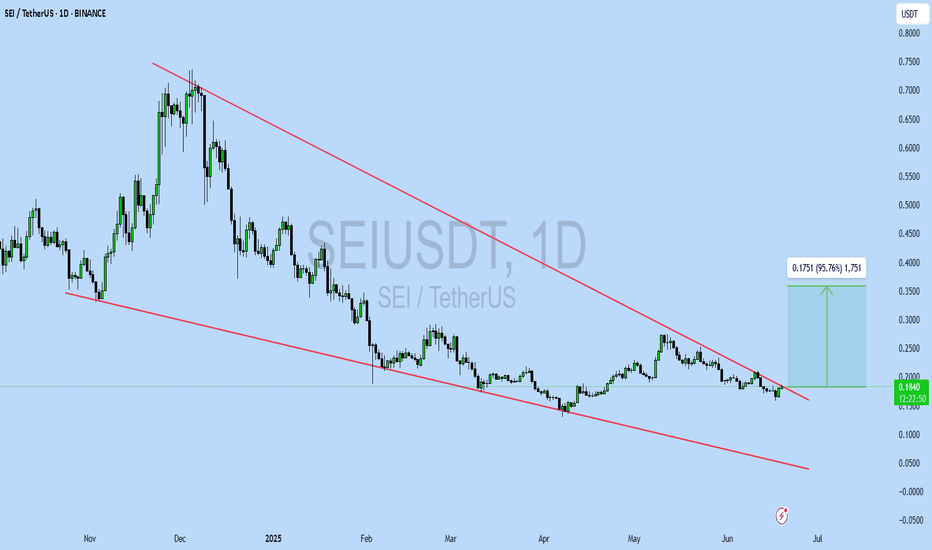

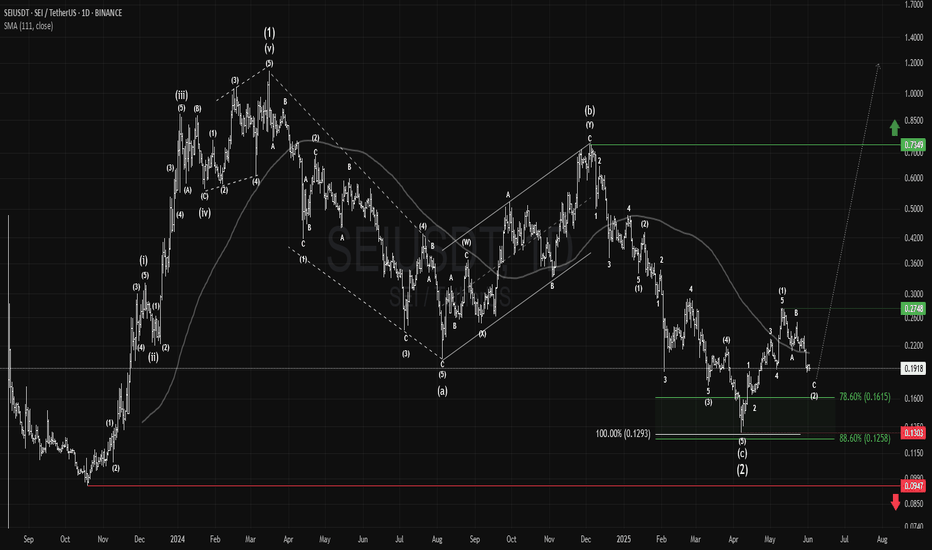

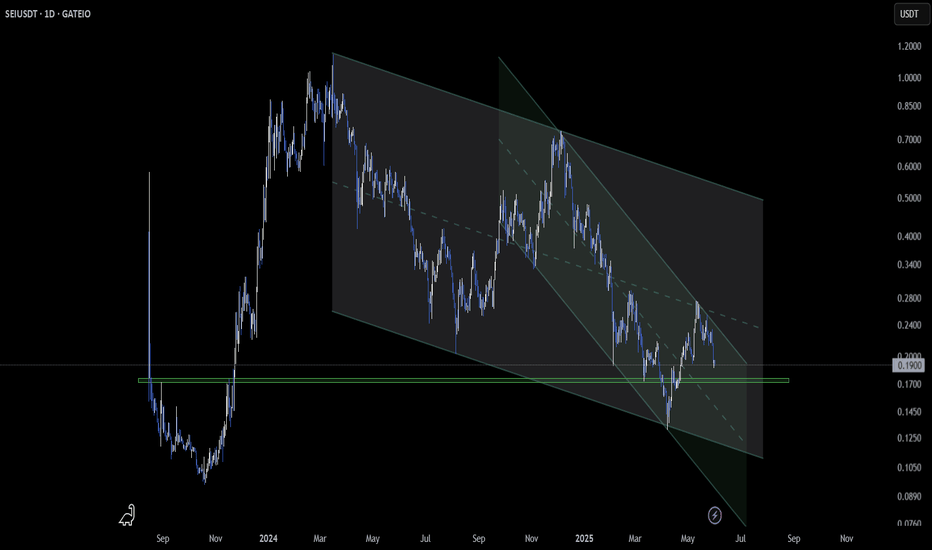

SEIUSDT UPDATEPattern : Falling Wedge Breakout

Current Price: $0.1839

Target Price: $0.3590

Target % Gain: 95.76%

Technical Analysis: SEI has broken out of a falling wedge pattern on the 1D chart, indicating potential reversal. The breakout is supported by increasing bullish momentum. A sustained close above resistance confirms the move.

Time Frame: 1D

SEIUST trade ideas

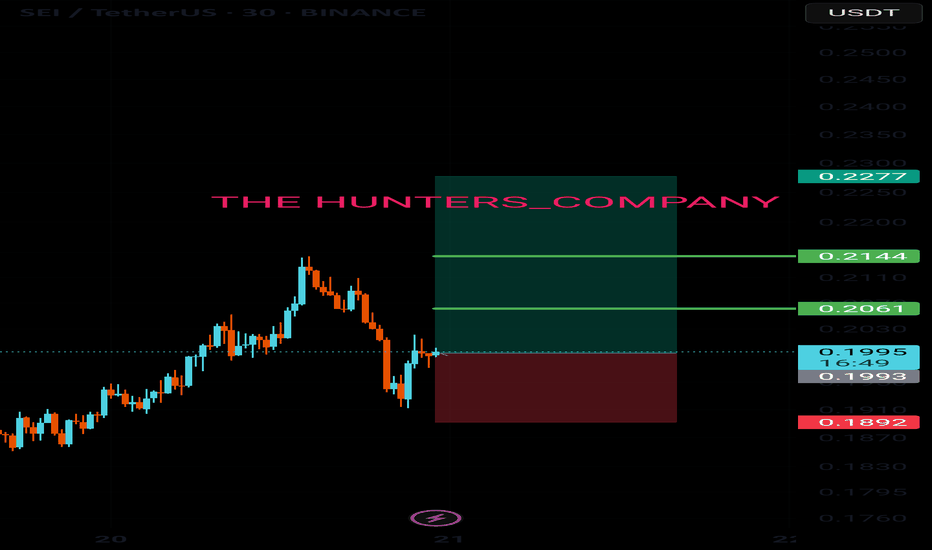

