Buy $V - NRPicks Ene 31Visa is the world's largest payment processor. In fiscal year 2020, it processed nearly $9 trillion in purchase transactions. Visa operates in more than 200 countries and processes transactions in more than 160 currencies. Its systems are capable of processing more than 65,000 transactions per second.

The pandemic has affected electronic payment companies to a lesser extent, Visa has reduced its sales by 17%. Visa and its major competitors (Mastercard and Paypal) have developed and expanded their brand around the world. Operationally, the company maintains a low level of debt compared to its competitors so it will meet its financial obligations.

Fundamentals:

- Growth

- 15.7% estimated net profit growth for the next 3 years.

- ROE 30% VS 13.7% industry

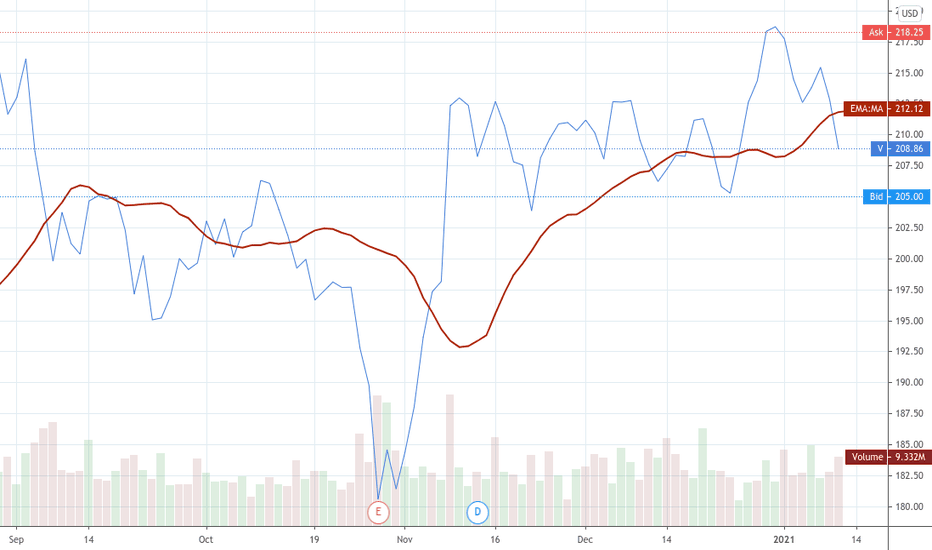

Technicals:

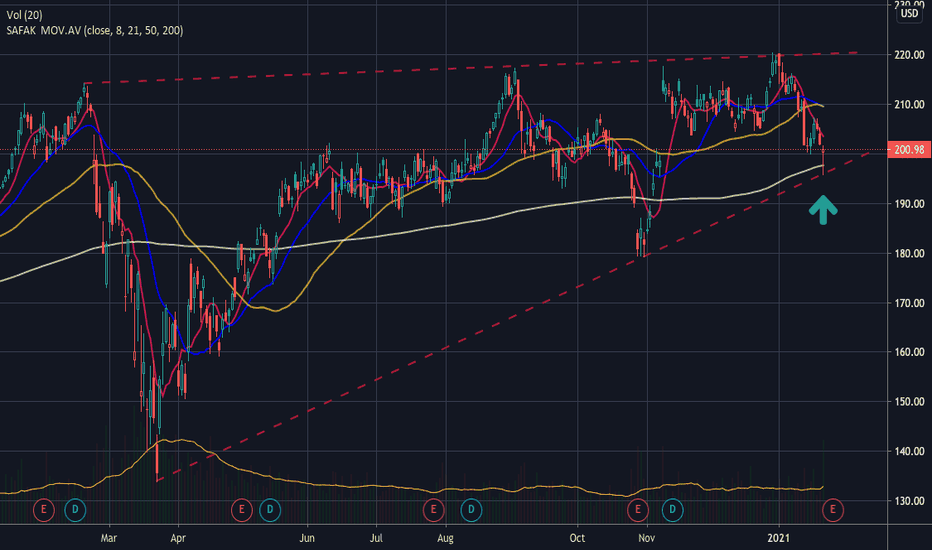

- Price level below the 250-200-150 SMA.

