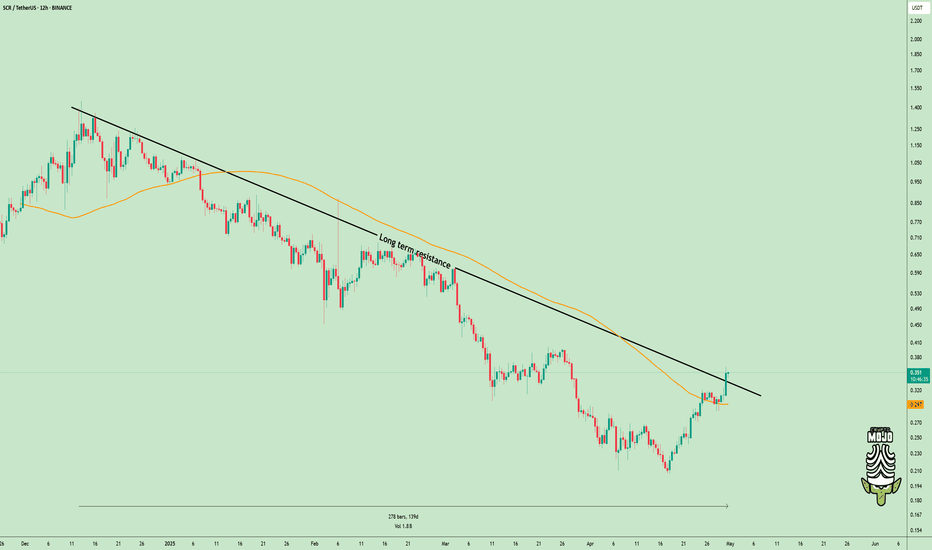

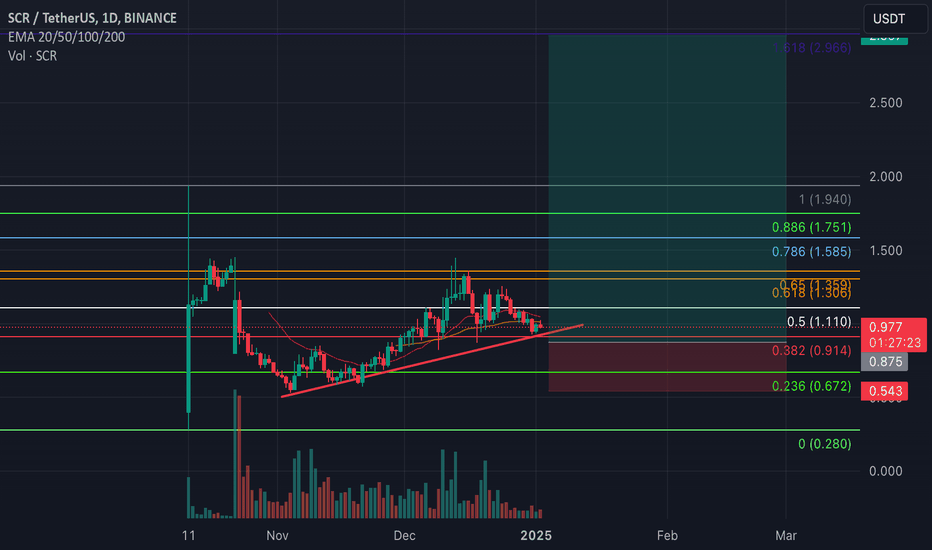

Downtrend Over? $SCR Just Flipped the Script!TSX:SCR just broke out after moving down for 139 days.

This isn’t just another pump, it’s a change in direction.

- Price broke the long-term downtrend

- Jumped above the 200 EMA

- Now testing the breakout zone again

If this area holds, bulls could take control and push higher.