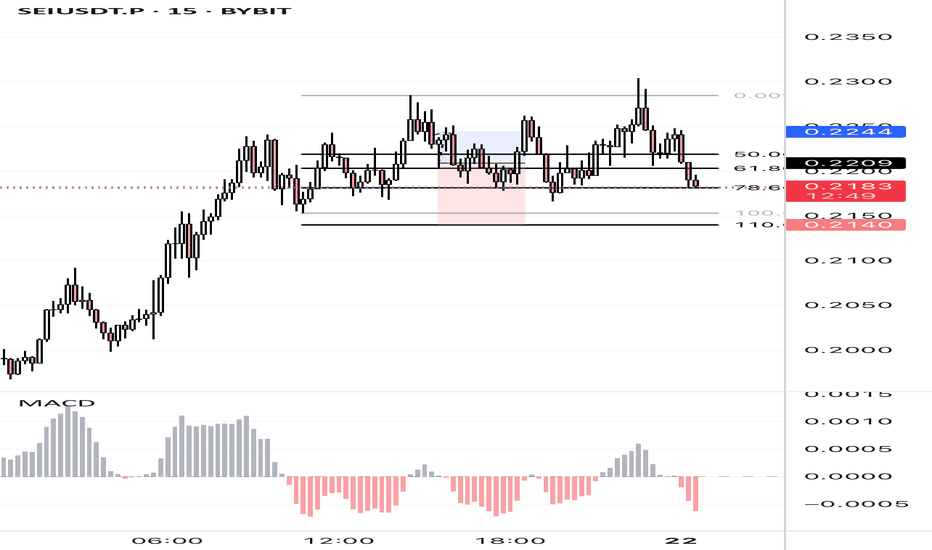

SEI/USDT – Bullish Breakout Setup!SEI consolidates in a classic ascending triangle, showing a strong structure with higher lows and flat resistance.

A breakout above ~$0.225 could trigger a move toward higher targets.

Key Levels:

Support: $0.2142 (triangle base)

Resistance: $0.2257 (breakout level)

Stoploss: Below $0.214 (invalidation of structure)

Targets on Breakout:

TP1: $0.2514

TP2: $0.2724

RSI is climbing from mid-range with a bullish crossover, indicating strengthening momentum.

