a mining algorithm (KAWPOW, formerly X16R and X16RV2 respectively) intended to mitigate the centralization of mining caused by ASIC hardware.

Ravencoin aimsto solve the problem of assets transfer and trading over blockchain. Previously, if someone created an asset on the Bitcoin blockchain, it could be accidentally destroyed when someone traded the coins it was created with.

RVN coins are designed as internal currency within the network and must be burnt in order to issue token assets on the Ravenchain. The assets can represent anything: real world custodial objects like gold or physical euros, virtual goods and objects, a share of a project like stocks and securities, airline miles or an hour of someone’s wage, etc.

The planned future versions of Ravencoin protocol will support integrated messaging and voting systems.

The Ravencoin whitepaper was published by Bruce Fenton, Tron Black and Joel Weight.

They stand out over the majority of the crypto crowd in that they were all seasoned businessmen and developers before they started this project.

Fenton is well known in crypto for being a board member and an executive director of the Bitcoin Foundation from 2015 to 2018. Before crypto, he had a solid career in investment banking as the vice president of Morgan Stanley in the 90s and a managing director of Atlantis Consulting for 13 years. Currently, he works as a managing director of Chainstone Labs, a stealth fintech startup.

Tron Black is a principal software developer with more than 30 years of experience, including leading several software companies as a CEO. He has been working in crypto since 2013 on several ventures including Verified Wallet, CoinCPA and t0. He is currently employed with Medici Ventures, a subsidiary of Overstock.com focused on blockchain technology applications.

Weight is a chief technology officer at Overstock.com, a well known online retailer. Previously, he has also been involved with Medici Ventures in roles of COO and CTO. He is a veteran software developer who started his career after graduating from the University of Utah in 1998 right in the middle of the dotcom bubble.