It’s a clean setup

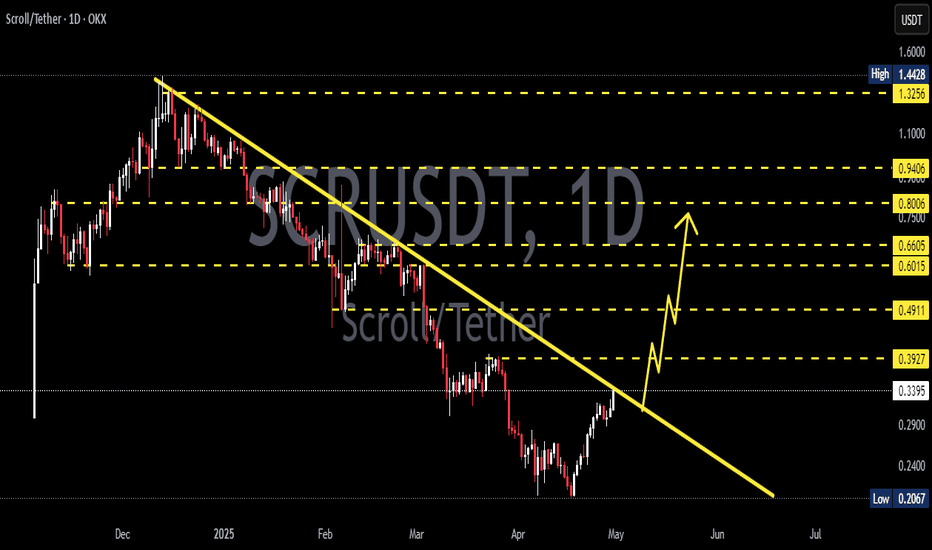

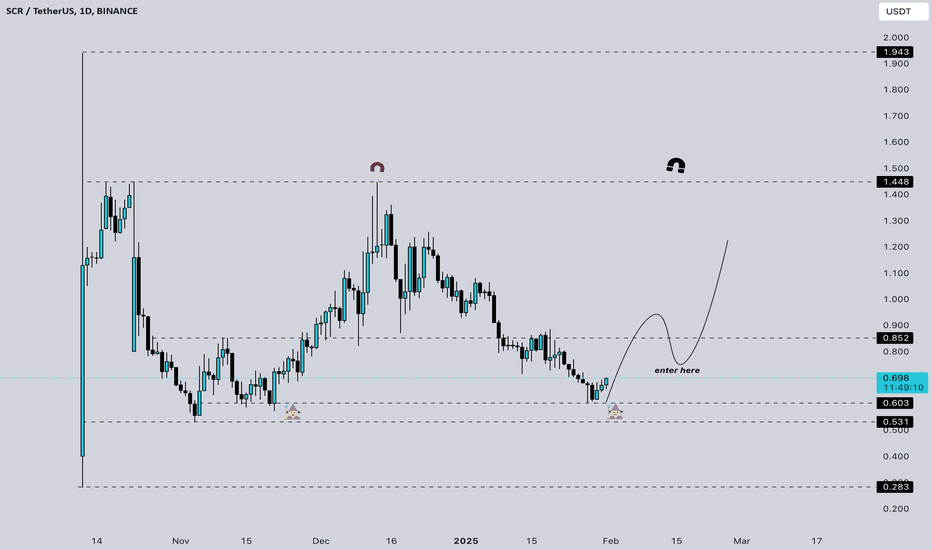

SCR/USDT Analysis – Weekly Chart at March 10, 2025.SCR has completed a significant correction, reaching a key Fibonacci support zone around 0.342. The chart shows a deep retracement, hinting at a potential reversal from this level.

