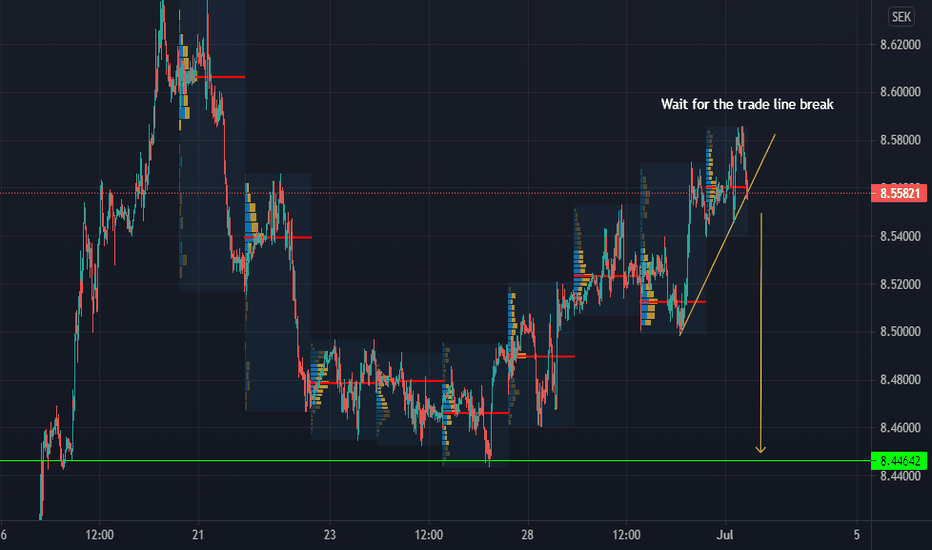

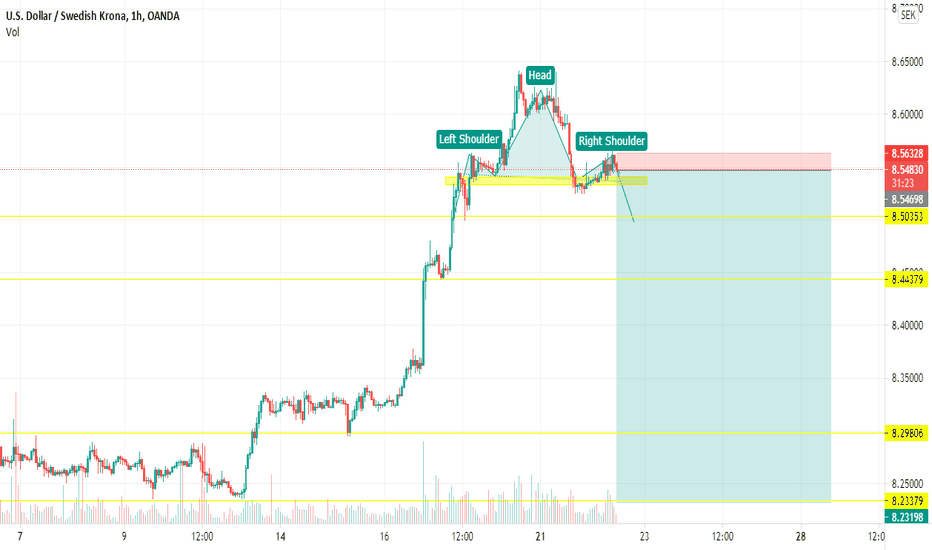

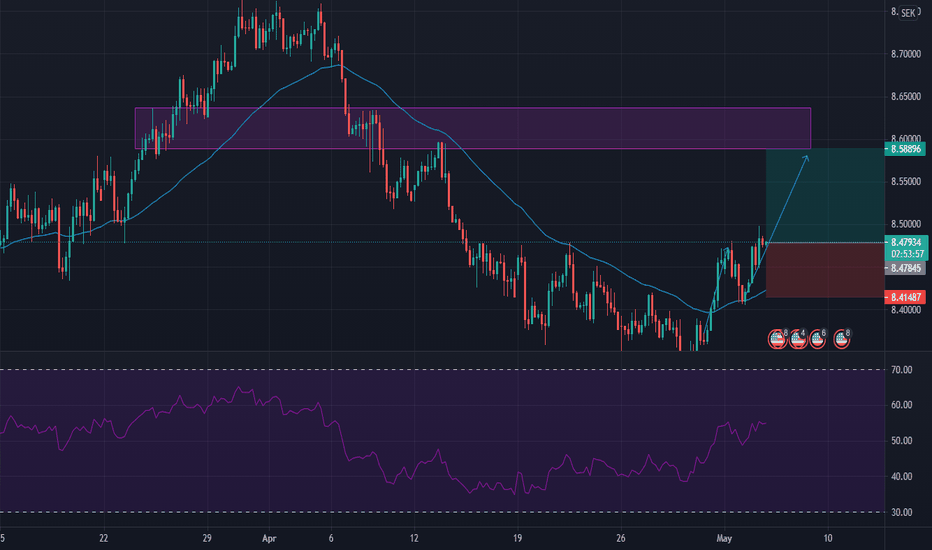

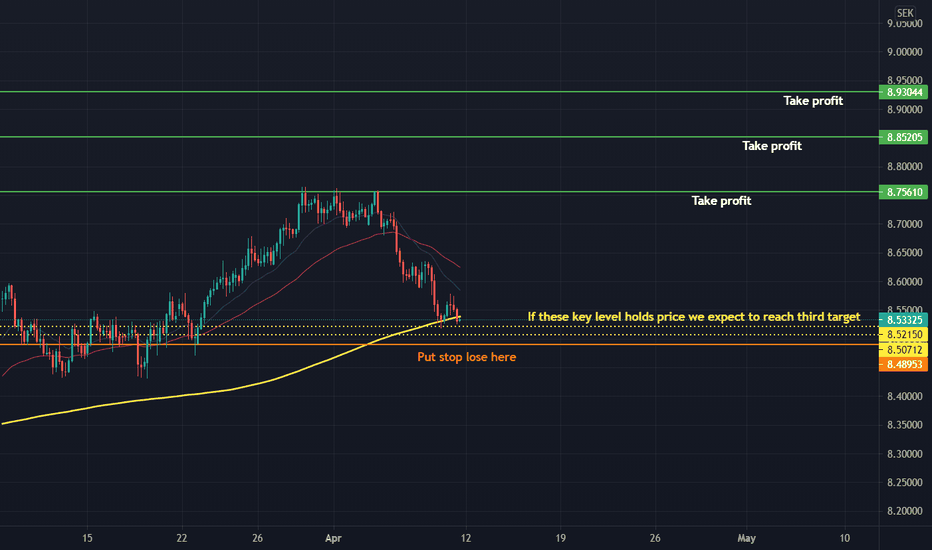

USDSEK(Short)Short Call

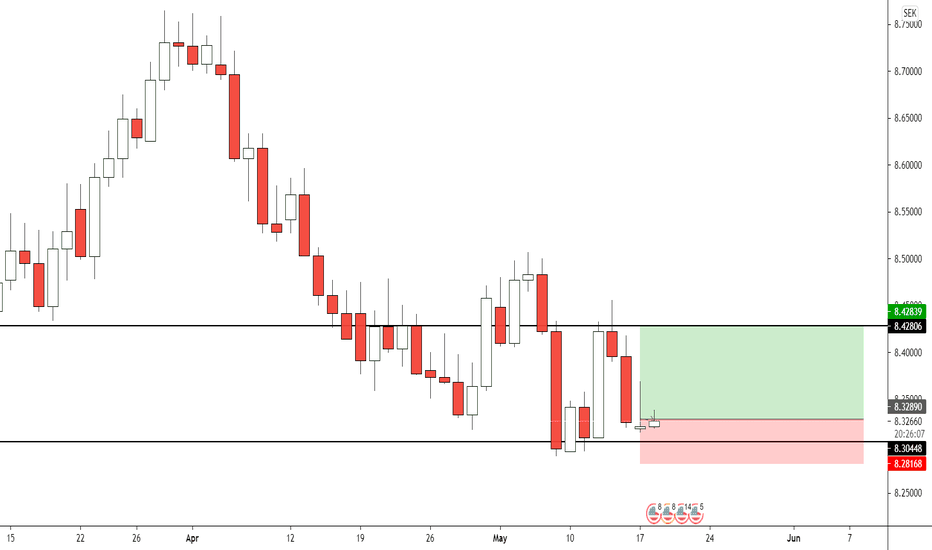

Bearish Signal at Daily Resistance Line

Lower High and Lower Low formations in place

Inverted Hammer

Bearish Engulfing

Twizzer Top

Above formations @ daily resistance line

