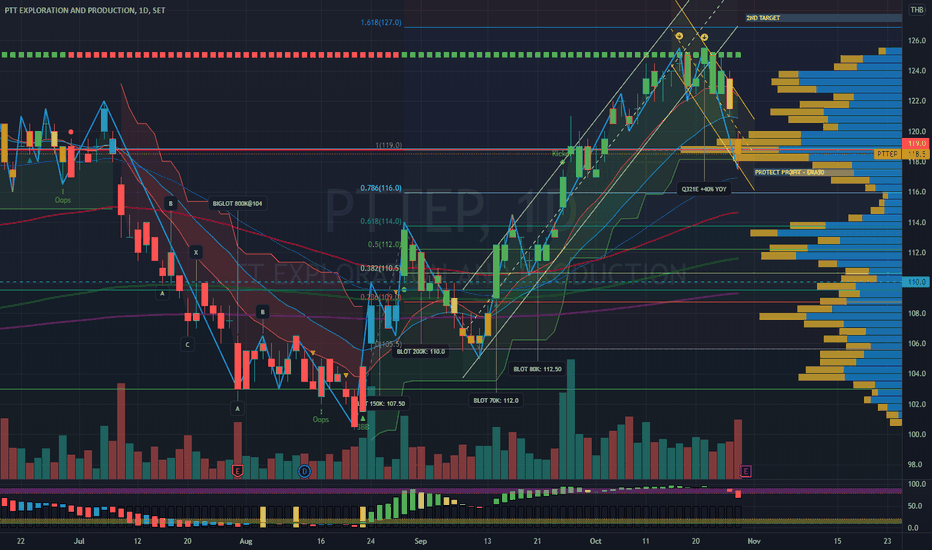

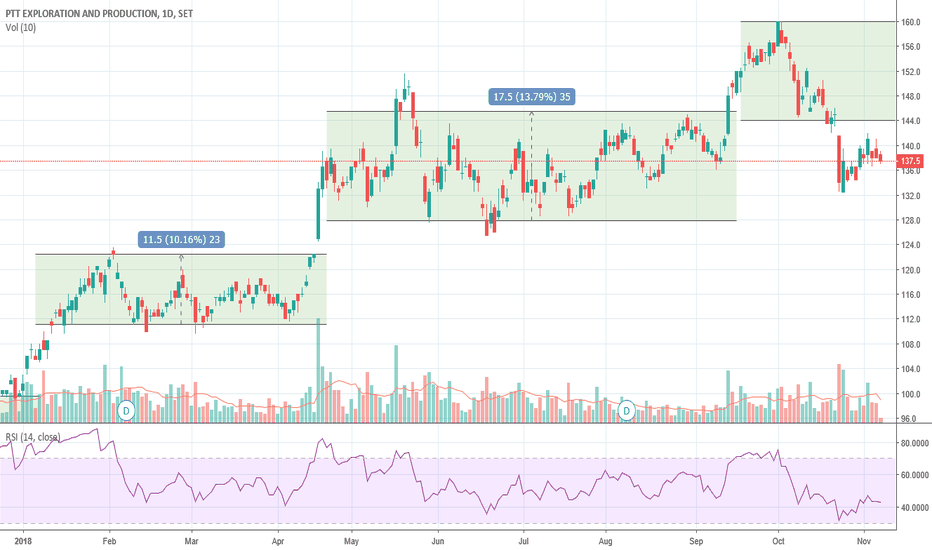

PTTEP | Q321E +40% Sell On Fact | Buy signal@RSI reboundPTTEP | Thailand SET Index | Price Action Analysis