🔹 Fibonacci Levels – The current support aligns closely with the 0.618 Fibonacci retracement level at 0.927, which is

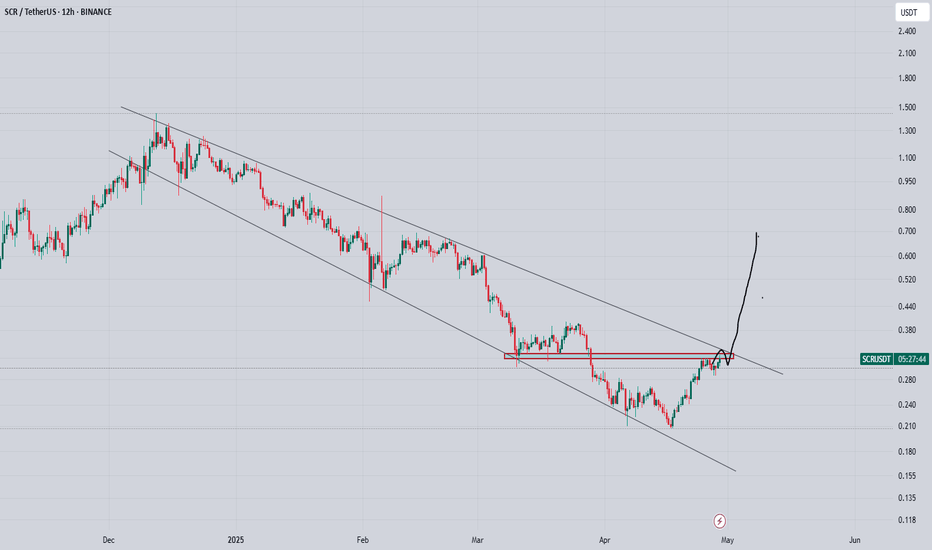

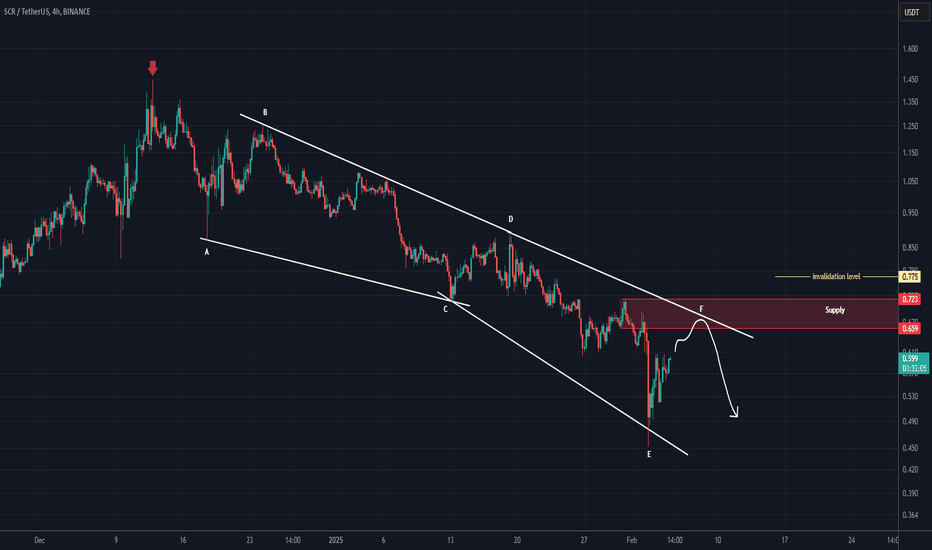

SCR ANALYSIS (4H)From the point where we marked "START" on the chart, it seems that SCR's correction has begun.

This correction appears to be either a diametric or a symmetrical pattern. Currently, the price seems to be completing wave F of this diametric structure.