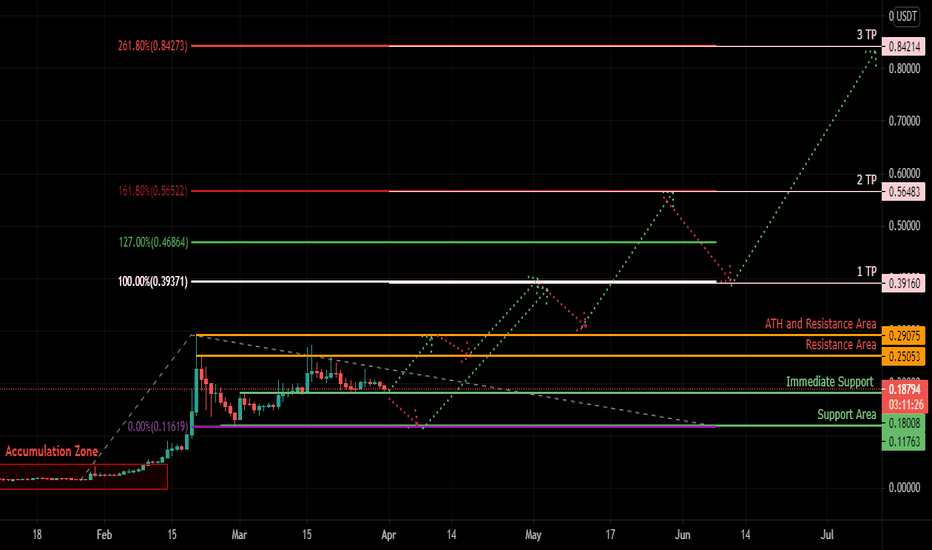

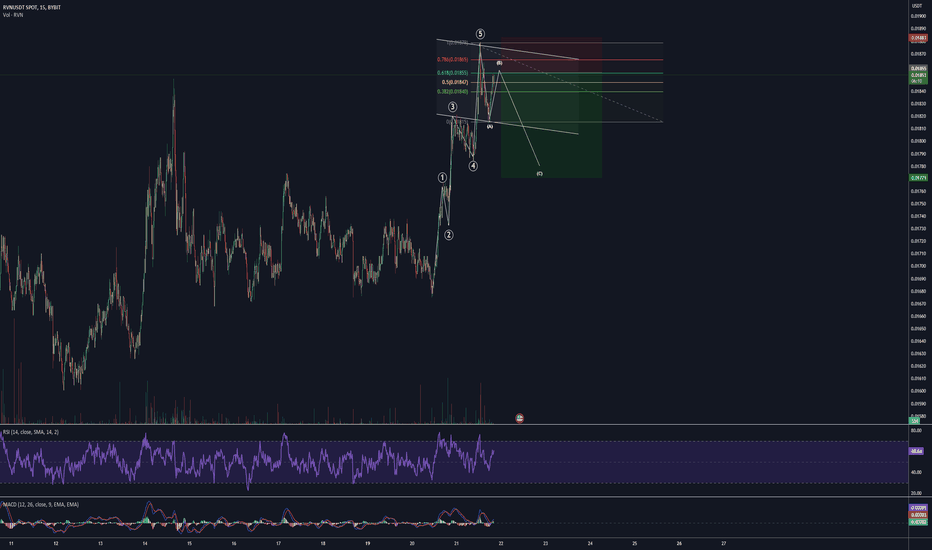

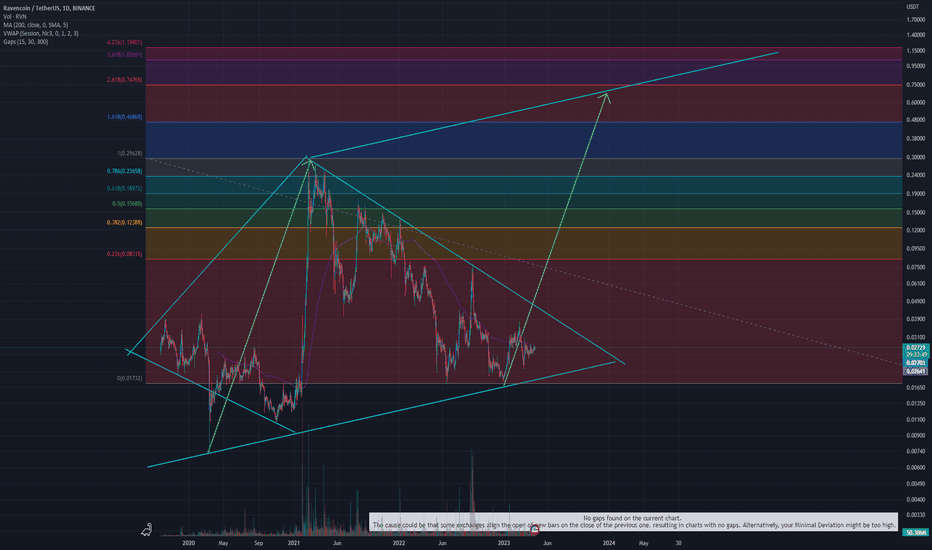

Technical Analysis:

the coin has done its Accumulation zone and now reaccumulating after the impulsive wave which will lead a move up

there are total of 3 Targets defined by Fibonacci Projection

the 3 TP get its confirmation as the 2 TP gets triggered followed by some retracement and price Correction