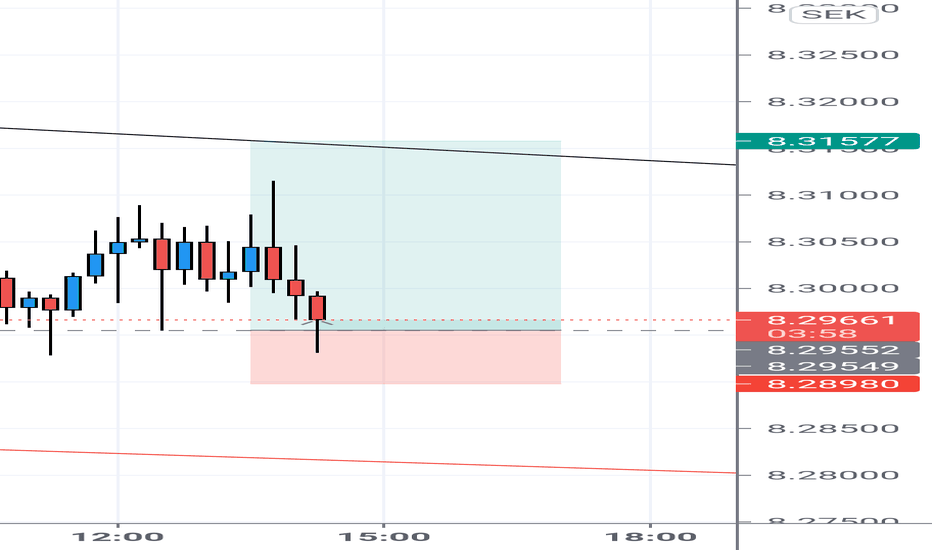

Trend Line @ 4HR candlesticks

Take Entry @ previous lower low break point

Stop loss above lower High

Entry @ 8.682

Stop Loss @ 8.723

2 Stage Take Profit

1st TP = Take Entry - Stop Loss = 8.4325

2nd TP - Trailing Stop Loss

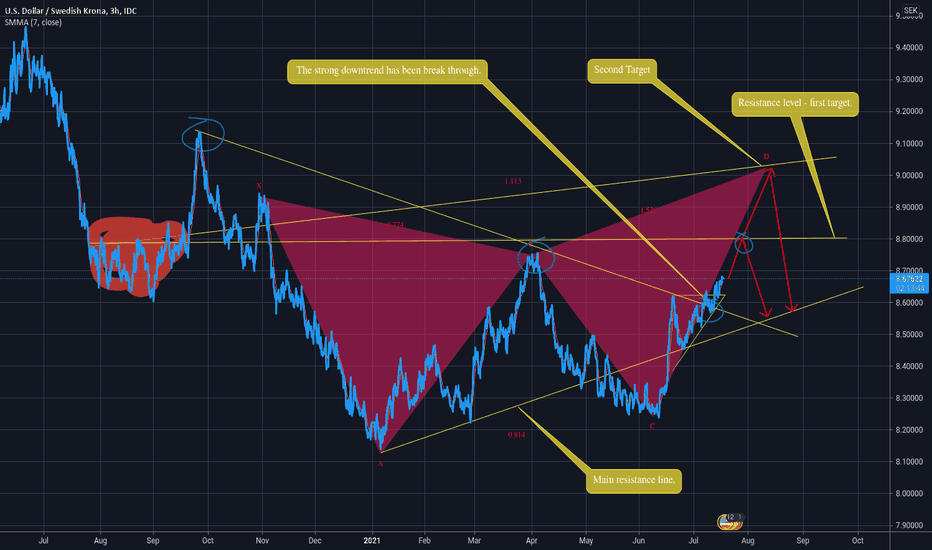

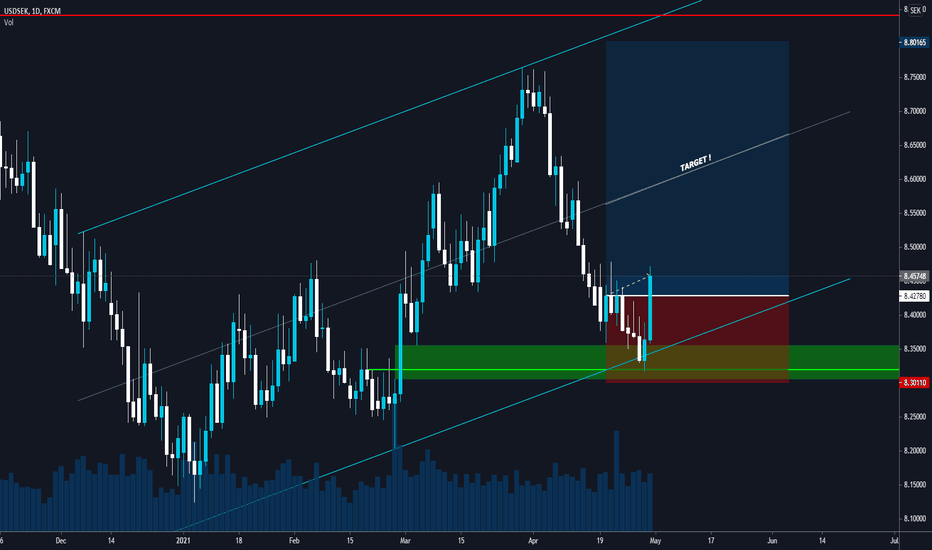

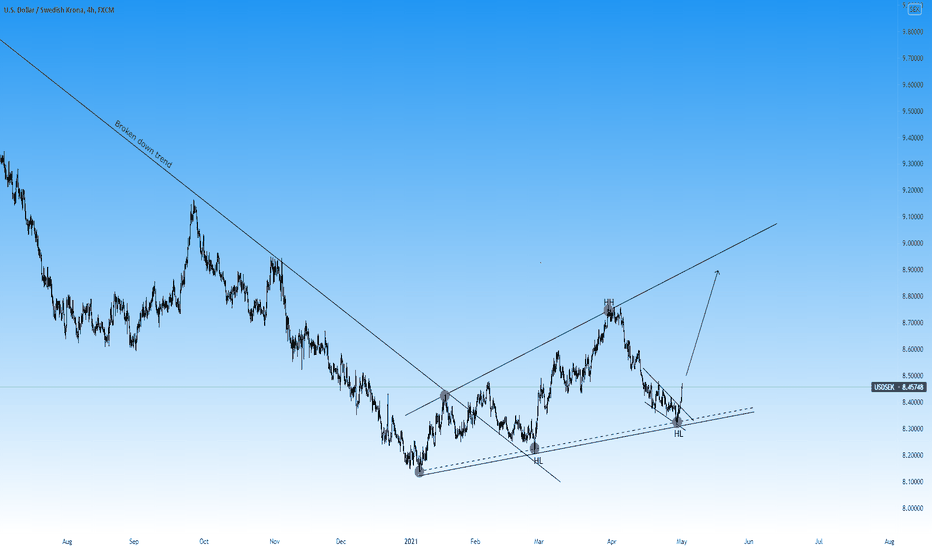

SEKUSD trade ideas