It may get rejected downward again from the red

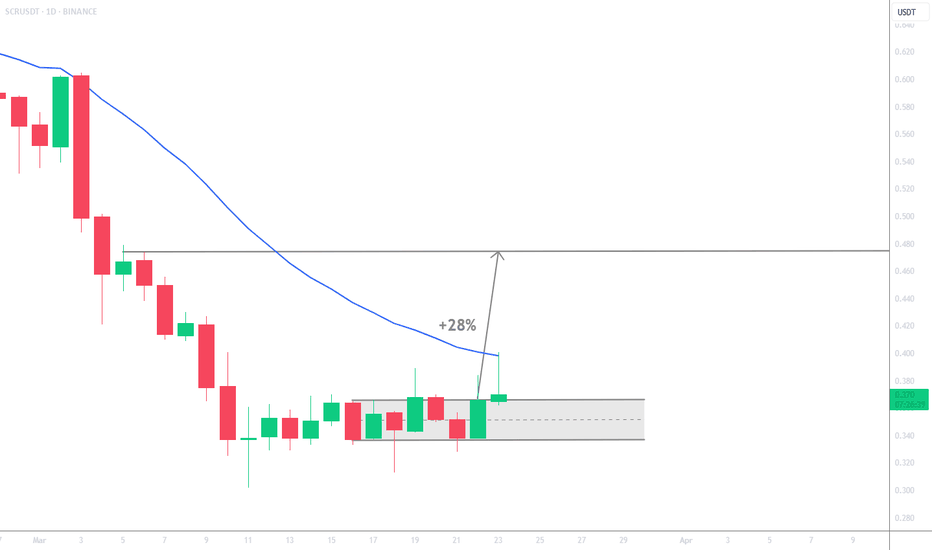

Three White Soldiers pattern at the bottom suggests a potential Your TA looks solid, and the Three White Soldiers pattern at the bottom suggests a potential reversal to the upside. However, let’s break it down:

Bullish Case:

1. Three White Soldiers Pattern – This is a strong bullish reversal signal, especially after a prolonged downtrend.

2. Support Held at ~

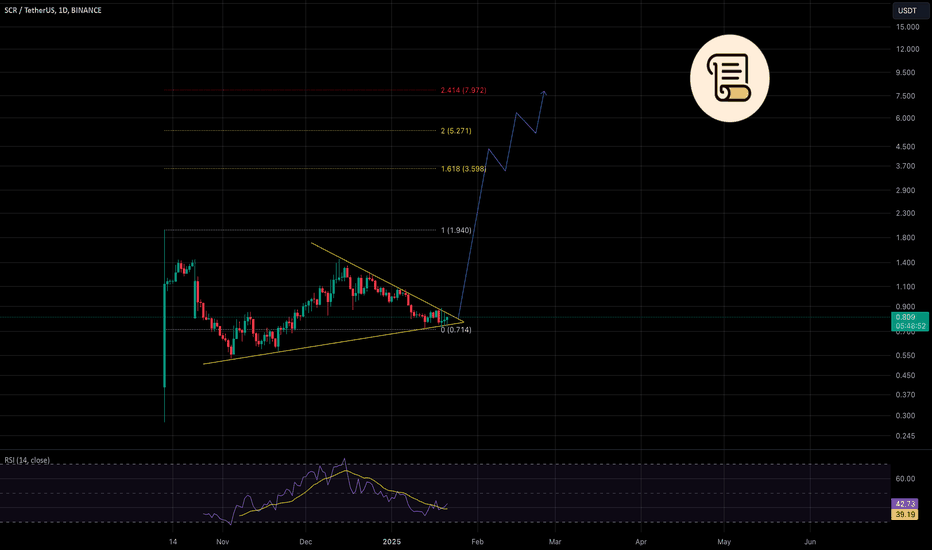

SCROLL is taking off this week!Finally the SCR accumulation is over and we are out of the triangle! My global target is 8$! I like how Polychain works with the assets they have invested in. Fibonacci values to lock in your positions on the chart, RSI unloaded, mm typed tokens and already running the script.

Horban Brothers!

Scroll - January 3, 2025Today, I’m writing about Scroll (SCR/USDT). Currently, SCR is trading at $0.97, sitting close to the 0.382 Fibonacci level at $0.913.

Based on the technicals, I expect SCR to climb to the 1.618 Fibonacci level, around $3, in the next 2-3 months 🚀. During the much-awaited altcoin season, Scroll look

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.