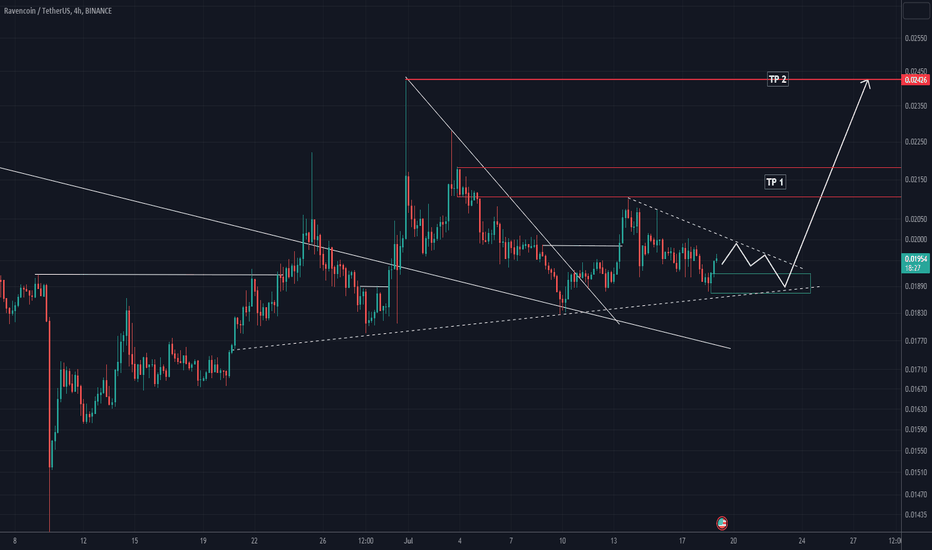

RVN LONG SETUPHi, dear traders. how are you ? Today we have a viewpoint to BUY/LONG the RVN symbol.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