- Williams R% at -79 levels

- RSI oversold (37)

- -10% downside during the month

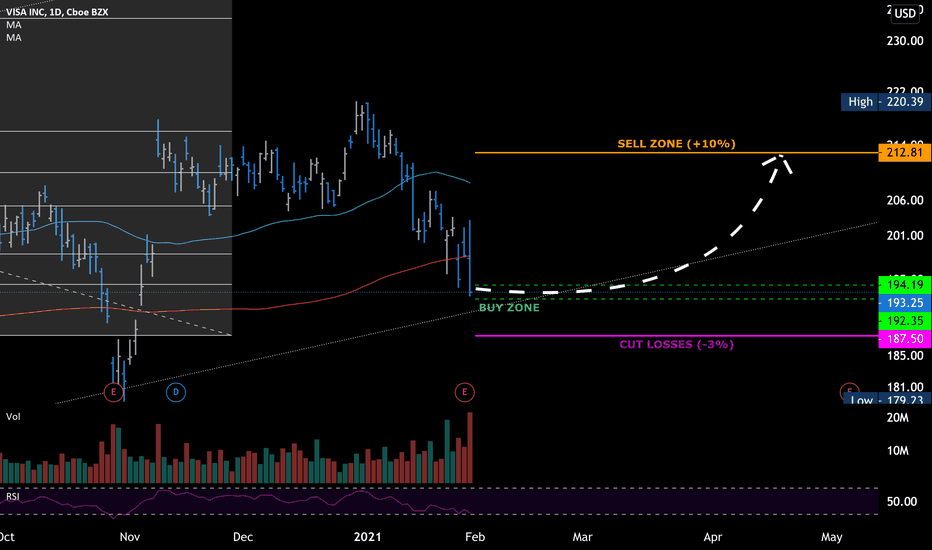

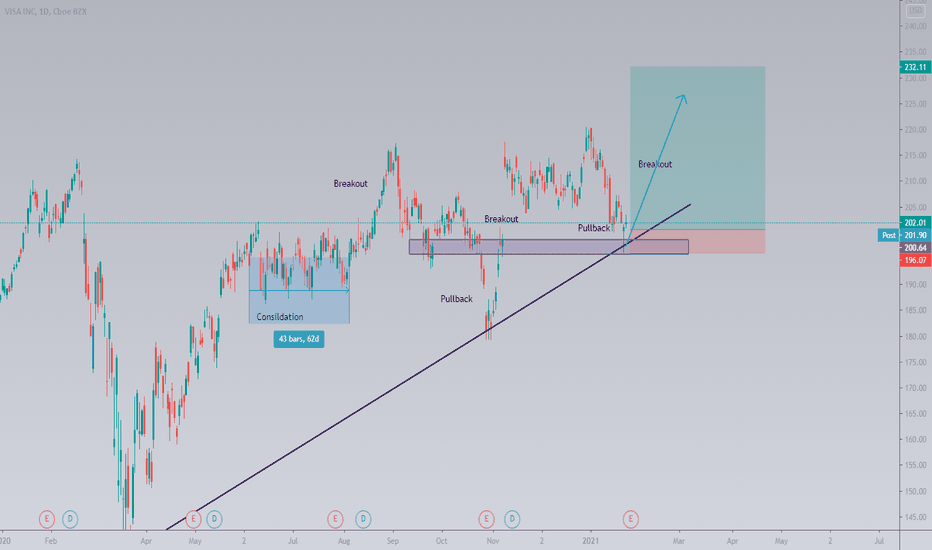

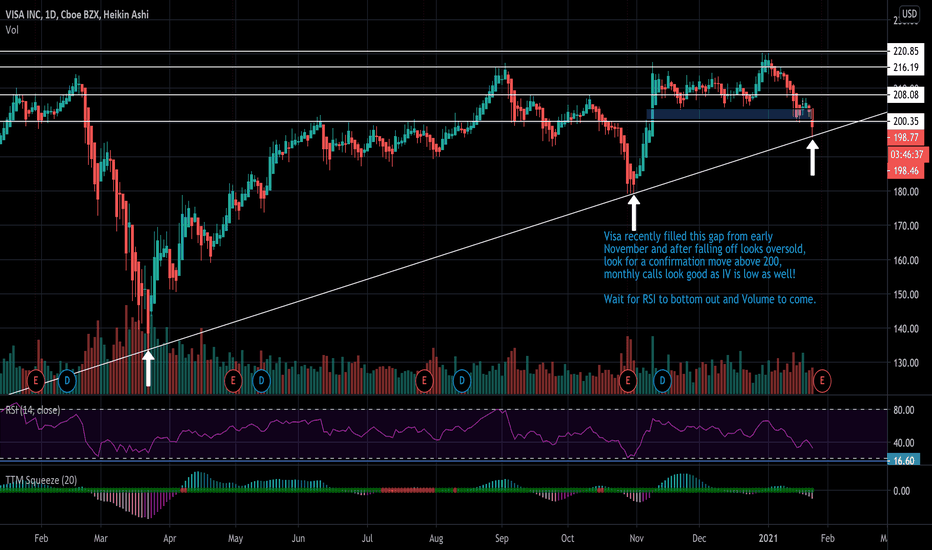

Visa showed an 11% correction from Dec. 9 to Jan. 28, which stopped at $193.6 support. The last results presentation on January 28th have not affected the share price, so it should have been already discounted. Finally, technical indicators such as SMA and Williams R% show positive signals for the stock.