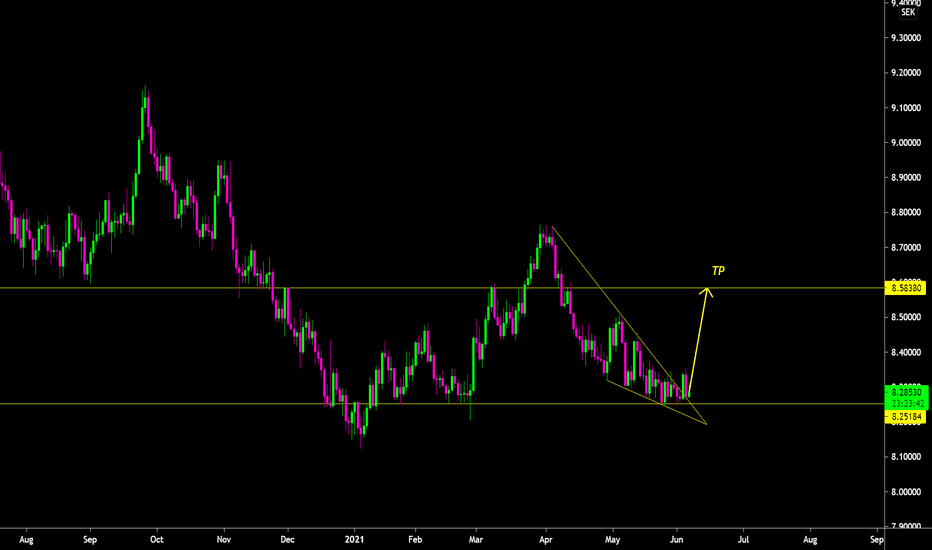

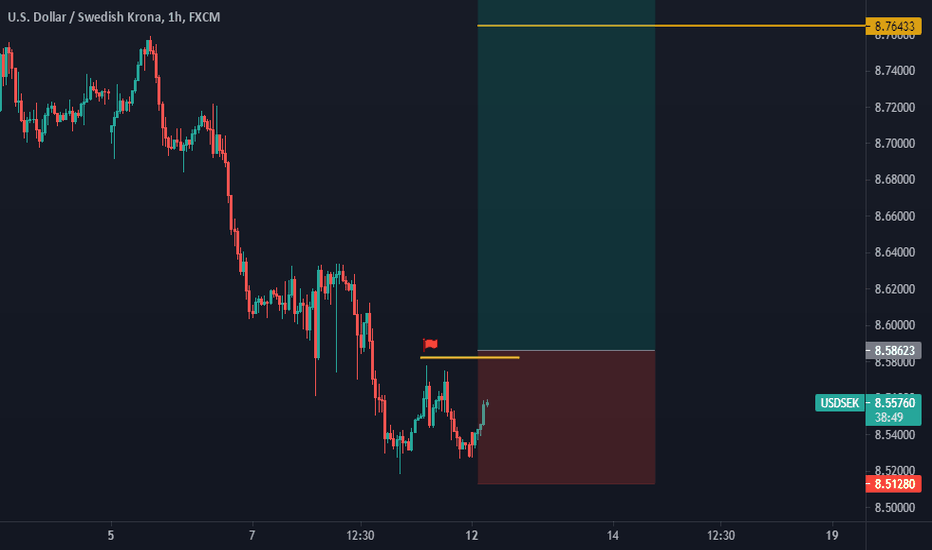

USD|SEKMost of the information is given in the graph.

Fast overview:

The upside triangle should result in an increase from 8.66 to 8.84 for two to three weeks.

Next, there are two possible developments: the first is that the price will go further, to values around 9. At this point the paths are also divided. The