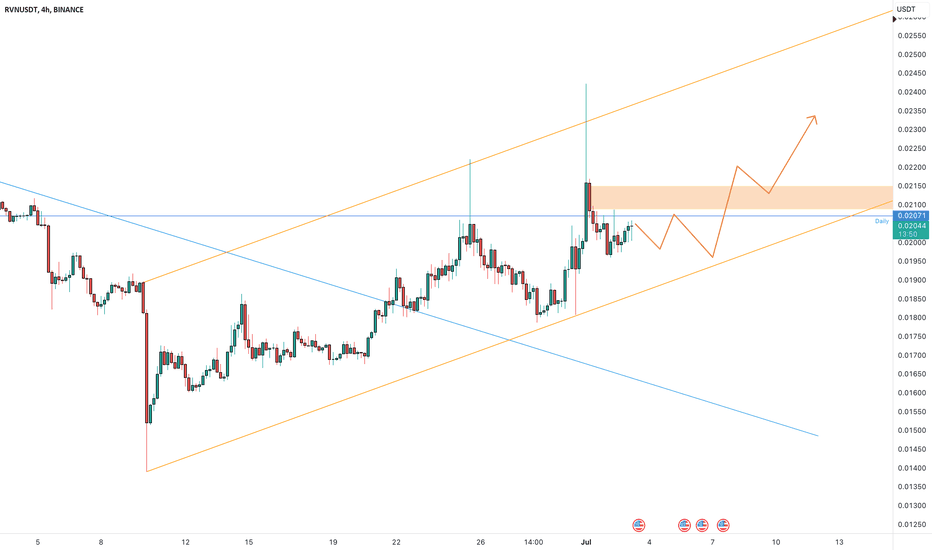

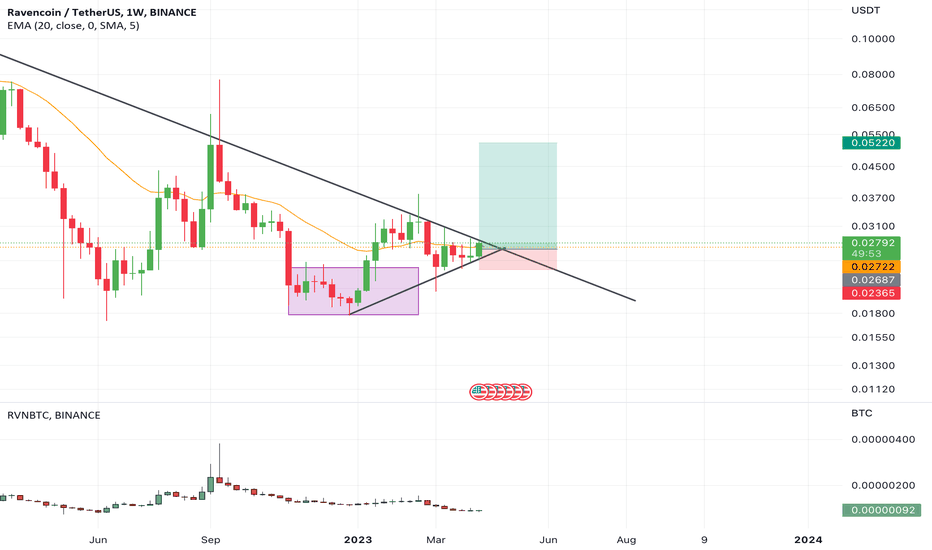

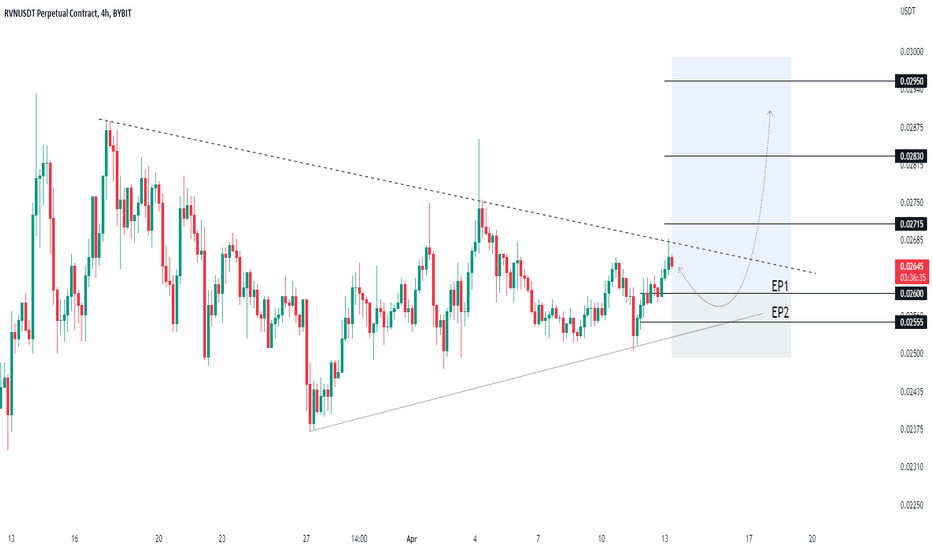

RVNUSDT needs the confirmation breakoutRVNUSDT is currently exhibiting a bullish pattern within an ascending channel. An ascending channel is a technical analysis pattern characterized by the formation of parallel lines that act as support and resistance levels, indicating a potential upward trend.

In this case, the lower trendline of the ascending channel is providing support, while the upper trendline acts as resistance. The price of RVNUSDT has been consistently respecting these trendlines, creating a series of higher lows and higher highs, which suggests an overall bullish sentiment in the market.

Traders who follow Plancton's Rules are closely monitoring the price action near the $0.02 area. A clear breakout above this level would indicate a strong bullish momentum and potentially open up new long trading opportunities. Plancton's Rules, a trading strategy developed by a well-known trader, provide guidelines for identifying optimal entry and exit points based on market patterns and trends.

Should RVNUSDT successfully break out from the $0.02 area, traders adhering to Plancton's Rules would consider initiating new long positions. This means they would buy the RVNUSDT pair with the expectation that the price will continue to rise further.

–––––

Follow the Shrimp 🦐

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

⚫️ Black structure -> <= 1h structure.

Follow the Shrimp 🦐

RVN ANALYSIS (4H)Hi, dear traders. how are you ? Today we have a viewpoint to BUY/SELL the RVN symbol.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