Structure looks favorable as long as support holds. Wait for volume confirmation on breakout for higher probability.

Not financial advice. Do your own research before investing (DYOR).

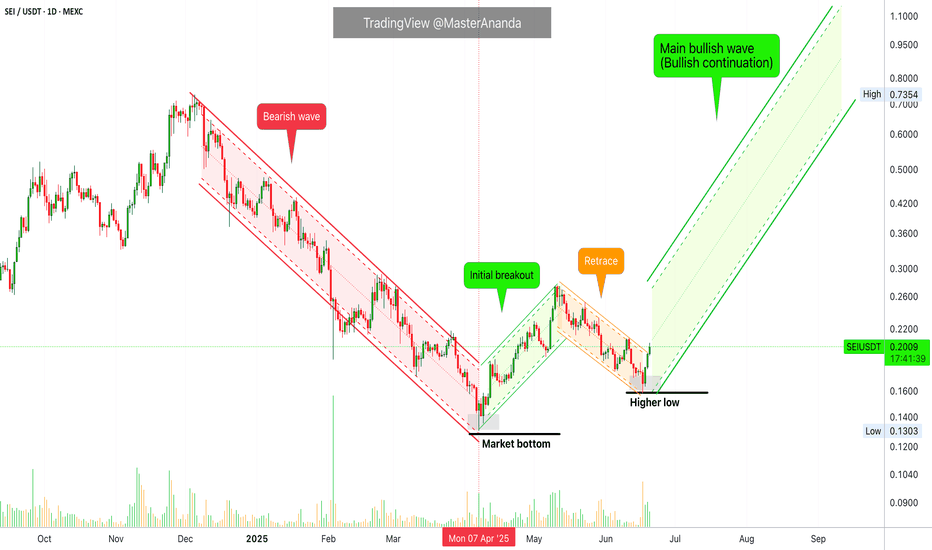

Sei Goes Bullish, Same Pattern & SequenceIt is the same price pattern and sequence. A bullish wave ends December 2024 and leads to a correction. The correction ends with a bottom 7-April. This bottom marks the start of a new phase, the bullish cycle. Recently, SEIUSDT produced a higher low and this higher low marks the start of the next advance, a bullish continuation.

Makes sense?

Bullish action already confirmed —The bigger picture

Today we have three green candles and the most bullish since the end of the initial bullish breakout. If you take this chart together with my other recent publications: COIN, ETH, DOGS, NOT and BCH, you can start to decipher the bigger picture. It is already confirmed.

A great opportunity

I am here to alert you of the event before it happens. Taking action now can be life changing or simply put, taking action now can translate into huge profits; the best possible entry after the 7-April low.

Don't worry, even if this opportunity gets away from you, the market will continue to produce countless more; endless opportunities the Cryptocurrency market has to offer for sure.

Thanks a lot for your continued support.

Namaste.