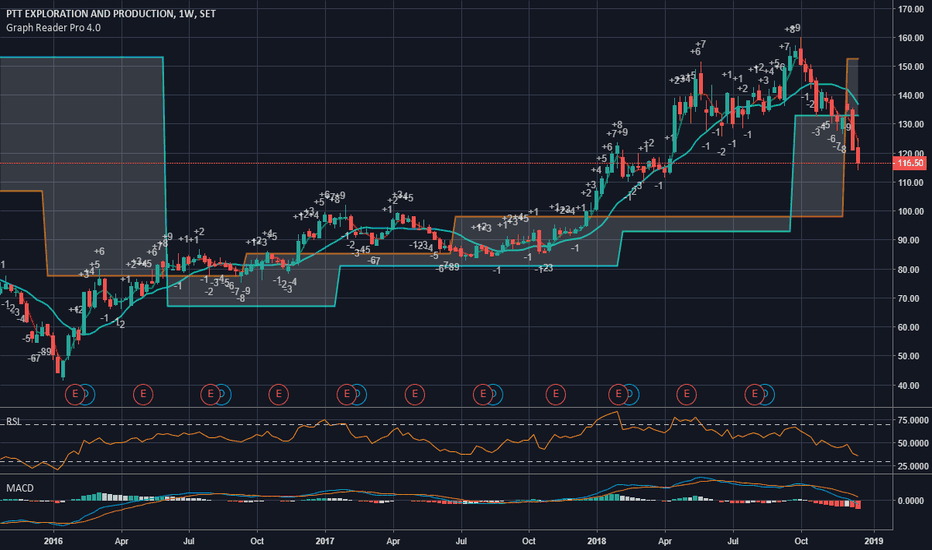

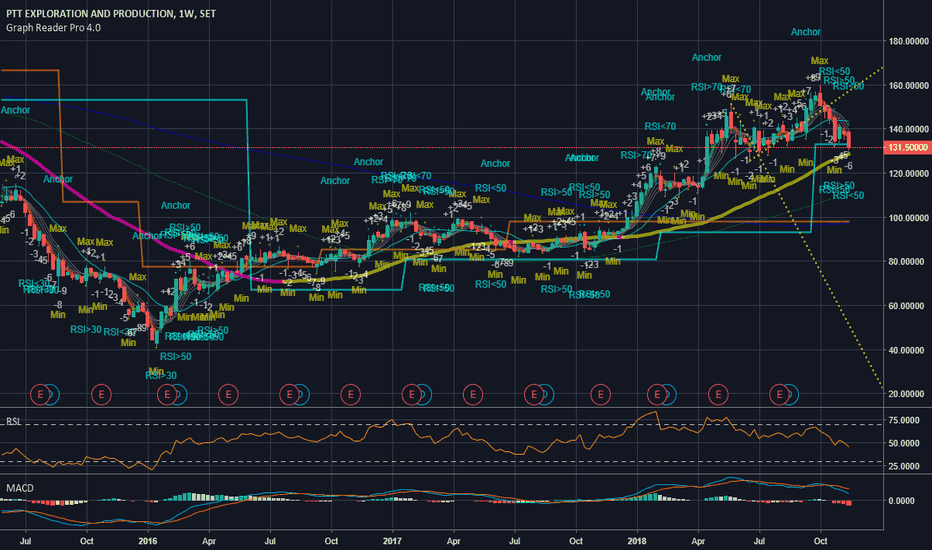

This is my 3rd Buy position and decided not to take profit as the oil price continue to claim.