price can enter the channel formed by two resistance - support lines and continue in the horizontal (this scenario is not considered here). The second option is the completion of the formation of the pattern BAT at this level and planned pullback down to the values of 8.50.

Not a finance advise;)

This is my personal point of view.;)

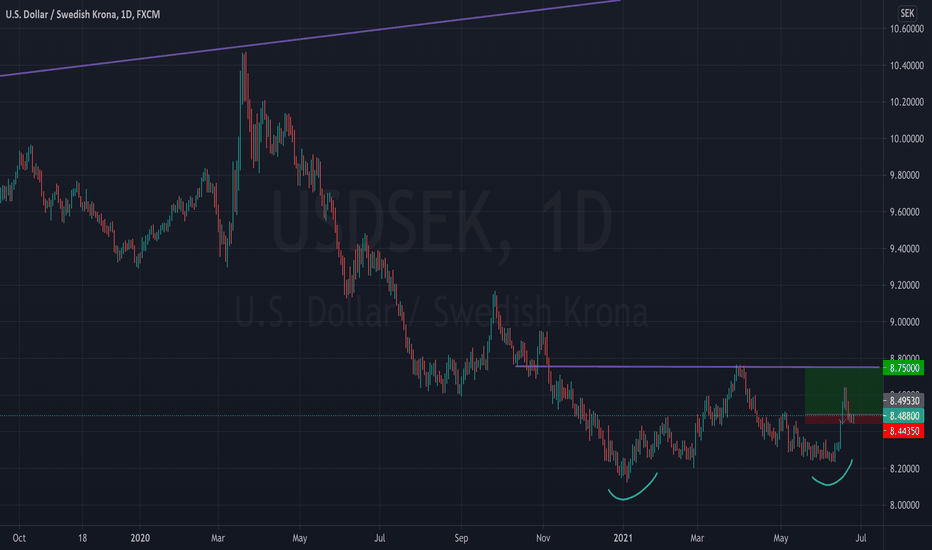

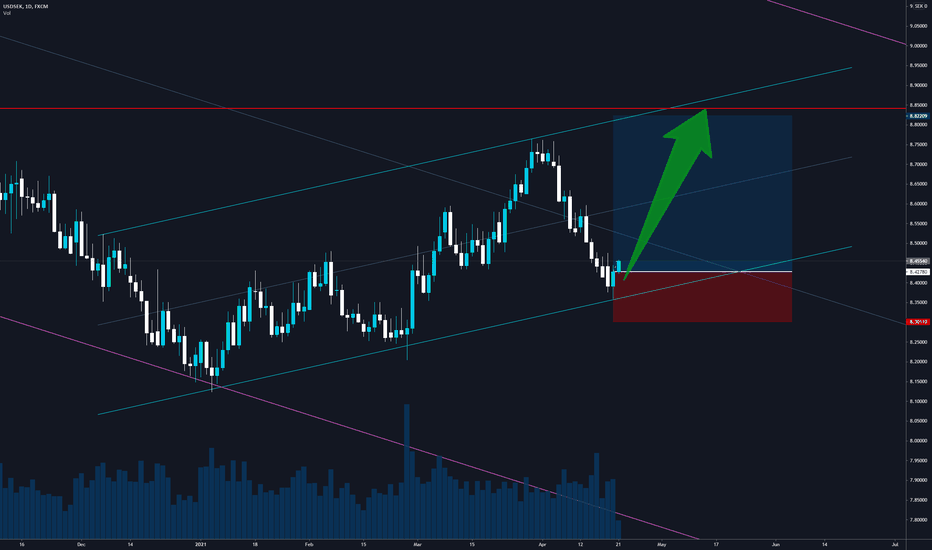

USD/SEK LONGUSD/SEK broke out of 7 month rectangle by 30 day ADX Criteria on Friday the 16th (over 69 PIP). Significant breakout. A bull back to the rectangle breakout area could occur. Last bar in the pattern is marked with a low. This is a decent classic chart pattern but the idea brought to be per @AndreasSteno. Much thanks. Newsletter specific recommendation (free) here: corporate.nordea.com