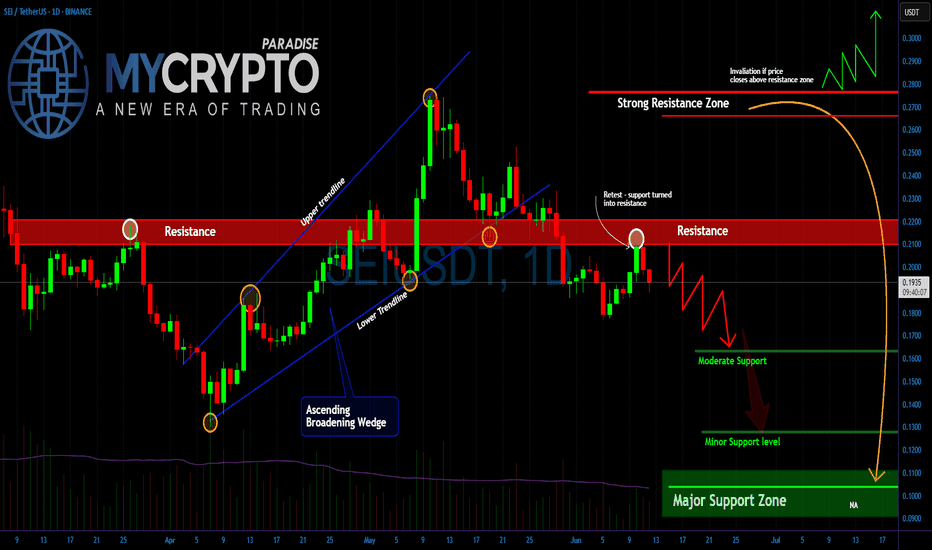

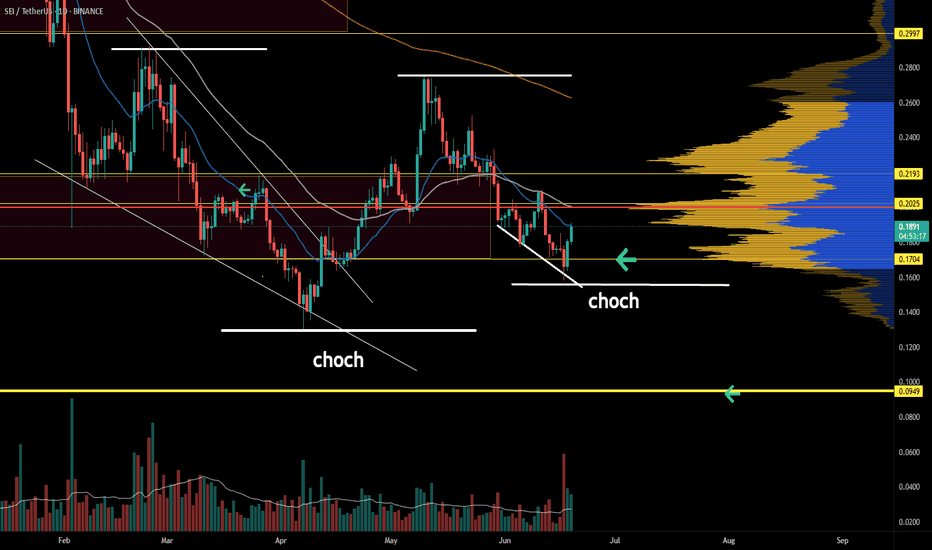

SEI Rebound or Final Trap?Yello Paradisers, have you considered that this little bounce might be the last trap before a brutal selloff? SEIUSDT is giving us strong signals that most retail traders are missing and if you’re not reading the structure clearly, you’re walking straight into a setup designed to clean you out.

💎The recent price action shows a clear rejection from the $0.22 level, which has now confirmed itself as a strong resistance zone. What’s more concerning is that this resistance rejection comes right after the price broke down from an Ascending Broadening Wedge. This is not a random pattern it’s a classic formation that tends to attract breakout buyers and then punishes them with aggressive downside moves once the structure fails.

💎Currently, the market is drifting just below that resistance, attempting weak bounces. However, there is a clear lack of bullish momentum. If this weakness persists, the next stop is around the $0.16 region, where moderate support is likely to be tested.

💎If sellers get aggressive, that level might not hold, and we could head lower into the $0.13 area still not where true value lies. The major support zone sits far below, around the psychological $0.10 level, and that’s where the real high-probability bounce setup is likely to occur.