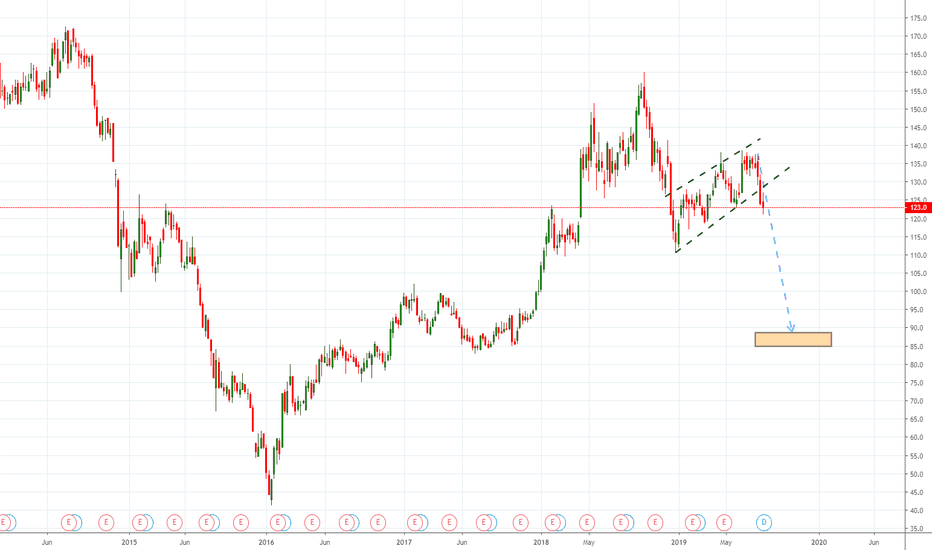

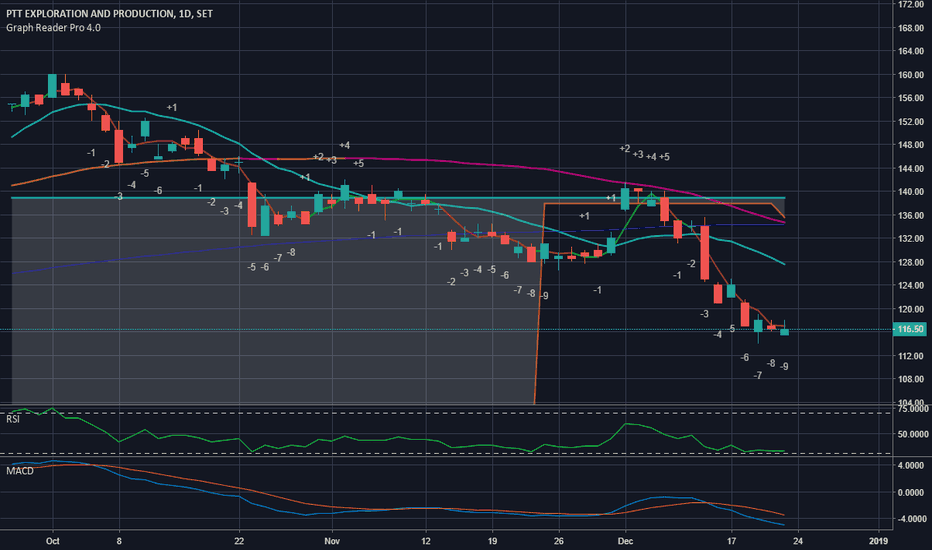

> Chart Pattern: Double Top and declining to test the Supertrend support.

> Banker Chip Volume support at EMA50 @ 117.0

> Buy position when RSI rebou

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

19.5 THB

78.82 B THB

312.31 B THB

3.97 B

About PTT EXPLORATION & PRODUCTION PUBLIC

Sector

Industry

CEO

Montri Rawanchaikul

Website

Headquarters

Bangkok

Founded

1985

ISIN

TH0355010R16

FIGI

BBG000BTWVY2

PTT Exploration & Production Plc engages in the exploration and production of petroleum, foreign gas pipeline transportation, and investment in energy business. The firm's projects include Myanmar M3 Project, Bongkot Project, Contract 4 Project, and Mariana Oil Sands Project. It operates through the following segments: Exploration and Production, and Head Office and Others. The company was founded on June 20, 1985 and is headquartered in Bangkok, Thailand.