VISA06 trade ideas

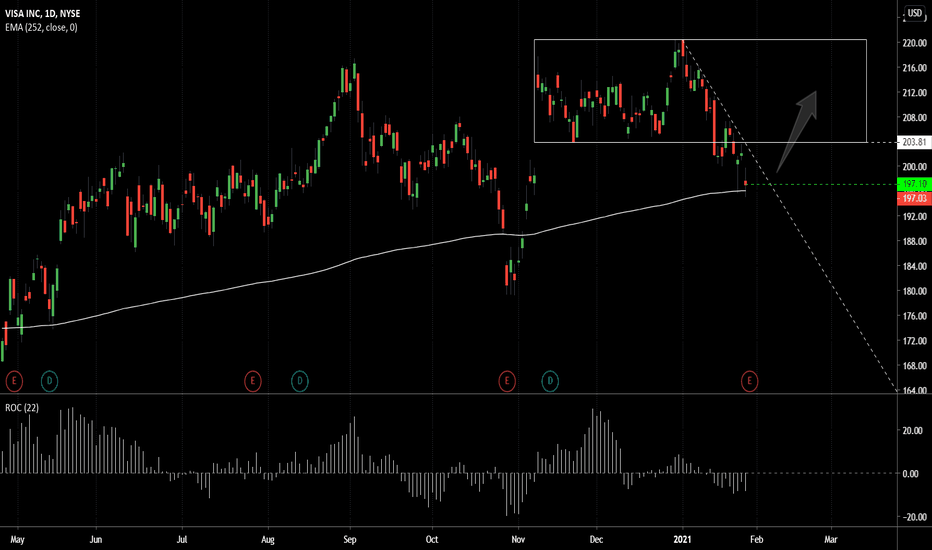

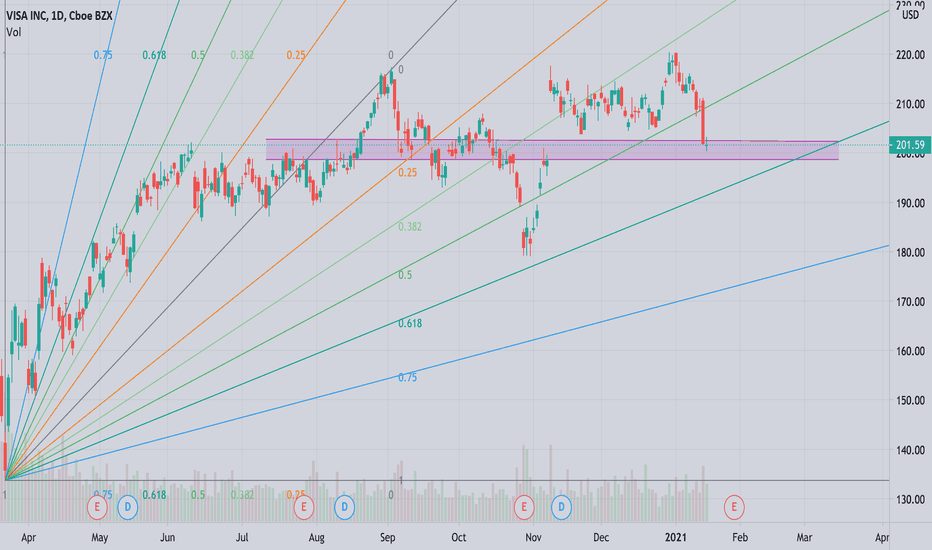

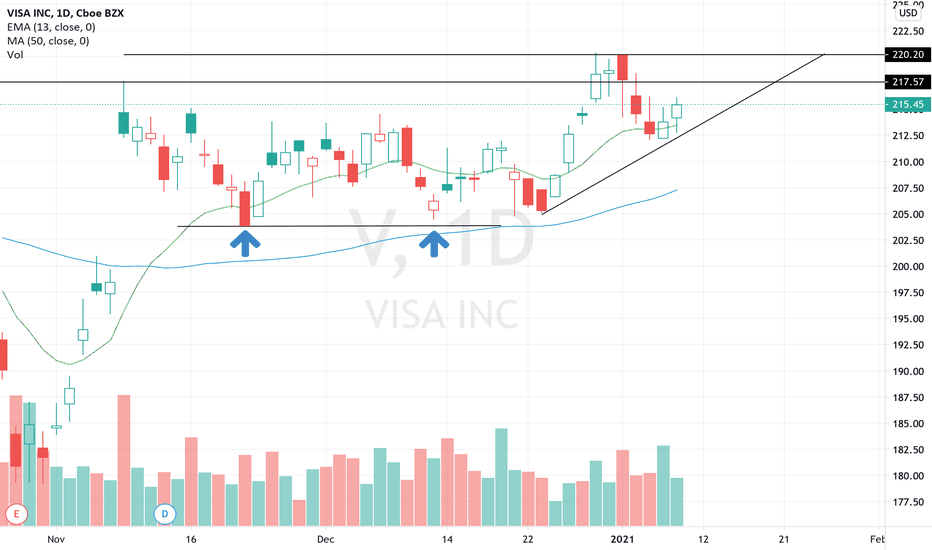

Visa Resistance @220I really look this stock. I believe the pandemic treated them well with the online shopping. Resistance is 220 and Visa has tried a few times to break it. I believe it will be 300$ in months to come. I am long on visa. Will add on dip if we sub 190.

Ascending triangle forming on daily. Short term target 1 is $210 followed by $220 and $230.