MyCryptoParadise

iFeel the success🌴

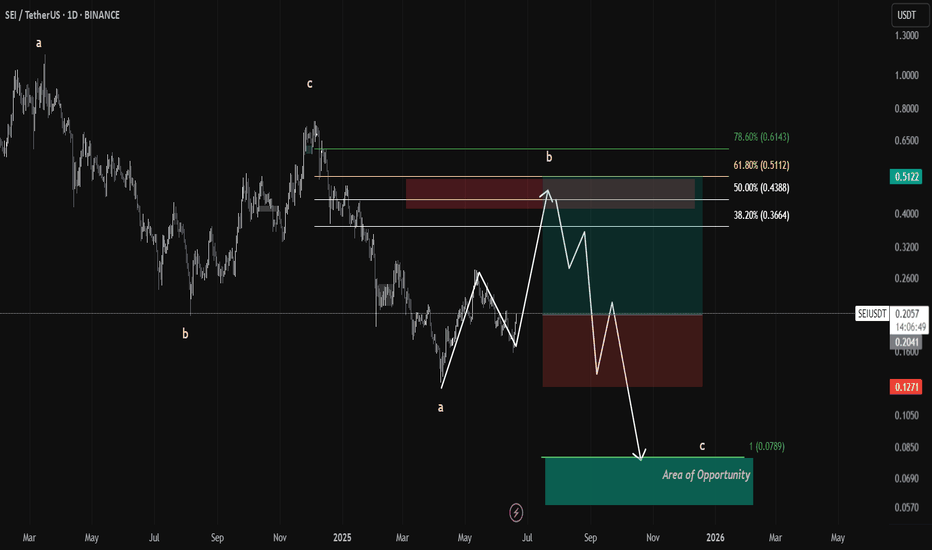

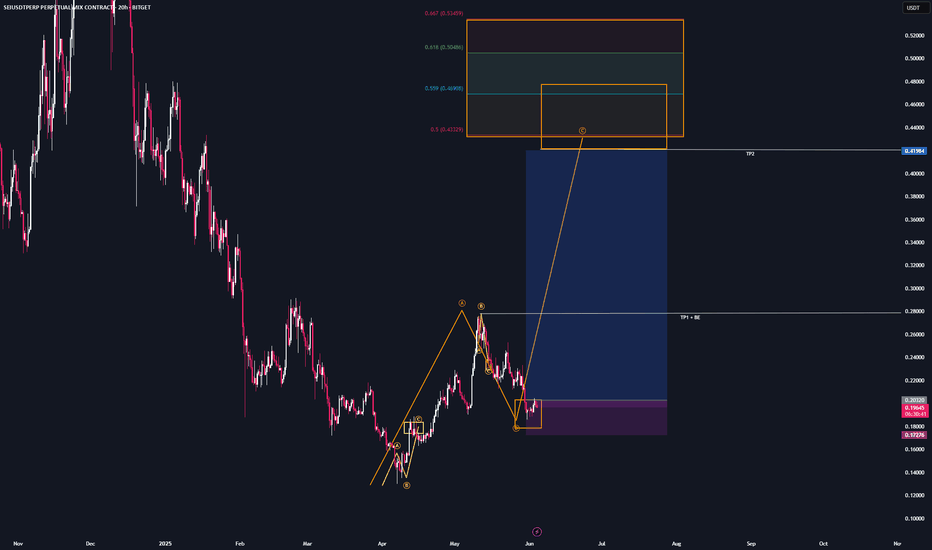

Sei trade plan SEI/USDT – Bearish Zigzag Correction In Play | Waiting for the Final Leg C

📉 Current Structure:

The chart displays a developing A-B-C zigzag correction.

Wave a is complete, and price is currently unfolding wave b, pushing into a key supply zone between 0.4388 – 0.5112 USDT.

This zone also aligns with major Fibonacci retracements:

🟡 50% at 0.4388 TP1

🟢 61.8% at 0.5112 TP 2

🔵 78.6% at 0.6143 (max deviation before invalidation) TP3 if given

traders can trade the wave b I have marked the entry and Sl it's a 4RR high probability setup

Targets for Wave C:

🎯 Primary Target (1.0 extension): 0.0789 USDT

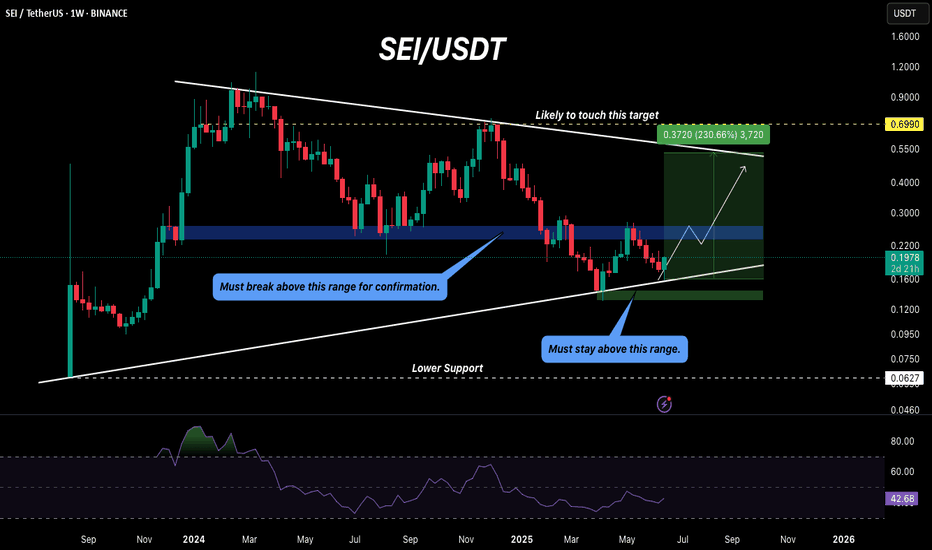

SEI holds potential for a 300% gain!Hello Traders,

Today, we’ll analyze SEI on the weekly timeframe.