Related stocks

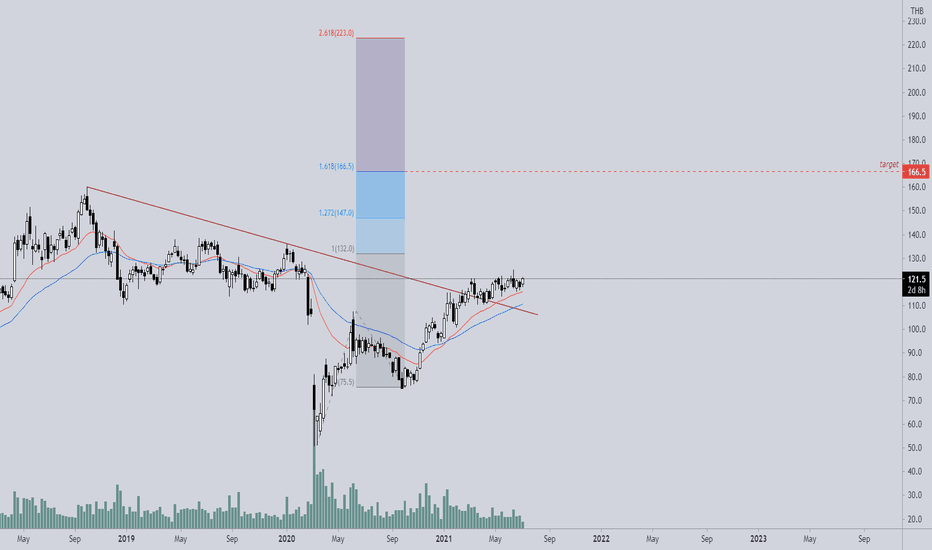

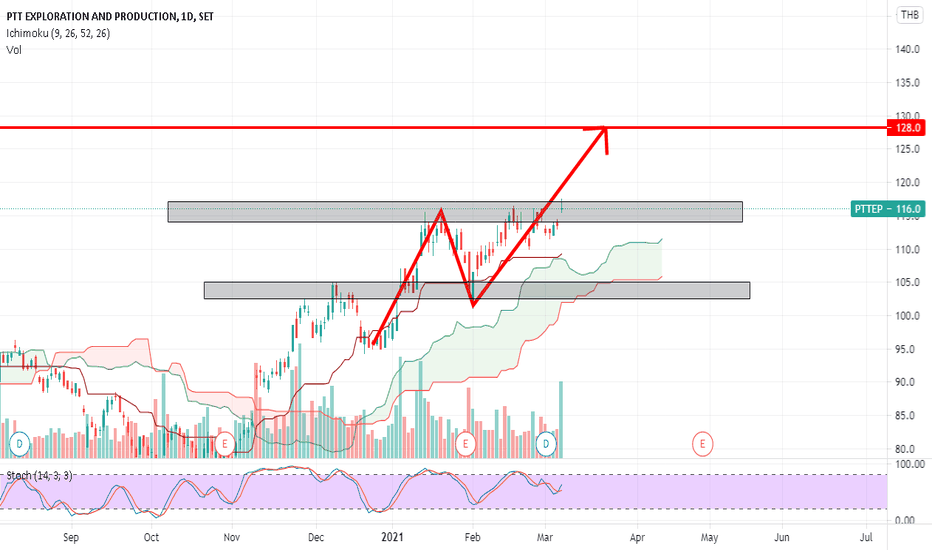

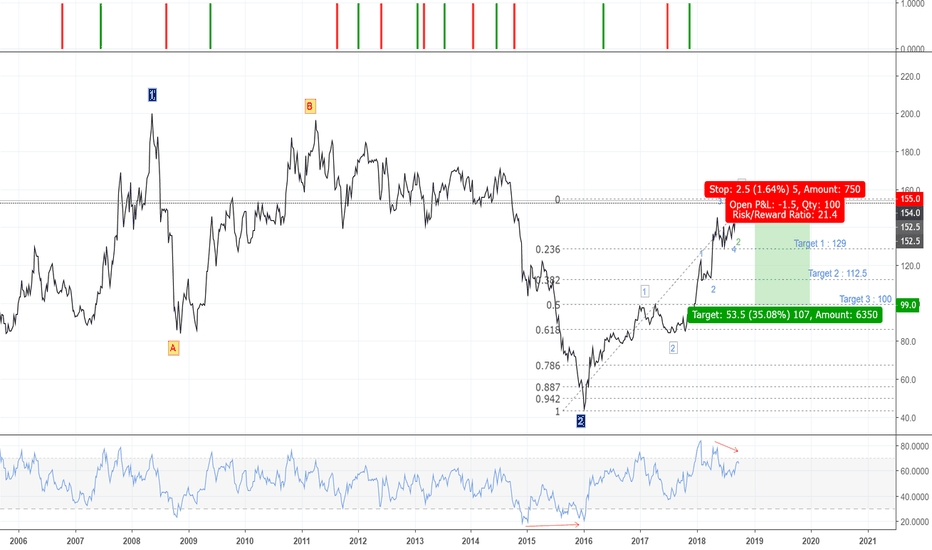

PTTEP (SET) - Continue BullishGreetings

Humbled, we would like to thanks for your support who has already liked, commented and followed us. Your support, strengthens us, to help in analyzing the market. If you have any questions, do not be hesitant to send us message (inbox). Our Service : Signal recomendation, Trading Course, P

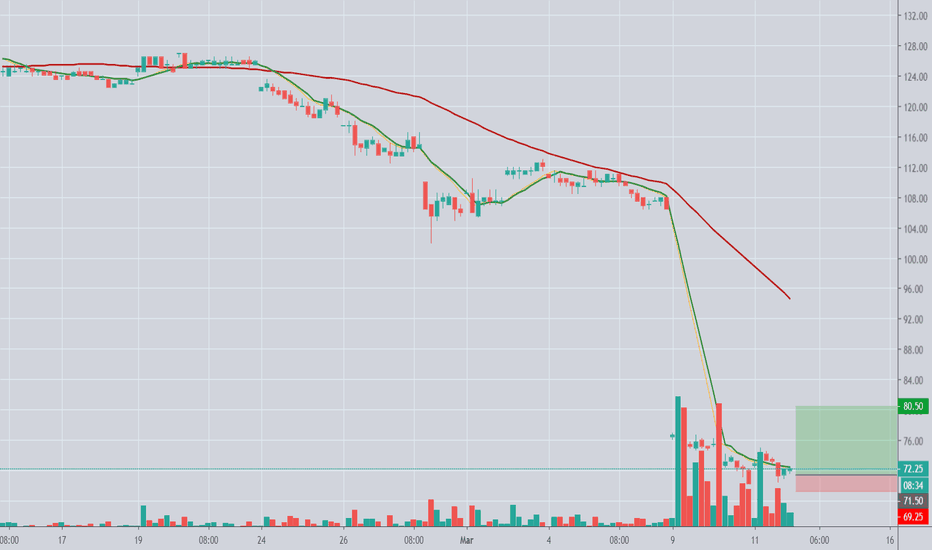

Re-open PTTEP positionIt was my bad being stopped out too early yesterday. I'm going to buy it again at this price after it had failed to break the resistance in the morning. I decrease the stop-loss price to 69.5. I will make a lot of profit from this trade if its the bottom. If else, I'm just gonna cut my loss again to

Template for fast setting of GRP 4.0 (20181222) for stocks.Copying is the fastest way to set a chart into your own account. The chart on this page is an example of one from TradingView with Graph Reader Pro 4.0 as of 20181222. You can copy it into your account immediately by clicking on the megaphone (Share) symbol under it, then click on "Make it mine" but

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

PETFF4919439

PTTEP Treasury Center Company Limited 3.903% 06-DEC-2059Yield to maturity

7.07%

Maturity date

Dec 6, 2059

PETFF3864302

PTTEP Treasury Center Company Limited 6.35% 12-JUN-2042Yield to maturity

5.18%

Maturity date

Jun 12, 2042

PETFF4935001

PTTEP Treasury Center Company Limited 2.993% 15-JAN-2030Yield to maturity

4.94%

Maturity date

Jan 15, 2030

PETFF4998063

PTTEP Treasury Center Company Limited 2.587% 10-JUN-2027Yield to maturity

4.68%

Maturity date

Jun 10, 2027

See all PTTEP.R bonds