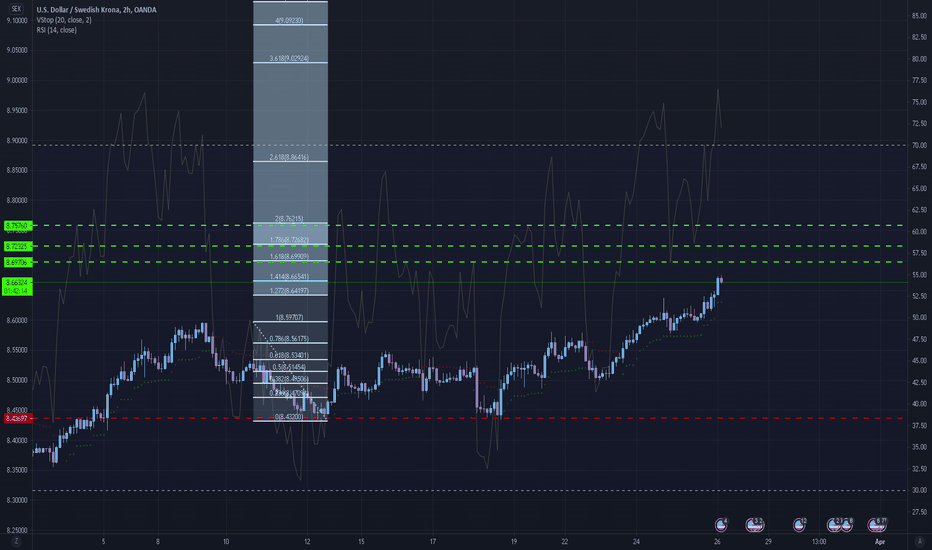

USDSEK Wave X ?BullishQuite likely.

We are in a general bearish pattern on this one, now in respite. The latest set of waves do not for a 5 wave impulse in my opinion. It just doesn't have the look, let alone fulfill the extension rules of EWT. It is more in line with "double two" that Mr Elliott described so many years ago. I am willing to put a number of fibgoals, more based on the huge zigzags preceding these short, small spurts of growth.

As always, this is not financial advice, so please do your own research.