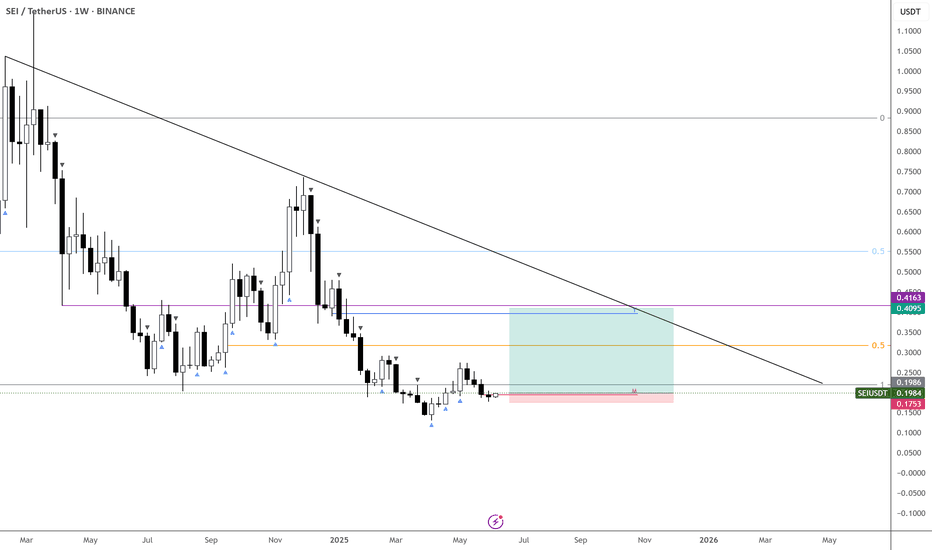

SEI is currently rebounding from its support trendline, and we may see a bullish rally of up to 300% if it breaks above the blue box, which ranges between $0.23 and $0.26. The price has dropped significantly from $1 to around $0.40, which could present a good opportunity—if accumulated in time.

On the bearish side, SEI must not fall below the green box ($0.13–$0.14). If it does, the price could drop as low as $0.06.

Note: Always do your own research and analysis before investing.

Regards,

Dexter

#SEI/USDT#SEI

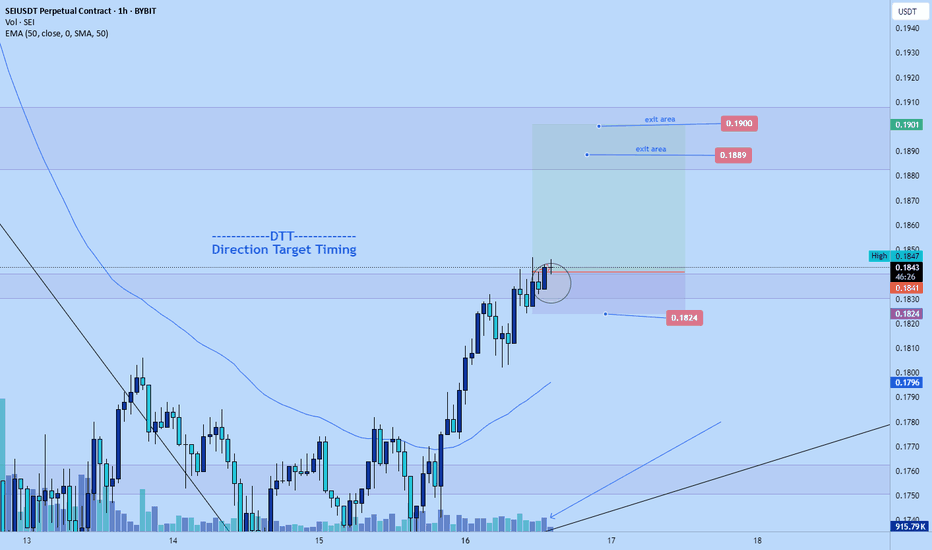

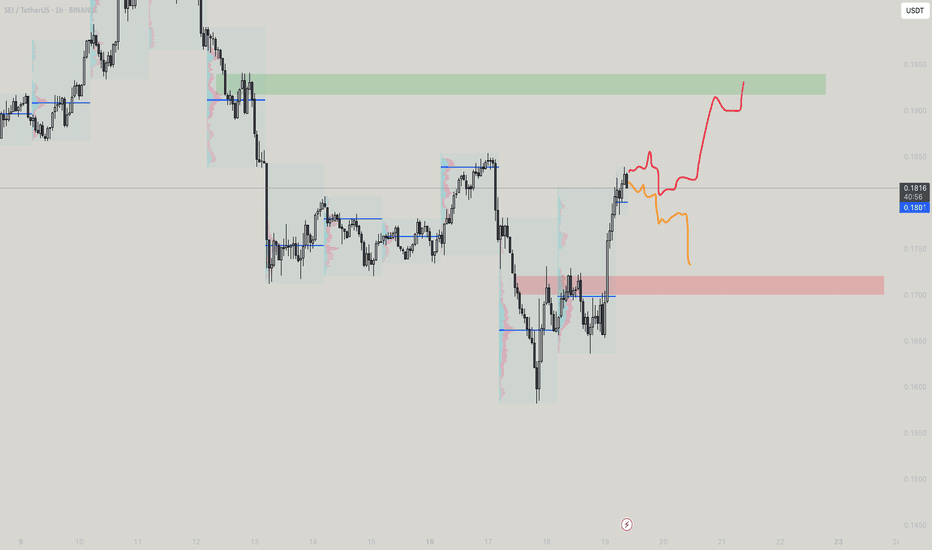

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.1725.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading for stability above the 100 Moving Average.