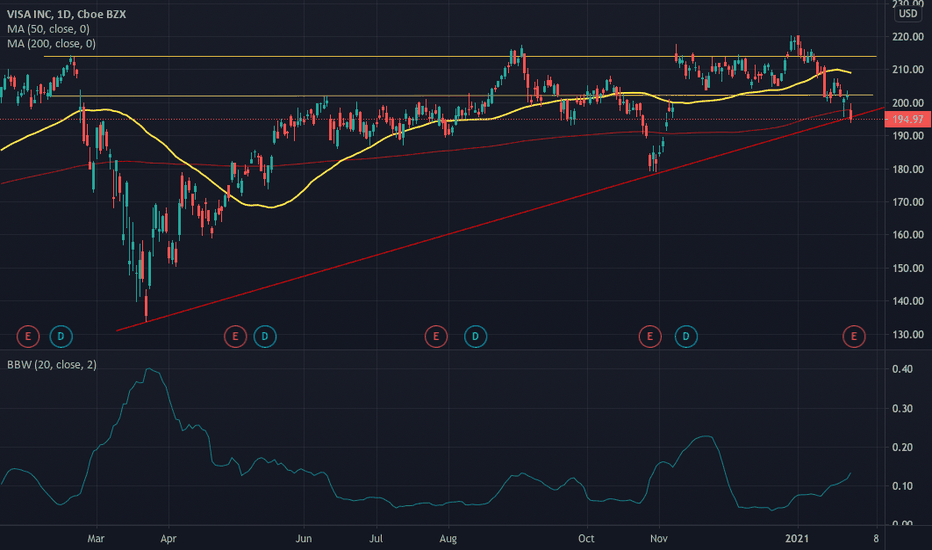

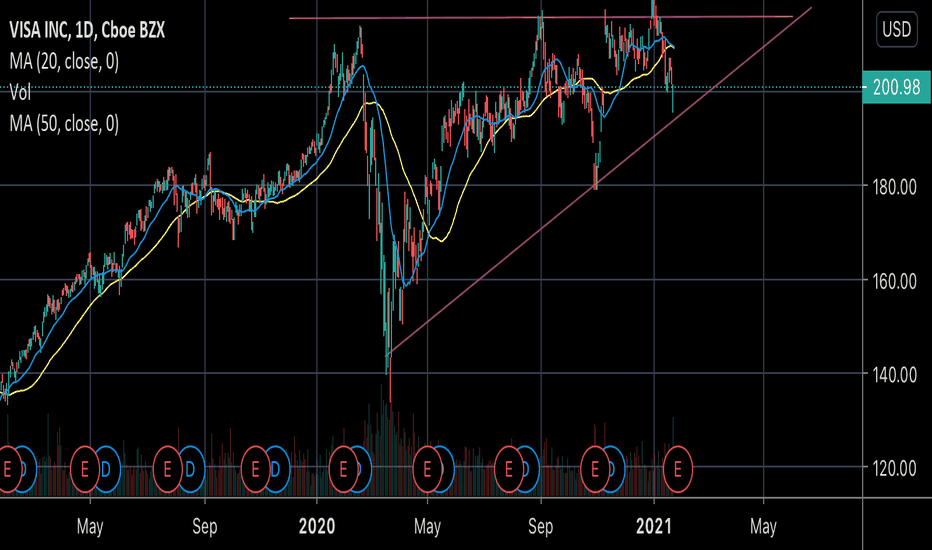

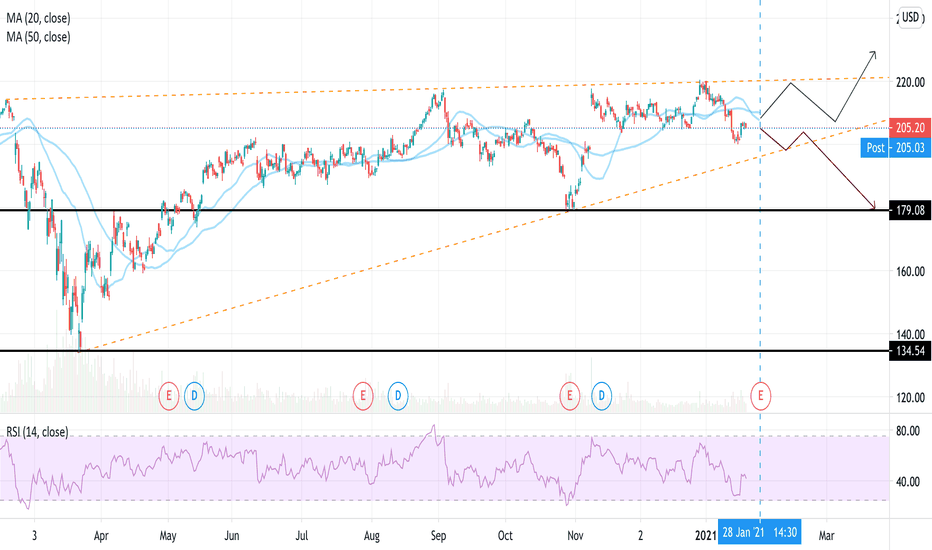

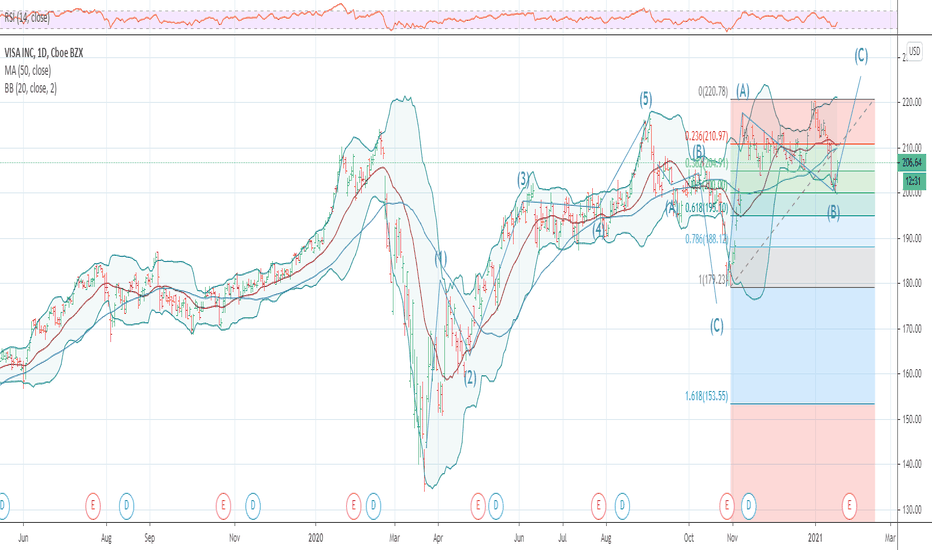

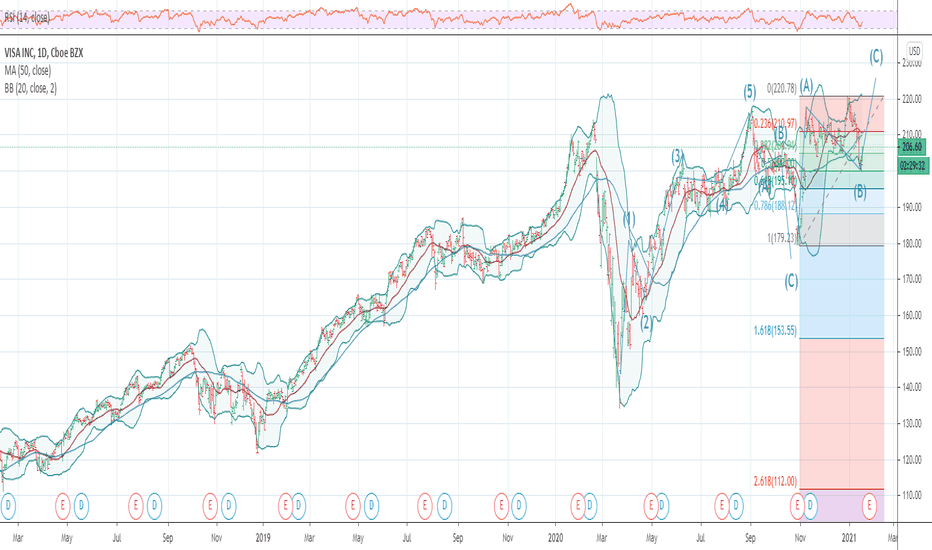

V | A quick Zoom Out gives a mixed outlookVisa has been forming a rising wedge since it's pre-March Highs, forming Higher lows over the past few months.

Now, I am really unsure how to interpret this one coming into ER on the 27th Jan. I am slightly inclined to think Covid may have been the beginning of the end of Visa as we know it.

My bear case on any negative news would see this trading back down to ~$174, implying 12% downside from current levels, potentially setting off a slow bleed for this payments behemoth.

Will be ready to pull the sell trigger on a very long term holding of mine in V if the lower up-trending support were to be broken to the downside. I would not go short, however, just lock in gains.

Any thoughts? Would happily be wrong on this one!

(*This is not financial advice, for sake of discussion and illustrative purposes only*)