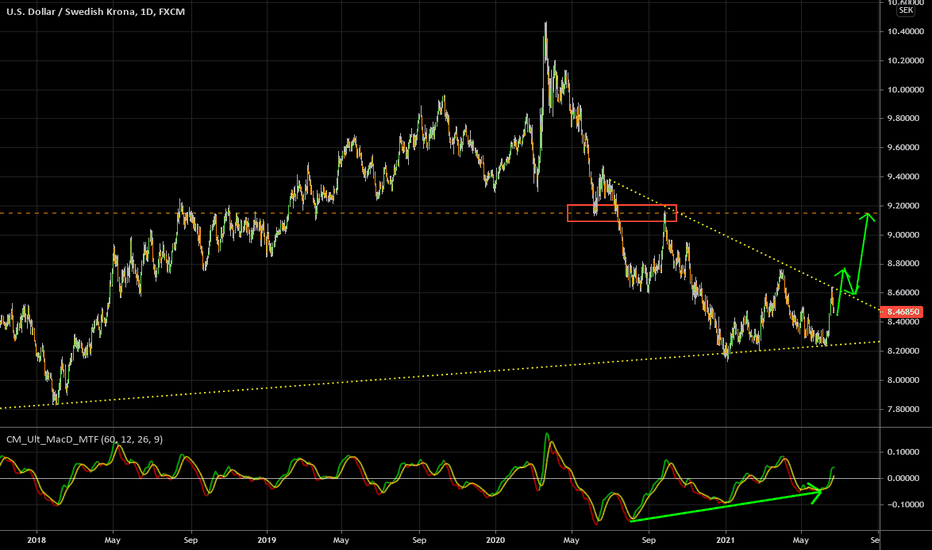

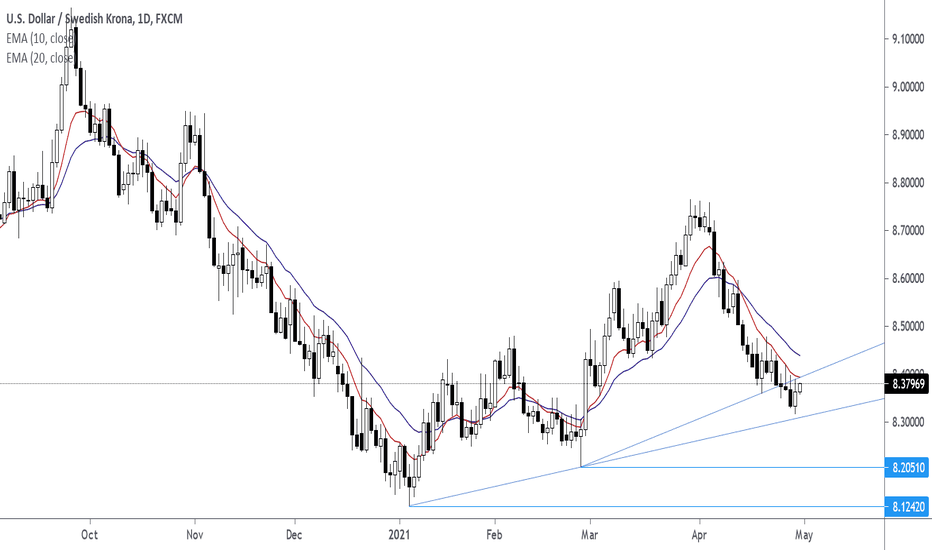

USDSEK long term buyLook at the chart: there's a skewed H&S pattern, long term trend line (support), and bullish pressure visible on MACD.

Switch to lower time frame and buy gradually starting from current pullback. Target is @9.15 (strong support/resistance level which held multiple times during past years).

Good luck.