Entry price: 0.1766

First target: 0.1794

Second target: 0.1834

Third target: 0.1890

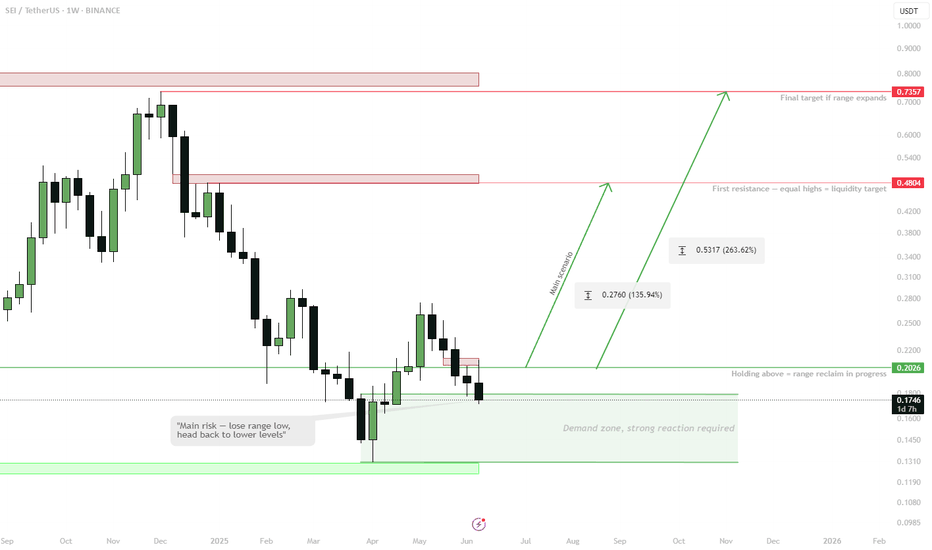

SEI | 1W range reclaim in progress.Holding above $0.20 (range low & demand zone) — expecting a move towards the mid-range ($0.48), where a stack of equal highs is waiting.

Lose $0.20 — invalidation, back to lower support.

Key idea: Range play, targeting liquidity at the mid-range. Macro resistance at $0.75 if breakout extends.

Accumulation still visible, bullish bias above range low.

SEIUSDT.P – Long Setup in Fib Golden Zone with Volatility CompreSEIUSDT.P is consolidating after a strong bullish move. Price is now retracing into the 61.8–78.6% Fibonacci zone, which historically acts as a key reversal area. Multiple rejections and compression in this range suggest a potential bounce.

MACD shows signs of bearish momentum fading. If confirmed, this could be a solid risk-managed long with upside toward previous highs.

One Problem - No Solution - SEISEII just moved up and it create problem for new longs or short, they be like what to do buy or sell? Technically the moves are precendted by two ocassions, orange is the one where the moves top is to be get loaded and the moves down would get wrecked, the move it says need a orange move to get up and red says a straight top move

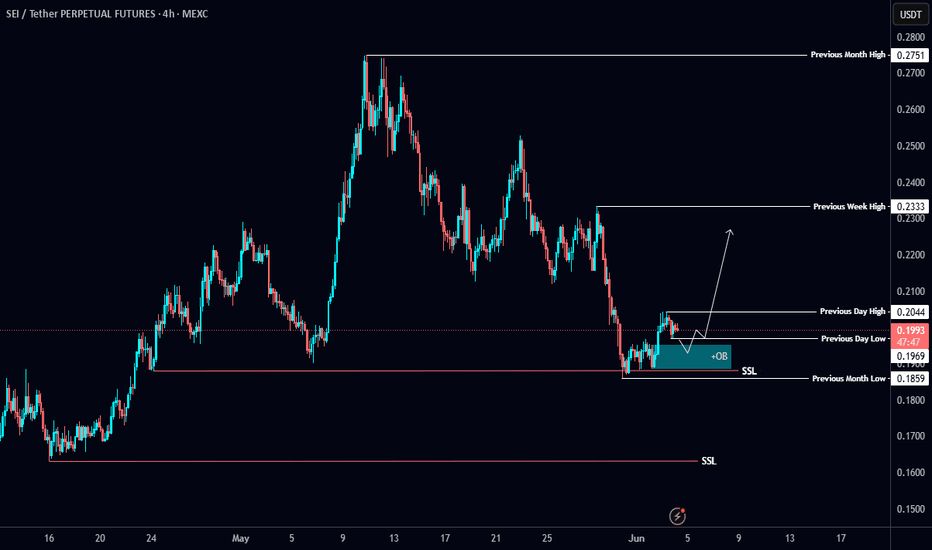

SEI - SetupI don’t have an active position on NYSE:SEI right now — I’m already heavily allocated to my three other setups.