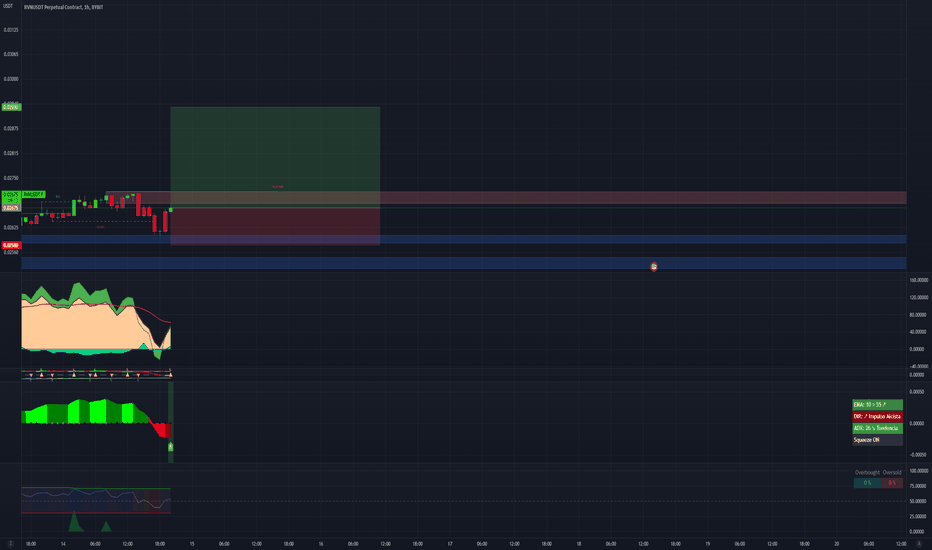

#RVN/USDT - Long - Potential 9.38%Direction: Long

Market: Spot

Risk: 0.25% - 1%

#USDT_RVN

Exchange: BINANCE

Timeframe: 360

TP1: 0.01935

Entry: 0.01768

STOP: 0.01601

Entry Conditions:

| Trendline break

| RVI break

| Volume confirmed

Beware of the FED announcement volatility. I'd close early if up prior to the announcement in 6 hours. We can see wild swings in price in the minutes before the rate drops. Also if it is the anticipated pause check total market cap if BTC pumps. A lack of new liquidity will mean BTC dominance pumps even further pulling money from alts to fuel its breakout.

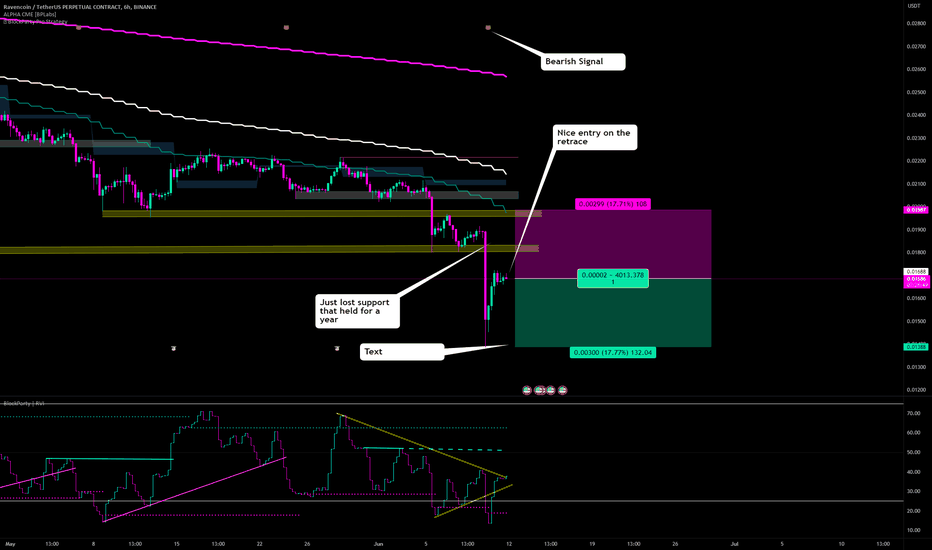

TRADE OF THE DAY | RVN broke year old support pot. 18% ShortTRADE OF THE DAY | RVN broke year old support pot. 18% Short

Not an overly complex trade here, lost a support that has held of a year with the initial bounce momentum slowing down on the retrace it is shaping up for quite a nice entry with some strong resistances now between entry and Stop-loss and a very comfortable take profit target sitting inside the first key support. Please beware that BTC is insanely volatile at the moment with the current SEC impact - which put this as a higher risk trade regardless of the strong technicals.