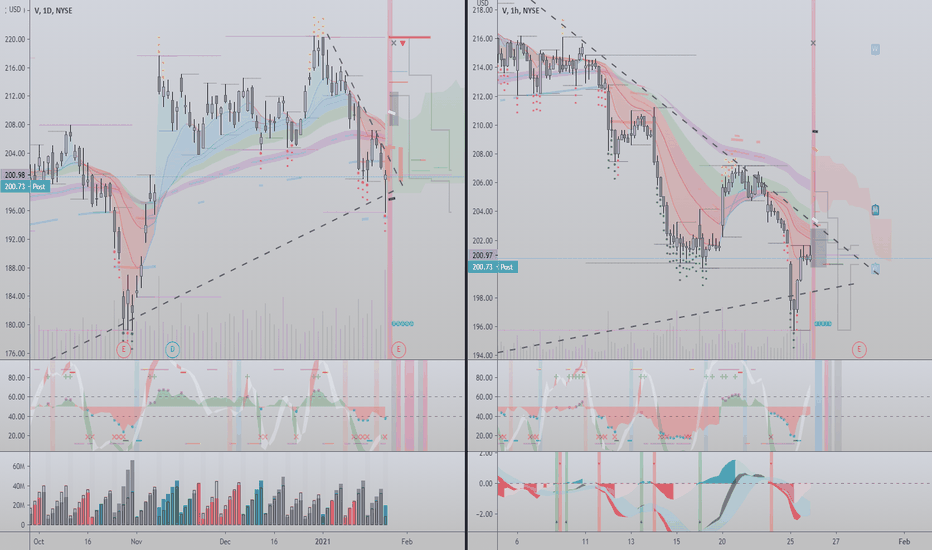

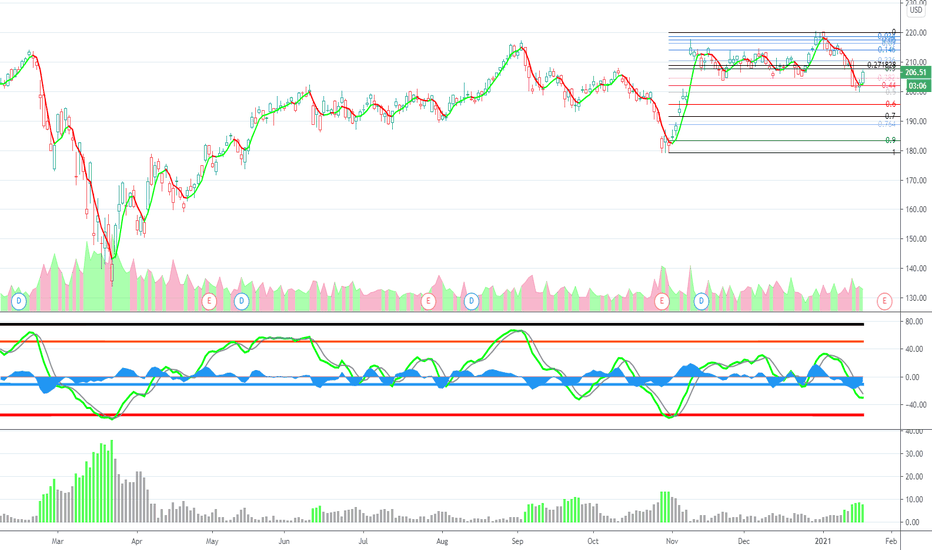

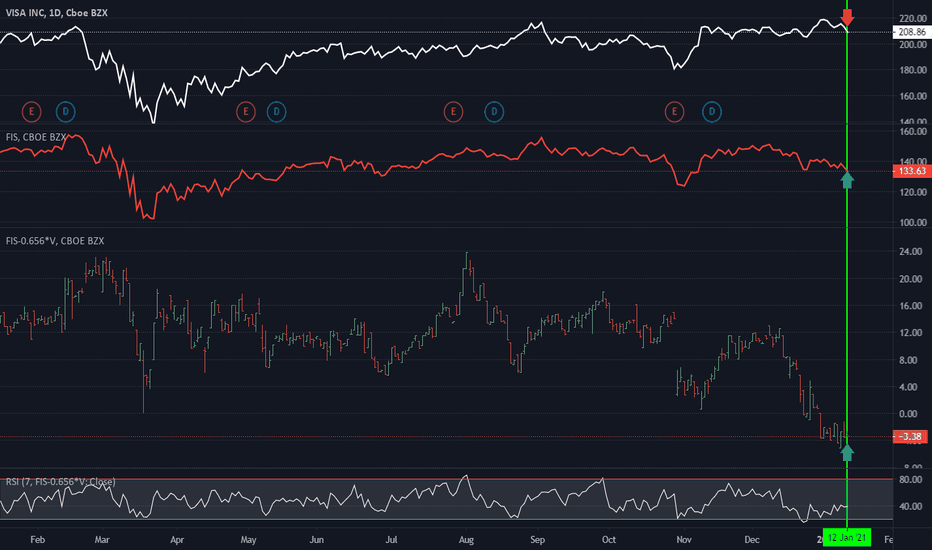

B's 5-in-1 Multi-Time Frame Relative Strength IndexThis RSI shows the RSI of the 5m, 15m, 60m, 240m and daily time frame in one indicator and includes an equal weighted average of all five (pink).