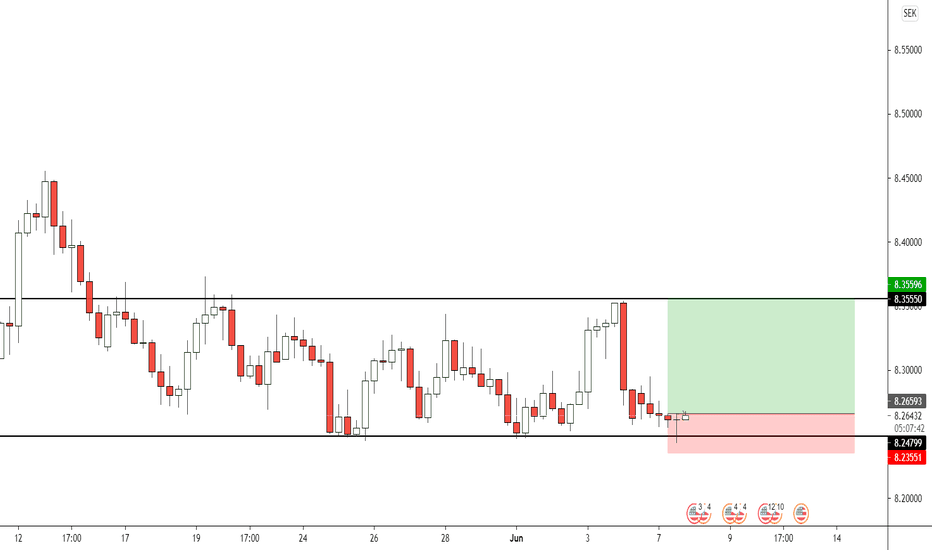

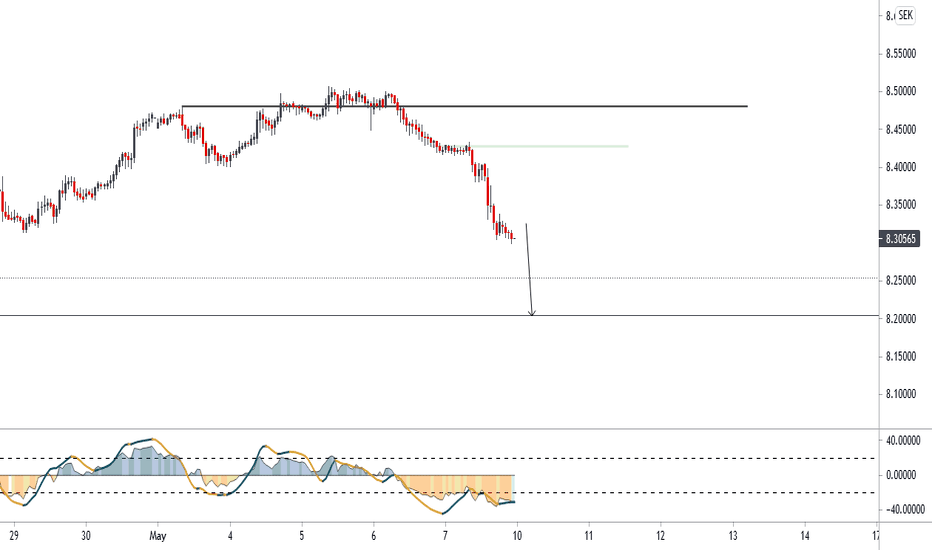

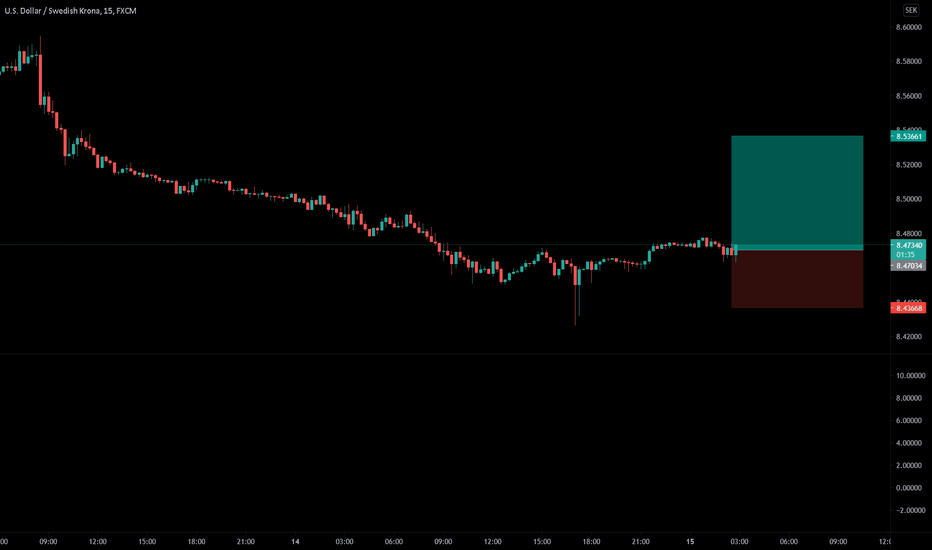

USDSEK ForecastIt's been some time since we checked on this one. It looks bearish.

.

Khiwe

At this profile page, the shared analysis, ideas and also, the strategy of a chart belong to Khiwe with some being influenced. The technical set-ups are speculative, they are not guaranteed for accuracy or in completeness in the form of any content; -it is not to advice on financial markets. Please apply your own analysis and confirm it with price action.

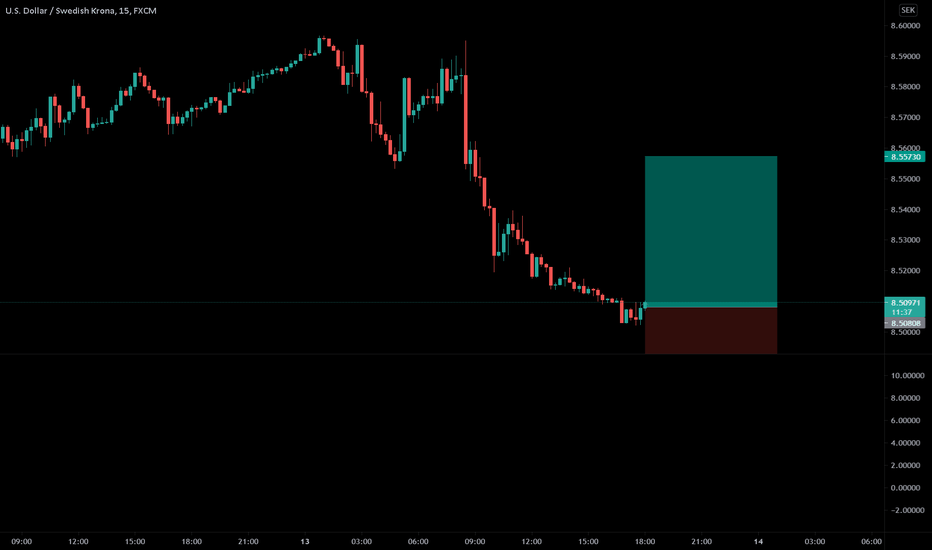

USDSEK Lower Highs On The Daily Chart, Weekly Chart, H4 ChartLower Highs are pushing into trend line support. Wait for confirming price action signal like a pin bar for an entry. Lower Highs are present on the Daily, Weekly Chart, and H4 Chart.

EMA 10 EMA 20 are pointing downwards on the time frames mentioned.