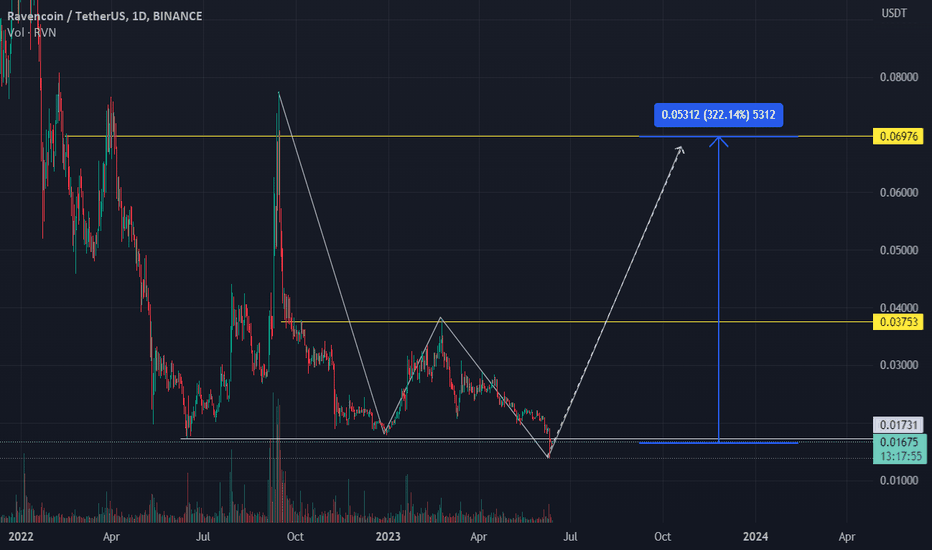

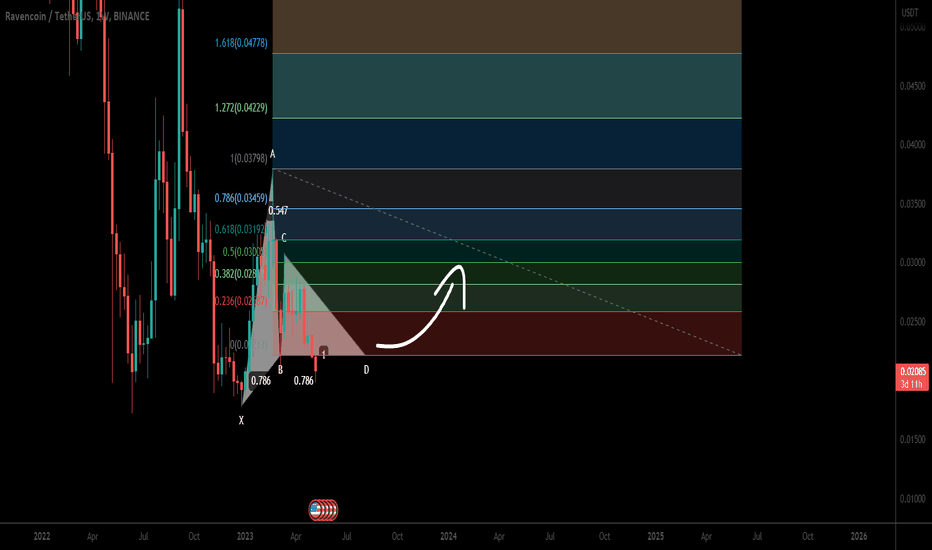

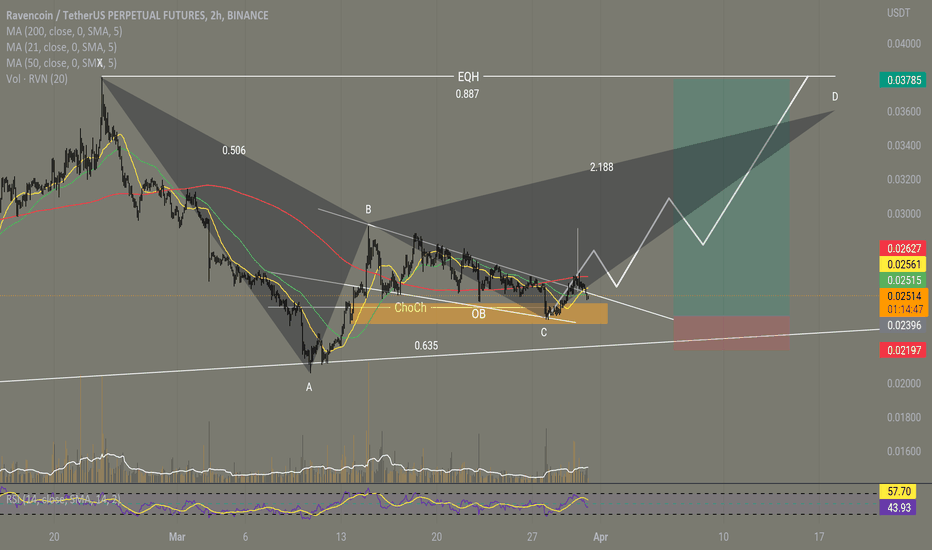

Ravencoin (RVN) formed bullish Gartley for upto 94% rallyHey dear friends, hope you are well, and welcome to the new update on Ravencoin (RVN) with US Dollar pair.

Previously we caught more than 16% pump of RVN a below:

Now on a weekly time frame, RVN has formed a bullish Gartley pattern for the next price reversal.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