But this is a potential trade I’d consider if I weren’t in the market yet:

Tp1 + BE : at $0.28 — recent highs

Tp2: at $0.41 — target region

If you have any questions about my system or trade logic, drop them below — I read every comment 👇

And feel free to share your own analysis too — I’d love to see it!

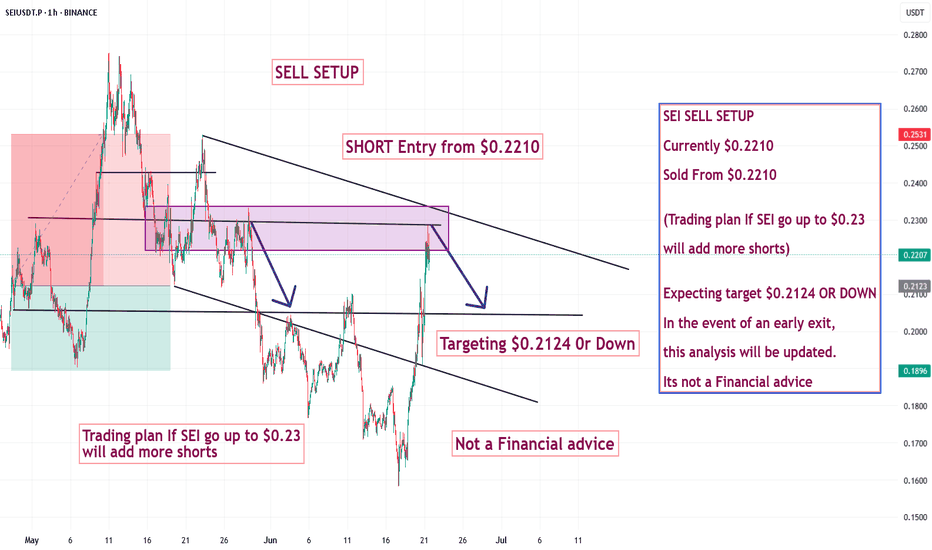

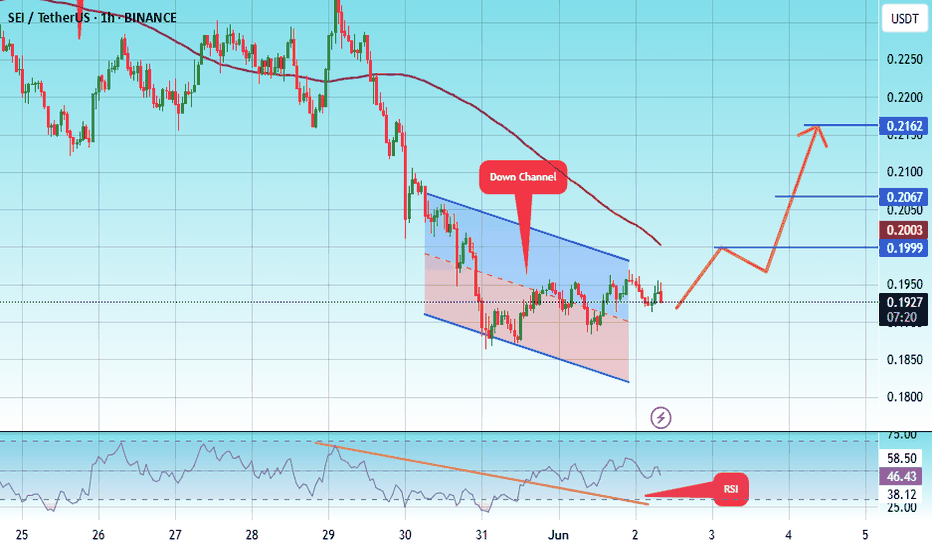

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.1840.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are in a trend of consolidation above the 100 Moving Average.

Entry price: 0.1927

First target: 0.1999

Second target: 0.2067

Third target: 0.2162

SEI – Descending Channel Test on Daily🟡 NYSE:SEI is consolidating within a descending channel on the daily timeframe. Price is approaching the key support zone between $0.1750 and $0.1650 — an area that needs to hold for any chance of a reversal.

👀 Keep this level on your radar as the next move could decide short-term momentum!