The darkest colours represent the shortest timeframes and the lightest colours represent the longest. You can change which timeframes are used.

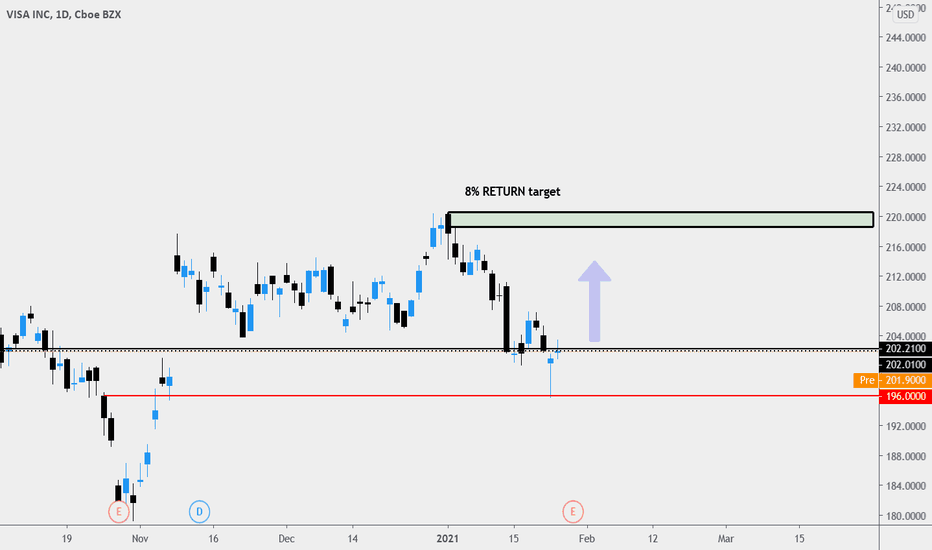

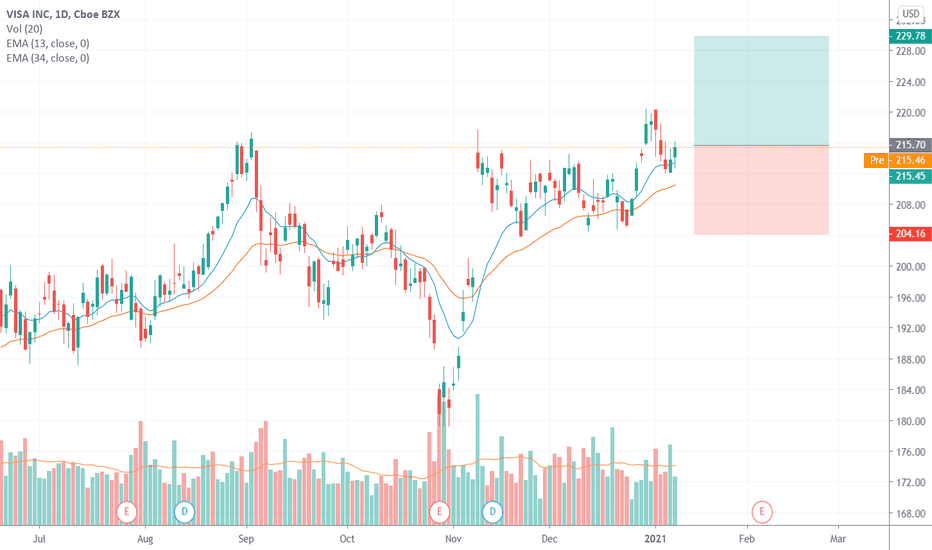

👀🚨SUNDAY OPTIONS WATCHLIST 1/10/21🚨👀V - One last one I will be keeping an eye on. We got our breakout we were watching for previously but looks like its giving us another opportunity to jump in after pulling back down to 13 ema support and now forming a new short term uptrend. Watch for a continuation higher if this uptrend holds. Could be a great one to ride back to highs 220.39 and potentially higher if it can gain some momentum.