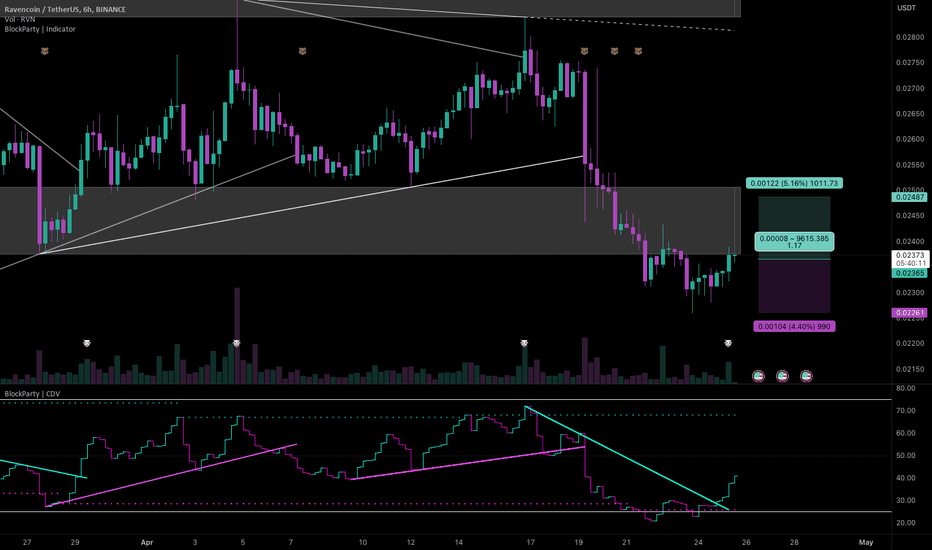

#RVN/USDT - Long - Potential 5.16%#RVN/USDT provided by the pro trader BlockParty SPOT | USDT

Strategy: Long

Exchange: Multi-Exchange

Account: Spot

Entry mode: Market order in range

Invest: 10.87%

Exit:

• ⎿ Target 1 : 0.02486 4.94%

Entry: 0.02369 ⌁ 0.02369

• ⎿ Current market price: 0.02369

Stop: 0.0226 (-4.6%)

Technical indicators:

• ⎿ 24h Volume: 2050778.85074

• ⎿ Satoshis: 0.02369

Entry Conditions:

| vol spike

| Trendline breakout

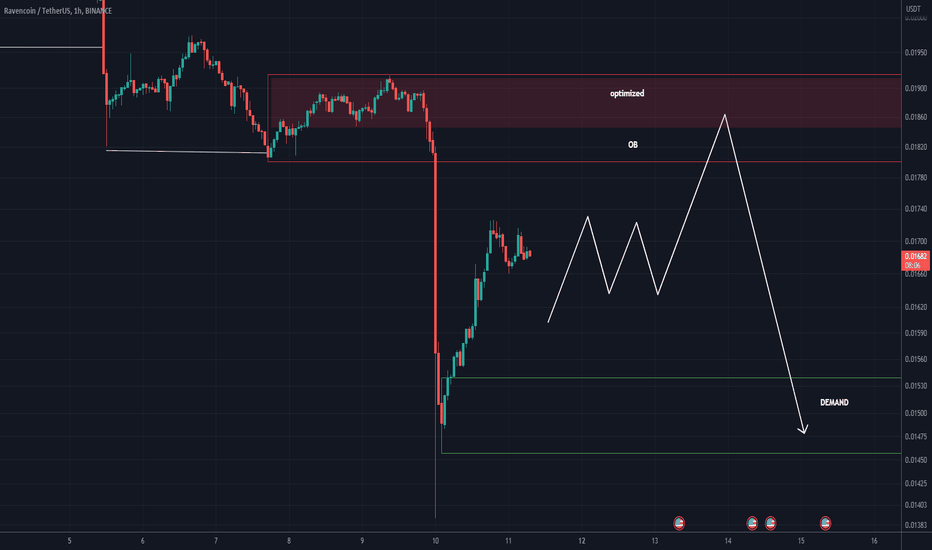

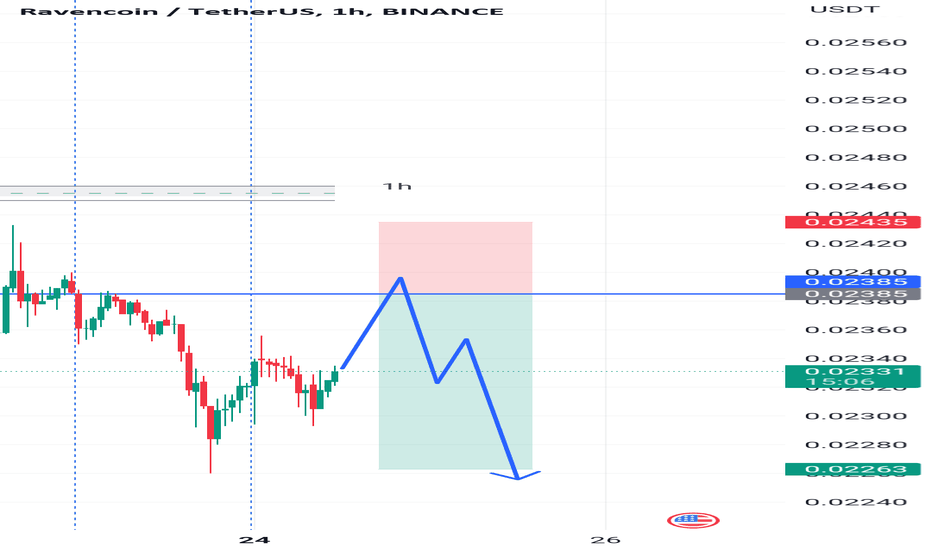

RVNUSDT is forming a pattern for a short 🟠On the 1h tf we can see how our downward structure continues. After the break we formed a new zone of interest for the sellers. Exactly from it we will enter the short.

The trend is generally descending, so the deal should work out well.

Note : Its not an investment advice Its my point of view always do your own research and analysis before making any investment.

RAVENCOIN🐦PUMP AHEAD😎🚀For more updates, please follow my TradingView page, and if you find the content useful, kindly hit the "thumbs up" button to show your support. If you have any queries regarding trading, please feel free to send me a direct message on TradingView. Additionally, please share this content with your friends who may find it beneficial.

Please note that any trading updates provided here are for educational purposes only, and it is always advisable to conduct your own research before making any investment decisions. It is important to ensure that all conditions are met before following any trade plan suggested in this update.

RVN trend breakout A symmetrical triangle formation was formed on the chart, price consolidation narrowed very much, volumes also fell, liquidity was removed from the bottom behind the minimum and no maximum was blocked from above, as well as a large number of approaches to resistance and the current preload indicates a desire to break through this inclined, I expect a gradual breakdown of the formation and fixing the price above it to continue long to the consolidation maximums marked on the chart